DFDS Bundle

How Does DFDS Navigate the Seas of Commerce?

DFDS, a titan in European shipping and logistics, connects nations and facilitates trade with its extensive network. With a 2024 revenue of DKK 29.8 billion and a workforce of 14,000, DFDS SWOT Analysis is essential to understand this company. From passenger and freight ferry routes to comprehensive logistics solutions, DFDS’s influence is undeniable.

In early 2025, DFDS secured a significant contract, expanding its reach and reinforcing its role in essential connectivity. This deep dive into DFDS operations will explore its core value propositions, revenue streams, and strategic maneuvers. Understanding the DFDS business model and its commitment to sustainability is crucial for anyone looking to understand the future of European transport, including its ferry routes and schedules.

What Are the Key Operations Driving DFDS’s Success?

The DFDS Company provides integrated ferry services, port operations, and logistics solutions across Europe. It serves both businesses and individual travelers, creating value through its extensive network. The core of DFDS operations involves passenger and freight ferry routes, crucial for trade and the movement of goods and people across various European geographies.

The company's value proposition focuses on reliability, efficiency, and capacity. For freight customers, DFDS services offer end-to-end transport, leveraging its ferry network alongside road and rail transport. This integrated approach aims to provide high performance and superior reliability to over 10,000 freight customers. DFDS also operates its own port terminals to enhance control over the logistics chain.

For passengers, DFDS offers safe overnight and short-sea ferry services on numerous routes. The diversified business model reduces concentration risks and supports the resilience of its operating results. This approach, combined with continuous efforts in standardization and digitization, enhances customer service and operating efficiency, leading to easier and more cost-effective services.

The company offers a broad range of services including passenger and freight ferry services, port terminal operations, and logistics solutions. These services are designed to facilitate the efficient movement of goods and people across Europe. The company's integrated approach allows for comprehensive solutions.

Operational efficiency is a core focus, with investments in standardization and digitization to improve customer service and operational performance. This includes enhanced data transparency and workflow optimization, leading to more efficient services. Recent initiatives include the use of electric trucks for night logistics on certain routes.

The company holds strong market shares in key regions such as the North Sea and Turkey, demonstrating a significant presence in the European market. The company's market share on several routes exceeds 75%, reflecting its strong position. This strong presence is a key component of the company's success.

Customers benefit from easier, more cost-effective services, improved data transparency, and automation. These improvements accelerate growth and improve customer satisfaction. The company is committed to providing high-quality services.

The company's focus on reliability and efficiency, combined with its diversified business model, supports its strong market position. For additional insights into the company's strategic approach, consider reading about the Growth Strategy of DFDS. This integrated strategy enhances the DFDS ability to serve its customers effectively.

The company's operations are characterized by a strong emphasis on integrated services, operational efficiency, and customer satisfaction. Continuous improvements in technology and logistics are crucial for maintaining its competitive edge. Recent initiatives include the use of electric trucks for certain routes.

- Extensive ferry network across Europe.

- Integrated logistics solutions.

- Focus on customer service and satisfaction.

- Continuous investments in technology and efficiency.

