Pennant Bundle

Can Pennant Company Sustain Its Impressive Growth?

Launched in 2019, The Pennant Group has quickly become a major player in post-acute healthcare, but how does it stack up against the competition? With a staggering 27.6% revenue increase in 2024 and projections soaring for 2025, understanding the Pennant SWOT Analysis and its competitive arena is crucial. This in-depth analysis explores the Pennant Company Competitive Landscape, offering critical insights for investors and strategists alike.

This comprehensive Pennant Company Market Analysis will dissect the company's strategic moves, pinpoint its main Pennant Company Competitors, and assess its market positioning. We'll delve into the Pennant Company Industry trends and evaluate its Pennant Company Business Strategy, providing a thorough Competitive Analysis to inform your investment decisions and business planning.

Where Does Pennant’ Stand in the Current Market?

The Pennant Group has established a strong market position within the healthcare services sector, focusing on home health, hospice, and senior living. A detailed Pennant Company Market Analysis reveals its strategic approach to providing care. The company's operational model emphasizes local leadership and clinical excellence, which has contributed to its financial success and market standing.

Pennant's business model is centered on a decentralized structure that empowers local leaders. This approach supports high-quality care and operational efficiency. The company's focus on underserved markets and adaptability to changing market dynamics has been key to its success.

In Q1 2025, Pennant's total revenue reached $209.8 million, marking a 33.7% year-over-year increase. The home health and hospice segment was the primary driver of this growth, contributing 76% of total revenue, with a 37.2% year-over-year increase to $159.9 million. The senior living segment also saw growth, increasing 14.2% in Q1 2024 and 23.6% in Q1 2025.

Pennant operates 123 home health and hospice agencies and 57 senior living communities across 13 states, primarily in the Western U.S. The company's strategic expansion includes acquisitions and joint ventures, such as the expansion into Utah's senior living market and the joint venture with John Muir Health in California. These moves contribute to a broader operational reach.

Pennant maintains a 4.1-star CMS rating for its home health operations, significantly above the industry average of three stars. The company also boasts a low potentially preventable hospitalization rate of 8.7%, well below the industry average of 10%. These metrics highlight Pennant's focus on delivering high-quality care and operational efficiency.

Recent acquisitions, including the addition of Signature Healthcare at Home assets, have expanded Pennant's operational footprint. Pennant's ability to adapt to changing market needs, including diversifying payer sources, has allowed it to thrive in a volatile market. A key aspect of their strategy is focusing on underserved markets.

While Pennant is a significant player in home health, it operates at a smaller scale compared to some larger public competitors. However, its focus on underserved markets and its ability to adapt to market changes provide a competitive edge. The company's decentralized model and emphasis on clinical excellence contribute to its financial health and market position. Learn more about the Marketing Strategy of Pennant.

- Strong Revenue Growth: Demonstrated significant year-over-year revenue increases, particularly in home health and hospice.

- High-Quality Care: Maintains a 4.1-star CMS rating, exceeding industry averages.

- Strategic Acquisitions: Expanding its operational footprint through acquisitions and joint ventures.

- Market Adaptability: Successfully navigating market volatility by diversifying payer sources.

