Laurent-Perrier Bundle

How Does Laurent-Perrier Thrive in the Luxury Champagne Market?

Founded in 1812, Laurent-Perrier is a distinguished French Champagne House, celebrated for its elegant and sophisticated offerings, particularly its Chardonnay-dominant champagnes. Despite a recent global dip in Champagne sales, Laurent-Perrier has maintained impressive operating margins, showcasing its resilience and strategic focus. This success makes understanding its operational model crucial for anyone interested in the luxury beverage sector.

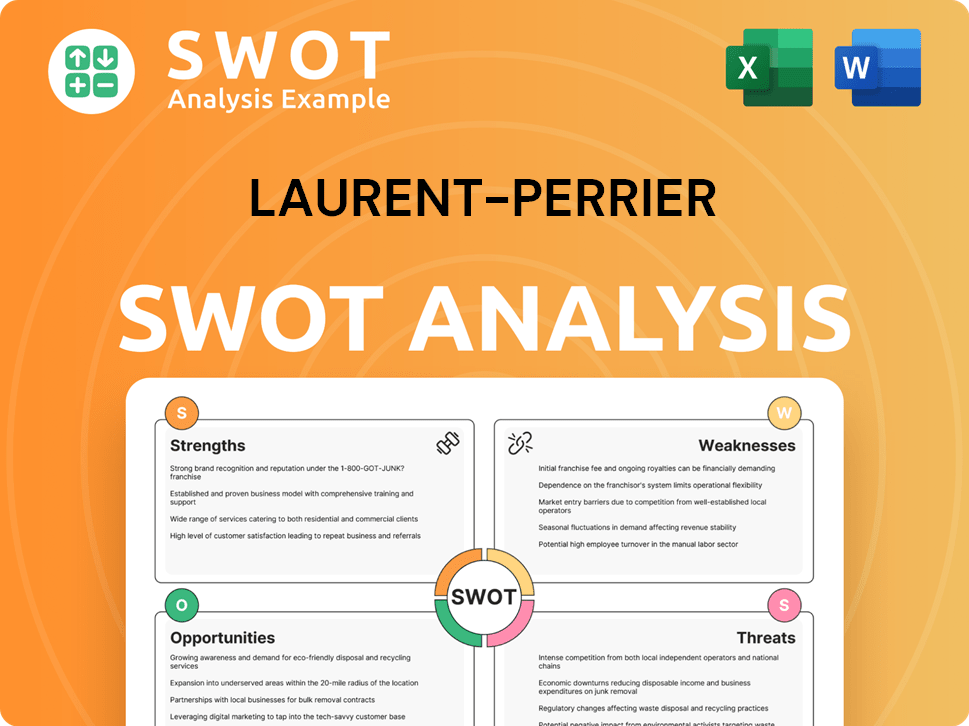

Laurent-Perrier's enduring appeal in the sparkling wine market is a testament to its commitment to quality and innovation. Its global distribution network, reaching over 120 countries, highlights its expansive reach within the industry. To gain a deeper understanding of Laurent-Perrier's strategic positioning, consider exploring the Laurent-Perrier SWOT Analysis, which provides valuable insights into its strengths, weaknesses, opportunities, and threats. This analysis offers a comprehensive view of how this French Champagne house navigates the complexities of the market.

What Are the Key Operations Driving Laurent-Perrier’s Success?

The core operations of Laurent-Perrier center on the creation and global distribution of high-quality champagnes, catering to a clientele valuing luxury, tradition, and innovation. The company's product portfolio, known for its Chardonnay dominance, includes highly regarded cuvées like Grand Siècle, Cuvée Rosé, and Blanc de Blancs Brut Nature. These offerings serve various customer segments, from luxury consumers in export markets to those seeking premium experiences in high-end restaurants and hotels.

Laurent-Perrier's operational process begins with viticulture, where sustainable practices are prioritized. Winemaking techniques are a cornerstone of their value proposition, including the pioneering use of stainless steel vats and the development of the maceration method for Cuvée Rosé Brut. The company also emphasizes the role of reserve wines in bringing stylistic consistency and complexity to its champagnes, a key competitive advantage.

The supply chain involves extensive grape grower contracts, with approximately 1,200 grape growers supplying the company. Products are distributed globally through a well-controlled network, including specialized stores, department stores, and direct sales. This disciplined global distribution ensures supply never outstrips demand, preserving brand exclusivity. The company's ability to maintain high operating margins stems from its strategy to prioritize premium pricing and brand equity over volume.

Laurent-Perrier actively pursues sustainable practices in its vineyards. In 2018, 100% of its vineyard plots achieved certifications for Sustainable Viticulture in Champagne (SVC) and High Environmental Value (HEV). This commitment ensures the quality of their grapes, which is crucial for producing exceptional Champagne.

