CDW Bundle

Unlocking CDW: How Does This Tech Titan Operate?

CDW Corporation, a Fortune 500 leader, is a powerhouse in the technology solutions arena, and its recent financial performance is turning heads. With a 6.7% increase in net sales reported in Q1 2025, the CDW SWOT Analysis becomes even more critical for understanding its strategic positioning. But how does this company, with its vast reach across business, government, and healthcare, actually work?

This exploration of the CDW company dives deep into its operational model, revealing how it distributes technology and generates revenue. We'll dissect CDW's business, from its diverse product offerings to its crucial services, like cloud computing and cybersecurity. Understanding the intricacies of the CDW business model is key to appreciating its continued success and future prospects in the ever-evolving IT landscape, making it a compelling subject for investors and industry watchers alike.

What Are the Key Operations Driving CDW’s Success?

The CDW company operates as a leading provider of information technology solutions, serving a diverse customer base that includes businesses, government agencies, educational institutions, and healthcare organizations. Its core business revolves around offering a comprehensive suite of IT products and services. This includes hardware, software, and integrated IT solutions designed to meet the evolving needs of its clients.

The CDW business model is centered on connecting customers with technology solutions. They act as a multi-brand provider, offering a wide array of products from leading manufacturers. Their services extend beyond just selling products, encompassing cloud computing, cybersecurity, data center management, and professional services like consulting and training.

The company's approach is built on strong vendor relationships and a focus on customer service. CDW differentiates itself by acting as an extension of both its customers' IT staff and the sales/marketing resources of its vendor partners. This integrated approach allows them to deliver customized solutions and maintain a competitive edge in the market. To understand more about who CDW serves, you can read about the Target Market of CDW.

Hardware offerings include desktops, laptops, tablets, mobile devices, servers, storage solutions, networking equipment, and printers. These products come from leading manufacturers such as Dell, HP, Lenovo, and Apple. This wide selection allows CDW to provide solutions tailored to various customer needs.

Software offerings encompass operating systems, productivity software, and various applications. These solutions are designed to enhance productivity, security, and operational efficiency. CDW ensures that customers have access to the latest software to meet their business requirements.

CDW provides a range of services, including cloud computing, cybersecurity, data center management, and professional services. These services support customers in managing their IT infrastructure and improving their overall performance. The services are designed to be comprehensive and adaptable.

The company maintains strong relationships with over 1,000 leading and emerging technology brands. This extensive vendor network, combined with its skilled specialists, allows CDW to offer a broad selection of multi-branded solutions. This strong supply chain is a key component of their business model.

The operational processes involve a robust supply chain, strategic partnerships, and diverse distribution networks. CDW focuses on providing deep knowledge and customer intimacy across corporate, small business, and public sectors. This approach allows them to deliver customized solutions and maintain a competitive edge.

- Strong vendor relationships with over 1,000 technology brands.

- Extensive sales channels focused on customer knowledge and intimacy.

- Highly skilled and certified specialists and engineers.

- Focus on providing multi-branded solutions and technical resources.

CDW SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CDW Make Money?

The CDW business model centers on providing a broad range of IT products and services to a diverse customer base. Their revenue streams are primarily generated through the sale of hardware, software, and associated services, making them a key player in the technology solutions market. This approach allows CDW to cater to various needs, from individual components to comprehensive IT infrastructure solutions.

Monetization strategies for the CDW company involve offering solutions that provide short-term ROI and cost flexibility, particularly in areas like cloud computing and cybersecurity. The company also focuses on its role as a trusted advisor, guiding customers through complex IT landscapes and their digital transformation journeys. This approach helps them build long-term relationships and drive recurring revenue.

By focusing on a comprehensive suite of offerings and a consultative sales approach, CDW aims to maintain its position as a leading provider of IT solutions.

The primary revenue streams for CDW are the sales of hardware, software, and services. Hardware sales form the largest segment, followed by software and then services. Other products and services contribute a smaller portion of the total revenue.

In fiscal year 2024, hardware sales were the biggest contributor, generating $15.22 billion, which accounted for 72.48% of total revenue. This reflects the ongoing demand for IT infrastructure components like notebooks, mobile devices, and desktops.

Software products contributed $3.80 billion, or 18.12% of the total revenue in 2024. This includes a wide range of software solutions that support business operations and IT functions.

Services generated $1.87 billion, representing 8.89% of the total revenue in 2024. These services include consulting, implementation, and managed services that help customers optimize their IT investments.