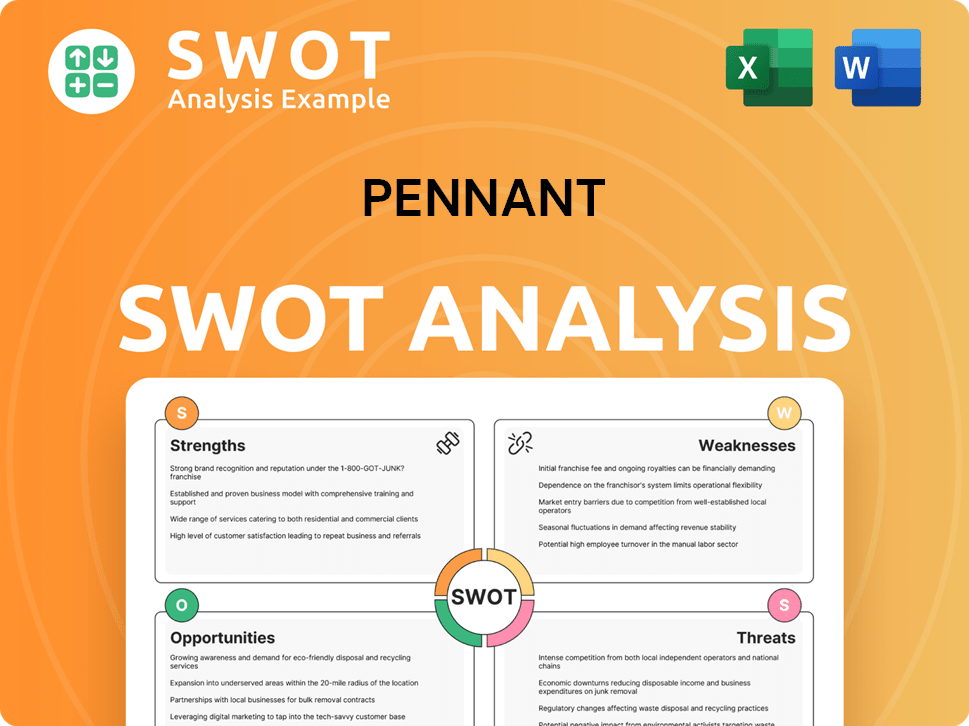

Pennant SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Pennant?

The healthcare services market, where The Pennant Group operates, is highly competitive. The company faces both regional and national rivals in its home health, hospice, and senior living segments. Understanding the Pennant Company Competitive Landscape is crucial for assessing its market position and strategic challenges.

A thorough Pennant Company Market Analysis reveals the dynamics of this competitive environment. This analysis considers the various players, their market shares, and the strategies they employ. The competitive landscape is continuously evolving, with mergers, acquisitions, and technological advancements reshaping the industry.

To conduct a Competitive Analysis, it's important to identify the key players and their strengths and weaknesses. This includes evaluating their financial performance, market reach, and innovative capabilities. This detailed analysis helps in understanding the competitive advantages and challenges faced by The Pennant Group.

Key direct competitors include large national providers. These companies often challenge The Pennant Group through economies of scale and broader geographic reach.

The company also faces competition from regional players. These competitors may have a strong local presence and deep understanding of regional market dynamics.

The market includes a fragmented segment of independent home care providers. This segment adds complexity to the competitive landscape.

New and emerging players, especially those leveraging advanced technology, also pose a challenge. These companies often bring innovative business models to the market.

Mergers and alliances significantly alter competitive dynamics. These strategic moves can reshape the market and impact the competitive landscape.

The Pennant Group itself has engaged in acquisitions to expand its reach. These acquisitions are a part of its business strategy to integrate new operations.

The Pennant Company Industry is subject to various trends and disruptions. For instance, the home healthcare, hospice, and senior living space saw significant consolidation in Q1 2025. This consolidation, along with the entry of new players, impacts the competitive dynamics. The company's ability to navigate these challenges and capitalize on growth opportunities is critical. To understand the company's performance, it's important to review its financial performance compared to rivals and consider its strategic partnerships and alliances. Further insights can be found in this article about Owners & Shareholders of Pennant.

The Pennant Company's Competitors include several large national providers. These competitors often have a significant market share and established brand recognition. The fragmented market also presents a challenge due to the large number of independent providers.

- Amedisys, Inc. reported $2.3 billion in revenue in 2023.

- LHC Group, Inc. (now part of UnitedHealth Group's Optum) reported $1.9 billion in revenue in 2023.

- Kindred Healthcare reported $1.6 billion in revenue in 2023.

- Genesis HealthCare reported $1.1 billion in revenue in 2023.

