Jyske Bank Bundle

How Did Jyske Bank Rise to Financial Prominence?

Discover the captivating Jyske Bank SWOT Analysis and the remarkable journey of a Danish bank that transformed from regional roots into a financial powerhouse. From its inception, Jyske Bank has navigated the complexities of the market, consistently adapting and innovating to meet the evolving needs of its customers. Explore how this financial institution carved its niche in the competitive landscape.

The story of Jyske Bank company begins in 1967, born from a merger of local banks in Jutland, Denmark, aiming to strengthen regional banking. This strategic move laid the foundation for its future growth, focusing on local communities and collaborative spirit. Today, the Jyske Bank's history reflects a significant impact on the Danish economy, showcasing its evolution from its founding to its current status as a key player in the financial sector.

What is the Jyske Bank Founding Story?

The story of the Jyske Bank company began on July 7, 1967. This marked the formal establishment of the bank through the merger of four regional banks in Denmark. This strategic move was a direct response to the evolving financial landscape of the time.

The merging of Silkeborg Bank, Kjellerup Bank, Kjellerup Laane- og Sparekasse, and Handels- og Landbrugsbanken i Holstebro was driven by the need to create a more competitive and resilient financial institution. The founders aimed to pool resources and expertise to better serve the local businesses and individuals in the Jutland region.

The name 'Jyske Bank' directly translates to 'Jutlandic Bank,' reflecting its regional origins and focus. The initial funding came from the combined capital and assets of the merging banks, a consolidation rather than a traditional capital raise. The mid-1960s in Denmark saw growing economic prosperity, which influenced the bank's creation, alongside a desire for more integrated financial services.

The formation of Jyske Bank history was a strategic response to the competitive pressures and regulatory demands faced by smaller banks in the Jutland region of Denmark. The merger aimed to create a more robust financial institution.

- Jyske Bank was formed on July 7, 1967, through the merger of four regional banks.

- The primary goal was to create a more competitive and resilient financial institution.

- The bank's initial business model focused on traditional retail and commercial banking.

- The name 'Jyske Bank' reflects its regional origin and focus on Jutland.

The early years of Jyske Bank were focused on establishing a strong foundation in retail and commercial banking. This involved providing essential services such as deposits, loans, and payment solutions to local businesses and individuals. The bank's initial operations were centered in the Jutland region, aiming to meet the specific financial needs of the local community. The bank's early focus was on organic growth, building its customer base and expanding its service offerings within its regional footprint. A key element of its strategy was to understand and cater to the unique economic characteristics of the area.

As a Danish bank, Jyske Bank's early strategy was shaped by the economic conditions of the mid-1960s, a period of growing prosperity in Denmark. The bank benefited from the increasing demand for financial services as the economy expanded. During this time, the bank's focus was on building relationships with its customers and providing personalized service. The bank's early success was built on its ability to adapt to the changing needs of its customers. For more insights, you can explore the Marketing Strategy of Jyske Bank.

In the context of banking history, the formation of Jyske Bank represents a significant consolidation effort. This merger allowed the bank to pool resources, expertise, and customer bases, creating a more competitive entity. The bank's early focus on traditional banking services, such as deposits, loans, and payment services, laid the groundwork for its future growth. The bank's initial funding came from the combined capital and assets of the merging banks, a consolidation rather than a traditional capital raise. The bank's early years were marked by a focus on organic growth and building a strong customer base.

