Hainan Airlines Bundle

How did Hainan Airlines Take Flight?

From a small provincial airline to a global aviation giant, the story of Hainan Airlines is one of remarkable growth and strategic pivots. Established in the special economic zone of Hainan, China, this airline swiftly broke ground as the nation's first joint-stock air-transport company. Curious about the key moments that propelled Hainan Airlines' rise?

This Hainan Airlines SWOT Analysis is a fascinating look into the dynamic world of the Chinese airline industry. Hainan Airlines' journey, from its humble beginnings in 1989 as Hainan Province Airlines to its current status as a major player, reflects the rapid evolution of China's aviation sector. Understanding the brief history of Hainan Airlines is crucial for anyone interested in the airline industry China and the broader impact of HNA Group.

What is the Hainan Airlines Founding Story?

The founding of Hainan Airlines marks a significant chapter in the history of the Chinese airline industry. Initially established in October 1989 as Hainan Province Airlines, the company embarked on its journey to revolutionize air travel in China.

Hainan Airlines officially launched its scheduled services on May 2, 1993. This followed a crucial restructuring in January 1993, which transformed it into China's first joint-stock air-transport company. This model was a pioneering move, setting the stage for future developments in the aviation sector.

The initial financial backing for Hainan Airlines amounted to 250 million yuan, equivalent to approximately $31.25 million USD. The capital was sourced from the Hainan government (5.33%), corporate staff (20%), and institutional shareholders. This structure allowed founders, top executives, and foreign investors to hold shares, a departure from the traditional state-owned airline model.

Hainan Airlines' early years were marked by strategic investments and expansions that shaped its trajectory within the Revenue Streams & Business Model of Hainan Airlines.

- 1989: Hainan Province Airlines is founded.

- 1993: Hainan Airlines officially begins scheduled services.

- 1995: American financier George Soros invests $25 million, boosting credibility.

- 1995: Executive-jet operations commence with a Bombardier Learjet 55.

- 1996: Hainan Province Airlines is renamed Hainan Airlines.

A pivotal moment came in 1995 when American financier George Soros invested $25 million in the airline. This investment significantly bolstered its financial standing and credibility. In April 1995, the company expanded its operations by introducing executive-jet services with a Bombardier Learjet 55.

In 1996, the company officially changed its name from Hainan Province Airlines to Hainan Airlines. The airline's initial business model focused on providing comprehensive passenger and cargo air transportation services. These services included aircraft maintenance and ground handling. The development of its home base, Haikou, on Hainan Island, also played a crucial role in its early success and expansion within the Chinese airline industry.

