Asr Nederland Bundle

How well do you know the history of Asr Nederland?

Journey back in time to discover the fascinating Asr Nederland SWOT Analysis and the evolution of a Dutch financial powerhouse. From its humble beginnings in 1789, Asr company has transformed into a leading force in the insurance and financial services sector. Explore the key milestones and strategic decisions that have shaped Asr history and its enduring legacy in the Netherlands.

Delving into the brief history of Asr Nederland company reveals a story of resilience and innovation. The Asr group's commitment to providing reliable financial security has been a constant throughout its journey. Understanding Asr insurance's roots provides valuable context for its current market position and future prospects within the Dutch market and beyond.

What is the Asr Nederland Founding Story?

The story of the Asr Nederland company, a prominent player in the Dutch financial landscape, is rooted in the evolution of insurance services in the Netherlands. Understanding the Asr history involves tracing its origins back to the late 18th century, a period marked by significant societal and economic changes.

The brief history of Asr Nederland company begins with the merger of several entities. The most notable of these was 'De Weduwe van Stuyvesant,' a fire insurance company established in 1789. The formation of Asr company reflects the need for reliable financial protection in a rapidly industrializing society.

The company's initial objective was to provide essential financial protection, starting with fire insurance. The business model centered on offering fundamental insurance policies to individuals and businesses. Early funding likely came from mutual principles or initial capital contributions, mirroring the practices of insurance establishments during that era. The company's name, Asr, is an abbreviation of Amersfoortse Stedelijke Verzekeringen, reflecting its historical connection to Amersfoort, a Dutch city.

The founding of Asr Nederland was driven by the need for financial protection in the face of increasing industrialization and urbanization in the Netherlands.

- The primary focus was on providing fire insurance, expanding later to include life insurance and other financial services.

- Early funding models were based on mutual principles and capital contributions from founders and stakeholders.

- The company's evolution through mergers and acquisitions shaped its structure and growth over time.

- The cultural and economic context of the late 18th and 19th centuries significantly influenced the creation and expansion of protective financial services.

The Dutch market, where Asr Nederland operates, has seen significant changes. In 2024, the insurance industry in the Netherlands generated approximately €45 billion in premium income. This reflects a stable market with a consistent demand for insurance products. The company's ability to adapt to these market dynamics is crucial. For more insights, you can explore the Marketing Strategy of Asr Nederland.

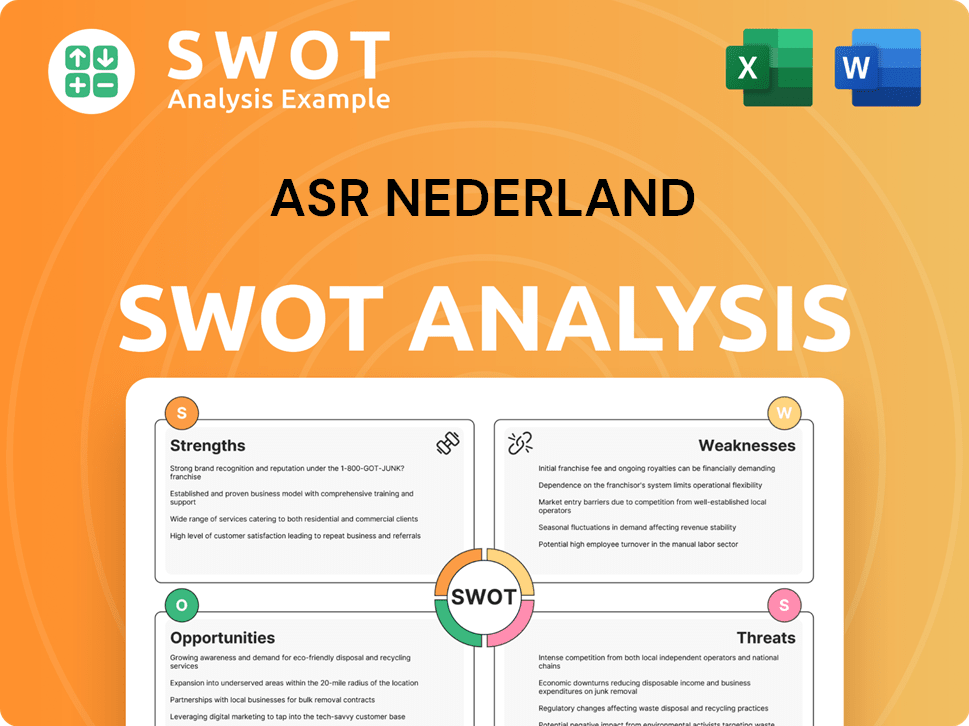

Asr Nederland SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Asr Nederland?

