Alarm.com Bundle

How Did Alarm.com Revolutionize Home Security?

Dive into the Alarm.com SWOT Analysis to understand the company's trajectory. From its inception, Alarm.com has reshaped the landscape of home security and smart home technology. This brief history explores the key milestones that transformed Alarm.com from a business unit to an industry leader. Discover how this company redefined how we protect and manage our properties.

The Alarm.com timeline reveals a fascinating journey of innovation within the security industry. Founded in 2000, the company quickly recognized the potential of cloud-based solutions, setting it apart from traditional security systems. Understanding the Alarm.com history provides valuable insights into its strategic decisions and its impact on the evolution of smart home technology and the home security market. Explore the early days and the key milestones that shaped this influential company.

What is the Alarm.com Founding Story?

Let's delve into the founding story of Alarm.com, a company that has significantly impacted the home security and smart home industries. The Revenue Streams & Business Model of Alarm.com provides further insight into the company's operations.

The company's roots trace back to the year 2000. Alarm.com emerged from a research and development unit within MicroStrategy. This marked the beginning of what would become a leading provider of interactive security solutions. The founders, Jean Paul Martin and Alison Slavin, played pivotal roles in shaping the company's early direction.

The initial challenge identified was the limitations of traditional security systems. These systems lacked the remote interaction capabilities that consumers were increasingly seeking. This need led to the development of an interactive security program. Launched in 2002, this program enabled remote monitoring and arming via cellular networks and mobile apps, a significant advancement at the time.

Here are some key milestones in the Alarm.com history:

- 2000: Founded as an R&D unit within MicroStrategy.

- 2002: Launched its interactive security program, enabling remote monitoring and arming.

- February 2009: Acquired by ABS Capital Partners for $27.7 million, marking the establishment of Alarm.com Holdings, Inc.

- 2015: Alarm.com went public with an IPO.

In February 2009, ABS Capital Partners acquired Alarm.com for $27.7 million. This acquisition marked a significant turning point, establishing Alarm.com Holdings, Inc., as MicroStrategy divested its interest. Initial funding came from MicroStrategy's R&D unit, followed by the acquisition by ABS Capital Partners.

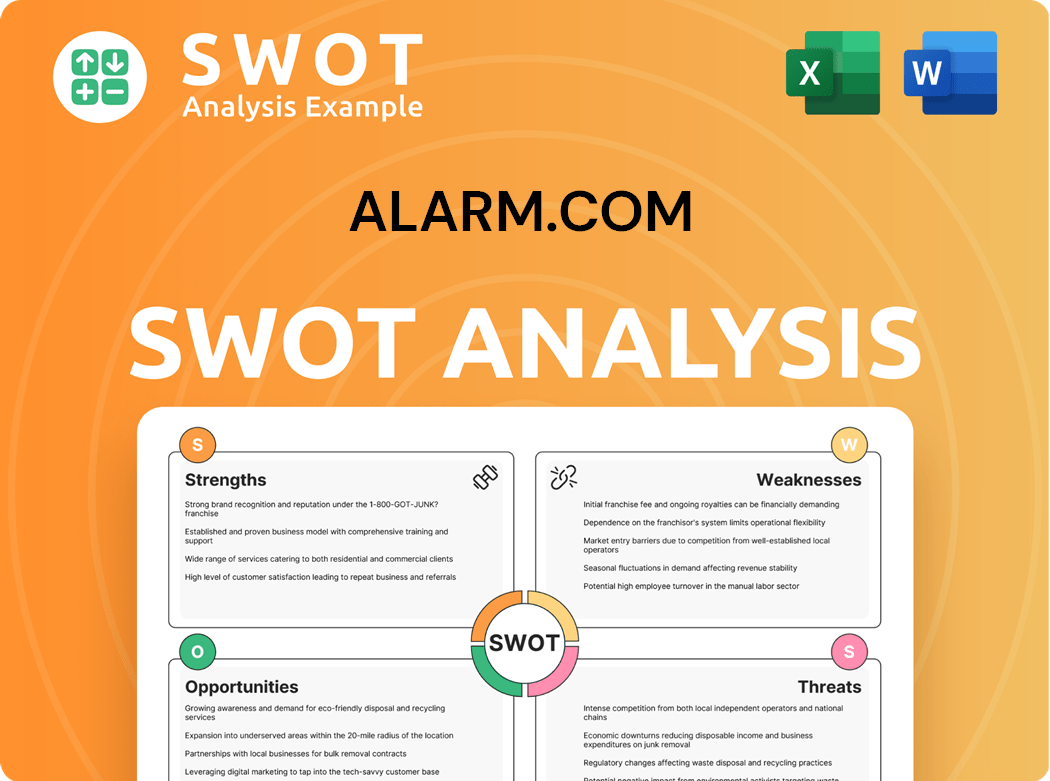

Alarm.com SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Alarm.com?

