Alibaba Pictures Group Bundle

How Did Alibaba Pictures Rise to Entertainment Powerhouse?

Embark on a journey through the dynamic world of entertainment with Alibaba Pictures Group, a leading Alibaba Pictures Group SWOT Analysis. From its inception in 2014, this Alibaba film company has rapidly transformed the Chinese film industry, becoming a major player in content creation, distribution, and marketing. Discover how Alibaba leveraged its digital prowess to reshape the entertainment landscape.

This exploration into the brief history of Alibaba Pictures Group Company reveals a strategic evolution, from its initial investment to its current status as a global entertainment force. Learn about the company's innovative approach, combining content creation with cutting-edge technology and its impact on the film production industry. Understand how this media company continues to shape the future of cinema and entertainment.

What is the Alibaba Pictures Group Founding Story?

The story of Alibaba Pictures Group, formerly known as ChinaVision Media, began with a strategic acquisition in March 2014. Alibaba Group, founded by Jack Ma in 1999, saw a significant opportunity in the burgeoning Chinese film industry. This move marked the official inception of what would become a major player in film production and distribution.

The acquisition, finalized in June 2014, involved Alibaba Group purchasing a 60% stake in ChinaVision Media for $805 million. This strategic move was driven by the rapid growth of the Chinese film market. The company aimed to revolutionize movies and entertainment for the digital age by leveraging Alibaba Group's existing ecosystem.

Alibaba's vision was to capitalize on the growth of the Chinese film industry, which experienced a remarkable increase in box office receipts. The company's initial business model focused on content production, promotion, and distribution, utilizing online platforms. A key figure in this transformation was Zhang Qiang, who joined as the head of Alibaba Pictures in July 2014, bringing extensive industry experience. Learn more about the Growth Strategy of Alibaba Pictures Group.

Alibaba Pictures Group's founding was a strategic move by Alibaba Group to enter the Chinese film industry.

- Renamed in June 2014 after Alibaba Group acquired ChinaVision Media.

- The initial acquisition was for $805 million, securing a 60% stake.

- The company aimed to integrate content production, promotion, and distribution.

- Zhang Qiang, former vice president of China Film Group, became head of Alibaba Pictures.

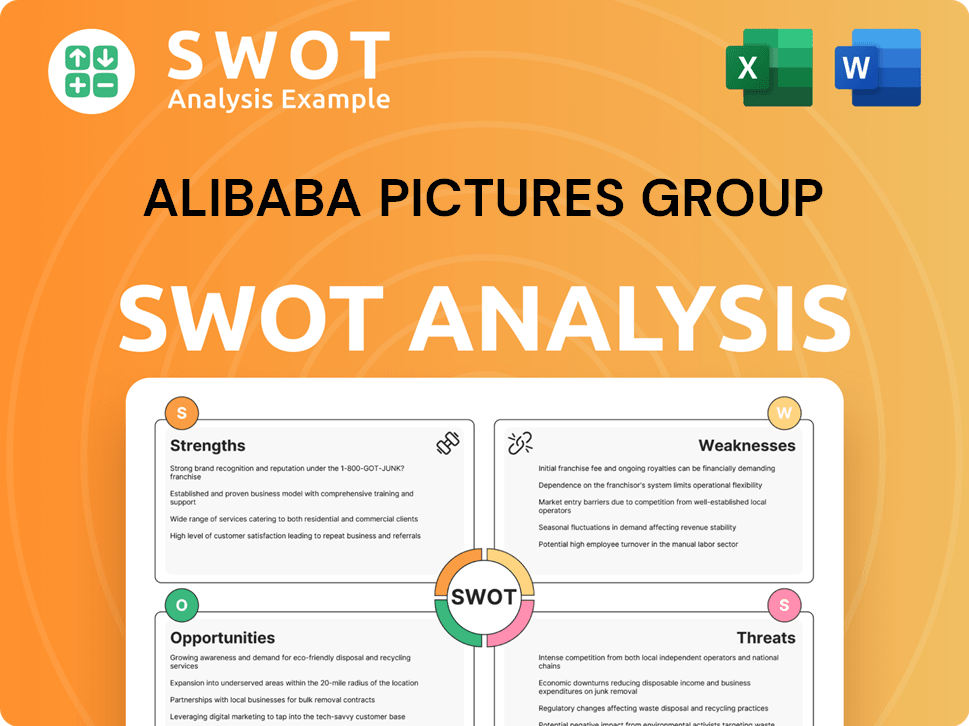

Alibaba Pictures Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Alibaba Pictures Group?

