Comcast Bundle

How Did Comcast Conquer the Media World?

From a small cable operation to a global powerhouse, the Comcast SWOT Analysis reveals a fascinating story. Uncover the pivotal moment in 1963 when Ralph J. Roberts acquired American Cable Systems, setting the stage for an industry titan. This brief history of Comcast company explores the strategic decisions and technological leaps that defined its remarkable journey.

The Comcast evolution is a testament to strategic foresight and adaptability. Explore the early days of Comcast and its initial services, which laid the foundation for its future dominance. This exploration of the Comcast timeline will also cover its key milestones and acquisitions history, revealing how it became a leader in the cable industry and beyond, significantly impacting media and telecommunications.

What is the Comcast Founding Story?

The story of the [Company Name], a prominent player in the telecommunications industry, began on June 28, 1963. This marked the start of what would become a major force in cable television and internet services. The journey offers a fascinating look at the brief history of Comcast and its evolution.

The company's beginnings were modest, with a focus on providing cable services to areas that lacked access. This early strategy set the stage for the company's expansion and its eventual dominance in the media landscape. Understanding the Comcast history is crucial to grasping its current position.

The Comcast company was founded when Ralph J. Roberts, along with Daniel Aaron and Julian A. Brodsky, acquired American Cable Systems. This initial investment, valued at $500,000, included a small cable operator in Tupelo, Mississippi. This operator served about 12,000 customers with five channels. Roberts, drawing on his experience and entrepreneurial spirit, saw the potential in community antenna television (CATV).

The company's early strategy focused on expanding its cable services and diversifying its business interests.

- In 1965, American Cable Systems acquired Storecast Corporation of America, a marketing firm.

- In 1968, they purchased a Muzak franchise, broadening their portfolio.

- The company was renamed Comcast in 1969.

- Comcast went public in 1972, marking a significant milestone in its growth.

The initial business model of Comcast was straightforward: to provide cable television access to areas that were underserved. This simple approach laid the foundation for its future growth. The company strategically expanded its operations through acquisitions and diversification. The Comcast timeline reflects these key decisions.

In February 1990, Brian L. Roberts, Ralph Roberts' son, took over as president, highlighting the family's ongoing involvement. Brian L. Roberts later became Chairman and CEO, which showcased the family's long-term commitment to the business. This transition was a key moment in the Comcast evolution.

The Comcast background reveals a company that began with a clear vision. This vision was to bring cable services to those who needed them. The company's early acquisitions and strategic moves set the stage for its future success. To understand more about the company's audience, you can explore the Target Market of Comcast.