The period following the establishment of Alarm.com Holdings, Inc. in 2009 marked a phase of substantial expansion for the company. This growth was fueled by strategic developments and the integration of emerging technologies. The company focused on broadening its offerings and solidifying its position in the burgeoning smart property market. This expansion included the introduction of new services and the integration of various Internet of Things (IoT) devices.

In early 2010, the company introduced energy management solutions, allowing users to remotely control thermostats and lighting. This expansion into energy management was a key step in broadening the company's smart home capabilities. The move enhanced the functionality of its platform and provided users with added convenience and control over their properties.

Alarm.com expanded its platform to integrate a growing variety of Internet of Things (IoT) devices. This integration strategy was crucial for enhancing the functionality and appeal of its smart home and security systems. By incorporating various devices, the company provided users with a more comprehensive and interconnected experience.

The company's go-to-market strategy relies on a network of thousands of professional service providers who install and maintain their systems. This approach ensured high-quality installation and ongoing support for its products. This network of providers has been essential for the company's reach and customer satisfaction.

By 2014, Alarm.com reported revenues of $167.3 million and had a user base exceeding 2.3 million subscribers. The company went public in June 2015, filing for an initial public offering. This IPO raised a total of $136.52 million. The IPO marked a significant milestone in the company's growth trajectory.

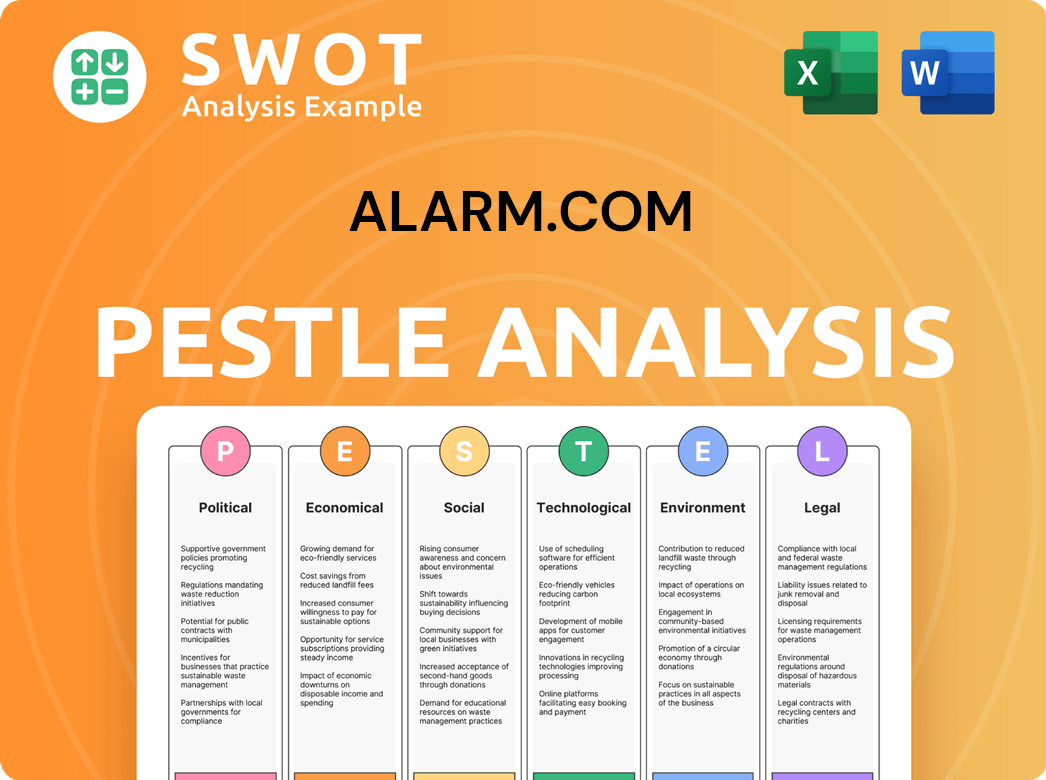

Alarm.com PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Alarm.com history?

