Alibaba Pictures Group Bundle

Decoding Alibaba Pictures' Audience: Who Are They?

In the ever-evolving Alibaba Pictures Group SWOT Analysis, understanding customer demographics is crucial. The film industry thrives on knowing its audience, and for Alibaba Pictures, this means pinpointing its target market. A deep dive into customer demographics reveals the key to content creation, marketing strategies, and ultimately, success in the competitive entertainment landscape.

Alibaba Pictures Group Company's journey from tech-focused entertainment to a full-fledged film studio hinges on its ability to understand its audience. This comprehensive analysis explores who Alibaba Pictures' main customers are, examining their age range, income levels, and geographic location, including China and Southeast Asia. By analyzing customer behavior and preferences for film genres, we uncover how Alibaba Pictures segments its audience and tailors its content, distribution, and online streaming strategies to meet their evolving demands, ensuring relevance and driving market share within the dynamic film industry.

Who Are Alibaba Pictures Group’s Main Customers?

Understanding the customer demographics and target market is crucial for Alibaba Pictures Group Company's success. The company primarily focuses on two main customer segments: business-to-consumer (B2C) and business-to-business (B2B). This dual approach allows Alibaba Pictures to engage with both individual consumers and industry partners, shaping its content strategy and distribution methods.

For its B2C operations, Alibaba Pictures targets Chinese moviegoers of various age groups, from teenagers to middle-aged adults. This broad demographic is increasingly influenced by digital platforms and social media. The B2B segment includes film studios, independent filmmakers, and other stakeholders in the film industry, who seek financing, production support, and distribution channels.

The company's strategic integration with the broader ecosystem, particularly through platforms like Taopiaopiao, has significantly boosted its market presence. This has allowed Alibaba Pictures to capture a large share of the online movie ticketing market in China. The target market has also expanded to include a wider audience, with the company producing diverse content genres and co-productions.

The primary customer segment for Alibaba Pictures in the B2C market is Chinese moviegoers. This group includes a broad age range, with a significant portion being young adults aged 18-35. These younger demographics are frequent users of online ticketing platforms and are highly engaged with social media for film recommendations. This segment's preferences heavily influence content consumption patterns.

The B2B segment comprises film studios, independent filmmakers, and other industry stakeholders. These customers seek financing, production support, and effective distribution channels. Alibaba Pictures serves as an investor and distributor, providing crucial services to these clients. The company's role is critical in supporting content creation and market access.

Alibaba Pictures employs several market segmentation strategies to reach its target audience. These strategies include segmenting by age, content preference, and geographic location. The company also uses psychographic segmentation, considering the lifestyles and values of its audience. This approach helps tailor content and marketing efforts for maximum impact.

Digital platforms play a crucial role in shaping customer behavior and preferences. Online ticketing platforms, social media, and streaming services are key channels for reaching the target audience. The company leverages these platforms for marketing, promotion, and content distribution. This digital focus is essential for maintaining relevance in the film industry.

The online penetration rate for movie tickets in China reached over 80% in 2023, highlighting the importance of digital platforms. Data from 2024 indicates that younger demographics, particularly those aged 18-35, are the most active consumers of online ticketing services. The company's strategic partnerships and integration with the broader ecosystem have significantly boosted its market share. For more insights into the company's structure, you can explore the Owners & Shareholders of Alibaba Pictures Group.

- Online ticketing penetration rate in China: Over 80% in 2023.

- Primary target audience age range: 18-35 years old.

- Key platforms: Taopiaopiao, social media, and streaming services.

- Strategic focus: Expanding content genres and international co-productions.

