Minerals Technologies Bundle

What's the Story Behind Minerals Technologies Company?

Ever wondered how a company transforms raw minerals into solutions that shape industries worldwide? Minerals Technologies Inc. (MTI) has a fascinating past, marked by innovation and strategic shifts. From revolutionizing papermaking with its groundbreaking technology to its current global presence, MTI's journey is a compelling case study in the Minerals Technologies SWOT Analysis.

This brief exploration into the MTI history will uncover the pivotal moments that defined its trajectory. From its roots as a spin-off from Pfizer Inc. to its current status, understanding the company's evolution sheds light on its adaptability and its significant impact on the mining industry and the broader market of industrial minerals. The company's financial performance and strategic decisions over time provide valuable insights into its resilience and growth.

What is the Minerals Technologies Founding Story?

The story of Minerals Technologies Company begins in 1968, but its roots stretch back further. It all started when Pfizer Inc. established a special minerals division, consolidating several mineral excavation companies it had acquired since the 1940s. This marked the initial steps toward what would become a significant player in the mineral processing sector.

A pivotal moment arrived in 1982 with the launch of the satellite precipitated calcium carbonate (PCC) program. This innovation led to the opening of the first satellite PCC plant in 1986, revolutionizing the paper industry. This technology enabled paper production using an alkaline process, a significant shift from the traditional acid-based method.

The official formation of Minerals Technologies Inc. as an independent, publicly traded entity occurred on October 23, 1992. This was achieved through an initial public offering (IPO) where Pfizer Inc. spun off its Specialty Minerals and Refractories businesses. The company, headquartered in New York City, USA, began its journey with assets from the former Pfizer Specialty Minerals group. Dr. Jean-Paul Valles was the first Chairman and CEO.

The early years of Minerals Technologies Company were marked by strategic decisions and significant industry impacts.

- 1968: Pfizer Inc. forms a minerals division, laying the groundwork for MTI.

- 1982: The satellite PCC program is initiated, a crucial technological advancement.

- 1986: The first satellite PCC plant opens, transforming the paper industry.

- 1992: Minerals Technologies Inc. is established as an independent, publicly traded company through an IPO.

The IPO priced MTI's stock at $16 per share under the symbol MTX. A secondary public offering in April 1993 completed the separation from Pfizer. This strategic move allowed MTI to concentrate on the specialty minerals market, fostering independent growth. The company's focus on industrial minerals has been a cornerstone of its business strategy. For a deeper dive into the company's growth trajectory, consider reading about the Growth Strategy of Minerals Technologies.

