DXC Technology Bundle

What's the Story Behind DXC Technology?

Ever wondered how a global IT powerhouse like DXC Technology came to be? From a monumental merger to a leading position in the tech world, DXC's journey is a fascinating tale of strategic moves and industry evolution. This DXC Technology SWOT Analysis will help you understand its current standing.

DXC Technology's DXC history began on April 1, 2017, a pivotal date marking the union of Computer Sciences Corporation (CSC) and Hewlett Packard Enterprise's Enterprise Services. As a major technology company, DXC quickly established itself as a key player in the IT services sector, serving clients across the globe. Understanding the DXC company profile is crucial for anyone interested in the business history of modern technology.

What is the DXC Technology Founding Story?

The DXC Technology story is a blend of two major IT players, marking a significant chapter in the IT services industry. While officially established on April 1, 2017, its origins are rooted in the merger of Computer Sciences Corporation (CSC) and the Enterprise Services (ES) segment of Hewlett Packard Enterprise (HPE).

This strategic alliance created a new entity designed to tackle the evolving technological landscape. The merger brought together two companies with rich histories and established market positions, setting the stage for a global IT services provider. This is a brief DXC history.

The formation of DXC Technology was a strategic move to create a leading end-to-end IT services company.

Computer Sciences Corporation (CSC) was founded in 1959 by Roy Nutt and Fletcher Jones in El Segundo, California, initially focusing on software development. It went public in 1963, becoming the first software company to do so. HPE's Enterprise Services segment, which contributed to DXC, had its own significant history, including the 2008 acquisition of Electronic Data Systems (EDS), founded by Ross Perot in 1962.

- The merger in 2017 was a strategic move to create a new, independent IT services powerhouse.

- Mike Lawrie, formerly CEO of CSC, became the first Chairman, President, and CEO of DXC Technology.

- DXC began operations with combined annual revenues of approximately $25 billion and a substantial global client base.

- This merger was a major corporate restructuring aimed at integrating operations, cultures, and systems.

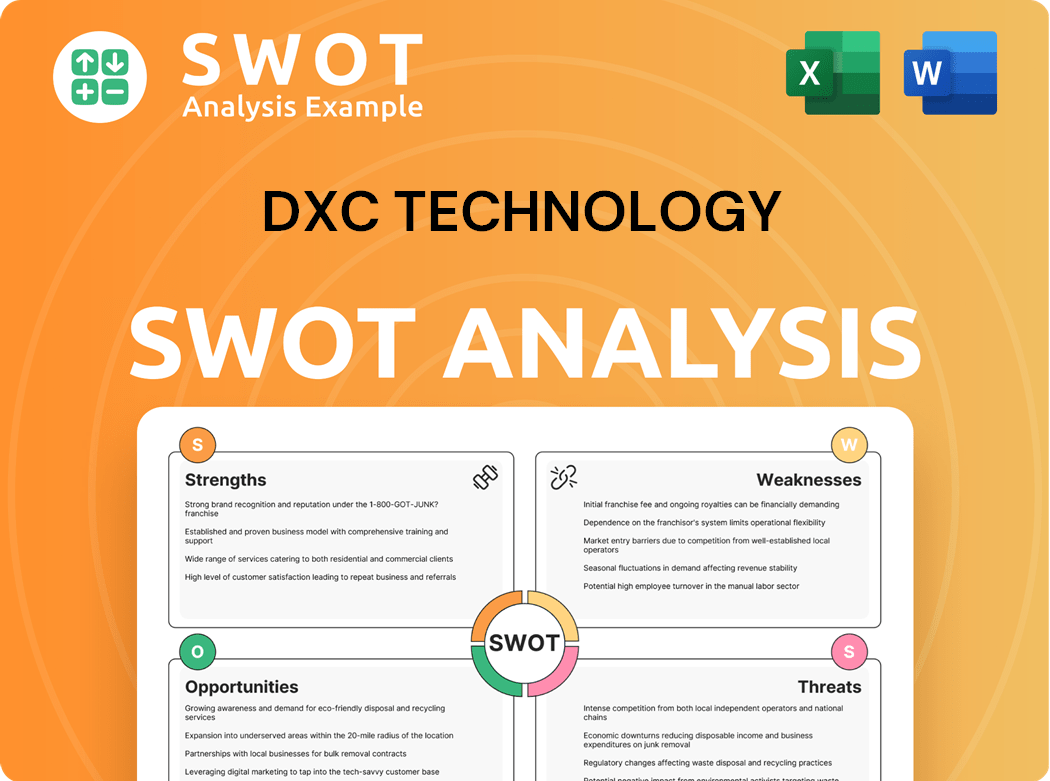

DXC Technology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of DXC Technology?

