iHeartMedia Bundle

Can iHeartMedia Maintain Its Audio Dominance?

The audio entertainment world is in constant flux, with streaming services and podcasts reshaping how we consume content. iHeartMedia, a titan in the radio industry, has navigated this transformation, but the competitive landscape is fierce. Understanding iHeartMedia's position requires a deep dive into its rivals, strategies, and market dynamics.

This analysis delves into the iHeartMedia SWOT Analysis to explore its competitive advantages. We'll dissect its market share, revenue streams, and digital audio strategy, comparing it against key players in the radio industry and the broader media landscape. Furthermore, we'll examine iHeartMedia's acquisition history and financial performance to understand its strengths and weaknesses in a rapidly evolving market. This will provide a comprehensive media company analysis.

Where Does iHeartMedia’ Stand in the Current Market?

iHeartMedia holds a dominant position in the U.S. audio industry, primarily due to its extensive broadcast radio network and growing digital audio presence. The company reaches over 90% of Americans monthly, making it the largest audio company in the U.S.

In 2024, iHeartMedia generated approximately $3.7 billion in total revenue. Its primary offerings include broadcast radio stations, digital audio content (podcasts, streaming), and live events. iHeartMedia's focus is on the United States, with a strong local presence in many cities, serving a broad range of listeners and advertisers.

Over time, iHeartMedia has transformed digitally, focusing on digital audio and podcasting alongside its traditional radio. This has helped the company adapt to changing consumer habits and compete with digital-first audio platforms. The company maintains a strong position in local advertising markets due to its extensive network of local radio stations.

iHeartMedia has the largest reach of any audio company in the U.S., connecting with over 90% of Americans monthly. This extensive reach is primarily due to its vast network of over 860 broadcast radio stations across 160 markets. The company's market share in the radio industry is significant, especially in advertising revenue.

iHeartMedia's revenue streams include advertising from broadcast radio, digital audio (podcasts and streaming), and live events. The company's digital revenue has shown consistent growth, reflecting its successful diversification strategy. In 2024, the company reported total revenue of approximately $3.7 billion.

iHeartMedia has strategically shifted its focus to digital audio offerings and podcasting. This move has allowed the company to adapt to changing consumer behavior and compete with digital-first platforms. The company's digital audio strategy is a key component of its long-term growth and market position.

iHeartMedia is primarily focused on the United States, with a strong presence in local markets. The company serves a broad range of customer segments, including individual listeners and advertisers. Its extensive network of local radio stations gives it a significant advantage in local advertising markets.

iHeartMedia's strengths include its vast reach, diverse content offerings, and strong presence in local markets. Its competitive advantages stem from its extensive radio network and its ability to adapt to changing consumer habits. The company’s digital transformation and focus on podcasting are key strategies for maintaining its market position.

- Extensive Reach: Connecting with over 90% of Americans monthly.

- Diversified Portfolio: Offering broadcast radio, digital audio, and live events.

- Local Market Presence: Strong presence in numerous cities across the U.S.

- Digital Strategy: Focusing on digital audio and podcasting to adapt to market changes.

For a deeper understanding of the target audience, explore the Target Market of iHeartMedia.