The company is known for its innovative winemaking methods. They were pioneers in using stainless steel vats for vinification in the late 1970s. The development of the maceration method for Cuvée Rosé Brut in 1968 set a benchmark for rosé champagnes, showcasing their dedication to quality and innovation in the French Champagne market.

Laurent-Perrier maintains a disciplined global distribution network to preserve brand exclusivity. This includes specialized stores, department stores, and direct sales. This approach ensures that supply never exceeds demand, which is a key factor in maintaining the Luxury Champagne brand's premium positioning.

The company's substantial inventory, valued at €705.4 million as of September 2024, acts as a 'quality buffer.' This inventory underpins future sales and creates irreplaceable value as the Champagne ages for 3-10 years. This strategy supports their premium pricing and brand equity.

Laurent-Perrier's approach to the market is detailed in an article about the Growth Strategy of Laurent-Perrier. The company's ability to maintain high operating margins is a direct result of prioritizing premium pricing and brand equity over volume. This strategy is supported by their substantial inventory, which acts as a 'quality buffer' and creates long-term value as the champagne ages.

Laurent-Perrier focuses on sustainable viticulture, innovative winemaking, and disciplined distribution to maintain its position in the Sparkling Wine market. The company's commitment to quality is evident in its production methods and its ability to maintain a premium brand image.

- Sustainable practices in vineyards.

- Innovative winemaking techniques, including stainless steel vats.

- Global distribution network to preserve brand exclusivity.

- Substantial inventory to support future sales and quality.

Laurent-Perrier SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Laurent-Perrier Make Money?

The primary revenue stream for Laurent-Perrier, a distinguished Champagne House, is the sale of its premium Champagne offerings. The company's financial success is significantly tied to its ability to market and sell its high-quality sparkling wine. The monetization strategy is centered on premium pricing and brand equity, focusing on high-end products to maintain profitability.

For the fiscal year ending March 31, 2025, Laurent-Perrier's total revenue was €294.4 million, with Champagne sales accounting for €282.9 million. This represents a decrease compared to the previous year. In the first half of the 2024-2025 financial year, group turnover reached €132.0 million, with Champagne sales at €128.8 million. The company reported a revenue of $400 million in 2025, demonstrating a strong market share in the sparkling wine market.

Laurent-Perrier's strategy emphasizes premium products, with the share of premium sales increasing since 2007. This approach has allowed the company to maintain strong gross margins, reaching 57.5% in 2022. Ultra-premium products like Grand Siècle and Grande Cuvée Rosé Alexandra contribute significantly to profitability. The company's controlled distribution channels also play a role in preserving brand exclusivity.

The geographical distribution of Laurent-Perrier's net sales for the full year ended March 31, 2024, reveals the company's global presence. Export markets are a significant driver of growth, especially in the luxury consumer segments in Asia and the U.S.

- France: 21.1% of sales

- Europe: 46.1% of sales

- Other regions: 32.8% of sales

- Export markets now constitute 51% of sales

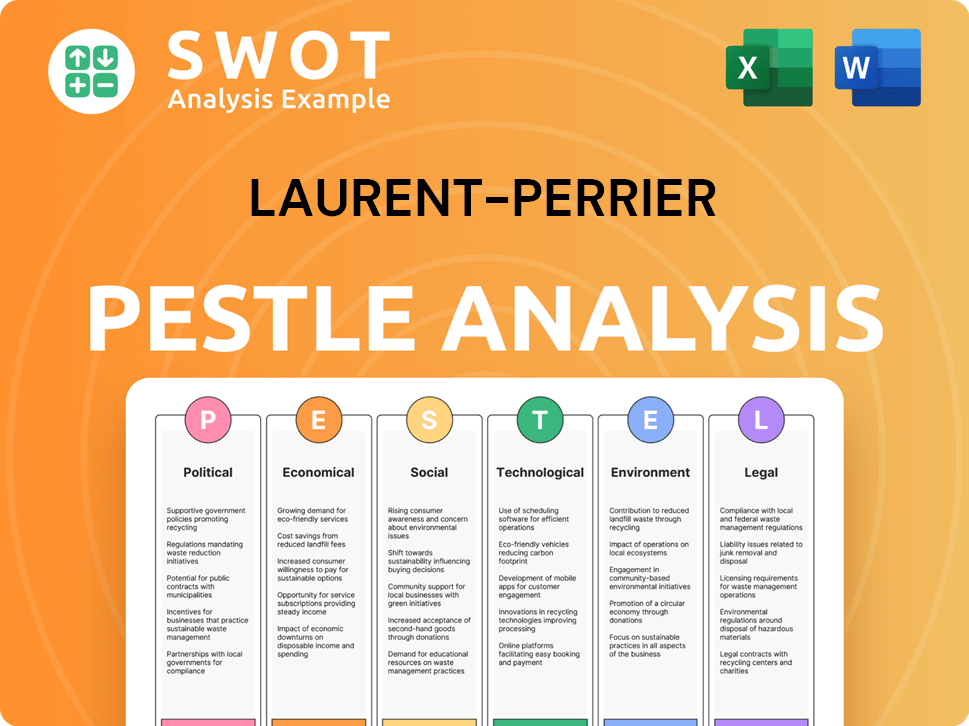

Laurent-Perrier PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Laurent-Perrier’s Business Model?

