Hainan Airlines Bundle

Can Hainan Airlines Soar to New Heights?

Hainan Airlines, a titan of the Chinese aviation market, has charted a course through turbulent skies since its inception in 1993. Its evolution from a regional carrier to a global force is a testament to its dynamic growth strategy and strategic agility. Understanding the Hainan Airlines SWOT Analysis is crucial to grasp the company's trajectory.

This exploration delves into the core of Hainan Airlines' success, examining its ambitious future prospects and strategic initiatives within the competitive Airline Industry Analysis. We'll dissect its expansion plans, financial performance analysis, and the impact of the Chinese Aviation Market on its operations. Furthermore, we'll analyze its route network development, strategic partnerships, and how it navigates the challenges and opportunities within the global aviation sector, including its response to the COVID-19 pandemic and its sustainability initiatives.

How Is Hainan Airlines Expanding Its Reach?

The Revenue Streams & Business Model of Hainan Airlines are heavily influenced by its expansion initiatives, which are crucial for its long-term success. The airline is actively working to broaden its reach and diversify its services. This approach is designed to enhance its market share and maintain a competitive edge in the dynamic aviation sector.

Hainan Airlines' growth strategy involves a dual focus on international and domestic markets. The company aims to strengthen its international network while optimizing its domestic routes. This balanced strategy helps capture a broader customer base and improve overall financial performance. The airline's efforts are also supported by strategic partnerships and new business models.

The company's expansion is further supported by investments in cargo operations and fleet modernization. These initiatives are designed to meet the evolving demands of the airline industry. By focusing on these areas, Hainan Airlines aims to secure its future in the competitive aviation market.

Hainan Airlines is increasing its international flight offerings to capture a larger share of the global travel market. In early 2024, the airline resumed routes to key European cities and launched new services to Southeast Asia and North America. This expansion is a key part of the Hainan Airlines Growth Strategy and aims to diversify revenue sources.

Domestically, the airline is optimizing its route network to enhance connectivity within China. This includes increasing flight frequencies on popular routes and exploring new connections to emerging regional hubs. The focus is particularly strong on routes to and from Hainan Province, leveraging its strategic importance as a free trade port.

Hainan Airlines is expanding its cargo operations to meet the growing demand for air freight services. The airline is investing in its cargo fleet and logistics infrastructure to support this growth. This expansion is crucial for capturing opportunities in e-commerce and high-value goods transportation.

Strategic partnerships and alliances are essential for Hainan Airlines' expansion. The airline leverages existing codeshare agreements and interline partnerships to extend its reach. While specific new major alliances have not been widely publicized in late 2024 or early 2025, these collaborations are crucial for offering seamless travel experiences.

Hainan Airlines is actively pursuing several initiatives to boost its Hainan Airlines Future Prospects. These initiatives include strategic investments in fleet modernization and digital transformation. These efforts are designed to improve operational efficiency and enhance customer experience.

- Fleet Modernization: The airline is focused on modernizing its fleet to improve efficiency and reduce operational costs.

- Digital Transformation: Hainan Airlines is investing in digital technologies to enhance customer service and streamline operations.

- Customized Travel Packages: The airline is exploring new business models, such as customized travel packages, to cater to evolving customer preferences.

- Premium Services: Hainan Airlines is enhancing premium services to attract high-value customers and increase revenue.