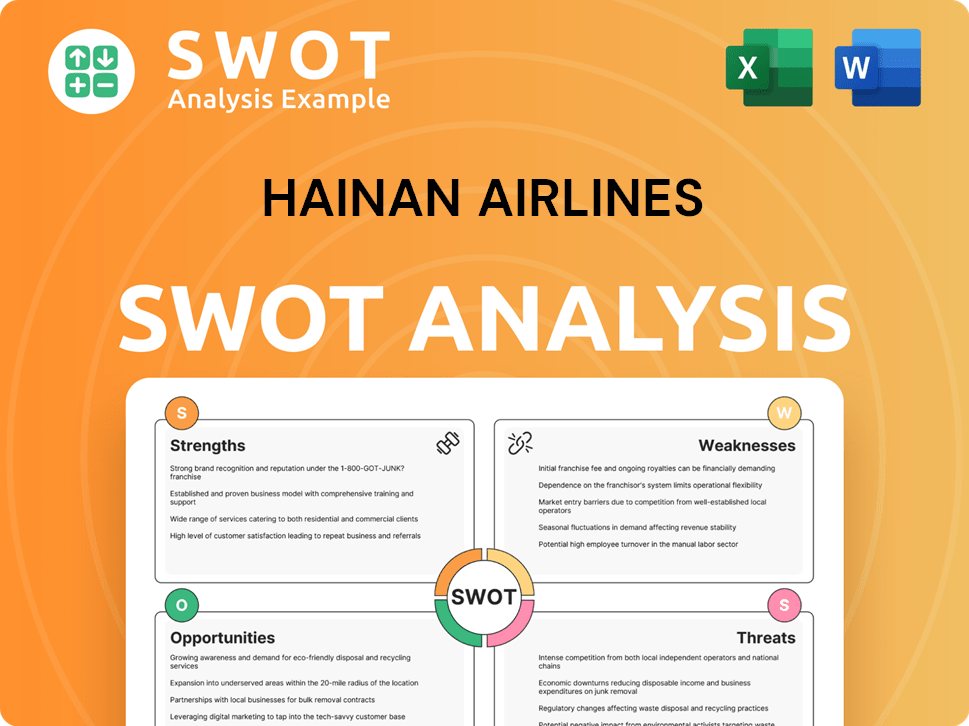

Hainan Airlines SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Hainan Airlines?

The early growth of Hainan Airlines was characterized by significant fleet expansion and the establishment of a strong operational network. In its initial years, the airline, then known as Hainan Province Airlines, utilized Boeing 737-33As leased from Ansett Worldwide Aviation Services. This period also saw the airline make strategic moves in ownership and route development, setting the stage for its future growth.

By 1998, Hainan Airlines became the first Chinese airline to finance and operate the new Boeing 737-800, with the first aircraft arriving in July 1998. The airline also acquired a 25% stake in Haikou Meilan International Airport in 1998, becoming the first Chinese carrier to own shares in an airport. This demonstrates a proactive approach to securing resources and expanding infrastructure.

The year 2000 marked the establishment of HNA Group, which became a major shareholder of Hainan Airlines and began controlling other airlines. This strategic move allowed for the consolidation of resources and expansion of the airline's reach. By 2003, Hainan Airlines had grown to become the fourth-largest airline in China.

In 2007, Grand China Air was formed as the new holding company for Hainan Airlines. The airline continued to expand its fleet, ordering Boeing 787-8s in 2005 and commencing Embraer E-190 deliveries in December 2007. Hainan Airlines launched its first North American destination, Beijing-Seattle, in June 2008, initiating its international expansion.

By March 2007, Hainan Airlines had grown to over 9,000 employees, reflecting its significant expansion. In 2024, the airline and its subsidiaries had established operational bases and branches in 23 cities, including major hubs like Haikou, Beijing, Guangzhou, and Shenzhen. This extensive network supports its domestic and international operations.