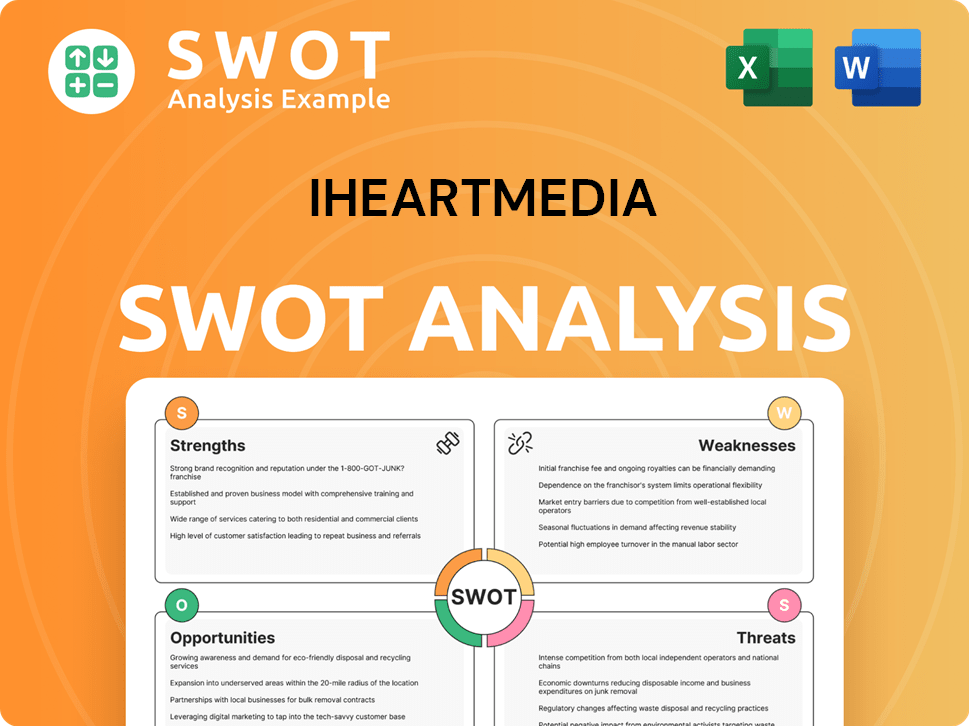

iHeartMedia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging iHeartMedia?

Understanding the iHeartMedia competitive landscape is crucial for a comprehensive media company analysis. The company operates in a dynamic environment, facing competition from traditional radio broadcasters and digital audio platforms. This analysis provides insights into iHeartMedia's market position and the challenges it faces.

iHeartMedia's revenue streams are diverse, including advertising, subscription services, and event promotion. The company's monetization strategies evolve to adapt to shifts in listener habits and advertising spend. The radio industry and digital audio markets are key areas of focus.

The company's competitive environment is shaped by both traditional and digital media players. The competitive landscape includes companies like Audacy, Cumulus Media, Spotify, Apple Podcasts, SiriusXM (including Pandora), and Amazon Music. These competitors challenge iHeartMedia across various segments.

Audacy, Inc. is a primary direct competitor, operating a vast network of radio stations. Cumulus Media also competes directly in the local and national radio advertising markets. These companies compete for advertising revenue and listener share within the terrestrial radio landscape.

Spotify is a major competitor in the digital audio space, offering extensive music and podcast content. Apple Podcasts is a dominant platform for podcast consumption. SiriusXM, with Pandora, offers a wide array of audio content, competing for listener engagement and subscription revenue.

Amazon Music, leveraging its e-commerce ecosystem, is a significant player in music streaming and podcasting. Digital competitors challenge iHeartMedia through innovative technology, exclusive content, and diverse monetization strategies.

New and emerging players in podcasting and audio content creation continually disrupt the landscape. Mergers and alliances in the audio streaming market further alter competitive dynamics. These factors influence iHeartMedia's market share and strategic decisions.

iHeartMedia's advertising revenue is a key performance indicator, influenced by competition and market trends. The company's ability to attract and retain advertisers is crucial for its financial performance. Understanding iHeartMedia's advertising revenue is essential.

iHeartMedia's digital audio strategy and podcasting strategy are critical for maintaining its competitive edge. The company's ability to adapt to changing consumer preferences and technological advancements will determine its future outlook. For more details, see Brief History of iHeartMedia.

Competitors like Spotify focus on personalized experiences and extensive reach, while Apple Podcasts leverages its ecosystem. SiriusXM, through its satellite radio service and Pandora, offers a wide range of audio content. These strategies impact iHeartMedia's market position.

- Spotify's global presence and music library attract a large audience.

- Apple Podcasts benefits from its integration within the Apple ecosystem.

