Cheniere Energy Bundle

How Did Cheniere Energy Become an LNG Giant?

From humble beginnings as a natural gas explorer, Cheniere Energy has dramatically reshaped the global energy landscape. This Cheniere Energy SWOT Analysis reveals how a strategic pivot in the early 2000s positioned the company to capitalize on the burgeoning demand for liquefied natural gas (LNG). Discover the fascinating Cheniere history that propelled it to become the largest LNG exporter in the United States.

Cheniere Energy's transformation is a compelling case study in adaptability within the volatile energy sector. The company's journey from a natural gas exploration firm to a leading LNG company highlights its ability to leverage the U.S. shale gas revolution. Understanding the Cheniere LNG story provides valuable insights into the dynamics of the natural gas and broader energy company markets, making it a crucial subject for investors and analysts alike.

What is the Cheniere Energy Founding Story?

The story of Cheniere Energy begins in 1996, marking its inception as an energy company. Initially, the focus was on the exploration and production of natural gas. This early phase set the stage for the company's future in the dynamic energy sector.

The founders saw an opportunity to build essential infrastructure in the evolving natural gas market. This foundational vision would later drive a significant strategic shift. This strategic move would redefine the company's trajectory within the energy landscape.

Cheniere Energy's history is closely tied to the evolution of the natural gas market. The company's transformation into a leading LNG company highlights its adaptability and strategic foresight.

Cheniere Energy was founded in 1996, initially focusing on natural gas exploration and production.

- The initial business model centered on natural gas exploration and production.

- The company pivoted to liquefied natural gas (LNG) import and regasification in the early 2000s.

- This shift was driven by the growing demand for natural gas in the United States.

- Acquisition of the Creole Trail Pipeline in 2003 was a key strategic move for infrastructure.

The company's early strategy involved natural gas exploration and production. However, the early 2000s brought a pivotal shift. This change was driven by the increasing demand for natural gas in the U.S. market.

The acquisition of the Creole Trail Pipeline in 2003 was a strategic move. This acquisition was crucial for transporting natural gas to and from the Sabine Pass LNG terminal. This strategic move highlighted the company's commitment to developing significant LNG capabilities.

The early 2000s saw growing energy demands and an increasing appreciation for natural gas. This context significantly influenced Cheniere's decision to focus on LNG infrastructure. This strategic shift positioned Cheniere to capitalize on the evolving energy landscape.

