Axtel Bundle

How Does Axtel Navigate the Cutthroat Telecom Arena?

Axtel, a key player in Mexico's ICT sector since 1994, faces a dynamic Axtel SWOT Analysis and evolving competitive landscape. This Mexican telecommunications provider has consistently adapted to technological shifts, offering integrated solutions for businesses and homes. Understanding Axtel's market position requires a deep dive into its rivals and strategic moves.

This analysis provides a detailed look into Axtel's

Where Does Axtel’ Stand in the Current Market?

Axtel holds a significant position in the Mexican telecommunications and ICT sector, particularly within the B2B and government segments. This market position is supported by its focus on providing comprehensive ICT solutions, which differentiates it from competitors mainly offering residential services. The company's infrastructure and service offerings are designed to meet the evolving demands of businesses and government entities across Mexico.

Its geographic presence spans key economic regions across Mexico, serving a broad customer base including large enterprises, SMBs, and government entities. Axtel's strategic shift towards higher-value ICT services, such as fiber optic broadband, managed network services, and data center solutions, reflects its adaptation to market trends. This focus has allowed the company to maintain a strong foothold in the enterprise and government sectors.

Axtel's core operations emphasize integrated ICT solutions, including fiber optic broadband, data center solutions, and IT security, targeting the B2B and government sectors. The value proposition centers on providing secure and reliable digital services, which aligns with the increasing demand for advanced digital solutions. This strategic approach allows Axtel to maintain a competitive edge in the market.

Axtel concentrates on the B2B and government segments, offering specialized ICT services. This focus allows for tailored solutions that meet the specific needs of these sectors. Its strategic shift towards higher-value services aligns with market demands.

The company provides fiber optic broadband, managed network services, data center solutions, and IT security. These services are designed to support the digital transformation needs of its clients. Axtel's comprehensive offerings set it apart from competitors.

Axtel operates across key economic regions in Mexico, ensuring broad market coverage. This extensive presence allows the company to serve a diverse customer base. Its geographic reach supports its competitive position.

Axtel's financial performance reflects a focus on optimizing operations and enhancing profitability. The company reported MXN 2,624 million in revenue for Q4 2023, demonstrating its strategic shift. This financial health underpins its competitive stance.

Axtel's Brief History of Axtel reveals a strategic evolution from basic connectivity to specialized ICT services. The company's focus on higher-value services, such as data center solutions and IT security, positions it well in the market. Despite the dynamic nature of market share figures, Axtel is recognized as a leading provider, with its strategic moves and financial performance indicating a strong competitive stance. Axtel's recent financial reports demonstrate its ability to adapt and maintain a strong position in the Mexican telecommunications market. The company's focus on the enterprise and government sectors allows it to offer comprehensive ICT solutions.

Axtel's strengths include its focus on integrated ICT solutions and a strong infrastructure. Its strategic shift towards high-value services enhances its market position. The company's financial health and geographic presence support its competitive advantages.

