Axtel Bundle

How has the Axtel Company Transformed Mexico's Telecom Landscape?

Founded in 1994, Axtel emerged as a key player in Mexico's burgeoning telecommunications sector. From its inception, the company navigated regulatory hurdles to offer essential telephony services, marking a pivotal moment in Mexican telecommunications. This journey showcases Axtel's adaptability and strategic growth, evolving from local and long-distance services to a comprehensive suite of modern ICT solutions.

This article explores the Axtel history, from its early challenges to its present-day status as a major provider of Axtel services in Mexico. We'll examine its significant milestones, including innovations and expansions within the Mexican telecommunications market. Discover how Axtel has impacted internet access and the competitive landscape through mergers, acquisitions and its fiber optic network.

What is the Axtel Founding Story?

The Axtel company has a rich history rooted in the liberalization of Mexico's telecommunications sector. Founded in 1994 in Monterrey, Mexico, by a group of visionary businessmen, the company quickly positioned itself to capitalize on the emerging opportunities in the Mexican market. This strategic move set the stage for Axtel's growth and its eventual impact on the telecommunications landscape.

While the company's official operations began in 1999, the intervening years were crucial for securing the necessary concessions and spectrum licenses from the Mexican government. This foundational work was essential for building the infrastructure needed to provide telecommunications services. The company's early focus on local and long-distance telephony services addressed a critical need in Mexico at the time, laying the groundwork for its future expansion.

The founding of Axtel marked a pivotal moment in the history of Mexican telecommunications. The company's initial focus on local and long-distance telephony services addressed a critical need in Mexico at the time. The company's ability to secure significant concessions and spectrum indicates substantial initial investment and strategic foresight in a newly liberalized market. The company's journey reflects the broader transformation of Mexico's telecommunications sector.

Axtel was founded in 1994 in Monterrey, Mexico, by a group of businessmen. The company's operations officially commenced in 1999. Securing concessions and spectrum licenses was a crucial initial step.

- June 1996: Awarded a concession by the Mexican government to install and operate a public telecommunications network.

- 1998-1999: Secured additional spectrum through auctions, including 60 MHz at 10.5 GHz and 112 MHz at 15 GHz.

- Early Focus: Providing local and long-distance telephony services.

- Strategic Vision: Recognizing the burgeoning opportunities within Mexico's telecommunications sector.

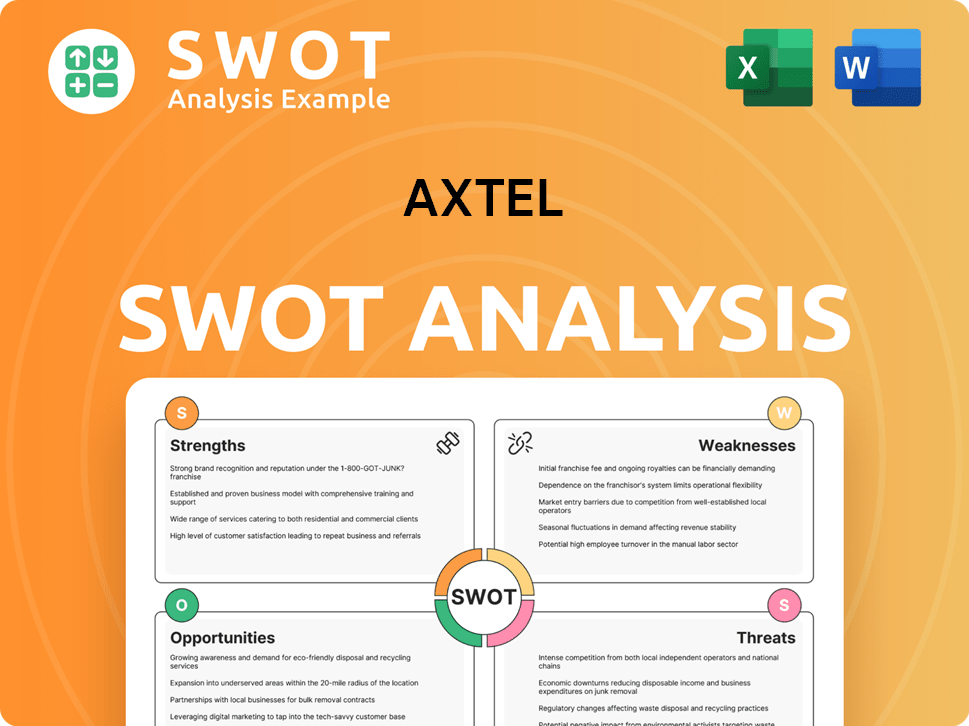

Axtel SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Axtel?

