Nine West Holdings, Inc. Bundle

What Went Wrong at Nine West Holdings?

The fashion retail sector is a battlefield of shifting consumer tastes and fierce competition, making it crucial to understand the rise and fall of industry players. Examining the Nine West Holdings, Inc. SWOT Analysis offers a unique perspective on the challenges faced by a once-dominant brand. This deep dive into Nine West's competitive landscape explores the strategic missteps and external pressures that reshaped its destiny.

This market analysis provides a comprehensive industry overview, investigating Nine West's initial success and subsequent struggles. We'll dissect the competitive landscape, identifying Nine West's main rivals and analyzing its brand strategy within the fashion retail market. Understanding Nine West's financial performance and industry position offers invaluable insights for anyone seeking to navigate the complexities of the modern business environment, from identifying challenges and opportunities to understanding the impact of strategic decisions.

Where Does Nine West Holdings, Inc.’ Stand in the Current Market?

Prior to its 2018 bankruptcy, Nine West Holdings, Inc. was a significant player in the fashion footwear and apparel market. The company's core operations focused on designing, sourcing, and distributing women's shoes, apparel, and accessories under various brands. Its value proposition centered on offering fashionable, accessible products to a broad customer base.

The company's market position was once strong, especially in North America, with a wide retail network and wholesale channels. Nine West aimed to provide stylish options at competitive price points, catering to women seeking on-trend items. However, this position faced increasing pressure from evolving consumer preferences and the changing retail environment.

Over time, Nine West's market positioning faced challenges from fast-fashion retailers and online competitors. The company's financial performance reflected these difficulties, with significant debt and declining sales in certain segments. The once-dominant position of Nine West was eroding due to increased competition and shifts in consumer behavior. For more insights, explore the Growth Strategy of Nine West Holdings, Inc..

Nine West's market share declined as the retail landscape evolved. The rise of fast-fashion brands and online retailers intensified competition. Specific market share data for the final years is limited due to the company's private status.

North America was a key market for Nine West, with a strong retail presence. However, this region also saw intense competition from both established and emerging brands. The company's retail footprint was extensive, but faced challenges.

Nine West targeted a broad customer segment of women seeking fashionable and affordable footwear and apparel. The brand aimed to provide a balance of style and value. This target market was a key element of the company's strategy.

The company faced financial difficulties, including significant debt and declining sales in certain segments. These challenges contributed to the eventual bankruptcy filing in 2018. The financial performance reflected the pressures in the market.

The fashion retail industry saw significant shifts, including the rise of e-commerce and fast fashion. Consumer preferences moved towards more casual footwear options. Nine West had to adapt to these changes to remain competitive.

- Increased competition from online retailers.

- Growing demand for casual footwear.

- Changing consumer preferences and fashion trends.

- Financial pressures leading to restructuring.

