ANZ Group Holdings Bundle

How has ANZ Group Holdings Shaped the Financial World?

Journey back to 1835 and discover the origins of ANZ Group Holdings, a financial powerhouse that began as the Bank of Australasia. This ANZ Group Holdings SWOT Analysis reveals a fascinating narrative of growth, innovation, and strategic adaptation within the Australian bank and New Zealand bank landscape. From its humble beginnings, witness how ANZ has evolved to become a major player in the global banking industry.

This brief history of ANZ Bank explores the significant developments that have shaped ANZ Group Holdings. Understanding the ANZ Bank history provides critical insights into the evolution of the ANZ financial group, its mergers and acquisitions, and its impact on the banking industry. Explore the ANZ Bank timeline to uncover key milestones, the ANZ Bank founding date, and ANZ Bank's global presence, offering a complete ANZ Group Holdings company overview.

What is the ANZ Group Holdings Founding Story?

The story of ANZ Group Holdings begins with the establishment of the Bank of Australasia. This occurred on March 18, 1835, in London. The bank then opened its doors in Sydney, Australia, later that year.

The founders were British merchants and bankers. They saw a significant opportunity in providing financial services to the growing British colonies of Australia and New Zealand. Their expertise in finance and trade was crucial for meeting the need for banking services.

Their focus was on commercial banking. They facilitated trade and provided capital for the expansion of agriculture and pastoral activities. The name 'Bank of Australasia' reflected the founders' broad geographical ambitions. Funding came from British investors. The bank faced challenges in a developing economy, including fluctuating commodity prices. The colonial expansion and gold rush eras shaped the bank's early strategies.

ANZ Bank history begins with the Bank of Australasia's establishment in 1835. The bank's founders were British merchants and bankers. They aimed to provide financial infrastructure to the British colonies.

- The Bank of Australasia was founded in London in 1835.

- It opened in Sydney, Australia, in 1835.

- The initial business model focused on commercial banking.

- The bank's early years were marked by challenges in a developing economy.

The Growth Strategy of ANZ Group Holdings has evolved. The bank's early focus was on supporting the economic growth of Australia and New Zealand.

In 2024, the Australian banking industry saw significant changes. The banking industry is a crucial part of the economy. ANZ Group Holdings has grown over time, adapting to changing market conditions and economic cycles. The bank's history reflects its commitment to serving its customers.

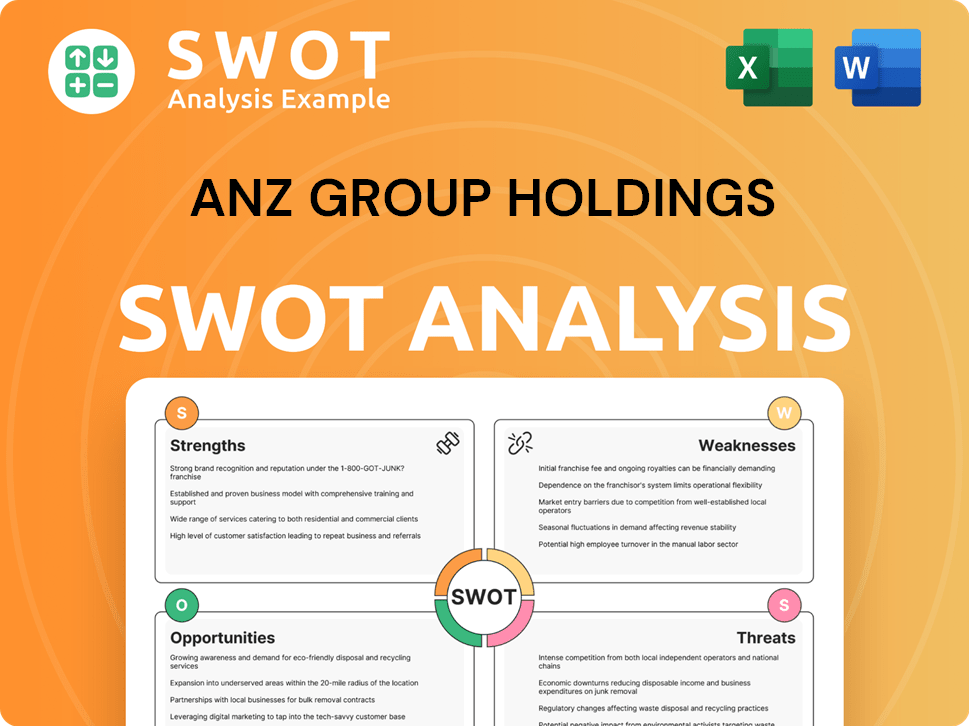

ANZ Group Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of ANZ Group Holdings?