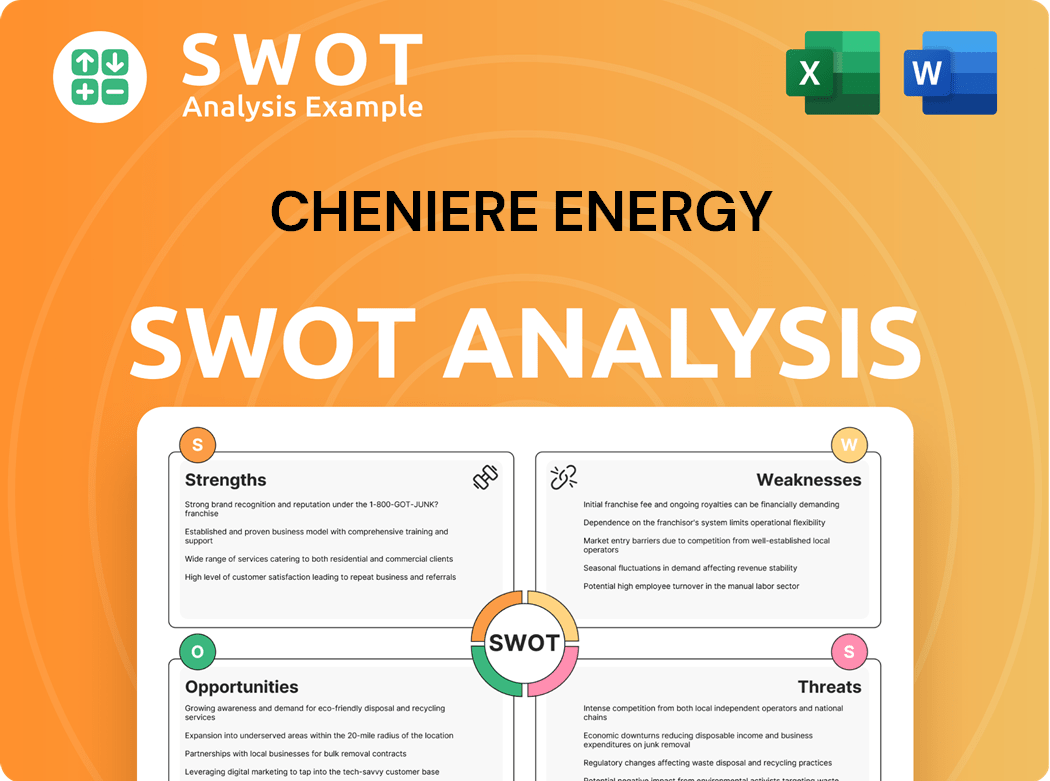

Cheniere Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Cheniere Energy?

The early growth and expansion of Cheniere Energy, a leading LNG company, was marked by a strategic shift from natural gas import to export, driven by the shale gas revolution in the U.S. This pivot allowed the company to capitalize on the increasing global demand for LNG. This transformation solidified Cheniere Energy's position in the global energy market.

After acquiring the Creole Trail Pipeline in 2003, Cheniere Energy began constructing the Sabine Pass LNG terminal between 2005 and 2008, initially for import and regasification. However, the shale revolution prompted a shift to LNG export between 2010 and 2011. This foresight enabled Cheniere Energy to become the first to export LNG from the Lower 48 states.

Operations commenced at the Sabine Pass LNG terminal in February 2016. Train 1 at Sabine Pass became operational in May 2016, followed by Train 2 in September 2016. Further expansion included Train 5 at Sabine Pass and Trains 1 and 2 at the Corpus Christi LNG facility in 2019. These expansions significantly increased Cheniere Energy's export capabilities.

Cheniere Energy announced a positive final investment decision (FID) on the Corpus Christi Stage 3 expansion project. In the first quarter of 2025, Cheniere Energy exported 609 trillion British thermal units (TBtu) of LNG, a slight increase from 602 TBtu in the same period last year. The company continues its expansion efforts, with the Corpus Christi Stage 3 project nearing completion.

The Federal Energy Regulatory Commission (FERC) authorized the construction and operation of the CCL Midscale Trains 8 & 9 Project. These developments highlight Cheniere Energy's ongoing commitment to growth and its strategic position in the LNG market. This strategic growth was supported by securing long-term LNG supply agreements.

Cheniere Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Cheniere Energy history?

The Cheniere Energy journey is marked by significant milestones, including pioneering the export of liquefied natural gas (LNG) from the United States. This strategic shift has fundamentally reshaped the global LNG market, positioning Cheniere as a key player in the energy sector.

| Year | Milestone |

|---|---|

| 2016 | Cheniere became the first company to export LNG from the Lower 48 states. |

| 2025 | The first train of the Corpus Christi Stage 3 Project achieved substantial completion in March, ahead of schedule. |

| 2025 | As of February 14, Cheniere had produced and exported approximately 3,930 cumulative LNG cargoes, totaling around 270 million tonnes of LNG. |

A key innovation was the conversion of the Sabine Pass LNG import terminal into an export facility, capitalizing on the U.S. shale gas boom. Cheniere has since expanded its liquefaction capacity with multiple trains at both Sabine Pass and Corpus Christi LNG terminals, consistently bringing projects online efficiently.

Cheniere was the first to export LNG from the Lower 48 states, a groundbreaking move that transformed the natural gas market. This strategic pivot allowed Cheniere to capitalize on the growing global demand for LNG.