- SiriusXM's diverse content offerings, including talk radio and podcasts, compete directly.

- Amazon Music leverages its e-commerce platform for streaming and podcasting.

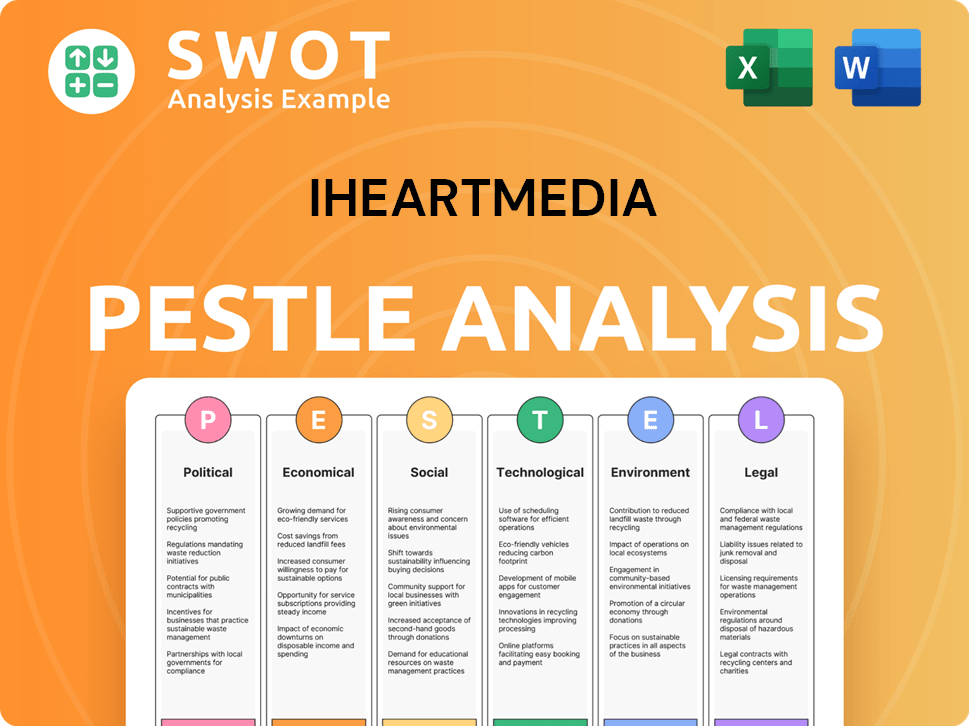

iHeartMedia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives iHeartMedia a Competitive Edge Over Its Rivals?

The iHeartMedia company has a strong position in the radio industry, with significant competitive advantages. These advantages stem from its extensive reach, established brand, and technological capabilities. Analyzing the competitive landscape reveals how iHeartMedia maintains its edge in a changing media environment.

Key to iHeartMedia's success is its ability to adapt and innovate within the audio entertainment market. The company has expanded beyond traditional radio to include digital platforms and podcasting, broadening its appeal to a wider audience and diversifying its revenue streams. This strategic evolution has positioned iHeartMedia to compete effectively against digital-first platforms.

Understanding the competitive advantages of iHeartMedia is crucial for assessing its long-term prospects. These advantages include its vast network of radio stations, strong brand recognition, and technological prowess, which collectively support its ability to attract listeners and advertisers. These factors are vital for maintaining its market share and driving advertising revenue.

With over 860 broadcast radio stations across 160 markets, iHeartMedia reaches over 90% of Americans monthly. This extensive reach provides an unmatched platform for advertisers seeking mass audience exposure. This wide distribution network is a significant barrier to entry for new competitors.

Many of iHeartMedia's radio stations have built strong connections with listeners over decades. This listener loyalty translates into consistent listenership, which is attractive to advertisers. The company has also leveraged its brand to expand into digital platforms, with the iHeartRadio app serving as a comprehensive audio destination.

iHeartMedia's technology, enhanced by the acquisition of Triton Digital, provides a competitive edge in digital audio advertising. These technologies enable sophisticated audience targeting and measurement. This technological prowess supports its programmatic advertising offerings and enhances its ability to compete with digital-first platforms.