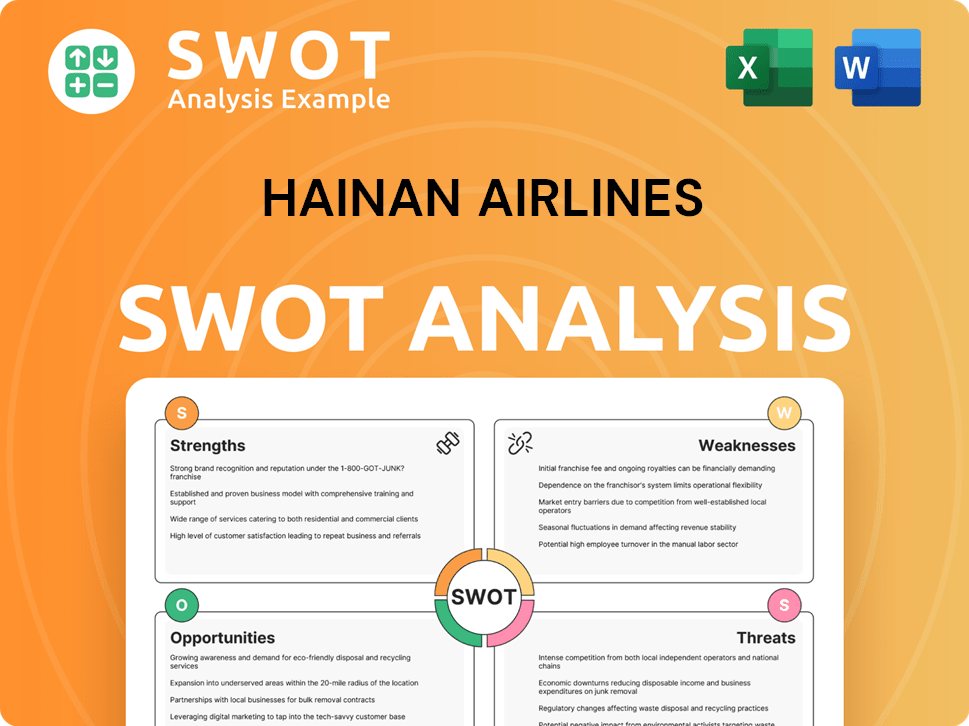

Hainan Airlines SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hainan Airlines Invest in Innovation?

Hainan Airlines is actively integrating technology and innovation to foster sustainable growth and enhance operational efficiency. This strategic focus is evident in its commitment to digital transformation, aiming to improve both customer experience and streamline internal processes. The airline's initiatives encompass advanced reservation systems, mobile applications for passenger services, and digital platforms for cargo management. These advancements are crucial for maintaining a competitive edge in the dynamic airline industry.

The company is also exploring the application of big data analytics to gain deeper insights into passenger behavior, optimize route planning, and personalize services. Furthermore, Hainan Airlines is investing in automation and smart solutions for aircraft maintenance, ground handling, and flight operations. This includes the use of predictive maintenance technologies to reduce downtime and improve safety, reflecting a proactive approach to operational excellence.

In the context of the Brief History of Hainan Airlines, it's clear that the airline's evolution is closely tied to its technological and innovative capabilities. The airline's strategic embrace of these technological advancements is crucial for improving cost-effectiveness, enhancing service quality, and ultimately contributing to its long-term growth objectives in a highly competitive market.

Hainan Airlines is focused on digital transformation to enhance customer experience and internal processes. This includes investments in advanced reservation systems and mobile applications. Digital platforms for cargo management are also a key area of development.

The airline utilizes big data analytics to understand passenger behavior. This data helps optimize route planning and personalize services. These efforts aim to improve customer satisfaction and operational efficiency.

Hainan Airlines invests in automation and smart solutions for aircraft maintenance and ground handling. Predictive maintenance technologies are used to reduce downtime. These investments are crucial for improving safety and efficiency.

The company explores sustainable aviation fuels (SAF) and flight path optimization. These initiatives aim to reduce carbon emissions. This aligns with global trends toward environmental responsibility.

Hainan Airlines is exploring the integration of AI and IoT into its operations. Potential applications include dynamic pricing and predictive maintenance. These technologies could significantly improve cost-effectiveness.

The airline focuses on acquiring more fuel-efficient aircraft. Advanced navigation systems are also being adopted. This strategy supports long-term growth and operational sustainability.

Technological advancements are central to Hainan Airlines' growth strategy. The airline is focused on digital transformation, data analytics, and operational efficiency. These initiatives aim to enhance customer experience and streamline internal processes.

- Digital Transformation: Investments in advanced reservation systems, mobile apps, and digital cargo platforms.

- Data Analytics: Utilizing big data for passenger behavior analysis, route optimization, and personalized services.

- Operational Technology: Implementing automation and smart solutions for aircraft maintenance and ground handling.

- Sustainability: Exploring sustainable aviation fuels and optimizing flight paths to reduce emissions.

- AI and IoT: Investigating the integration of AI for dynamic pricing and predictive maintenance, and IoT for real-time tracking.

