BXP Bundle

How has Boston Properties Shaped the US Real Estate Landscape?

Delve into the BXP SWOT Analysis and discover the fascinating

This

What is the BXP Founding Story?

The BXP Company, a prominent real estate company, traces its roots back to 1970. Founded in Boston, Massachusetts, by Mortimer B. Zuckerman and Edward H. Linde, the company embarked on a journey to establish itself as a leading real estate investment trust (REIT).

Their vision centered on acquiring, developing, and managing high-quality properties, initially focusing on the Boston area. The founders aimed to distinguish the company through a commitment to excellence in design, construction, and property management. This strategic focus laid the groundwork for what would become a significant player in the real estate sector.

This article explores the BXP history, focusing on its founding and early years.

The original business model emphasized developing and acquiring Class A office properties in select urban centers. This strategy allowed the company to concentrate its resources in markets with strong demand and limited supply.

- The company's focus on premium office space in urban centers was a key differentiator.

- This approach contributed to higher occupancy rates and rental income.

- Details regarding initial funding sources are not readily available in the provided search results.

- An interesting anecdote from the company's early history includes outbidding Donald Trump in 1985 for the redevelopment of the New York Coliseum at Columbus Circle, though the company ultimately sold the property.

In 1986, BXP Company completed its first development in New York City, 599 Lexington Avenue. This marked a significant expansion beyond its initial Boston base. The company's early milestones set the stage for its future growth and impact on the real estate landscape. For a deeper understanding of their marketing approach, consider reading about the Marketing Strategy of BXP.

BXP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of BXP?

The early growth of the BXP Company, formerly known as Boston Properties, involved a strategic focus on acquiring properties in prime locations within major metropolitan areas. This real estate company expanded its presence in Boston and began acquiring properties in other key cities during the 1980s. The company's Initial Public Offering (IPO) in 1997 was a significant milestone. This transition allowed BXP to become a publicly traded REIT, providing access to capital markets for further expansion and solidifying its BXP history.

In 1998, BXP acquired a portfolio from Equitable Real Estate, significantly increasing its presence in key markets like Boston, New York, and Washington, D.C. This early expansion was crucial for establishing its market position. The IPO in 1997 was a key event in the BXP Company founding date, enabling access to capital for further acquisitions and growth. This strategic move supported its early years of Boston Properties.

In 2006, BXP expanded its portfolio by acquiring office buildings from Prudential Real Estate, strengthening its position in Boston, Washington D.C., and San Francisco. BXP also engaged in capital raises, such as the sale of interests in five office properties to a joint venture with Kuwait Investment Authority in 2006. These capital raises generated funds for reinvestment and further growth. For more information, check out the Competitors Landscape of BXP.

As of March 31, 2025, BXP's in-service properties occupancy was at 86.9%. The company's revenue grew by 3.47% over the last twelve months, reaching $3.4 billion as of May 2025. These figures reflect the company's continued efforts to deliver value to shareholders through strategic acquisitions and development projects. These are key milestones in the BXP Company real estate portfolio.

Throughout its growth, BXP has consistently aimed to deliver value to shareholders through strategic acquisitions and development projects. The company's early focus on prime locations and expansion into major metropolitan areas set the stage for its future success. The acquisitions and IPO were vital to the BXP overview and demonstrate the company's commitment to growth.

BXP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in BXP history?

The BXP Company, a prominent real estate company, has achieved several significant milestones throughout its history. These accomplishments have shaped its trajectory and solidified its position in the industry.

| Year | Milestone |

|---|---|

| 2018 | Completed the Salesforce Tower in San Francisco, a LEED Platinum-certified skyscraper, showcasing a commitment to sustainable development. |

| Ongoing | Strategic ventures into the life sciences sector, acquiring and developing properties for biotechnology and pharmaceutical companies. |

| 2025 | Released the 2024 Sustainability & Impact Report in April, highlighting leadership in sustainable business practices. |

Throughout its history, Boston Properties has consistently embraced innovation. The company has focused on developing sustainable and technologically advanced properties.

BXP has consistently prioritized sustainable practices, as demonstrated by the LEED Platinum certification of the Salesforce Tower. This commitment underscores its dedication to environmentally friendly and energy-efficient building designs.

Recognizing the growth in the life sciences sector, BXP has strategically expanded its portfolio to include properties tailored for biotechnology and pharmaceutical companies. This diversification reflects an understanding of evolving market demands.

Despite its successes, BXP has faced challenges. These challenges include market fluctuations and shifts in demand, particularly in the office space sector.

The real estate market is subject to various economic factors, including interest rates and economic conditions, requiring BXP to navigate uncertainties. The company must adapt to these changing market dynamics to maintain its performance.

The shift towards remote work has influenced the demand for office space, leading companies to reevaluate their needs. This trend presents a challenge for BXP as it manages its office properties.

In the first quarter of 2025, BXP's Funds From Operations (FFO) per share of $1.64 missed the consensus estimate of $1.65, and the reported figure fell 5.2% year over year, partly due to lower occupancy. As of March 31, 2025, BXP's in-service properties occupancy decreased 60 basis points sequentially to 86.9% due to a lease expiration of 350,000 square feet at 200 Fifth Avenue in New York.

