DFDS Bundle

How did a Danish shipping company become a European logistics giant?

Journey back in time to explore the captivating DFDS SWOT Analysis and the remarkable DFDS history! From its humble beginnings in 1866 Copenhagen, DFDS, or Det Forenede Dampskibs-Selskab, has navigated over 150 years of European shipping and logistics, transforming from a merger of Danish steamship companies into a prominent international player. Discover the pivotal moments that shaped this DFDS company.

The DFDS story is one of continuous adaptation and strategic growth. Understanding the DFDS origins and development provides crucial context for its current operations, including its extensive DFDS fleet and diverse services. Examining DFDS's significant milestones reveals the key decisions that propelled it to its current position, and the evolution of its route map.

What is the DFDS Founding Story?

The DFDS company has a rich history, beginning with its establishment in the late 19th century. This overview explores the founding of DFDS, detailing its origins and the key figures who shaped its early development.

DFDS, a prominent Danish shipping company, was founded on December 11, 1866. This marked the beginning of a company that would become a significant player in the shipping industry.

DFDS's founding was a strategic move by Carl Frederik Tietgen, a leading Danish financier. Tietgen's vision was to create a more efficient and reliable transportation network to support the growing global trade.

- Carl Frederik Tietgen orchestrated the merger of four existing Danish steamship companies.

- The merged companies included Det Nordiske Dampskibsselskab, Det Kjøbenhavnske Dampskibsselskab, Det sjællandske Dampskibsselskab, and Det danske Dampskibsselskab.

- The primary goal was to facilitate the transport of goods and people, particularly between the UK and Scandinavia.

- DFDS initially focused on transporting products and coal from the UK to Scandinavia and other European countries.

The company's initial business model was centered on connecting Europe, particularly facilitating trade between the UK and Scandinavia. DFDS provided crucial freight and passenger ferry routes, supporting the exchange of goods and people during a period of rapid industrialization and trade expansion.

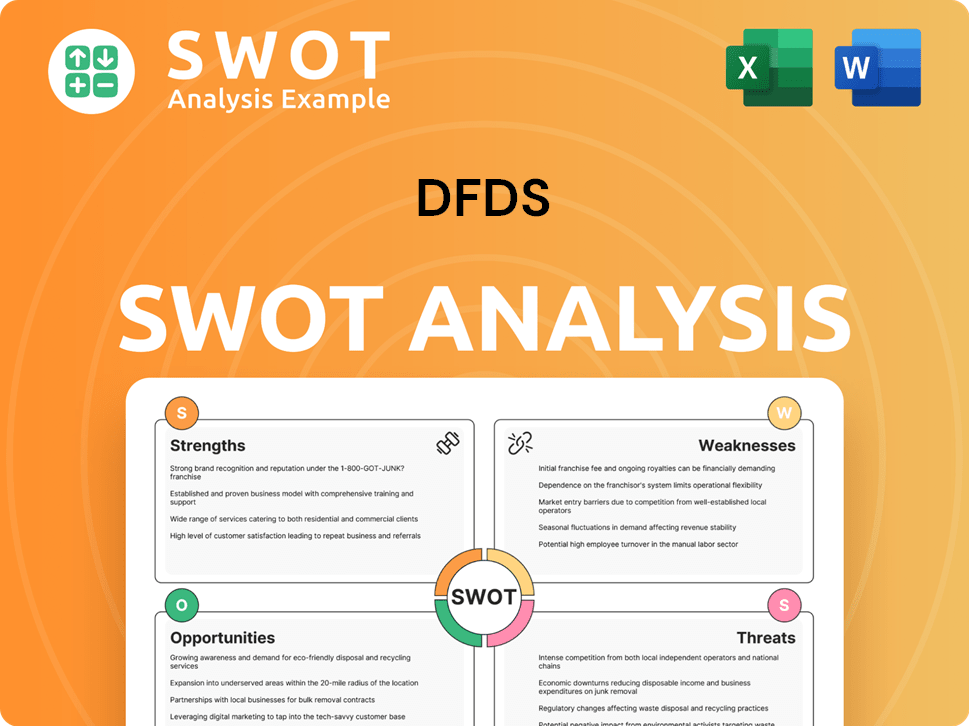

DFDS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of DFDS?