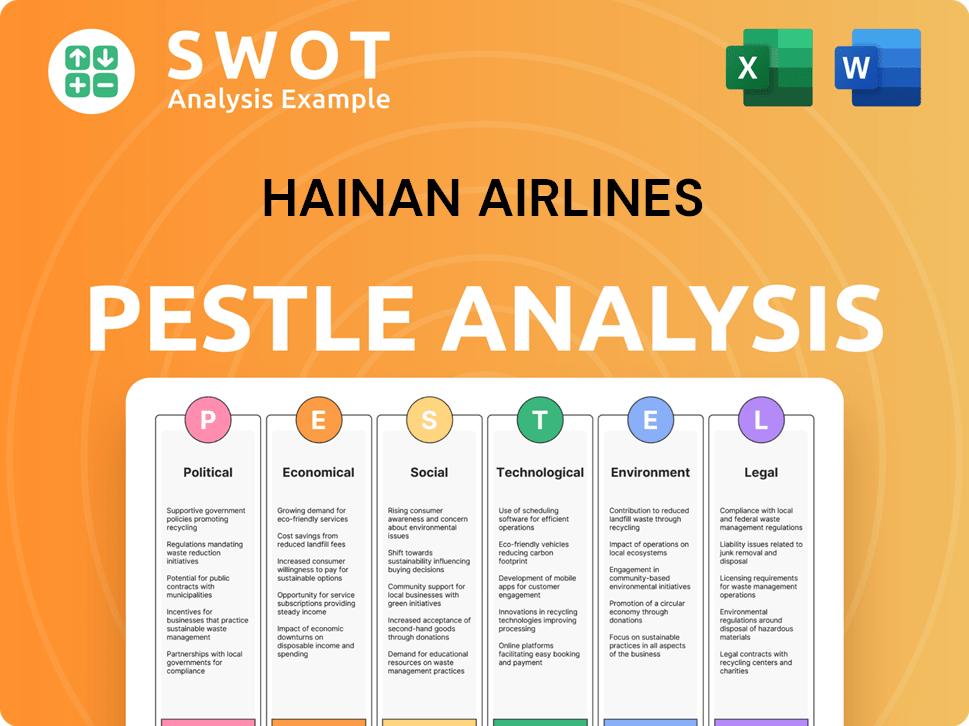

Hainan Airlines PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Hainan Airlines’s Growth Forecast?

The financial outlook for Hainan Airlines is closely tied to the recovery of the global aviation market, particularly within China. The airline, part of a larger group, has been undergoing restructuring to improve its financial health and operational efficiency. In early 2024, reports indicated signs of recovery in passenger traffic and revenue, aligning with the broader rebound in air travel. This Marketing Strategy of Hainan Airlines is crucial for its future.

The company's financial goals are centered on sustainable growth, driven by increased passenger volumes and the expansion of international routes. Investment is likely to focus on fleet modernization, technology upgrades, and network expansion. The airline aims to regain its pre-pandemic financial strength and achieve consistent profitability. Industry benchmarks suggest that airlines are focusing on optimizing cost structures and maximizing revenue per available seat kilometer (RASK).

The financial strategy emphasizes prudent financial management, debt optimization, and generating healthy cash flows to support growth initiatives and ensure long-term viability. While specific financial figures for 2024-2025 are not readily available in public reports, the focus remains on operational stability and profitability. The airline is expected to prioritize sustainable practices, which could influence its financial performance. The recovery of the Chinese aviation market is a key factor in the airline's financial prospects.

The airline's financial performance is closely linked to the Chinese aviation market. The airline is focused on improving operational efficiency and profitability. The financial health of the airline is expected to improve with the recovery of air travel.

The Chinese aviation market is a key factor in the airline's financial prospects. The market is expected to continue its recovery in 2024 and 2025. The airline's expansion plans depend on the growth of this market.

The airline is looking to expand its route network in Asia. This expansion is part of the airline's growth strategy. The expansion will likely focus on key markets within the region.

Fleet modernization is a key part of the airline's strategy. This includes investing in new aircraft and upgrading existing ones. Modernizing the fleet can improve fuel efficiency and reduce costs.

The growth strategy focuses on increasing passenger volumes and expanding international routes. The airline aims to regain its pre-pandemic financial strength. Key aspects include fleet modernization and route network development.

- Focus on operational stability.

- Debt optimization.

- Generating healthy cash flows.

- Sustainable practices.

