CDW Bundle

How did CDW go from a classified ad to a Fortune 500 giant?

Journey back to 1984, where the seeds of CDW, a leading technology solutions provider, were sown. It all began with a simple advertisement, a pivotal moment that would transform into 'MPK Computing' and eventually, the powerhouse known as CDW. From Lincolnshire, Illinois, the company's CDW SWOT Analysis reveals a fascinating history of innovation and expansion.

This brief history of CDW company showcases its remarkable evolution, from its early years to its current status as a key player in the technology landscape. Understanding the CDW business model and CDW Corporation's growth over time provides valuable insights for investors and business strategists alike. Exploring CDW's key milestones and acquisitions further illuminates its journey to becoming a market leader, solidifying its place in the S&P 500.

What is the CDW Founding Story?

The story of the CDW company, a leading provider of technology solutions, began in 1984. It was founded by Michael Krasny, marking the start of what would become a significant player in the IT industry. The company's journey from its inception to its current status is a testament to its adaptability and strategic vision.

Initially known as 'MPK Computing,' the business quickly evolved. Krasny's entrepreneurial spirit and understanding of the market drove the company's early success. This foundation set the stage for CDW's future growth and its evolution into a major IT solutions provider.

The Growth Strategy of CDW has been a key factor in its success. Here's a look at the company's founding story.

Michael Krasny founded CDW in 1984, initially naming it 'MPK Computing'. The company's roots trace back to Krasny's experience as a computer salesman and his observation of the direct sales model's potential.

- Krasny started the business from a small apartment in Lincolnshire, Illinois.

- He invested his personal savings and credit cards, with an initial capital of $3,000.

- The business model focused on direct marketing and selling computer hardware and software to small and medium-sized businesses.

- The name 'Computer Discount Warehouse' reflected its emphasis on competitive pricing.

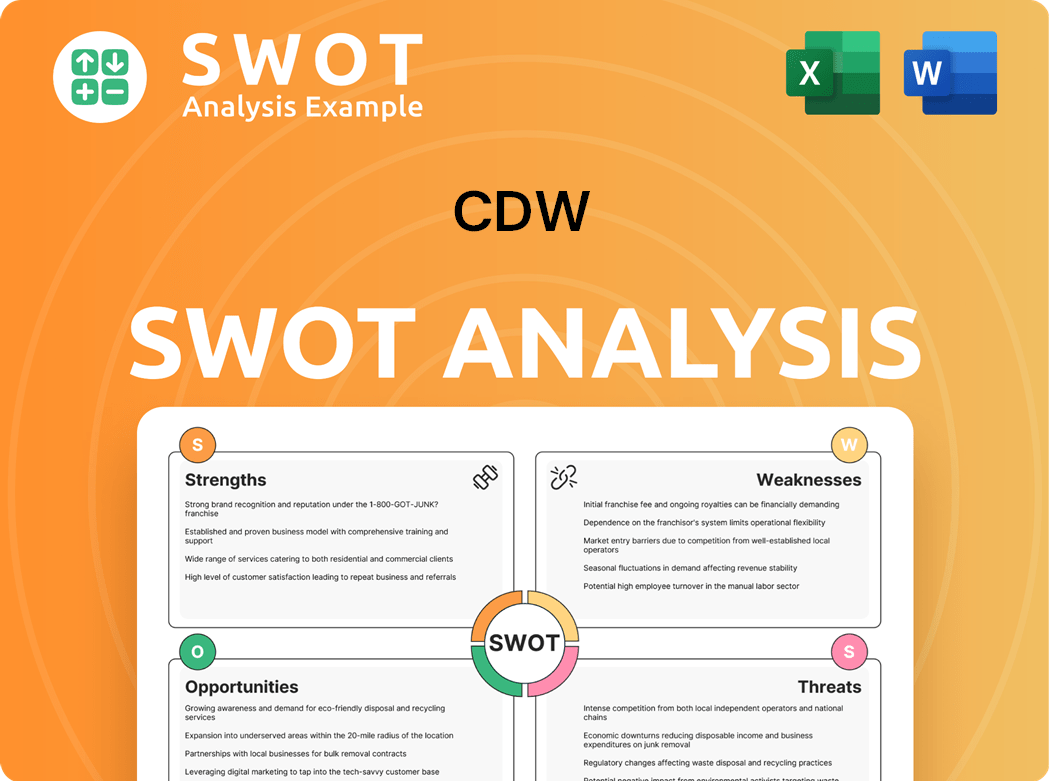

CDW SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CDW?

