BXP Bundle

How Does Boston Properties Navigate the Cutthroat Real Estate Arena?

In the dynamic world of commercial real estate, understanding the BXP SWOT Analysis is crucial for investors and strategists alike. Boston Properties (BXP), a leading REIT, constantly faces fierce competition in prime markets. This analysis dives deep into BXP's competitive landscape, examining its rivals, and dissecting its strategies for success.

This exploration of the BXP competitive landscape will provide a comprehensive real estate market analysis, including a detailed look at BXP's competitors and its competitive positioning. We'll uncover the competitive advantages of BXP in the office market and analyze how Boston Properties responds to changing market conditions. Understanding BXP's strengths and weaknesses compared to peers is key to assessing its future prospects in commercial real estate.

Where Does BXP’ Stand in the Current Market?

Boston Properties (BXP) holds a significant market position within the U.S. Class A office sector. Its operations are primarily concentrated in major gateway cities, including Boston, New York, San Francisco, Seattle, and Washington, D.C. This strategic focus allows the company to capitalize on high-demand markets. The company is consistently ranked among the top office REITs, reflecting its substantial presence in the commercial real estate market.

The company's core operations revolve around owning, managing, and developing premium office spaces. These spaces often feature modern amenities, sustainable designs, and strategic urban or suburban locations. This focus on quality assets caters to a diverse tenant base, including leading companies in technology, finance, legal, and professional services. BXP's ability to attract and retain high-profile tenants is a key factor in its market success. You can learn more about the company's origins in the Brief History of BXP.

BXP's value proposition centers on providing high-quality, well-located office properties that meet the evolving needs of its tenants. The company emphasizes flexible workspaces and tenant experience to adapt to market shifts. BXP’s commitment to sustainability and modern design enhances the appeal of its properties, attracting a diverse tenant base.

As of late 2024, BXP's portfolio encompasses approximately 54.3 million square feet across 196 properties. This substantial portfolio solidifies its standing as one of the largest owners, managers, and developers of Class A office properties in the United States. The company's significant market share in key cities like Boston and New York positions it favorably in the BXP competitive landscape.

In the first quarter of 2024, BXP reported Funds From Operations (FFO) of $1.73 per share. This financial performance demonstrates the company's ability to generate revenue despite market dynamics. Strong occupancy rates and stable revenue streams are typical characteristics of BXP's financial health, contributing to its competitive positioning.

BXP's strong presence in innovation-centric markets like Boston and San Francisco is a key factor in its competitive advantages in the office market. These markets, while offering significant opportunities, also present challenges due to shifts in office demand. The company's strategic focus on these markets is crucial for its long-term growth.

BXP has selectively diversified into retail and residential components within its mixed-use developments. This strategy enhances the vibrancy and appeal of its properties, reflecting its response to changing market conditions. The company's ability to adapt and evolve is essential for maintaining its competitive edge in the commercial real estate sector.

BXP faces competition from other major REITs and real estate developers. Key rivals include companies with significant portfolios in the same gateway cities. Understanding the competitive landscape is crucial for BXP's strategic planning and market positioning.

- Market Share: BXP's market share analysis reveals its position relative to competitors in specific geographic areas.

- Financial Metrics: Comparing BXP's stock performance to competitors provides insights into its financial health.

- Property Quality: BXP's focus on premium office spaces differentiates it from competitors.

- Strategic Focus: The company's emphasis on flexible workspaces and tenant experience is a key differentiator.

BXP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging BXP?

The BXP competitive landscape is characterized by intense rivalry within the commercial real estate sector, particularly in major gateway markets. This competition stems from numerous sources, including other REITs, private developers, and evolving workplace trends. Understanding these dynamics is crucial for a thorough real estate market analysis of BXP's competitive positioning and its strategies for market dominance.

The company faces challenges from both direct and indirect competitors, each vying for market share and tenant occupancy. The BXP company profile reveals a focus on high-quality office properties, making it essential to assess the competitive pressures affecting its portfolio and future growth prospects. This analysis helps investors and stakeholders understand the risks and opportunities within this dynamic environment.

Analyzing BXP's competitive environment requires a deep dive into its key rivals and their strategies. This includes evaluating their portfolios, financial performance, and strategic initiatives. Furthermore, assessing the impact of broader market trends, such as remote work, is critical for understanding the future of BXP's competitive landscape.

Direct competitors include publicly traded office REITs that own and manage Class A office properties. These rivals often operate in the same gateway markets as BXP, competing for the same tenants and investment opportunities. They challenge BXP through their portfolios, competitive leasing rates, and development pipelines.

Vornado Realty Trust is a significant direct competitor, particularly in New York City. Its extensive portfolio in the city directly competes with BXP's holdings. Vornado's presence in key markets makes it a primary rival for top-tier tenants and investment prospects.

Kilroy Realty Corporation is a prominent player on the West Coast, posing a direct challenge to BXP. Kilroy's focus on high-quality assets and strategic development projects puts it in direct competition with BXP for tenants and investment opportunities in the region.