The conversion of the Sabine Pass terminal from an import to an export facility was a critical innovation. This allowed Cheniere to leverage the U.S. shale gas boom and tap into international markets.

Cheniere has consistently expanded its liquefaction capacity through multiple trains at its Sabine Pass and Corpus Christi LNG terminals. These expansions have been completed ahead of schedule and within budget.

Cheniere has demonstrated a strong track record of bringing projects online ahead of schedule and within budget. This efficiency is a key factor in its success.

Cheniere's focus on long-term contracts provides stability against market volatility. Over 90% of forecasted operational volumes are expected to be sold under such agreements in 2025.

Cheniere's commitment to sustainability and operational efficiency further enhances its market position. This focus helps to reduce environmental impact and improve operational performance.

Despite its achievements, Cheniere has faced challenges, including market downturns and competitive pressures from other LNG companies. Regulatory hurdles and geopolitical risks also present ongoing complexities for its operations and expansion plans.

Cheniere has experienced market downturns, such as the negative revenue growth in 2020. This highlights the inherent volatility of the energy market.

Cheniere faces competition from other LNG producers worldwide, including Qatar and new U.S. projects. This competitive landscape requires strategic agility.

Regulatory hurdles and geopolitical risks, including shifts in energy policies, pose complexities for Cheniere's operations. The indefinite pause on pending permitting decisions for LNG exports to non-FTA countries in January 2024, highlighted these uncertainties.

Geopolitical risks, such as shifts in energy policies, can impact Cheniere's operations and expansion plans. These risks require careful monitoring and strategic planning.

Potential trade conflicts also pose ongoing challenges for Cheniere. These conflicts can disrupt supply chains and impact market access.

Cheniere faces operational challenges related to project execution, and maintaining efficiency in a dynamic environment. These challenges require continuous improvement and strategic adaptability.

Cheniere Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Cheniere Energy?

The Cheniere Energy story is a journey of strategic pivots and significant achievements in the LNG sector, evolving from a natural gas exploration company to a leading LNG exporter. Key moments include the acquisition of the Creole Trail Pipeline, the construction of the Sabine Pass LNG terminal, and the shift to an export model driven by the shale gas revolution. Cheniere Energy's milestones also include the commencement of LNG exports in 2016, the commissioning of new trains at Sabine Pass and Corpus Christi, and the recent production start from the Corpus Christi Stage 3 Project.

| Year | Key Event |

|---|---|

| 1996 | Cheniere Energy is founded as a traditional natural gas exploration and production company. |

| 2003 | Acquires the Creole Trail Pipeline. |

| 2005-2008 | Construction of the Sabine Pass LNG terminal. |

| 2010-2011 | Transitions to an LNG export model due to the shale gas revolution. |

| February 2016 | Commences LNG exports from the Sabine Pass LNG terminal, becoming the first company to export LNG from the Lower 48 states. |

| 2019 | Places Train 5 at Sabine Pass and Trains 1 and 2 at Corpus Christi LNG facility into service. |

| December 2024 | Achieves first LNG production from Train 1 of the Corpus Christi Stage 3 Project. |

| February 2025 | Produces the first cargo of LNG from the CCL Stage 3 Project. |

| March 2025 | Achieves substantial completion of Train 1 of the Corpus Christi Stage 3 Project. |

| May 2025 | Reports strong Q1 2025 financial results with revenues of $5.4 billion. |

Cheniere Energy is focused on continued expansion, leveraging increasing global demand for natural gas. The company anticipates a final investment decision on the CCL Midscale Trains 8 & 9 Project in 2025. This expansion, along with the Corpus Christi Stage 3 project, will significantly boost production capacity, adding over 10 million tonnes per annum (mtpa) and 3 mtpa respectively.

