BYD Electronic Bundle

How Does BYD Electronic Company Stack Up in the Tech Arena?

In the dynamic world of smart device manufacturing, BYD Electronic SWOT Analysis reveals a company at the forefront of innovation. As a key player in the global market, BYD Electronic Company is constantly adapting to technological shifts and consumer demands. Understanding its competitive landscape is crucial for anyone looking to navigate the complexities of the electronics industry.

This deep dive into BYD electronics examines its competitive positioning, exploring key rivals and industry trends. We'll dissect the company's growth strategies, market share analysis, and financial performance to provide a comprehensive market analysis. Discover the competitive advantages of BYD Electronic Company and gain insights into its future outlook within this ever-evolving sector, including challenges and opportunities.

Where Does BYD Electronic’ Stand in the Current Market?

BYD Electronic Company has established itself as a key player in the global smart device manufacturing sector. It operates within the electronics manufacturing services (EMS) industry, competing with major international EMS providers. The company's diverse product range includes smartphones, laptops, new intelligent products, and automotive intelligent systems, serving a wide array of customers.

The company's manufacturing and service capabilities are strategically located worldwide, catering to a global customer base across Asia, Europe, and the Americas. BYD Electronic has evolved from a component manufacturer to a full-service solutions provider, focusing on design, research and development, and supply chain management. This shift underscores its commitment to offering higher-value services within the EMS sector.

Financial results demonstrate the company's strong performance. In 2023, BYD Electronic's net profit attributable to shareholders reached approximately RMB 4.04 billion, a significant increase of 117.6% year-on-year. The company's revenue for the same year was approximately RMB 177.63 billion, reflecting a 21.2% year-on-year increase. This growth is mainly driven by its performance in consumer electronics and new intelligent products, and its expansion into automotive intelligent systems further strengthens its market position.

BYD Electronic Company holds a significant position within the EMS industry. While specific market share data is not always publicly available, the company is recognized as a major global player. Its competitive landscape includes some of the largest EMS providers worldwide, reflecting its substantial scale and influence.

The company's key product lines include smartphones, laptops, and new intelligent products. BYD electronics also focuses on automotive intelligent systems. This diversified product portfolio allows the company to serve various customer segments and adapt to changing market demands.

BYD Electronic Company has a global presence, with manufacturing facilities and service capabilities strategically located worldwide. This global footprint enables the company to effectively serve its diverse customer base across Asia, Europe, and the Americas. This broad reach supports its competitive positioning.

BYD Electronic Company's financial performance in 2023 was robust. The company reported a net profit attributable to shareholders of approximately RMB 4.04 billion, a substantial year-on-year increase of 117.6%. Revenue reached approximately RMB 177.63 billion, up 21.2% year-on-year, driven by strong performance in consumer electronics and new intelligent products.

BYD Electronic Company's strategic focus has shifted toward higher-value services, including design, research and development, and supply chain management. This move allows the company to enhance its competitive advantages. The expansion into automotive intelligent systems highlights a strategic move into a high-growth sector, further solidifying its market position.

- The company's growth is supported by strong performance in consumer electronics and new intelligent products.

- Expansion into automotive intelligent systems.

- The company's financial health is demonstrated by significant revenue and profit increases in 2023.

- The company's global presence and diversified product portfolio are key to its competitive positioning.

