Mosaic Bundle

How Does Mosaic Company Stack Up in the Fertilizer Industry?

In the ever-evolving world of agriculture, understanding the Mosaic SWOT Analysis is crucial for investors and strategists alike. The Mosaic Company, a key player in the global fertilizer market, faces a dynamic competitive landscape. This analysis delves into the intricacies of the company's position within the industry, providing critical insights for informed decision-making.

This exploration of the Mosaic Company's competitive landscape will examine its market share, key rivals, and strategic advantages in the fertilizer industry. We'll analyze Mosaic's financial performance compared to competitors, focusing on its potash and phosphate production capabilities. Furthermore, the analysis will cover Mosaic's global presence, sustainability initiatives, and the challenges and opportunities it faces in the fertilizer market, offering a comprehensive view for stakeholders.

Where Does Mosaic’ Stand in the Current Market?

The Mosaic Company holds a leading market position in the global concentrated phosphate and potash crop nutrient industry. As of early 2024, the company is one of the world's largest producers of both phosphate and potash, which are essential for agricultural productivity. Mosaic's primary products include diammonium phosphate (DAP), monoammonium phosphate (MAP), and various potash products, which are sold primarily to wholesalers and retailers worldwide.

Mosaic's geographic presence is extensive, with significant operations and customer bases in North America, South America (particularly Brazil), and India. The company strategically focuses on higher-value products and key agricultural regions with robust demand growth. Mosaic also invests in digital transformation to improve operational efficiency and customer engagement. In 2023, Mosaic's Potash segment saw sales volumes of 7.5 million tonnes, and its Phosphates segment recorded sales volumes of 7.4 million tonnes.

Financially, Mosaic demonstrates significant scale compared to industry averages, with net sales of $13.7 billion in 2023. This financial strength allows for continued investment in operations and strategic initiatives. Mosaic benefits from its extensive mining assets and integrated supply chain, particularly in North American phosphate and potash production. While strong, the company continuously navigates regional market dynamics and competitive pressures in various international markets. Learn more about the company's strategic moves in a detailed analysis of the Mosaic Company's strategic positioning.

Mosaic consistently ranks among the top global producers of phosphate and potash. While specific market share figures fluctuate, the company often vies for the top spot in certain segments. Its strong position is supported by its extensive mining assets and integrated supply chain, especially in North America.

Mosaic's primary product lines include DAP, MAP, and various potash products. These are sold to wholesalers and retailers worldwide. In 2023, the company's Potash segment reported sales of 7.5 million tonnes, and the Phosphates segment reported sales of 7.4 million tonnes.

Mosaic has a broad geographic presence, with significant operations and customer bases in North America, South America (especially Brazil), and India. The company strategically focuses on key agricultural regions. This global footprint supports its market position.

Mosaic's financial strength is demonstrated by net sales of $13.7 billion in 2023. This financial performance enables continued investment in operations and strategic initiatives. The company's scale is significant compared to industry averages.

Mosaic strategically focuses on higher-value products and key agricultural regions with robust demand growth. The company is also investing in digital transformation initiatives to improve operational efficiency and customer engagement. This strategy supports its long-term market position.

- Focus on higher-value products.

- Emphasis on key agricultural regions.

- Investments in digital transformation.

- Continuous optimization of its portfolio.

