BYD Electronic Bundle

How Did BYD Electronic Company Rise to Global Prominence?

Journey into the fascinating BYD Electronic SWOT Analysis and explore how this Chinese electronics giant transformed the industry. From its humble beginnings, BYD Electronic Company has become a leading force in electronic manufacturing. Uncover the key milestones and strategic decisions that propelled BYD's impressive growth trajectory.

The BYD history is a compelling narrative of adaptation and innovation within the BYD Group. This exploration of BYD Electronic Company's evolution, from its initial focus on battery production to its current status as a comprehensive solutions provider, offers valuable insights. Understanding the Chinese electronics landscape through the lens of BYD Electronic's success provides a strategic advantage for investors and industry watchers alike.

What is the BYD Electronic Founding Story?

The story of BYD Electronic Company begins in February 1995. Wang Chuanfu established BYD Company Limited in Shenzhen, China. The initial focus was on manufacturing nickel-cadmium (Ni-Cd) batteries, marking the start of what would become a global electronics and manufacturing powerhouse.

Wang Chuanfu, the founder and CEO, saw potential in the rechargeable battery market. The company started by analyzing and improving battery technologies from companies like Sony and Sanyo. The early business model revolved around producing rechargeable batteries for various applications, including mobile phones.

BYD Electronic, as a separate entity, was established in 2002 within the larger BYD Company. It concentrated on manufacturing handset components and modules. This strategic move allowed BYD to integrate its operations, using its battery expertise to support the growing mobile phone industry. The company's commitment to innovation and expansion is evident in its history.

The company's journey includes significant milestones that shaped its current status. From its humble beginnings to its current global presence, BYD Electronic has consistently demonstrated its commitment to growth and innovation. Learn more about the Marketing Strategy of BYD Electronic to understand how they have achieved their goals.

- 1995: BYD Company Limited was founded in Shenzhen, China, with a focus on battery manufacturing.

- 2002: BYD Electronic began operations as a division within BYD, focusing on handset components.

- June 14, 2007: BYD Electronic was incorporated in Hong Kong.

- December 2007: BYD Electronic went public on the Hong Kong Stock Exchange, setting a record for the highest offering price among H shares at the time.

