ANZ Group Holdings Bundle

How Does ANZ Group Holdings Thrive in Today's Market?

Explore the inner workings of ANZ Group Holdings, a financial powerhouse shaping the landscape of ANZ Australia and beyond. As one of the 'Big Four' banks, ANZ financial services offers a fascinating case study in strategic growth and market adaptation. Discover how ANZ Bank generates revenue and navigates the complexities of the global economy.

With a recent surge in profits, understanding ANZ Group Holdings' operational strategies is more critical than ever. This analysis will dissect its diverse revenue streams, from retail and commercial banking to institutional services, providing a comprehensive view of its financial performance. For investors seeking to understand the ANZ Group Holdings SWOT Analysis, this is your gateway to informed decision-making, exploring the company's strengths, weaknesses, opportunities, and threats within the competitive banking sector, including insights on the ANZ share price, ANZ banking, and more.

What Are the Key Operations Driving ANZ Group Holdings’s Success?

The core operations of ANZ Group Holdings revolve around providing a comprehensive suite of banking and financial services. These services cater to a diverse clientele, including retail, commercial, and institutional customers. ANZ's value proposition lies in its ability to offer a wide array of financial products and services, supported by a robust operational framework and a global presence.

ANZ's offerings include home and personal loans, deposits, credit cards, wealth management, and investment banking. These services are delivered through multiple channels, such as a broad branch network, home loan specialists, contact centers, self-service platforms, and third-party brokers. The company's operational processes are designed to support these diverse offerings, ensuring accessibility and efficiency for its customers.

The company's operational success is evident in its financial performance. For example, in the first half of FY2025, ANZ Australia Retail saw a system home loan growth of 3%, with customer deposits increasing by 4%. The digital banking platform, ANZ Plus, has been a significant success, attracting one million customers and over $20 billion in deposits. The commercial sector contributed 22% of the total group revenue in the first half of FY2025.

ANZ provides a wide range of retail banking services, including home and personal loans, deposits, and credit cards. These services are accessible through branches, online platforms, and mobile apps. The bank focuses on customer convenience and digital innovation to enhance the banking experience.

For commercial clients, ANZ offers asset financing, working capital, and liquidity solutions. The commercial banking segment supports businesses of various sizes, providing tailored financial products and services to meet their specific needs. This segment is a key contributor to the overall revenue.

The Institutional business serves global institutional and business customers, focusing on transaction banking, corporate finance, foreign exchange, and risk management. This division has shown strong growth in operational deposits and core lending, both up 4% (FX adjusted), and has delivered a fifth consecutive half of 13%+ return on equity.

ANZ operates in 29 markets across Asia-Pacific, Europe, North America, and the Middle East. The bank's supply chain involves extensive partnerships and distribution networks, including third-party brokers for loan distribution. This international presence allows ANZ to facilitate trade and investment flows.

ANZ's global presence and diversified service offerings contribute to its strong market position. The bank's ability to facilitate trade and investment flows, along with its on-the-ground expertise, provides tailored solutions and diversification outside its home markets. For more insights into the strategic direction of the company, consider exploring the Growth Strategy of ANZ Group Holdings.

ANZ distinguishes itself through its comprehensive service offerings and extensive global footprint. Its focus on digital innovation and customer-centric solutions further enhances its competitive advantage.

- Extensive international presence across 29 markets.

- Strong growth in digital banking platforms like ANZ Plus.

- Diversified revenue streams from retail, commercial, and institutional banking.

- Focus on customer-centric solutions and digital innovation.