The early years of DXC Technology, following its formation, were marked by significant integration efforts and strategic realignments. The DXC history includes a focus on consolidating operations and cultures inherited from its predecessors. This period also saw the company making key acquisitions and divestitures to refine its business model. The DXC company navigated leadership changes and revenue challenges while focusing on margin improvement.

Immediately after its April 2017 formation, DXC Technology began integrating operations inherited from CSC and HPE ES. In July 2017, DXC acquired Tribridge and its affiliate Concerto Cloud Services for $152 million. A three-year plan was initiated in 2017 to reduce its Indian offices, impacting around 10,000 employees by cutting roughly 5.9% of the workforce.

In 2018, DXC spun off its US public sector segment to create Perspecta Inc., aiming to focus on core enterprise IT services. Additional acquisitions in 2018 included Molina Medicaid Solutions, Argodesign, and two ServiceNow partners. The June 2019 acquisition of Luxoft for approximately $2 billion expanded digital capabilities.

Mike Salvino was appointed President and CEO in September 2019, succeeding Mike Lawrie. This leadership change signaled a shift towards operational execution and customer relationships. Despite revenue declines, DXC focused on margin improvement and targeted acquisitions and divestitures to refine service offerings.

While specific financial data for this period would be detailed in company reports, the strategic moves aimed to position DXC in the competitive IT services and technology company landscape. The acquisitions, divestitures, and leadership changes were all geared towards improving the company's financial profile and market competitiveness. The company's focus on digital capabilities, particularly through the Luxoft acquisition, reflected a broader industry trend towards digital transformation.

DXC Technology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in DXC Technology history?

The DXC Technology has experienced several significant milestones since its inception, shaping its trajectory in the IT services sector. A key moment was its establishment as one of the world's largest independent IT services providers.

| Year | Milestone |

|---|---|

| 2017 | DXC Technology was formed through the merger of Computer Sciences Corporation (CSC) and the Enterprise Services business of Hewlett Packard Enterprise. |

| 2018 | The company focused on streamlining operations and integrating its global workforce. |

| 2020 | DXC Technology announced a strategic transformation plan to improve its financial performance and focus on core business areas. |

| 2024 | Raul Fernandez was appointed as CEO in February 2024. |

Innovations at DXC Technology have centered on modernizing IT infrastructure, optimizing data architectures, and ensuring robust security across various cloud environments. The company has also formed strategic partnerships with major technology providers to enhance its service offerings and expand its market reach.

DXC Technology has been developing and implementing cloud solutions to help clients transition to cloud environments. This includes services for cloud migration, management, and optimization.

The company provides data analytics services, helping clients leverage data for insights and decision-making. This includes data warehousing, business intelligence, and advanced analytics solutions.

DXC Technology assists clients in their digital transformation journeys, offering services such as digital strategy, application modernization, and customer experience solutions.

DXC Technology offers comprehensive security services to protect clients' IT environments. This includes cybersecurity consulting, threat detection, and incident response services.

The company provides modern workplace solutions, including services for unified communications, collaboration tools, and end-user support.

DXC Technology offers IT outsourcing services, managing clients' IT infrastructure and operations. This includes data center services, network management, and application support.

Despite its achievements, DXC Technology has faced challenges, including market downturns and competitive pressures. In fiscal year 2024, the company reported a total revenue decline of 5.3% to $13.67 billion and a net loss of $639 million.

DXC Technology has had to navigate fluctuations in the IT services market, which can impact demand for its services. Economic downturns can lead to reduced IT spending by clients.

The IT services industry is highly competitive, with numerous companies vying for market share. DXC Technology competes with large global IT service providers, as well as specialized firms.

DXC Technology has undergone restructuring programs to improve its profitability and reduce costs. These initiatives can involve workforce reductions, consolidation of operations, and changes in service offerings.

The company has seen changes in its leadership, including the appointment of a new CEO. Leadership transitions can sometimes create uncertainty and require adjustments in strategy and operations.

DXC Technology's financial performance has been impacted by various factors, including revenue declines in certain segments and net losses. The company's ability to generate strong free cash flow has been a key focus.

DXC Technology's operational execution, including project delivery and service quality, has been critical to its success. Challenges in these areas can affect client satisfaction and financial results.

