Cirrus Logic Bundle

How Did Cirrus Logic Become an Audio Powerhouse?

Ever wondered how the crisp sound in your smartphone is achieved? The story of Cirrus Logic, a leading Cirrus Logic SWOT Analysis, began in the heart of Silicon Valley. From its roots as Patil Systems, Inc. in 1984, this Cirrus Logic company has transformed the audio landscape. Discover the Cirrus Logic history and the evolution of this semiconductor company.

Cirrus Logic's journey showcases remarkable Cirrus Logic innovation in audio technology. Its focus on mixed-signal processing solutions has made it a key player in the mobile device market. From its early days to its current prominence, the Cirrus Logic products have consistently pushed the boundaries of what's possible in consumer electronics. This brief history of Cirrus Logic reveals a compelling narrative of technological advancement and market adaptation.

What is the Cirrus Logic Founding Story?

The story of the Cirrus Logic company began on October 29, 1984. It was founded by Dr. Suhas Patil, initially named Patil Systems, Inc. This marked the beginning of what would become a significant player in the semiconductor industry.

Dr. Patil, a graduate of MIT with a Ph.D. in electrical engineering, brought a strong background in semiconductor design. He saw an opportunity in the growing personal computer market. The company's initial focus was on creating more efficient and compact controller chips for hard disk drives.

The company's initial business model centered on designing and selling specialized integrated circuits (ICs). Their first major product was a highly integrated controller chip for hard disk drives. Early funding came from Dr. Patil's personal resources and early venture capital. The name 'Cirrus Logic' was adopted in 1986. This change reflected a broader focus on logic circuits and a desire for a name that conveyed clarity and innovation. This period was characterized by intense research and development.

Cirrus Logic's founding was rooted in addressing performance bottlenecks in the early PC market.

- Founded on October 29, 1984, as Patil Systems, Inc.

- Founder: Dr. Suhas Patil.

- Initial focus: Controller chips for hard disk drives.

- Name change to Cirrus Logic in 1986.

- Early funding: Personal resources and venture capital.

