iHeartMedia Bundle

How Did iHeartMedia Become a Radio Giant?

Dive into the fascinating iHeartMedia SWOT Analysis and uncover the remarkable journey of iHeartMedia, a media company that reshaped the radio broadcasting industry. From a single radio station in 1972, this American powerhouse evolved into a dominant force, reaching millions of listeners monthly. Explore the early days of iHeartMedia and discover how its strategic vision propelled it to the forefront of audio entertainment.

This brief history of iHeartMedia company explores the company's roots as Clear Channel Communications, its early expansion, and its pivotal role in shaping the radio landscape. Understanding the iHeartMedia history provides valuable insights into the company's adaptability and its ability to navigate the ever-changing media environment. Learn about the iHeartMedia founders and the key milestones that have defined this media giant's journey.

What is the iHeartMedia Founding Story?

The story of iHeartMedia, Inc., begins in 1972 in San Antonio, Texas. It was founded by Lowry Mays and Red McCombs. Their venture started with an unexpected opportunity in the radio industry.

Mays, an investor, found himself in control of a radio station, KAJA-FM, after co-signing a loan. This led to the creation of the San Antonio Broadcasting Company. This company would later become known as Clear Channel Communications, marking the start of a significant player in the media landscape.

The initial focus was on acquiring and operating radio stations, setting the stage for the company's future growth and influence in the radio broadcasting sector. This early strategy was key to its expansion.

The early days of the company were marked by strategic acquisitions and a vision for growth. The founders saw the potential of radio as a mass medium.

- The company's first acquisition was KEEZ-FM (now KAJA-FM) for $125,000.

- In 1975, they acquired their first 'clear channel' AM station, WOAI-AM.

- The company went public in 1984, signaling its early success and expansion plans.

- Mays and McCombs, with their backgrounds in investment and business, aimed to build a strong presence in the radio market.

The founders, Lowry Mays and Red McCombs, were instrumental in shaping the company's direction. Their backgrounds in investment and business, particularly McCombs' experience as a car dealer, provided a solid foundation for their radio venture. They recognized the potential of radio as a powerful medium for entertainment and communication. This understanding fueled Clear Channel's expansion.

The cultural and economic environment of the time, with radio's widespread reach, provided a fertile ground for Clear Channel's growth. The company's early acquisitions and strategic moves set the stage for its evolution into a major media company. For more insights into how the company has grown, check out the Growth Strategy of iHeartMedia.