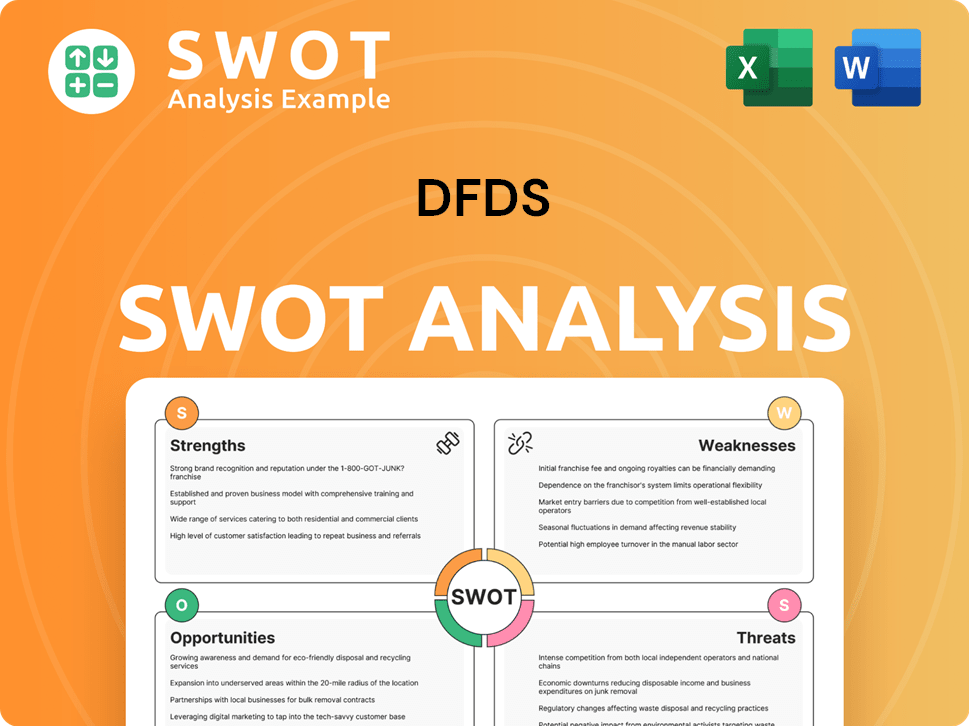

DFDS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does DFDS Make Money?

The DFDS Company generates revenue through its integrated ferry and logistics operations. In 2024, the company's total revenue was DKK 29.8 billion. This revenue stream is diversified across various services, ensuring a robust financial foundation.

For the first quarter of 2025, DFDS operations saw an 8% increase in revenue, reaching DKK 7.5 billion. This growth was significantly influenced by the strategic acquisition of Ekol International Transport, enhancing the company's market position and service offerings.

Understanding the revenue streams and monetization strategies of DFDS is crucial for grasping its financial dynamics and market approach. The company's ability to adapt and innovate within the shipping and logistics sectors is key to its ongoing success.

Ferry services are a major revenue source for DFDS, encompassing both freight and passenger transport. This division operates a vast network of routes throughout Europe, carrying goods, vehicles, and passengers. Revenue for the ferry division in 2025 is projected to be lower than in 2024 due to the Oslo-route divestment, although the Jersey ferry services launch will add volumes.

The logistics segment offers comprehensive transport solutions, including road and rail transport, along with warehousing. This division's revenue is expected to rise in 2025, driven by the full-year impact of the Ekol International Transport acquisition and organic growth. This expansion enhances DFDS services and market reach.

DFDS employs several monetization strategies, including tiered pricing for its services and cross-selling opportunities. Bundled transport and logistics solutions are offered to larger freight customers. The company focuses on improving its cost base and capacity utilization to enhance profitability.

In 2025, DFDS prioritizes protecting and growing revenue and profits across its business units. This involves adapting Mediterranean ferry operations and turning around the acquired Ekol International Transport to breakeven by year-end 2025. Digitalization continues to enhance customer service and operational efficiency.

Digitalization is a key focus for DFDS, aiming to improve customer service and operational efficiency. These efforts lead to cost savings and improved revenue generation. This strategy is crucial for maintaining a competitive edge within the industry.

Adapting to changing market conditions is a key strategy, particularly in the Mediterranean ferry operations. This adaptability is crucial for maintaining profitability and competitiveness. The company's ability to adjust to new challenges is vital for its long-term success.

The financial performance of DFDS is closely tied to its operational efficiency and strategic decisions. The company's ability to manage its diverse revenue streams and adapt to market changes is essential for sustained growth. For more insights into the company's background, consider reading about the Brief History of DFDS.

- Revenue Growth: In Q1 2025, revenue increased by 8%, demonstrating strong performance.

- Strategic Acquisitions: The acquisition of Ekol International Transport significantly impacted revenue growth.

- Operational Focus: Initiatives include adapting ferry operations and improving efficiency to boost profits.

- Digital Transformation: Ongoing digitalization efforts aim to enhance customer service and streamline operations.