The early growth of the CDW Corporation was marked by rapid expansion. This period saw the company broaden its product offerings and customer base significantly. Key milestones included going public and embracing online sales, which fueled its growth and market reach.

In 1985, the CDW company ran its first national advertisement in PC World magazine. It began expanding its product offerings beyond computers to include software and peripherals. By 1987, CDW published its first catalog and started offering initial services, assisting customers with computer setup and hiring coworkers with technical expertise.

A significant turning point occurred in 1993 when CDW went public on NASDAQ under the ticker symbol CDWC. Sales reached $270 million, and the workforce comprised 247 coworkers. The company embraced online sales by introducing CDW.com in 1995, broadening its reach and accessibility to a wider audience.

By 1997, CDW established its headquarters in Vernon Hills, Illinois, and surpassed the $1 billion sales mark, reaching $1.27 billion with 986 coworkers. The establishment of CDW-G in 1998 further solidified its commitment to serving government and education customers. Key acquisitions, such as the purchase of Micro Warehouse assets in 2003, led to the formation of CDW Canada.

In 2005, CDW opened its Western Distribution Center in Las Vegas, expanding its total distribution center space to over 950,000 sq. ft., and launched CDW Healthcare. In 2006, CDW acquired Berbee Information Networks, adding data centers and offices and expanding its team of advanced technology specialists and engineers. This period of early growth showcased CDW's ability to adapt to market demands and strategically expand its offerings and reach.

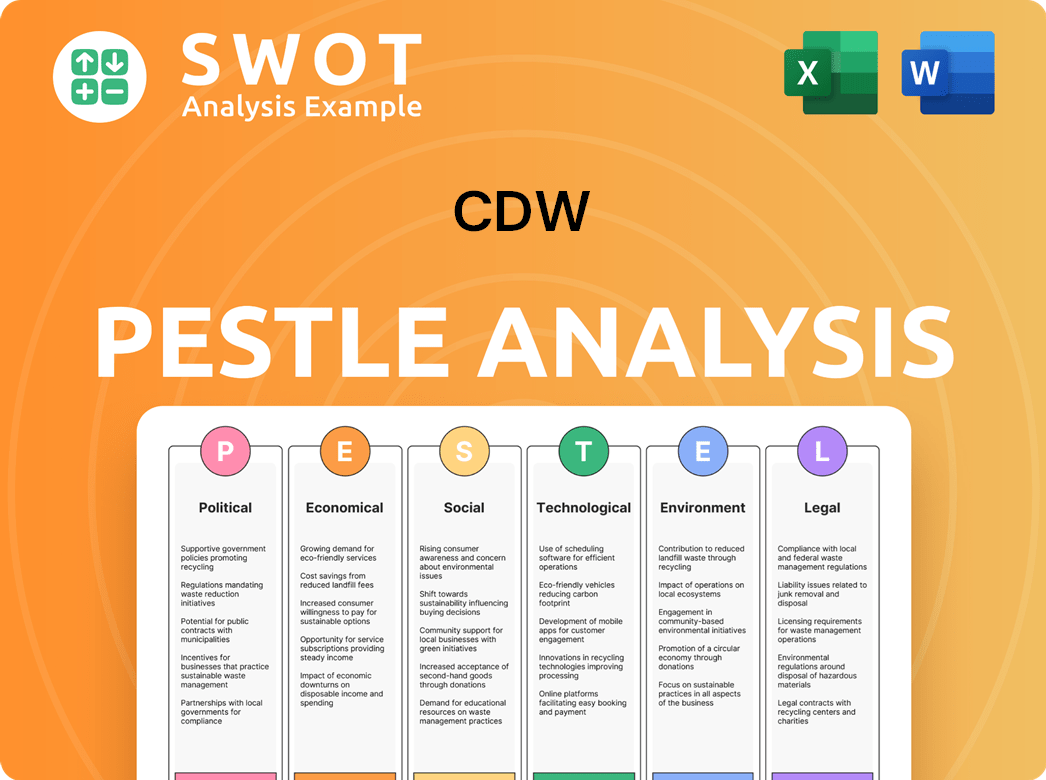

CDW PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CDW history?

