Pennant Bundle

How Did the Pennant Company Rise to Healthcare Prominence?

Established in 2019, the Pennant Group has rapidly become a key player in post-acute healthcare. This American company, headquartered in Idaho, quickly expanded its reach across 13 states. Its journey reveals a compelling Pennant SWOT Analysis of strategic growth and innovation in a vital sector.

This brief history explores the Pennant Company's early years and significant events. From its initial vision of patient-centered care to its current market capitalization, understanding the Pennant Company timeline is crucial. Discover how this company has made a lasting impact on the industry and its innovative business model.

What is the Pennant Founding Story?

The Pennant Company history began in 2019. This American company emerged from a spin-off of Ensign Group. The formation of the company was driven by a shared vision among professionals.

The founders aimed to enhance healthcare services. Their focus was on providing high-quality, patient-centered care. They targeted home health, hospice, and senior living segments.

The initial challenge was addressing the need for improved care in underserved markets. The company's early years were marked by a commitment to a decentralized operational model. This approach empowered local leaders to manage agencies and tailor services to local needs.

The Pennant Company was incorporated in 2019 as a spin-off from Ensign Group. The company's roots trace back to a shared vision among professionals to enhance healthcare services.

- The company identified a need for high-quality, patient-centered care.

- The initial services offered included home health, hospice, and senior living solutions.

- The business model was built on a decentralized approach, empowering local leaders.

- The operating model emphasizes leadership development.

The Pennant Company business model focused on a decentralized approach. This model gave local leaders autonomy. The company offered home health, hospice, and senior living solutions. This included assisted living, independent living, and memory care. The operating model emphasized leadership development and opportunities for local leaders to become owners.

The spin-off from Ensign Group in 2019 provided a strong foundation. It also offered a proven playbook for scaling healthcare firms. This included expertise in financial engineering and operational integration. The company's structure allowed for effective growth and integration of new operations. The unique approach has been crucial for its expansion.

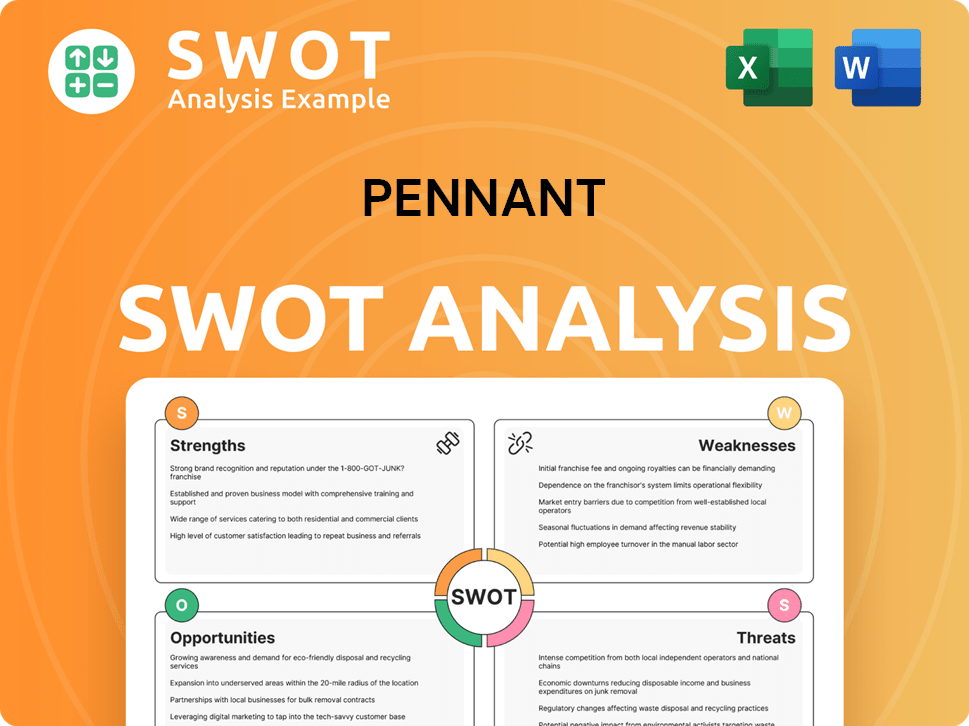

Pennant SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Pennant?

The Pennant Company's early years have been marked by significant growth and expansion. Since its incorporation in 2019, the company has rapidly increased its operational footprint and service offerings. This growth strategy has involved both organic expansion and strategic acquisitions, demonstrating a clear path for the company's development. By Q1 2025, the company had a substantial presence across multiple states.

By the end of the first quarter of 2025, the company's footprint included 137 home health, hospice, and home care agencies. It also had 60 senior living communities across 12 states. This represents a significant increase from December 31, 2021, when the company operated 88 home health and hospice agencies and 54 senior living communities.