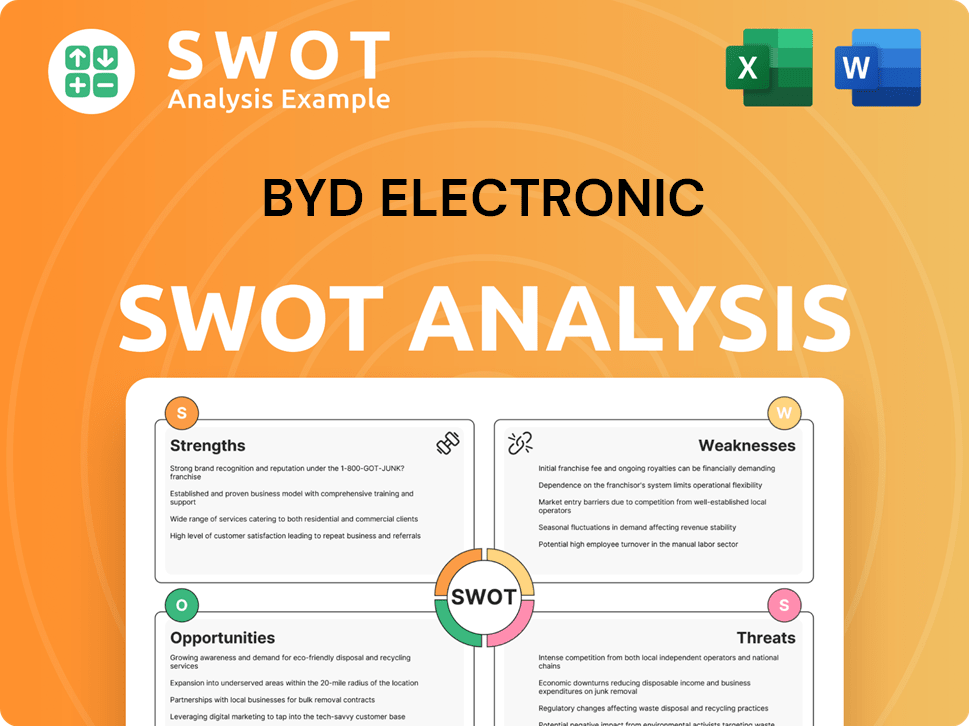

BYD Electronic SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of BYD Electronic?

The early growth and expansion of BYD Electronic Company significantly shaped its trajectory. Following its establishment in 2002 and subsequent IPO in 2007, the company broadened its scope beyond components. This expansion included strategic moves into new markets and product categories, solidifying its position in the electronics manufacturing sector.

A key step in BYD history was its integration into the global supply chain. It became Motorola's first Chinese supplier of lithium-ion batteries, and later, Nokia's first Chinese supplier of such batteries. These partnerships were crucial for establishing its presence in the international market and expanding its BYD electronics business.

Geographical expansion was a core element of BYD Electronic Company's strategy during this period. Overseas factories were established in Cluj, Romania, and Chennai, India, both completed in 2008. The acquisition of Mirae Hungary Industrial Manufacturer Ltd. in February 2008, which included a factory in Komárom, Hungary, further expanded its European footprint, facilitating its growth in the electronics manufacturing services sector.

In 2003, the parent company, BYD Group, entered the automobile industry by acquiring Xi'an Qinchuan Automobile. This strategic move aimed to combine battery technology with vehicle technology to develop electric cars. This diversification created synergies for BYD Electronic Company, particularly in the development of automotive intelligent systems, showcasing its commitment to innovation and growth.

By 2024, components, assembly for smartphones and notebooks, intelligent products, and automotive electronics accounted for 20.1%, 59.5%, 8.8%, and 11.6% of BYD Electronic's gross revenue, respectively. The company's revenue grew by 36% year-over-year to RMB 177.3 billion in FY24, with net profit growing by 6% year-over-year to RMB 4.3 billion. For more insights, consider reading about Owners & Shareholders of BYD Electronic.