In the first quarter of 2025, CDW reported net sales of $5.199 billion, a 6.7% increase year-over-year. This growth was driven by strong demand across various segments, indicating continued success in the market.

The Corporate segment reported net sales of $2.236 billion, up 6.3% from the previous year. The Public segment, including healthcare and education, saw a 10.6% increase, with healthcare sales up 19.5%. Small Business saw a 7.9% increase.

CDW focuses on providing solutions with short-term ROI and cost flexibility, particularly in cloud, security, and services. They act as trusted advisors, guiding customers through complex IT landscapes, including their AI journey. Their comprehensive cloud solutions, including on-premise, hybrid, and cloud capabilities, contribute to their revenue mix.

- Offering a broad portfolio of CDW products and CDW services.

- Providing solutions that offer short-term return on investment.

- Focusing on cloud, security, and services to meet evolving customer needs.

- Acting as a trusted advisor to guide customers through their IT challenges.

- Offering a comprehensive suite of cloud solutions.

CDW PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CDW’s Business Model?

The operational and financial trajectory of the CDW company has been significantly shaped by strategic initiatives and its ability to adapt to market dynamics. In 2024, the company maintained its strategic focus despite a challenging demand environment, which saw net sales decrease by 2% and gross profit by approximately 1%. The company prioritized strengthening its scale and competitive advantages, focusing on streamlined sales processes and productizing its approach to high-growth technology vectors, such as wrap-around cloud services.

A key strategic move was the acquisition of Mission Cloud Services, which complements CDW's cloud investments. This acquisition enhances the company's expertise in cloud professional services, managed services, and consulting, positioning it to offer a broader range of cloud solutions. This strategic pivot is crucial as customers increasingly prioritize flexibility and scalability with cloud/SaaS solutions and security spending due to rising cyber threats.

The company has faced market challenges, including economic uncertainty, inflationary pressures, and cautious customer spending. CDW responded by deepening its expertise and portfolio in security, cloud, and services, which have become multi-billion dollar businesses for the company. This strategic shift reflects a proactive approach to evolving customer needs and market demands, ensuring it remains uniquely positioned to capitalize on key technology drivers.

The acquisition of Mission Cloud Services in 2024 expanded CDW's cloud capabilities. This move enhanced its cloud professional and managed services offerings. This acquisition is part of a broader strategy to strengthen CDW's position in the cloud computing market.

Focus on high-growth technology vectors like cloud services. Streamlining sales processes to improve efficiency. Prioritizing investments in security, cloud, and services to meet evolving customer needs. These moves have helped CDW navigate challenges and capitalize on market opportunities.

Extensive product portfolio covering hardware, software, and services. Strong vendor relationships with over 1,000 technology manufacturers. Customer-centric approach with a dedicated team of technology experts. CDW's scale and scope, combined with its performance-driven culture, enable it to capture market share.

Responding to economic uncertainty and cautious customer spending. Deepening expertise in security, cloud, and services. Continuous evolution to take advantage of IT changes. These adaptations help CDW stay competitive and meet customer demands.

In 2024, CDW faced a challenging demand environment, with net sales decreasing by 2%. The company maintained its strategic focus on key growth areas despite these challenges. The company's strategic focus on cloud services and security solutions has positioned it well for future growth.

- Focus on cloud computing offerings.

- Prioritizing cybersecurity solutions.

- Expanding services for small businesses.

- Leveraging partnerships with technology vendors.

The company's competitive advantages are multifaceted, including a wide product portfolio, strong vendor relationships, and a customer-centric approach. Strong vendor relationships with over 1,000 technology manufacturers provide access to exclusive products and competitive pricing. Its customer-centric approach, coupled with a dedicated team of technology experts, allows CDW to deliver customized solutions. To understand more about the competitive landscape, consider exploring the Competitors Landscape of CDW.

CDW Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CDW Positioning Itself for Continued Success?

The CDW company holds a strong position in the technology solutions market. It serves businesses, governments, educational institutions, and healthcare providers across the US, UK, and Canada. In the first quarter of 2025, the CDW business reported net sales of $5.199 billion, showcasing improvements across key metrics. Its diversified portfolio and customer base contribute to its market strength.

However, CDW faces several risks. These include economic downturns, inflationary pressures, and customer hesitation in large project investments. Geopolitical risks, policy uncertainties, and budget constraints could also hinder growth. Competition from tech giants and a reliance on hardware sales, particularly notebooks and mobile devices, are additional challenges. Understanding the Growth Strategy of CDW is crucial for assessing its future trajectory.