The story of Laurent-Perrier, a distinguished Champagne House, is marked by significant milestones and strategic decisions. The company's journey showcases a commitment to innovation and quality, essential elements in the luxury champagne market. This has allowed Laurent-Perrier to maintain a strong position in the competitive world of French Champagne.

Key innovations and strategic moves have defined Laurent-Perrier. The pioneering use of stainless steel vats in the late 1970s revolutionized winemaking. The launch of Laurent-Perrier Cuvée Rosé Brut in 1968, using the maceration method, set a new standard for rosé champagnes. These moves highlight its dedication to quality and its ability to adapt to market trends.

In June 2024, Laurent-Perrier introduced 'Heritage,' a new multi-vintage blend, to attract consumers and boost purchase frequency. The company was also granted the Royal Warrant by King Charles III in May 2024, a prestigious recognition. Despite market challenges, including a 5.8% volume decline in the global champagne market during the 2024-2025 financial year, Laurent-Perrier has maintained its focus on premium pricing and brand equity.

Laurent-Perrier has a rich history, starting with the introduction of Grand Siècle in the 1950s. The pioneering use of stainless steel vats in the late 1970s was a game-changer. The launch of Laurent-Perrier Cuvée Rosé Brut in 1968 set a new standard for rosé champagnes.

The company focuses on premium pricing and brand equity. Laurent-Perrier continuously invests in brand strength and quality control. They have increased average selling prices (ASP) by 2.6% annually since 2007, outpacing the industry average of 1.4%.

Its brand strength, built on quality and innovation since 1812, is a key advantage. The focus on Chardonnay-dominant champagnes and innovative winemaking techniques differentiates its products. Economies of scale are evident in its production of around seven million bottles annually.

The global champagne market saw a volume decline of 5.8% in the 2024-2025 financial year. Laurent-Perrier's sales volumes decreased by 6.0% in the same period. Despite these challenges, the company maintains a high operating margin of 26.3%.

Laurent-Perrier's competitive advantages include its strong brand, innovative winemaking, and controlled distribution. The company focuses on Chardonnay-dominant champagnes and uses innovative winemaking techniques. They continuously adapt to new trends, as demonstrated by their marketing campaigns and partnerships.

- Brand strength built on quality and innovation.

- Focus on Chardonnay-dominant champagnes.

- Controlled global distribution.

- Innovative marketing campaigns.

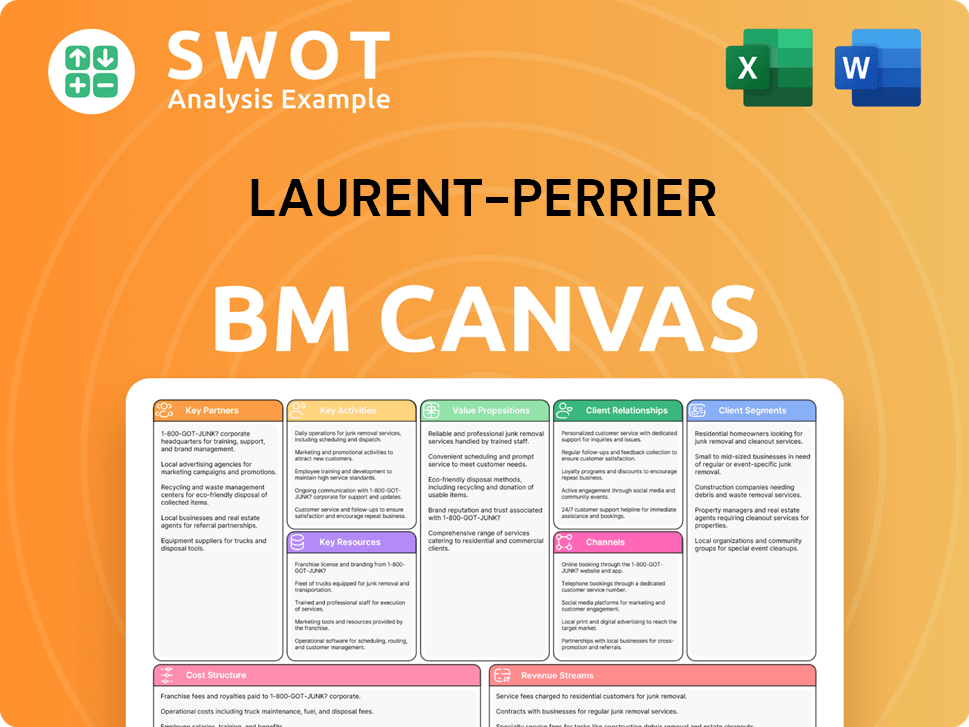

Laurent-Perrier Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Laurent-Perrier Positioning Itself for Continued Success?