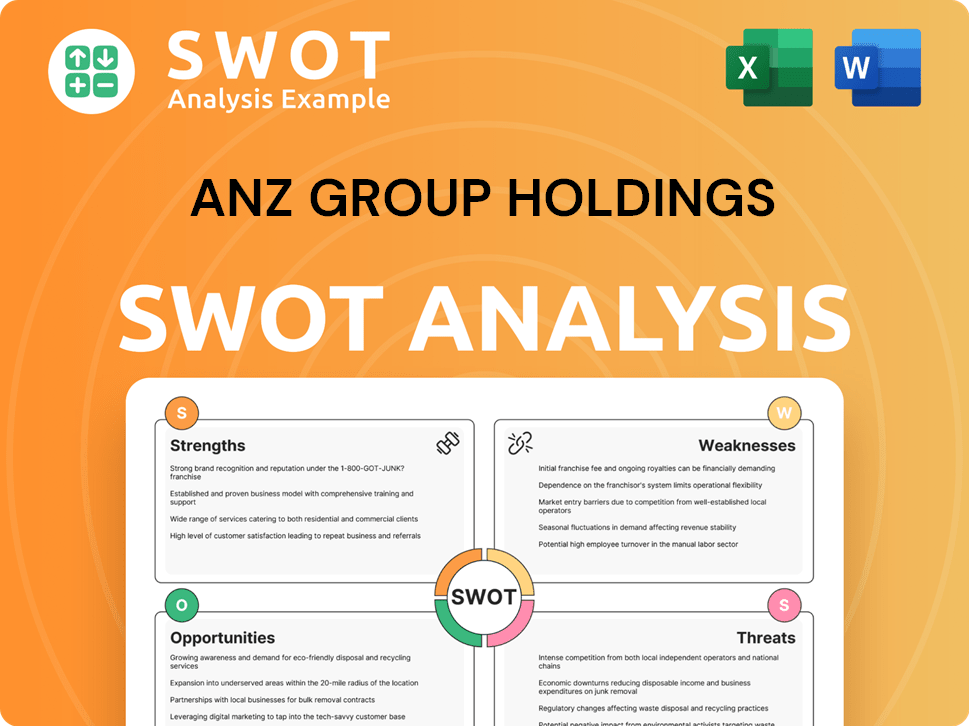

ANZ Group Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ANZ Group Holdings Make Money?

The revenue streams and monetization strategies of ANZ Group Holdings are multifaceted, reflecting its diverse financial services offerings. The company generates income through a variety of channels, including net interest income, fees, commissions, and its Markets business. In 2024, the total revenue for ANZ Group Holdings reached AUD 20.14 billion.

For the six months ending March 31, 2025, ANZ reported a 5% increase in revenue, reaching AUD 10,995 million. This growth underscores the company's ability to maintain and expand its revenue base. The bank's strategic initiatives and market performance have contributed to its financial success.

ANZ's banking business, encompassing retail, commercial, and institutional banking (excluding Markets), saw a 5% revenue increase in the first half of FY2025, with a Return on Equity of 14%. The Markets Business achieved over AUD 1 billion in income for the third consecutive first half, driven by increased customer activity. Other income streams include foreign exchange-related earnings in Transaction Banking, Corporate Finance, and Central Functions, which saw a AUD 14 million increase in the Institutional division.

ANZ employs various monetization strategies to enhance its financial performance. These strategies include leveraging digital platforms, strategic acquisitions, and a diversified portfolio of financial services. The company's focus on customer engagement and market expansion has driven its revenue growth.

- The digital platform, ANZ Plus, has attracted over one million customers and more than AUD 20 billion in deposits.

- The acquisition of the Suncorp Bank business in July 2024 significantly contributed to revenue growth.

- International markets reported a 16% revenue increase in the first half of FY2024, demonstrating the company's global reach.

- ANZ's diversified portfolio provides a stable revenue base.

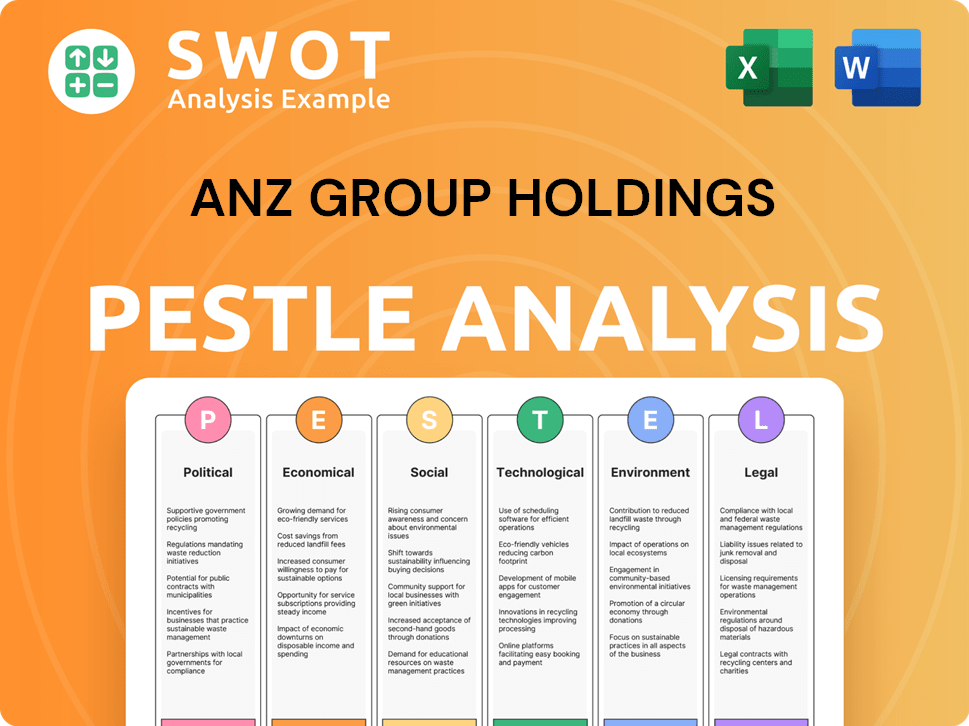

ANZ Group Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ANZ Group Holdings’s Business Model?