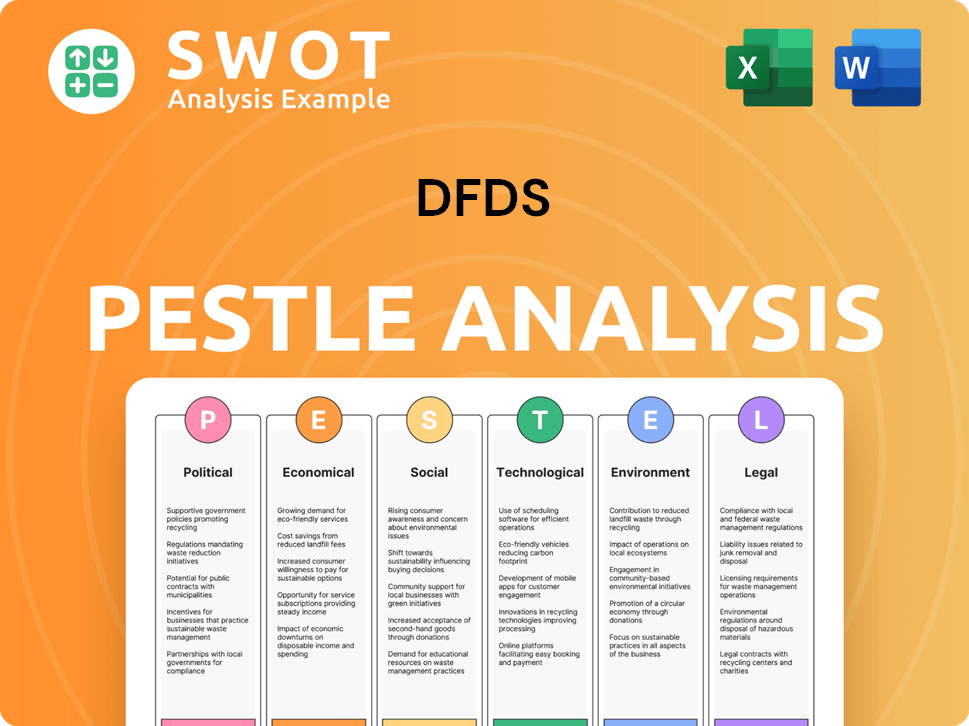

DFDS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped DFDS’s Business Model?

The DFDS Company has navigated a dynamic landscape, marked by strategic acquisitions, operational adjustments, and a commitment to innovation. Its journey reflects a blend of expansion, adaptation, and a focus on long-term sustainability. Key milestones and strategic decisions have shaped its current position in the shipping and logistics sector.

In 2024, DFDS expanded its footprint through acquisitions, including FRS Iberia/Maroc and Ekol International Transport, enhancing its service offerings and geographic reach. Conversely, the company divested certain routes, such as the Oslo route, to align with its strategic priorities. A notable achievement for 2025 is the securing of a long-term concession for Jersey ferry services, demonstrating its commitment to providing essential services.

Operationally, DFDS operations have faced challenges, particularly a decline in earnings during Q4 2024, influenced by competitive pressures and the initial integration of acquisitions. The company has responded with a 'transitional year' approach in 2025, implementing measures to improve profitability and adapt to market changes. These measures include price adjustments, capacity management, and cost-cutting initiatives.

In 2024, DFDS acquired FRS Iberia/Maroc and Ekol International Transport, expanding its network. The company also divested its Oslo route. A significant achievement is the 20-year Jersey ferry services concession contract, which began in March 2025.

DFDS is implementing turnaround actions, including price increases, capacity adjustments, and cost reductions. The company is adapting its Mediterranean network to new competition. It aims to achieve breakeven for Ekol International Transport by the end of 2025 and is progressing with logistics turnaround projects initiated in 2024.

DFDS benefits from a diversified business model encompassing ferry and logistics operations across Europe. It holds strong market shares in freight ferry transport, particularly in the North Sea and Turkey. The company has been named 'Europe's Leading Ferry Operator' for 12 consecutive years (2012-2023) and 'World's Leading Ferry Operator' for 12 years (2011-2022).

