Mosaic Bundle

How Did the Mosaic Company Rise to Agricultural Prominence?

The global agricultural landscape depends on efficient crop nutrient production, and at the heart of this vital sector lies The Mosaic Company. Born from a strategic merger in 2004, Mosaic quickly established itself as a leading producer and marketer of essential phosphate and potash crop nutrients. This pivotal combination reshaped the industry, setting the stage for its current market dominance.

From its inception, Mosaic Company aimed to create a powerhouse in global agriculture by integrating phosphate mining, potash production, and distribution. Today, it significantly impacts the Mosaic SWOT Analysis. This article delves into the brief history of Mosaic Company, exploring its formation, strategic growth, and key milestones within the agricultural industry. We'll examine its role in phosphate mining and potash production, alongside its broader impact on global agriculture.

What is the Mosaic Founding Story?

The Mosaic Company's story began on October 22, 2004. This marked the official formation through a merger of IMC Global Inc. and Cargill's crop nutrition business. This strategic move aimed to create a leading global player in phosphate and potash crop nutrients.

The merger was driven by the goal of creating a more integrated and efficient supplier. This would address the growing global demand for essential crop nutrients. The combined strengths of the two companies were key to this strategy.

The leadership teams of IMC Global and Cargill's crop nutrition business spearheaded the merger. They recognized the benefits of combining their resources and expertise. The initial funding came from the assets of the merging companies. The name 'Mosaic' was chosen to reflect the company's diverse operations in the agricultural sector.

The merger created a company focused on phosphate mining and potash production. It aimed to streamline the supply of crop nutrients. The early 2000s saw increasing globalization, which influenced the company's formation.

- Mosaic history began with the merger of IMC Global and Cargill's crop nutrition business.

- The merger aimed to create a globally competitive supplier of crop nutrients.

- The business model integrated the entire value chain, from mining to distribution.

- The name 'Mosaic' symbolized the diverse and interconnected nature of the company's operations.

The formation of Mosaic was influenced by the need for efficient nutrient supply. The company's initial focus was on integrating the value chain. This included phosphate mining, potash production, processing, and worldwide distribution. The company's early years were shaped by the agricultural industry's needs and global economic trends. For more details on the company's growth strategy, you can read about the Growth Strategy of Mosaic.

In 2024, the agricultural industry continues to evolve, with a focus on sustainable practices. Mosaic's role in phosphate mining and potash production remains critical. The company's global presence and strategic acquisitions have solidified its position. The company's financial performance reflects its impact on agriculture. As of the latest reports, Mosaic continues to adapt to market changes.