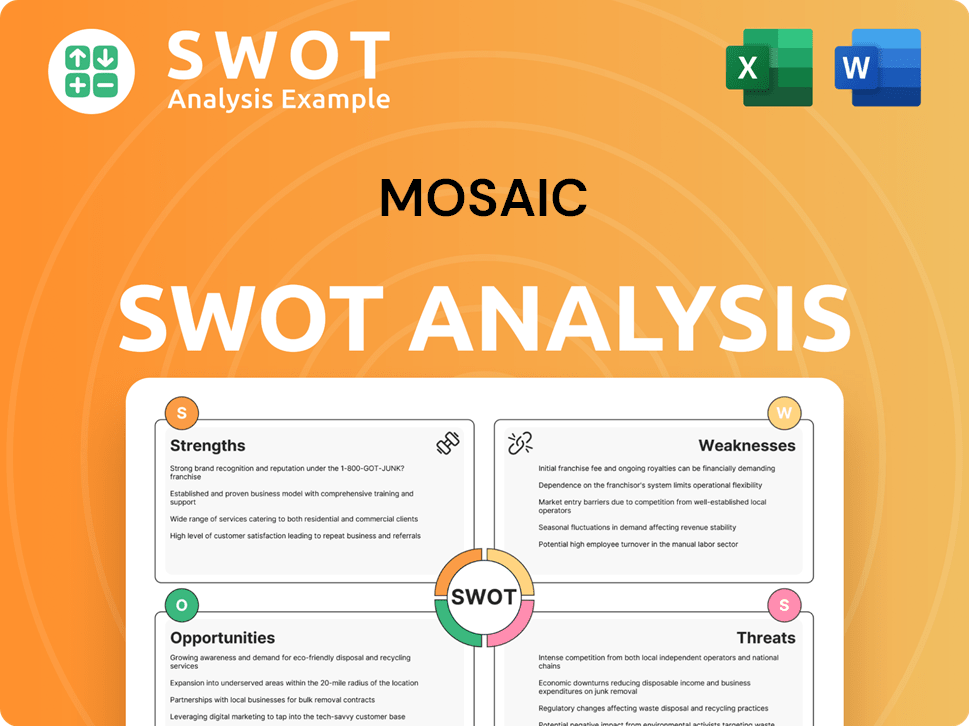

Mosaic SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Mosaic?

The Mosaic Company operates within the highly competitive fertilizer industry, facing challenges from both large, integrated players and smaller, regional producers. This dynamic competitive landscape requires strategic agility and a deep understanding of market forces. The company's performance is heavily influenced by global supply and demand dynamics, as well as geopolitical factors impacting trade and resource availability.

Understanding the Mosaic Company's key competitors is crucial for assessing its market position and future prospects. The fertilizer market is subject to significant price volatility, influenced by factors such as weather patterns, agricultural commodity prices, and government policies. These elements shape the competitive environment and impact the strategies of all players involved.

The Mosaic Company faces competition from a variety of sources, each with its own strengths and weaknesses. These competitors employ diverse strategies to gain market share, including pricing, product innovation, and expanding their global presence. For more information, you can read about the Brief History of Mosaic.

Nutrien is a major player in the agricultural sector, offering a wide range of crop inputs. They are a significant producer of potash, nitrogen, and phosphate products. Nutrien's extensive retail network and diverse product offerings create a strong competitive position.

OCP Group, a Moroccan state-owned company, is a global leader in phosphate rock and related products. They possess vast phosphate reserves and focus on markets in Africa and Asia. OCP's strategic focus presents a significant challenge in the phosphate market.

Yara International ASA, based in Norway, has a strong global presence, particularly in nitrogen fertilizers. They are increasingly focused on specialty crop nutrition. Yara competes through product innovation and efficient distribution networks.

PhosAgro, a Russian vertically integrated company, is a leading producer of phosphate-based fertilizers. They compete through various strategies, including pricing and branding. PhosAgro's integrated model provides a competitive edge.

Competition is intense in key import markets like Brazil and India, where producers compete on price and supply agreements. The industry is also affected by emerging players and mergers. These factors reshape market dynamics and consolidate market power.

Competitors use various strategies such as pricing, product innovation, and efficient distribution. High-profile 'battles' often emerge in key import markets. The focus can vary, with some specializing in nitrogen while others, like Mosaic, focus on phosphate and potash.

Several factors influence the competitive landscape within the fertilizer market.

- Production Capacity: The ability to produce large volumes of potash and phosphate is critical.

- Resource Reserves: Access to phosphate rock and potash deposits impacts long-term competitiveness.