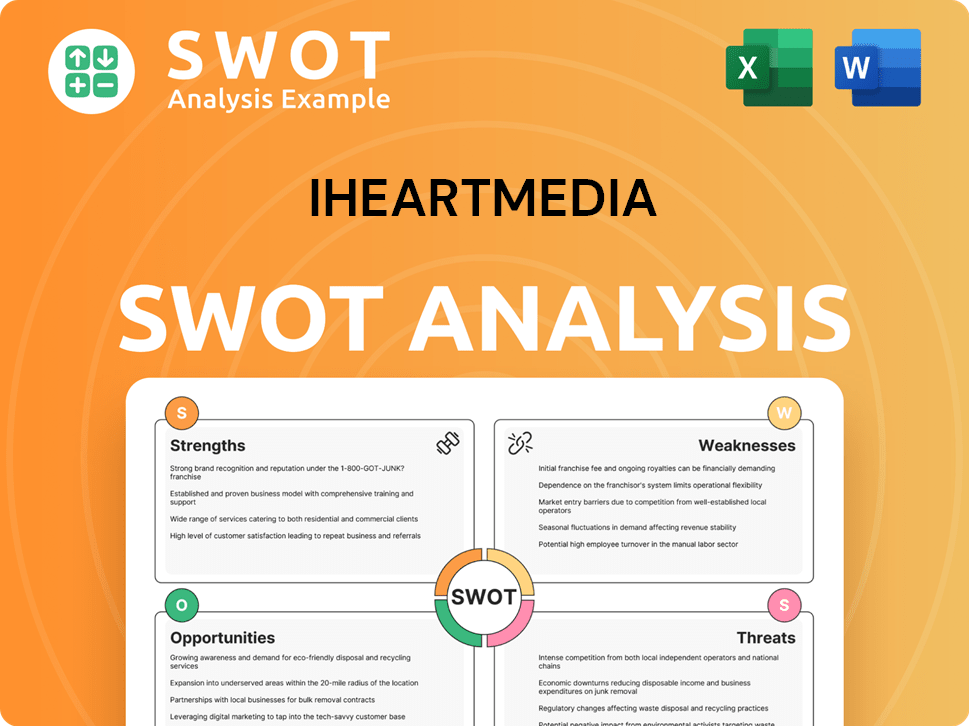

iHeartMedia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of iHeartMedia?

The early growth of what is now known as iHeartMedia, then Clear Channel Communications, was marked by significant expansion. The company's journey began with strategic acquisitions and a focus on dominating the media landscape. This period saw the company grow from a regional player to a major force in radio broadcasting and outdoor advertising.

Clear Channel Communications expanded beyond its initial stations after acquiring its first stations outside San Antonio in 1976. The company went public in 1984, marking a significant step in its early financial history. This move provided capital for further expansion and acquisitions within the radio broadcasting industry.

The relaxation of radio ownership rules in 1992 was a pivotal moment, allowing Clear Channel to acquire more stations. By 1995, the company owned 43 radio stations and 16 television stations. The Telecommunications Act of 1996 further fueled this expansion, enabling the acquisition of numerous media companies.

Clear Channel acquired over 70 media companies and individual stations, becoming the largest radio group. Key acquisitions included Eller Media Company and Universal Outdoor, expanding into outdoor advertising. The acquisition of Jacor Communications added to its radio station holdings, and in 2000, it acquired AMFM, Inc.

Robert W. 'Bob' Pittman became CEO of CC Media Holdings in October 2011, marking a leadership transition. The company's growth strategy focused on dominating the broadcast media landscape. To learn more about the company's audience, you can explore the Target Market of iHeartMedia.

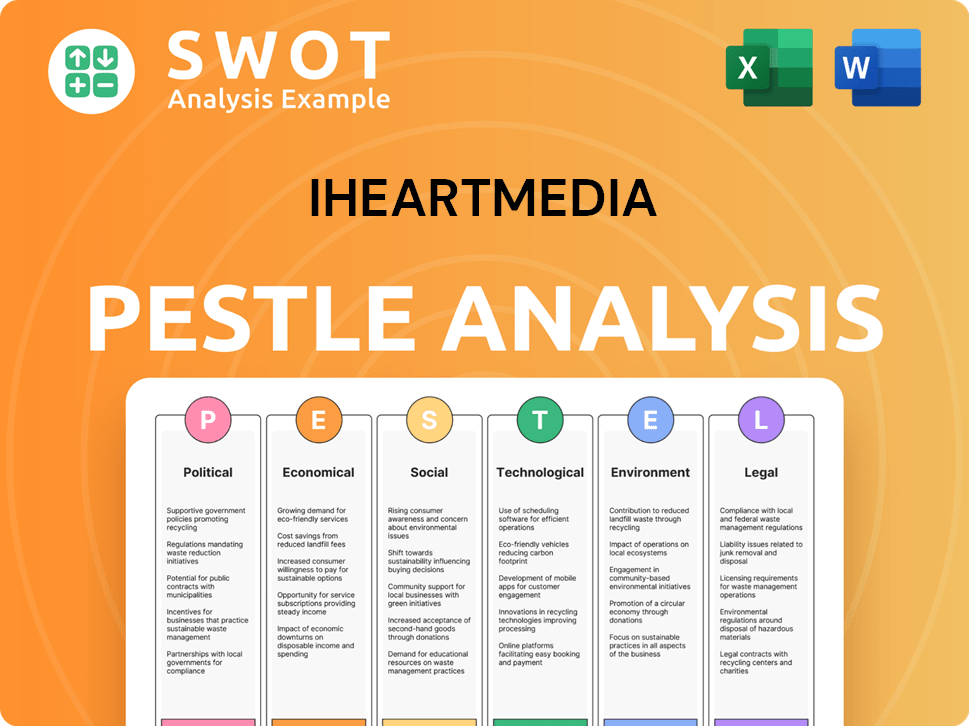

iHeartMedia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in iHeartMedia history?