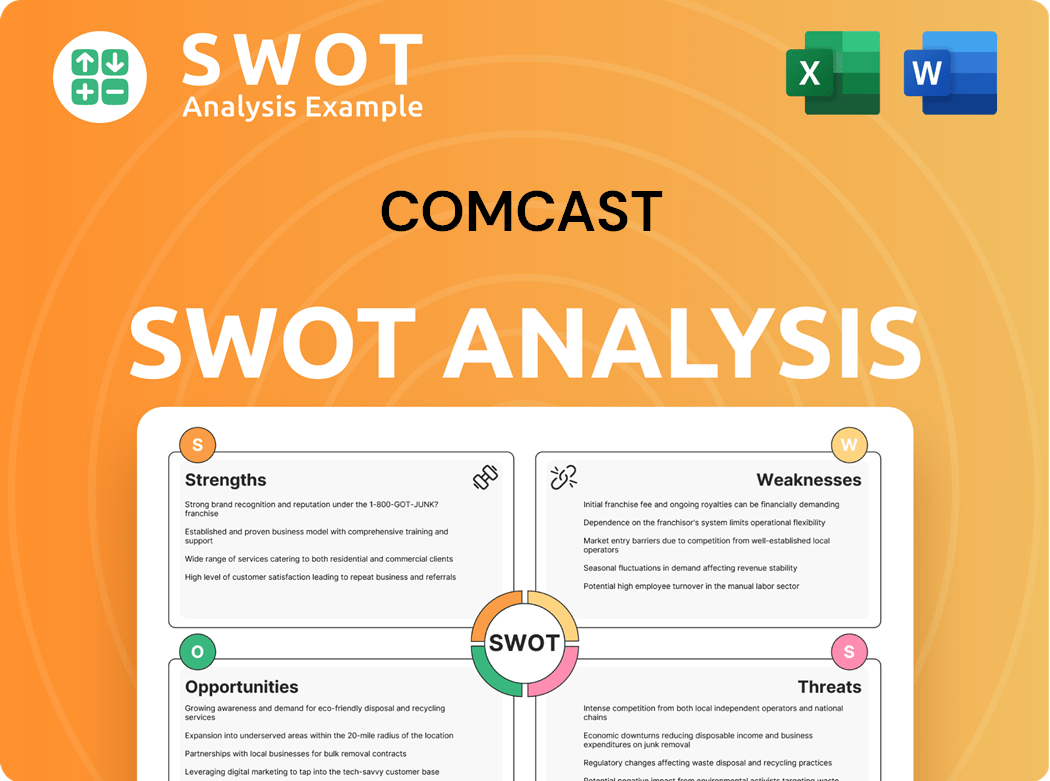

Comcast SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Comcast?

The early growth of the Comcast company was marked by strategic acquisitions and the expansion of its service offerings, shaping its trajectory in the cable industry. This period saw the company evolve from a regional player to a major force in telecommunications. The Comcast evolution involved significant investments and acquisitions that broadened its reach and capabilities, laying the groundwork for its future dominance. Understanding the Comcast history during this time is key to grasping its current position in the market.

In 1992, Comcast's mobile division, Comcast Cellular, acquired a significant stake in Metromedia's Philadelphia-area cellular interests. By 1994, the company held a 50% share in Garden State Cable, serving approximately 195,000 subscribers. A key diversification move occurred in 1996 with the acquisition of Spectacor, a professional sports company, broadening its portfolio beyond cable services.

The 2000s saw Comcast accelerate its growth through major mergers and acquisitions. The acquisition of AT&T Broadband in November 2002 for $47.5 billion in stock and $25 billion in assumed debt was a landmark deal. This acquisition made Comcast the largest cable provider in the nation, with over 21 million subscribers across 41 states, significantly outpacing its competitors. Further insights into the company's financial structure can be found in Owners & Shareholders of Comcast.

The company's expansion continued with the acquisition of thePlatform in 2006, a digital distribution company, and FreeWheel in 2014, an ad-tech company. These strategic moves broadened Comcast's technological capabilities and market presence. These acquisitions helped shape its trajectory from a cable provider to a comprehensive media and technology company, influencing the Comcast timeline.

These early expansions and acquisitions were pivotal in shaping Comcast's role in the telecommunications industry. The Comcast background during this time established its influence on the cable industry and its ability to adapt and grow. These strategic moves set the stage for Comcast's continued evolution and its impact on the media landscape. As of 2024, the company continues to be a major player in the industry.