- Focus on B2B and government sectors

- Comprehensive ICT service offerings

- Strategic investments in fiber and data centers

- Strong financial performance in core segments

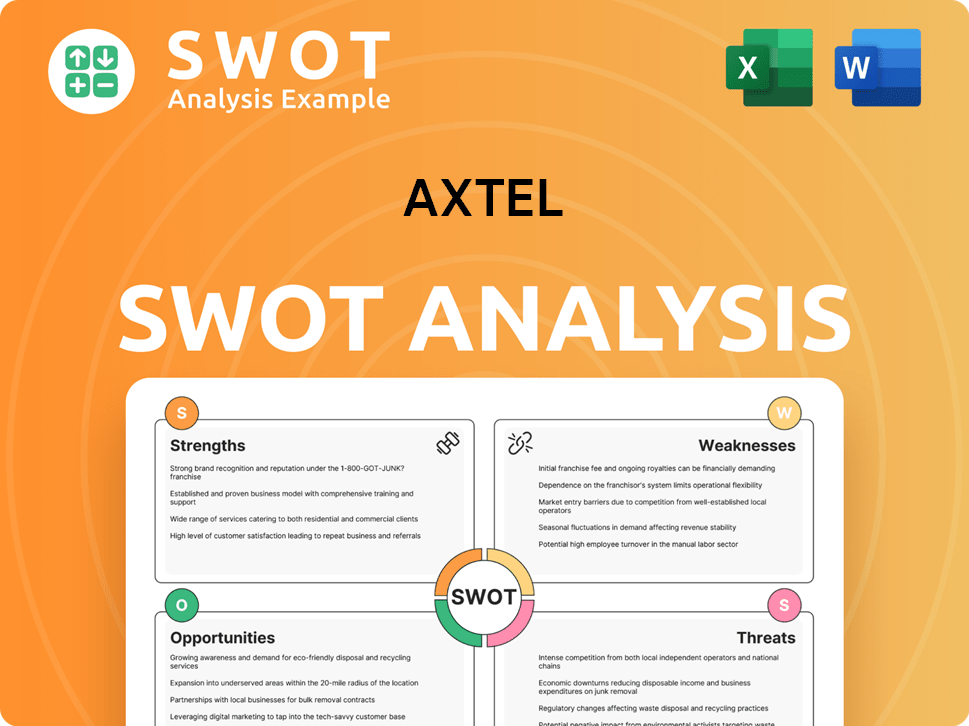

Axtel SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Axtel?

The Axtel competitive landscape in Mexico is characterized by intense competition, driven by a dynamic telecommunications market. Axtel faces a range of direct and indirect competitors, each vying for market share across various segments. Understanding the competitive environment is crucial for Axtel's

The Mexican telecommunications market is highly competitive, with major players continually adjusting their strategies. This environment demands that Axtel continually assess its

Axtel's primary direct competitors include major integrated telecommunications providers. These companies offer a wide array of services, competing directly with Axtel across multiple sectors. They often have significant resources and established market positions.

Telmex, part of América Móvil, is the dominant player in the Mexican market. It boasts extensive infrastructure and offers a broad range of services, including residential, business, and government solutions. Telmex often challenges Axtel on price and coverage.

AT&T Mexico has a strong mobile presence and is expanding its fixed-line and enterprise solutions. It leverages its global network and brand recognition to compete with Axtel. AT&T's strategies include aggressive marketing and service bundling.

Telefónica Movistar, a global telecommunications giant, competes in various segments, particularly in mobile and bundled services. It focuses on offering competitive pricing and innovative service packages to attract customers. Movistar's market share is a key indicator of the competitive intensity.

Beyond the major integrated players, Axtel faces competition from specialized providers. These companies focus on specific segments like data centers, cloud solutions, and IT security. They often offer specialized expertise and tailored services.

KIO Networks is a significant competitor in data center services and cloud solutions. It provides dedicated infrastructure and specialized expertise, posing a challenge to Axtel in these areas. KIO's focus on enterprise clients is a key aspect of its strategy.

The

- Market Consolidation: Ongoing discussions and potential acquisitions within the Mexican telecom sector can reshape the competitive dynamics.

- Strategic Alliances: Partnerships and collaborations are common as companies aim to enhance their service offerings and market presence.

- Technological Advancements: Innovations in areas like 5G, cloud computing, and cybersecurity drive competition and require continuous investment.

- Regulatory Environment: Regulatory changes and government policies significantly impact the competitive landscape, influencing market access and pricing.