The early growth of the DFDS company focused on expanding its network and services to meet the demands of growing trade. The company developed its logistics activities starting in 1972, aiming to provide comprehensive door-to-door transportation solutions. A significant milestone was the acquisition of Dan Transport in 1998, which propelled DFDS to become a major player in forwarding and logistics in Northern Europe. Although Dan Transport was later divested in 2000 to refocus on shipping, the commitment to integrated logistics solutions remained.

Strategic expansion continued with the acquisition of Norfolkline in 2010, strengthening DFDS's position as a unique European Shipping and Logistics Group. This period also included several other logistics acquisitions, enhancing the company's network and service offerings. These moves enabled DFDS to provide vital infrastructure services across Europe, combining ferry operations with road and rail transport solutions.

In 2024, DFDS continued to expand into high-growth regions through acquisitions, such as FRS Iberia/Maroc and Ekol International Transport. These acquisitions aimed to strengthen and expand the network, particularly in areas benefiting from nearshoring trends. In 2024, DFDS's revenue increased by 9.0% to DKK 29.8 billion. Despite a challenging fourth quarter in 2024, the company remains focused on improving financial performance in 2025.

DFDS's strategic shifts have consistently aimed at enhancing its customer offering, particularly for larger freight customers, and improving operational efficiency through standardization and digitization. The company's focus on integrated logistics and strategic acquisitions has been key to its growth. The company is working on improving financial performance in 2025.

The acquisition of Dan Transport in 1998 significantly boosted DFDS's forwarding and logistics capabilities. The 2010 acquisition of Norfolkline further solidified its position as a leading European shipping and logistics group. Recent acquisitions, such as FRS Iberia/Maroc and Ekol International Transport in 2024, are aimed at expanding the network and capitalizing on nearshoring trends.

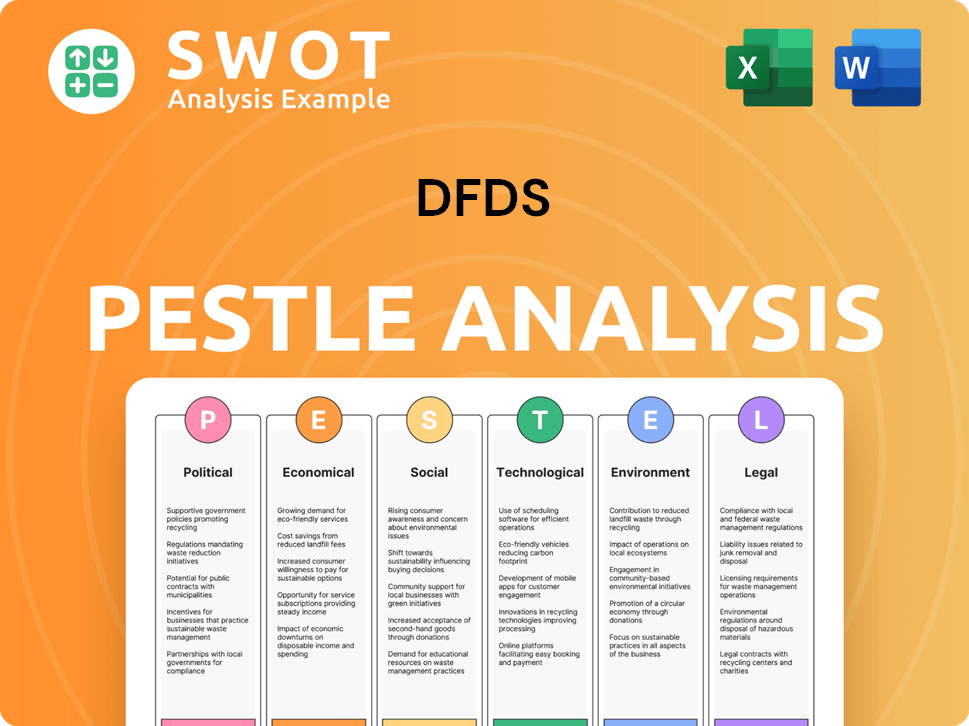

DFDS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in DFDS history?

The DFDS history is marked by significant achievements in the shipping and logistics industry. The company has expanded its operations and adapted to changing market conditions over the years.

| Year | Milestone |

|---|---|

| Ongoing | DFDS continues to focus on sustainability, with targets to reduce CO2 emissions and ongoing investment in standardization and digitization. |

| 2024 | DFDS faced a decrease in earnings, with a 35% drop in EBIT to DKK 1.5 billion, and the acquisition of Ekol International Transport negatively impacting earnings. |

| Ongoing | DFDS has implemented strategic pivots, including adapting Mediterranean ferry operations and restructuring programs in the Türkiye & Europe South division. |

| Ongoing | DFDS integrates ferry infrastructure with logistics solutions, offering door-to-door transport services across Europe. |

A key innovation for the Danish shipping company has been the integration of ferry infrastructure with comprehensive logistics solutions. This approach enables the company to provide door-to-door transport services.