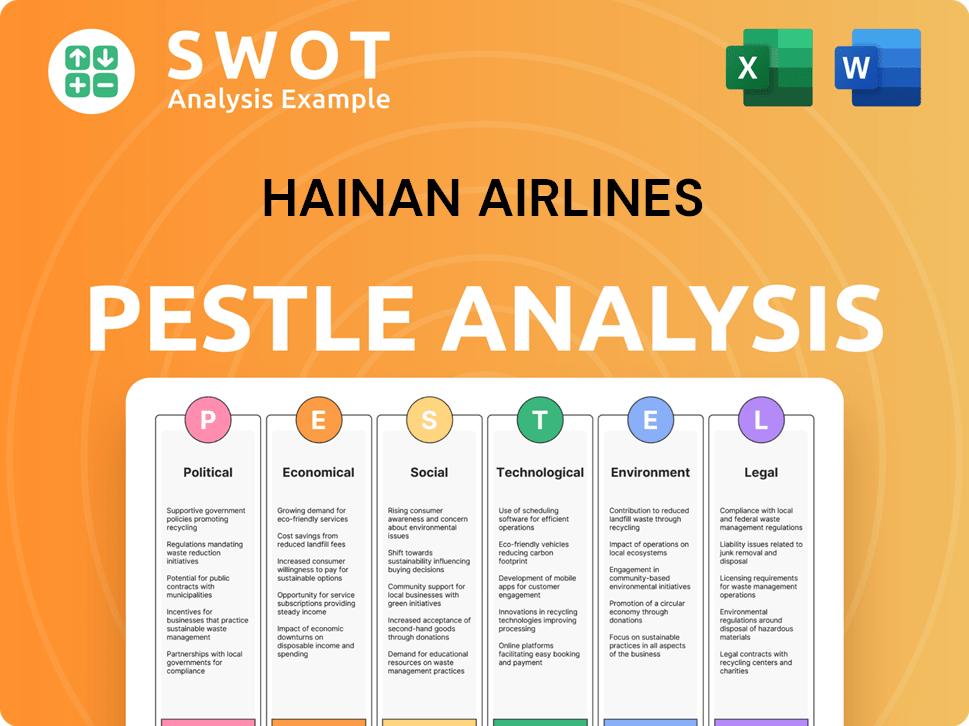

Hainan Airlines PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Hainan Airlines history?

Hainan Airlines, a prominent Chinese airline, has achieved significant milestones in its history. The Hainan Airlines company has expanded its operations and services over the years, becoming a key player in the airline industry China.

| Year | Milestone |

|---|---|

| 2011 | Hainan Airlines has held the SKYTRAX 5-Star airline status for 13 consecutive years. |

| February 2024 | The Civil Aviation Administration of China awarded Hainan Airlines the 'One Star Flight Safety Diamond Award' for achieving 10 million consecutive hours of safe flight. |

| March 2025 | Resumption of the Beijing-Oslo flights after a five-year hiatus. |

| February 3, 2025 | Launch of the Haikou-Tokyo (Narita) route. |

Hainan Airlines has focused on expanding its international network, including plans to increase its European network to 17 destinations by summer 2025. The airline is also actively modernizing its fleet and expanding its routes, aiming to enhance its service offerings.

Hainan Airlines is updating its fleet with Boeing 787-9s, with deliveries scheduled to be completed by 2021. They will also be among the first operators of the Comac C919, with deliveries beginning in the 2020s.

Hainan Airlines is expanding its international routes, including new routes such as Shenzhen-Madrid, Haikou-Seoul, Beijing-Vladivostok, and Chengdu-Vienna. The airline is continually working to broaden its global presence.

In November 2024, Hainan Airlines reached an agreement with COMAC for 40 new ARJ-21-700s for its subsidiary Urumqi Air, valued at over $1.52 billion. This agreement helps in their fleet expansion and upgrade.

Hainan Airlines plans to lease four new Boeing 737 MAX 8s, with deliveries scheduled for Q4 2025 and Q1 2026. This is part of their efforts to maintain a modern and efficient fleet.

The airline's achievement of 10 million consecutive hours of safe flight, as recognized by the 'One Star Flight Safety Diamond Award', underscores its commitment to safety. This commitment is a key aspect of their operations.

The airline strategically plans its route expansions, such as the resumption of the Beijing-Oslo flights and the launch of new routes like Haikou-Tokyo (Narita). This is a key part of their growth strategy.

Hainan Airlines, like other airlines, has faced financial challenges, including losses in 2008 and 2024. Despite these challenges, the airline is working to improve its financial performance and maintain its operations.

In 2024, Hainan Airlines and its subsidiaries reported a consolidated annual loss of RMB 921 million (approximately $128.38 million USD), or a loss of RMB 2.1 billion after accounting for non-recurring items. The airline has faced financial difficulties.

Despite the losses, the group's revenue improved by 0.3% to RMB 17.6 billion (approximately $2.44 billion USD) in the first quarter of 2025. It recorded a net profit of RMB 272 million (approximately $38 million USD) for the same period.

The global financial crisis in 2008 led to losses and a reduction in aircraft orders. External factors have influenced the financial performance of the airline.

The airline operates in a highly competitive market, which can impact profitability and growth. Competition from other airlines poses a challenge.

High operational costs, including fuel, maintenance, and labor, can affect the airline's financial performance. Managing these costs is a key challenge.

Economic downturns or fluctuations can impact travel demand, affecting the airline's revenue. The economic environment poses challenges.