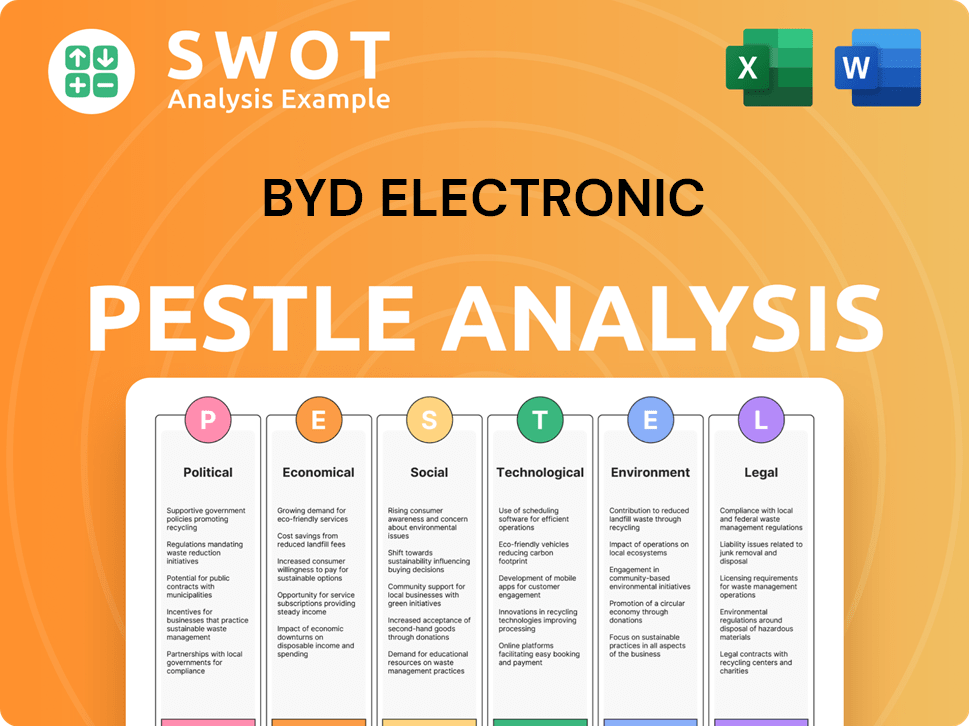

BYD Electronic PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in BYD Electronic history?

The BYD Electronic Company has achieved significant milestones throughout its history, evolving from a component supplier to a comprehensive solutions provider. The BYD history reflects its growth and adaptation in the dynamic Chinese electronics market.

| Year | Milestone |

|---|---|

| 2007 | Established as a subsidiary of BYD Group, focusing on electronic manufacturing. |

| 2007 | Listed on the Hong Kong Stock Exchange. |

| 2010s | Expanded into smartphone components and assembly, becoming a key supplier. |

| 2024 | Commenced mass production of AI servers, entering the AI data center market. |

| 2024 | Expanded its role in Apple's ecosystem, manufacturing high-value components. |

BYD Electronic Company has consistently pursued innovation, particularly through its vertically integrated manufacturing approach. This strategy allows for control over all stages, from materials to assembly, resulting in cost advantages and agility.

The company controls the entire manufacturing process, from raw materials to final assembly, enhancing efficiency and reducing costs. This approach gives BYD Electronic Company a competitive edge in the market.

As of December 2024, BYD Electronic Company held approximately 10,502 patents/applications globally across 6,084 unique patent families, with over 67.45% being active. This extensive patent portfolio underscores its commitment to technological advancement.

The company has developed and patented Plastic Metal Hybrid (PMH) technology. This technology is used in the production of various electronic components, improving their durability and performance.

BYD Electronic Company has invested in the development of high-strength aluminum alloys. These alloys are used in the production of components for smartphones and other devices, enhancing their structural integrity.

The company has focused on advanced surface treatments to improve the aesthetics and durability of its products. These treatments are crucial for maintaining the quality and appearance of electronic devices.

In 2024, BYD Electronic Company entered the AI server market, starting mass production of AI servers. This move positions the company to capitalize on the growing demand for energy-efficient AI data center solutions.

BYD Electronic Company faces several challenges, including reliance on key customers and geopolitical risks. For instance, in April 2025, the company's stock value declined due to new US tariffs, demonstrating the impact of external factors.

A significant portion of BYD Electronic Company's revenue comes from a few major clients, such as Apple. This dependence can make the company vulnerable to changes in those clients' strategies or market conditions.

US-China trade tensions and other geopolitical factors pose risks to BYD Electronic Company's operations. These factors can affect tariffs, supply chains, and overall market access.

Intensifying competition in the electronic manufacturing sector puts pressure on profit margins. BYD Electronic Company must continually innovate and improve efficiency to maintain profitability.

In April 2025, the company's stock value experienced a decline due to new US tariffs on Chinese imports. This situation highlights the direct impact of external trade policies on the company's financial performance.

The company has demonstrated its ability to adapt to market demands and challenges, such as including plug-in hybrid electric vehicles (PHEVs) alongside battery electric vehicles (BEVs) in response to tariff challenges in Europe.

BYD Electronic Company's focus on in-house robotics is expected to drive continuous efficiency gains, helping to mitigate margin pressures and enhance operational performance.