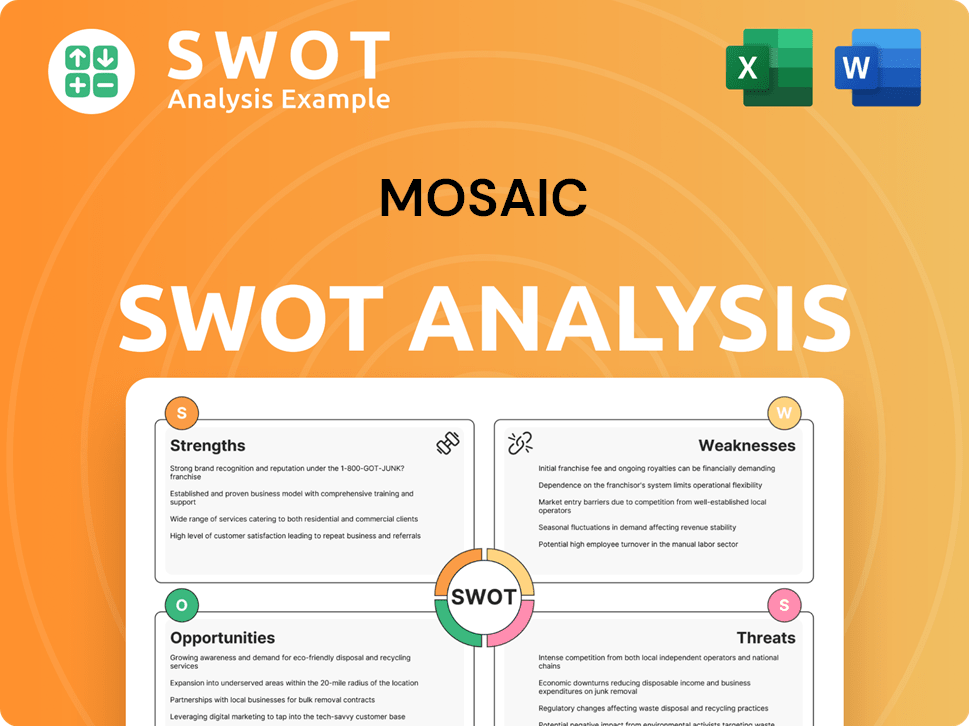

Mosaic SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Mosaic?

Following its formation in 2004, The Mosaic Company, a key player in the agricultural industry, quickly began its journey of early growth and expansion. This involved integrating its operations and expanding its global presence to meet the growing demand for crop nutrients. The company focused on optimizing its supply chain and refining its product offerings to cater to diverse agricultural needs. This period was marked by strategic acquisitions and investments in infrastructure to strengthen its position in the market.

Early efforts by Mosaic Company concentrated on optimizing its integrated supply chain. This included streamlining mining operations, production processes, and global distribution networks. The company leveraged its combined resources to enhance efficiency and reduce operational costs. This focus on efficiency was crucial for establishing a strong market presence and meeting customer demands effectively.

The company quickly established itself as a major player in the North American market, building on the existing customer bases of IMC Global and Cargill's crop nutrition business. This strong foundation allowed Mosaic fertilizer to rapidly expand its market share. By focusing on customer needs and providing reliable products, Mosaic solidified its position as a key supplier in the region.

Mosaic expanded its product offerings, refining its portfolio of concentrated phosphate and potash fertilizers to meet diverse agricultural needs across various regions. This involved developing new formulations and enhancing existing products to improve crop yields and quality. The company's commitment to product innovation helped it stay competitive and meet the evolving demands of the agricultural industry.

Mosaic Company focused on expanding its international presence, particularly in key agricultural regions experiencing rapid growth in demand for crop nutrients. This involved strengthening existing distribution channels and establishing new partnerships to reach a broader customer base. The company's global strategy was essential for driving growth and diversifying its revenue streams.

Significant capital was invested in upgrading mining and processing facilities to increase production capacity and improve operational effectiveness. These investments were critical for meeting the growing global demand for fertilizers and ensuring a reliable supply. The company's focus on infrastructure improvements helped it maintain its competitive edge.

Strategic shifts included a strong emphasis on sustainability and responsible resource management, recognizing the long-term importance of these factors in the agricultural sector. Mosaic Company focused on integrating its substantial phosphate rock reserves in Florida and its potash mines in Saskatchewan, Canada, to create a robust and reliable supply chain. For more insight into the company's core values, read about the Mission, Vision & Core Values of Mosaic.

