Alarm.com Bundle

Can Alarm.com Continue to Dominate the Smart Home Security Market?

Founded in 2000, Alarm.com has evolved from a MicroStrategy business unit into a global leader in connected property solutions. Offering cloud-based services for home automation, security, and energy management, Alarm.com empowers users with control and awareness through their mobile apps and web interfaces. The company's journey has been marked by strategic acquisitions and continuous innovation, solidifying its position in the Alarm.com SWOT Analysis.

With the recent acquisition of CHeKT in February 2025, Alarm.com is poised for significant expansion in the remote video monitoring market. This strategic move, combined with ongoing advancements in AI-based video analytics, underscores the company's commitment to shaping the future of the home security market and smart home technology. This analysis dives into the Alarm.com growth strategy, future prospects, and provides a comprehensive Alarm.com company analysis to understand its trajectory.

How Is Alarm.com Expanding Its Reach?

The company is actively pursuing expansion through strategic initiatives, including acquisitions and broadening its market reach. This approach is designed to capitalize on opportunities within the home security market and smart home technology sectors. These efforts are crucial for maintaining a competitive edge and driving long-term growth.

A key element of the company's growth strategy involves strategic acquisitions. These acquisitions are intended to enhance its capabilities, diversify revenue streams, and stay ahead in the evolving security system trends. The company's focus on both organic growth and strategic acquisitions demonstrates a commitment to expanding its presence and influence in the industry.

The company's expansion initiatives are multifaceted, involving both acquisitions and organic growth strategies. These efforts are designed to increase its market share and capitalize on the increasing demand for smart home technology and security solutions. The company's approach reflects a strategic focus on sustained growth and market leadership.

In early 2025, the company acquired a majority stake in CHeKT, a specialist in remote video monitoring. This acquisition aims to boost its capabilities in proactive video monitoring. In April 2025, the company invested in Safe Streets USA, LLC, acquiring a 24.7% stake. These acquisitions are part of the company's strategy to expand its market presence and diversify its offerings.

The company is expanding its commercial solutions portfolio with new offerings like the EPX500 Fire Communicator. This product provides seamless fire alarm connectivity to its platform. The company is also witnessing growth in its international markets, particularly in video services. These initiatives support its overall growth strategy.

The company is increasing its presence in international markets, with video services gaining traction. In 2024, approximately 6% of total revenue came from customers outside North America. Its products are available in over 50 countries. These efforts are crucial for expanding the company's global footprint and revenue streams.

In 2024, the company acquired certain assets of Kapacity.io to accelerate the international deployment of a cloud-based demand response platform for its EnergyHub subsidiary. This acquisition supports the company's expansion into the energy management sector. These initiatives are designed to diversify its revenue streams and enhance its market position.

The company's multifaceted approach to expansion, combining acquisitions and organic growth, is designed to strengthen its position in the home security market and capitalize on emerging smart home technology trends. For more details on the company's target market, consider reading this article about the Target Market of Alarm.com. The company's strategic investments and product innovations are key to its long-term success and ability to meet the evolving demands of its customers.

The company's growth strategy is driven by several key initiatives, including strategic acquisitions, product launches, and international market expansion. In 2024, the company's SaaS revenue in commercial, international, and EnergyHub businesses grew by nearly 25% year-over-year, demonstrating the effectiveness of these strategies. These initiatives are designed to increase market share and revenue.

- Strategic acquisitions to enhance capabilities and expand market reach.

- Product launches to meet evolving customer needs and market demands.

- International market expansion to tap into new customer bases.

- Focus on commercial solutions and energy management.

