Nine West Holdings, Inc. Bundle

What Happened to the Nine West Brand?

From its humble beginnings in 1977, Nine West Holdings, Inc. became a fashion powerhouse, celebrated for its stylish footwear and accessories. This Nine West Holdings, Inc. SWOT Analysis can provide more insights into the company's journey. But how did this iconic brand navigate the ever-changing fashion landscape, and what challenges did it face along the way?

The Nine West history is a story of ambition, innovation, and ultimately, significant restructuring. The Nine West company's journey, from its initial focus on women's shoes to its expansion into a comprehensive fashion brand, reflects both its successes and the financial struggles that led to its bankruptcy. Understanding the Nine West brand's evolution offers valuable insights into the dynamics of the fashion industry and the importance of strategic adaptation.

What is the Nine West Holdings, Inc. Founding Story?

The Competitors Landscape of Nine West Holdings, Inc. traces its roots back to May 1977. That's when Jerome Fisher and Vincent Camuto founded the Fisher Camuto Corporation. This marked the beginning of what would eventually become Nine West Holdings, Inc., a significant player in the fashion industry.

Their initial focus was on wholesale women's shoes. They strategically used manufacturing connections in southern Brazil. This allowed them to take advantage of lower production costs due to readily available raw materials, cheaper labor, and reduced capital expenses.

The company aimed to provide fashionable yet affordable footwear to the American market. The original business model centered on designing and wholesaling women's shoes. The 'Nine West' brand became particularly successful after its 1989 repositioning, targeting the $50 to $65 price range. The name 'Nine West' came from its original location at 9 West 57th Street in New York City.

Nine West Holdings, Inc. started as Fisher Camuto Corporation in 1977, focusing on wholesale women's shoes.

- The company leveraged low-cost manufacturing in Brazil.

- The Nine West brand was redefined in 1989 to target a specific price point.

- The company's name originated from its New York City location.

- A key challenge was competing in the women's shoe market during the late 1970s and early 1980s.

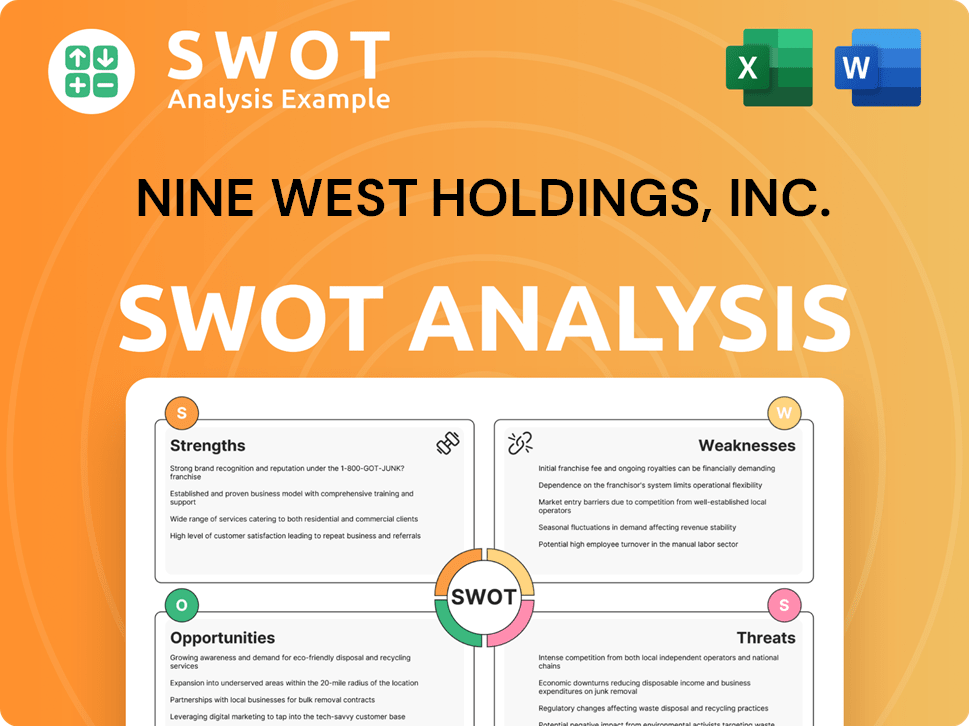

Nine West Holdings, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Nine West Holdings, Inc.?