The early growth of the Axtel company, a key player in Mexican telecommunications, was marked by strategic expansion into various technologies and market segments. Starting as a fixed wireless access operator in 1999, Axtel progressively integrated technologies like WiMAX, FTTx, and IPTV. A significant milestone in its expansion was the 2016 merger with Alestra, which significantly boosted its infrastructure and market reach. This enabled Axtel to broaden its information and communication technology solutions for business, government, and residential markets.

Axtel's infrastructure has seen substantial growth, including over 42,000 km of trunk network, metropolitan rings, and fiber optic FTTx. This expansion is crucial for delivering its services across Mexico. The company's commitment to enhancing its network is evident through strategic investments aimed at improving its service offerings and market penetration.

Beyond traditional telephony and internet services, Axtel has expanded its offerings to include managed network services, data center services, and IT security solutions. This diversification allows Axtel to cater to a broader range of customer needs and maintain a competitive edge in the evolving telecommunications landscape. Further insights can be found in the Marketing Strategy of Axtel.

In 2023, Axtel secured a US$60 million loan from the International Finance Corporation (IFC) to expand its fiber network, tower footprint, and data centers. This investment supports Mexico's nearshoring potential and ensures reliable digital connectivity. This financial backing underscores Axtel's commitment to growth and its role in the Mexican telecommunications sector.

In the first quarter of 2025, Axtel reported a 13% year-over-year revenue growth across its Enterprise, Government, and Wholesale segments. Enterprise revenues increased by 5%, Government by 54%, and Wholesale by 31%. Recurring net revenues from new contracts in the Enterprise segment grew by 9% year-over-year, and in the Wholesale segment by 12%.

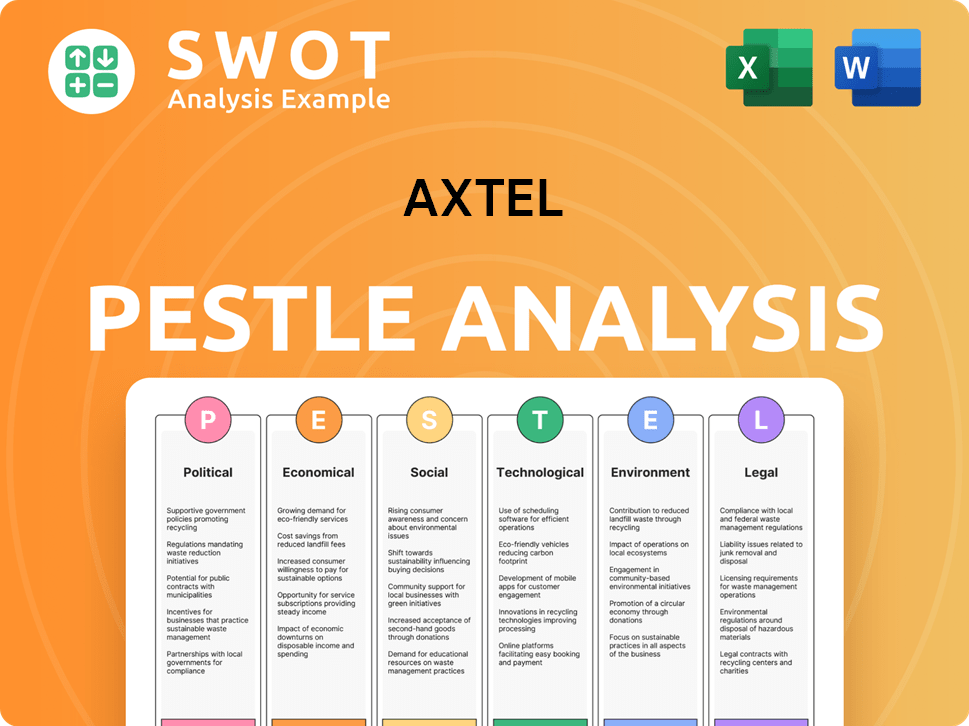

Axtel PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Axtel history?