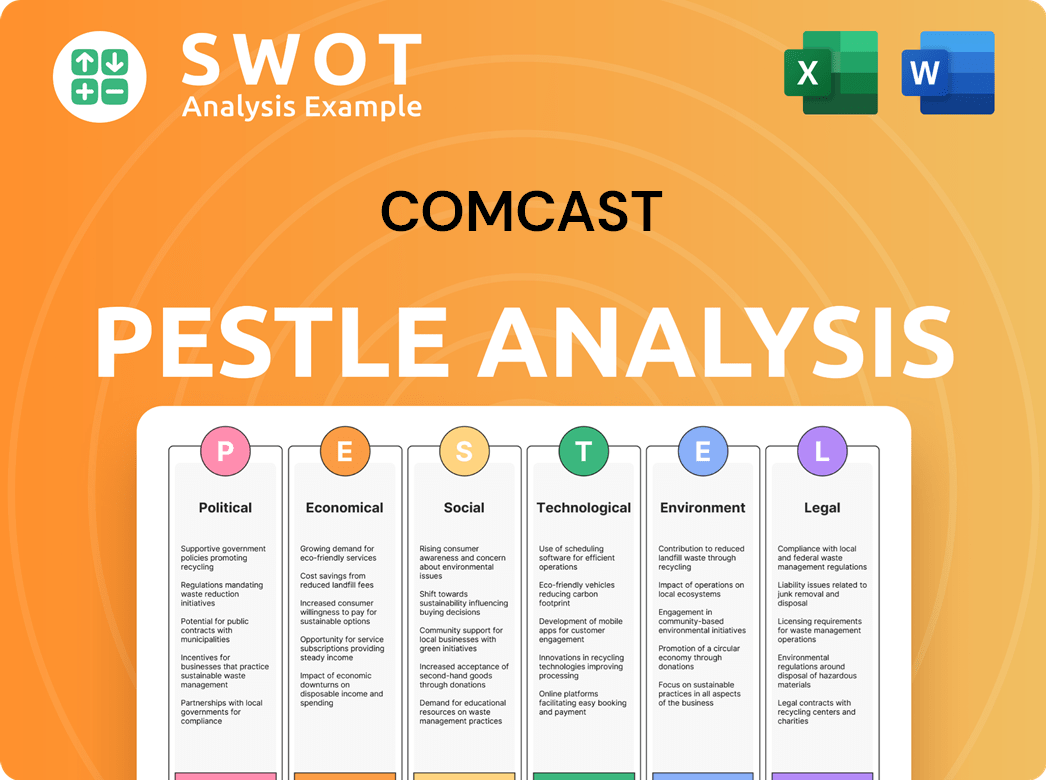

Comcast PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Comcast history?

The Comcast company has a rich Comcast history marked by significant milestones in the telecommunications and media industries. From its early days to its current status as a media and technology giant, Comcast has consistently adapted and expanded its services and reach. The Comcast timeline reflects a journey of strategic acquisitions, technological advancements, and market expansions that have shaped its current position.

| Year | Milestone |

|---|---|

| January 2011 | Comcast acquired a 51% controlling stake in NBCUniversal from General Electric, valued at approximately $30 billion, marking a major expansion into content creation. |

| March 2013 | Comcast acquired GE's remaining 49% interest, taking full ownership of NBCUniversal. |

| August 2016 | NBCUniversal acquired DreamWorks Animation for $3.8 billion, integrating it into Universal Filmed Entertainment. |

| 2017 | Comcast launched Xfinity Mobile, an MVNO cellular network utilizing Verizon Wireless's infrastructure. |

| October 2018 | Comcast acquired the British media and telecommunications conglomerate Sky Group for an estimated $40 billion. |

Comcast's evolution has been driven by innovation in both technology and business models. The company has continuously integrated new technologies to enhance its service offerings and expand its market presence. A key element of Comcast's growth strategy has been its focus on digital transformation and the development of new platforms.

In 2017, Comcast launched Xfinity Mobile, entering the mobile virtual network operator (MVNO) market. This move allowed Comcast to offer a 'quadruple play' of services, including cable, internet, and home security.

Comcast launched Peacock in July 2020, a streaming platform that has become a key growth driver. Peacock's success has significantly contributed to Comcast's overall revenue and market position.

Comcast has expanded its 5G investments for Xfinity Mobile, enhancing its mobile service capabilities. These investments are crucial for maintaining competitiveness in the telecommunications sector.

Comcast offers bundled services that combine cable, internet, and mobile services. This strategy has increased customer loyalty and average revenue per user.

Comcast is focused on digital transformation, improving its online customer experience and operational efficiency. This focus helps Comcast adapt to changing consumer behavior and market trends.

The acquisition of Sky Group in October 2018, for an estimated $40 billion, expanded Comcast’s international presence. This acquisition allowed Comcast to gain a significant foothold in the European market.