The company provides full and part loads for dry cargo, cold chains, and contract logistics tailored to specific industries.

DFDS offers comprehensive door-to-door transport services across Europe, streamlining the logistics process for its customers.

In recent years, DFDS has encountered market downturns and increased competition, particularly in its Mediterranean ferry network. The fourth quarter of 2024 saw a significant earnings decrease due to these challenges.

The company has faced market downturns, particularly in its Mediterranean ferry network, impacting financial performance.

Increased competition and overcapacity on routes like Istanbul-Trieste have negatively affected earnings.

The company is undergoing restructuring efforts, including headcount reductions and fleet adjustments in the Türkiye & Europe South division.

The acquisition of Ekol International Transport negatively impacted earnings in 2024 and is expected to continue in 2025.

DFDS is adapting Mediterranean ferry operations, implementing price increases, and reducing capacity on certain routes.

The company aims to turn around the Ekol International Transport business to breakeven by year-end 2025 and expects improving earnings trends in Q2 2025.

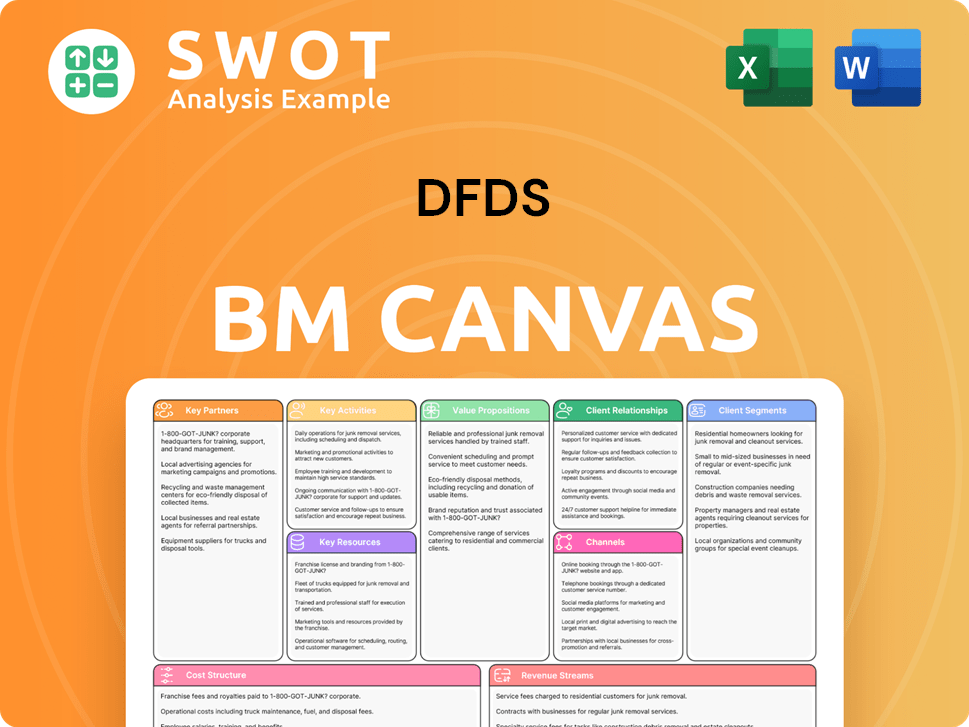

DFDS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for DFDS?

The DFDS company, a prominent player in the shipping and logistics industry, has a rich history marked by significant milestones. Founded in 1866 by C.F. Tietgen through the merger of four Danish steamship companies, it has evolved from its origins as a Danish shipping company to a major logistics provider. DFDS's journey includes strategic expansions, acquisitions, and a strong focus on sustainability and growth.