The CDW company is a leading multi-brand technology solutions provider. It serves approximately 250,000 customers globally. The company offers an extensive product portfolio from over 1,000 leading and emerging technology brands, highlighting its significant global reach and customer loyalty.

Key risks include economic slowdowns, inflation, and customer caution. Geopolitical risks and budget constraints in government and education could also impact growth. Competition from tech giants like Cisco and Dell poses a threat. Reliance on hardware sales, like notebooks, represents a vulnerability if PC demand declines.

CDW aims to exceed US IT market growth by 200 to 300 basis points. Strategic initiatives include cash flow optimization, working capital management, and a balanced capital allocation strategy. The company is focusing on streamlined sales processes and productizing its approach to high-relevance technology vectors.

The company is actively helping customers on their Artificial Intelligence journey with offerings like their 'Mastering the Art of AI Transformation Workshop'. CDW's future hinges on its ability to transition further from a hardware-centric model to one rooted in software and services.

CDW is focused on sustainable revenue growth and competitive advantages. This includes streamlining sales, offering repeatable solutions, and expanding cloud services. The company's commitment to AI and transitioning to software and services are critical for long-term success.

- Streamlined sales processes.

- Repeatable solutions.

- Productizing high-relevance technology vectors, especially cloud services.

- Helping customers with their AI journey.

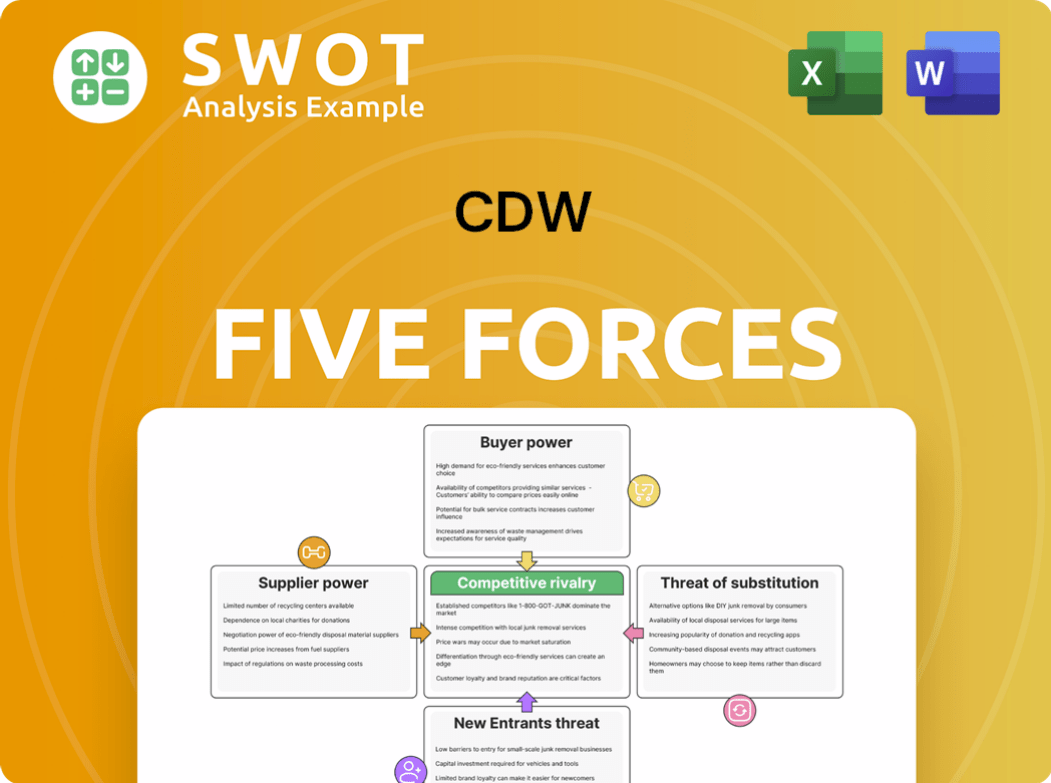

CDW Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CDW Company?

- What is Competitive Landscape of CDW Company?

- What is Growth Strategy and Future Prospects of CDW Company?

- What is Sales and Marketing Strategy of CDW Company?

- What is Brief History of CDW Company?

- Who Owns CDW Company?

- What is Customer Demographics and Target Market of CDW Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.