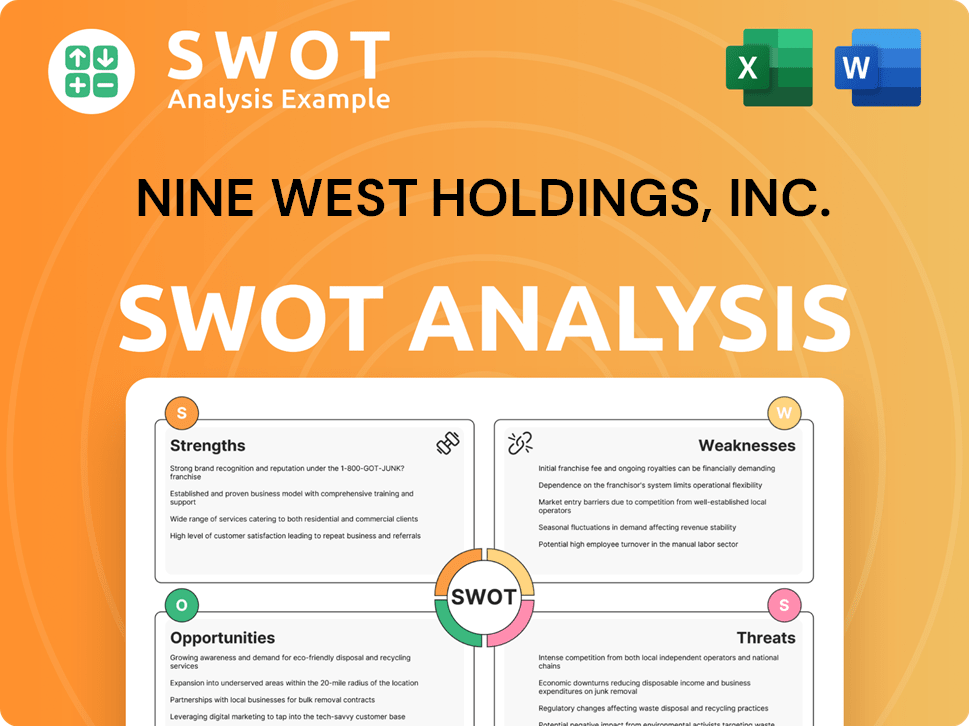

Nine West Holdings, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Nine West Holdings, Inc.?

The competitive landscape for Nine West Holdings, Inc. was complex, encompassing both direct and indirect rivals in the footwear, apparel, and accessories markets. Understanding this landscape is crucial for a thorough market analysis and assessing the company's industry position. Nine West faced a variety of challenges and opportunities shaped by the actions of its competitors and broader market trends.

Key to understanding Nine West's position is recognizing the diverse nature of its competition. The company's business model and brand strategy were constantly tested by the actions of its rivals, necessitating a keen awareness of market dynamics. Analyzing the competitive landscape provides insights into Nine West's strengths, weaknesses, and potential future outlook.

Nine West Holdings, Inc. faced a diverse array of direct and indirect competitors across the footwear, apparel, and accessories sectors. In the footwear segment, key direct competitors included established brands such as Aldo, Steve Madden, and Sam Edelman, all vying for market share in the women's fashion footwear space. These competitors often challenged Nine West through aggressive marketing, rapid trend adoption, and diverse product offerings. For instance, Steve Madden, known for its trendy designs and strong retail partnerships, often captured a similar demographic.

Direct competitors included brands like Aldo, Steve Madden, and Sam Edelman. These brands directly competed with Nine West for market share in the women's fashion footwear space. They often challenged Nine West through marketing and product offerings.

Indirect competitors included department stores' private labels and mass-market retailers such as DSW and Nordstrom Rack. These retailers offered a wide selection of brands at competitive price points. The rise of e-commerce platforms also introduced new competitive pressures.

E-commerce platforms and online retailers added to the competitive pressures. Smaller, agile brands could reach consumers directly. Fast-fashion retailers like Zara and H&M intensified competition by bringing new styles to market quickly.

Mergers and alliances in the retail sector influenced competitive dynamics. Consolidation created larger, more formidable entities. These changes impacted Nine West's ability to maintain its market position.

Beyond direct brand-to-brand competition, Nine West also contended with department stores' private labels and mass-market retailers like DSW and Nordstrom Rack, which offered a wide selection of brands at competitive price points. In the broader apparel and accessories market, the competitive landscape was even more fragmented, with numerous national and international brands. The rise of e-commerce platforms and online retailers also introduced new competitive pressures, allowing smaller, agile brands to reach consumers directly. The increasing prevalence of fast-fashion retailers, such as Zara and H&M, further intensified competition by rapidly bringing new styles to market at lower price points, challenging Nine West's traditional design and production cycles. The impact of mergers and alliances, such as the consolidation of retail groups, also influenced competitive dynamics, creating larger, more formidable entities. For more insights into the company's strategic direction, see Growth Strategy of Nine West Holdings, Inc..

Several factors influenced the competitive dynamics within the fashion retail sector, impacting Nine West's market position. These factors included brand recognition, pricing strategies, product innovation, and distribution networks.

- Brand Recognition: Established brands often had an advantage due to consumer loyalty.

- Pricing Strategies: Competitive pricing was crucial to attract consumers.

- Product Innovation: The ability to quickly adapt to fashion trends was vital.

- Distribution Networks: Retail presence and e-commerce capabilities were essential.