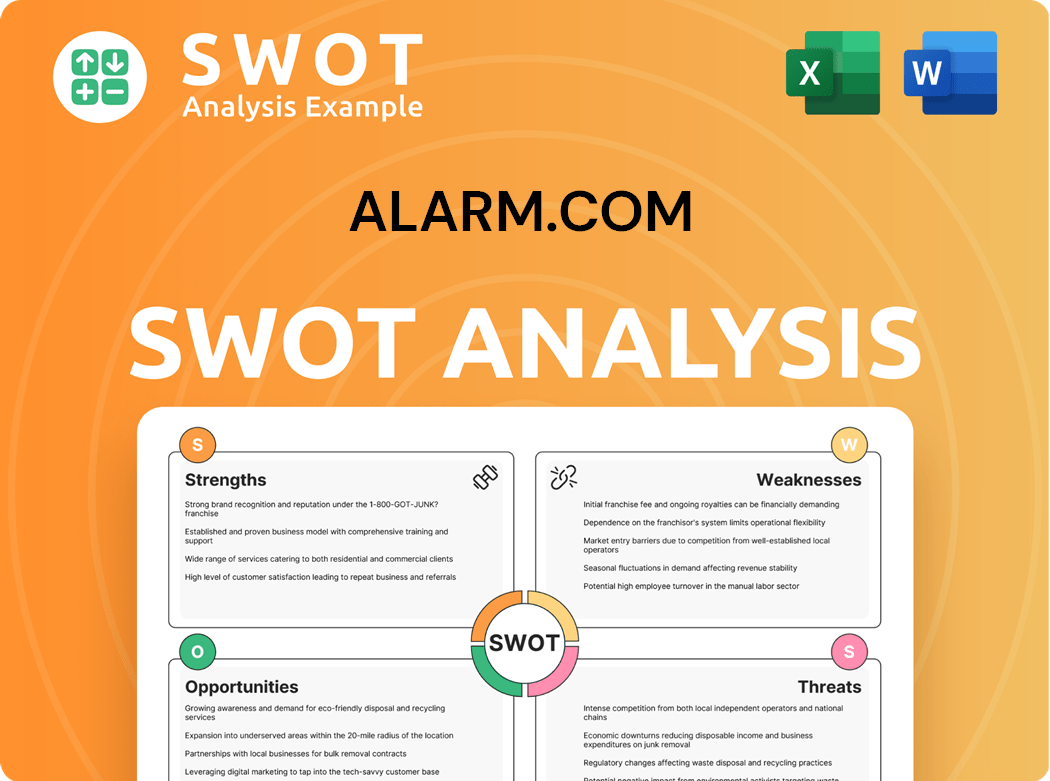

Alarm.com SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Alarm.com Invest in Innovation?

The growth strategy of Alarm.com is heavily reliant on technological innovation, making it a key player in the home security market. The company consistently invests in research and development, integrating cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT) into its offerings. This focus allows it to stay ahead in the competitive security system trends and maintain a strong market position.

Alarm.com's future prospects are closely tied to its ability to leverage these technological advancements. By enhancing its existing services and developing new solutions, the company aims to expand its user base and increase its revenue streams. A deep dive into the Brief History of Alarm.com reveals its evolution and strategic shifts over time.

The company's commitment to innovation is further demonstrated by its strategic expansion of its research and development division at its headquarters in Tysons, Virginia, in 2024. This expansion included a significant increase in office space to support continued growth and technology investment in cloud, IoT, and AI technologies. This expansion highlights Alarm.com's dedication to staying at the forefront of technological advancements in the smart home technology sector.

A notable innovation is the AI Deterrence (AID) automated audio response service, unveiled at CES 2025. AID uses AI to deliver adaptive verbal warnings to deter intruders. This technology enhances the effectiveness of Alarm.com's security solutions.

AID works seamlessly with Alarm.com camera systems. It can also be used with the Remote Video Monitoring (RVM) Console for a comprehensive perimeter defense. This integration provides enhanced security and peace of mind for users.

AID received an ESX Innovation Award in 2024. This recognition highlights its contribution to the electronic security and life safety industry. The award underscores Alarm.com's commitment to innovation.

The company is enhancing its video analytics capabilities, including the Business Activity Analytics (BAA) solution for the commercial market. BAA provides dashboards for analyzing activity and trends. These insights help commercial subscribers make informed operational decisions.

Alarm.com's platform processed over 345 billion data points in 2024. This data came from more than 160 million connected devices. This demonstrates the company's operational scale and data processing capabilities.