DFDS is committed to digital innovation, automating port terminal operations, and using AI. The 'Moving Together Towards 2030' strategy focuses on organic growth, standardization, and digitization. The company has ambitious green transition targets, including six green ferries by 2030 and net-zero emissions by 2050 for vessel operations.

DFDS's competitive strengths include its diversified business model, strong market shares, and brand recognition. The company's strategic focus on digital innovation and sustainability further enhances its position. The company's commitment to its 'Moving Together Towards 2030' strategy underlines its dedication to long-term growth and environmental responsibility.

- Diversified business model with ferry and logistics operations.

- Strong market shares in freight ferry transport, especially in the North Sea and Turkey.

- Brand recognition, with awards such as 'Europe's Leading Ferry Operator'.

- Commitment to digital innovation and sustainable practices.

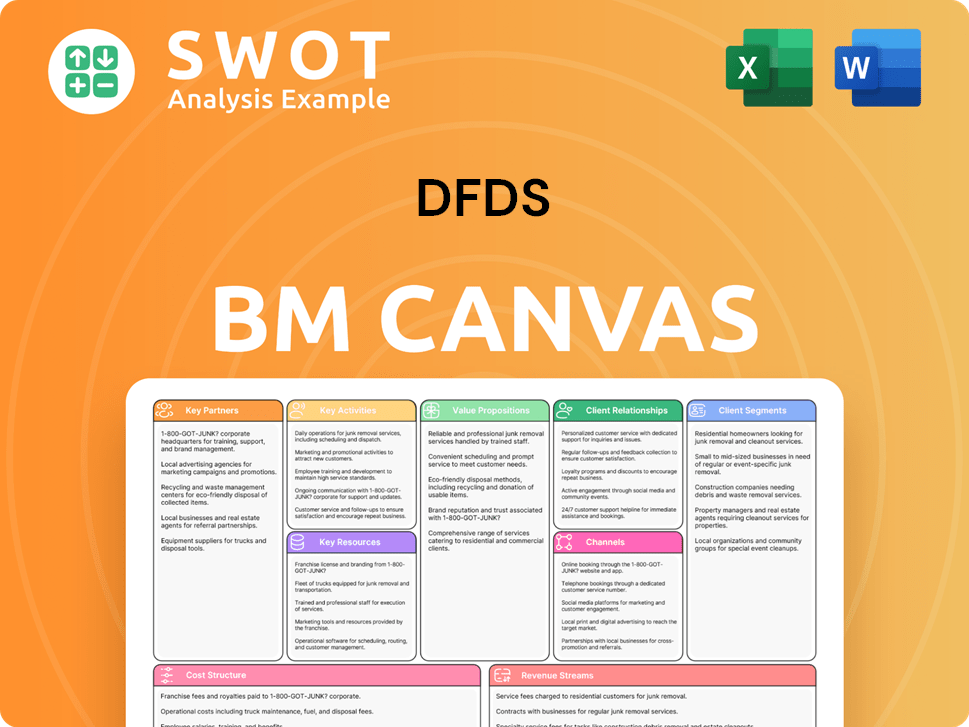

DFDS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is DFDS Positioning Itself for Continued Success?

DFDS Company holds a strong position in the European ferry and logistics sector. Its business model is diversified across the North Sea, Channel, Baltic Sea, Strait of Gibraltar, and the Mediterranean. The company's integrated ferry and logistics offerings support operational synergies and customer loyalty, with a global reach across 20 countries and approximately 16,500 full-time employees.

Despite its strengths, DFDS faces several risks. Profitability pressures intensified in the second half of 2024 due to increased competition and market headwinds. The acquisition of Ekol International Transport, while strategic, was initially loss-making and is expected to negatively impact EBIT in 2025. Furthermore, the increasing importance of carbon efficiency for vessels and the costs associated with the EU Emission Trading System (EU ETS) present financial risks.

DFDS maintains high market shares on key routes, like the North Sea and Turkey, where it controls over 75% of capacity on several routes. The company's wide geographic presence and integrated services contribute to its established market position. To learn more about the company's target market, you can read about the target market of DFDS.