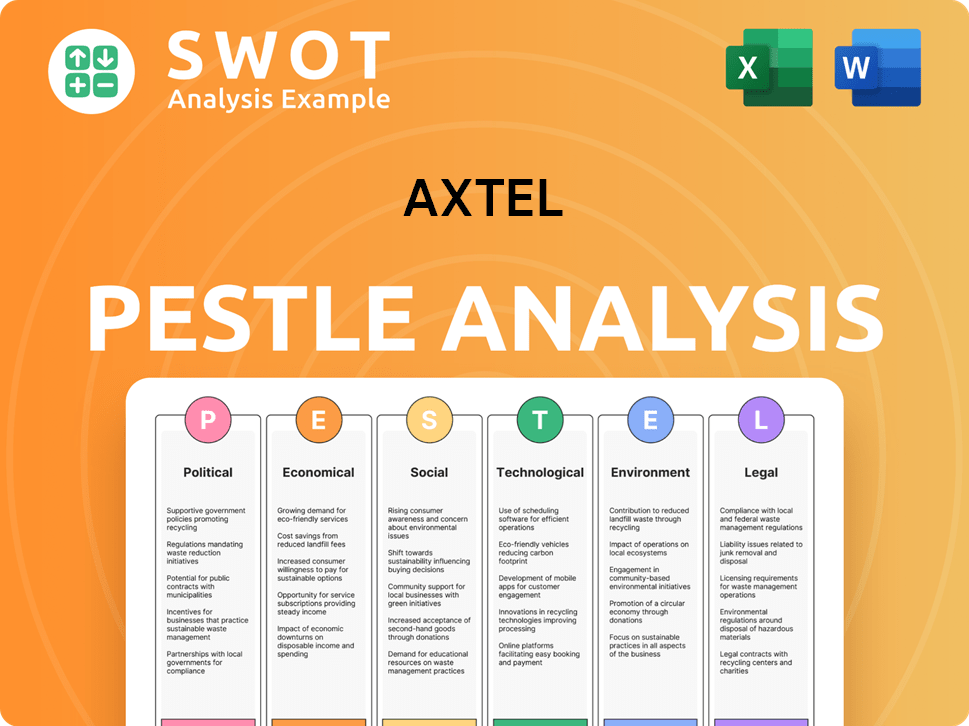

Axtel PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Axtel a Competitive Edge Over Its Rivals?

Analyzing the Axtel competitive landscape reveals key strengths that position the company within the Mexican telecommunications market. Axtel's strategic focus on enterprise and government clients, coupled with its robust fiber optic infrastructure, sets it apart from competitors. This focus allows for tailored solutions and high-speed connectivity, crucial for modern business operations.

Axtel's business strategy emphasizes integrated ICT solutions, providing a comprehensive suite of services from broadband to cybersecurity. This approach simplifies IT management for clients, enhancing efficiency and reducing operational complexities. The company's ability to customize solutions and offer dedicated support fosters strong customer loyalty, a critical factor in the competitive telecommunications sector.

The company's commitment to innovation, particularly in cybersecurity and cloud services, ensures its offerings remain relevant and competitive. This proactive approach to technological advancements, combined with its established infrastructure, supports Axtel's growth potential. A detailed Axtel market analysis shows how these competitive advantages have evolved over time, adapting to the changing digital demands of its target markets.

Axtel's extensive fiber optic network provides high-speed, reliable connectivity, a key advantage for enterprise clients. This proprietary infrastructure supports managed network services, data center solutions, and IT security offerings. This allows for greater control over service quality and delivery, differentiating Axtel from competitors relying on less robust networks.

Offering a comprehensive portfolio of ICT services, including broadband, voice, cloud, and cybersecurity, simplifies IT management for clients. This holistic approach enhances efficiency and reduces operational complexities, providing a significant value proposition. This integrated approach is a key element of Axtel's Axtel business strategy.

Axtel's focus on understanding and meeting the specific needs of its enterprise clientele enables customized solutions and dedicated technical support. This customer-centric approach fosters strong loyalty and long-term relationships. This strategy is crucial for Axtel's industry position.

The company's commitment to innovation in areas like cybersecurity and cloud services ensures its offerings remain competitive. Axtel continually enhances its service features and expands its network reach to meet the growing digital demands of its target markets. This focus on innovation is essential for long-term success.

Axtel's strengths lie in its infrastructure, integrated solutions, and customer focus. These elements collectively enhance its ability to compete effectively in the Mexican market. Understanding Axtel's strengths and weaknesses analysis is crucial for investors and stakeholders.

- Robust Fiber Optic Network: Provides high-speed, reliable connectivity.