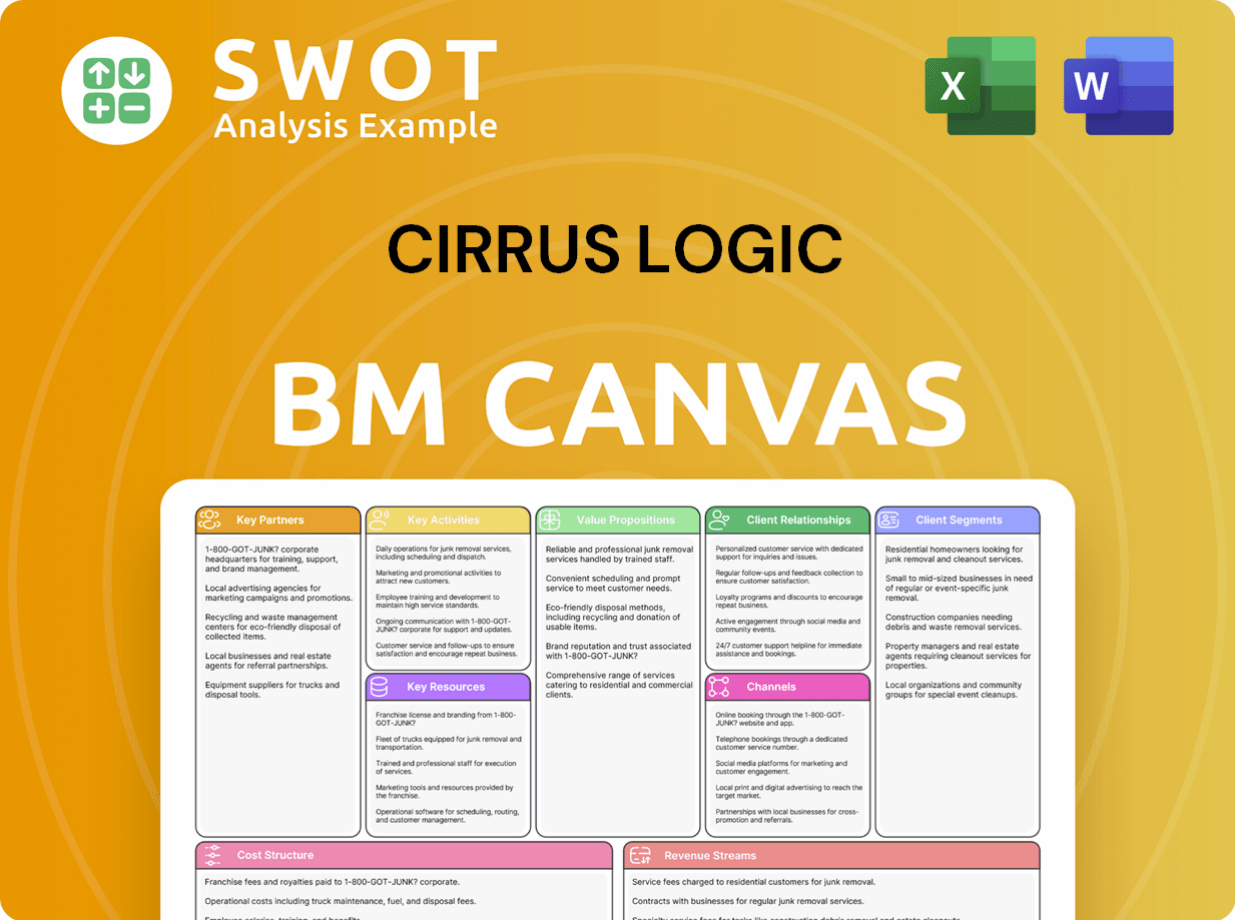

Cirrus Logic SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Cirrus Logic?

The early growth of Cirrus Logic, a prominent semiconductor company, was defined by strategic moves into new markets and product diversification. Following initial success, the company expanded its offerings, significantly impacting the PC graphics market. This expansion fueled revenue growth and led to the establishment of new design centers, marking a period of substantial development for the Cirrus Logic company.

In the late 1980s, Cirrus Logic entered the graphics controller market. Key product launches included highly integrated VGA and SVGA controllers. These controllers improved performance and reduced costs, attracting major PC manufacturers. This expansion helped Cirrus Logic establish a strong presence in the PC components market.

The early 1990s saw a pivotal shift towards mixed-signal processing, particularly in audio technology. The acquisition of Crystal Semiconductor in 1991 was a crucial step. Crystal Semiconductor's expertise in analog-to-digital and digital-to-analog converters (ADCs and DACs) laid the foundation for Cirrus Logic's future in audio ICs.

The Crystal Semiconductor acquisition marked Cirrus Logic's entry into the audio market. The company expanded its product portfolio to include modems and other communication ICs. By the mid-1990s, Cirrus Logic had become a diversified semiconductor supplier. This diversification contributed to its long-term growth and market position. For more insights, see Growth Strategy of Cirrus Logic.

During this period, Cirrus Logic conducted initial public offerings and subsequent capital raises. These financial activities fueled further research and development, as well as strategic acquisitions. These financial moves supported the company's growth and expansion into new markets and technologies. The company's strategic financial decisions were key to its development.

Cirrus Logic PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Cirrus Logic history?

The Cirrus Logic company has a rich history marked by significant milestones, innovations, and challenges. This semiconductor company's journey includes pivotal acquisitions, strategic shifts, and a consistent focus on audio technology. The Cirrus Logic history is a testament to its adaptability and innovation in the competitive tech landscape.

| Year | Milestone |

|---|---|

| 1984 | Cirrus Logic was founded, marking the beginning of its journey in the semiconductor industry. |

| 1991 | Acquisition of Crystal Semiconductor, which significantly boosted its capabilities in audio ICs. |

| Early 2000s | Became a leading provider of audio solutions for MP3 players and other portable consumer electronics, solidifying its market position. |

| Ongoing | Secured major design wins with leading smartphone manufacturers, establishing itself as a key supplier of audio codecs and haptic drivers for flagship mobile devices. |

Cirrus Logic has been at the forefront of audio technology, consistently pushing boundaries in audio processing and integration. Their innovations have been crucial in the evolution of portable audio devices and smartphones.

Cirrus Logic pioneered audio codecs, which are essential for digital audio processing in various devices. These codecs have improved audio quality and power efficiency in portable devices.