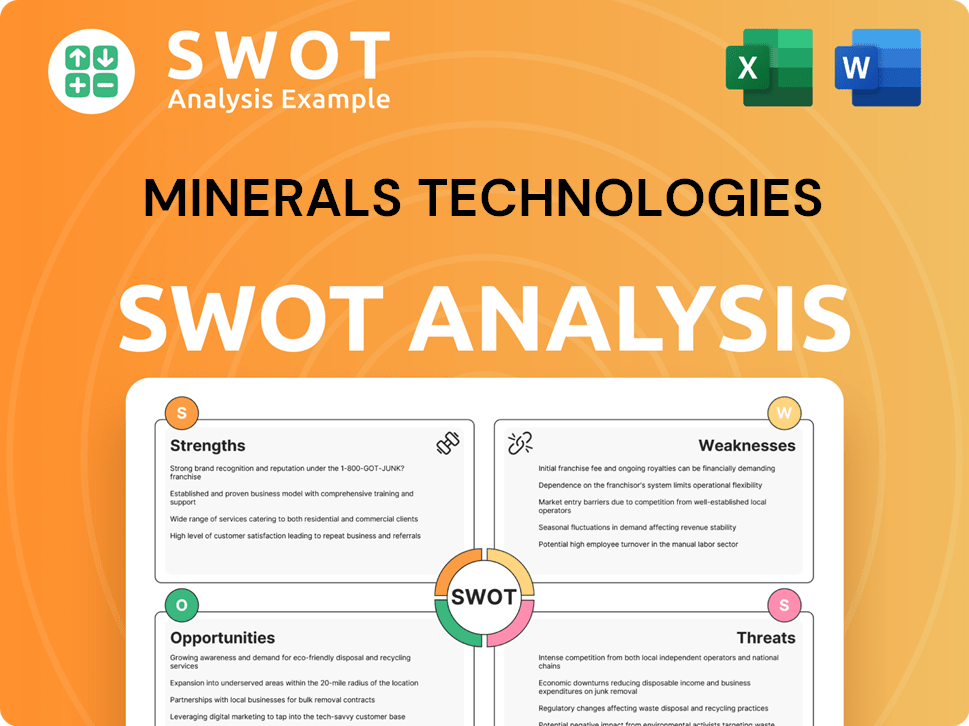

Minerals Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Minerals Technologies?

The early years of the Minerals Technologies Company, following its 1992 spin-off, were marked by significant growth and expansion. This initial success was largely fueled by its precipitated calcium carbonate (PCC) technology, which revolutionized the paper industry. By the mid-1990s, the company experienced approximately 15% annual earnings growth. This expansion also included a strategic focus on globalizing its operations.

A key strategy for MTI's early growth involved the global expansion of its satellite PCC plants. The company pioneered and expanded the on-site satellite plant concept, primarily serving the paper industry, which helped build a strong global footprint. This included the establishment of its first international PCC plant in France. By 1997, new satellite plants were also established in South Africa, Finland, and Germany.

MTI's sales grew substantially, from $394 million in 1992 to $1.638 billion in 2016. By 2012, the company had reached $1 billion in sales. A pivotal moment was the 2014 acquisition of AMCOL International, valued at approximately $1.7 billion. This acquisition significantly diversified its mineral portfolio and reduced its reliance on the paper industry.

The AMCOL acquisition added bentonite and other specialty minerals, expanding MTI into new markets. This strategic move broadened the company's scope beyond its traditional PCC base. The expansion included entry into markets such as metalcasting and household, personal care, and specialty products. This diversification was crucial in shaping the company's evolution.

The Minerals Technologies Company played a crucial role in the industrial minerals sector. MTI's early focus on PCC technology and its subsequent expansion into diverse markets, through acquisitions like AMCOL International, highlights its adaptability. The company's history reflects a strategic approach to growth and market diversification within the mining industry.

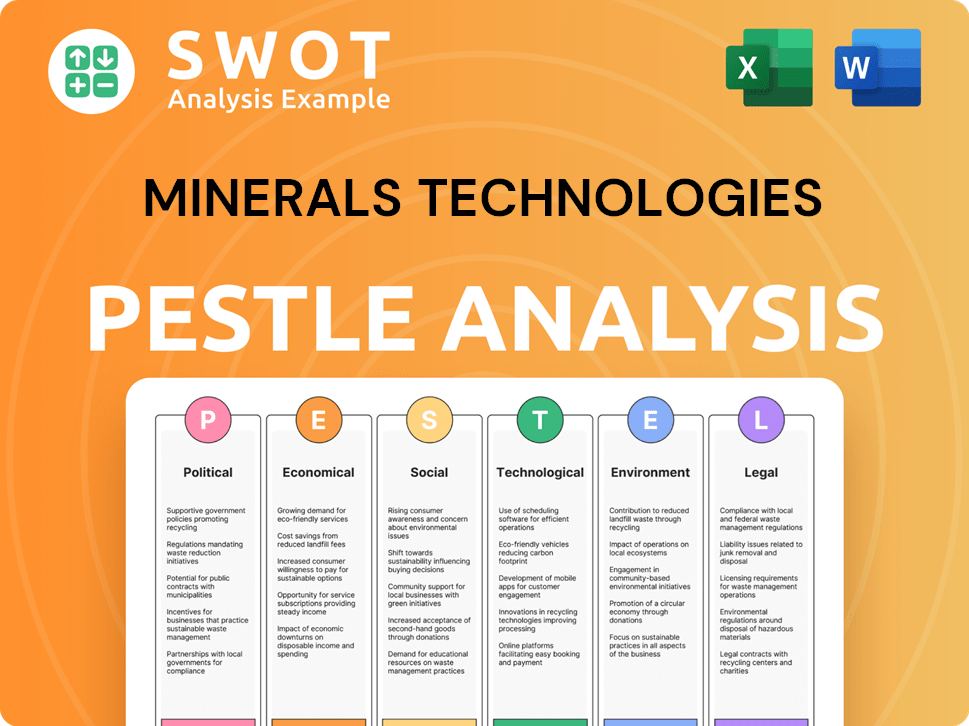

Minerals Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Minerals Technologies history?