Despite its successes, Comcast has faced several challenges. Market downturns and intense competition in the telecommunications and media sectors have impacted its financial performance. The company continues to navigate these challenges through strategic investments and operational adjustments.

In Q1 2025, total revenue was $29.89 billion, a slight 0.6% dip from Q1 2024. This decrease highlights the impact of market fluctuations on Comcast's financial performance.

Comcast faces competition from other telecommunications and media companies. The competitive landscape requires Comcast to continually innovate and improve its offerings.

Net income decreased by 12.5% in Q1 2025, primarily due to non-recurring costs. These costs have impacted Comcast's profitability in the short term.

Adjusted EBITDA increased by 1.9% to $9.53 billion in Q1 2025, reflecting operational improvements. This growth demonstrates Comcast's ability to enhance its efficiency.

Peacock saw paid subscribers surge to 41 million in Q1 2025, a 14% increase from Q1 2024. Peacock's adjusted EBITDA jumped 21%, demonstrating the streaming platform's growing influence.

Xfinity Mobile added 323,000 new customer lines in Q1 2025, bringing its total lines to 8.15 million. This growth indicates the success of Comcast's mobile service.

For a deeper dive into Comcast's marketing strategies, consider exploring the Marketing Strategy of Comcast.

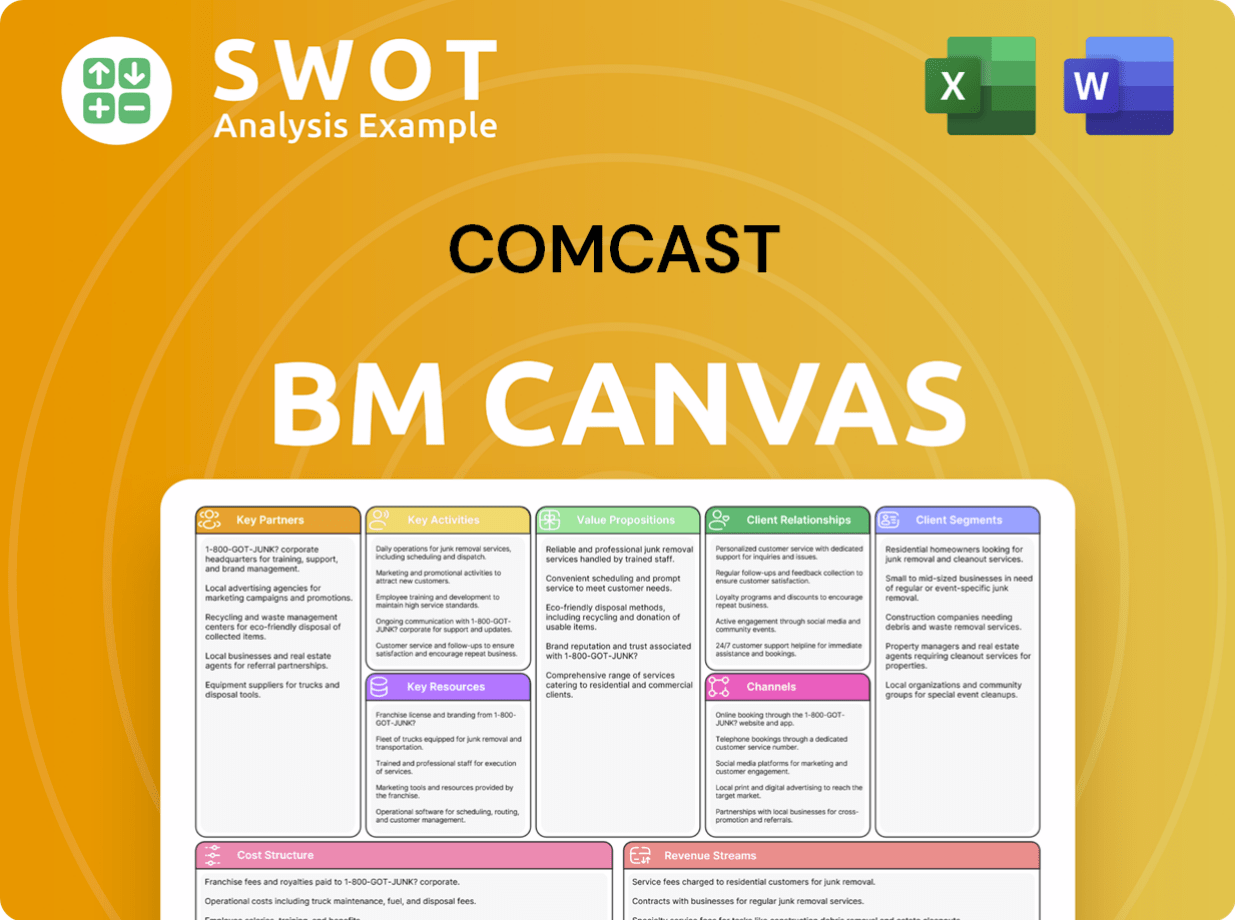

Comcast Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Comcast?

The Comcast company has a rich history, marked by strategic acquisitions and expansions that have shaped its position in the media and telecommunications industries. From its humble beginnings as American Cable Systems in 1963, the company has evolved significantly. This brief history Comcast showcases key moments, from its initial cable services to its current status as a media and technology giant. Understanding the Comcast evolution provides insights into its dynamic growth and influence.

| Year | Key Event |

|---|---|

| June 28, 1963 | Ralph J. Roberts founded American Cable Systems in Tupelo, Mississippi, marking the early days of Comcast. |

| 1969 | American Cable Systems was renamed Comcast, establishing its brand identity. |

| 1972 | Comcast went public, a significant step in its growth trajectory. |

| February 1990 | Brian L. Roberts became President of Comcast, succeeding his father. |

| November 2002 | Comcast acquired AT&T Broadband for $47.5 billion, boosting its subscriber base. |