| Year | Key Event |

|---|---|

| 1866 | Founded by C.F. Tietgen through the merger of four Danish steamship companies. |

| 1972 | Expanded into logistics activities. |

| 1998 | Acquired Dan Transport, becoming a major logistics player in Northern Europe. |

| 2000 | Sold Dan Transport to refocus on shipping. |

| 2010 | Acquired Norfolkline, expanding its European network. |

| 2024 | Revenue increased by 9.0% to DKK 29.8 billion. |

| 2024 | Acquired FRS Iberia/Maroc and Ekol International Transport, expanding into high-growth regions. |

| 2024 Q4 | Experienced a significant earnings decrease, with EBIT for the year at DKK 1.5 billion. |

| March 2025 | Awarded a 20-year Jersey ferry services concession contract. |

| Q1 2025 | Reported an 8% increase in revenue to DKK 7.5 billion, but a net loss of DKK 117 million. |

For 2025, the company anticipates an EBIT of around DKK 1.0 billion, with revenue growth projected at approximately 5%. The focus is on protecting and growing revenue, resolving key challenges, and deleveraging the capital structure. The company aims to turn around the Türkiye & Europe South business area to breakeven by year-end 2025.

Key initiatives include commencing a newbuilding program for green ferries in 2026 and introducing a high-speed electrified vessel for the St Malo route by 2028. By 2030, DFDS plans to have six new green ferries in operation and aims to reduce CO2 emissions intensity significantly. The company is also planning a freight-only ship and a slow passenger ship by 2031.

DFDS has set ambitious sustainability targets, including a 45% reduction in Tank-to-Wake CO2 emissions intensity for vessel operations and a 75% reduction in Well-to-Wheel CO2e emissions intensity for road, land transport, and warehousing by 2030. The company has a net-zero emissions target for vessel operations, road and land transport, and warehousing by 2050.

Analysts forecast DFDS's earnings to grow by 41.7% per year and revenue by 4.5% per year. CEO Torben Carlsen emphasizes that 2025 is a 'transitional year' focused on laying the groundwork for improved financial performance. The company is prioritizing organic growth, network value, standardization, digitization, and green transition.

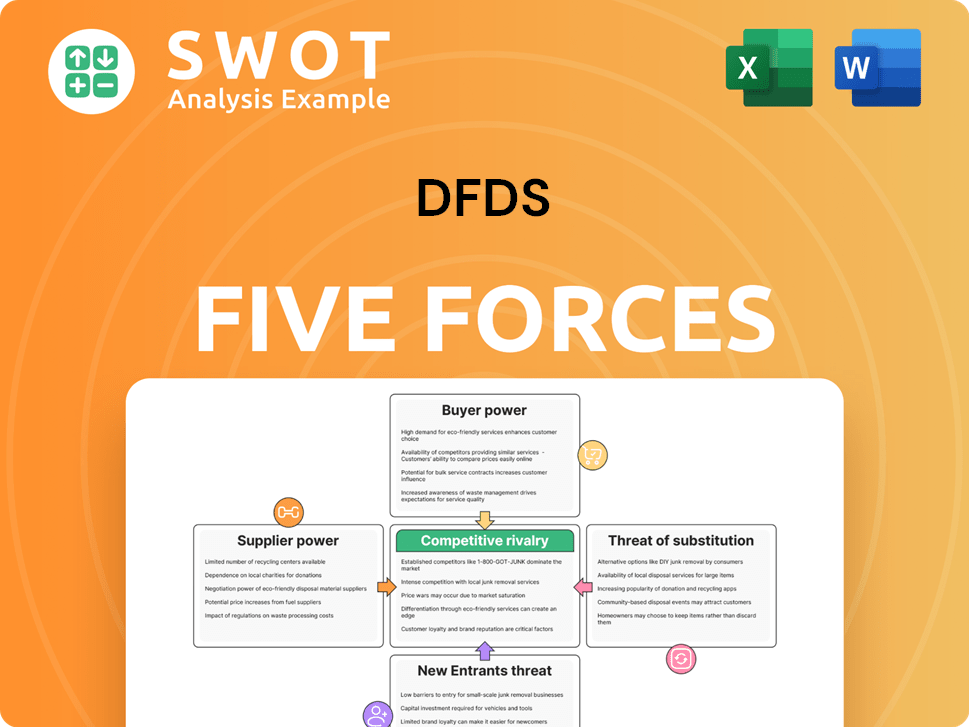

DFDS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of DFDS Company?

- What is Growth Strategy and Future Prospects of DFDS Company?

- How Does DFDS Company Work?

- What is Sales and Marketing Strategy of DFDS Company?

- What is Brief History of DFDS Company?

- Who Owns DFDS Company?

- What is Customer Demographics and Target Market of DFDS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.