The CDW journey is marked by significant milestones, including strategic shifts, acquisitions, and a return to the public market. This CDW history reflects its evolution and adaptation within the IT solutions sector. The CDW company has consistently demonstrated its ability to navigate market changes and pursue strategic growth opportunities.

| Year | Milestone |

|---|---|

| 2007 | CDW was acquired by Madison Dearborn Partners and Providence Equity Partners in a $7 billion deal, becoming a private company. |

| 2013 | CDW returned to the public market with an initial public offering (IPO) on NASDAQ, raising over $395 million. |

| 2015 | Kelway Ltd. was acquired, expanding CDW's international presence. |

| 2021 | Sirius Computer Solutions, Inc. was acquired, strengthening CDW's IT solutions capabilities. |

| 2024 | In December, CDW acquired Mission Cloud Services Inc. to enhance its cloud and AI capabilities, including cloud professional services and consulting, and specifically bolstering its AWS expertise. |

CDW has focused on innovation, notably with its multi-year digital transformation starting in 2020. This initiative aimed to modernize legacy technology and streamline processes. CDW's adoption of AI, such as the development of Harold, an AI assistant, highlights its commitment to operational efficiency and technological advancement.

CDW embarked on a digital transformation journey in 2020 to modernize legacy systems and streamline operations. This involved a shift to hybrid cloud solutions and enterprise-wide standardization of tools.

CDW developed Harold, an AI assistant, to handle IT and HR inquiries, demonstrating its commitment to leveraging AI for operational efficiency. This innovation has improved response times and streamlined internal processes.

CDW has consistently expanded its portfolio through strategic acquisitions to enhance its solutions and services. Acquisitions like Kelway Ltd. and Sirius Computer Solutions, Inc. have significantly strengthened its market position.

The acquisition of Mission Cloud Services Inc. in December 2024 enhances CDW's cloud and AI capabilities. This acquisition specifically bolsters its AWS expertise, positioning the company for growth in these critical areas.

CDW's digital transformation aimed to streamline manual processes, freeing up sales teams for enhanced customer engagement. This focus on customer relationships is a key aspect of CDW's strategy.

The shift to hybrid cloud solutions is a core component of CDW's digital transformation strategy. This approach enhances flexibility and scalability, allowing CDW to meet diverse customer needs.

CDW faces challenges such as intense competition and pricing pressures in the IT solutions market. For the full year 2024, net sales declined by 1.8% compared to 2023; however, Q1 2025 showed a positive turnaround.

CDW operates in a highly competitive IT solutions market, facing pressure from various competitors. This competitive landscape can impact profit margins and sales cycles.

Increased pricing pressure is another challenge CDW faces, potentially affecting profitability. Managing costs and maintaining competitive pricing is crucial for sustained growth.

Longer sales cycles can impact CDW's financial performance, requiring effective strategies to manage and shorten these cycles. This can affect revenue recognition and cash flow.

The decline in net sales in 2024 highlights the impact of market challenges, although the Q1 2025 results show a positive turnaround. Managing these fluctuations is key to long-term success.

The healthcare segment has emerged as a strong performer, with significant year-over-year growth in Q1 2025. This sector's performance is a key factor in CDW's overall financial health.

CDW's ability to navigate market shifts and continuously innovate underscores its strength in the evolving IT landscape. This adaptability is crucial for long-term success.

For more insight into CDW's core values and strategic direction, you can explore the Mission, Vision & Core Values of CDW.