The Alarm.com history is marked by significant milestones that have shaped the company's trajectory in the home security and smart home industries. The company has consistently evolved, adapting to technological advancements and market demands.

| Year | Milestone |

|---|---|

| Early 2000s | Alarm.com was founded, pioneering cloud-based interactive security solutions. |

| 2010 | The company went public, marking a significant step in its growth and expansion. |

| 2014-2015 | Alarm.com expanded its platform to include video monitoring, energy management, and access control. |

| February 2025 | Alarm.com acquired CHeKT, expanding its remote video monitoring offerings. |

Alarm.com has consistently focused on innovation, particularly in the areas of smart home technology and security systems. Recent innovations include advancements in AI-based video analytics and enhancements to their Business Activity Analytics solution.

Alarm.com pioneered cloud-based interactive security, which allowed for remote monitoring and control of security systems.

The company expanded its offerings to include video monitoring, providing users with real-time video feeds and event-triggered video clips.

Alarm.com integrated energy management features, allowing users to control thermostats and other energy-consuming devices.

The platform incorporated access control features, enabling users to remotely lock and unlock doors.

Recent innovations include AI-based video analytics, enhancing the ability to detect and respond to security events.

The company has enhanced its Business Activity Analytics solution, providing valuable insights for commercial customers.

Challenges for Alarm.com include managing research and development expenses and sales expenses in a competitive market. Macroeconomic factors, such as interest rates, can also influence spending trends within the home security and smart home sectors.

The security and automation industry is highly competitive, requiring continuous innovation and effective marketing strategies.

Managing research and development expenses and sales expenses are critical for sustaining growth and profitability.

Economic conditions, such as interest rates, can impact consumer spending on home security and smart home products.

Expanding its international presence presents challenges, including adapting to different market regulations and consumer preferences. In 2024, 6% of total revenue originated from outside North America.

Integrating acquired companies, such as CHeKT, can be complex and require careful management to ensure a smooth transition and realize the full potential of the acquisition.

Driving market adoption of new technologies and features requires effective marketing, education, and partnerships with service providers.