The early years of the company, now known as Nine West Holdings, Inc., were marked by substantial growth and expansion. The company quickly established itself in both wholesale and retail sectors of the women's shoe industry. Key strategic moves and acquisitions helped shape the company's trajectory, leading to its rise as a prominent player in the fashion world. The company's evolution included significant restructuring and strategic acquisitions.

In 1988, the company formed Jervin Inc., a private-label entity focused on unbranded women's footwear manufactured in Brazil. A major restructuring occurred on December 31, 1991, merging Fisher Camuto Corporation, Fisher Camuto Retail Corporation, and Espressioni, Inc. into Nine West Group Inc.

Nine West went public in early February 1993, listing shares on the New York Stock Exchange. By this time, the company operated 236 retail and outlet stores and supplied over 2,000 department, specialty, and independent stores. The company aimed to increase retail sales, planning to open 20 Enzo Angiolini stores in 1994.

A significant acquisition happened in March 1995 when Nine West purchased the footwear division of U.S. Shoe Corporation, including the Easy Spirit brand. The company also expanded internationally, opening its first Hong Kong location in 1994. By 1997, Nine West acquired London-based Pied a Terre for $5 million and the shoe concession business of UK retailer Sears plc for £9 million.

Market reception was generally positive during this period. Revenues climbed over 20%, and profits surged 55% from $38.2 million in 1992 to $59.3 million in 1993, despite a national economic recession. For more insights into the company's target consumer, check out Target Market of Nine West Holdings, Inc.

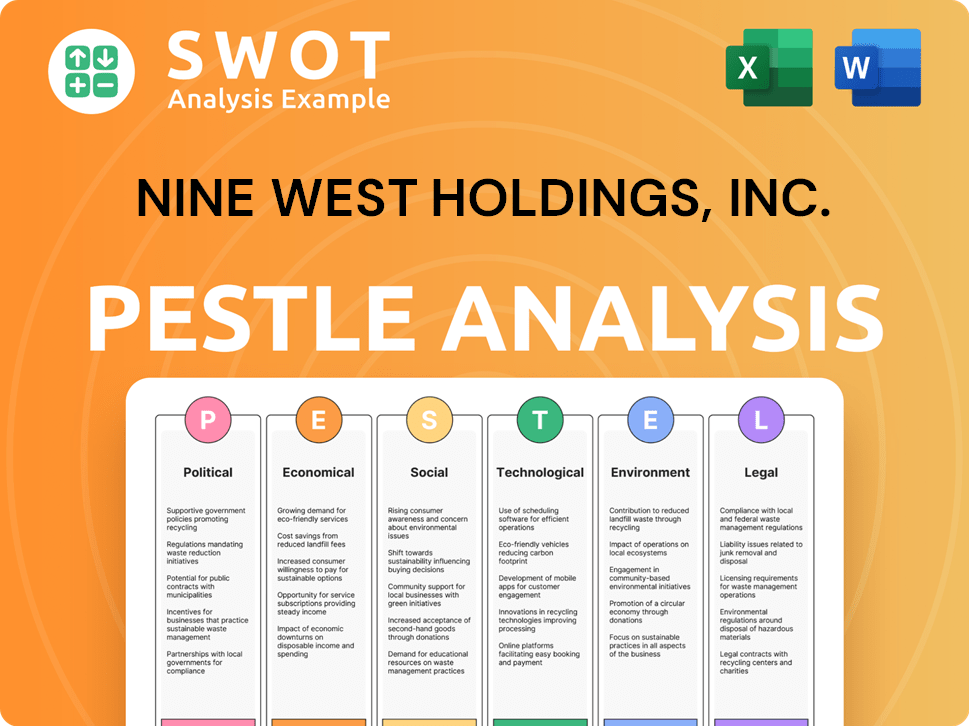

Nine West Holdings, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Nine West Holdings, Inc. history?

