Comcast Bundle

Can Comcast Maintain Its Momentum?

Comcast, a titan in the media and technology world, has consistently evolved since its inception. From its roots in cable television to its current status as a global powerhouse, Comcast's journey is a testament to strategic adaptation. This exploration delves into the Comcast SWOT Analysis, examining its growth strategy and future prospects in a dynamic market.

Understanding the Comcast growth strategy is crucial for investors and analysts alike, especially considering its Comcast market share and evolving Comcast business model. This Comcast company analysis will examine how Comcast plans to navigate the future, focusing on its Comcast future prospects in areas like broadband internet, streaming, and its overall Comcast financial performance. Analyzing these elements provides a comprehensive view of Comcast's potential for continued success and innovation within the competitive landscape of the entertainment and telecommunications industries.

How Is Comcast Expanding Its Reach?

Comcast's expansion initiatives are designed to drive the Comcast growth strategy, penetrate new markets, and diversify revenue streams. The company's focus on broadband, wireless, and enterprise solutions, alongside its theme park and streaming ventures, reflects a comprehensive approach to growth. These initiatives are crucial for maintaining and enhancing Comcast market share in a rapidly evolving industry.

A key aspect of Comcast future prospects involves strategic investments in infrastructure and acquisitions. The company is actively expanding its network to reach more homes and businesses, while also leveraging its mobile services. This multi-pronged strategy aims to capitalize on emerging opportunities and solidify Comcast's position in the market. Understanding the Comcast business model is essential to grasp how these initiatives contribute to the overall Comcast financial performance.

Comcast's approach to growth is multifaceted, encompassing various sectors and strategies to ensure long-term success. For more insights into the company's structure, consider the perspectives of Owners & Shareholders of Comcast.

Comcast aims to extend its broadband network to 1.2 million new homes and businesses in 2025, mirroring its 2024 achievement. This expansion is supported by partnerships with local communities to achieve 100% connectivity. This initiative directly addresses the Comcast future prospects for broadband internet, ensuring the company's continued relevance in the market.

The company is pushing a wireless and broadband convergence strategy, primarily through its Xfinity Mobile brand, which operates as a Verizon MVNO. Xfinity Mobile saw 1.2 million net additions in 2024, reaching a total of 7.8 million subscribers, an 11% year-over-year increase. This strategy supports the Comcast growth strategy in the mobile phone market.

Comcast Business acquired Nitel in 2024, expanding its presence in connectivity and secure networking solutions. This acquisition added approximately 6,600 enterprise clients, particularly in sectors like financial services and healthcare. Comcast Business generated $9.7 billion in revenue for full-year 2024, moving closer to its $10 billion annual goal.

Universal Epic Universe in Orlando is set to open on May 22, 2025, with pre-opening expenses impacting short-term profitability. However, significant long-term revenue and EBITDA growth are projected. Plans for a new theme park in the UK indicate further international expansion in the entertainment segment, enhancing the Comcast future prospects in the entertainment industry.

Peacock, with 36 million subscribers as of 2025, is a key component of Comcast's growth strategy. The company is investing heavily in content and marketing to boost subscriber numbers and aims for Peacock to achieve profitability. This strategy impacts the Comcast growth strategy in the streaming market.

- Significant investment in content creation and acquisition.

- Aggressive marketing campaigns to attract new subscribers.

- Focus on achieving profitability through increased subscriptions and advertising revenue.

- Strategic partnerships to enhance content offerings and distribution.