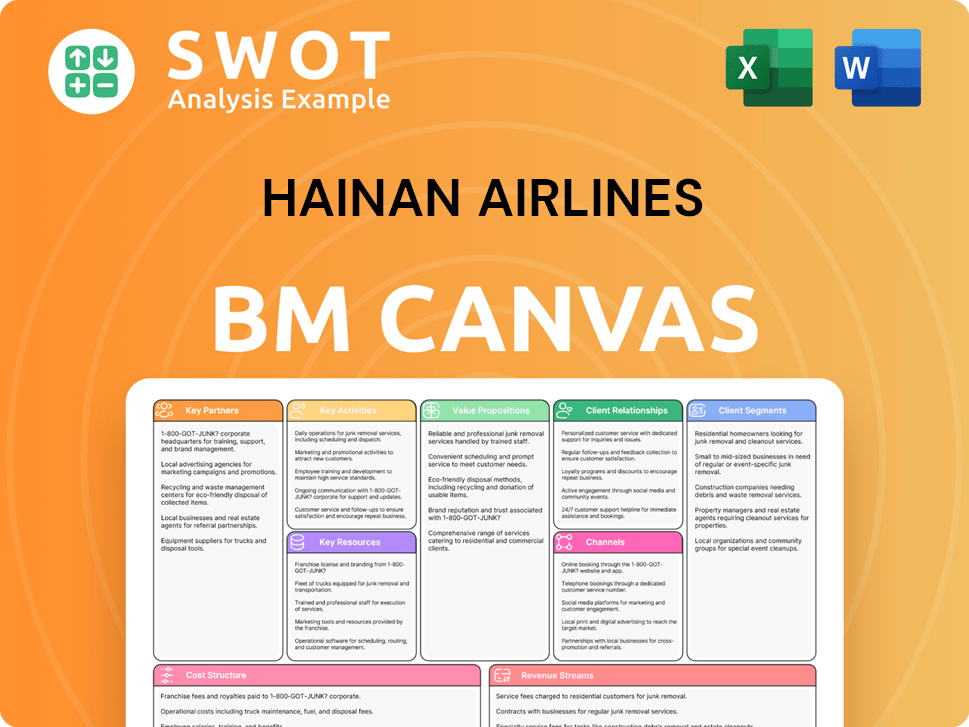

Hainan Airlines Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Hainan Airlines’s Growth?

The growth strategy and future prospects of Hainan Airlines are subject to several potential risks and obstacles. These challenges range from intense market competition to regulatory changes and supply chain vulnerabilities, all of which could impact the airline's operational and financial performance. Understanding these risks is crucial for assessing the long-term viability and success of the company.

Market dynamics, global events, and internal constraints pose significant hurdles. The airline must navigate these complexities to achieve its expansion plans and maintain its position within the competitive Chinese aviation market. Effective risk management and strategic adaptation are essential for mitigating these challenges and ensuring sustainable growth.

The airline's ability to adapt to technological advancements and emerging trends, such as sustainability initiatives, will also be critical. The following sections will explore these risks in detail, providing insights into their potential impacts and the strategies Hainan Airlines can employ to address them.

Intense competition from both domestic and international carriers is a major risk. This includes airlines like China Southern and China Eastern, as well as global players vying for market share, especially on lucrative routes. The competitive landscape can lead to price wars, which can negatively affect revenue and profit margins. In 2024, the Chinese aviation market saw significant capacity increases, intensifying competition.

Changes in regulations related to air travel policies, environmental standards, and international agreements pose significant risks. Evolving travel restrictions or new carbon emission standards could necessitate significant operational adjustments and investments. Compliance with new environmental standards, such as those related to sustainable aviation fuel (SAF), could increase operational costs.

Supply chain disruptions, particularly concerning aircraft parts, fuel, and maintenance services, can disrupt operations and increase costs. Delays in aircraft deliveries or shortages of critical components can lead to flight cancellations and reduced operational efficiency. Fluctuations in fuel prices, a significant operational cost, also pose a financial risk. According to a 2024 report, fuel costs accounted for approximately 25% of operational expenses.

Global events, such as geopolitical tensions or public health crises, can severely impact air travel demand and operational capacity. The COVID-19 pandemic demonstrated the devastating effects of such events on the aviation industry. While the industry has shown signs of recovery, future outbreaks or geopolitical instability could lead to similar disruptions. Passenger numbers in China are expected to reach pre-pandemic levels by late 2024 or early 2025.