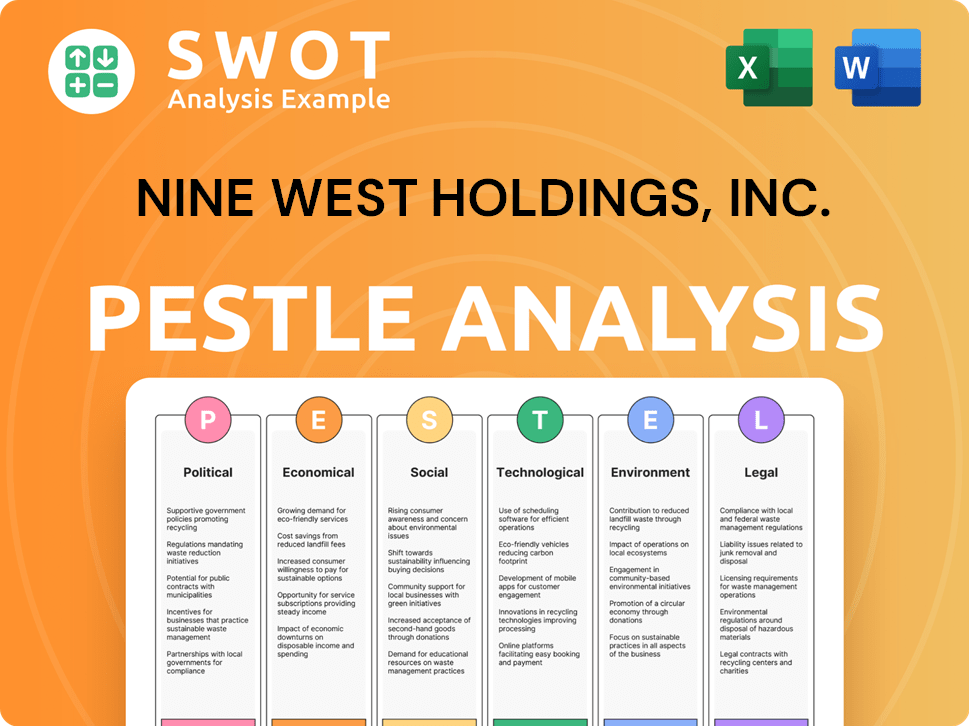

Nine West Holdings, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Nine West Holdings, Inc. a Competitive Edge Over Its Rivals?

Historically, the competitive advantages of Nine West Holdings, Inc. stemmed from its strong brand recognition, extensive distribution network, and ability to quickly adapt to fashion trends. The brand's established presence, built over many years, fostered consumer trust and repeat business. Furthermore, a broad distribution network, encompassing retail stores, department store concessions, and wholesale accounts, allowed the company to reach a wide customer base across various retail channels.

This extensive reach was a significant barrier to entry for smaller competitors. Nine West also leveraged its design capabilities to quickly translate runway trends into commercial footwear and apparel, offering fashionable options at a more accessible price point than high-end designers. However, these advantages faced increasing threats. The rise of digital-native brands and the shift to online shopping diminished the unique value of a vast physical retail footprint.

Moreover, the speed of fast fashion challenged Nine West's ability to remain at the forefront of trends. While the company held intellectual property in its designs, rapid imitation in the fashion industry often made it difficult to sustain a long-term advantage solely based on product aesthetics. The sustainability of these advantages was continually tested by evolving consumer behavior and a highly dynamic retail environment.

The Nine West brand enjoyed significant recognition among consumers, built through decades of consistent marketing and product availability. This recognition translated into brand loyalty and repeat business. However, maintaining this brand equity in a rapidly changing market requires continuous investment in marketing and product innovation.

Nine West's broad distribution network, including retail stores, department store concessions, and wholesale accounts, provided wide market access. This extensive reach was a barrier to entry for smaller competitors. The ability to reach customers through various channels was a key competitive advantage.

The company's ability to quickly translate runway trends into commercial footwear and apparel was a key advantage. Offering fashionable options at affordable prices attracted a broad customer base. This strategy allowed Nine West to compete effectively against both high-end designers and fast-fashion retailers.

Nine West held intellectual property in its designs, which provided some protection against immediate imitation. However, the fast-paced nature of the fashion industry meant that this advantage was often short-lived. Continuous innovation and new designs were essential to maintain a competitive edge.