| January 2011 | Comcast acquired a controlling stake in NBCUniversal from General Electric. |

| March 2013 | Comcast took full ownership of NBCUniversal, completing the acquisition. |

| August 2016 | NBCUniversal acquired DreamWorks Animation for $3.8 billion. |

| April 2017 | Comcast launched Xfinity Mobile, its mobile virtual network operator (MVNO) service. |

| October 2018 | Comcast acquired Sky Group for approximately $40 billion, expanding its international presence. |

| July 2020 | Peacock, NBCUniversal's streaming service, launched nationwide. |

| Q4 2024 | Comcast reported its best financial performance in its 60-year history, with revenue of $31.9 billion, a 2.1% increase from Q4 2023. |

| Q1 2025 | Comcast reported total revenue of $29.89 billion, adjusted EBITDA of $9.53 billion, and free cash flow of $5.4 billion. Peacock paid subscribers reach 41 million. Capital expenditures for Q1 2025 were $2.3 billion. |

Comcast plans to add 1.2 million new homes to its network in 2025, matching its 2024 expansion goals. They are focusing on network upgrades and expansion, including 275,000 new passings of homes and businesses in Q1 2025 alone. This continued investment is key to their growth strategy.

The company is targeting the significant $180 billion mobile market. Plans include 5G investments and bundled offerings to enhance their mobile services. This strategic move aims to capitalize on the growing demand for mobile connectivity.

Comcast aims to add 3.5 million business passings in 2025, expanding its business services segment. This expansion highlights their commitment to providing comprehensive services to businesses. This is a key aspect of Comcast's growth strategy.

The grand opening of Universal Epic Universe theme park in Orlando, scheduled for May 22, 2025, is a major growth driver. Plans to build a new Universal theme park and resort in the United Kingdom further demonstrate their commitment to content and entertainment. This is a key aspect of Comcast's key milestones.

Comcast Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Comcast Company?

- What is Growth Strategy and Future Prospects of Comcast Company?

- How Does Comcast Company Work?

- What is Sales and Marketing Strategy of Comcast Company?

- What is Brief History of Comcast Company?

- Who Owns Comcast Company?

- What is Customer Demographics and Target Market of Comcast Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.