The acquisition of Crystal Semiconductor enabled Cirrus Logic to develop high-performance audio ICs. These ICs are used in a variety of applications, including smartphones, tablets, and other consumer electronics.

Cirrus Logic also developed haptic drivers, which provide the sense of touch in mobile devices. These drivers enhance the user experience by providing tactile feedback.

Cirrus Logic focuses on creating power-efficient solutions to meet the demands of portable devices. This focus helps extend battery life and improve overall device performance.

The company excels at integrating multiple technologies into single chips, reducing the size and power consumption of devices. This integration is a key factor in their success.

Cirrus Logic maintains a robust patent portfolio, which protects its innovations. This portfolio supports continuous research and development.

Despite its successes, Cirrus Logic has faced challenges, including market downturns and competitive pressures. The company has had to adapt and refocus its efforts to maintain its position in the market.

The dot-com bust in the early 2000s impacted the semiconductor industry, causing market downturns. This led to financial pressures and the need for strategic adjustments.

Cirrus Logic has faced competition from other major players in the semiconductor market. This competition has required continuous innovation and strategic positioning.

The company has experienced internal crises related to product failures in certain segments. These failures necessitated strategic restructuring and a refocus on core competencies.

Cirrus Logic undertook strategic restructuring and divestitures to concentrate on its core strengths. This involved exiting less profitable businesses and focusing on audio processing.

The company has demonstrated an ability to adapt to changing market dynamics, ensuring its long-term viability. This adaptability has been crucial to its sustained growth.

A relentless focus on innovation has been central to Cirrus Logic’s sustained growth and market leadership. This focus has aligned with broader industry trends toward integrated solutions.

Cirrus Logic Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Cirrus Logic?

The Cirrus Logic company has a rich history, evolving strategically from its inception. The company's journey, marked by key acquisitions and technological advancements, has positioned it as a significant player in the audio and mixed-signal semiconductor market. Its focus has shifted over time, reflecting changes in consumer electronics and technological innovation.

| Year | Key Event |

|---|---|

| 1984 | Founded as Patil Systems, Inc. |

| 1986 | Renamed Cirrus Logic. |

| 1991 | Acquired Crystal Semiconductor, entering the audio IC market. |

| Mid-1990s | Became a leading supplier of audio solutions for portable consumer electronics. |

| Early 2000s | Exited PC graphics and communication businesses to concentrate on mixed-signal and audio. |

| 2007 | Secured significant design wins with major smartphone manufacturers for audio codecs. |

| 2010s | Expanded its portfolio to include haptic drivers and power conversion solutions. |

| 2020s | Continued innovation in low-power, high-performance audio and mixed-signal ICs. |

| 2024 | Reported net revenue of $367.8 million for the fourth quarter of fiscal year 2024, down 19% year-over-year. |

| 2024 | Announced a quarterly dividend of $0.35 per share in May 2024. |

Cirrus Logic is strategically focused on expanding its presence in high-performance mixed-signal markets beyond audio. This includes haptics, sensing, and power management solutions. The company is leveraging its expertise in low-power design and advanced signal processing.

The company aims to address new opportunities in segments like augmented reality, automotive, and industrial applications. This forward-looking strategy remains consistent with its founding vision of providing innovative integrated circuits. Cirrus Logic continues to invest in research and development.

Analyst predictions suggest continued growth in the demand for sophisticated audio and haptic feedback systems. This bodes well for Cirrus Logic's core business, particularly in mobile devices. The company is likely to see continued demand for its audio chips.

The company's leadership has emphasized ongoing investment in research and development to maintain its technological edge. This includes exploring new market adjacencies and focusing on low-power, high-performance audio solutions. The dividend of $0.35 per share in May 2024 indicates a commitment to returning value to shareholders.

Cirrus Logic Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Cirrus Logic Company?

- What is Growth Strategy and Future Prospects of Cirrus Logic Company?

- How Does Cirrus Logic Company Work?

- What is Sales and Marketing Strategy of Cirrus Logic Company?

- What is Brief History of Cirrus Logic Company?

- Who Owns Cirrus Logic Company?

- What is Customer Demographics and Target Market of Cirrus Logic Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.