The competitive advantages of Nine West Holdings, Inc. faced several challenges. The rise of digital-native brands and the shift to online shopping diminished the unique value of a vast physical retail footprint. Fast fashion also challenged the company's ability to stay ahead of trends. For a deeper dive, check out this detailed Nine West Holdings market analysis.

- Increased competition from online retailers and fast-fashion brands.

- Changing consumer preferences and shopping habits.

- The need for continuous innovation and adaptation to maintain relevance.

- Maintaining brand equity in a dynamic market.

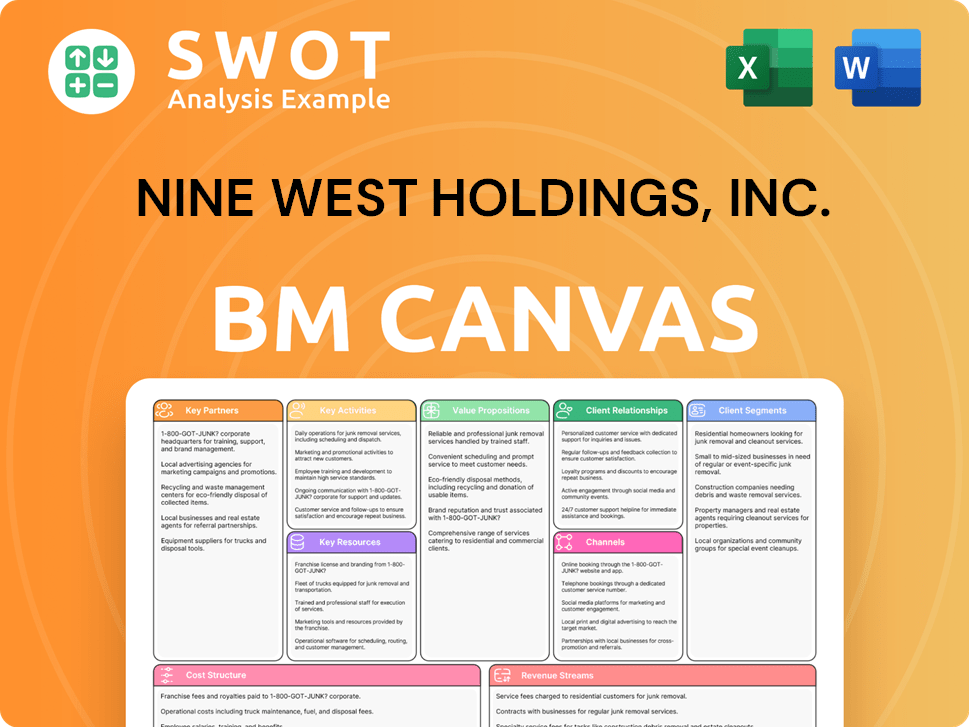

Nine West Holdings, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Nine West Holdings, Inc.’s Competitive Landscape?

The fashion retail sector, where entities like those that acquired parts of the former Nine West Holdings, Inc., operate, is experiencing significant shifts. These changes are driven by technological advancements, evolving consumer preferences, and a growing emphasis on sustainability. Understanding these trends is crucial for any company aiming to maintain a competitive edge and achieve long-term success in the Nine West Holdings competitive landscape.

The industry faces challenges such as rapid changes in consumer tastes, the need for flexible supply chains, and increased competition from online retailers. However, these challenges also present opportunities for innovation and growth. Companies that can adapt to these trends are better positioned to succeed in this dynamic market, making a thorough market analysis essential.

E-commerce and digital marketing continue to reshape the fashion industry, with online sales significantly increasing. Sustainability and ethical production practices are becoming increasingly important to consumers, influencing purchasing decisions. There is a growing demand for comfortable, versatile apparel and footwear, impacting traditional product categories.

Rapid changes in consumer preferences require companies to be agile and responsive. Supply chain disruptions and the need for flexible operations pose significant operational challenges. Increased regulatory scrutiny and compliance costs related to labor practices and environmental impact could increase. The competitive landscape is intensifying with the rise of direct-to-consumer brands and online marketplaces.