The Axtel company has experienced several significant milestones throughout its history, marking its growth and adaptation within the Mexican telecommunications landscape. A pivotal moment was its initial public offering in 2005, which allowed it to enter the public market. Further expansion and technological advancements have shaped its trajectory in the Mexican telecommunications market.

| Year | Milestone |

|---|---|

| 2005 | Axtel entered the public market with its shares (AXTELCPO) trading on the Mexican Stock Market. |

| 2015 | Axtel launched 'Axtel X-tremo,' a high-speed internet service offering speeds up to 200 Mbps. |

| 2024 | Axtel achieved the Best Performance 2024 recognition from Check Point, ascending to Partner Elite. |

| 2025 | Axtel's EBITDA grew by 34% year-over-year in Q1. |

Axtel has consistently embraced technological innovations to enhance its service offerings. The company has achieved Oracle Cloud Infrastructure certification and partnered with HP Enterprise to market private infrastructure for AI models.

The launch of 'Axtel X-tremo' in 2015, providing high-speed internet, was a key innovation. This service offered speeds up to 200 Mbps, enhancing Axtel's competitive edge in the Mexican telecommunications market.

Axtel achieved Oracle Cloud Infrastructure certification to market and operate Oracle hybrid cloud services. This initiative expanded Axtel's service portfolio into cloud solutions.

The company partnered with HP Enterprise to market private infrastructure for processing artificial intelligence models. This move positioned Axtel at the forefront of technological advancements.

Axtel achieved Diamond Innovator level within Palo Alto Networks' program. This demonstrates Axtel's commitment to advanced cybersecurity solutions.

Axtel received the Best Performance 2024 recognition from Check Point, ascending to Partner Elite. This highlights Axtel's strong performance in the cybersecurity sector.

Axtel has faced several challenges, including the need for continuous technological upgrades and the management of infrastructure costs. Regulatory and infrastructure expenses, along with the complexities of IPv6 deployment, have also presented obstacles.

Constant technology upgrades are essential to remain competitive. Axtel must invest in new technologies to keep up with market demands and evolving customer needs.

Careful planning of infrastructure investments is necessary to manage costs effectively. These costs are a primary operational concern for Axtel.

Regulatory and infrastructure costs pose significant challenges. Axtel advocates for streamlined regulatory approaches to facilitate broader investment and infrastructure sharing.

The deployment of IPv6 is a major technology evolution project. This requires significant financial and human resource allocation.

Despite these challenges, Axtel demonstrated robust financial performance in 2024. Revenues increased by 5%, and comparable EBITDA grew by 7% year-over-year.

In the first quarter of 2025, Axtel's EBITDA grew by 34% year-over-year. The EBITDA margin increased from 30% in Q1 2024 to 36% in Q1 2025.