Key risks include increased competition, particularly in the Mediterranean, and market headwinds in northern European logistics. The company is also facing financial risks from the EU ETS and its increasing financial leverage, which reached 3.9x in 2024. Muted expectations for European economic growth also pose market uncertainties.

For 2025, DFDS is focusing on improving financial performance through strategic initiatives. These include adapting Mediterranean ferry operations and turning around the Türkiye & Europe South business area to breakeven by year-end 2025. The company aims for network expansion, investing in more fuel-efficient vessels, and reducing CO2 emissions intensity.

DFDS expects an EBIT of around DKK 1.0 billion in 2025, a decrease from DKK 1.5 billion in 2024, with revenue growth anticipated at around 5%. The company plans to prioritize deleveraging its capital structure by not distributing capital to shareholders. Financial solidity is expected to improve in the second half of 2025.

DFDS is focused on several strategic initiatives to improve its financial performance. Key targets include achieving breakeven in the Türkiye & Europe South business area by the end of 2025 and reducing CO2 emissions intensity by 45% by 2030. The company is also committed to deleveraging its capital structure.

- Adaptation of Mediterranean ferry operations to the changed competitive environment.

- Turning around the Türkiye & Europe South business area to breakeven by year-end 2025.

- Prioritizing deleveraging its capital structure in 2025 by not distributing capital to shareholders.

- Investing in more fuel-efficient vessels.

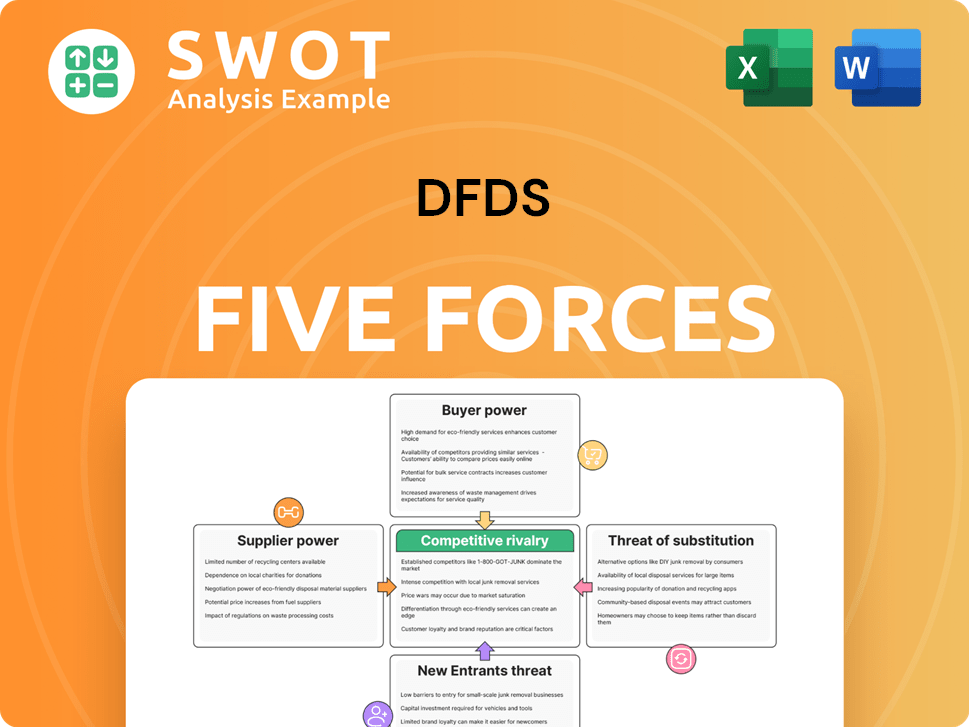

DFDS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DFDS Company?

- What is Competitive Landscape of DFDS Company?

- What is Growth Strategy and Future Prospects of DFDS Company?

- What is Sales and Marketing Strategy of DFDS Company?

- What is Brief History of DFDS Company?

- Who Owns DFDS Company?

- What is Customer Demographics and Target Market of DFDS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.