The early growth and expansion of Alibaba Pictures Group were marked by strategic investments and a focus on integrating content with technology. This phase involved significant international collaborations and diversification into live entertainment. These moves were crucial in shaping the company's position within the Chinese film industry and the broader media landscape.

In 2015, Alibaba Pictures made its initial investment in U.S. cinema by supporting Mission: Impossible - Rogue Nation. This was a key step towards international collaboration and distribution for the Alibaba film company. By 2016, Alibaba Group partnered with Steven Spielberg's Amblin Partners, taking a minority equity stake.

The partnership with Amblin Partners included handling marketing, distribution, and merchandising of Amblin Partners films in China. It also involved co-financing films worldwide, highlighting the importance of Alibaba Pictures Group Company's international collaborations. This collaboration drew international attention due to the partnership between a Hollywood giant and a leading Chinese film studio.

In November 2023, Alibaba Pictures completed the acquisition of Pony Media Holdings Inc., operating as 'Damai.' Damai is a leading provider of live performances in China, including concerts, musical festivals, and sports events. This acquisition significantly bolstered Alibaba Pictures' presence in the performance and event ticketing management business.

For the fiscal year ending March 31, 2025, Alibaba Pictures reported an annual revenue of 6.70 billion CNY, reflecting a 33.10% growth. The attributable profit rose 28% to 363.6 million yuan. This financial performance demonstrates the success of its diversified strategy and continuous investment in content and technology, impacting its film production and overall growth.

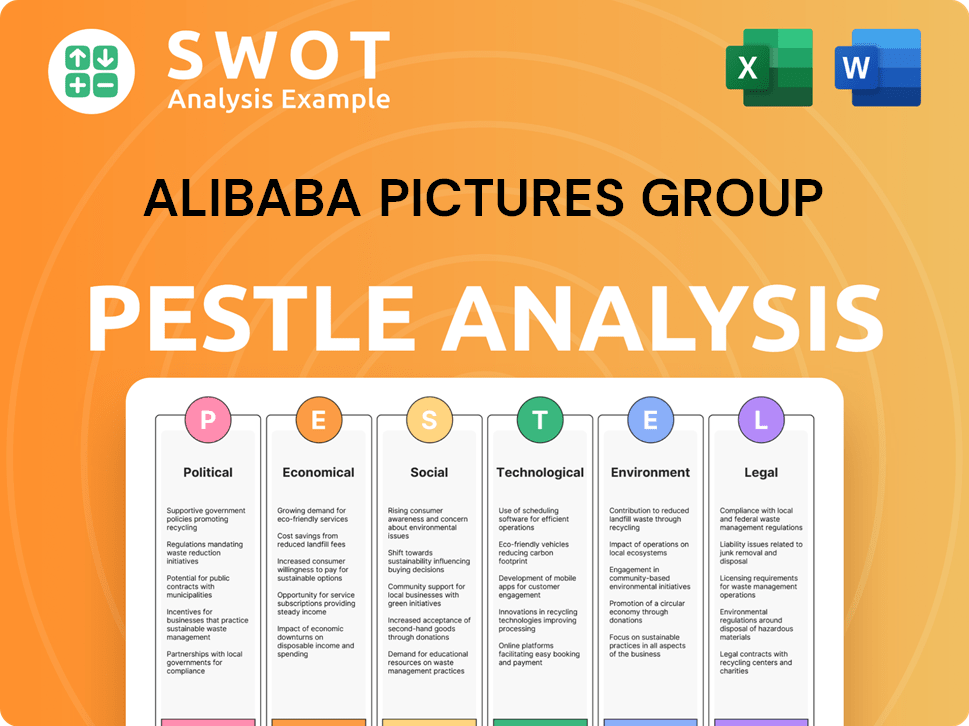

Alibaba Pictures Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Alibaba Pictures Group history?

Alibaba Pictures Group has achieved several significant milestones since its inception, marking its growth and influence within the Chinese film industry and beyond. Marketing Strategy of Alibaba Pictures Group has been a key driver of its success.

| Year | Milestone |

|---|---|

| 2014 | Alibaba Pictures Group was officially established, marking its entry into the media company sector. |

| 2016 | The company formed a major partnership with Steven Spielberg's Amblin Partners for global film production, marketing, and distribution. |

| 2019 | Alibaba Pictures financed 23 films, contributing significantly to China's box office. |

| 2023 | Alibaba Pictures received the 'Most Social Responsible Listed Company' award. |

| 2024 | MSCI upgraded Alibaba Pictures' ESG rating to 'A', reflecting its commitment to environmental, social, and governance practices. |

Alibaba Pictures has embraced technological advancements to transform film production and marketing. The company has invested in virtual studios to enhance digital filming solutions, aiming to reduce costs and boost efficiency in film and television production. Furthermore, it has developed digital humans for commercial use, including endorsements and collaborations.

