Laurent-Perrier Bundle

How Did Laurent-Perrier Rise to Champagne Royalty?

Journey back in time to explore the captivating Laurent-Perrier SWOT Analysis and the legacy of a distinguished French Champagne house. From its humble beginnings in 1812, Laurent-Perrier has transformed into a global icon, synonymous with luxury and innovation. Discover the remarkable story of how this iconic brand became a benchmark in the world of Champagne.

The brief history of Laurent-Perrier champagne reveals a story of unwavering commitment to quality and groundbreaking winemaking techniques. Founded in the Grand Cru village of Tours-sur-Marne, the Laurent-Perrier brand quickly distinguished itself through its pioneering use of Chardonnay-dominant blends. This article will delve into the early years, exploring how Laurent-Perrier navigated challenges and embraced innovations to become a celebrated name in the world of French champagne.

What is the Laurent-Perrier Founding Story?

The History of Laurent-Perrier began in 1812, marking the start of a distinguished journey for this iconic Champagne house. Founded by André-Michel Pierlot in Tours-sur-Marne, the company laid its roots in the heart of the Champagne region, establishing itself as a key player in French champagne production.

Initially, Pierlot, a former cooper and bottler, focused on building a Champagne wine merchant business. His acquisition of land, including 'Les Plaisances' and 'La Tour Glorieux,' provided the essential foundation for the company's future. This early focus set the stage for the Laurent-Perrier brand's evolution.

After André-Michel Pierlot's passing, his son, Alphonse Pierlot, inherited the business. Lacking direct heirs, Alphonse entrusted the company to Eugène Laurent, his cellar master. Eugène ran the business with his wife, Mathilde-Émilie Perrier.

Following Eugène Laurent's death in 1887, Mathilde-Émilie Perrier took over, renaming the company 'Veuve Laurent-Perrier.' Her leadership was pivotal.

- Mathilde-Émilie's leadership brought considerable success.

- By 1914, the company had reached a record production of 50,000 cases of champagne.

- In 1889, she introduced 'Grand Vin Sans Sucre,' a sugar-free Champagne.

- This innovation catered to British tastes and anticipated the modern Brut Nature category.

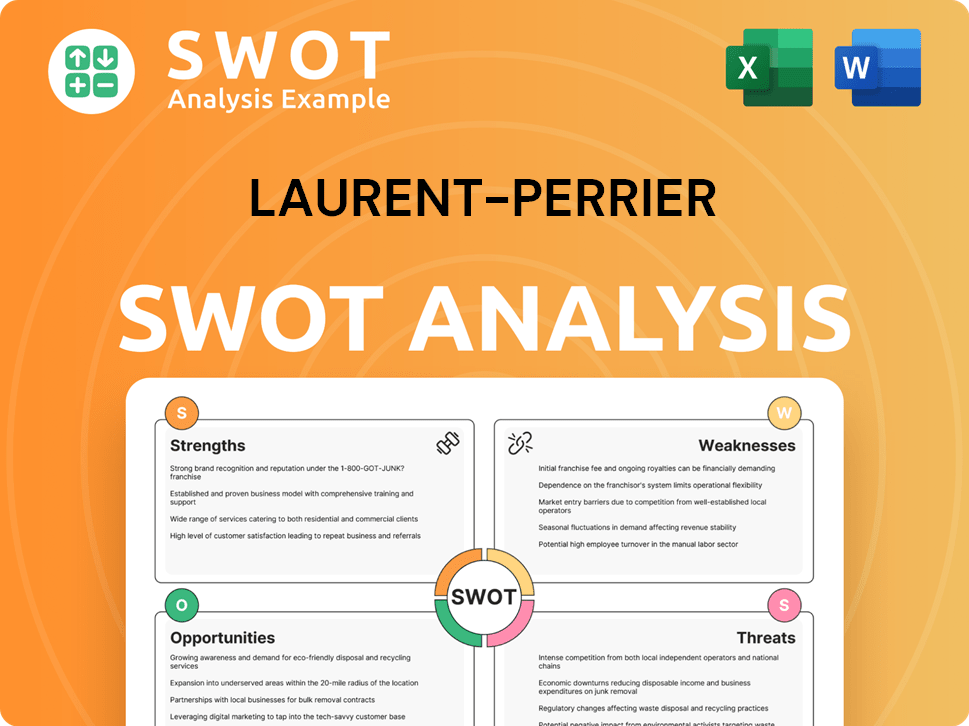

Laurent-Perrier SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Laurent-Perrier?

The early growth and expansion of the Laurent-Perrier Champagne house was marked by significant challenges and pivotal moments. Following Mathilde-Émilie Perrier's tenure, the company faced the disruptions of World War I. The sale of the company in 1939 to Marie-Louise Lanson de Nonancourt was a crucial turning point, effectively restarting the business.