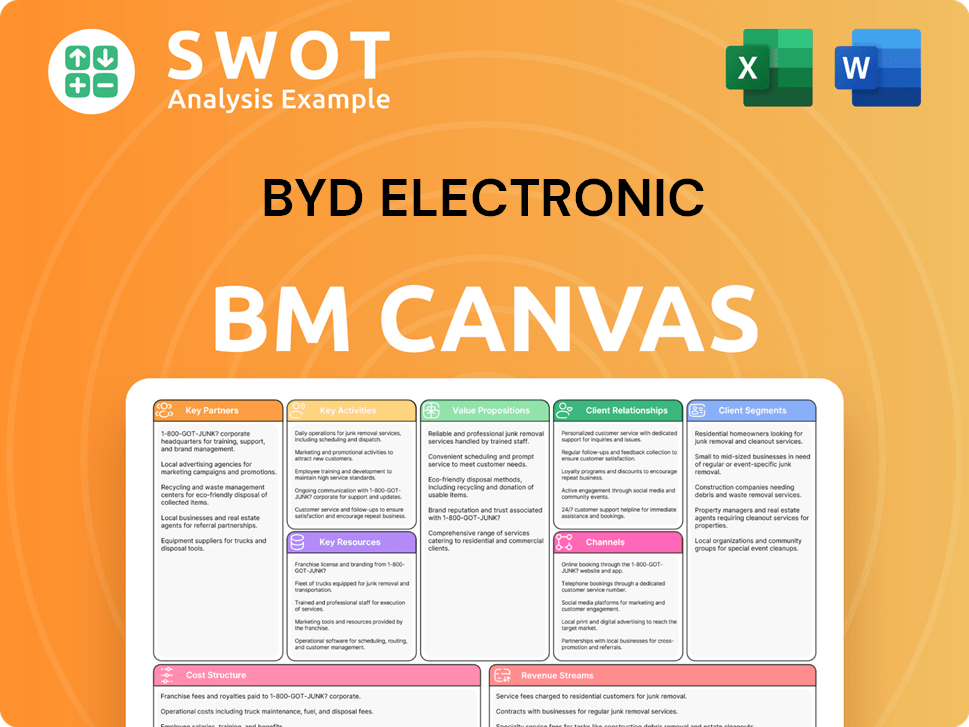

BYD Electronic Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for BYD Electronic?

The Growth Strategy of BYD Electronic is rooted in its parent company's, BYD Group, strategic moves and technological advancements. Key milestones in BYD Electronic Company's history include its founding in 2002 as a division of BYD, focusing on handset components. The company expanded globally, starting with factories in Romania, India, and Hungary. BYD Electronic's financial performance has shown significant growth, with a reported revenue increase of 36.43% to RMB 177.3 billion and a net profit increase of 5.55% to RMB 4.27 billion in 2024. The company also entered the AI server market, aiming to significantly increase sales. In March 2025, BYD Group announced record results for 2024, with a 34% increase in net profit to 40.25 billion yuan, and global vehicle sales of 4.27 million units. BYD Electronic's Q1 2025 financial performance showed steady revenue and profit.

| Year | Key Event |

|---|---|

| February 1995 | BYD Company Limited, the parent company, was founded by Wang Chuanfu in Shenzhen, China, initially focusing on battery manufacturing. |

| 2002 | BYD Electronic began operations as a division of BYD, concentrating on handset components and modules. |

| 2003 | BYD Auto, a major subsidiary of BYD, was established, marking the parent company's entry into the automotive industry. |

| 2007 | BYD Electronic (International) Company Limited was incorporated in Hong Kong and listed on the Hong Kong Stock Exchange. |

| 2008 | BYD Electronic expanded globally with factories in Romania, India, and Hungary. |

| 2023 | BYD's automotive business accounted for over 80% of its parent company's revenue. |

| 2024 | BYD Electronic reported a significant increase in financial performance, with revenue rising by 36.43% to RMB 177.3 billion and net profit up 5.55% to RMB 4.27 billion. The company also commenced mass production of AI servers. |

| March 2025 | BYD posted record 2024 results, with net profit up 34% to 40.25 billion yuan for the parent company, and sales of 4.27 million vehicles globally. BYD Electronic reports steady Q1 2025 financial performance with a slight increase in revenue and profit. |

BYD Electronic is expected to see a substantial increase in high-margin orders from Apple in Fiscal Year 2025-2027. This growth is driven by its expansion into high-precision components, such as metal middle frames for iPhones. The company's focus on high-value products is a key part of its strategy.