Private real estate developers and institutional investors, such as Brookfield Properties and Tishman Speyer, also compete with BXP. These entities often possess substantial capital resources and can undertake large-scale projects. They compete for the same tenants and investment opportunities.

Indirect competition comes from trends like remote and hybrid work models, which can reduce office demand. Co-working spaces, such as those offered by WeWork or Industrious, also impact BXP's occupancy rates and pricing power. These factors influence BXP's performance.

Mergers and acquisitions among private equity firms and REITs can alter market dynamics. These transactions intensify competition for prime assets and tenants. Such changes can significantly impact the competitive landscape.

To gain a deeper understanding of BXP's strategic direction, consider exploring the Growth Strategy of BXP. This analysis provides valuable insights into the company's approach to navigating the competitive landscape and achieving its financial goals. Understanding these factors is crucial for a comprehensive BXP competitive analysis report.

Several factors influence the competitive dynamics within the commercial real estate sector. These include property quality, location, leasing rates, tenant relationships, and development pipelines. Analyzing these elements helps in assessing the competitive advantages of BXP in the office market.

- Property Quality: Class A office properties are highly sought after, with BXP focusing on premium assets.

- Location: Gateway markets like New York City and Boston are key areas of competition.

- Leasing Rates: Competitive pricing is essential for attracting and retaining tenants.

- Tenant Relationships: Strong relationships with tenants can lead to higher occupancy rates.

- Development Pipeline: Strategic development projects can enhance a company's market position.

BXP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives BXP a Competitive Edge Over Its Rivals?

Understanding the BXP competitive landscape involves recognizing its strengths in the commercial real estate sector. BXP's focus on premium, Class A office properties in high-barrier-to-entry markets is a key differentiator. This strategic positioning allows the company to command higher rents and maintain stable income streams, even amidst market fluctuations.

BXP's competitive advantages are rooted in its strategic focus on high-quality assets and premier locations. The company's extensive experience in development and redevelopment provides a crucial edge. This allows BXP to create value through new construction and reposition existing assets, catering to specific market demands and tenant preferences.

BXP's strong relationships with creditworthy tenants contribute to high occupancy rates and tenant retention. The company's strong balance sheet and access to capital markets also provide a competitive edge. This enables BXP to pursue strategic acquisitions and development opportunities, even during challenging economic cycles.

BXP concentrates on high-quality assets in major gateway markets. These locations include Boston, New York, San Francisco, Washington D.C., and Seattle. This strategic geographic concentration helps to reduce exposure to volatile secondary markets and supports premium rents.

BXP has a proven track record in delivering state-of-the-art office buildings. This expertise allows the company to meet the evolving needs of modern tenants. It includes advanced technological infrastructure and sustainable design features, creating value through new construction and asset repositioning.

BXP's relationships with a diverse base of creditworthy tenants contribute to high occupancy rates. Long-term tenant retention fosters a stable revenue base. This is crucial for maintaining financial stability and attracting further investment.

BXP's strong balance sheet and access to capital markets provide a competitive edge. This enables the company to pursue strategic acquisitions and development opportunities. This is especially important during economic downturns, allowing for continued growth.

BXP's competitive advantages are multifaceted, encompassing strategic location, development expertise, and financial strength. These factors collectively position BXP favorably within the BXP competitive landscape. The company's ability to adapt to changing market conditions, as detailed in Growth Strategy of BXP, further strengthens its position.

- Strategic Location in Gateway Markets: Focusing on high-barrier-to-entry markets.

- Development and Redevelopment Expertise: Delivering modern, sustainable office buildings.

- Strong Tenant Relationships: High occupancy and tenant retention rates.

- Financial Strength: Robust balance sheet and access to capital.