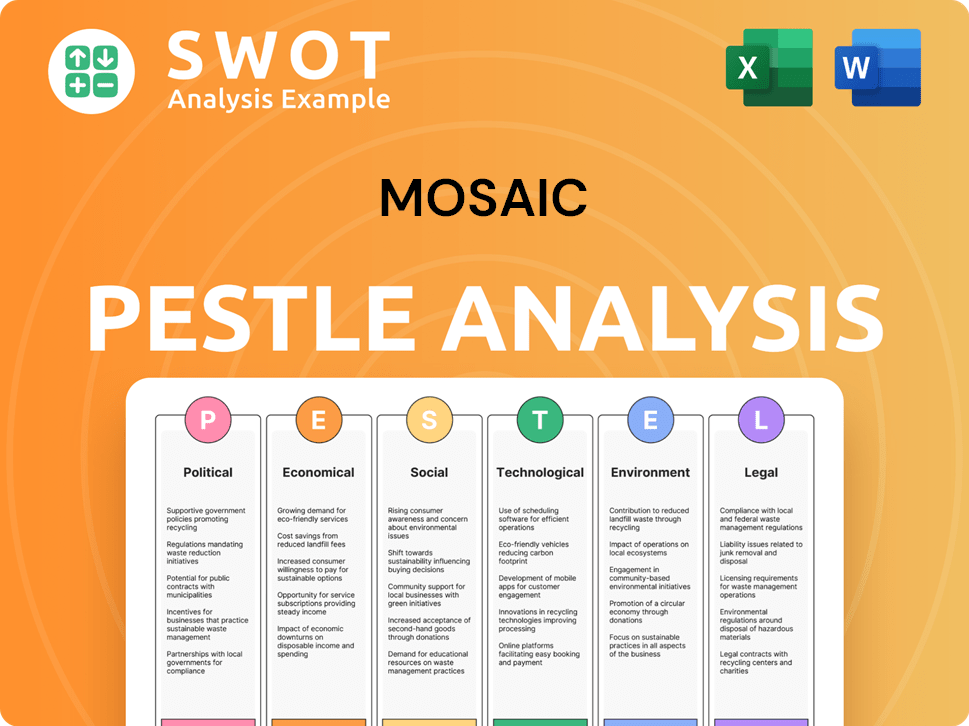

Mosaic PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Mosaic history?

The Mosaic Company has achieved significant milestones throughout its Mosaic history, focusing on operational efficiency and sustainable practices in phosphate mining and potash production. These achievements have shaped its trajectory within the agricultural industry, reflecting its commitment to growth and responsibility.

| Year | Milestone |

|---|---|

| 2004 | The Mosaic Company was formed through the merger of IMC Global and Cargill's crop nutrition business, creating a major player in the fertilizer industry. |

| 2007 | Mosaic completed its initial public offering (IPO), marking a significant step in its financial growth and expansion capabilities. |

| 2011 | Mosaic acquired CF Industries' phosphate business, expanding its phosphate reserves and production capacity substantially. |

| 2013 | Mosaic acquired the potash assets of Canpotex, further strengthening its position in the global potash market. |

| 2018 | Mosaic completed the acquisition of Vale Fertilizantes, increasing its presence in Brazil and expanding its product portfolio. |

| 2023 | Mosaic reported revenues of approximately $12.6 billion, demonstrating its continued financial strength and market presence. |

Mosaic Company has driven innovation through advancements in nutrient application technologies and the development of specialized crop nutrition products. These innovations have been designed for specific soil and crop needs, leading to improved agricultural yields globally.

Mosaic has invested in precision agriculture technologies to optimize fertilizer application, enhancing efficiency and reducing environmental impact. These technologies include GPS-guided application systems and soil-specific nutrient management strategies.

Mosaic develops and markets EEFs that improve nutrient use efficiency, reducing losses to the environment and maximizing crop uptake. These fertilizers include products with controlled-release properties.

Mosaic actively promotes 4R Nutrient Stewardship, a framework that focuses on applying the Right Source, at the Right Rate, at the Right Time, and in the Right Place. This approach helps farmers optimize fertilizer use.

Mosaic leverages digital tools and data analytics to provide farmers with insights into soil health, nutrient needs, and crop performance. These tools help in making informed decisions.

Mosaic is committed to sustainable mining practices, including land reclamation and water management, to minimize environmental impact. The company invests in technologies that reduce waste and emissions.

Mosaic is continually innovating its product offerings to meet the evolving needs of the agricultural industry. This includes developing new fertilizer formulations and application methods.