- Integrated ICT Solutions: Simplifies IT management for clients.

- Customer-Centric Approach: Offers customized solutions and dedicated support.

- Innovation Focus: Ensures offerings remain competitive through technological advancements.

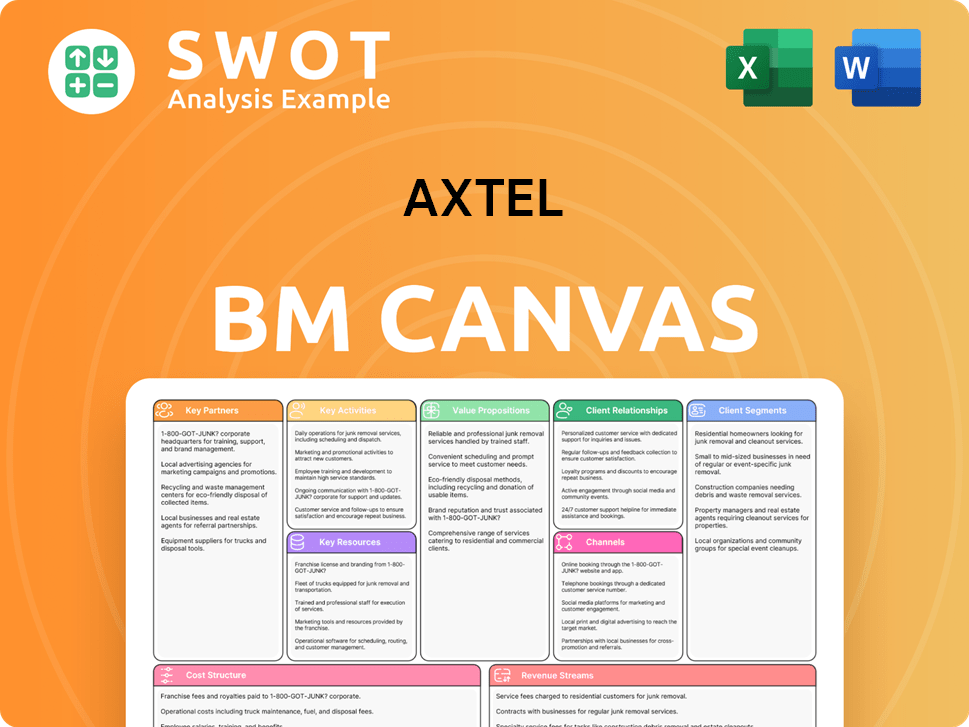

Axtel Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Axtel’s Competitive Landscape?

The Mexican telecommunications sector is currently experiencing significant shifts, influencing the Axtel competitive landscape. Technological advancements, such as 5G deployment, cloud computing, and enhanced cybersecurity measures, are reshaping the industry. Regulatory changes and evolving consumer preferences for integrated services and digital platforms also contribute to this dynamic environment, impacting Axtel's market analysis.

For Axtel, these trends present both challenges and opportunities. Intense price competition from larger players, the need for continuous infrastructure investment, and the threat of cyberattacks are key concerns. However, the growing demand for cloud services, advanced cybersecurity, and digital transformation initiatives across various sectors offer significant growth avenues. Understanding Axtel's industry position is crucial for navigating this complex environment.

The telecommunications sector in Mexico is seeing increased demand for high-speed internet and data services, fueled by the rise of remote work and digital entertainment. 5G network expansion is a major trend, with significant investments being made by major players. Cybersecurity is becoming increasingly critical due to rising cyber threats, driving demand for robust security solutions. These trends heavily influence Axtel's business strategy.

Intense price competition from larger telecommunications companies, such as América Móvil and Telefónica, poses a significant challenge. The need for ongoing investment in infrastructure, including 5G upgrades, requires substantial capital expenditure. Cyberattacks and data breaches remain a constant threat, demanding continuous investment in cybersecurity measures. Understanding Axtel's challenges in the current market is essential.