Marie-Louise de Nonancourt invested her life savings to sustain Laurent-Perrier during World War II. Her son, Bernard de Nonancourt, became instrumental in the company's growth. He took over as Chairman and Chief Executive in October 1948, at the age of 28, after gaining experience in every aspect of the business.

Under Bernard's leadership, Laurent-Perrier transformed from a small company to a global brand. He focused on building strong relationships with grape growers, as the company did not initially own extensive vineyards. This emphasis on quality sourcing and blending became central to the Laurent-Perrier brand style.

By the turn of the century, Laurent-Perrier had become a top Champagne house, exporting to over 160 countries. The company established wholly-owned subsidiaries in key markets, including the U.K. in 1978, Switzerland in 1992, the U.S. in 1998, and Belgium in 1999. This expansion demonstrated its commitment to global reach and controlled distribution.

When Bernard de Nonancourt took over, the company had around ten employees and sold approximately 80,000 bottles annually. This early period set the stage for the significant growth that followed, establishing Laurent-Perrier as a major player in the French champagne market.

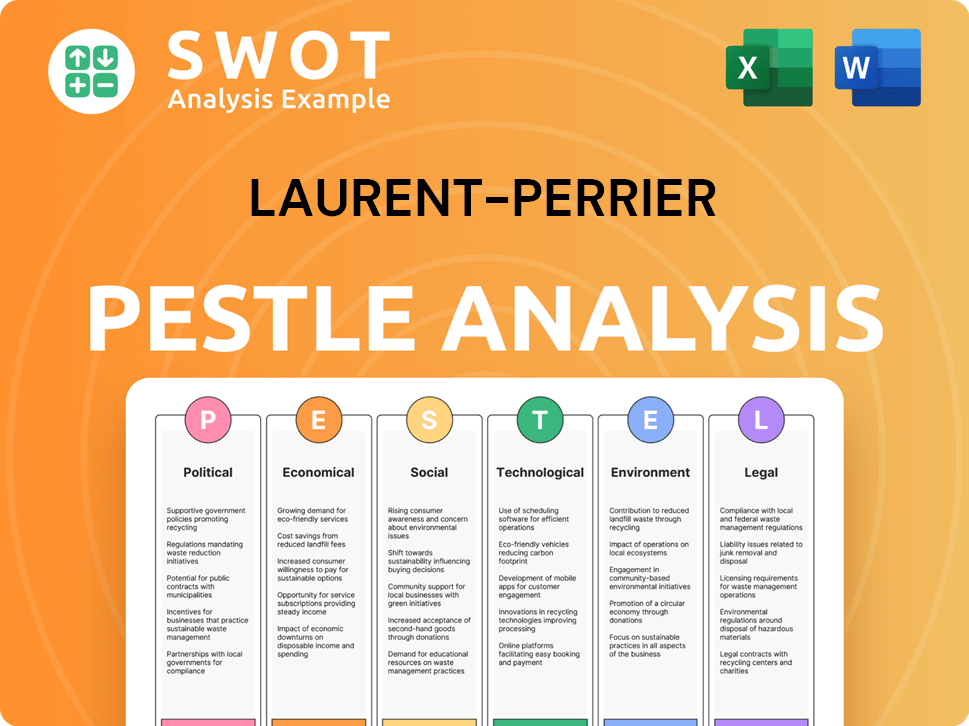

Laurent-Perrier PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Laurent-Perrier history?

The Champagne house of Laurent-Perrier has a rich history, marked by significant moments that have shaped its identity in the French champagne industry. From its early years to its current standing, the Laurent-Perrier brand has consistently demonstrated a commitment to quality and innovation.

| Year | Milestone |

|---|---|

| 1812 | The house was founded by Alphonse Pierlot, who acquired some parcels of land in Tours-sur-Marne. |

| 1881 | Eugène Laurent and Mathilde-Émilie Perrier took over the house, and the name was changed to Laurent-Perrier. |

| 1889 | Mathilde-Émilie Perrier created 'Grand Vin Sans Sucre', a precursor to the Brut Nature style. |

| 1939 | Marie-Louise Lanson de Nonancourt acquired Laurent-Perrier, saving it from potential demise. |

| 1968 | Laurent-Perrier Cuvée Rosé Brut, a pioneering rosé Champagne, was launched. |

| 1981 | Ultra Brut, a Brut Nature Champagne, was released, marking a return to a low-dosage philosophy. |

The Champagne house has been at the forefront of innovation, particularly in its production methods and product offerings. The adoption of stainless steel vats in the late 1970s for fermentation was a significant step, allowing for better temperature control and preserving the freshness of the base wines.

This allowed for precise temperature control, preserving the freshness and purity of the base wines, a departure from traditional oak barrels.