Let's explore the key milestones, strategic moves, and competitive advantages of ANZ Group Holdings. This analysis will cover significant developments that have shaped the company's trajectory and financial performance, including its recent acquisition and digital banking advancements. We'll also examine the challenges ANZ faces and how it leverages its strengths to maintain a competitive edge in the financial services sector.

ANZ has demonstrated strategic agility and a commitment to growth, as seen in its recent acquisitions and digital initiatives. The company's ability to adapt to market changes and invest in innovative solutions is crucial for its long-term success. Moreover, the company's focus on sustainability and ESG-focused investments reflects its broader commitment to responsible business practices.

The information below highlights key aspects of ANZ's operations and strategic direction, offering insights into its financial performance and competitive positioning. This information is crucial for understanding the dynamics of ANZ within the financial services landscape and for making informed decisions.

ANZ has achieved several significant milestones. A notable strategic move was the acquisition of the Suncorp Bank business, which was completed at the end of July 2024. The digital banking platform, ANZ Plus, has surpassed one million customers and AUD 20 billion in deposits.

The acquisition of Suncorp Bank has been a key driver of growth, contributing to a 5% increase in revenue and a 12% lift in cash profit for the first half of FY2025. ANZ is also focused on resolving non-financial risk issues and embedding necessary changes to meet regulatory requirements.

ANZ's competitive advantages stem from its diversified business model, strong brand, and extensive international network. The Institutional division's focus on low-risk processing businesses has led to record revenue, profit before provisions, and return on equity in 2024.

ANZ faces ongoing competition and regulatory scrutiny. The Australian Prudential Regulation Authority (APRA) increased the capital add-on applied to ANZ from AUD 750 million to AUD 1 billion in April 2025 due to weaknesses in non-financial risk management.

ANZ is strategically positioned for future growth by focusing on digital innovation, international expansion, and sustainability. The bank's commitment to facilitating at least AUD 100 billion in social and environmental activities by 2030 underscores its dedication to ESG principles. This positions ANZ to benefit from the growing demand for ESG-focused investments.

- Expansion of digital banking platforms like ANZ Plus to enhance customer experience.

- Further development of its international network to mitigate domestic market risks.

- Alignment of business strategy with global sustainability goals.

- Continuous improvement in risk management practices to meet regulatory standards.

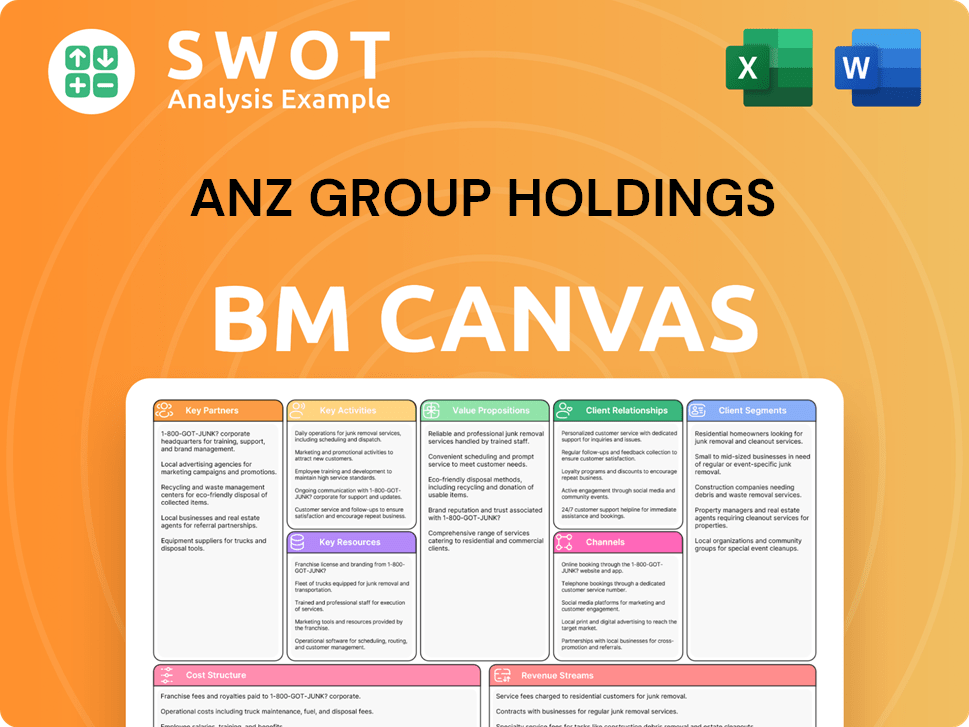

ANZ Group Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ANZ Group Holdings Positioning Itself for Continued Success?