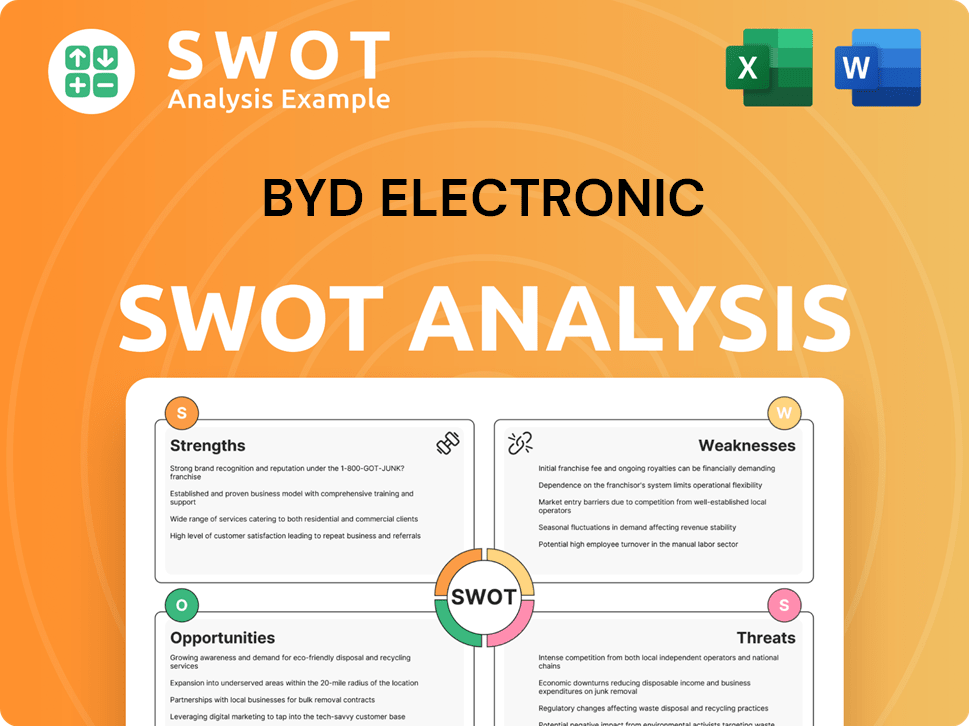

BYD Electronic SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging BYD Electronic?

The competitive landscape for BYD Electronic Company (BYD electronics) is intense, shaped by a global market with numerous players. The company faces challenges from both direct and indirect competitors in the electronics manufacturing services (EMS) and smart device sectors. Understanding the dynamics of this competition is crucial for any market analysis.

The industry sees constant evolution, with companies vying for market share through various strategies. Factors like technological advancements, supply chain resilience, and geopolitical considerations significantly influence the competitive positions of companies like BYD Electronic Company. This environment demands continuous adaptation and strategic foresight.

Direct competitors of BYD Electronic Company include established EMS giants. These companies compete head-on in the same markets, offering similar services to similar clients. They often vie for contracts from major global brands.

Foxconn is the world's largest contract electronics manufacturer. It poses a significant challenge due to its massive scale and extensive manufacturing capabilities. In 2024, Foxconn's revenue was approximately $220 billion USD.

Pegatron competes directly in segments like laptops and consumer electronics. They leverage specialized expertise and global supply chains. Pegatron's revenue in 2024 was around $45 billion USD.

Quanta also competes in the same markets, focusing on areas like laptops and servers. They utilize their expertise and supply chain networks. Quanta's revenue in 2024 was approximately $37 billion USD.

The competition often revolves around securing contracts from major global brands. Factors like pricing, quality, delivery timelines, and technological capabilities are crucial. The battle for market share is constant.

Indirect competitors include original design manufacturers (ODMs) and brands bringing manufacturing in-house. Emerging players in niche markets also pose a threat. These entities can alter the competitive dynamics.

BYD Electronic Company faces challenges in a dynamic market. Understanding the competitive landscape is essential for developing effective strategies. For more insights, consider reading about the Marketing Strategy of BYD Electronic.

- Cost Efficiency: Competing with companies like Foxconn on production costs.

- Technological Innovation: Investing in R&D to offer advanced manufacturing solutions.

- Supply Chain Resilience: Diversifying supply chains to mitigate risks.

- Market Focus: Identifying and capitalizing on niche markets and emerging technologies.

- Strategic Partnerships: Forming alliances to expand capabilities and market reach.