The AI server business is expected to be a major growth driver for BYD Electronic. The company aims to quintuple sales to RMB 4,000 million for FY25. This strategic move highlights BYD Electronic’s diversification into high-growth sectors.

Analysts project a robust 26% net profit Compound Annual Growth Rate (CAGR) for BYD Electronic in Fiscal Year 2025-2027. This growth is fueled by increasing orders from Apple, BYD, and NVIDIA. The company's strong financial outlook is based on its strategic partnerships and market position.

The auto electronics segment is projected to grow significantly, accounting for 25% of the company's revenue share by FY26F. This expansion reflects BYD Electronic's increasing presence in the automotive industry. It also shows the company's ability to adapt to industry trends.

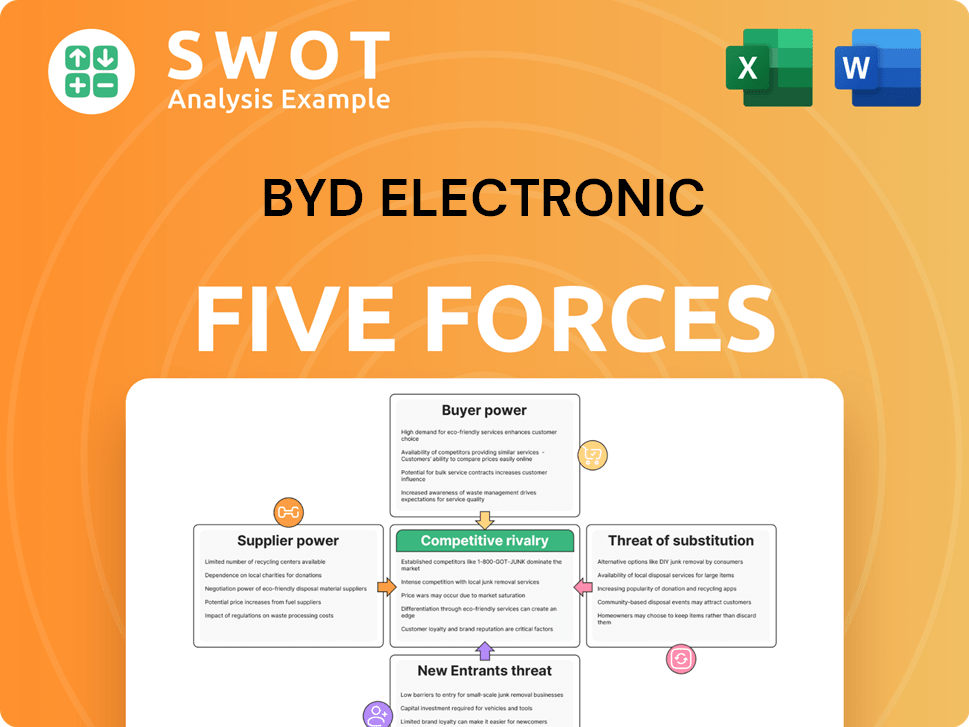

BYD Electronic Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of BYD Electronic Company?

- What is Growth Strategy and Future Prospects of BYD Electronic Company?

- How Does BYD Electronic Company Work?

- What is Sales and Marketing Strategy of BYD Electronic Company?

- What is Brief History of BYD Electronic Company?

- Who Owns BYD Electronic Company?

- What is Customer Demographics and Target Market of BYD Electronic Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.