The airline must keep pace with technological advancements. Failure to adopt new technologies in areas like sustainable aviation fuels, advanced air mobility, or digital customer interfaces can put Hainan Airlines at a disadvantage. The integration of digital technologies, such as AI-driven customer service and automated operations, is becoming increasingly important for competitiveness. The implementation of new technologies requires significant investments.

Internal resource constraints, including a shortage of skilled personnel like pilots and maintenance technicians, could limit expansion capabilities. Training and retaining qualified staff is crucial for operational efficiency and safety. Addressing these shortages requires investment in training programs and competitive compensation packages. The attrition rate for pilots in China has increased in recent years, posing a challenge for airlines.

Emerging risks include cybersecurity threats, which could compromise passenger data or operational systems, and the increasing pressure for environmental sustainability, requiring substantial investments in greener technologies and practices. Cybersecurity breaches can lead to financial losses and damage to reputation. The aviation industry is under increasing pressure to reduce carbon emissions, leading to investments in sustainable aviation fuels and more fuel-efficient aircraft. The global aviation industry aims to achieve net-zero carbon emissions by 2050. For further insights, consider reading about Owners & Shareholders of Hainan Airlines.

The management continually assesses these risks through scenario planning and adapts its strategies to mitigate potential negative impacts on its future trajectory. This includes diversifying routes, investing in fuel-efficient aircraft, and implementing robust cybersecurity measures. The airline's risk management framework includes regular assessments and updates to address emerging threats. Investment in fuel-efficient aircraft can reduce operational costs and environmental impact. Diversification of routes helps mitigate the impact of regional crises.

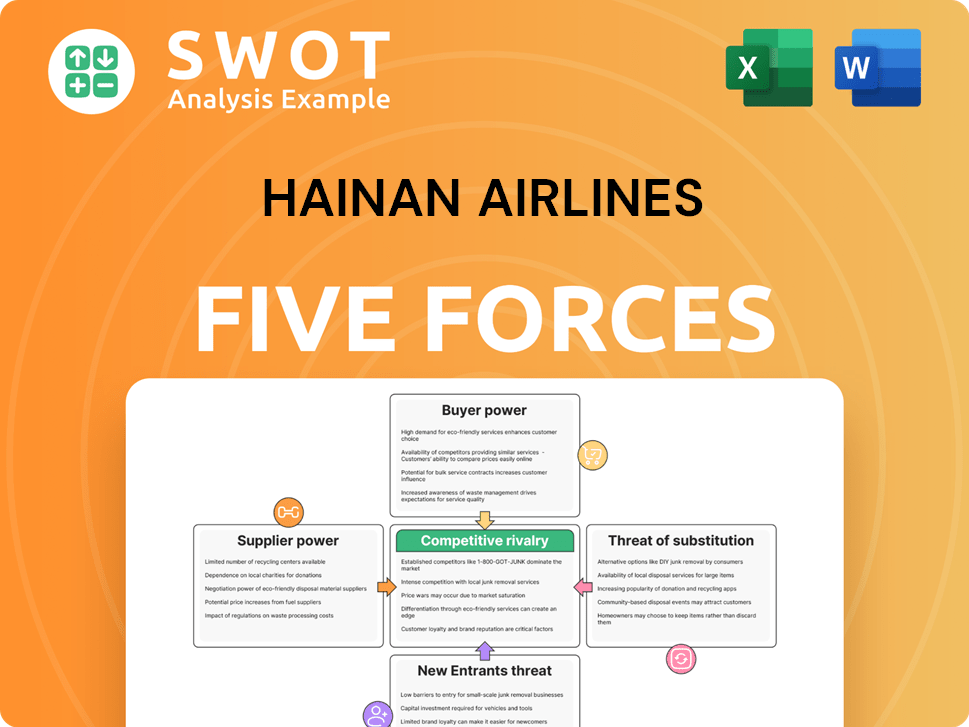

Hainan Airlines Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hainan Airlines Company?

- What is Competitive Landscape of Hainan Airlines Company?

- How Does Hainan Airlines Company Work?

- What is Sales and Marketing Strategy of Hainan Airlines Company?

- What is Brief History of Hainan Airlines Company?

- Who Owns Hainan Airlines Company?

- What is Customer Demographics and Target Market of Hainan Airlines Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.