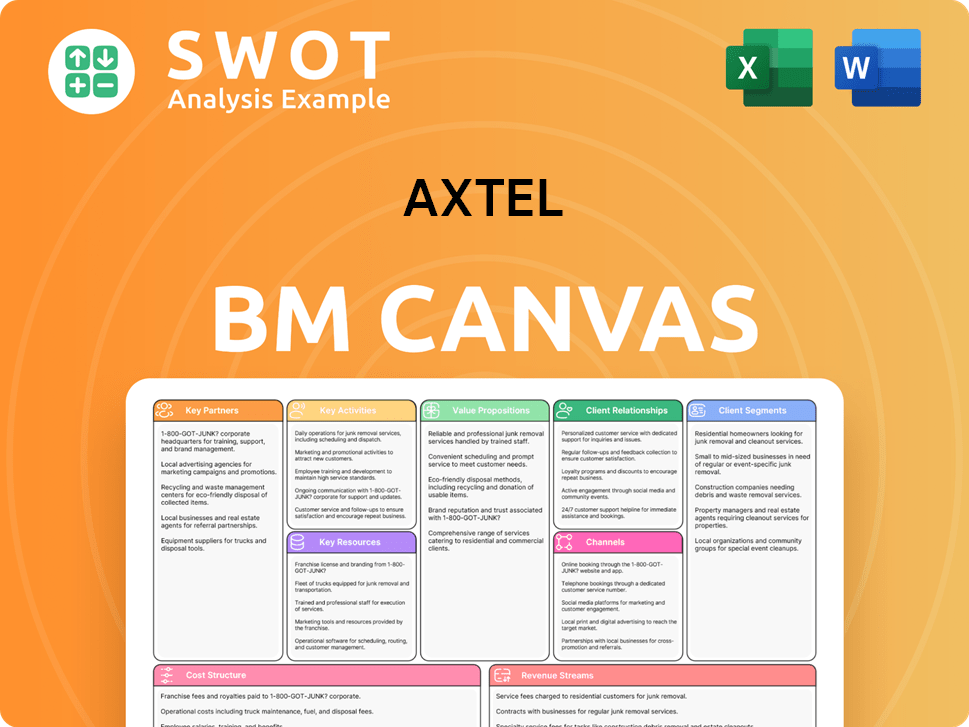

Axtel Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Axtel?

The Axtel history is marked by significant milestones in the Mexican telecommunications sector. From its founding in Monterrey to its expansion across Mexico, the company has evolved through strategic acquisitions and technological advancements, adapting to market demands and technological changes.

| Year | Key Event |

|---|---|

| 1994 | Axtel, S.A. de C.V. was founded in Monterrey, Mexico. |

| 1996 (June) | Axtel was awarded a concession by the Mexican government to operate a public telecommunications network. |

| 1999 | Axtel began operations as a fixed wireless access operator. |

| 2005 | Axtel shares (AXTELCPO) began trading on the Mexican Stock Market. |

| 2015 | The company launched 'Axtel X-tremo' high-speed internet service. |

| 2016 | Axtel merged with Alestra, expanding its ICT service offerings. |

| 2023 (December 11) | Axtel secured US$60 million in conventional debt funding from IFC for network expansion. |

| 2024 (February 6) | Axtel reported 4Q24 revenues grew 18% and EBITDA increased 6%, reaching the highest level in 5 years. |

| 2025 (March 18) | Shareholders approved a Ps. $100 million share repurchase program and the cancellation of approximately 1.8% of Axtel shares. |

| 2025 (March) | Axtel prepaid US $39 million of a bank loan, contributing to US $75 million in prepayments since December 2024, resulting in annual interest savings of US $6 million. |

| 2025 (April 24) | Axtel announced 1Q25 results, with revenues increasing 13% and EBITDA growing 34% year-over-year. |

Axtel is focused on leveraging emerging technologies and market trends to improve productivity and efficiency for its clients. This includes a strong emphasis on advanced connectivity and digital transformation, key elements of the company's ongoing strategy.

The company has obtained Oracle Cloud Infrastructure certification and reached an agreement with HP Enterprise to market private infrastructure for artificial intelligence models. These initiatives highlight Axtel's push into cloud and AI services, expanding its portfolio in the Mexican telecommunications market.

Axtel is committed to high-speed infrastructure, as demonstrated by its ongoing efforts to optimize its network, including testing 800Gbps connections. This investment in fiber optic networks and data centers supports its goal of providing advanced ICT solutions.

Despite potential economic deceleration in Mexico, Axtel's strong 1Q25 results, with significant revenue and EBITDA growth, position it well. The company anticipates annual interest savings of US $6 million in 2025 due to debt reduction efforts, reinforcing its financial stability.

Axtel Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Axtel Company?

- What is Growth Strategy and Future Prospects of Axtel Company?

- How Does Axtel Company Work?

- What is Sales and Marketing Strategy of Axtel Company?

- What is Brief History of Axtel Company?

- Who Owns Axtel Company?

- What is Customer Demographics and Target Market of Axtel Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.