- Distribution Networks: Efficient logistics and distribution systems are essential for reaching global markets.

- Pricing Strategies: Competitive pricing is a key factor in securing sales in a volatile market.

- Product Innovation: Developing new fertilizer formulations and specialty products.

- Geopolitical Factors: Trade policies, sanctions, and political stability in key regions.

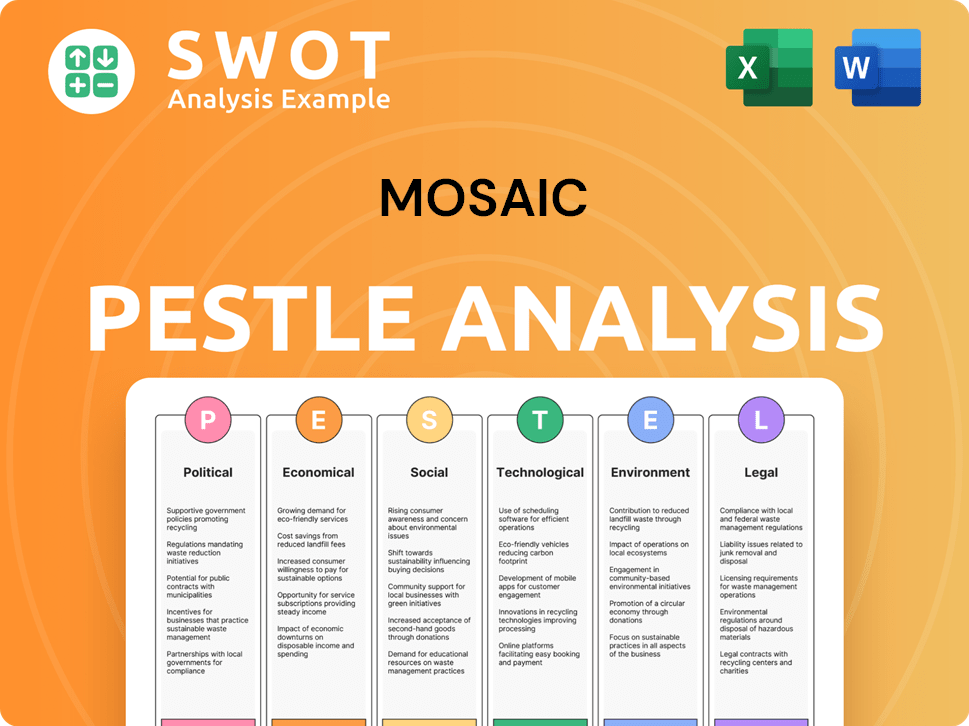

Mosaic PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Mosaic a Competitive Edge Over Its Rivals?

The Growth Strategy of Mosaic is significantly shaped by its competitive advantages within the Fertilizer Industry. These advantages are crucial in navigating the complex Competitive Landscape of Mosaic Company. Understanding these strengths is key for anyone analyzing the Fertilizer Market and the company's position within it.

Mosaic Company benefits from a robust foundation built on its extensive reserves of phosphate and potash, essential components of fertilizer. This ownership of key resources, particularly in Florida and Saskatchewan, provides a cost-effective and reliable supply chain. The company's strategic focus on operational efficiencies and innovation further enhances its competitive edge in the global market.

Mosaic's integrated operations, from mining to distribution, contribute to its resilience and cost advantages. This vertical integration allows for better control over production costs and supply chain management. These factors are critical in maintaining a strong position in the fertilizer industry and ensuring consistent delivery to customers worldwide.

Mosaic's ownership of significant phosphate rock and potash reserves is a primary advantage. This ensures a secure and cost-effective supply of raw materials. The company's long-life mining assets in Florida and Saskatchewan are key.

An integrated supply chain, from mining to distribution, enhances Mosaic's competitive edge. This includes a vast global distribution network. Efficient logistics ensure timely delivery to customers across diverse geographical markets.