The early growth of the Asr Nederland company was marked by strategic mergers and acquisitions, consolidating smaller insurance entities into a more substantial organization. This period saw the expansion of its product offerings beyond fire insurance to include life and other non-life insurance options. This growth was fueled by the increasing financial risk awareness among the Dutch population and evolving societal needs. Understanding the Target Market of Asr Nederland is crucial to understanding its growth.

During the 20th century, Asr Nederland significantly expanded its presence within the Netherlands. It established a robust distribution network and grew its customer base. Key milestones included integrating various insurance portfolios and professionalizing operations. The company strategically entered new product categories such as pensions and mortgages to offer a comprehensive suite of financial services.

The company's history includes periods of ownership under larger financial groups. A pivotal shift occurred in 2016 when Asr Nederland re-established itself as an independent, publicly listed company. This strategic move allowed Asr to focus on the Dutch market and its core competencies, leading to sustained growth and improved market reception. This independence has been crucial for its financial performance.

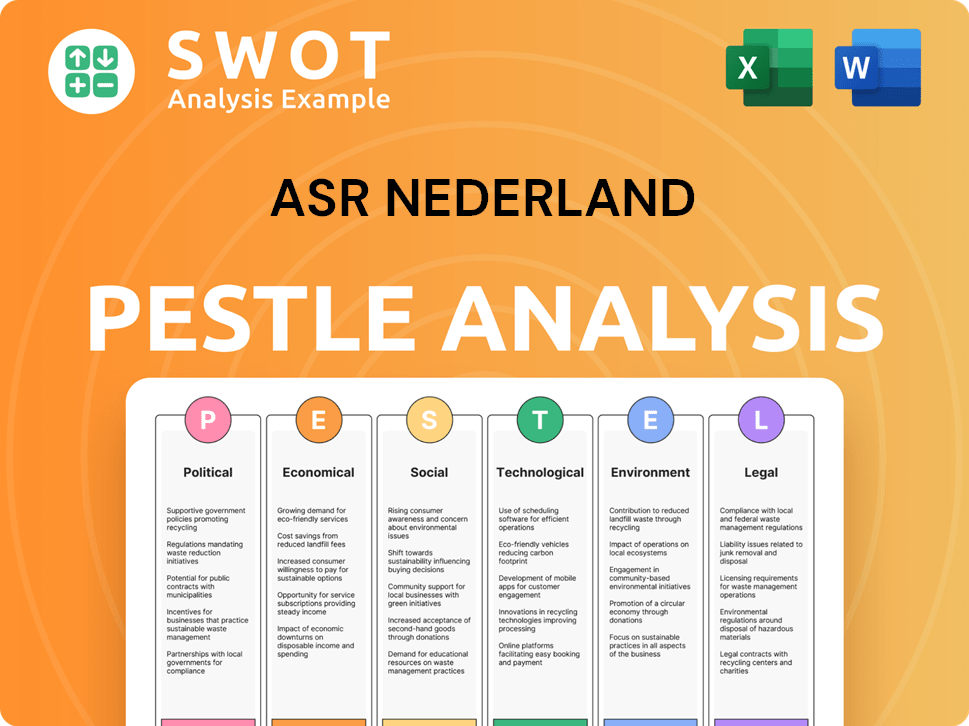

Asr Nederland PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Asr Nederland history?

The Asr Nederland has marked several significant milestones throughout its history, demonstrating its adaptability and strategic focus within the financial sector. This journey reflects a commitment to innovation and resilience, particularly in navigating the complexities of the insurance and financial services industries.

| Year | Milestone |

|---|---|

| 2016 | Re-listing as an independent, publicly listed entity following divestment from Fortis, allowing a strategic focus on the Dutch market. |

| 2023 | Achieved a net profit of EUR 954 million, reflecting strong financial performance and strategic execution. |

| 2023 | Reported a Solvency II ratio of 197% as of December 31, 2023, indicating robust financial health and stability. |

Innovation at Asr Nederland is evident in its consistent focus on sustainability and the development of products that promote responsible financial planning. The company has been an early adopter of sustainable investment principles, integrating them into its core business strategies.