- Other notable competitors include Upward Health, Addus HomeCare, and Envision Healthcare.

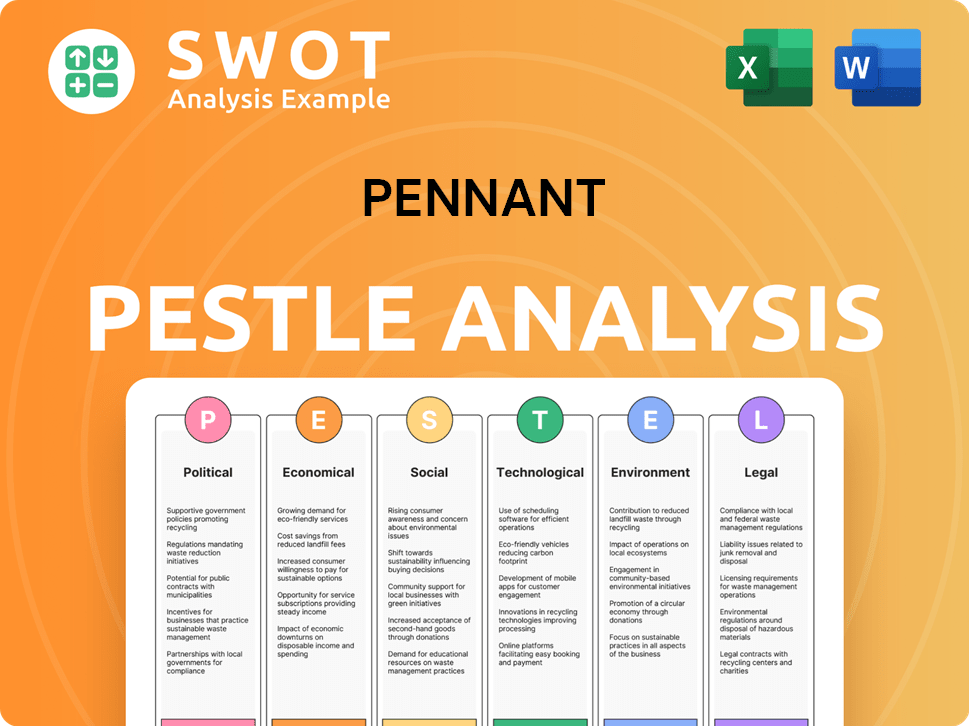

Pennant PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Pennant a Competitive Edge Over Its Rivals?

The Pennant Group's competitive advantages stem from its unique operational approach and strategic focus within the healthcare industry. They have cultivated a decentralized operating model, empowering local leaders, and have an integrated service offering. This approach allows for coordinated care across home health, hospice, and senior living communities. This structure enables the company to adapt quickly to market changes and patient needs.

A key element of their strategy involves acquiring underperforming properties and turning them around through local leadership. This focus, combined with a strong balance sheet, positions the company well for future acquisitions. The company's commitment to clinical excellence, as evidenced by its high CMS ratings, sets it apart. This approach makes them an attractive partner for hospital systems and payers.

The company's financial performance, marked by consistent revenue and EBITDA growth, underscores the effectiveness of its operational strategies. This financial health supports the company's ability to invest in growth and maintain a competitive edge. This is especially important in a market where understanding the Pennant Company Competitive Landscape is critical for investors and industry analysts.

The decentralized model allows local leaders to make decisions, fostering adaptability. This autonomy is supported by a robust leadership development program. In 2024, the company added over 60 local agency leaders to its CEO training program and launched a clinical leadership training initiative with 40 participants.

Pennant offers home health, hospice, and senior living services across 13 states. This integrated approach facilitates coordinated care and seamless transitions for patients. This comprehensive network helps reduce hospitalizations, supporting overall patient well-being.

The company's home health operations maintain a 4.1-star CMS rating, exceeding the industry average. They also have a low potentially preventable hospitalization rate. These factors contribute to their reputation for high-quality care and improved patient outcomes.