The iHeartMedia company's journey, from its early days to its current status as a major media company, has been marked by significant milestones. The company has navigated through periods of expansion, strategic shifts, and financial restructuring, shaping its position in the radio broadcasting and digital media landscape.

| Year | Milestone |

|---|---|

| 2005 | The company split into three entities: Clear Channel Communications, Clear Channel Outdoor, and Live Nation. |

| 2006 | Clear Channel announced plans to go private via a leveraged buyout by Thomas H. Lee Partners and Bain Capital Partners. |

| 2008 | The leveraged buyout was finalized, resulting in substantial debt for the company. |

| 2014 | Clear Channel Communications officially changed its name to iHeartMedia, Inc., reflecting its digital media focus. |

| 2024 | A cybersecurity incident occurred, impacting systems at several local stations. |

| 2025 | The company is implementing a modernization cost reduction program. |

iHeartMedia has consistently embraced innovation, particularly in digital media. The iHeartRadio platform has been a key innovation, providing a free, all-in-one digital radio service across numerous platforms. Additionally, the company has expanded into podcasting, becoming a leading publisher in the United States.

The iHeartRadio platform offers a free all-in-one digital radio service.

iHeartMedia has become a leading podcast publisher in the United States.

Despite its innovations, iHeartMedia faces ongoing challenges, including a substantial debt burden. The company reported a net loss in 2024, and in Q1 2025, it reported a GAAP operating loss. The company is also dealing with the aftermath of a cybersecurity incident. For a deeper understanding of the financial aspects, consider exploring Revenue Streams & Business Model of iHeartMedia.

iHeartMedia has a substantial debt burden of $5.05 billion as of March 31, 2025.

The company reported a net loss of $1 billion in 2024 and a GAAP operating loss in Q1 2025.

A cybersecurity incident occurred between December 24 and 27, 2024, impacting several local stations.