Key developments included the successful integration of newly acquired operations. This includes assets like Signature Healthcare at Home in Oregon, Idaho, and Washington. The Oregon acquisition was finalized on January 1, 2025. Since the start of 2024, there have been 36 new acquisitions, expanding the company's reach in the Pacific Northwest and other regions.

In the first quarter of 2025, the company expanded its senior living portfolio. This involved adding three senior living communities and entering new triple-net lease agreements comprising 188 units. This included the acquisition of a 128-unit senior living community in Arizona and three properties in Idaho and Texas.

Total revenue surged 33.7% year-over-year to $209.8 million in Q1 2025. The home health and hospice segment, accounting for 76.1% of total revenue, saw a 37.2% increase to $159.9 million. The senior living segment grew by 23.6% to $50.0 million. Adjusted EBITDA increased by 45.9% to $16.4 million.

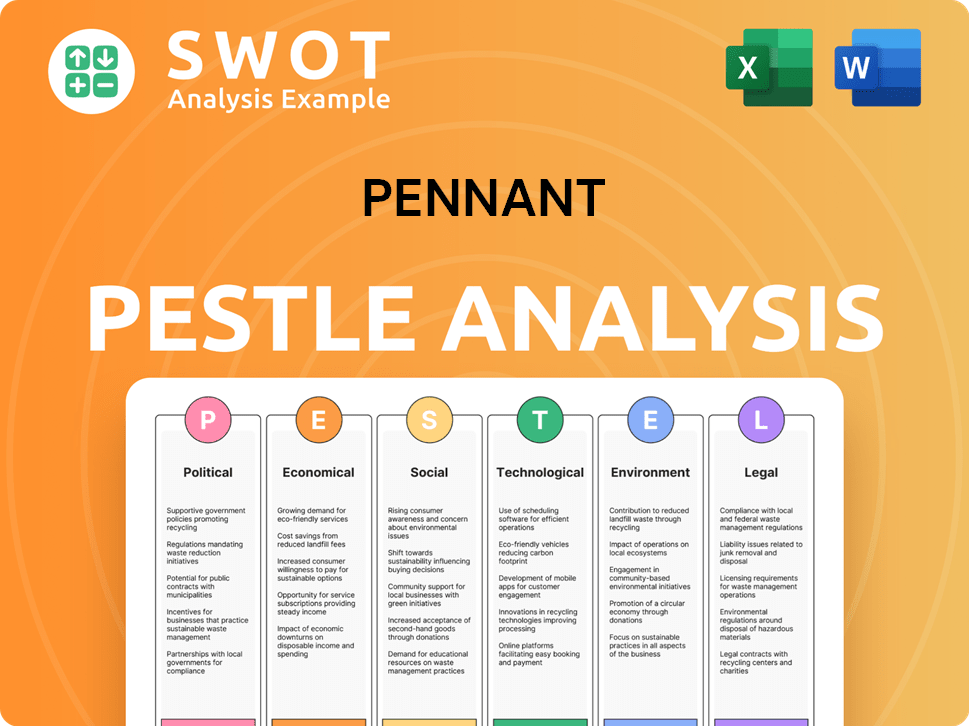

Pennant PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Pennant history?

The Pennant Company history is marked by significant growth and strategic acquisitions, establishing it as a key player in the healthcare sector. The company's journey includes notable expansions and a focus on operational excellence, contributing to its current market position.

| Year | Milestone |

|---|---|

| 2019 | Spin-off from Ensign Group, marking the beginning of its independent operations. |

| Jan 2025 | Acquisition of Signature Healthcare at Home's hospice and home health assets for $80 million, expanding its services. |

| Q1 2025 | Operates 137 home health/hospice agencies and 60 senior living communities, demonstrating significant expansion. |

| May 2025 | Appointment of Suzanne Snapper to the board, signaling strategic moves to accelerate M&A activity. |

A key innovation for the

This model allows local leaders to make decisions, promoting efficiency and responsiveness. This structure supports the integration of acquired operations, driving both financial and clinical success.

The company has a history of acquiring businesses to expand its reach and service offerings. The acquisition of Signature Healthcare at Home's assets is a prime example of this strategy.

The company emphasizes operational efficiency to maintain high-quality care and financial performance. This includes maintaining a 4.1-star CMS rating in home health.

Despite its growth,

Changes in healthcare reimbursement policies can impact revenue and profitability. The company must navigate these risks to maintain financial stability.

Rising labor costs are a significant challenge in the healthcare industry, affecting operational expenses. The company must manage these costs effectively.

The company’s debt-to-EBITDA ratio rose to approximately 3.2x in Q1 2025, and operating cash flow decreased. These factors require careful financial management.