Alibaba Pictures is committed to integrating content and technology to drive the digital transformation of the entertainment industry.

The company has invested in virtual studios to promote digital filming solutions, aiming to reduce costs and increase efficiency in film and television production.

Alibaba Pictures has developed digital humans that have achieved commercial monetization through endorsements and customized collaborations.

Its smart marketing data product 'Lighthouse AI,' enhanced with the Tongyi Qianwen large model, is also improving user work efficiency.

Despite its achievements, Alibaba Pictures faces challenges such as the slowing global film industry and the impact of the pandemic on the Chinese film market. The company's strategic focus on content production and distribution, however, has shown resilience.

The company has faced challenges, including a slowing global film industry and the impact of the pandemic on the film market in China.

Content revenue saw an 85% year-over-year increase in the six months ended September 30, 2022, due to strong performance in films and drama series.

Alibaba Pictures presented and distributed over 60 films in the reporting period ending March 31, 2024, with nearly 30 as leading promoter and distributor.

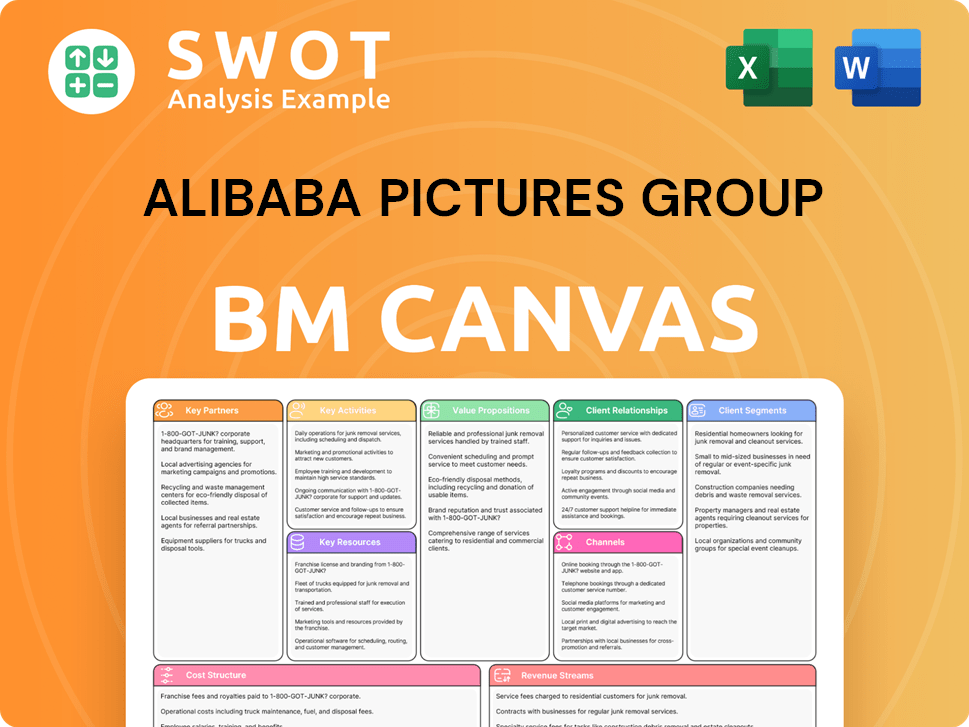

Alibaba Pictures Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Alibaba Pictures Group?

The brief history of Alibaba Pictures Group Company is marked by strategic acquisitions, expansions, and a focus on leveraging technology within the Chinese film industry. The company, a significant media company, has grown rapidly since its inception, becoming a major player in film production and distribution, both domestically and internationally.

| Year | Key Event |

|---|---|

| March 2014 | Alibaba Group acquired a 60% stake in ChinaVision Media for $805 million, marking a pivotal entry into the film industry. |

| April 2014 | 'Alibaba Films Group' was initially registered, later evolving into 'Alibaba Pictures Group,' signaling the company's strategic direction. |

| June 2014 | ChinaVision Media officially rebranded as Alibaba Pictures Group. |

| July 2014 | Zhang Qiang was appointed as the head of Alibaba Pictures. |

| 2015 | Alibaba Pictures made its first investment in a U.S. film, Mission: Impossible - Rogue Nation, expanding its global presence. |

| October 2016 | Alibaba Group partnered with Steven Spielberg's Amblin Partners for co-financing, production, marketing, and distribution, fostering international collaboration. |