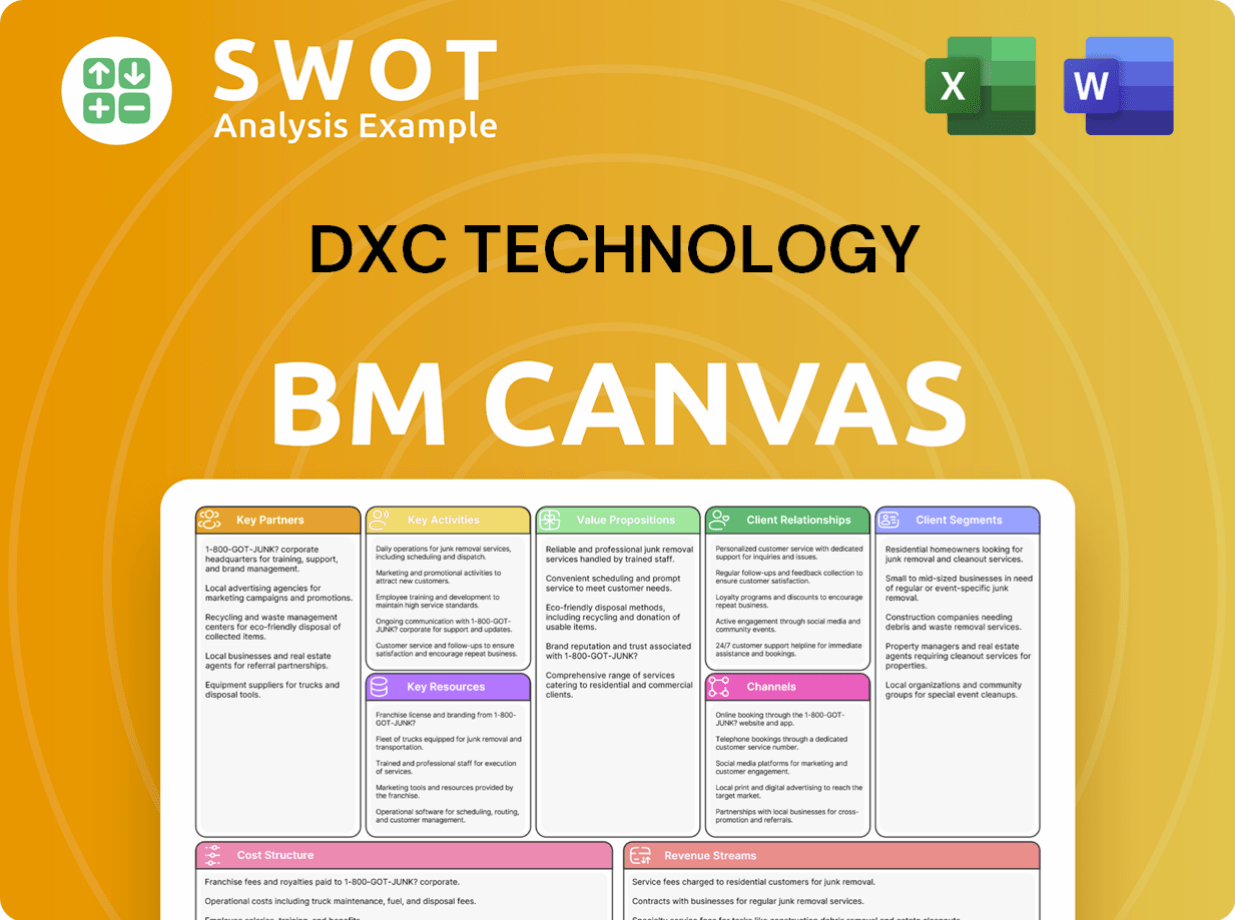

DXC Technology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for DXC Technology?

The DXC Technology journey is marked by significant mergers, acquisitions, and strategic shifts. Founded through the merger of Computer Sciences Corporation (CSC) and the Enterprise Services segment of Hewlett Packard Enterprise (HPE) on April 1, 2017, DXC has quickly evolved in the IT services sector. This evolution includes key acquisitions like Luxoft and strategic decisions such as spinning off its US public sector segment to create Perspecta Inc.