The Nine West Holdings, Inc. story is a mix of successes and setbacks, marked by strategic expansions, financial maneuvers, and significant legal battles. Key moments include its initial public offering and brand collaborations, but also encompass major acquisitions and a high-profile bankruptcy.

| Year | Milestone |

|---|---|

| 1993 | Nine West went public, experiencing a surge in revenues and profits. |

| 2006 | The company launched limited-edition 'capsule collections' in collaboration with designers like Vivienne Westwood. |

| 2009 | Nine West partnered with New Balance to develop a footwear collection. |

| 2014 | Sycamore Partners acquired Nine West through a leveraged buyout. |

| 2018 | Nine West Holdings filed for Chapter 11 bankruptcy. |

| 2019 | Nine West Holdings emerged from bankruptcy and rebranded as Premier Brands Group Holdings LLC. |

Nine West demonstrated innovation in footwear technology, securing patents related to shoe construction. These advancements included designs for sockliners and cushioned shoes, enhancing comfort and performance.

Nine West obtained patents related to shoe construction, indicating innovation in footwear technology. This included advancements in sockliners and cushioned shoe designs.

The brand engaged in collaborations with notable designers, creating limited-edition collections. These partnerships helped to diversify the brand's offerings and attract a wider audience.

Nine West expanded its brand portfolio through acquisitions and licensing agreements. This strategy aimed to broaden its market reach and product offerings.

The company established a significant global presence, with retail locations in numerous countries. This international expansion helped to increase brand visibility and sales.

Nine West developed its online presence through e-commerce platforms and social media marketing. This strategy aimed to reach a wider customer base and enhance brand engagement.

The brand diversified its product offerings beyond footwear, including apparel, jewelry, and jeanswear. This diversification helped to reduce reliance on a single product category and attract new customers.

Nine West faced legal and financial challenges, including an SEC investigation and an anti-trust suit. The leveraged buyout by Sycamore Partners in 2014 saddled the company with substantial debt, contributing to its eventual bankruptcy.

In 1997, the SEC launched an investigation into Nine West's accounting practices. This scrutiny added to the company's legal and financial difficulties.

Independent store owners filed an anti-trust suit against Nine West, alleging unfair pricing. This legal challenge further complicated the company's operations.

The leveraged buyout by Sycamore Partners in 2014 increased Nine West's debt significantly. This financial burden ultimately led to the company's bankruptcy filing.

Nine West Holdings filed for Chapter 11 bankruptcy in April 2018, burdened by over $1 billion in debt. The bankruptcy process involved contentious disputes with creditors.

Allegations of fraudulent transfers emerged during the bankruptcy proceedings. These claims suggested that valuable assets were sold to Sycamore affiliates at below fair market value.

The company's debt increased from $1 billion to $1.55 billion due to the leveraged buyout. This substantial debt load was a major factor in Nine West's financial struggles.