| 2019 | Alibaba Pictures financed 23 films, accounting for one-fifth of China's total box office, demonstrating its substantial impact on Chinese cinema. |

| November 2023 | The Group completed the acquisition of Pony Media Holdings Inc., operating as 'Damai,' strengthening its position in live entertainment. |

| March 31, 2024 | Alibaba Pictures' MSCI ESG rating was upgraded to 'A', highlighting its commitment to environmental, social, and governance practices. |

| March 31, 2025 | Alibaba Pictures reported an annual revenue of 6.70 billion CNY, with a 33.10% growth, and an attributable profit rise of 28% to 363.6 million yuan, showcasing strong financial performance. |

| March 2024 | Alibaba Group announced a HK$5 billion (USD 640 million) investment over five years to boost Hong Kong's entertainment industry, with Alibaba Pictures establishing its second headquarters in Hong Kong. |

| May 2025 | Alibaba Pictures' Digital Media and Entertainment Group is rebranded as Hujing Digital Media and Entertainment Group. |

Alibaba Pictures is focused on content investment and technological innovation to drive future growth. The company has over 80 films in its pipeline, with 40 reserved for future market strength. This strategic approach aims to solidify its position in the evolving digital media landscape.

The company is investing in virtual shooting studios and digital humans, promoting AI and new technologies. These advancements aim to reduce costs and increase efficiency in film and television production. This is a key aspect of how Alibaba Pictures Group Company operates.

Alibaba Pictures is expanding its partnerships with other media content and entertainment operations within Alibaba Group. Leveraging the strengths in big data and e-commerce will be critical. Furthermore, the proposed renaming to Damai Entertainment highlights a strategic pivot.

Analysts forecast Alibaba Pictures Group to grow earnings by 33.3% and revenue by 9.9% per annum. This positive outlook is supported by its strategic initiatives and investments in the Chinese film industry. For more details, you can read this article about the [Alibaba Pictures Group's journey](0).

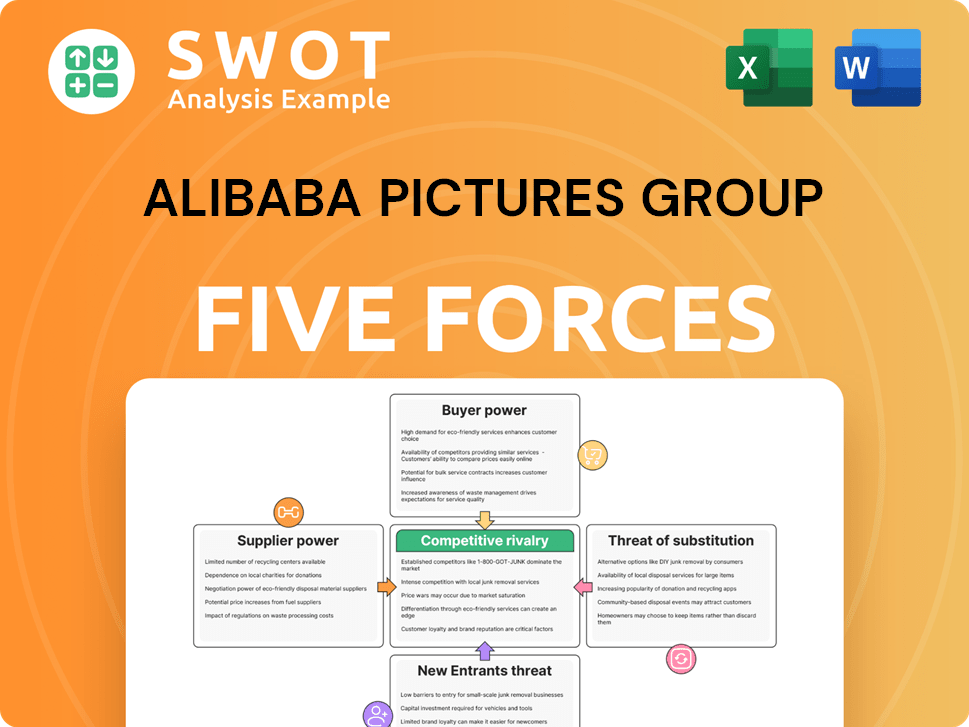

Alibaba Pictures Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Alibaba Pictures Group Company?

- What is Growth Strategy and Future Prospects of Alibaba Pictures Group Company?

- How Does Alibaba Pictures Group Company Work?

- What is Sales and Marketing Strategy of Alibaba Pictures Group Company?

- What is Brief History of Alibaba Pictures Group Company?

- Who Owns Alibaba Pictures Group Company?

- What is Customer Demographics and Target Market of Alibaba Pictures Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.