Mosaic Company has faced challenges including volatile commodity prices, global economic downturns, and geopolitical shifts impacting trade and supply chains. The company has responded to these challenges through strategic cost-cutting measures and diversifying its customer base, as detailed in Competitors Landscape of Mosaic.

Fluctuations in the prices of phosphate and potash can significantly impact Mosaic's profitability, requiring the company to adapt to changing market conditions. These fluctuations are influenced by global supply and demand dynamics.

Geopolitical events and trade policies can disrupt supply chains and affect the availability of raw materials and finished products. These risks require careful management of international operations.

Stringent environmental regulations and public scrutiny regarding mining operations necessitate significant investments in compliance and sustainable practices. These regulations can increase operational costs.

Global economic downturns can reduce demand for fertilizers, leading to lower sales volumes and pricing pressure. The company must implement cost-saving measures during these periods.

Disruptions in the supply chain, such as those caused by logistical issues or natural disasters, can impact the timely delivery of products. Mosaic needs to maintain robust supply chain management.

Intense competition in the fertilizer industry requires Mosaic to continuously innovate and improve its cost structure. The company faces competition from both domestic and international producers.

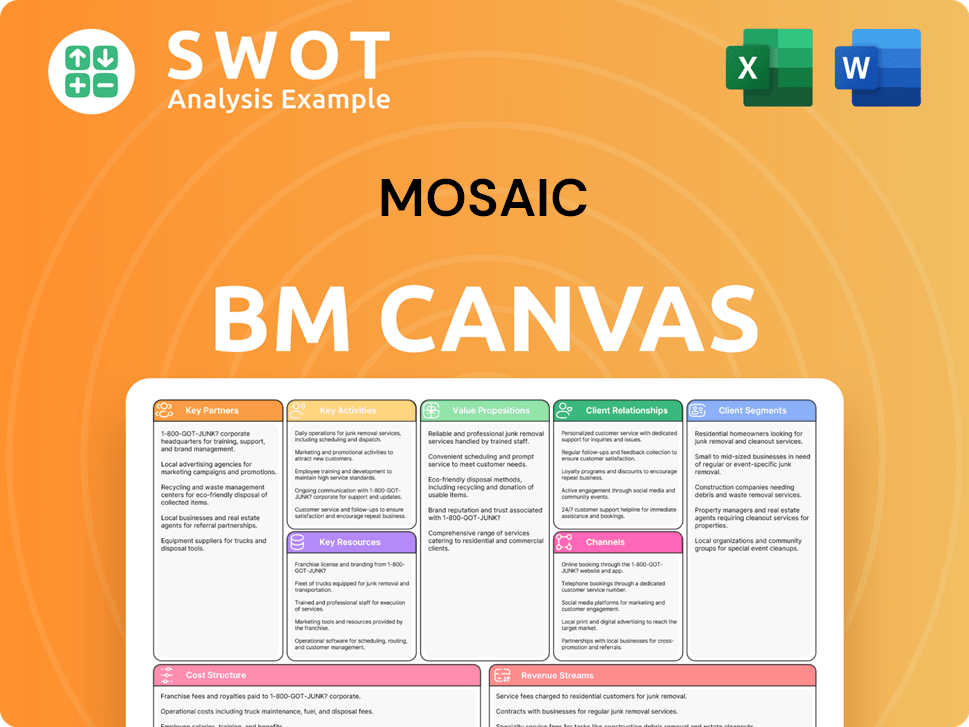

Mosaic Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Mosaic?