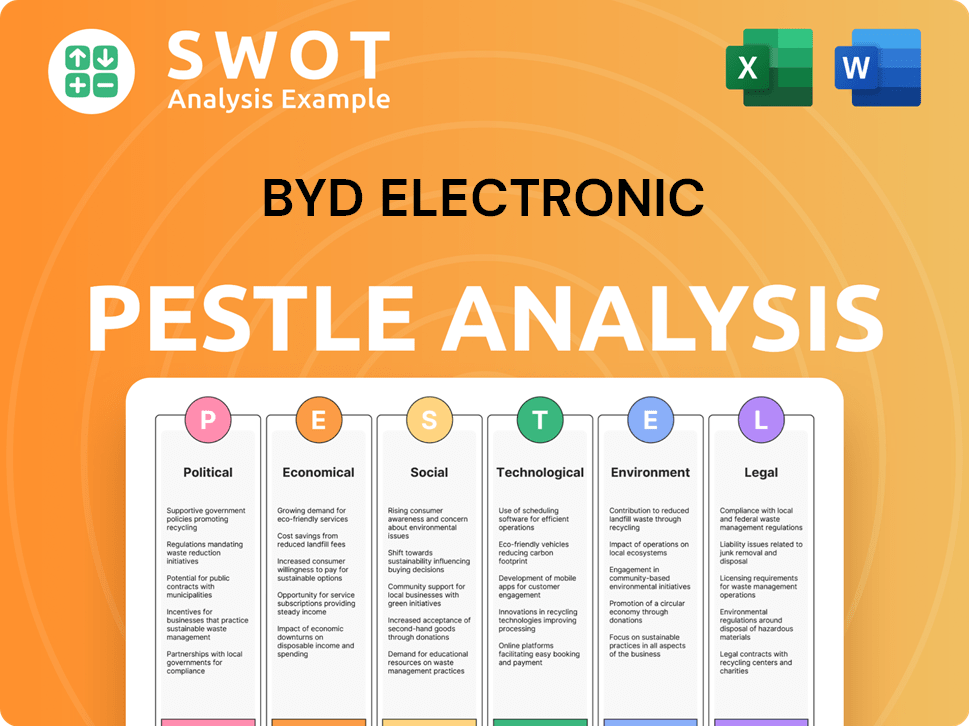

BYD Electronic PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives BYD Electronic a Competitive Edge Over Its Rivals?

Understanding the BYD Electronic Company competitive landscape involves assessing its core strengths and how they position it against rivals. The company's success is rooted in its technological prowess and a highly integrated supply chain. This integrated approach allows for greater control over production, leading to enhanced efficiency and quality. This strategy is crucial in a market where rapid innovation and cost-effectiveness are paramount.

The company's competitive advantages are further bolstered by its proprietary technologies and intellectual property. Significant investments in research and development, particularly in areas like precision manufacturing and intelligent systems, enable it to offer comprehensive solutions for complex smart devices and automotive electronics. The company's ability to maintain strong relationships with major global brands, built on a foundation of reliability and quality, further strengthens its market position.

BYD Electronic Company leverages its established market presence and technological capabilities to compete effectively. Its focus on end-to-end solutions and advanced technology integration is central to its product development and marketing strategies. While facing challenges from rapid technological advancements and the need for continuous cost reduction, the company's commitment to innovation and strategic adaptation is critical for sustaining its competitive edge in the dynamic electronics market.

BYD Electronic distinguishes itself through deep technological expertise and a vertically integrated supply chain. This allows for greater control over production, leading to higher quality and efficiency. This strategy is particularly effective in reducing lead times and enhancing overall operational performance. This integrated approach is a key differentiator in the BYD electronics market.

BYD Electronic Company invests heavily in research and development, focusing on precision manufacturing and intelligent systems. This commitment to innovation enables the company to offer comprehensive solutions for complex smart devices and automotive electronics. The company's focus on technological advancement is crucial for maintaining its competitive edge.

The company has established strong relationships with major global brands, fostering customer loyalty and repeat business. While economies of scale may not match some competitors in all segments, BYD Electronic benefits from substantial production volumes. This scale supports cost efficiencies and reinvestment in innovation. This is a key factor in the BYD Electronic Company market share analysis.

BYD Electronic has a strong talent pool, especially in engineering and manufacturing. The company's ability to adapt to rapid technological changes and market demands is also critical. Sustaining its competitive advantages requires continuous innovation and strategic adaptation, as discussed in the Growth Strategy of BYD Electronic.