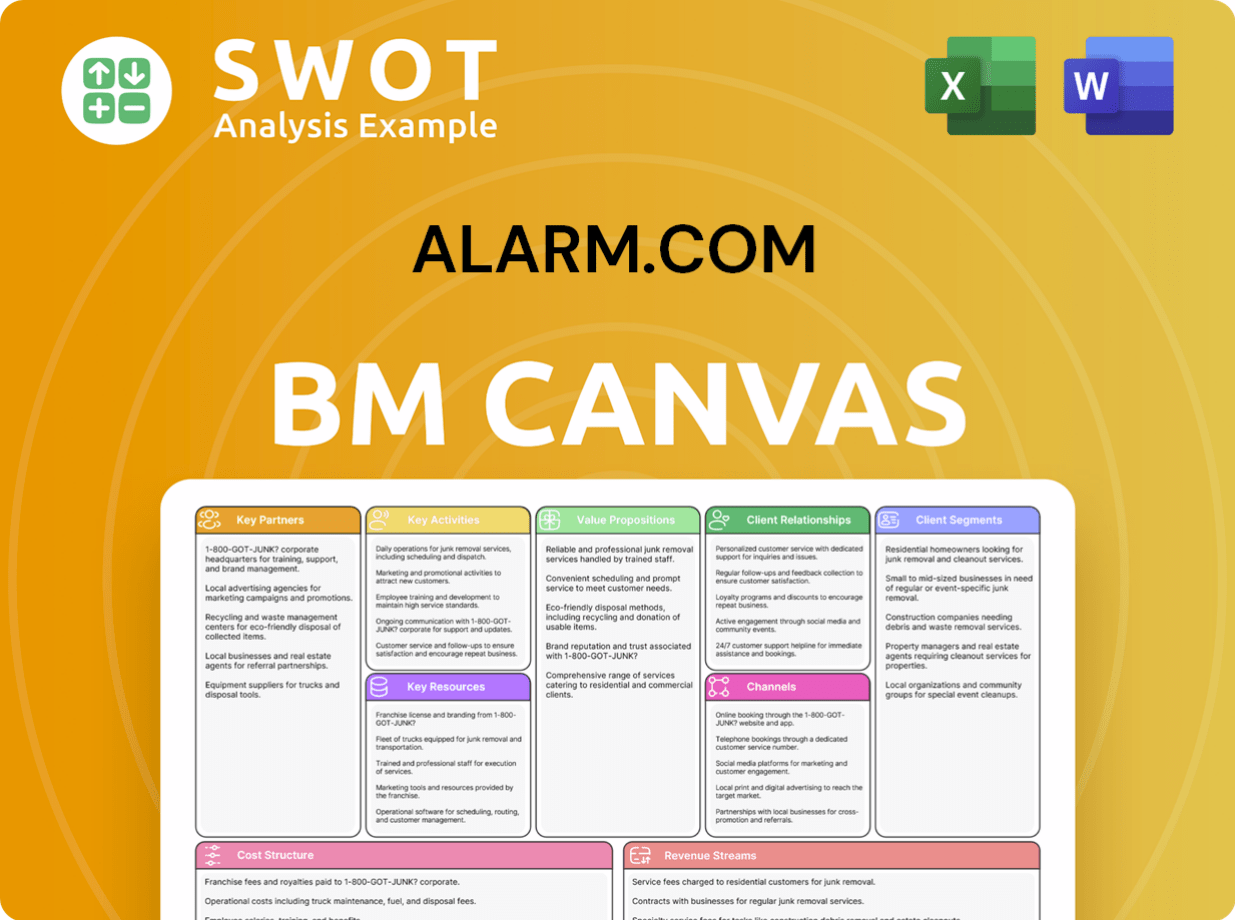

Alarm.com Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Alarm.com?

Here's a look at the key milestones in the Alarm.com history, highlighting the evolution of the company within the home security and smart home industries.

| Year | Key Event |

|---|---|

| 2000 | Founded as a business unit within MicroStrategy. |

| 2002 | Launched interactive security program. |

| 2009 | Established as Alarm.com Holdings, Inc. after acquisition by ABS Capital Partners. |

| Early 2010 | Began offering energy management solutions. |

| 2014 | Reported $167.3 million in revenue and over 2.3 million subscribers. |

| June 2015 | Went public with an IPO. |

| 2016 | Integrated with Amazon Echo and Apple TV. |

| 2024 | Total revenue reached $939.8 million. Introduced AI-based video analytics and enhanced Business Activity Analytics. Expanded headquarters space by 30% in Tysons, Virginia. |

| January 2025 | Introduced AI Deterrence (AID) at CES 2025. |

| February 2025 | Acquired majority stake in CHeKT. Reported Q4 2024 and full-year 2024 financial results. |

| March 2025 | Showcased market-expanding solutions at ISC West 2025. |

| May 2025 | Reported Q1 2025 financial results. Hosted European Partner Connections event. |

Alarm.com is focused on continued product innovation, particularly in AI capabilities, to enhance its smart home and security systems. The company's recent introduction of AI Deterrence (AID) at CES 2025 highlights its commitment to leveraging advanced technologies. This focus aims to provide users with more intelligent and responsive security solutions.

The company plans to further expand its market reach through strategic acquisitions and enhancing its remote video monitoring offerings. The acquisition of a majority stake in CHeKT in February 2025 is an example of this strategy. This expansion includes growth in commercial and international markets.

For the full year 2025, Alarm.com expects SaaS and license revenue to be between $675.8 million and $676.2 million, and total revenue between $975.8 million and $991.2 million. These projections reflect the company's continued growth and expansion efforts. Recent financial results, including Q4 2024 and Q1 2025 reports, support this positive outlook.

Analyst sentiment is generally positive, with a consensus of 'Moderate Buy'. The average target price suggests potential upside for Alarm.com. This positive outlook is driven by the company's innovative approach and its strategic position in the home security market.

Alarm.com Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Alarm.com Company?

- What is Growth Strategy and Future Prospects of Alarm.com Company?

- How Does Alarm.com Company Work?

- What is Sales and Marketing Strategy of Alarm.com Company?

- What is Brief History of Alarm.com Company?

- Who Owns Alarm.com Company?

- What is Customer Demographics and Target Market of Alarm.com Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.