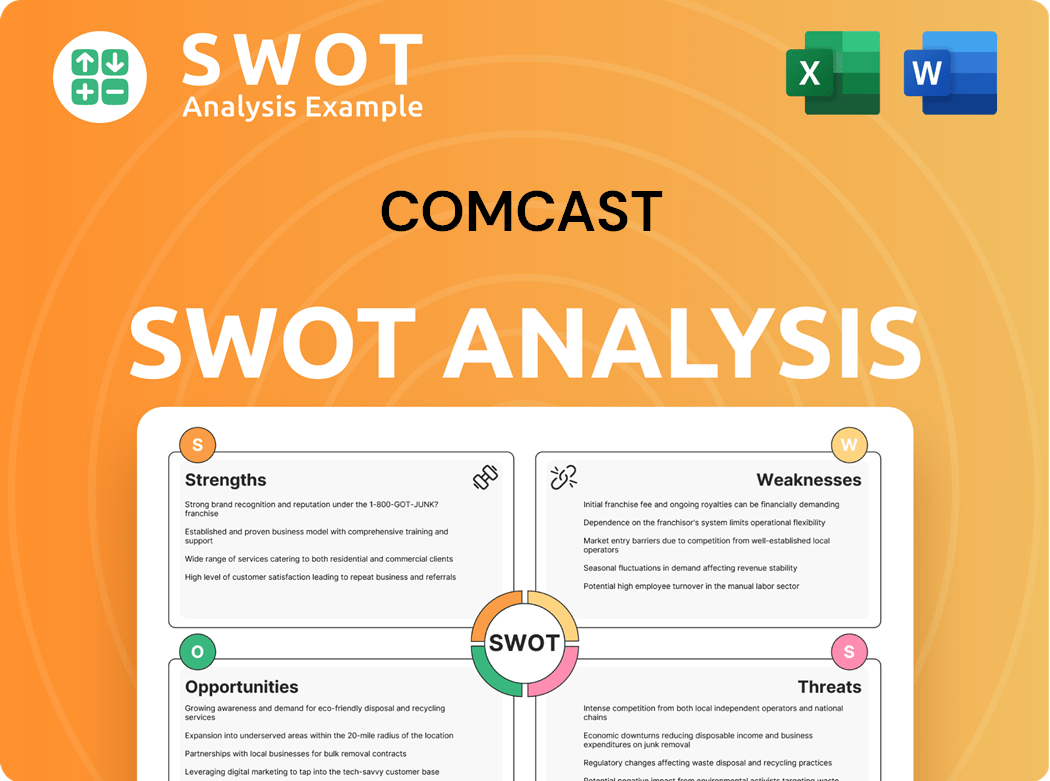

Comcast SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Comcast Invest in Innovation?

Comcast consistently utilizes technology and innovation as core drivers of its sustained growth, which is a key element of its Comcast growth strategy. The company's commitment to investing in cutting-edge technologies like 5G, artificial intelligence (AI), and virtual reality is evident in its product and service enhancements. These advancements are critical to maintaining and growing its Comcast market share in a competitive landscape.

The company's strategic initiatives showcase its dedication to technological advancement, although specific R&D expenditure figures are not always reported as a standalone item. These investments are crucial for Comcast's Comcast future prospects, ensuring it remains competitive in the rapidly evolving telecommunications and media industries. This approach is a central part of the Comcast business model, enabling it to adapt to changing consumer demands and technological shifts.

Comcast's digital transformation efforts are evident in its Xfinity and Comcast Business services, which are integral to its Comcast company analysis. These services leverage technology to provide enhanced customer experiences and operational efficiencies. By focusing on innovation, Comcast aims to improve its Comcast financial performance and maintain its position in the market.

Comcast's 'Janus' initiative, unveiled in 2024, virtualizes its core network using cloud and AI/ML technology. This aims to maximize network performance and efficiency, leading to faster speeds and more reliable internet service.

In 2024, Comcast Technology Solutions launched its Cloud TV platform. This cloud-based solution allows broadcasters and providers to deliver multi-platform experiences without complex infrastructure.

Introduced in 2024, Xfinity StreamSaver bundles Peacock, Netflix, and Apple TV+, offering customers a streamlined entertainment experience and cost savings.

Xfinity Mobile's 'WiFi Boost' offers speeds up to 1 Gigabit per second when customers connect to millions of Xfinity WiFi hotspots, enhancing its wireless offering.

Comcast SportsTech selects 10 innovative companies annually to integrate new technologies into the sports industry, demonstrating its commitment to collaborative innovation.

Comcast aims to be carbon-neutral by 2035, partly by reducing the physical footprint and energy consumption of its network facilities through virtualization.