BYD Electronic's competitive advantages are multifaceted, encompassing technological expertise, vertical integration, and strong customer relationships. These strengths allow for efficient production, high-quality products, and the ability to meet the evolving demands of the smart device and automotive electronics markets. The company's strategic focus on innovation and adaptability is crucial for its long-term success.

- Vertical integration enhances control over production processes.

- Investments in R&D drive innovation in key technological areas.

- Strong relationships with global brands ensure customer loyalty.

- Economies of scale contribute to cost efficiencies.

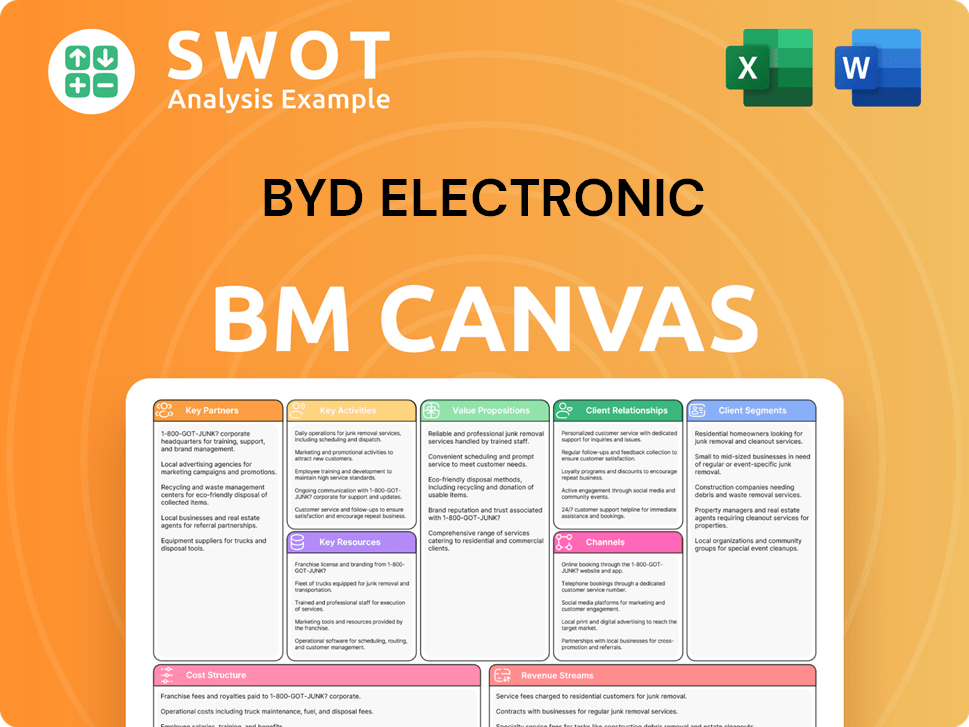

BYD Electronic Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping BYD Electronic’s Competitive Landscape?

The smart device manufacturing industry, where BYD Electronic Company operates, is currently shaped by significant trends, including the expansion of 5G technology, the rise of Artificial Intelligence (AI) and the Internet of Things (IoT), and increasing demands for sustainable electronics. These factors influence the competitive landscape, presenting both opportunities and challenges for BYD electronics and its rivals. The evolution of the automotive industry towards electric vehicles (EVs) and smart cockpits further creates growth prospects, particularly for BYD Electronic's automotive intelligent systems segment.

Anticipated disruptions include supply chain reconfigurations due to geopolitical factors and the push for localized manufacturing. New market entrants specializing in niche AI hardware or advanced robotics could also challenge existing players. Changing business models, such as a focus on circular economy principles and device-as-a-service models, will require adaptability. Potential threats include intensified competition from lower-cost manufacturers, increasing regulatory scrutiny, and the volatility of consumer electronics demand. Global economic uncertainties may also affect consumer spending on smart devices, affecting the BYD Electronic Company market share analysis.