The expansion of the research and development division at its headquarters in Tysons, Virginia, in 2024, included a significant increase in office space. This supports continued growth and technology investment in cloud, IoT, and AI technologies. It shows Alarm.com's dedication to future innovation.

Alarm.com's technological advancements are central to its growth strategy. The company focuses on integrating AI and IoT to enhance its offerings and maintain a competitive edge in the home security market. These advancements drive the company's long-term strategy.

- AI-driven solutions, such as AID, provide proactive security measures.

- Enhanced video analytics, like BAA, offer valuable insights for commercial subscribers.

- Significant investment in R&D, including expansion of facilities, supports continuous innovation.

- Data processing capabilities, handling billions of data points, demonstrate operational scale.

- Focus on cloud, IoT, and AI technologies ensures future relevance and growth.

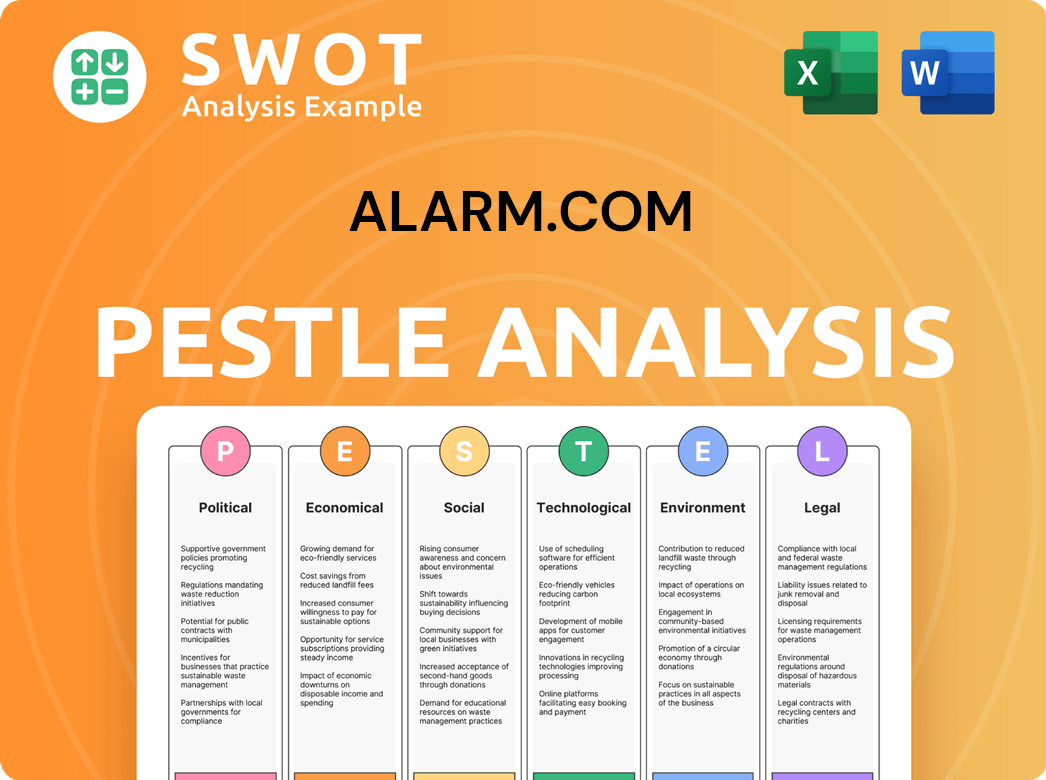

Alarm.com PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Alarm.com’s Growth Forecast?

The financial performance of Alarm.com in 2024 reflects a solid growth trajectory. The company's revenue and profitability metrics show positive trends, driven by increasing demand in the home security market and its expanding user base. This growth is supported by strategic investments in technology and partnerships, positioning the company well for future expansion.

In 2024, Alarm.com demonstrated robust financial health. Key performance indicators show the company's ability to capitalize on opportunities within the smart home technology and security system trends. The company's focus on recurring revenue streams and customer retention has contributed significantly to its financial success.