As a large-scale producer, Mosaic benefits from economies of scale. This results in lower per-unit production costs. Competitive pricing is maintained while preserving healthy profit margins.

Mosaic invests in research and development to improve product innovation and operational efficiencies. The company focuses on enhancing mining techniques and processing technologies. This continuous improvement helps in maintaining its competitive position.

Mosaic's competitive advantages are rooted in its resource ownership, integrated supply chain, and economies of scale. These factors contribute to the company's strong position in the Fertilizer Market. The company's strategic focus on operational efficiencies and innovation further enhances its competitive edge.

- Extensive Phosphate and Potash Reserves: Mosaic's ownership of key mining assets provides a secure and cost-effective supply of raw materials.

- Integrated Supply Chain: Efficiently manages the movement of products from mines to customers worldwide.

- Economies of Scale: Large-scale production leads to lower per-unit costs, supporting competitive pricing.

- Investment in R&D: Focus on product innovation and operational efficiencies to maintain a competitive edge.

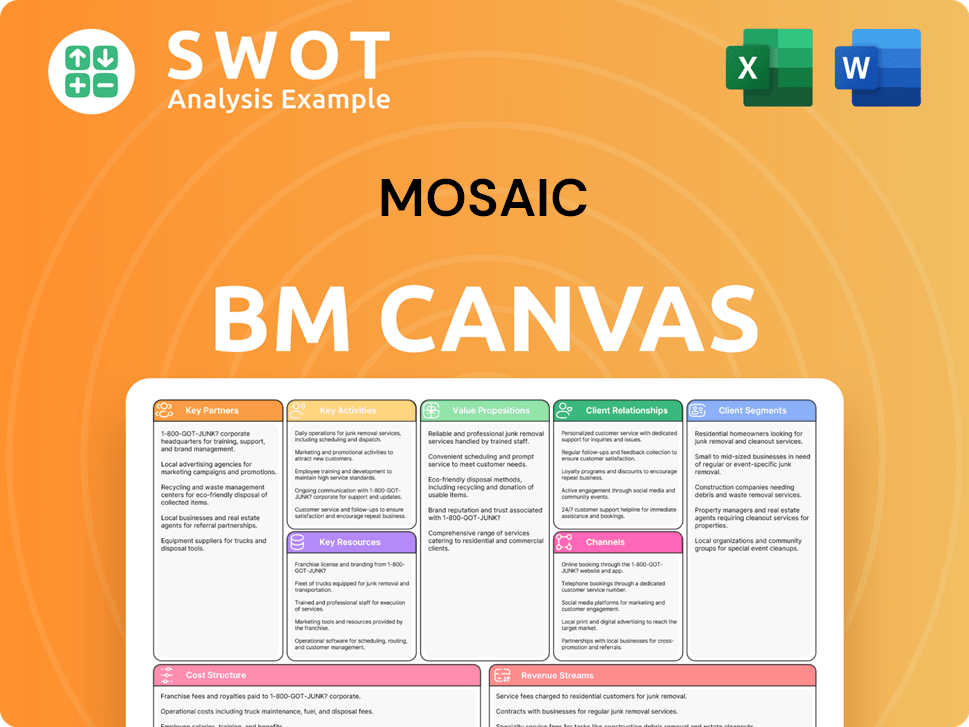

Mosaic Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Mosaic’s Competitive Landscape?

The crop nutrient industry, where the Growth Strategy of Mosaic plays a significant role, is shaped by global trends. The increasing world population, expected to reach nearly 10 billion by 2050, drives the demand for crop nutrients. Climate change and regulatory changes are also key influencers in the industry.

The competitive landscape of the fertilizer industry is subject to potential disruptions, including new market entrants and shifts in business models. Potential threats include declining agricultural commodity prices and geopolitical instability. Rising input costs also pose a challenge for companies like Mosaic. However, significant growth opportunities exist in emerging markets, product innovations, and strategic partnerships.