Data analytics and AI offer opportunities to understand consumer behavior better and personalize offerings. Investing in sustainable materials and transparent supply chains can enhance brand reputation. Emerging markets with growing middle classes provide expansion opportunities. Strategic partnerships and product innovation can drive growth.

Companies must leverage data analytics to understand consumer behavior and tailor offerings. They should invest in sustainable materials and ethical supply chains. Expanding into emerging markets with growing economies is crucial. Building a strong digital presence and focusing on product innovation are key.

To thrive in the Nine West competitive landscape, businesses need to adopt several key strategies. This includes prioritizing digital transformation, emphasizing sustainability, and fostering innovation.

- Digital Transformation: Enhance e-commerce platforms and digital marketing strategies to reach consumers effectively. In 2024, e-commerce sales in the apparel and footwear market reached approximately $450 billion.

- Sustainability: Adopt sustainable materials and transparent supply chains to appeal to environmentally conscious consumers. The global market for sustainable fashion is projected to reach over $9.81 billion by 2025.

- Innovation: Focus on product innovation, particularly in comfort and versatility, to meet evolving consumer demands. The athleisure market, for example, continues to grow, with an estimated value of $350 billion in 2024.

- Market Expansion: Explore opportunities in emerging markets with rising disposable incomes. The Asia-Pacific region is expected to see significant growth in the fashion retail sector.

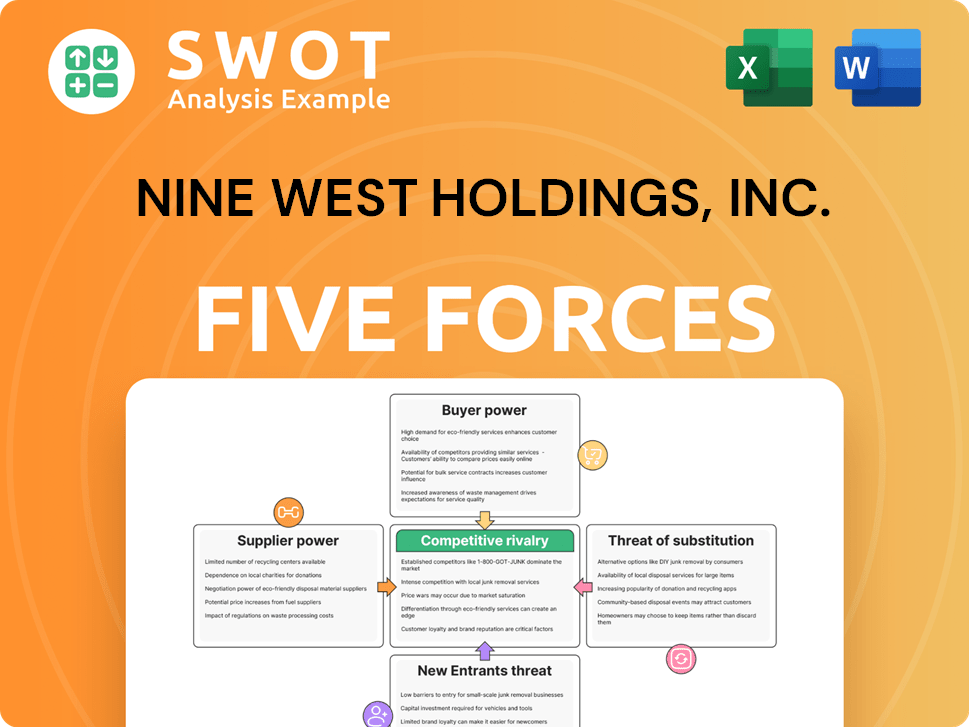

Nine West Holdings, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nine West Holdings, Inc. Company?

- What is Growth Strategy and Future Prospects of Nine West Holdings, Inc. Company?

- How Does Nine West Holdings, Inc. Company Work?

- What is Sales and Marketing Strategy of Nine West Holdings, Inc. Company?

- What is Brief History of Nine West Holdings, Inc. Company?

- Who Owns Nine West Holdings, Inc. Company?

- What is Customer Demographics and Target Market of Nine West Holdings, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.