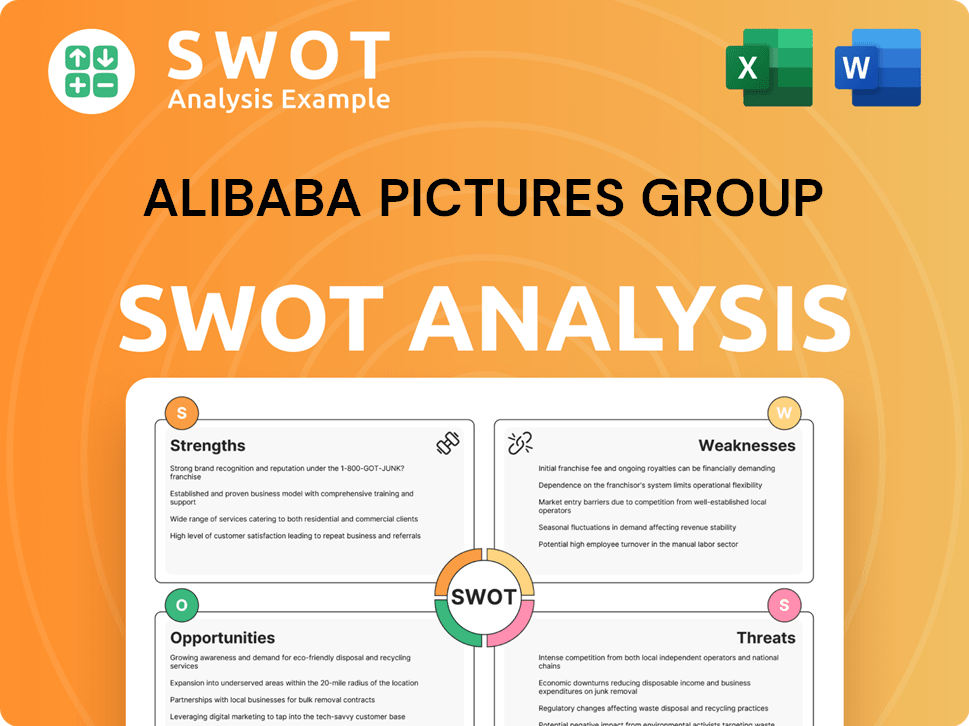

Alibaba Pictures Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Alibaba Pictures Group’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any entertainment company, and for Alibaba Pictures Group Company this is especially true. The company's B2C customers, primarily moviegoers, seek accessible, diverse, and high-quality entertainment experiences. This involves a blend of practical considerations like convenience and affordability, along with psychological drivers such as escapism and social connection.

Convenience is a key factor for customers. They want easy access to information, seamless ticket purchasing, and a comfortable viewing experience. The demand for a wide variety of content, including blockbuster films, independent features, and animated productions, also drives customer preferences. This is reflected in the company's strategy to cater to diverse tastes and attract a broad audience.

The company addresses these needs through its online ticketing platforms and investments in diverse content. This customer-centric approach is essential for maintaining and growing its market share in the competitive film industry.

Customers highly value the ease of purchasing tickets, often using mobile apps for seamless booking and real-time information. This includes features like seat selection and data-driven recommendations. In 2024, mobile ticketing accounted for over 60% of all movie ticket sales in China, highlighting the importance of this preference.

A broad selection of content, including blockbuster films, independent features, and animated productions, is crucial. The co-production of films like 'The Meg 2: The Trench' in 2023 demonstrates the company's commitment to diverse genres. The film industry saw a 15% increase in the popularity of animated films in 2024.

Moviegoers are driven by escapism, social connection, and cultural engagement. Watching films with friends and family enhances the overall experience. Market research indicates that 70% of moviegoers consider the social aspect a key factor in their decision to go to the cinema.

Affordable ticket prices and comfortable cinema environments are practical considerations. The company also focuses on offering premium viewing experiences to cater to evolving customer preferences. The average ticket price in China was around $8 in 2024, showing the importance of competitive pricing.

The company addresses common pain points such as long queues and limited information. Online ticketing platforms like Taopiaopiao offer user-friendly interfaces and data-driven recommendations. Customer satisfaction with online ticketing platforms increased by 20% in 2024.

Market trends, such as the increasing demand for online streaming, influence product development. The company has invested in online distribution models and technologies to enhance the cinematic experience. The online streaming market grew by 25% in 2024.

Alibaba Pictures' target market prioritizes convenience, content variety, and a comfortable viewing experience. Understanding these preferences helps the company tailor its offerings. The company's strategic investments and platform features reflect a deep understanding of these customer needs.

- Convenience: Easy online booking, real-time information, and mobile accessibility.

- Content Diversity: A wide range of genres and film types to cater to different tastes.

- Affordability: Competitive ticket prices and value-added services.

- Viewing Experience: Comfortable cinema environments and premium viewing options.

- Personalization: Data-driven recommendations and personalized content suggestions.