Key trends include population growth, which increases food demand and, consequently, the need for fertilizers. Climate change and weather volatility necessitate specialized nutrient applications. Regulatory changes focusing on environmental sustainability are also driving industry adjustments.

Challenges include potential market entrants with innovative production methods. Declining agricultural commodity prices and geopolitical instability can impact demand and supply chains. Rising input costs, particularly for energy and raw materials, also present hurdles for the fertilizer market.

Significant growth opportunities exist in emerging markets, especially in Africa and parts of Asia. Product innovations, such as enhanced efficiency fertilizers, represent a key area for growth. Strategic partnerships can unlock new markets and improve market penetration.

Mosaic is deploying strategies focused on optimizing its existing assets and expanding in key growth markets. The company is also investing in sustainable solutions to capitalize on evolving trends. This includes a greater emphasis on sustainability and tailored nutrient solutions.

The company's strategic focus includes expanding in key growth markets and investing in sustainable solutions. This involves a greater emphasis on sustainability, efficiency, and tailored nutrient solutions. The evolution of the competitive landscape will likely see a greater emphasis on these factors.

- Emerging Markets: Focus on regions like Africa and parts of Asia.

- Product Innovation: Development of enhanced efficiency fertilizers.

- Strategic Partnerships: Collaborations to improve market penetration.

- Sustainability: Investment in sustainable mining practices and reduced environmental footprint.

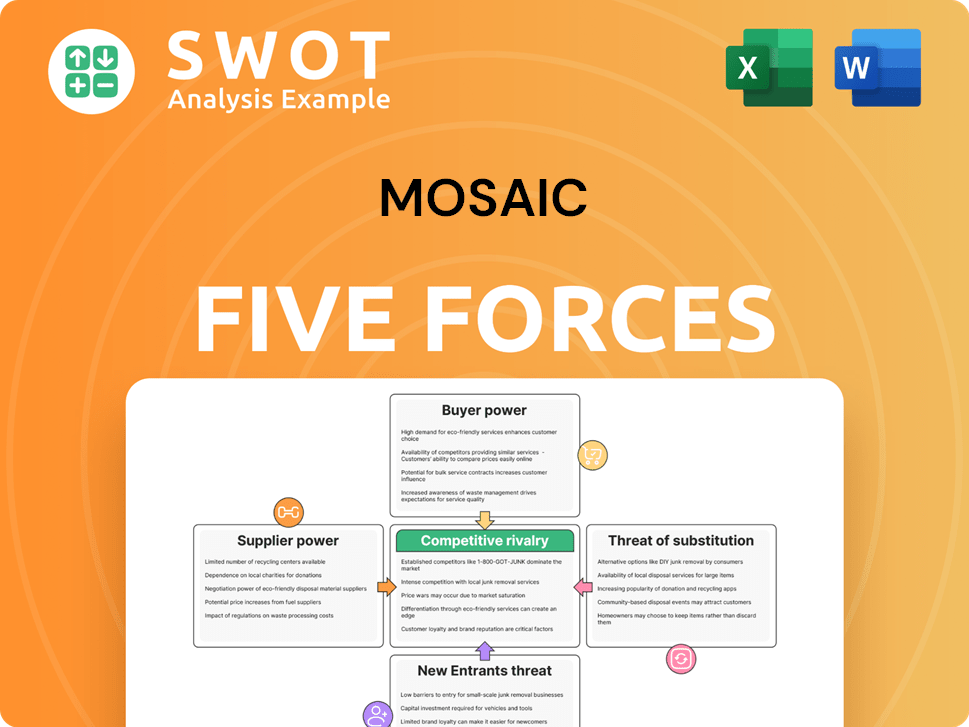

Mosaic Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mosaic Company?

- What is Growth Strategy and Future Prospects of Mosaic Company?

- How Does Mosaic Company Work?

- What is Sales and Marketing Strategy of Mosaic Company?

- What is Brief History of Mosaic Company?

- Who Owns Mosaic Company?

- What is Customer Demographics and Target Market of Mosaic Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.