Comcast's innovation strategy includes several key initiatives designed to enhance its services and improve operational efficiency. These advancements are crucial for maintaining a competitive edge in the market. For more insights into the competitive landscape, see our analysis of the Competitors Landscape of Comcast.

- Network Virtualization: The 'Janus' initiative is a significant step, leveraging cloud and AI/ML to improve network performance.

- Cloud TV Platform: Comcast Technology Solutions' Cloud TV platform enables broadcasters to deliver multi-platform experiences.

- Streaming Bundles: Xfinity StreamSaver bundles streaming services, offering cost-effective entertainment options.

- WiFi Boost: Xfinity Mobile's WiFi Boost enhances wireless speeds and connectivity.

- SportsTech Program: Comcast SportsTech fosters innovation by integrating new technologies into the sports industry.

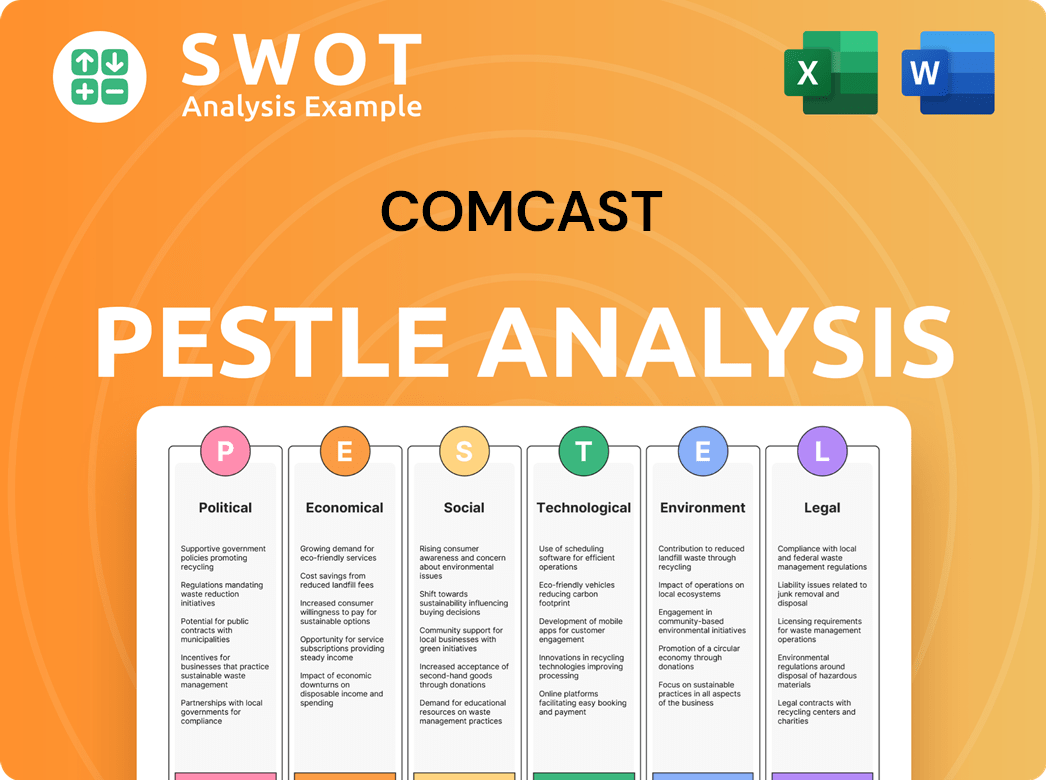

Comcast PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Comcast’s Growth Forecast?

Comcast's financial outlook for 2024 and 2025 reflects a complex landscape of growth and challenges. The company is adapting to shifts in the market while investing in key areas for future expansion. A detailed Comcast company analysis reveals strategic moves aimed at maintaining its market position and driving profitability.

For the full year 2024, Comcast reported a total consolidated revenue of $123.7 billion. Connectivity & Platforms, a significant segment, contributed $81.3 billion, representing 66% of the total revenue. The company's Comcast market share in various sectors is crucial to understanding its overall performance. The financial results highlight the importance of diversification and strategic investments.