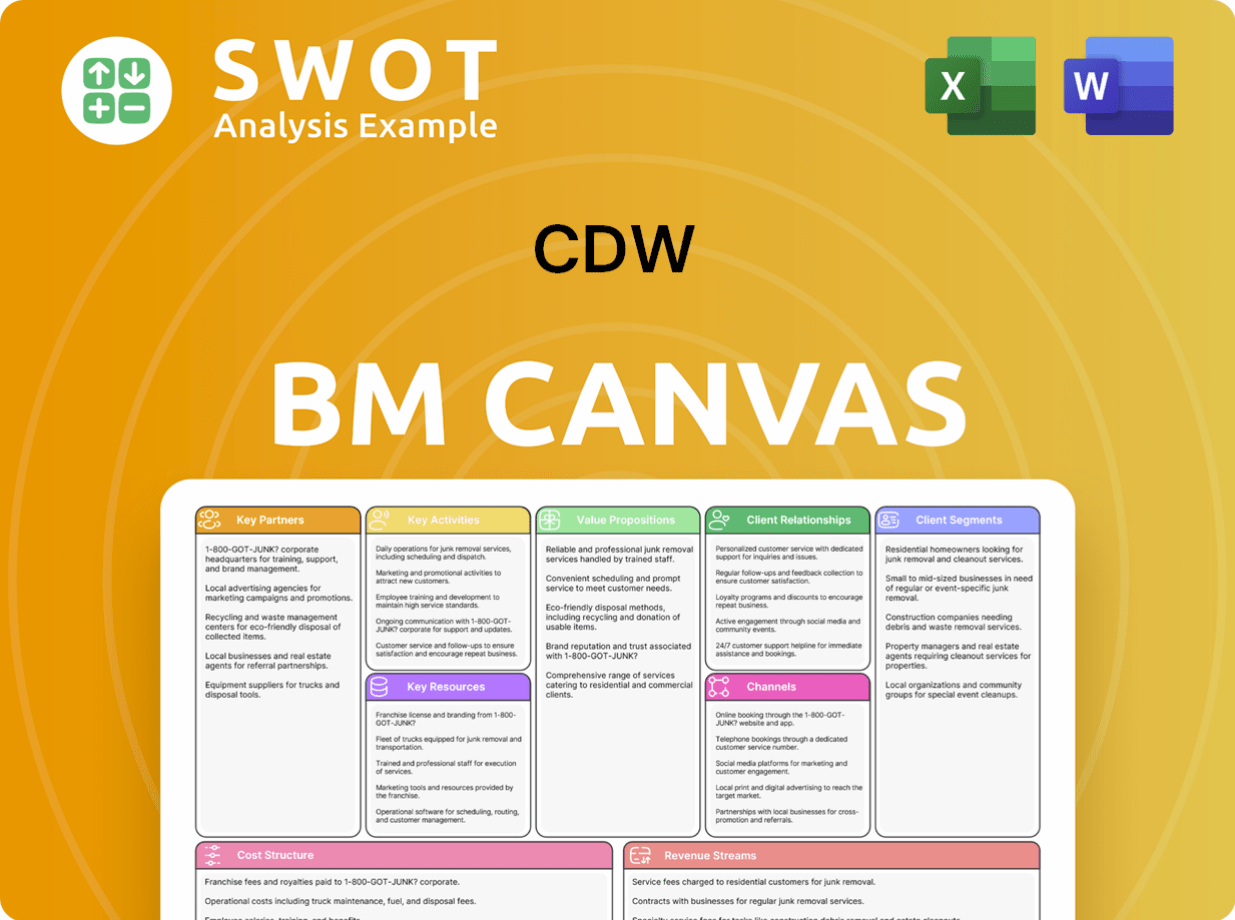

CDW Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CDW?

The CDW company, a prominent player in the IT solutions sector, has a rich history marked by strategic expansions and adaptations to market trends. Founded in 1984 as MPK Computing by Michael Krasny, the company quickly evolved, launching its first national advertisement in 1985 and publishing its first catalog in 1987. CDW's journey includes a successful initial public offering in 1993, the embrace of online sales with CDW.com in 1995, and significant acquisitions like Micro Warehouse assets in 2003 and Kelway Ltd. in 2015. The company went private in 2007, then returned to the public market in 2013, continuing its growth trajectory with the acquisition of Sirius Computer Solutions, Inc. in 2021 and Mission Cloud Services Inc. in December 2024. Recent financial reports reflect this evolution, with net sales increasing in the first quarter of 2025.

| Year | Key Event |

|---|---|

| 1984 | Michael Krasny founded CDW, initially named MPK Computing, in Lincolnshire, Illinois. |

| 1985 | The company placed its first national advertisement in PC World magazine, expanding its product offerings. |

| 1987 | CDW published its first catalog and began hiring technical staff. |

| 1993 | CDW completed its first IPO, listing on NASDAQ under the ticker symbol CDWC. |

| 1995 | CDW embraced online sales by launching CDW.com. |

| 1997 | The company established its headquarters in Vernon Hills, IL, and surpassed $1 billion in sales. |