The company's diverse content portfolio, including music, talk radio, news, and a rapidly expanding podcast library, caters to a wide range of listener preferences. This diverse content offering attracts a broad audience and enhances iHeartMedia's ability to compete in the evolving audio landscape. This helps to understand iHeartMedia's competitive advantages.

The primary competitive advantages of iHeartMedia include its vast reach, established brand, and technological capabilities. These strengths allow the company to maintain a strong position in the radio industry and expand into digital audio. These factors are crucial for understanding iHeartMedia's market position.

- Extensive broadcast radio network.

- Strong brand recognition and listener loyalty.

- Advanced data analytics and advertising technology.

- Diverse content offerings, including podcasts.

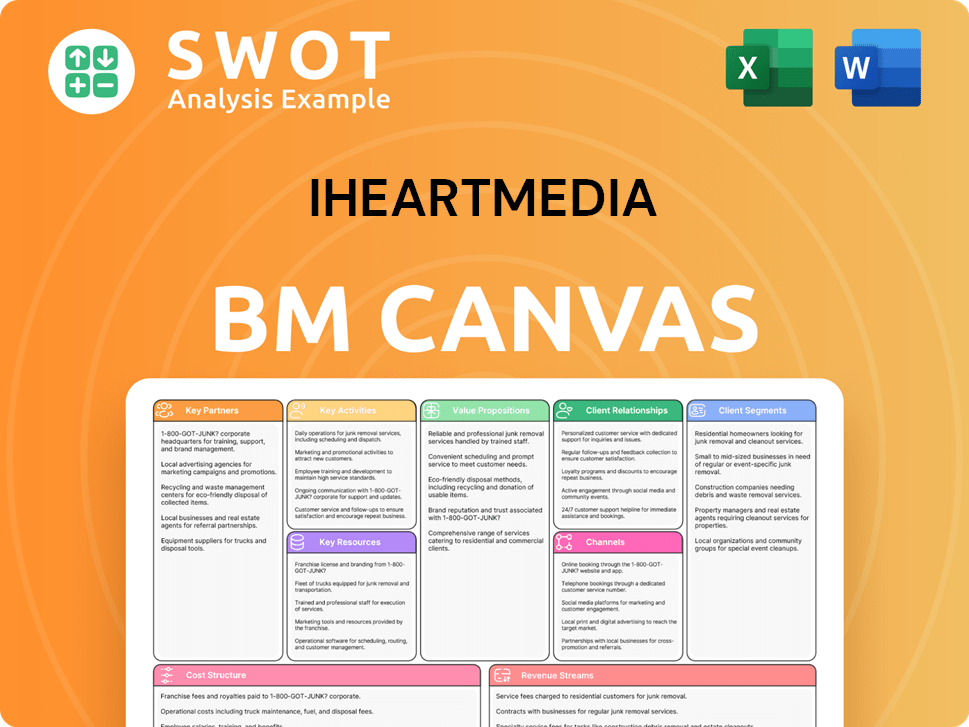

iHeartMedia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping iHeartMedia’s Competitive Landscape?

The audio industry is undergoing a significant transformation, driven by the growth of digital audio consumption and the rise of podcasting. This shift presents both challenges and opportunities for companies like iHeartMedia. The company's ability to adapt to these changes will be crucial for maintaining its market position and achieving future growth.

The competitive landscape for iHeartMedia is intense, with streaming giants and independent content creators vying for audience share and advertising revenue. Regulatory changes and data privacy concerns add further complexity. However, iHeartMedia's investments in digital platforms and its podcasting network position it to capitalize on the evolving audio market.

Digital audio consumption continues to rise, with more listeners shifting from traditional radio to on-demand platforms. This trend impacts iHeartMedia's traditional radio listenership and advertising revenue. The company is focusing on enhancing its digital platforms to meet the changing consumer preferences.