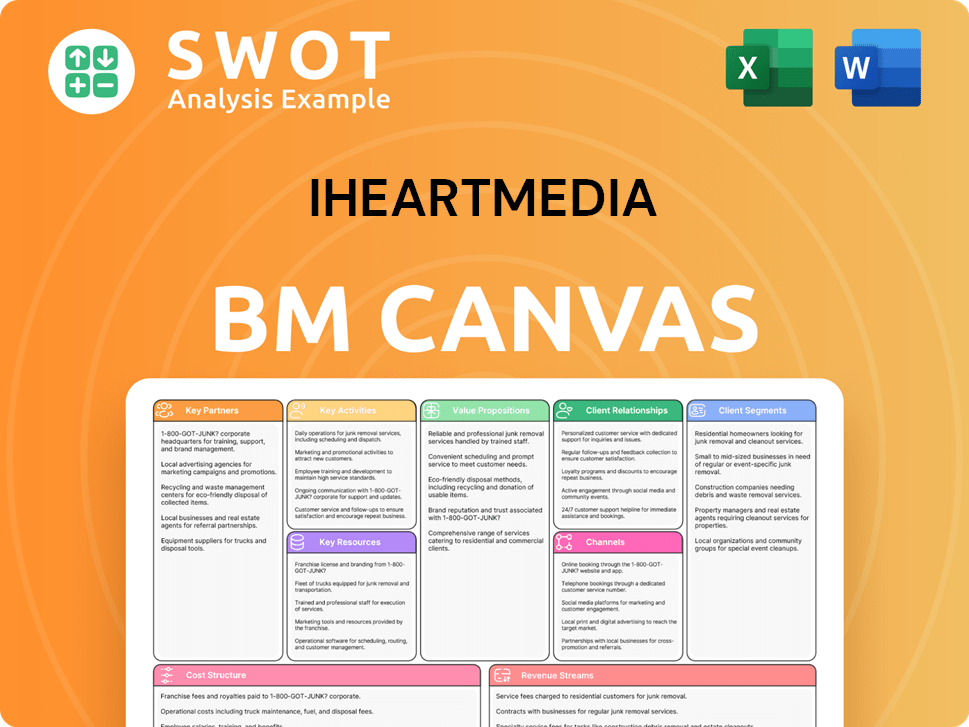

iHeartMedia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for iHeartMedia?

The Owners & Shareholders of iHeartMedia company has a rich history rooted in radio broadcasting. Founded in 1972 by Lowry Mays and Red McCombs as San Antonio Broadcasting Company, the media company has evolved significantly. Key milestones include going public in 1984, the acquisition of AMFM, Inc. in 2000, and the renaming to iHeartMedia in 2014, reflecting its shift toward digital media. The company has navigated ownership changes, including a leveraged buyout in 2008, and faced challenges, including a data breach disclosed in April 2025.

| Year | Key Event |

|---|---|

| 1972 | Lowry Mays and Red McCombs founded San Antonio Broadcasting Company (later Clear Channel Communications) in San Antonio, Texas. |

| 1984 | Clear Channel Communications went public on the New York Stock Exchange. |

| 1992 | US Congress relaxed radio ownership rules, allowing for greater station acquisitions. |

| 1996 | The Telecommunications Act further deregulated media ownership, leading to significant expansion. |

| 2000 | Clear Channel acquired its chief competitor, AMFM, Inc. |

| 2005 | The company split into three companies: Clear Channel Communications, Clear Channel Outdoor, and Live Nation. |

| 2008 | Clear Channel was taken private in a leveraged buyout by Bain Capital and Thomas H. Lee Partners, incurring significant debt. |

| 2011 | Robert W. 'Bob' Pittman was named CEO of CC Media Holdings. |

| 2014 | Clear Channel Communications was renamed iHeartMedia, Inc., to reflect its focus on digital media and the iHeartRadio platform. |

| 2024 | The company completed a modernization cost reduction program expected to generate up to $200 million in annual cost savings in 2025. |

| December 2024 | iHeartMedia experienced a data breach, publicly disclosed in April 2025. |

| May 2025 | iHeartMedia reported Q1 2025 consolidated revenue of $807 million, up 1.0% year-over-year, with Digital Audio Group revenue up 16% and podcast revenue up 28%. |

iHeartMedia's Q1 2025 consolidated revenue was $807 million, a 1.0% increase year-over-year. The Digital Audio Group experienced a 16% revenue increase, and podcast revenue grew by 28%. The company expects flat consolidated revenue for the full year 2025.

iHeartMedia aims to reduce its net debt to Adjusted EBITDA ratio to 5.5x by the end of 2025 and further to 3.2x by 2028. The company is targeting $150 million in annual cost savings in 2025, with a focus on headcount reductions. Management is exploring subscription-based models and partnerships.

The company's digital audio operations, particularly in podcasting, are a key growth area. iHeartMedia is focusing on building new platforms, products, and services to leverage its audience reach. The digital strategy is essential for the future of the radio broadcasting industry.

iHeartMedia is implementing a modernization cost reduction program to improve efficiency. The company anticipates $150 million in annual cost savings in 2025. Approximately 65% of these savings are related to headcount reductions, primarily within the Multiplatform Group.

iHeartMedia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of iHeartMedia Company?

- What is Growth Strategy and Future Prospects of iHeartMedia Company?

- How Does iHeartMedia Company Work?

- What is Sales and Marketing Strategy of iHeartMedia Company?

- What is Brief History of iHeartMedia Company?

- Who Owns iHeartMedia Company?

- What is Customer Demographics and Target Market of iHeartMedia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.