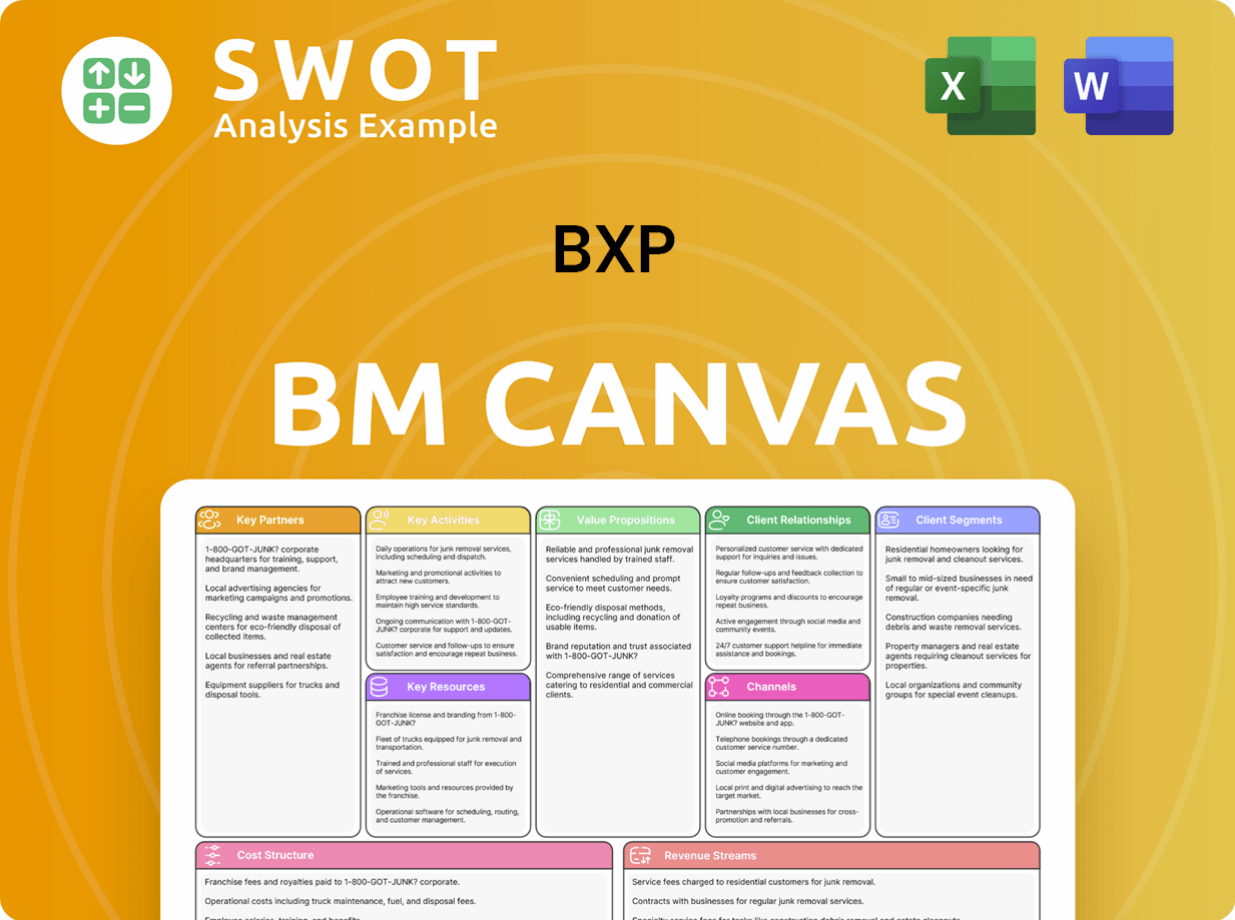

BXP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for BXP?

The BXP Company, a prominent real estate company, has a rich BXP history marked by significant milestones. Founded in 1970 by Mortimer B. Zuckerman and Edward H. Linde, the company has grown into a major player in the commercial real estate market. This BXP overview highlights key events that have shaped its trajectory.

| Year | Key Event |

|---|---|

| 1970 | Founded in Boston, Massachusetts, marking the beginning of Boston Properties history. |

| 1985 | Attempted to acquire the New York Coliseum at Columbus Circle but was unsuccessful. |

| 1986 | Completed its first development in New York City, 599 Lexington Avenue. |

| 1990 | Began construction of the NASA Headquarters. |

| 1997 | Became a publicly traded company through an Initial Public Offering (IPO) on the NYSE. |

| 1998 | Expanded its portfolio by acquiring properties from Equitable Real Estate. |

| 2006 | Sold interests in five office properties and acquired a portfolio from Prudential Real Estate. |

| 2010 | Acquired the John Hancock Tower in Boston. |

| 2018 | Completed the development of the Salesforce Tower in San Francisco. |

| Q1 2025 | Reported strong leasing momentum, executing 91 leases spanning over 1.1 million square feet. |

| April 29, 2025 | Announced First Quarter 2025 Results, with revenue increasing 3.1% to $865.2 million. |

| April 2025 | Formed a joint venture to develop a 670-unit residential project in Jersey City, New Jersey. |

| May 2025 | BXP to present at Nareit's 2025 REITweek Investor Conference. |

The company plans to increase its development pipeline, which could lead to future Funds From Operations (FFO) growth. Analysts predict a return to profitability in 2025.

Occupancy rates are projected to improve, with 89.2% in 2025 and 90.7% in 2026, up from 88.1% in 2024. Earnings per share are expected to range from $1.60 to $1.72 for the full year of 2025.

Demand for Class A office space and development opportunities are expected to positively impact the company. Rising interest rates and economic downturns pose potential challenges.

The company's commitment to sustainable development, including green building technologies and LEED certifications, is expected to continue attracting environmentally conscious tenants. This aligns with the company's founding vision.

BXP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of BXP Company?

- What is Growth Strategy and Future Prospects of BXP Company?

- How Does BXP Company Work?

- What is Sales and Marketing Strategy of BXP Company?

- What is Brief History of BXP Company?

- Who Owns BXP Company?

- What is Customer Demographics and Target Market of BXP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.