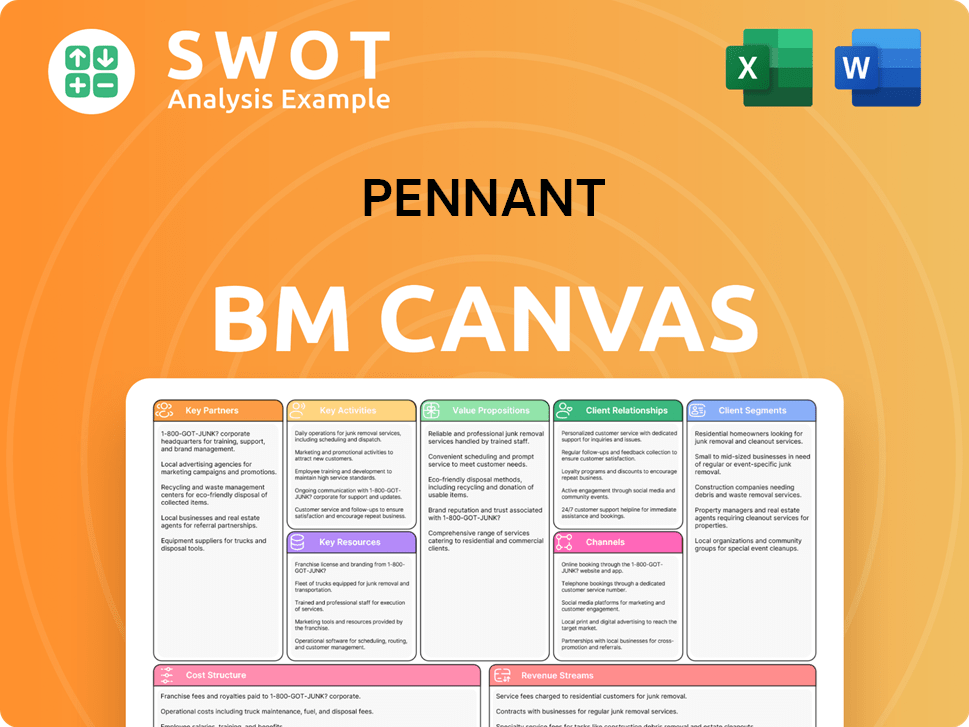

Pennant Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Pennant?

The Pennant Company history is relatively concise, marked by strategic growth and expansions. Incorporated in 2019, the company quickly expanded its footprint through acquisitions and organic growth, demonstrating a commitment to providing home health and senior care services. The company's timeline reflects a focused strategy on increasing its service offerings and geographic reach, positioning it for sustained growth in the healthcare sector.

| Year | Key Event |

|---|---|

| 2019 | The Pennant Group, Inc. was incorporated, spinning off from Ensign Group. |

| 2023 (Q3) | The Company operated 79 home health and hospice agencies and 54 senior living communities. |

| 2024 (Full Year) | Total revenue reached $695.2 million, a 27.6% increase over 2023, with Adjusted EBITDA at $53.3 million, up 30.9% year-over-year. |

| August 1, 2024 | Pennant completed acquisition of Signature Healthcare's Idaho and Washington assets. |

| January 1, 2025 | Pennant finalized the acquisition of Signature Healthcare at Home assets in Oregon, adding seven locations. |

| February 1, 2025 | Acquisition of three senior living facilities in Idaho and Texas, adding 188 units. |

| February 27, 2025 | Pennant released its fourth quarter and full year 2024 financial results. |

| April 1, 2025 | Acquisition of a 128-unit senior living community in Arizona. |

| May 6, 2025 | Pennant reports First Quarter 2025 results, with revenue of $209.8 million (up 33.7% YoY) and adjusted diluted EPS of $0.27 (up 35% YoY). |

| May 7, 2025 | Pennant Group holds its First Quarter 2025 Earnings Call. |

| May 16, 2025 | The Pennant Group appoints Suzanne Snapper as Director. |

| Q1 2025 End | Company footprint includes 137 home health, hospice, and home care agencies, and 60 senior living communities across 12 states. |

The company anticipates continued positive momentum in 2025. Management projects total revenue between $800.0 million and $865.0 million. Full-year 2025 adjusted EPS is anticipated to be between $1.03 and $1.11, reflecting confidence in growth.

Pennant plans to ramp up acquisitions later in 2025, evaluating opportunities including assets from the UnitedHealth Group/Amedisys transaction. They focus on leadership development and clinical excellence. The company aims to improve occupancy and margin in its senior living segment.

Pennant is well-positioned to capitalize on the increasing demand for home health and senior care services. This is driven by an expanding elderly population. The company's decentralized model and focus on local leadership support its growth strategy.

The company's forward-looking statements align with its vision of delivering high-quality, patient-centered healthcare. Pennant aims to expand its reach in underserved markets. The company's focus remains on both organic growth and strategic acquisitions.

Pennant Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Pennant Company?

- What is Growth Strategy and Future Prospects of Pennant Company?

- How Does Pennant Company Work?

- What is Sales and Marketing Strategy of Pennant Company?

- What is Brief History of Pennant Company?

- Who Owns Pennant Company?

- What is Customer Demographics and Target Market of Pennant Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.