The early growth and expansion of ANZ Group Holdings, stemmed from its predecessor, the Bank of Australasia, and focused on strategic growth across Australia and New Zealand. This ANZ Bank history began with basic deposit accounts, loans, and trade finance. The bank quickly established a branch network to serve a growing customer base, particularly in agricultural and mining areas. Key milestones included opening branches in Melbourne in 1838 and New Zealand in 1840.

The Australian bank initially offered basic financial products. These included deposit accounts, loans for land development, and trade finance. This strategy helped the bank establish a strong foundation in the early years.

The bank strategically expanded its branch network. Branches were opened to serve a growing client base, especially in agricultural and mining regions. This expansion was crucial for reaching customers across diverse geographical areas.

Significant milestones included opening branches in Melbourne in 1838 and in New Zealand in 1840. These expansions marked the New Zealand bank's commitment to growth and service in key regions.

Early team expansion involved recruiting local agents and managers. These individuals oversaw operations in diverse geographical areas. This approach ensured local expertise and efficient management.

A pivotal moment in ANZ Bank history was the 1951 merger of the Bank of Australasia and the Union Bank of Australia, forming the Australia and New Zealand Bank Limited (ANZ Bank). This merger significantly increased ANZ's market share. Further expansion included the acquisition of the English, Scottish and Australian Bank in 1970, leading to the formation of the Australia and New Zealand Banking Group Limited, the direct predecessor of today's ANZ Group Holdings. These mergers were driven by the desire to achieve economies of scale, broaden customer reach, and enhance competitiveness in the banking industry. Leadership transitions, such as new chairmen and CEOs, often coincided with strategic shifts aimed at optimizing growth and responding to market demands. The market reception to these expansions was generally positive, providing greater financial stability and access to services.

The merger of the Bank of Australasia and the Union Bank of Australia formed ANZ Bank. This merger significantly expanded ANZ's footprint and market share. This was a critical step in the bank's early growth.

The acquisition of the English, Scottish and Australian Bank in 1970 was another key expansion. This led to the formation of the Australia and New Zealand Banking Group Limited. This acquisition further solidified its position.

Mergers aimed to achieve economies of scale and broaden customer reach. They also aimed to enhance competitiveness in the consolidating banking sector. These strategies were essential for long-term growth.

Leadership changes often coincided with strategic shifts. New chairmen and CEOs focused on optimizing growth and responding to market demands. These changes helped the bank adapt to evolving conditions.

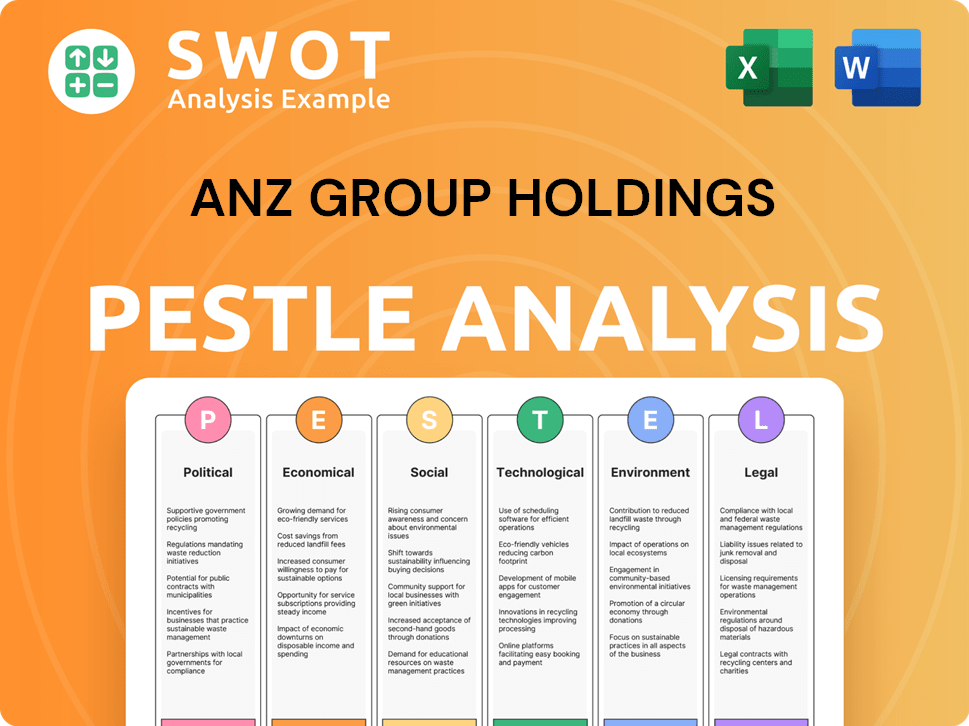

ANZ Group Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in ANZ Group Holdings history?