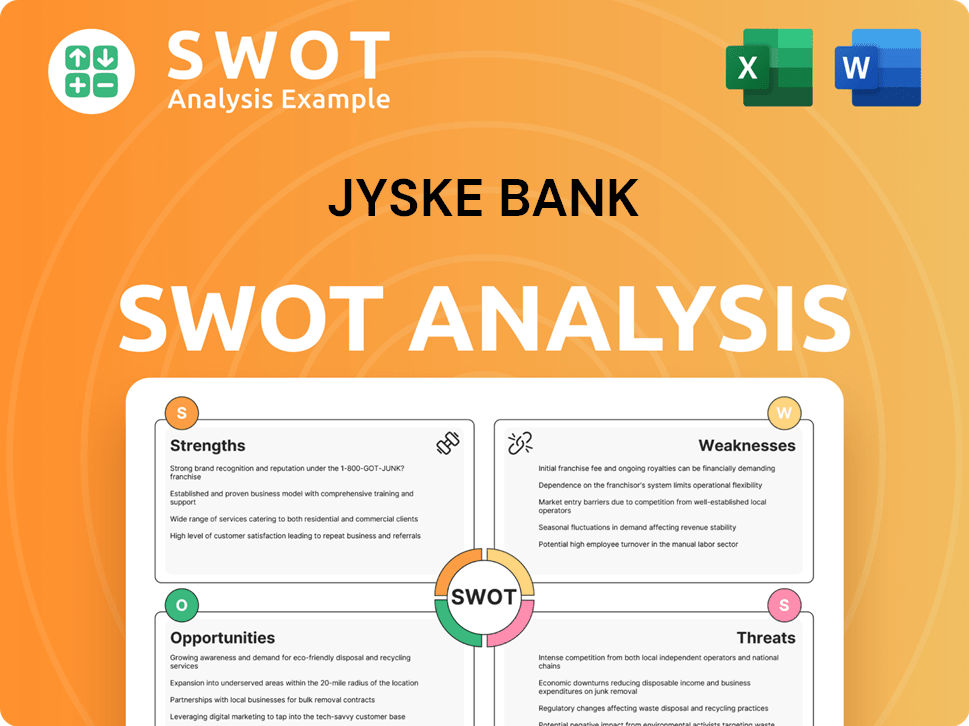

Jyske Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Jyske Bank?

The early growth of the Jyske Bank company focused on solidifying its operations and expanding its branch network within Jutland. Initially, the bank offered standard financial products such as savings and checking accounts, along with various loan options for both individuals and businesses. This period saw the integration of staff from the merged entities and the gradual hiring of more personnel to support the growing operations. The bank's central administration was established in Silkeborg.

A significant aspect of Jyske Bank's early growth was its expansion beyond Jutland, gradually establishing a presence in other parts of Denmark. This geographical expansion often involved strategic acquisitions of smaller local banks, enhancing its market share. The Jyske Bank history includes this period of strategic growth through mergers and acquisitions, solidifying its position as a major national player.

Key leadership transitions occurred, with new management teams guiding the Danish bank through periods of economic change and increased competition. The bank adapted its services to meet evolving customer needs while maintaining a strong regional identity. This pragmatic approach laid the foundation for its future diversification into areas like mortgage finance and asset management, transforming it into a full-service financial institution.

In the 1970s and 1980s, Jyske Bank continued to grow through a series of mergers and acquisitions. This strategy was crucial for expanding its reach and influence within the Danish banking sector. These actions helped to solidify its status as a major player in the financial landscape. For more details on the ownership structure, you can read about the Owners & Shareholders of Jyske Bank.

The initial product offerings of Jyske Bank company were standard for the time, including savings accounts, checking accounts, and various types of loans for individuals and businesses. The bank quickly began to attract a larger customer base due to its increased size and perceived stability compared to its predecessor banks. The bank's early years were focused on building a solid foundation.