The industry is witnessing a surge in 5G adoption, fueling demand for advanced smart devices. AI and IoT are driving innovation in intelligent products and sensors. The automotive sector's shift to EVs and smart cockpits offers growth opportunities. These industry trends are shaping the competitive landscape.

Geopolitical factors and localized manufacturing are causing supply chain reconfigurations. The emergence of new competitors specializing in AI hardware poses a threat. Changing business models and increased regulatory scrutiny add complexity. Economic uncertainties could impact consumer spending, creating market challenges.

Emerging markets in Southeast Asia and Latin America offer significant growth potential. Product innovations in foldable devices, wearables, and automotive electronics create differentiation. Strategic partnerships can strengthen market positions. BYD Electronic Company's growth strategies include innovation and strategic partnerships.

BYD Electronic is likely focusing on continuous R&D investment and vertical integration to enhance supply chain resilience. Diversification into high-growth sectors and adherence to ESG standards are key. The company aims to adapt strategically to dynamic industry shifts, impacting its competitive positioning.

BYD Electronic Company is likely responding to these trends through strategic investments and partnerships. The company's ability to adapt to changing market conditions will be critical. For a deeper understanding of BYD electronics, consider reading Owners & Shareholders of BYD Electronic.

- Continued investment in R&D to drive innovation.

- Vertical integration to secure supply chains and improve efficiency.

- Diversification into high-growth sectors, such as automotive intelligent systems.

- Adherence to ESG standards to meet evolving consumer and regulatory demands.

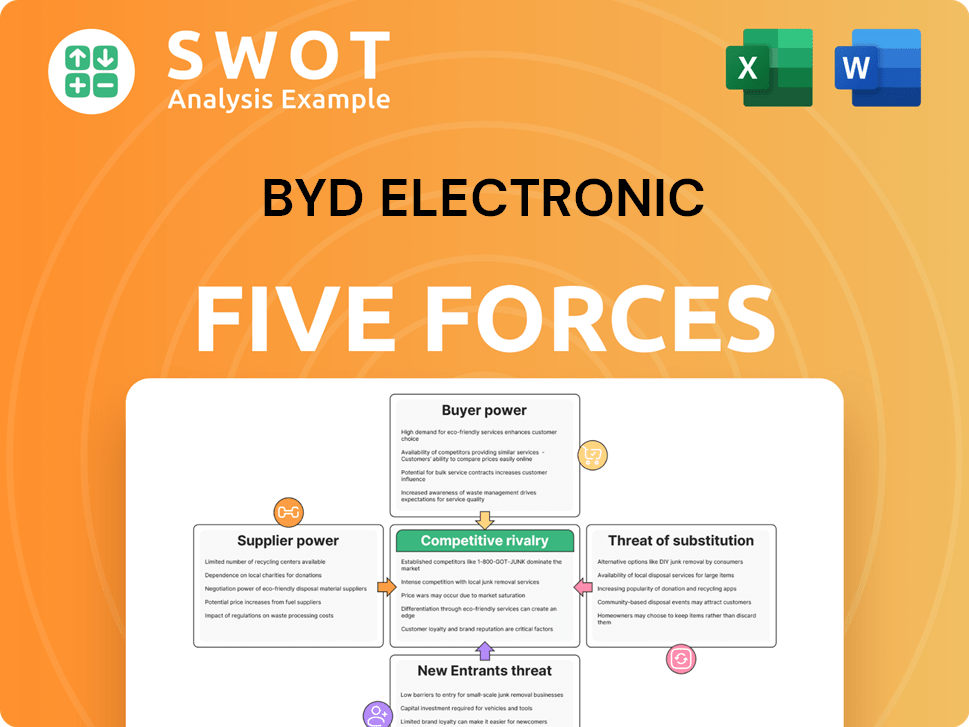

BYD Electronic Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BYD Electronic Company?

- What is Growth Strategy and Future Prospects of BYD Electronic Company?

- How Does BYD Electronic Company Work?

- What is Sales and Marketing Strategy of BYD Electronic Company?

- What is Brief History of BYD Electronic Company?

- Who Owns BYD Electronic Company?

- What is Customer Demographics and Target Market of BYD Electronic Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.