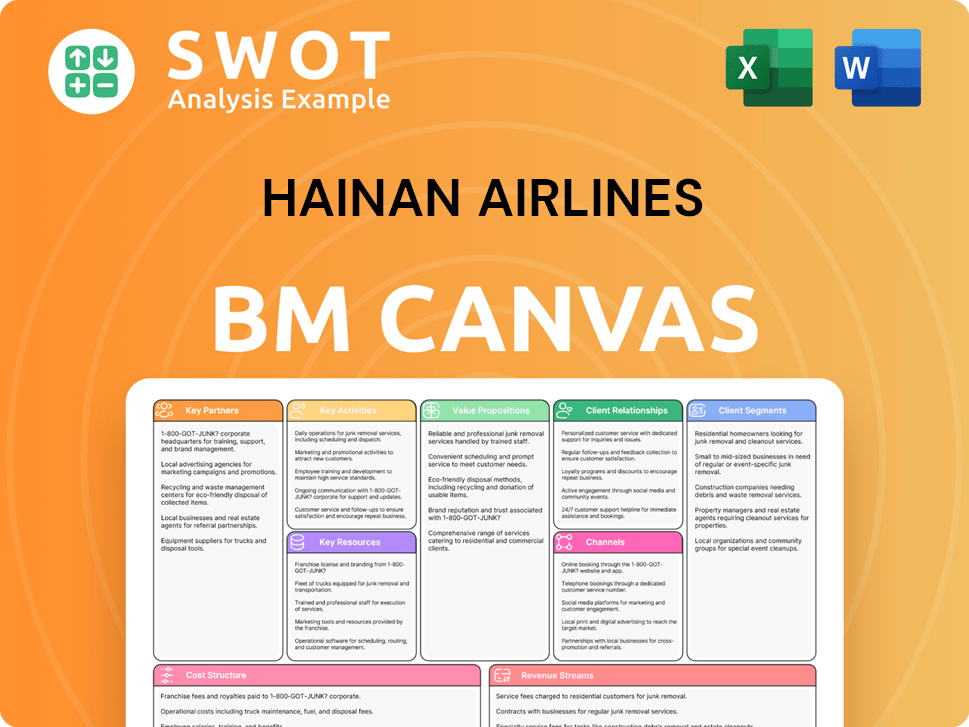

Hainan Airlines Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Hainan Airlines?

The brief history of Hainan Airlines, a prominent player in the Chinese airline industry, is marked by significant milestones. Established in October 1989 as Hainan Province Airlines, it evolved into China's first joint-stock air-transport company in January 1993. The airline commenced scheduled services on May 2, 1993, and expanded into executive-jet operations in April 1995. Renamed Hainan Airlines in 1996, it further expanded by acquiring a stake in Haikou Meilan International Airport in 1998. The establishment of HNA Group in 2000 positioned it as a major shareholder, driving the airline's growth, including ordering Boeing 787-8s in 2005 and launching its first North American route in 2008. Hainan Airlines has received accolades like the SKYTRAX 5-Star Airline status, maintained for 13 years. Recent developments include a 'One Star Flight Safety Diamond Award' in February 2024 and an agreement with COMAC for ARJ-21-700s in November 2024. In March 2025, it reported carrying 5,514.16 thousand passengers and a net profit of RMB 272 million ($38 million USD) in Q1 2025 on revenue of RMB 17.6 billion.

| Year | Key Event |

|---|---|

| October 1989 | Established as Hainan Province Airlines. |

| January 1993 | Became China's first joint-stock air-transport company. |

| May 2, 1993 | Began scheduled services. |

| April 1995 | Added executive-jet operations. |

| 1996 | Renamed Hainan Airlines. |

| 1998 | Became the first Chinese carrier to own shares in an airport. |

| 2000 | HNA Group established, becoming a major shareholder. |

| 2005 | Ordered 42 Boeing 787-8s. |

| 2008 | Launched first North American route (Beijing-Seattle). |

| 2011 | Awarded SKYTRAX 5-Star Airline status. |

| 2013 | Began Beijing-Chicago flights with Boeing 787 Dreamliner. |

| March 2015 | Announced intention to acquire 30 Boeing 787-9s. |

| February 2024 | Awarded 'One Star Flight Safety Diamond Award'. |

| November 2024 | Reached agreement with COMAC for 40 ARJ-21-700s. |

| March 2025 | Reported 5,514.16 thousand passengers carried. |

| Q1 2025 | Reported a net profit of RMB 272 million ($38 million USD) on revenue of RMB 17.6 billion. |