Alarm.com's financial outlook for 2025 is optimistic, with projected increases in both SaaS and license revenue and total revenue. The company's strong cash position provides financial flexibility to pursue its growth initiatives. The following financial data provides a detailed view of Alarm.com's performance and future expectations.

Total revenue for the full year 2024 increased by 6.6%, reaching $939.8 million, up from $881.7 million in 2023. This growth highlights the company's ability to increase sales and market presence.

SaaS and license revenue, a key driver of growth, increased by 10.9% to $631.2 million in 2024, compared to $569.2 million in the previous year. This increase showcases the success of its recurring revenue model.

GAAP net income saw a significant increase, rising to $122.5 million in 2024 from $80.3 million in 2023. This improvement demonstrates enhanced profitability.

The company's strong cash position, with $1.22 billion in cash and cash equivalents at the end of 2024, provides ample liquidity to support its growth initiatives and future expansion plans.

For the full year 2025, Alarm.com anticipates SaaS and license revenue to be in the range of $671.2 million to $671.8 million, reflecting continued growth in its core business. This projection indicates sustained momentum in the home security market.

Total revenue for 2025 is projected to be between $978.2 million and $980.8 million, demonstrating the company's expectation of continued expansion and success in the smart home technology sector.

Non-GAAP adjusted EBITDA is expected to be in the range of $188.0 million to $192.0 million, showcasing the company's focus on profitability and operational efficiency. This financial metric highlights the company's ability to manage costs effectively.

The issuance of convertible senior notes has further strengthened Alarm.com's financial position, providing additional resources to support its strategic initiatives and investment opportunities. This financial strategy enhances the company's capacity for growth.

Alarm.com's financial health supports its ability to invest in technological advancements and expand its market share. These investments are crucial for sustaining its competitive edge in the home security market.

With a strong financial foundation, Alarm.com is well-positioned to execute its long-term strategy and capitalize on the evolving security system trends. This positions the company to maintain its leadership in the industry.