Early integration of sustainable investment principles into its financial strategies, demonstrating a commitment to environmental, social, and governance (ESG) factors. This approach has influenced product development and investment decisions, aligning with broader market trends towards responsible investing.

Launch of groundbreaking products aimed at promoting sustainable living and responsible financial planning, catering to evolving consumer preferences and societal needs. These products reflect a proactive approach to market demands and a commitment to innovation in the insurance and financial services sectors.

Despite its successes, Asr Nederland has faced significant challenges, including market fluctuations and regulatory changes. The company's ability to adapt to these challenges has been crucial for its long-term success, as highlighted in the Growth Strategy of Asr Nederland.

Navigating economic downturns, such as the 2008 financial crisis, which required strategic repositioning and strengthening of the capital base to maintain financial stability. These efforts demonstrate the company's resilience and proactive risk management strategies.

Intense competition within the insurance and financial services sectors, necessitating continuous innovation and customer-centric strategies to maintain market share and profitability. This competitive landscape drives the company to enhance its offerings and improve operational efficiency.

Adapting to evolving regulatory pressures, including changes in solvency requirements and compliance standards, which require robust risk management and strategic adjustments. These changes influence the company's operational and financial strategies.

Successfully divesting from its previous parent company, Fortis, and re-establishing itself as an independent entity, which involved significant strategic and operational adjustments. This transition allowed Asr Nederland to focus on the Dutch market.

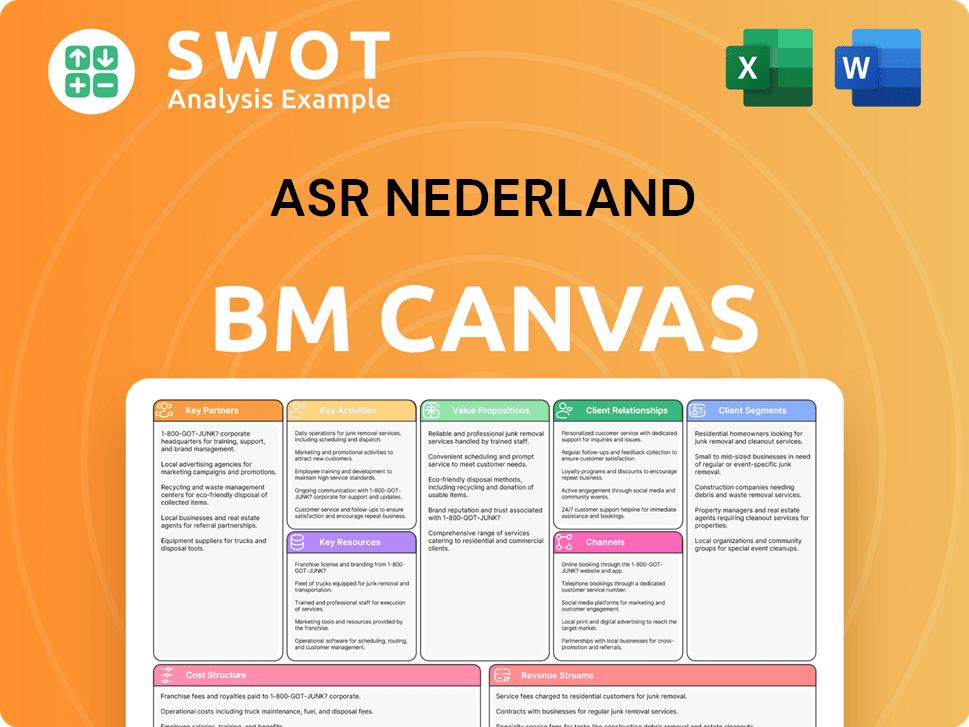

Asr Nederland Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Asr Nederland?