The Minerals Technologies Company has a rich history, marked by significant milestones in the mineral processing and industrial minerals sectors. These achievements reflect its growth and adaptation within the mining industry.

| Year | Milestone |

|---|---|

| 1980s | Development of precipitated calcium carbonate (PCC) technology, revolutionizing paper manufacturing. |

| 1986 | Establishment of the first satellite PCC plant, setting a model for global expansion. |

| 2014 | Acquisition of AMCOL International for approximately $1.7 billion, diversifying into bentonite and other specialty minerals. |

| 2017 | Acquisition of Sivomatic Holding B.V., strengthening its position in the European private label cat litter market. |

| 2022 | Acquisition of Normerica Inc., expanding its pet care product line in North America. |

Innovations have been central to the company's strategy, particularly in industrial minerals. The development of PCC technology in the 1980s was a groundbreaking innovation, transforming paper manufacturing processes.

This technology allowed for acid-free paper manufacturing, significantly impacting the paper industry. This innovation enabled the company to establish a strong foothold in the mineral processing sector.

The satellite plant model facilitated efficient supply chains and supported the company's global reach. This approach proved crucial for expanding its market presence and customer service capabilities.

The company invested approximately $23.0 million in research and development in 2024, focusing on advanced new products and technologies. This investment is aimed at accelerating the development of new products, particularly in consumer-oriented sectors.

Despite its achievements, the company has faced challenges. Market dynamics, including inflation and supply chain issues, have presented hurdles. In Q1 2025, the company reported preliminary sales of $492 million and operating income of $63 million, falling short of guidance due to slower demand and customer inventory adjustments.

The company offset $191 million of inflationary increases with $210 million of price increases in 2022, demonstrating its ability to manage costs. These adjustments highlight the company's resilience in the face of economic challenges.

In Q1 2025, a $215 million provision was recorded to establish a reserve for talc-related claims related to its BMI OldCo subsidiary. This reflects the company's proactive approach to addressing legal and financial risks.

In Q1 2025, the company initiated a cost savings program, targeting approximately $10 million in annualized savings, primarily through workforce reductions. This program is designed to improve operational efficiency and financial performance.