| Year | Key Event |

|---|---|

| 1959 | Computer Sciences Corporation (CSC) was founded by Roy Nutt and Fletcher Jones. |

| 1962 | Electronic Data Systems (EDS) was founded by Ross Perot. |

| 2008 | Hewlett-Packard Company acquired EDS. |

| April 1, 2017 | DXC Technology officially launched through the merger of Computer Sciences Corporation (CSC) and the Enterprise Services segment of Hewlett Packard Enterprise (HPE). |

| July 2017 | DXC acquired Tribridge and Concerto Cloud Services. |

| 2018 | DXC spins off its US public sector segment to create Perspecta Inc. |

| January 2019 | DXC Technology acquired Luxoft, expanding its digital capabilities. |

| September 2019 | Mike Salvino was appointed President and CEO. |

| February 2021 | French firm Atos ended talks for a potential acquisition of DXC. |

| May 2022 | Mike Salvino was appointed Chairman of DXC's board. |

| October 2023 | DXC is delisted from the S&P 500 Index and moved to the S&P SmallCap 600 Index. |

| February 1, 2024 | Raul Fernandez was appointed President and CEO. |

| May 16, 2024 | DXC Technology reports Q4 FY24 results, with total revenue down 5.7% to $3.39 billion. |

| May 14, 2025 | DXC Technology reports Q4 and full year fiscal 2025 results. Total revenue for Q4 FY25 was $3.17 billion, down 6.4% year-over-year, and full year fiscal 2025 revenue was $12.87 billion, down 5.8% year-over-year. |

DXC Technology is focused on stabilizing revenues and improving profitability. The company aims to align its growth rate with competitors in the near term. It is also concentrating on reducing debt levels.

The company sees growth opportunities in its insurance business unit. DXC plans to generate free cash flow above fiscal 2024 levels by fiscal 2026. AI integration is a key area of focus, especially in the Modern Workplace segment.

Leadership emphasizes delivering deep and broad capabilities to customers. The company is focused on driving performance with an energized employee base. Building a culture of accountability, collaboration, and urgency is a priority.

DXC is building on its strategic partnerships to bring value to customers. The company is committed to innovation in the era of AI and cloud modernization. This includes leveraging AI to improve its IT services.

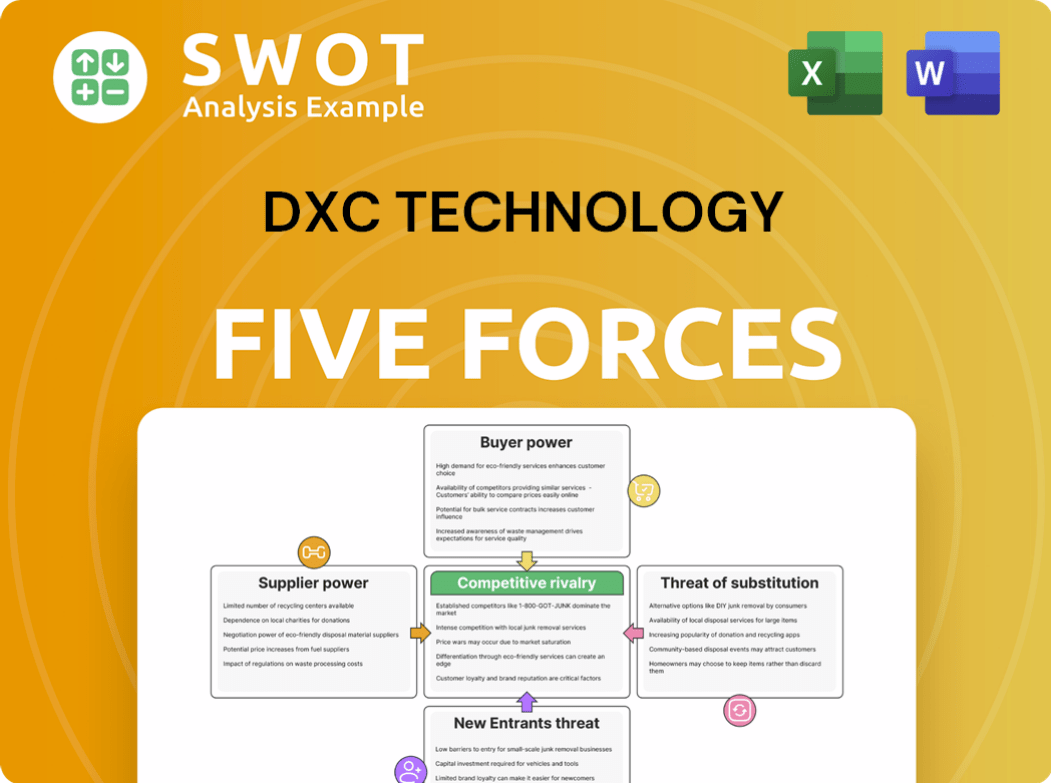

DXC Technology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of DXC Technology Company?

- What is Growth Strategy and Future Prospects of DXC Technology Company?

- How Does DXC Technology Company Work?

- What is Sales and Marketing Strategy of DXC Technology Company?

- What is Brief History of DXC Technology Company?

- Who Owns DXC Technology Company?

- What is Customer Demographics and Target Market of DXC Technology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.