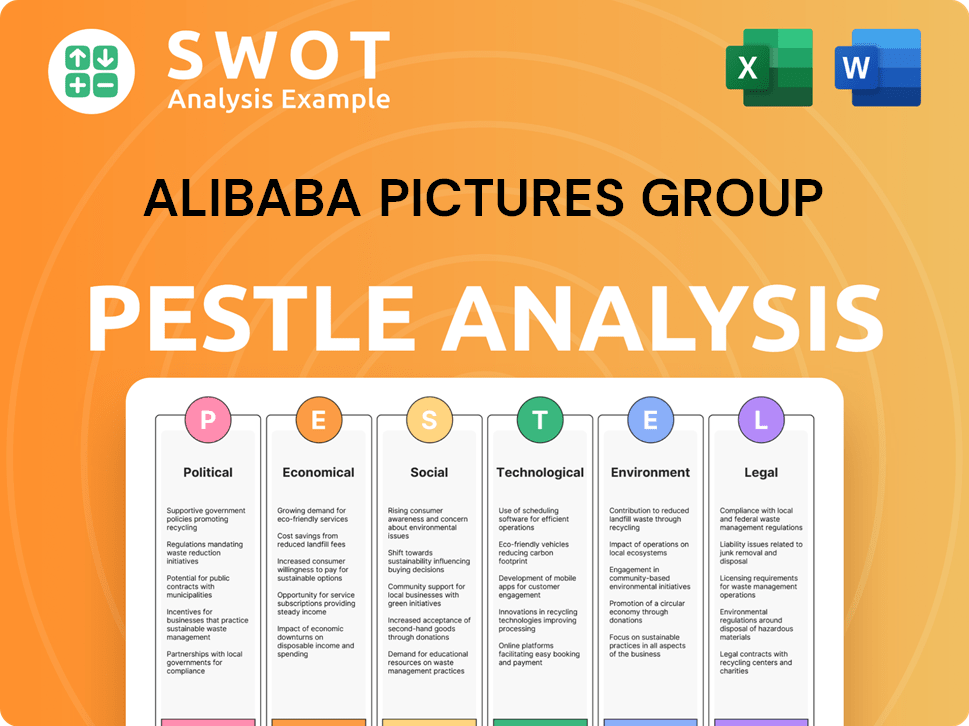

Alibaba Pictures Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Alibaba Pictures Group operate?

The primary geographical market for Alibaba Pictures Group Company is China. The company's operations are heavily concentrated in the Chinese film industry, where it is involved in production, distribution, and online ticketing. This strategic focus allows the company to capitalize on the substantial and growing demand for entertainment within China, making it a key player in the Competitors Landscape of Alibaba Pictures Group.

Within China, Alibaba Pictures targets a diverse range of locations. The company's reach extends from major metropolitan areas like Beijing and Shanghai to the rapidly expanding markets of second and third-tier cities. This multi-tiered approach enables the company to cater to varied audience preferences and capitalize on the increasing cinema infrastructure across different regions.

Through its Taopiaopiao platform, Alibaba Pictures holds a significant share of the online movie ticketing market in China. This platform is a leading competitor, alongside Maoyan, enhancing the company's ability to connect with audiences and gather valuable data on customer behavior and preferences. This data-driven approach supports informed decision-making in content selection and marketing strategies.

Customer demographics vary significantly across China. In larger cities, there's a higher demand for international films and art-house cinema. In contrast, smaller cities often favor domestic blockbusters and family-friendly content. Understanding these differences is crucial for effective market segmentation.

Alibaba Pictures segments its audience by investing in diverse Chinese films and collaborating with local talent. They tailor marketing campaigns to regional tastes to maximize audience engagement. This approach helps them to reach a wider audience base across the country.

Alibaba Pictures has started international co-productions and distribution partnerships to expand its global reach. This strategy aims to diversify revenue streams and enhance brand recognition on a global scale. This move is a key part of their long-term growth strategy.

In 2023, Alibaba Pictures was involved in 'Mission: Impossible - Dead Reckoning Part One,' which indicates a strategic move to participate in the global film market. This participation is a step towards reaching audiences beyond China and increasing international revenue.

The company's strategic focus on China, combined with its moves towards international collaborations, positions it well to adapt to changing audience preferences and market dynamics. This approach is crucial for sustaining growth and competitiveness in the dynamic film industry. The company's ability to understand and cater to diverse customer demographics is key to its success. The Chinese film market generated over $8.9 billion in revenue in 2023, demonstrating the significant potential for companies like Alibaba Pictures.