Throughout its history, ANZ Group Holdings has achieved significant milestones, demonstrating its evolution and resilience within the banking industry. These accomplishments highlight the company's growth and adaptation to changing market conditions.

| Year | Milestone |

|---|---|

| 1970s | Introduction of credit cards, expanding financial services accessibility. |

| 1990s | Pioneering internet banking, enhancing customer convenience and digital presence. |

| Late 1990s | Navigated the Asian Financial Crisis, implementing strategic adjustments. |

| 2008 | Managed the Global Financial Crisis, strengthening risk management practices. |

| Recent Years | Focused on core banking operations in Australia and New Zealand, divesting non-core assets. |

The company has consistently introduced innovations to enhance its services and market position. These innovations have been crucial in adapting to the evolving demands of the banking industry.

Advancements in digital payment solutions have streamlined transactions for customers. This includes mobile payment options and enhanced security features.

The development of sophisticated wealth management platforms has provided customers with better tools for financial planning. These platforms offer personalized investment advice and portfolio management.

Collaborations with fintech companies have expanded digital offerings and enhanced customer experience. These partnerships allow for the integration of innovative technologies.

ANZ has been recognized for its corporate social responsibility and sustainable finance efforts. These initiatives include green bonds and sustainable lending programs.

Significant investments have been made in strengthening compliance frameworks and ethical practices in response to increased regulatory scrutiny. This ensures the bank operates with integrity.

Strategic pivots, such as divesting non-core assets, have allowed ANZ to focus on core banking operations. This has strengthened its position in the Australian and New Zealand markets.

Despite its successes, ANZ Group Holdings has faced several challenges, including market downturns and competitive pressures. The ability to adapt and learn from these experiences has been critical for its ongoing success.

The Asian Financial Crisis and the Global Financial Crisis tested the bank's resilience, requiring strategic adjustments. These events highlighted the importance of robust risk management.

Competition from traditional banks and new digital disruptors has consistently challenged ANZ's market position. The bank must continually innovate to stay ahead.

Product failures, though infrequent, have required agile responses and product refinement. These incidents emphasize the need for thorough testing and customer feedback.

Issues related to regulatory compliance or customer service have led to significant restructuring and rebranding efforts. These crises underscore the importance of ethical practices.

Increased regulatory scrutiny has prompted significant investments in compliance frameworks and ethical practices. This ensures the bank operates with integrity and transparency.

Global events and economic fluctuations can impact the bank's performance and strategic direction. ANZ must remain adaptable to navigate these challenges effectively.

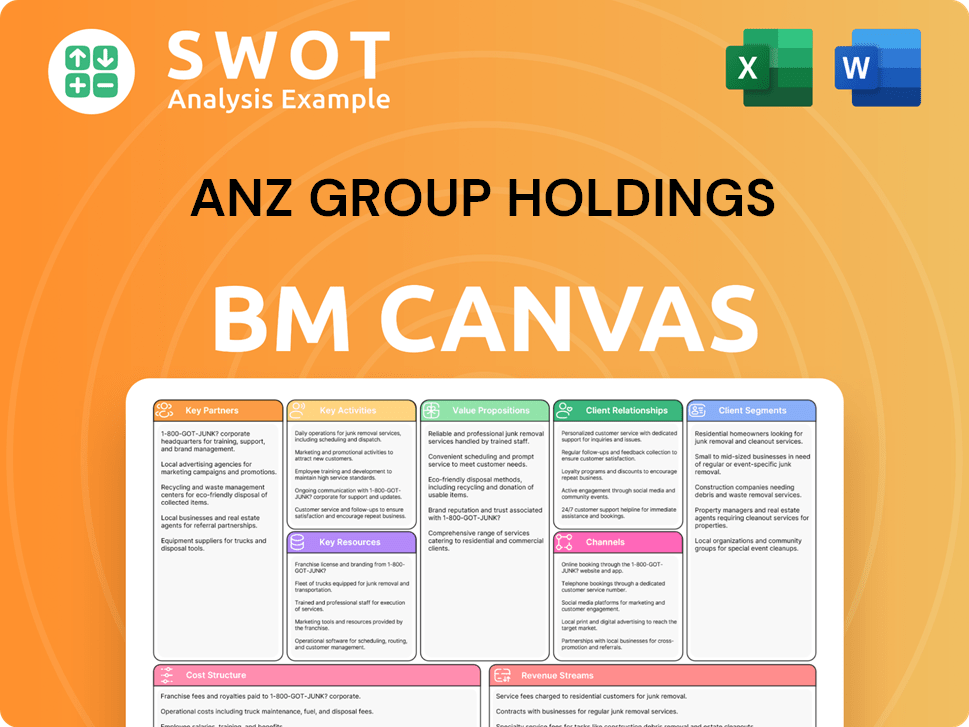

ANZ Group Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for ANZ Group Holdings?