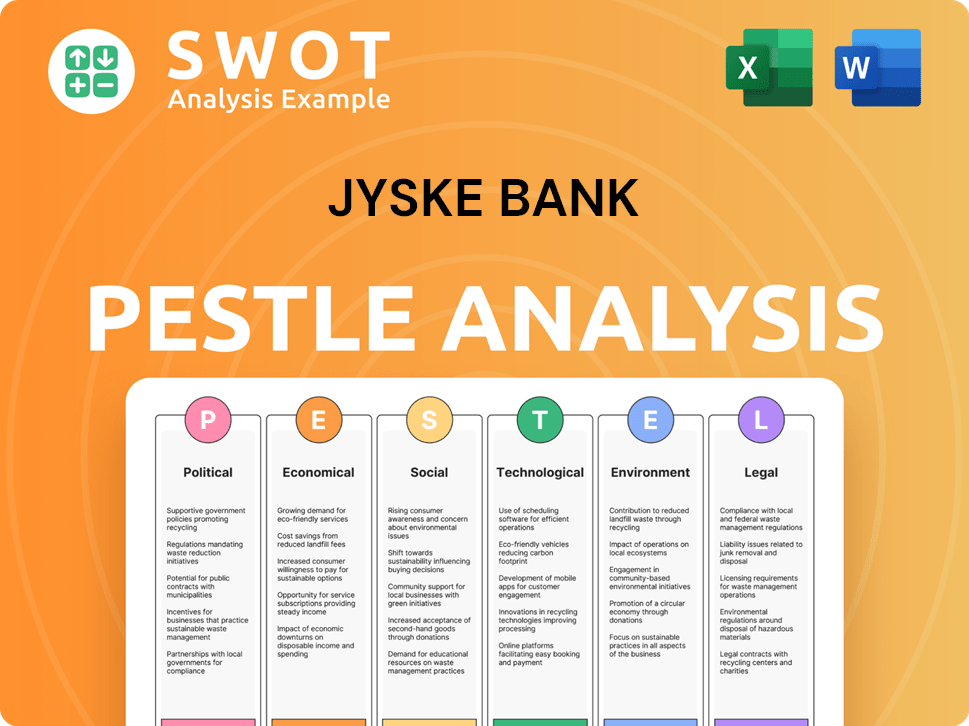

Jyske Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Jyske Bank history?

The Jyske Bank history is marked by a series of significant milestones that have shaped its evolution as a leading Danish bank. From its founding to its current status, the bank has navigated various economic climates and regulatory changes, solidifying its position within the financial institution landscape.

| Year | Milestone |

|---|---|

| 1967 | Founded in Silkeborg, Denmark, marking the beginning of the Jyske Bank company. |

| 1980s | Expanded its operations through strategic acquisitions and mergers, broadening its market presence. |

| Late 1990s | Pioneered online banking services, becoming an early adopter of digital banking technologies. |

| 2008 | Successfully navigated the global financial crisis by strengthening its capital base and risk management. |

| 2010s | Focused on optimizing operations and investing in digital transformation to adapt to changing market dynamics. |

| 2020s | Continued to adapt to the challenges of negative interest rates and evolving regulatory environments, focusing on new revenue streams and operational efficiencies. |

Jyske Bank has consistently embraced innovation to enhance its services and maintain a competitive edge within the Danish bank sector. Its early adoption of online banking and self-service solutions in the late 20th century set a precedent for digital banking in Denmark. This forward-thinking approach allowed the bank to offer convenient and accessible financial services to its customers.

Pioneering online banking and self-service solutions in the late 20th century, setting a precedent for digital banking in Denmark.

Forming key partnerships, particularly in the mortgage finance sector, to expand service offerings and market reach.

Continuous investment in digital transformation to improve customer experience and operational efficiency.

Focusing on transparency in communication and providing personalized financial solutions to meet customer needs.

Utilizing data analytics to enhance risk management, improve customer service, and identify new business opportunities.

Integrating environmental, social, and governance (ESG) factors into its investment strategies and operations.

Jyske Bank, like other players in the banking history, has faced several challenges throughout its existence. The global financial crisis of 2008 tested the resilience of the financial institution, requiring strategic adjustments to maintain stability. More recently, the prolonged period of negative interest rates in Denmark has presented a significant hurdle to profitability.

Navigating the global financial crisis by strengthening its capital base and adjusting risk management strategies to ensure financial stability.

Adapting to the challenges posed by negative interest rates by implementing strategies such as introducing negative interest rates for large deposits.

Responding to increasingly stringent regulatory requirements by enhancing compliance measures and operational efficiency.

Facing intense competition within the Danish financial market by focusing on customer service, innovation, and strategic partnerships.

Adapting to economic headwinds by focusing on operational optimization, digital transformation, and exploring new revenue streams.

Adapting to evolving market dynamics by continuously reviewing and adjusting its business strategies to maintain a strong market position.