The Asr Nederland company has a rich history, evolving from its roots in the late 18th century to a significant player in the Dutch financial market. This timeline highlights key milestones in the Asr history and development of the Asr company.

| Year | Key Event |

|---|---|

| 1789 | Founding of 'De Weduwe van Stuyvesant', a precursor to a.s.r. |

| Late 18th - 19th Century | Gradual consolidation of various Dutch insurance companies. |

| 20th Century | Expansion of product offerings to include life insurance, pensions, and mortgages. |

| Early 2000s | Integration into the Fortis group. |

| 2008-2009 | Global financial crisis impacts the financial sector, leading to significant restructuring efforts. |

| 2016 | a.s.r. becomes an independent, publicly listed company on Euronext Amsterdam. |

| 2020 | a.s.r. reports a net profit of EUR 776 million. |

| 2022 | a.s.r. announces its intention to acquire the Dutch activities of Aegon. |

| 2023 | a.s.r. reports a net profit of EUR 954 million. |

| 2024 | a.s.r. reports a Solvency II ratio of 197% as of December 31, 2023. |

| 2025 | Continued focus on integrating Aegon Nederland and achieving synergy targets. |

The successful integration of Aegon Nederland, completed in 2024, is a central focus. This integration aims to generate substantial synergies, strengthening Asr insurance and Asr financial services market positions, especially in pensions and mortgages. The company is working on achieving the anticipated benefits from this acquisition.

Asr Nederland continues to prioritize sustainable investments and the development of products that support a more sustainable society. This commitment aligns with growing consumer demand for responsible financial solutions. The company is actively integrating ESG factors into its investment strategies.

The company aims to expand its market share within the Dutch insurance and financial services sectors. Leveraging its strong brand reputation and customer trust is key to this strategy. They are focusing on innovative products and services to attract and retain customers.

The company has set ambitious targets for growth and profitability, including a dividend per share of EUR 2.70 for the financial year 2024. These financial goals reflect the company's confidence in its strategic initiatives and its ability to deliver value. The Asr group is focused on maintaining strong financial performance.

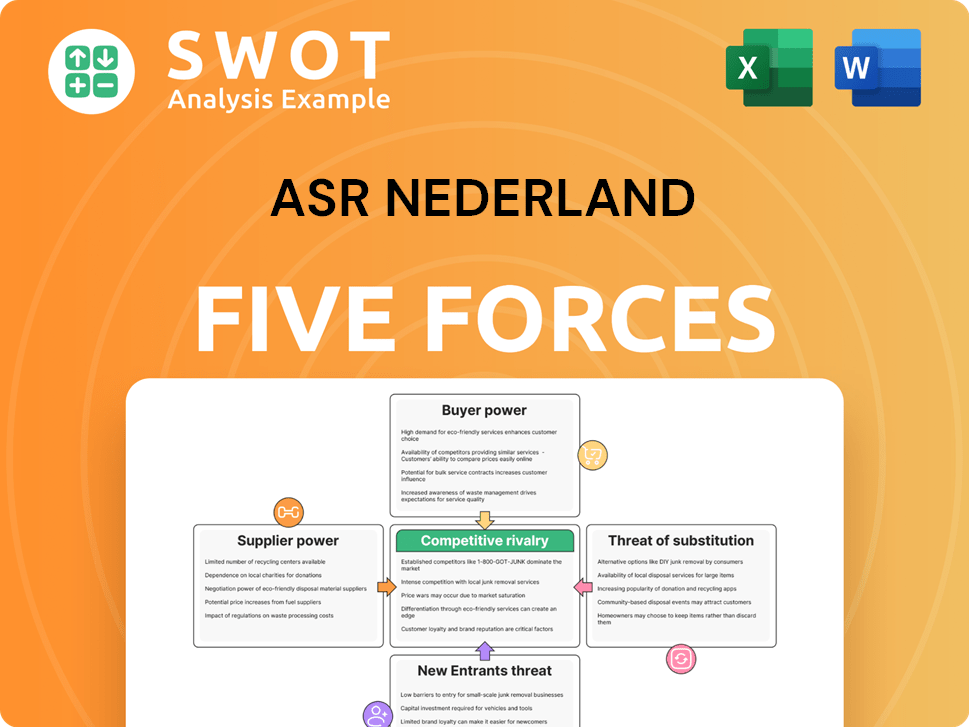

Asr Nederland Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Asr Nederland Company?

- What is Growth Strategy and Future Prospects of Asr Nederland Company?

- How Does Asr Nederland Company Work?

- What is Sales and Marketing Strategy of Asr Nederland Company?

- What is Brief History of Asr Nederland Company?

- Who Owns Asr Nederland Company?

- What is Customer Demographics and Target Market of Asr Nederland Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.