Pennant focuses on acquiring underperforming properties and turning them around. This strategy allows them to unlock significant value through operational improvements. The company's strong financial position supports its acquisition strategy.

Pennant's competitive advantages are rooted in its operational model, integrated services, and strategic approach to acquisitions. These strengths enable the company to navigate the market effectively. Understanding these advantages is crucial for a thorough Pennant Company Market Analysis.

- Decentralized operating model for adaptability.

- Integrated services for coordinated patient care.

- Focus on acquiring and improving underperforming properties.

- Strong balance sheet supporting growth initiatives.

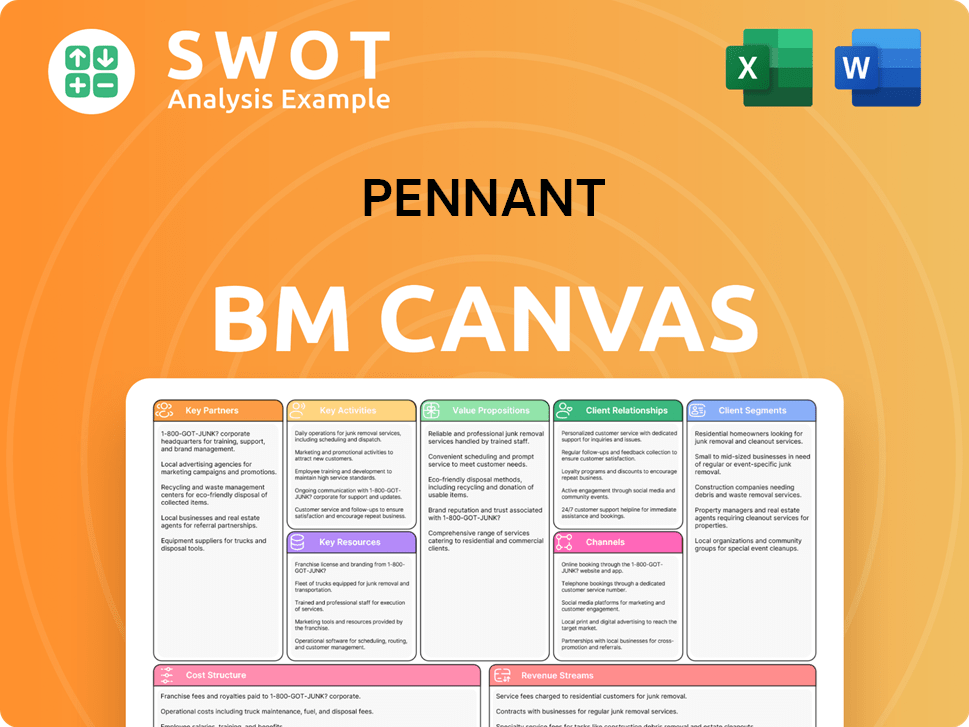

Pennant Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Pennant’s Competitive Landscape?

The healthcare industry's competitive landscape is currently shaped by several significant trends, presenting both challenges and opportunities for The Pennant Group. Technological advancements, particularly in telehealth and remote patient monitoring, are transforming care delivery. Pennant can enhance its services through AI-powered health monitoring systems and integrated electronic health record platforms. The increasing adoption of value-based care models and Medicare Advantage penetration also presents opportunities for strategic diversification.

A primary challenge facing Pennant, and the healthcare sector as a whole, is labor inflation, especially within the Senior Living and Home Health segments, which could impact profitability. The integration of recent acquisitions, while a growth driver, also presents operational challenges. Market volatility and broader economic uncertainties could affect future performance. The competitive landscape remains dynamic, with ongoing consolidation in the home health, hospice, and senior living space.

Technological advancements in telehealth and remote patient monitoring are changing care delivery. Value-based care models and Medicare Advantage are gaining traction. Consolidation within the home health, hospice, and senior living sectors is ongoing.