Hainan Airlines plans to operate up to 500 domestic routes covering 80 cities. It is adding 40 new domestic routes for winter 2024/spring 2025. The airline also aims to fly over 50 international and regional round-trip passenger routes.

The airline is expanding its European network to 17 destinations in summer 2025. A projected 30% increase in two-way seats between China and Europe is expected compared to summer 2024. New service from Haikou to Tokyo (Narita) will begin on February 3, 2025.

Hainan Airlines aims to operate a combined 1,000-strong fleet by 2029 across its group. It currently has a fleet of 220 aircraft (Hainan Airlines alone) and over 650 aircraft across the Hainan Airlines Group. The airline is actively pursuing fleet modernization.

The airline's long-term strategy includes fleet modernization through new leases and orders. This includes Boeing 737 MAX 8s and COMAC C919s. The company is focusing on international expansion, particularly under the 'Belt and Road Initiative.'

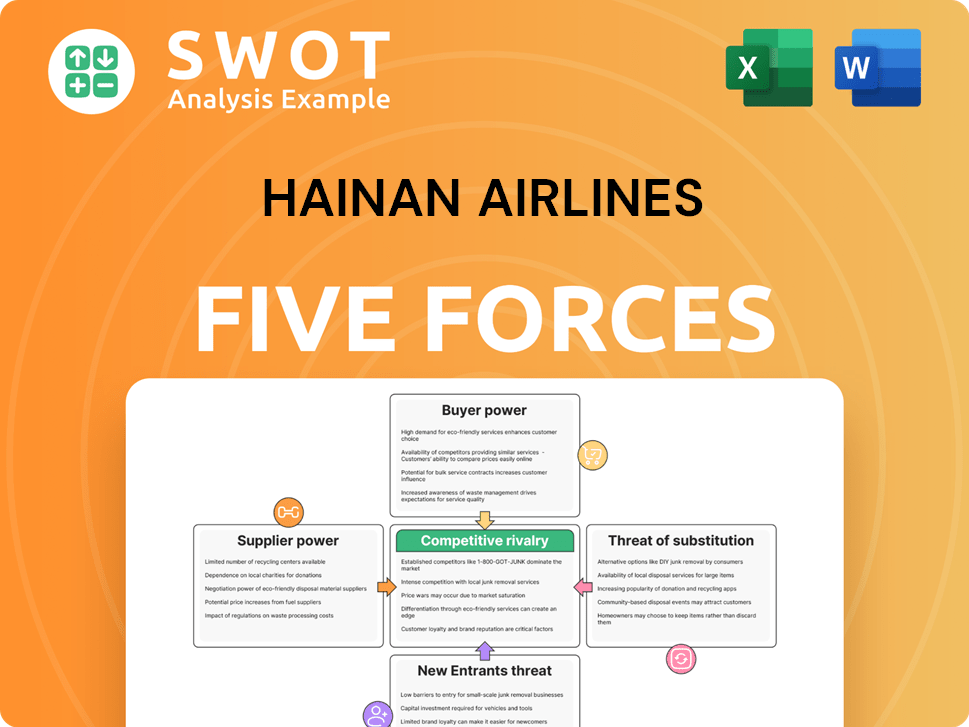

Hainan Airlines Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Hainan Airlines Company?

- What is Growth Strategy and Future Prospects of Hainan Airlines Company?

- How Does Hainan Airlines Company Work?

- What is Sales and Marketing Strategy of Hainan Airlines Company?

- What is Brief History of Hainan Airlines Company?

- Who Owns Hainan Airlines Company?

- What is Customer Demographics and Target Market of Hainan Airlines Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.