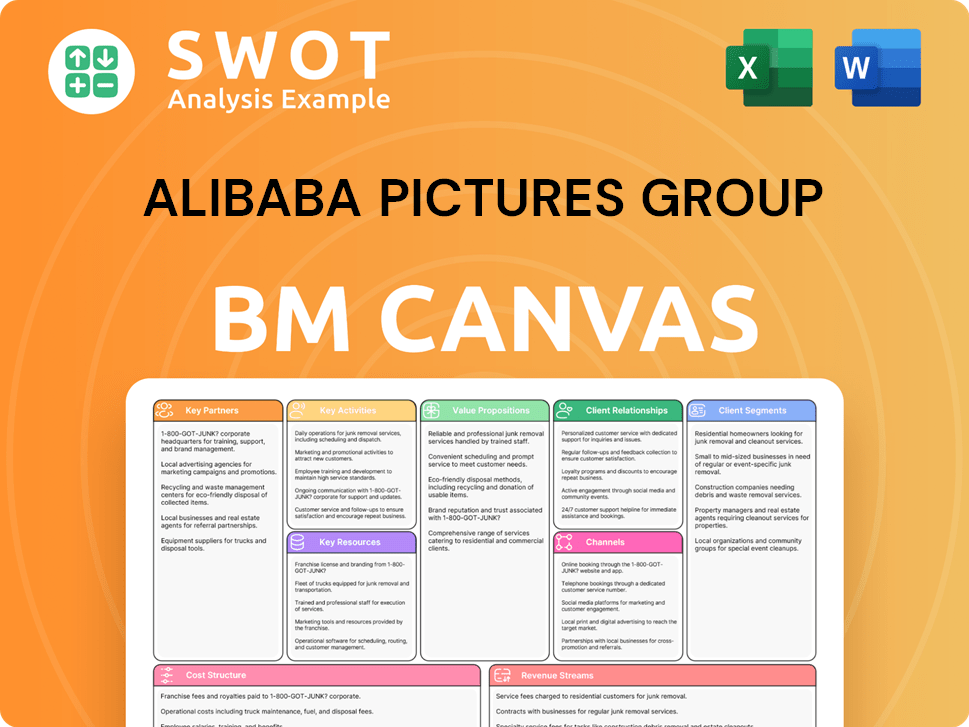

Alibaba Pictures Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Alibaba Pictures Group Win & Keep Customers?

To acquire and retain customers, the company leverages its integration within the broader Alibaba ecosystem, employing a multi-faceted approach. Digital marketing channels are central, utilizing social media platforms like Weibo and Douyin for film promotions, influencer collaborations, and viral marketing. Direct marketing and personalized recommendations are driven by the company's own platforms, such as Taopiaopiao.

Sales tactics include early bird ticket sales, bundled offers, and exclusive content previews to drive initial interest and bookings. Customer data plays a crucial role in campaign targeting, with insights from user behavior on ticketing platforms and other Alibaba services used to personalize recommendations and advertisements. Loyalty programs, often integrated with Alibaba's membership schemes, offer discounts and exclusive content to retain frequent moviegoers.

Strategic partnerships with major film studios for co-production and distribution are a significant acquisition strategy, ensuring a steady stream of highly anticipated content. For example, the company's continued collaboration with major Hollywood studios has been instrumental in attracting viewers. The company's approach has evolved to include increased focus on data analytics for more precise targeting and a greater emphasis on creating engaging online communities around films to foster loyalty and word-of-mouth marketing.

Digital marketing is a cornerstone of the company's customer acquisition strategy. The company uses social media platforms like Weibo and Douyin extensively for film promotions, influencer collaborations, and viral marketing campaigns to reach its target market. These platforms are used to create buzz around upcoming releases and engage with potential viewers.

- Social Media Campaigns: The company invests heavily in social media campaigns to promote its films.

- Influencer Marketing: Collaborations with key opinion leaders (KOLs) on platforms like Douyin and Weibo are common.

- Viral Marketing: The company leverages viral marketing strategies to increase reach and engagement.

Customer data is crucial for targeting campaigns, with the company leveraging insights from user behavior on its ticketing platforms and other Alibaba services to personalize recommendations and advertisements. This data-driven approach helps the company to understand customer preferences and tailor its marketing efforts. Analyzing Revenue Streams & Business Model of Alibaba Pictures Group can provide additional insights into how data is utilized.

- User Behavior Analysis: The company analyzes user behavior on its ticketing platforms to understand customer preferences.