In Q1 2025, consolidated revenue was $29.9 billion, a slight decrease of 0.6% compared to the prior year period. However, Adjusted EBITDA for Q1 2025 increased by 1.9% year-over-year to $9.5 billion. This indicates the company's ability to manage costs and improve profitability despite revenue fluctuations. The company's ability to generate free cash flow remains a key strength.

Comcast's total consolidated revenue for 2024 was $123.7 billion. Connectivity & Platforms generated $81.3 billion. Adjusted EBITDA for Connectivity & Platforms saw a 2% year-over-year increase to $32.8 billion in 2024.

Consolidated revenue in Q1 2025 was $29.9 billion, a 0.6% decrease. Adjusted EBITDA increased by 1.9% year-over-year to $9.5 billion. Free cash flow increased by 19.4% to $5.4 billion.

In Q1 2025, Comcast lost 199,000 broadband subscribers and 427,000 video subscribers. These losses highlight the ongoing shift in consumer preferences and the need for strategic adjustments. The Comcast business model is evolving to address these trends.

Xfinity Mobile added 289,000 wireless lines in Q1 2024, reaching 7.8 million subscribers by the end of 2024. Peacock generated $4.9 billion in revenue for 2024, with losses improving by nearly $1 billion. These areas are key to Comcast growth strategy.

Despite the challenges, Comcast's wireless connectivity segment has shown strong growth. Peacock, the company's streaming service, is also improving, with revenue increasing and losses decreasing. The company's strategic investments in these areas are crucial for its future. For more insights into the company's marketing approach, consider reading about the Marketing Strategy of Comcast.

Comcast experienced a net loss of 199,000 broadband subscribers in Q1 2025. This decline underscores the competitive pressures and changing consumer preferences in the broadband market. Understanding these trends is vital for predicting Comcast future prospects.

The company lost 427,000 video subscribers in Q1 2025. This ongoing trend reflects the shift toward streaming services and cord-cutting. The company's ability to adapt to these changes is crucial.

Xfinity Mobile added 289,000 wireless lines in Q1 2024. The total number of wireless subscribers reached 7.8 million by the end of 2024. This growth highlights the success of Comcast's mobile strategy.

Peacock generated $4.9 billion in revenue in 2024, up from $3.4 billion in 2023. Losses for the streaming service improved by nearly $1 billion, totaling $1.79 billion in 2024. The streaming service's financial trajectory is improving.

Comcast generated $5.4 billion in free cash flow in Q1 2025, a 19.4% increase from the previous year. The strong free cash flow generation supports the company's strategic initiatives and shareholder returns.

Comcast returned $3.2 billion to shareholders in Q1 2025 through dividends and share repurchases. This demonstrates the company's commitment to returning value to its shareholders. This is an integral part of Comcast financial performance.