The podcast market is booming, offering significant growth opportunities. iHeartMedia has invested heavily in original podcast content and acquisitions. It is positioned to capture a larger share of the rapidly expanding podcast advertising market, which is projected to reach approximately $4 billion in 2025.

Advancements in audio advertising technology offer opportunities for more targeted advertising. iHeartMedia is strengthening its capabilities in programmatic audio advertising and data analytics. This allows them to offer more effective advertising solutions, appealing to a wider range of advertisers.

The rise of smart speakers and voice assistants creates new distribution channels. iHeartMedia can leverage these platforms to expand its reach and engagement. This helps to ensure its content is easily accessible to a broader audience.

iHeartMedia's future depends on its ability to adapt and innovate in the dynamic audio landscape. The company is focusing on digital transformation, expanding its podcasting footprint, and leveraging data for advertising. Its success will hinge on integrating traditional strengths with growing digital capabilities. For more insights, check out the Growth Strategy of iHeartMedia.

- Continued investment in digital platforms and podcasting.

- Enhancement of advertising technology to improve targeting.

- Strategic use of data analytics to optimize advertising.

- Focus on expanding distribution through new channels.

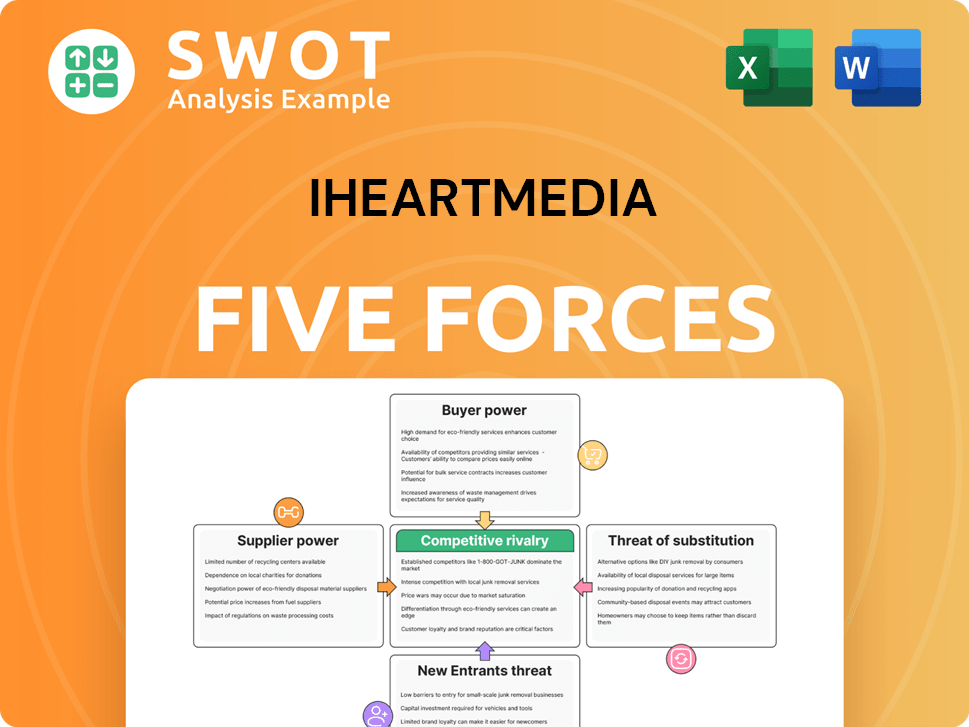

iHeartMedia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of iHeartMedia Company?

- What is Growth Strategy and Future Prospects of iHeartMedia Company?

- How Does iHeartMedia Company Work?

- What is Sales and Marketing Strategy of iHeartMedia Company?

- What is Brief History of iHeartMedia Company?

- Who Owns iHeartMedia Company?

- What is Customer Demographics and Target Market of iHeartMedia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.