Cheniere expects 2025 to be another record year for LNG production, with an estimated 47-48 million tons of LNG. The company reported strong Q1 2025 financial results with revenues of $5.4 billion. Cheniere aims to maintain a strong liquidity position, with $10.553 billion in available liquidity as of March 31, 2025, and intends to further reduce its long-term leverage.

Cheniere's long-term initiatives include expanding liquefaction capacity at both the Corpus Christi and Sabine Pass LNG Terminals. The company is also focused on optimizing existing assets and exploring partnerships. In May 2025, Cheniere signed a long-term Integrated Production Marketing (IPM) agreement with Canadian Natural Resources Limited, starting in 2030.

The increasing global demand for LNG, particularly from Asia and Europe, is expected to positively impact Cheniere's future. Analysts have a positive outlook, with an average 12-month price target of $247.44 for Cheniere Energy as of February 2025. Cheniere Energy's business model is well-positioned to capitalize on these trends.

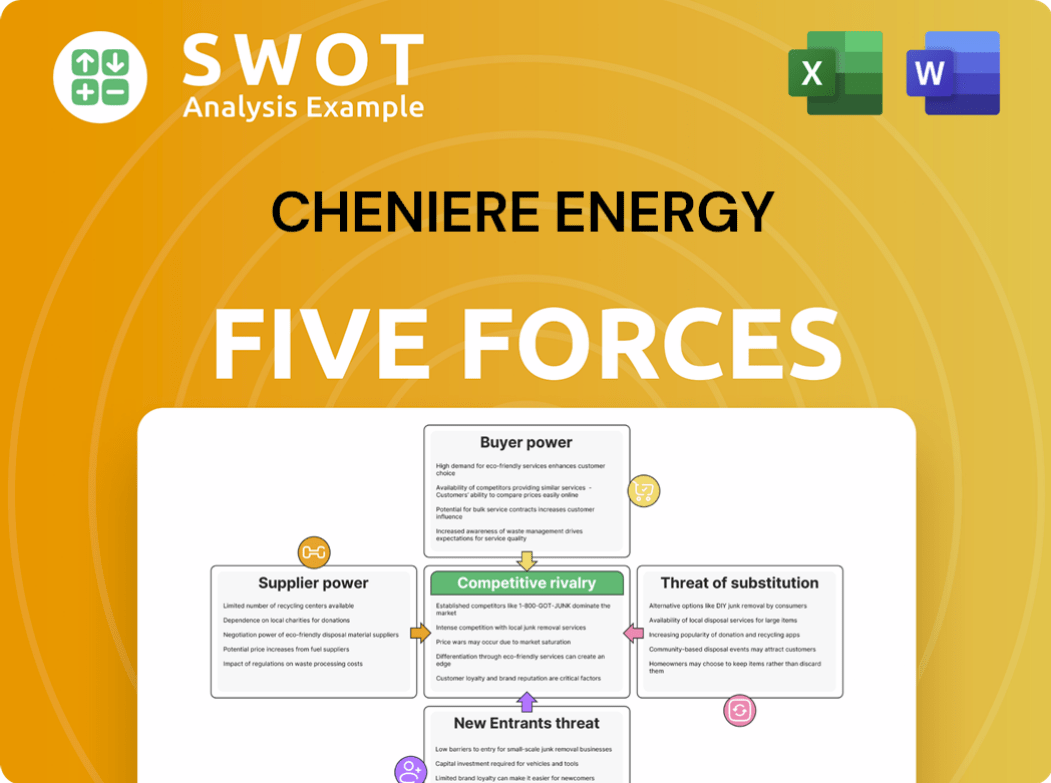

Cheniere Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Cheniere Energy Company?

- What is Growth Strategy and Future Prospects of Cheniere Energy Company?

- How Does Cheniere Energy Company Work?

- What is Sales and Marketing Strategy of Cheniere Energy Company?

- What is Brief History of Cheniere Energy Company?

- Who Owns Cheniere Energy Company?

- What is Customer Demographics and Target Market of Cheniere Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.