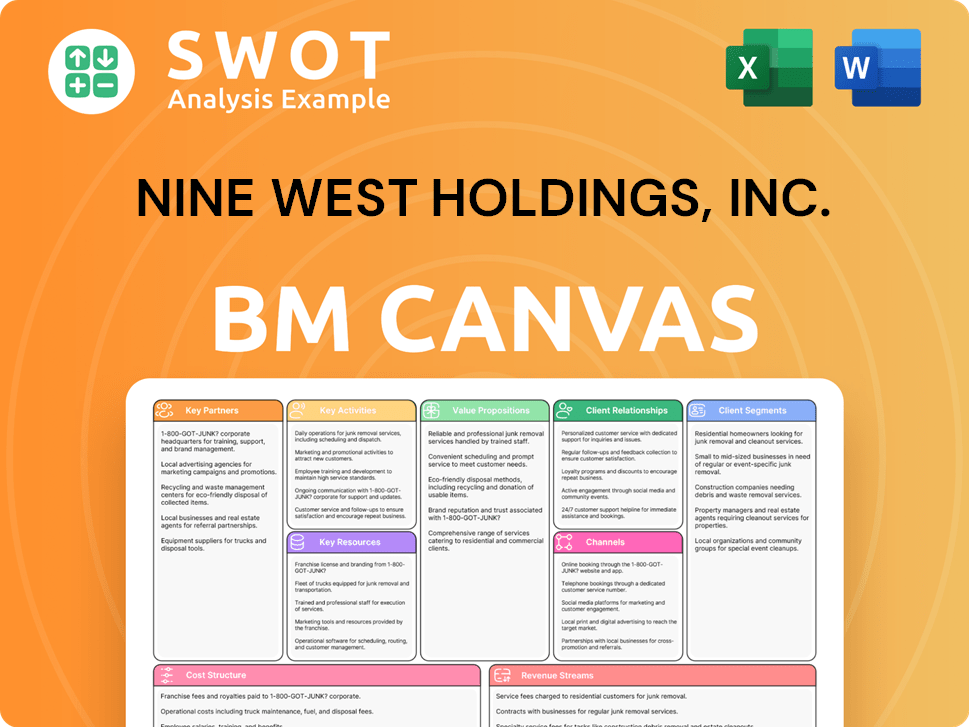

Nine West Holdings, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Nine West Holdings, Inc.?

The Owners & Shareholders of Nine West Holdings, Inc. experienced a significant journey, marked by strategic acquisitions, expansions, and financial challenges. The Nine West history began in 1970 with Sidney Kimmel's founding of the Jones Apparel Division. From its origins in the fashion industry to its evolution into a global brand, the Nine West company navigated various market shifts. Key moments include the opening of its first retail store in 1983 and its public offering in 1993. The story of Nine West Holdings is a dynamic narrative of growth, change, and adaptation within the competitive fashion landscape.

| Year | Key Event |

|---|---|

| 1970 | Sidney Kimmel founds the Jones Apparel Division. |

| 1978 | Nine West Holdings is founded. |

| 1983 | Nine West opens its first specialty retail store in Stamford, Connecticut. |

| 1993 | Nine West Group Inc. goes public on the New York Stock Exchange. |

| 1995 | Nine West acquires U.S. Shoe Corporation's footwear division, including the Easy Spirit brand. |

| 1999 | Nine West is acquired by Jones Apparel Group for $885 million. |

| 2013 | Sycamore Partners acquires The Jones Group for approximately US$2.2 billion. |

| 2018 | Nine West Holdings files for Chapter 11 bankruptcy. |

| 2018 | The Nine West and Bandolino footwear brands are sold to Authentic Brands Group for $340 million. |

| 2019 | Nine West Holdings emerges from Chapter 11 bankruptcy and rebrands as Premier Brands Group Holdings LLC. |

As of 2024-2025, the entity formerly known as Nine West Holdings operates as Premier Brands Group Holdings LLC. Its focus is now on its remaining profitable businesses, including One Jeanswear Group and Kasper Group. The company is strategically shifting away from mall-based retailing, emphasizing wholesale and licensing opportunities.

Post-bankruptcy, Premier Brands Group has over $100 million in liquidity. While specific analyst predictions are unavailable, the company aims for continued growth. The focus is on leveraging brand licenses and partnerships for expansion. The company is well-positioned with significantly reduced debt and interest costs.

The strategic shift involves a strong emphasis on wholesale and licensing, moving away from the earlier retail model. This change is a key part of the company's plan to ensure sustainable business operations. This new direction is designed to capitalize on market opportunities and build on its remaining brand assets.

Premier Brands Group plans to capitalize on the potential of its existing platforms through new brand licenses. The company is also focusing on both domestic and international partnerships to drive growth. The goal is to build on the success of its remaining profitable brands.

Nine West Holdings, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Nine West Holdings, Inc. Company?

- What is Growth Strategy and Future Prospects of Nine West Holdings, Inc. Company?

- How Does Nine West Holdings, Inc. Company Work?

- What is Sales and Marketing Strategy of Nine West Holdings, Inc. Company?

- What is Brief History of Nine West Holdings, Inc. Company?

- Who Owns Nine West Holdings, Inc. Company?

- What is Customer Demographics and Target Market of Nine West Holdings, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.