The reintroduction of the 'Brut Nature' category with Ultra Brut in 1981, emphasizing purity and balance, built on earlier innovations.

The launch of Laurent-Perrier Cuvée Rosé Brut in 1968, crafted using the maceration method, set a new benchmark for rosé Champagne.

Introduced in the late 1950s, Grand Siècle exemplifies the house's philosophy of blending wines from three exceptional vintages.

The brand has embraced sustainable winemaking, including organic farming across its vineyards, shunning chemical fertilizers and pesticides.

Prioritizing premium pricing and brand equity over volume, a strategic decision that has helped offset volume losses.

Despite its successes, Laurent-Perrier has faced challenges, including the impact of world wars and, more recently, market fluctuations. For the fiscal year ending March 31, 2025, the Champagne market experienced a 5.8% volume decline, with Laurent-Perrier's sales volume decreasing by 6.0%.

The global Champagne market experienced a 5.8% volume decline, with Laurent-Perrier's sales volume decreasing by 6.0% in the fiscal year ending March 31, 2025.

Champagne sales decreased by 6.8% to €282.9 million, and net profit attributable to the Group reached €47.4 million, a 25.4% decrease.

The operating profit saw a significant drop of 21.8% to €74.4 million, reflecting the impact of market conditions.

The company maintained a high operating margin of 26.3% by prioritizing premium pricing and brand equity over volume.

The company's strong financial foundation, with shareholders' equity of €627.3 million and a net debt of €220.2 million as of March 31, 2025, demonstrates its resilience.

For more insights into the company's approach, you can explore the Growth Strategy of Laurent-Perrier.

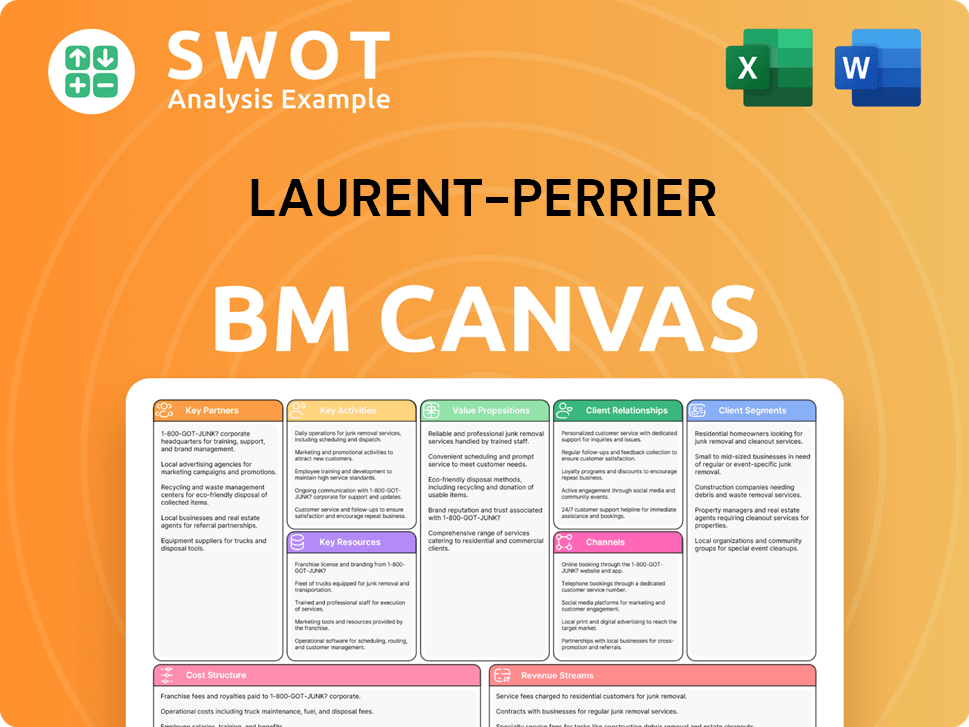

Laurent-Perrier Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Laurent-Perrier?

The brief history of Laurent-Perrier showcases a journey from its founding to its current status as a renowned Champagne house. This timeline highlights key moments in the evolution of the Laurent-Perrier brand, demonstrating its adaptability and innovation in the competitive world of French champagne.