Labor inflation, especially in Senior Living and Home Health, poses a profitability risk. Integrating acquisitions presents operational challenges. Market volatility and economic uncertainties could impact future performance.

Pennant can leverage technology for enhanced services. The shift towards value-based payments is a strategic advantage. Strategic acquisitions in underserved markets can unlock value and expand the company's footprint.

Pennant's decentralized model and leadership pipeline support effective integration and organic growth. The focus on clinical excellence and operational efficiencies, such as reducing home health visits while maintaining high CMS ratings, will be crucial.

Despite these challenges, The Pennant Group is positioned for growth. The company anticipates full-year 2025 revenue between $800 million and $865 million, with adjusted EPS between $1.03 and $1.11. Pennant is actively pursuing strategic acquisitions and focusing on clinical excellence to maintain a competitive edge.

- The company's decentralized model supports effective integration and organic growth.

- Strategic acquisitions, particularly in underserved markets, are a key focus.

- Focus on clinical excellence, patient satisfaction, and operational efficiencies is crucial.

- The aging population drives market growth.

For a deeper dive into Pennant's target market, consider reading this article about the Target Market of Pennant. This provides additional insights into the company's strategic positioning.

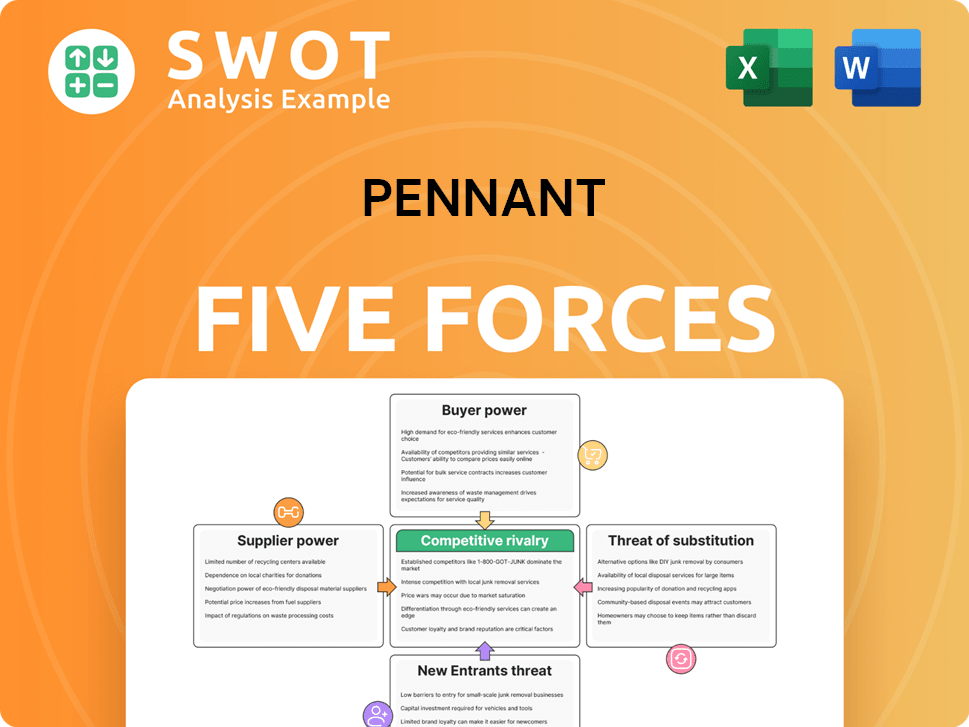

Pennant Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pennant Company?

- What is Growth Strategy and Future Prospects of Pennant Company?

- How Does Pennant Company Work?

- What is Sales and Marketing Strategy of Pennant Company?

- What is Brief History of Pennant Company?

- Who Owns Pennant Company?

- What is Customer Demographics and Target Market of Pennant Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.