- Personalized Recommendations: Recommendations are tailored based on user data, enhancing the customer experience.

- Targeted Advertising: Advertising campaigns are targeted based on customer demographics and preferences.

Loyalty programs, often integrated with Alibaba's membership schemes, offer discounts, priority access, and exclusive content to retain frequent moviegoers. These programs are designed to build customer loyalty and encourage repeat business. The company focuses on building long-term relationships with its customer base.

- Membership Integration: Loyalty programs are often integrated with Alibaba's membership schemes.

- Exclusive Content: Offers of exclusive content and early access to screenings are common.

- Discounts and Rewards: Discounts and other rewards are provided to loyal customers.

Strategic partnerships with major film studios for co-production and distribution are a significant acquisition strategy, ensuring a steady stream of highly anticipated content. These partnerships provide a consistent supply of high-quality films, which naturally attract large audiences. The company's ability to secure top-tier content is a key factor in its success.

- Co-production Agreements: The company enters into co-production agreements with major film studios.

- Distribution Deals: Securing distribution rights for high-profile films is a priority.

- Content Pipeline: The company focuses on building a strong content pipeline to attract viewers.

Changes in strategy over time have included an increased focus on data analytics for more precise targeting and a greater emphasis on creating engaging online communities around films to foster loyalty and word-of-mouth marketing, reflecting the evolving digital landscape and consumer behavior. The company continuously adapts its strategies to stay relevant in the dynamic film industry.

- Data Analytics: Increased focus on data analytics for more precise targeting.

- Online Communities: Emphasis on creating engaging online communities.

- Adaptation to Consumer Behavior: Strategies reflect the evolving digital landscape and consumer behavior.

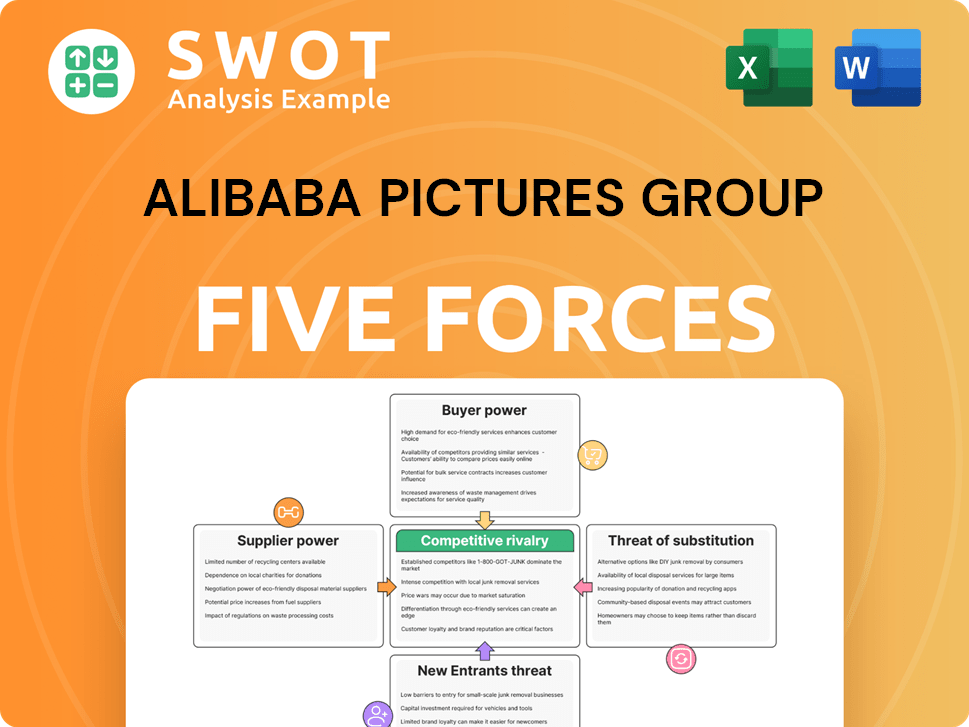

Alibaba Pictures Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alibaba Pictures Group Company?

- What is Competitive Landscape of Alibaba Pictures Group Company?

- What is Growth Strategy and Future Prospects of Alibaba Pictures Group Company?

- How Does Alibaba Pictures Group Company Work?

- What is Sales and Marketing Strategy of Alibaba Pictures Group Company?

- What is Brief History of Alibaba Pictures Group Company?

- Who Owns Alibaba Pictures Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.