| Year | Key Event |

|---|---|

| 1812 | André-Michel Pierlot establishes the Champagne house in Tours-sur-Marne, marking the origins of Laurent-Perrier. |

| 1887 | Mathilde-Émilie Perrier, widow of Eugène Laurent, takes over the company and renames it Veuve Laurent-Perrier. |

| 1889 | The introduction of 'Grand Vin Sans Sucre,' a precursor to Brut Nature, showcases early innovation. |

| 1914 | The company achieves a record production of 50,000 cases of champagne, reflecting its early success. |

| 1939 | Marie-Louise Lanson de Nonancourt acquires the struggling business, setting the stage for future growth. |

| 1948 | Bernard de Nonancourt becomes CEO, initiating a period of modernization and expansion. |

| Late 1950s | Introduction of Grand Siècle, the first multi-vintage prestige cuvée, establishes a new standard. |

| Late 1960s | Laurent-Perrier adopts stainless steel tanks for fermentation, a significant technological advancement. |

| 1968 | Launch of Cuvée Rosé Brut, using the maceration method, revolutionizes rosé Champagne production. |

| 1978 | The company establishes its first wholly-owned subsidiary in the U.K., expanding its global presence. |

| 1981 | Ultra Brut is released, reintroducing the non-dosage concept. |

| 1998 | Awarded the Royal Warrant by HRH The Prince of Wales, enhancing its prestige. |

| 1999 | The Laurent-Perrier Group is listed on the Paris Stock Exchange, opening it to public investment. |

| 2001 | Becomes an official champagne partner of Relais et Chateau, increasing its brand visibility. |

| 2004 | Acquisition of Chateau Malakoff further diversifies its portfolio. |

| 2010 | Bernard de Nonancourt passes away, with his daughters taking over leadership. |

| 2024-2025 | Reports champagne sales of €282.9 million and net profit of €47.4 million for the fiscal year ending March 31, 2025. |

Laurent-Perrier plans to navigate economic uncertainties by prioritizing brand excellence. This includes maintaining the high quality of its Champagne and enhancing its brand image, which is key to its long-term success.

Strategic investments are vital for Laurent-Perrier's future. These investments will focus on innovation in vineyard and cellar technology, as well as on sustainable practices to meet the challenges of climate change.

Analyst predictions for Laurent-Perrier project earnings growth of 2.1% and revenue growth of 4.1% per annum. The company's robust financial structure, with shareholders' equity of €627.3 million as of March 31, 2025, provides a strong foundation.

Despite a global volume decline of 5.8% in the Champagne market during the 2024-2025 fiscal year, Laurent-Perrier is focusing on premiumization. Maintaining a high operating margin of 26.3% is expected to contribute to its long-term value.

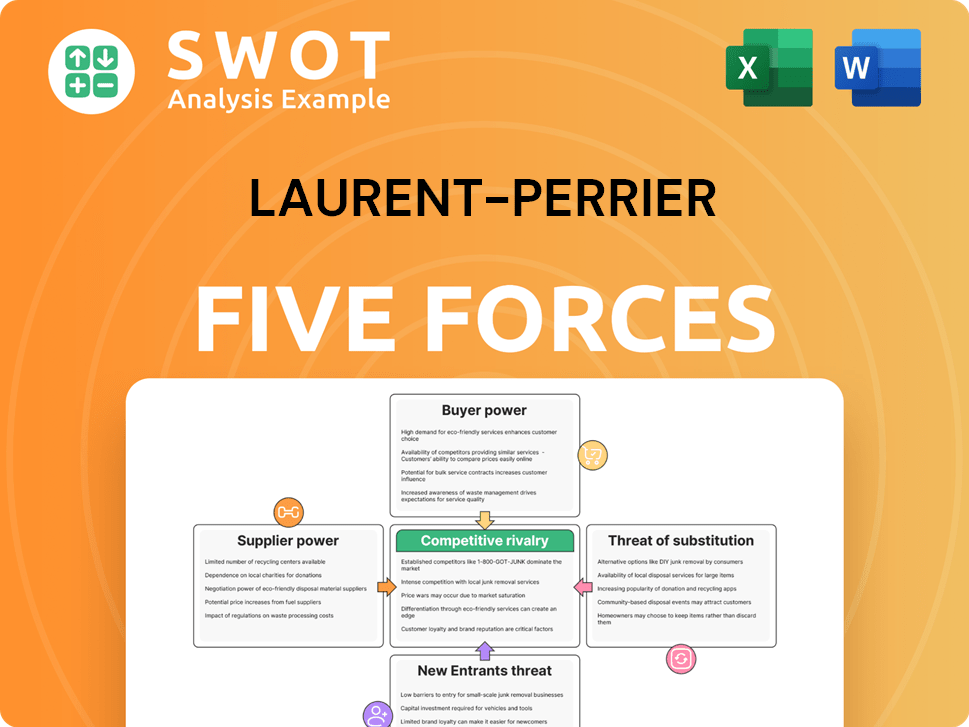

Laurent-Perrier Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Laurent-Perrier Company?

- What is Growth Strategy and Future Prospects of Laurent-Perrier Company?

- How Does Laurent-Perrier Company Work?

- What is Sales and Marketing Strategy of Laurent-Perrier Company?

- What is Brief History of Laurent-Perrier Company?

- Who Owns Laurent-Perrier Company?

- What is Customer Demographics and Target Market of Laurent-Perrier Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.