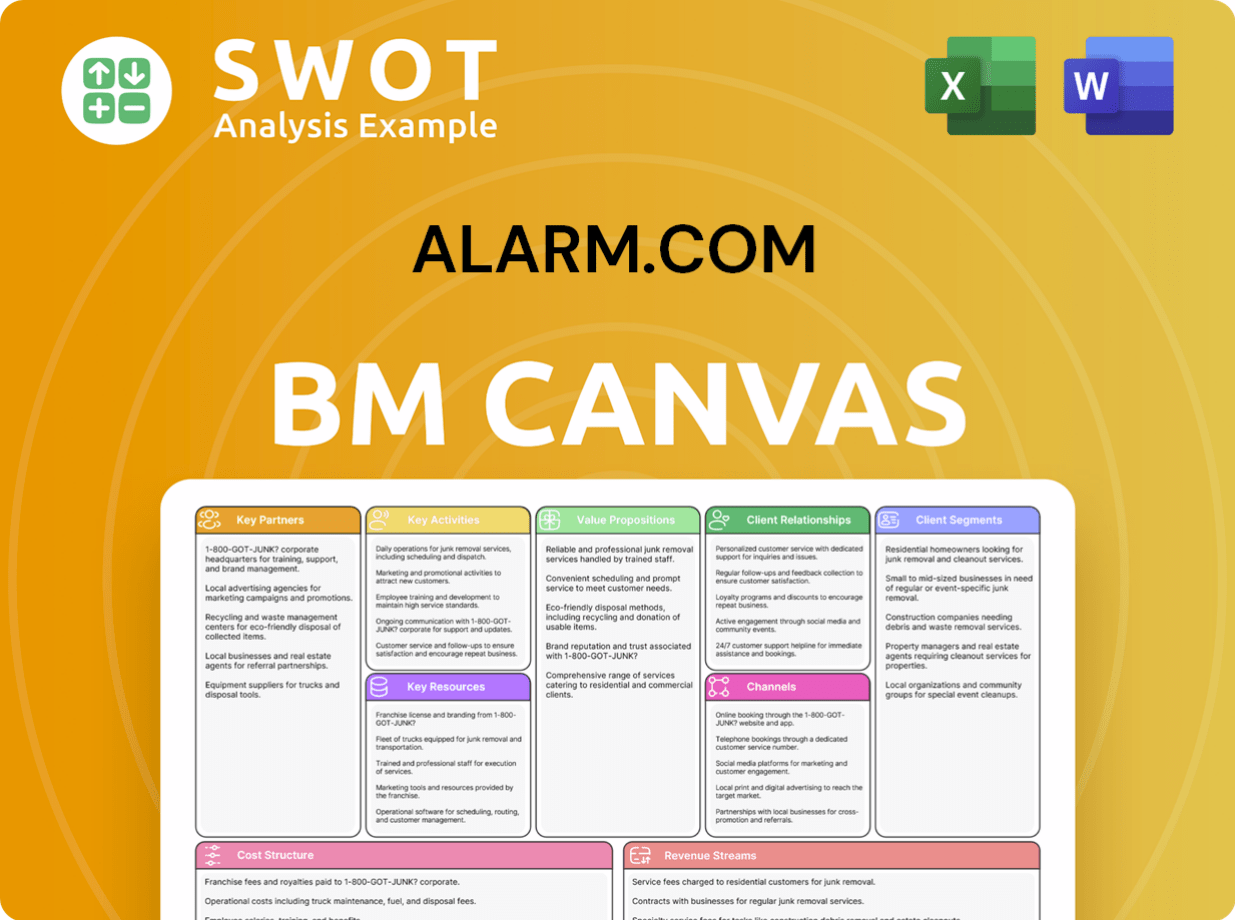

Alarm.com Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Alarm.com’s Growth?

Despite its promising outlook, the future of Alarm.com faces several potential hurdles. The company operates in a competitive market, where it contends with both established players and emerging DIY solutions. Furthermore, changing regulations and unforeseen economic shifts present additional challenges that could impact its performance.

The company's success also hinges on its ability to navigate supply chain complexities and technological disruptions. These factors, combined with its reliance on specific partnerships, require careful management to ensure sustained growth. Addressing these risks is crucial for maintaining its position in the home security market and achieving its long-term goals.

Understanding these potential obstacles is vital for investors and stakeholders evaluating the company's prospects. An in-depth Competitors Landscape of Alarm.com provides further insights into the competitive environment and its implications.

The home security market is highly competitive, with numerous companies vying for market share. Competitors include large tech firms offering DIY solutions, putting pressure on pricing and innovation. This competition could affect Alarm.com's ability to maintain its growth trajectory.

Regulatory changes concerning consumer protection, privacy, and data security pose a significant risk. Evolving regulations could increase compliance costs and potentially limit the services offered. The impact of these regulations needs to be carefully monitored.

Although diversified, the company still sources a portion of its hardware from China. Unpredictable tariff policies or supply chain disruptions could impact its operations. Maintaining a resilient supply chain is essential for business continuity.

Economic and market downturns could reduce demand for its platforms and solutions. A decrease in consumer spending or business investment could negatively affect its financial performance. Monitoring economic indicators is crucial for strategic planning.

A significant portion of revenue historically comes from a limited number of service provider partners. Any disruption in these partnerships could substantially impact revenue. Strengthening relationships with partners is vital for mitigating this risk.

Rapid technological advancements could render existing products obsolete. The company must invest heavily in R&D to stay ahead of the curve. Adaptability and innovation are critical for long-term success.

To address these risks, the company invests in R&D, expands internationally, and strengthens partner relationships. These strategies are designed to mitigate potential challenges and maintain growth. The company's proactive approach is key to its future success.

Analyzing the company's financial performance, including revenue streams and market share, provides a clearer picture of its resilience. Understanding its financial health is crucial for evaluating investment opportunities. This analysis helps in assessing the company's ability to navigate challenges.

Alarm.com Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alarm.com Company?

- What is Competitive Landscape of Alarm.com Company?

- How Does Alarm.com Company Work?

- What is Sales and Marketing Strategy of Alarm.com Company?

- What is Brief History of Alarm.com Company?

- Who Owns Alarm.com Company?

- What is Customer Demographics and Target Market of Alarm.com Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.