The Target Market of Mosaic has a rich history, evolving significantly since its formation. Key milestones highlight its growth and influence within the agricultural industry.

| Year | Key Event |

|---|---|

| 2004 | The company was formed through the merger of IMC Global and Cargill's crop nutrition business, marking a significant consolidation in the agricultural sector. |

| 2007 | The company became a publicly traded entity, expanding its access to capital and increasing its visibility in the market. |

| 2011 | Acquired CF Industries' phosphate business, boosting its phosphate mining operations and production capacity. |

| 2014 | Expanded its potash production capabilities through acquisitions and strategic investments. |

| 2020 | Announced significant sustainability initiatives, reflecting a growing focus on environmental responsibility within its operations. |

The company is expected to continue its strategic expansion, particularly in regions with high agricultural demand. This includes potential acquisitions and investments in both phosphate mining and potash production. The company is likely to focus on increasing its global presence, especially in emerging markets.

Sustainability will likely remain a key focus, with further investments in environmentally friendly practices. This includes reducing its carbon footprint, improving water management, and promoting responsible mining. The company's commitment to sustainability is crucial for long-term viability.

The company's performance will be heavily influenced by global agricultural trends, including crop prices, fertilizer demand, and geopolitical factors. Phosphate mining and potash production are sensitive to these market dynamics. Supply chain disruptions and fluctuations in raw material costs will continue to impact the company.

Financial analysts predict continued focus on operational efficiency and cost management to maintain profitability. The company's stock performance will be closely watched by investors. Key financial metrics, such as revenue, earnings per share, and free cash flow, will be critical indicators of success.

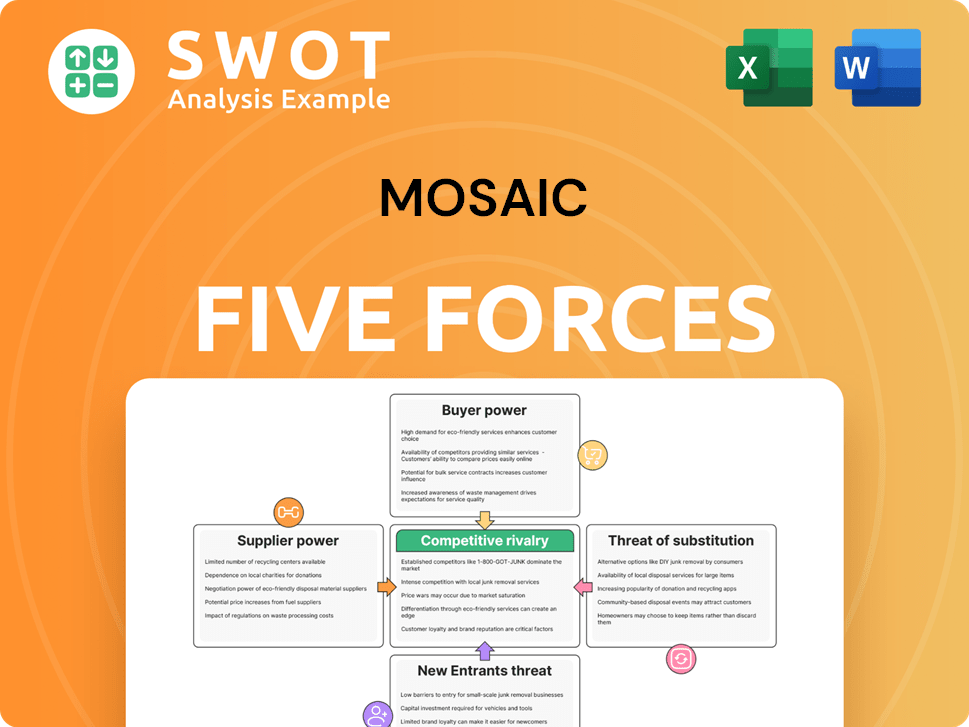

Mosaic Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Mosaic Company?

- What is Growth Strategy and Future Prospects of Mosaic Company?

- How Does Mosaic Company Work?

- What is Sales and Marketing Strategy of Mosaic Company?

- What is Brief History of Mosaic Company?

- Who Owns Mosaic Company?

- What is Customer Demographics and Target Market of Mosaic Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.