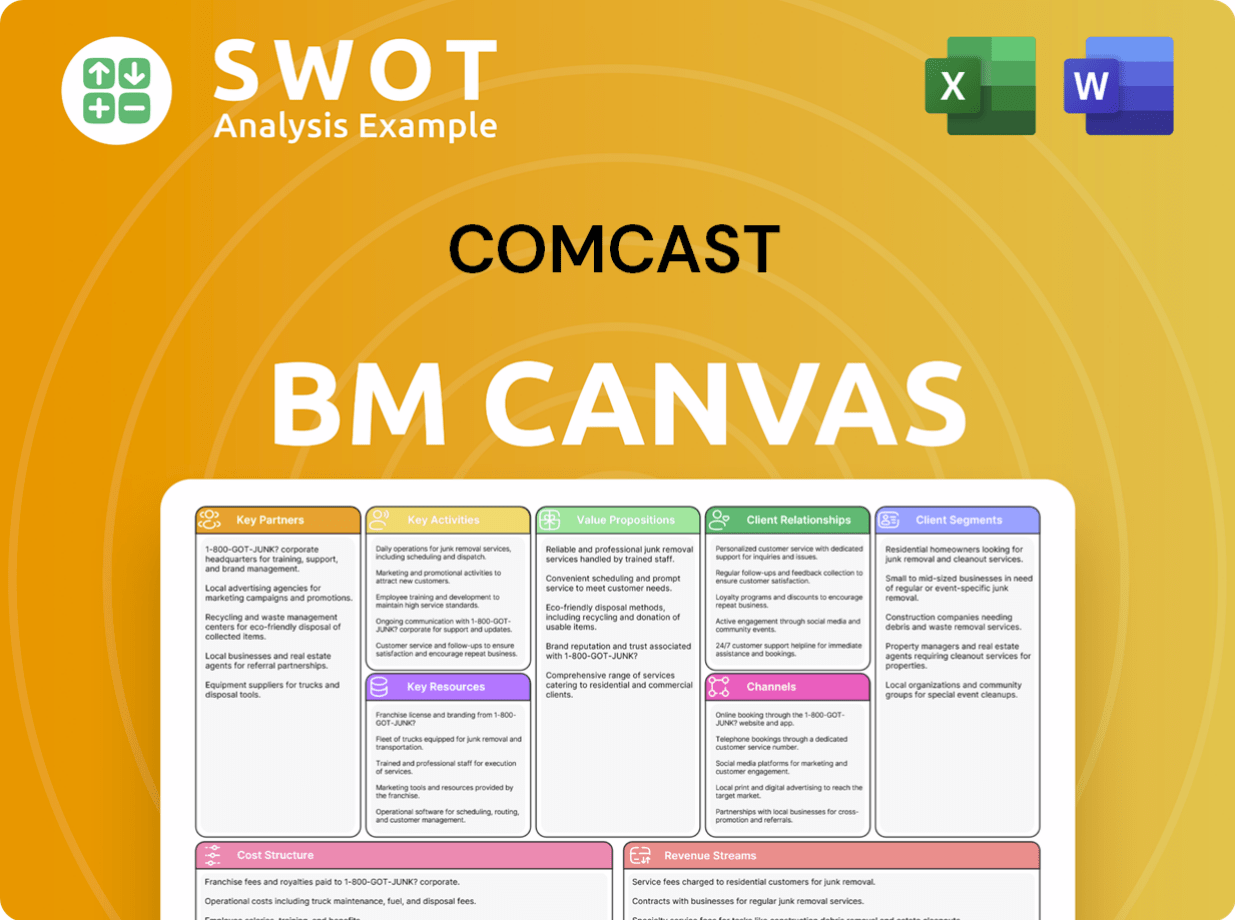

Comcast Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Comcast’s Growth?

The growth strategy of Comcast faces several significant risks in the competitive media and telecommunications landscape. These challenges range from intensifying competition in core services like broadband to shifts in consumer behavior and regulatory hurdles. Understanding these potential obstacles is crucial for evaluating Comcast's future prospects and its ability to maintain and expand its market share.

One of the primary risks is the increasing competition in the broadband market. Comcast's traditional video business is also under pressure from the rise of streaming services. Furthermore, regulatory changes and internal operational issues add complexity to the company's strategic outlook, potentially impacting its financial performance and overall business model.

To navigate these challenges, Comcast is employing various strategies, including diversification into new areas and improving customer value. However, the success of these initiatives is not guaranteed, and the company must continuously adapt to maintain its competitive edge. A comprehensive Target Market of Comcast analysis is essential to understand their consumer base.

Comcast faces stiff competition in the broadband sector from fiber-to-the-home providers and fixed wireless access (FWA) offerings. This has led to subscriber losses, with a decline of 411,000 broadband net additions in 2024, ending with 31.8 million connections. In Q1 2025, losses increased to 199,000.

The shift towards streaming services has negatively impacted Comcast's video business. Over the past three years, the company lost 5.7 million video customers, with 12.5 million domestic video customers at the end of 2024. This represents an 11% year-over-year decline.

Comcast's investment in Peacock faces intense competition from established streaming platforms. Despite revenue growth, Peacock is still operating at a loss, reporting a $372 million loss in Q4 2024, although this was an improvement.

Regulatory changes, including those related to net neutrality and privacy, can impact Comcast's operations. Supply chain issues and the need to keep pace with technological advancements also pose risks. Customer service issues have historically been a challenge.