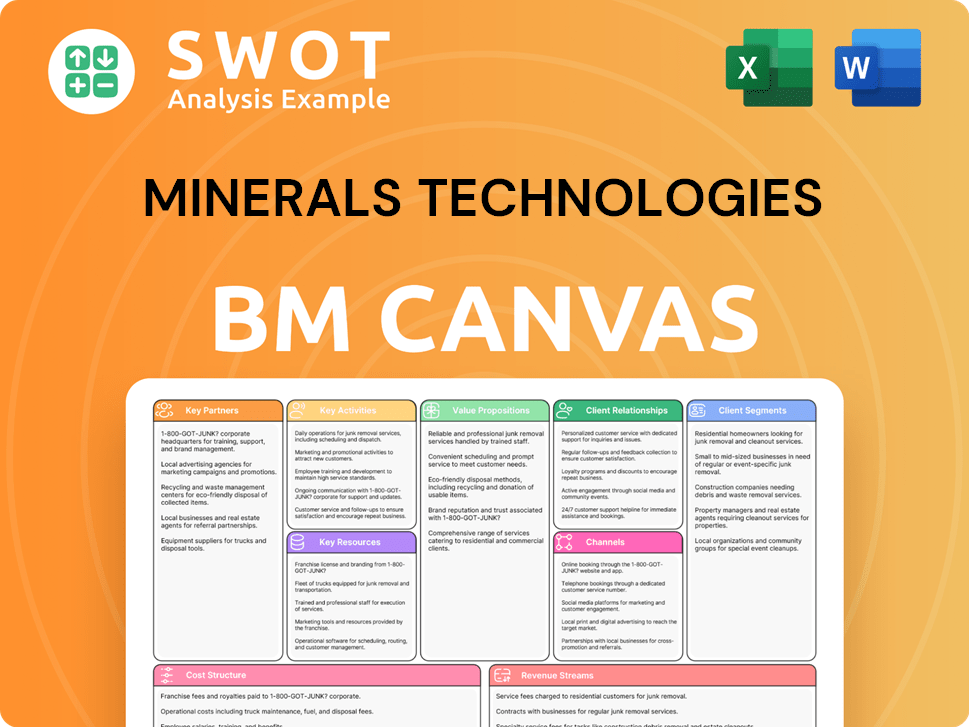

Minerals Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Minerals Technologies?

The MTI history is marked by strategic expansions and innovations in mineral processing. Starting as a division of Pfizer Inc. in 1968, it was later spun off as an independent entity in 1992. Significant milestones include the launch of satellite precipitated calcium carbonate (PCC) plants and the acquisition of AMCOL International in 2014, which broadened its portfolio. In 2024, Minerals Technologies reported global sales of $2.1 billion and a record operating margin of 15%, showcasing its financial growth over the years.

| Year | Key Event |

|---|---|

| 1968 | Pfizer Inc. forms its special minerals division, the precursor to Minerals Technologies Company. |

| 1982 | The satellite precipitated calcium carbonate (PCC) program is initiated. |

| 1986 | The first satellite PCC plant is opened. |

| October 23, 1992 | Minerals Technologies Inc. (MTI) is spun off from Pfizer Inc. through an initial public offering (IPO). |

| 1994 | Minerals Technologies moves its corporate headquarters to the Chrysler Building in New York City. |

| 1997 | International expansion continues with new satellite plants in South Africa, Finland, and Germany. |

| 2006 | MTI surpasses $1 billion in sales for the first time. |

| 2010 | MTI introduces FulFill® High Filler Technology. |

| 2014 | MTI acquires AMCOL International for approximately $1.7 billion. |

| 2017 | MTI acquires Sivomatic Holding B.V. |

| 2022 | MTI acquires Normerica Inc. and celebrates 30 years as a publicly traded company. |

| 2024 | Minerals Technologies reports global sales of $2.1 billion and a record operating margin of 15%. |

| Q1 2025 | MTI initiates a cost savings program targeting $10 million in annual savings and records a $215 million provision for talc-related claims. |

Minerals Technologies Company aims to expand its core businesses into rapidly growing regions. The company is focused on innovation and new product development to drive sales growth in 2025. Capital expenditures are anticipated to be between $90 million and $100 million for operational improvements and strategic growth.

The company projects a 5% to 10% increase in sales for the second quarter of 2025. Operating income is expected to rise by approximately 20% sequentially. MTI's strategic initiatives include increasing its presence in global pet litter products and expanding its bentonite product solutions for animal health applications.

MTI is pursuing expanded use of its products in environmental, building and construction, infrastructure, and oil and gas drilling and water treatment globally. The company focuses on consumer-oriented markets to increase market share and develop new products. This approach is in line with the company timeline.

Analyst predictions emphasize a balanced approach to capital deployment, utilizing cash flow for growth investments, shareholder returns, and continued debt reduction. The company's vision remains focused on leveraging specialty minerals and innovative technologies to serve diverse global markets. In Q1 2025, a cost savings program targeting $10 million in annual savings was initiated.

Minerals Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Minerals Technologies Company?

- What is Growth Strategy and Future Prospects of Minerals Technologies Company?

- How Does Minerals Technologies Company Work?

- What is Sales and Marketing Strategy of Minerals Technologies Company?

- What is Brief History of Minerals Technologies Company?

- Who Owns Minerals Technologies Company?

- What is Customer Demographics and Target Market of Minerals Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.