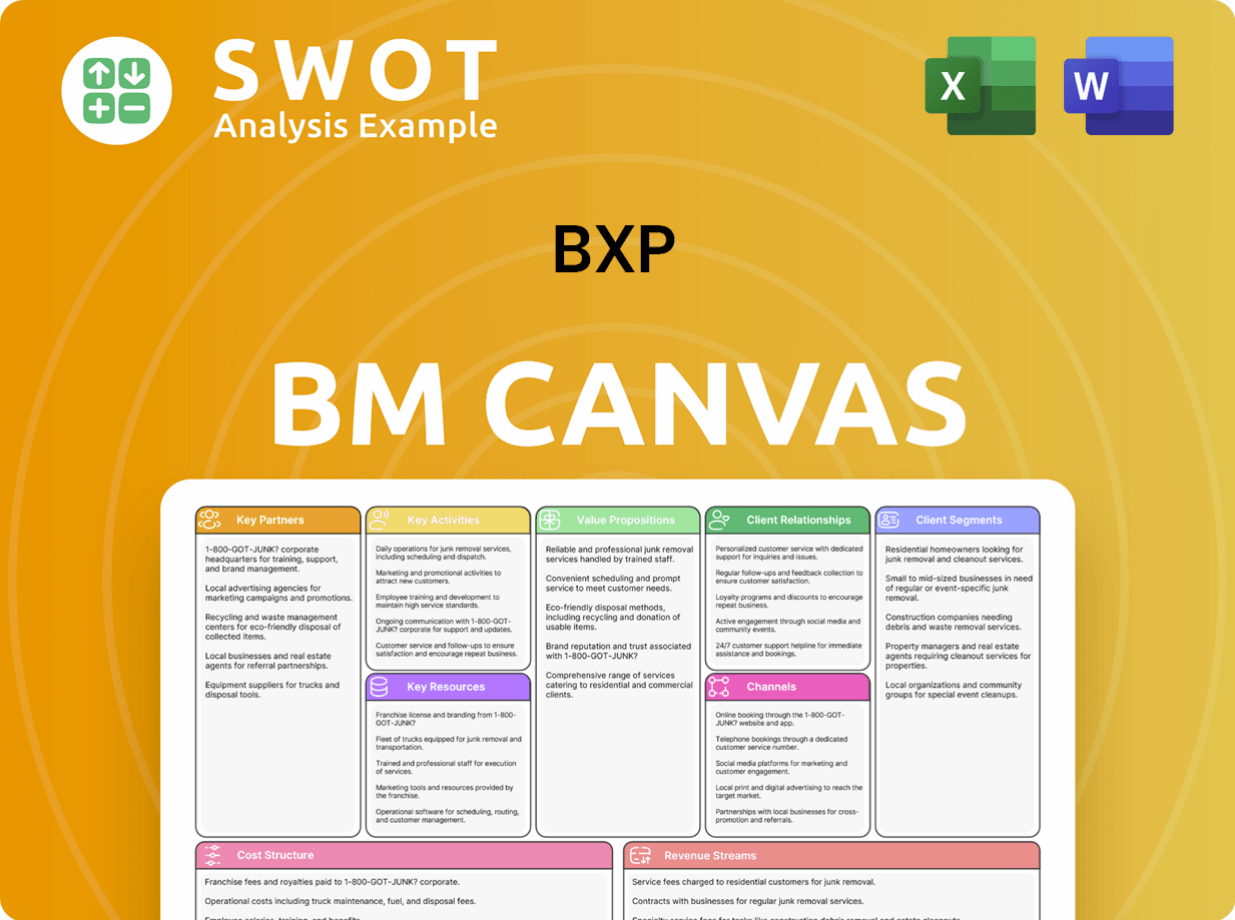

BXP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping BXP’s Competitive Landscape?

The commercial real estate sector, particularly the office segment, is undergoing considerable transformation, significantly influencing the competitive landscape for Boston Properties. Hybrid work models and sustainability regulations are key drivers, shaping office space demand and operational strategies. Understanding these dynamics is essential for evaluating BXP's position and future prospects within the real estate market.

Analyzing the Marketing Strategy of BXP provides insights into its approach to navigating industry challenges and capitalizing on opportunities. These include the flight-to-quality trend and the demand for flexible, amenity-rich spaces. BXP's strategic decisions and investment choices are critical in determining its competitive edge.

The primary trend impacting the BXP competitive landscape is the hybrid work model, which influences office space demand. Regulatory changes around environmental sustainability are also a major factor. These shifts require BXP to adapt and innovate to maintain its market position.

Challenges include potential increases in office vacancy rates due to hybrid work and competition from newer, amenity-rich properties. Economic downturns could also impact leasing activity. BXP must proactively address these challenges to sustain its financial performance.

Opportunities for BXP include the flight-to-quality trend, which favors its Class A properties. Demand for flexible office solutions and technological advancements present further avenues for growth. Strategic investments in amenities and sustainability are key to capitalizing on these opportunities.

BXP is strategically upgrading amenities and sustainability features within its portfolio. The company explores opportunities in life sciences and mixed-use developments. Focusing on prime locations and high-quality assets is central to BXP's strategy.

BXP's success hinges on its ability to adapt to evolving tenant needs and market dynamics. The company's focus on prime locations and high-quality assets positions it well in the face of changing demands. Understanding the competitive environment and adapting to market shifts is crucial for sustained growth.

- Hybrid Work Impact: The shift to hybrid work models continues to influence office space demand, with vacancy rates remaining elevated in major cities.

- Sustainability Regulations: Regulatory changes related to environmental sustainability require significant investments in green building technologies.

- Flight-to-Quality: Companies are consolidating into higher-quality office spaces, benefiting BXP's portfolio.

- Technological Advancements: Smart building systems and data analytics enhance operational efficiency and tenant experience.

BXP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BXP Company?

- What is Growth Strategy and Future Prospects of BXP Company?

- How Does BXP Company Work?

- What is Sales and Marketing Strategy of BXP Company?

- What is Brief History of BXP Company?

- Who Owns BXP Company?

- What is Customer Demographics and Target Market of BXP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.