Comcast is diversifying its business, investing in areas like wireless and theme parks to mitigate risks. The company has introduced a five-year price guarantee for broadband, starting at $55/month, to enhance customer retention.

Comcast's theme park ventures are capital-intensive and face execution risks. Management continuously assesses and prepares for these risks through strategic planning and operational refinements to navigate the dynamic environment.

Comcast's market share in the US cable industry is significant but faces pressure from competitors. The broadband market is highly competitive, with Comcast's growth strategy focusing on maintaining and expanding its subscriber base.

Comcast's business model relies on a combination of broadband, video, and other services. It is adapting to the changing market by investing in streaming and wireless offerings. The company's financial performance is influenced by its ability to manage these diverse revenue streams.

Comcast's financial performance is subject to various economic factors, including interest rates and consumer spending. The company's ability to generate revenue from its different business segments and manage its costs is critical. Comcast's stock price reflects its overall financial health and future prospects.

Comcast's future prospects depend on its ability to address the challenges and capitalize on the opportunities in its markets. Innovation and strategic investments in areas like streaming and broadband are critical for long-term success. The company's company analysis should include a focus on its strategic initiatives.

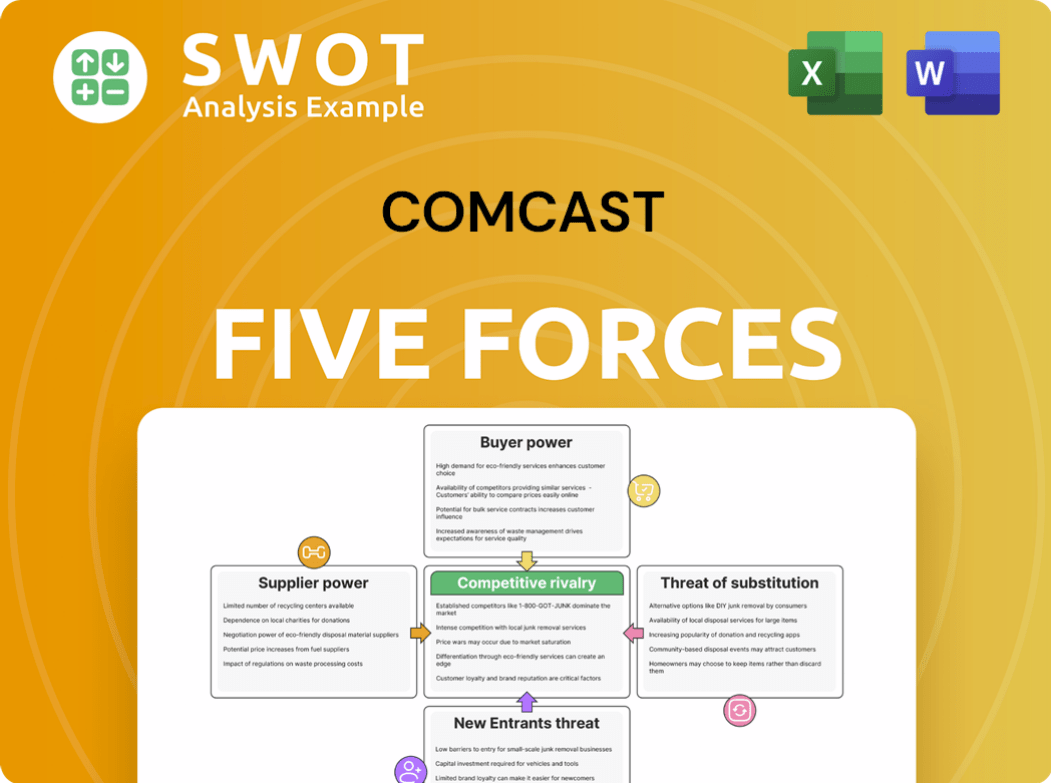

Comcast Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Comcast Company?

- What is Competitive Landscape of Comcast Company?

- How Does Comcast Company Work?

- What is Sales and Marketing Strategy of Comcast Company?

- What is Brief History of Comcast Company?

- Who Owns Comcast Company?

- What is Customer Demographics and Target Market of Comcast Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.