The growing demand for cloud services and managed IT solutions creates opportunities for Axtel to expand its enterprise services. The increasing need for advanced cybersecurity solutions, driven by rising cyber threats, provides a market for specialized security offerings. Digital transformation initiatives across various sectors in Mexico offer avenues for Axtel to provide innovative ICT solutions. Considering Axtel's growth potential compared to competitors is vital.

Axtel can leverage its existing fiber infrastructure and expertise in managed services to capitalize on the opportunities presented by these trends. Focusing on high-value enterprise solutions and forging strategic partnerships can help expand its reach and capabilities. Axtel is strategically positioned to benefit from the expansion of 5G networks by offering new enterprise applications. To learn more about Axtel's strategic direction, read this article about the Growth Strategy of Axtel.

In the Mexican telecommunications market, Axtel faces competition from major players like América Móvil (Telmex/Telcel), Telefónica México, and smaller regional providers. América Móvil holds a dominant market share in both fixed and mobile services. Telefónica México also has a significant presence, particularly in mobile services. Understanding Axtel's main rivals in Mexico is crucial for competitive analysis.

- América Móvil: Dominates the market with a broad range of services and extensive infrastructure.

- Telefónica México: Focuses on mobile services and is expanding its fiber-optic network.

- Smaller Regional Providers: Offer niche services and compete in specific geographic areas.

- Market Share: In 2024, América Móvil held approximately 45% of the fixed-line market and 60% of the mobile market in Mexico.

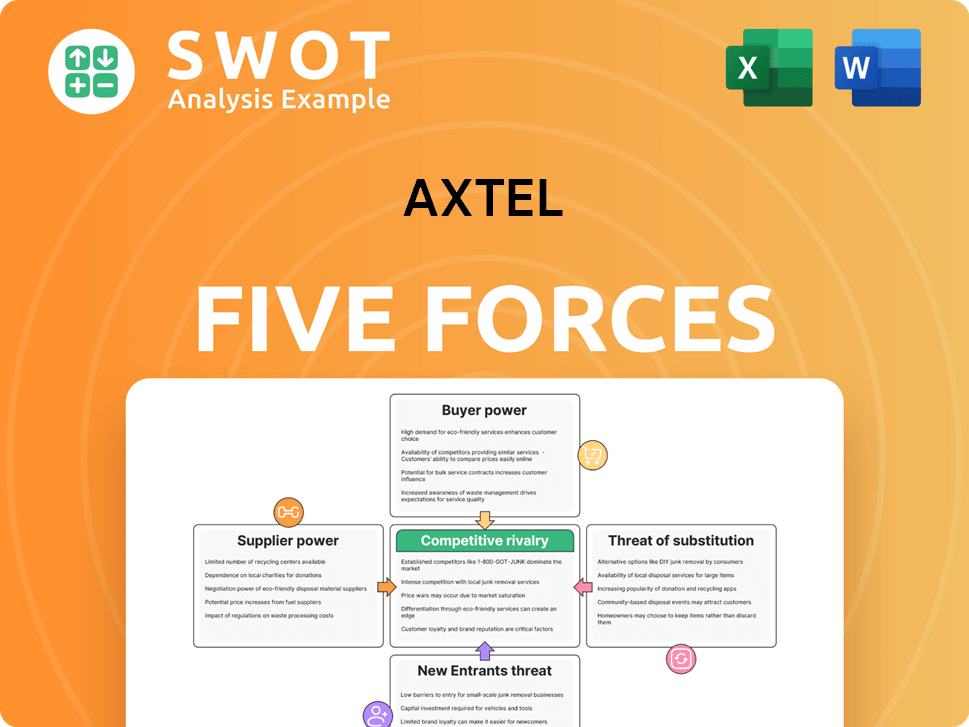

Axtel Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Axtel Company?

- What is Growth Strategy and Future Prospects of Axtel Company?

- How Does Axtel Company Work?

- What is Sales and Marketing Strategy of Axtel Company?

- What is Brief History of Axtel Company?

- Who Owns Axtel Company?

- What is Customer Demographics and Target Market of Axtel Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.