As a prominent player in the global champagne market, Laurent-Perrier, a distinguished Champagne House, holds a significant position. The company competes with other leading brands within the luxury champagne segment. In 2024, the global champagne market was valued at USD 6.63 billion, highlighting the scale of the industry and the importance of brands like Laurent-Perrier.

Despite its strong market presence, Laurent-Perrier faces various challenges. These include market slowdowns, increased competition, and changing consumer preferences. The company's strategic initiatives and focus on premiumization are vital for sustaining growth and navigating future uncertainties.

Laurent-Perrier is a leading Champagne House, recognized globally. The company's market share is substantial, with a strong presence in key export markets. Its focus on premiumization has allowed it to maintain brand loyalty.

The champagne market faces a slowdown, with a 5.8% volume decline in the 2024-2025 financial year. Inflation and interest rates impact consumption and inventory. Increased competition and regulatory changes pose additional risks.

Laurent-Perrier aims to sustain growth through investments in quality and brand strength. Premiumization and strategic initiatives are key. The company's substantial inventory and value strategy support future sales.

Europe held the largest share in the global champagne market in 2024. North America is expected to see the fastest growth. Global economic uncertainty and geopolitical instability require vigilance.

Laurent-Perrier is committed to strengthening its brands and controlling distribution. The company's strategy relies on the excellence of its Champagnes and the expertise of its teams. Understanding the Target Market of Laurent-Perrier is vital for sustained success.

- Continued investment in wine quality.

- Focus on premium pricing to increase average selling price.

- Leveraging substantial aged champagne inventory.

- Maintaining a high operating margin through a value strategy.

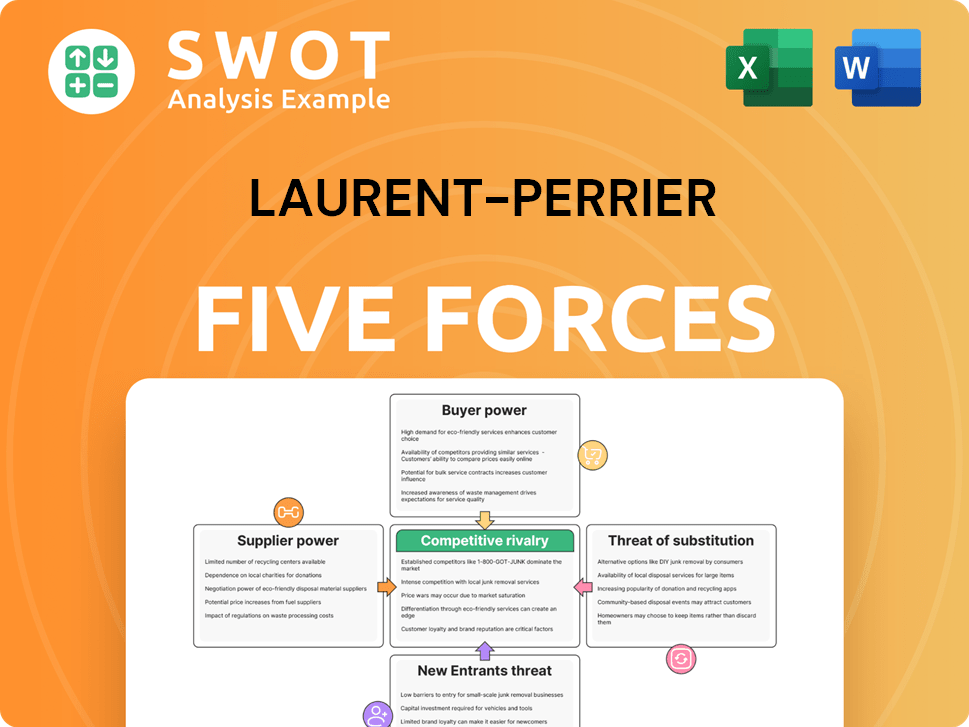

Laurent-Perrier Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Laurent-Perrier Company?

- What is Competitive Landscape of Laurent-Perrier Company?

- What is Growth Strategy and Future Prospects of Laurent-Perrier Company?

- What is Sales and Marketing Strategy of Laurent-Perrier Company?

- What is Brief History of Laurent-Perrier Company?

- Who Owns Laurent-Perrier Company?

- What is Customer Demographics and Target Market of Laurent-Perrier Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.