Let's delve into the industry position, risks, and future outlook for ANZ Group Holdings. As one of Australia's 'Big Four' banks and the largest in New Zealand, ANZ holds a strong market position. Its extensive international presence and continuous investment in digital platforms like ANZ Plus help foster customer loyalty.

Despite its strengths, ANZ faces several risks, including competition, regulatory changes, and economic challenges. Looking ahead, ANZ focuses on resolving non-financial risk issues, growing its dual platforms, and integrating the Suncorp Bank business. The bank's strategic initiatives aim to enhance customer service, manage costs, and improve productivity.

ANZ is a major player in the Australian and New Zealand banking sectors. It holds nearly 15% of the business and home loan market share in Australia. Its international presence spans 29 markets across Asia-Pacific, Europe, North America, and the Middle East, which provides diversification.

ANZ faces competition in the banking sector, regulatory scrutiny, and economic challenges. APRA increased ANZ's operational risk capital overlay. Continued financing of fossil fuels poses legal and reputational risks if not aligned with climate commitments.

ANZ aims to grow its dual platforms and integrate the Suncorp Bank business. The bank's five-year Climate and Environment Strategy, approved in October 2024, includes building capabilities in understanding climate and nature risks. Analysts project earnings growth of 9% over the next two years.

ANZ's capital position remains strong, with a Common Equity Tier 1 Ratio of 11.8% as of March 31, 2025. Dividends are forecast to grow by 1.8% to AUD 1.72 per share. For more insights into the bank's target market, consider reading the article about Target Market of ANZ Group Holdings.

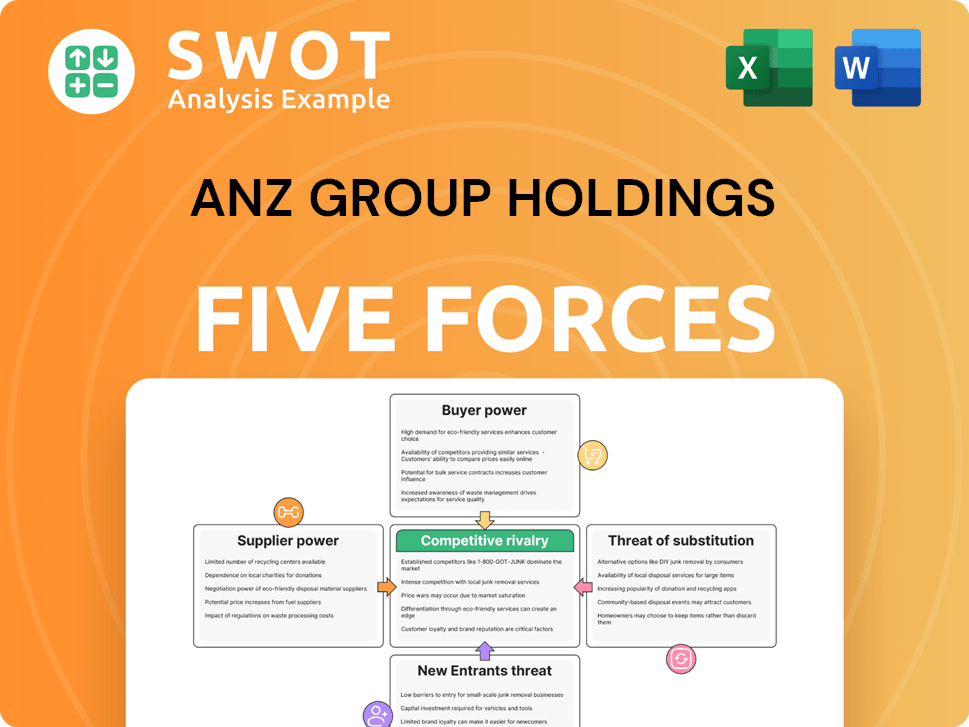

ANZ Group Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ANZ Group Holdings Company?

- What is Competitive Landscape of ANZ Group Holdings Company?

- What is Growth Strategy and Future Prospects of ANZ Group Holdings Company?

- What is Sales and Marketing Strategy of ANZ Group Holdings Company?

- What is Brief History of ANZ Group Holdings Company?

- Who Owns ANZ Group Holdings Company?

- What is Customer Demographics and Target Market of ANZ Group Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.