| 1998 | CDW-G was founded to support government and education customers. |

| 2003 | CDW acquired Micro Warehouse assets, leading to CDW Canada. |

| 2007 | CDW was acquired by private equity firms Madison Dearborn Partners and Providence Equity Partners for $7 billion, going private. |

| 2013 | The company returned to the public market with an IPO on NASDAQ (CDW). |

| 2015 | CDW acquired the remaining 65% of Kelway Ltd., expanding its international presence. |

| 2021 | CDW acquired Sirius Computer Solutions, Inc. |

| December 2024 | CDW acquired Mission Cloud Services Inc. to enhance cloud and AI capabilities. |

| February 2025 | CDW reported Fourth Quarter and Full Year 2024 Earnings, with full year net sales declining 1.8% from 2023. |

| May 2025 | CDW reported First Quarter 2025 Earnings, with net sales increasing 6.7% year-over-year to $5.2 billion. |

CDW is strategically focused on the growing demand for digital transformation solutions. This includes a strong emphasis on cloud computing, cybersecurity, and data analytics.

The company is investing in its technical expertise and certifications to provide high-value services. Strategic acquisitions, such as Mission Cloud Services, are key to expanding capabilities.

CDW emphasizes a customer-centric approach, aiming to help customers maximize their IT investments and prepare for future technological advancements, including AI.

Analysts forecast CDW to grow earnings by 6.1% and revenue by 4.3% per annum. The company's commitment to innovation and operational excellence supports its market leadership.

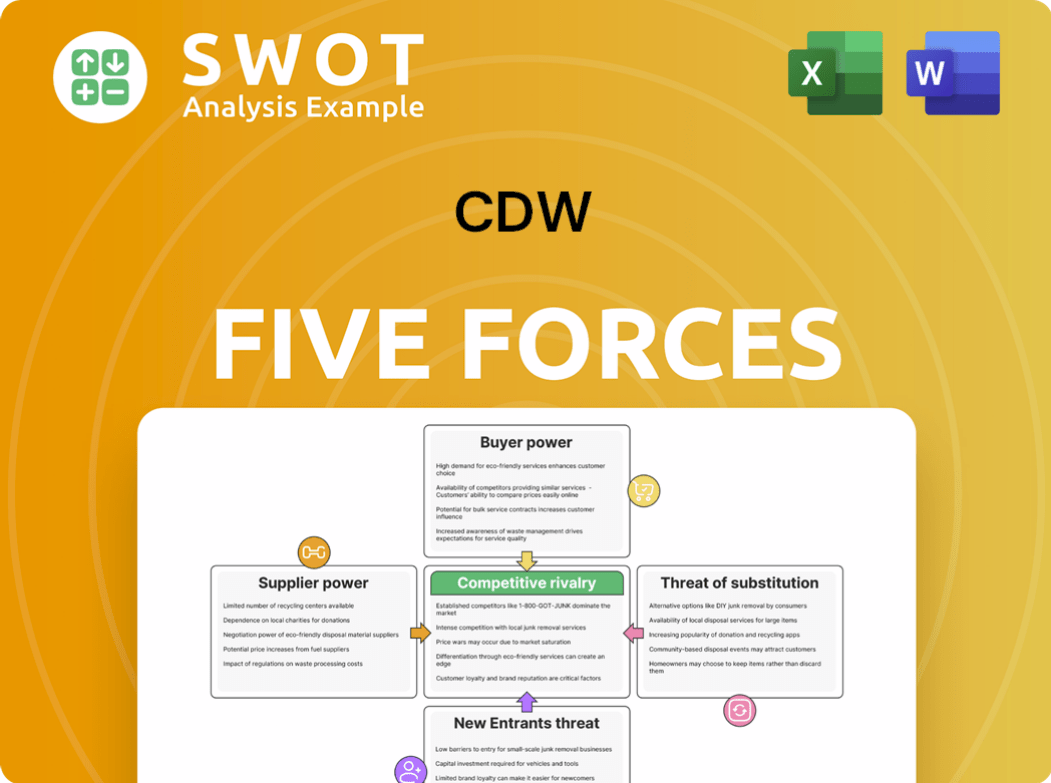

CDW Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CDW Company?

- What is Growth Strategy and Future Prospects of CDW Company?

- How Does CDW Company Work?

- What is Sales and Marketing Strategy of CDW Company?

- What is Brief History of CDW Company?

- Who Owns CDW Company?

- What is Customer Demographics and Target Market of CDW Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.