The ANZ Group Holdings has a rich history, evolving from its 19th-century origins to become a leading financial institution in Australia and New Zealand. The ANZ Bank history reflects significant mergers, expansions, and adaptations to technological and economic shifts, shaping its current structure and global presence. The ANZ financial group has continuously innovated to meet the changing needs of its customers and the broader banking industry.

| Year | Key Event |

|---|---|

| 1835 | Bank of Australasia established, marking the beginning of the Australian bank's story. |

| 1840 | Union Bank of Australia established, laying the foundation for future mergers. |

| 1951 | Bank of Australasia and Union Bank of Australia merge to form ANZ Bank. |

| 1970 | ANZ Bank merges with English, Scottish and Australian Bank, creating Australia and New Zealand Banking Group Limited. |

| 1976 | ANZ opens its first representative office in China, expanding its international footprint. |

| 1980s | Significant expansion into Asia, establishing branches and offices. |

| 1990s | Introduction of internet banking and early digital financial services. |

| 2000s | Focus on responsible lending and sustainable finance initiatives. |

| 2010s | Investment in digital transformation and fintech partnerships. |

| 2020s | Continued focus on digital banking and sustainability, emphasizing climate-related financial disclosures. |

ANZ is focused on simplifying its business and strengthening its core franchises in Australia and New Zealand bank. They are also growing their institutional banking presence, particularly in Asia. The company is aiming to deepen relationships with existing clients and selectively pursue opportunities in high-growth Asian markets.

Enhancing digital platforms is a key priority, with a focus on leveraging artificial intelligence for personalized customer experiences. They are also actively developing sustainable finance solutions to align with evolving market demands. As of early 2025, ANZ is actively pursuing its 'Simplification' program.

The accelerating pace of digital disruption, increasing regulatory complexity, and the growing importance of ESG factors are key trends. Analyst predictions suggest continued growth in digital adoption and sustainable finance. These trends will shape the company's strategic direction and operational priorities.

Leadership emphasizes a commitment to being a leading bank in Australia and New Zealand, with a strong regional presence. The focus is on delivering value for shareholders and customers, which remains consistent with the founding vision of providing essential and evolving financial services. The company's forward-looking approach is designed to navigate the evolving financial landscape.

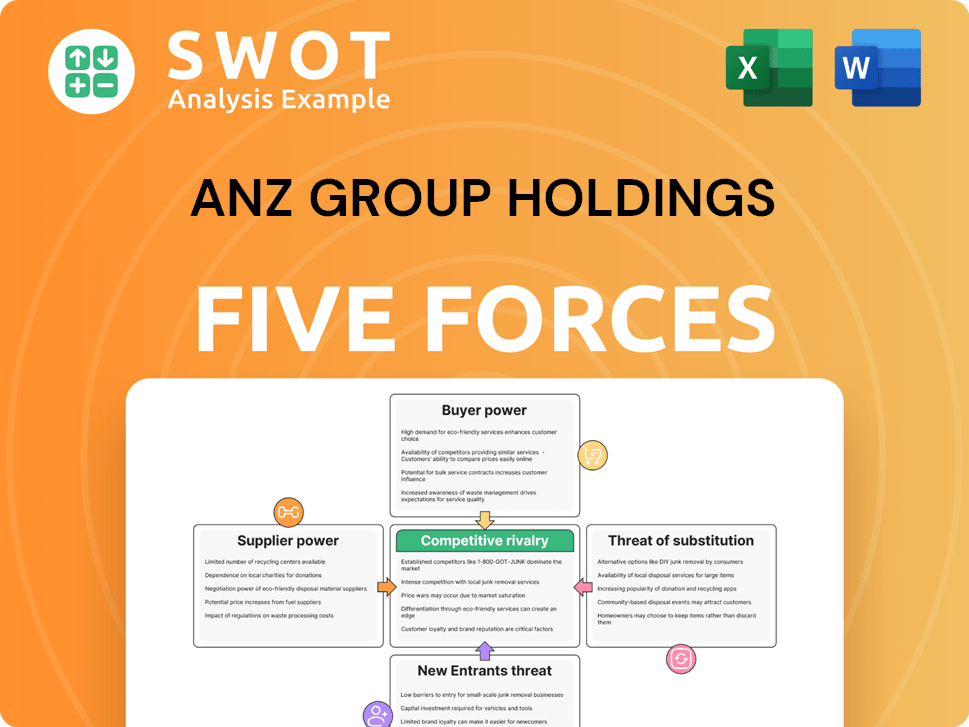

ANZ Group Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of ANZ Group Holdings Company?

- What is Growth Strategy and Future Prospects of ANZ Group Holdings Company?

- How Does ANZ Group Holdings Company Work?

- What is Sales and Marketing Strategy of ANZ Group Holdings Company?

- What is Brief History of ANZ Group Holdings Company?

- Who Owns ANZ Group Holdings Company?

- What is Customer Demographics and Target Market of ANZ Group Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.