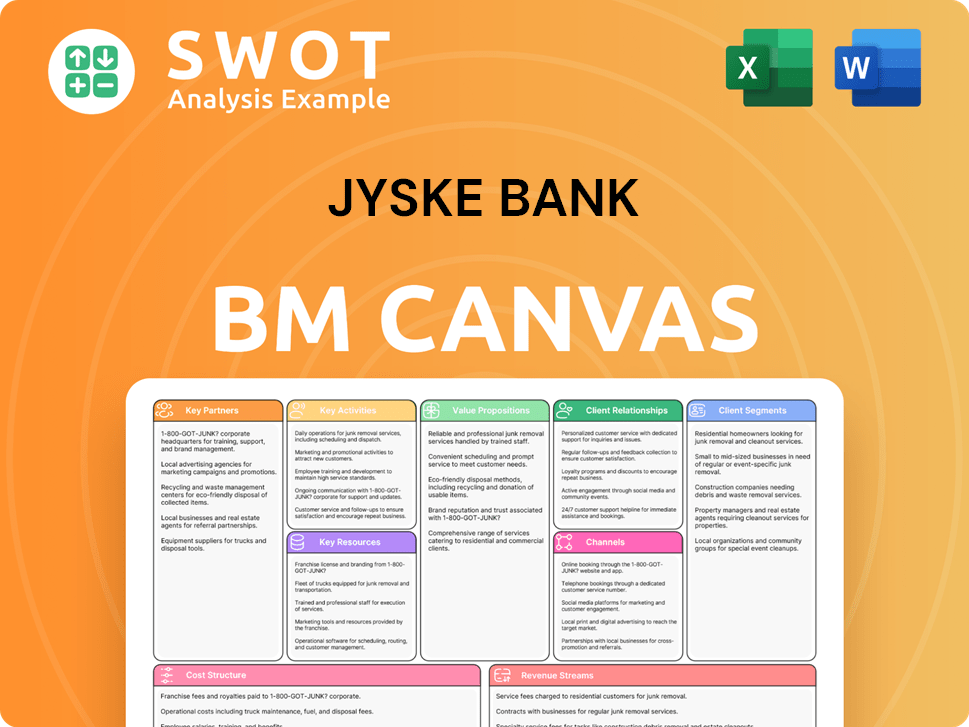

Jyske Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Jyske Bank?

The Jyske Bank history is marked by significant milestones, reflecting its evolution from a regional player to a prominent Danish bank. This financial institution has navigated various economic cycles, adapting to changing market conditions and regulatory frameworks.

| Year | Key Event |

|---|---|

| 1967 | Founded in Silkeborg, Denmark, marking the Jyske Bank founding date and beginning its journey as a regional bank. |

| 1980s | Expanded its operations through acquisitions and organic growth, solidifying its presence in the Danish market. |

| 1990s | Continued expansion, adapting to the evolving financial landscape and technological advancements. |

| 2000s | Navigated the global financial crisis, focusing on prudent risk management and maintaining financial stability. |

| 2010s | Further strengthened its position, focusing on digital transformation and customer-centric services. |

| 2024 | Jyske Bank continues to adapt to new regulatory changes and market dynamics, focusing on sustainable growth and digital innovation. |

Jyske Bank is investing heavily in digital technologies to enhance customer experience and operational efficiency. This includes upgrades to online banking platforms, mobile apps, and data analytics capabilities. The bank aims to increase its digital customer base by 15% by the end of 2025.

The bank is focusing on sustainable financing and environmental, social, and governance (ESG) factors. This includes offering green loans and investing in sustainable projects. Jyske Bank plans to allocate 20% of its loan portfolio to sustainable projects by 2026.

Jyske Bank is exploring strategic partnerships to expand its product offerings and market reach. This includes collaborations with fintech companies and other financial institutions. The bank is targeting to increase its market share by 5% through these partnerships by 2026.

The bank is committed to maintaining robust compliance frameworks to meet evolving regulatory requirements. This includes investments in risk management systems and compliance training programs. Jyske Bank aims to reduce compliance-related issues by 10% by 2025.

Jyske Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Jyske Bank Company?

- What is Growth Strategy and Future Prospects of Jyske Bank Company?

- How Does Jyske Bank Company Work?

- What is Sales and Marketing Strategy of Jyske Bank Company?

- What is Brief History of Jyske Bank Company?

- Who Owns Jyske Bank Company?

- What is Customer Demographics and Target Market of Jyske Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.