Ping An Insurance Group Bundle

How Did Ping An Insurance Become a Global Financial Powerhouse?

Dive into the Ping An Insurance Group SWOT Analysis to understand its trajectory. From its inception in Shenzhen to its current global presence, Ping An's story is one of remarkable transformation. Discover how this Chinese insurance company leveraged technology and strategic diversification to redefine the financial services landscape.

The brief history of Ping An Insurance Group reveals a fascinating journey of growth and innovation within the insurance industry development in China. Founded in 1988, Ping An's early years were marked by a vision to modernize insurance services in a rapidly evolving market. This strategic foresight, combined with a commitment to technological advancement, propelled Ping An from its origins to its current status as a financial services giant, making it a key player in financial services China.

What is the Ping An Insurance Group Founding Story?

The founding story of Ping An Insurance of China is rooted in the economic reforms of China during the late 1980s. The company was established to introduce modern insurance practices to support the growing market economy. The vision of its founder, Ma Mingzhe, was to fill the gap in financial protection and services for both individuals and businesses.

Ping An Group was officially founded on May 27, 1988, in Shekou, Shenzhen. The initial focus was on property and casualty insurance. The name 'Ping An,' meaning 'safe and sound,' reflected its core promise of security and stability to its customers. Initial funding came from state-owned enterprises and local government entities.

The cultural and economic environment of Shenzhen, a special economic zone, provided a favorable environment for a market-oriented financial institution like Ping An Insurance to take root and grow. The company's early success set the stage for its future expansion and diversification into a broad range of financial services.

The early years of Ping An were marked by strategic decisions and rapid growth within the evolving Chinese market. This period laid the foundation for its future success as a leading Chinese insurance company.

- 1988: Ping An Insurance Company of China is founded in Shenzhen.

- Early Products: Primarily property and casualty insurance products were offered.

- Funding: Initial funding was provided by state-owned enterprises and local government.

- Market Focus: Catering to the needs of businesses and individuals in the special economic zone.

For further insights into the business model and revenue streams, you can explore the business model of Ping An Insurance Group.

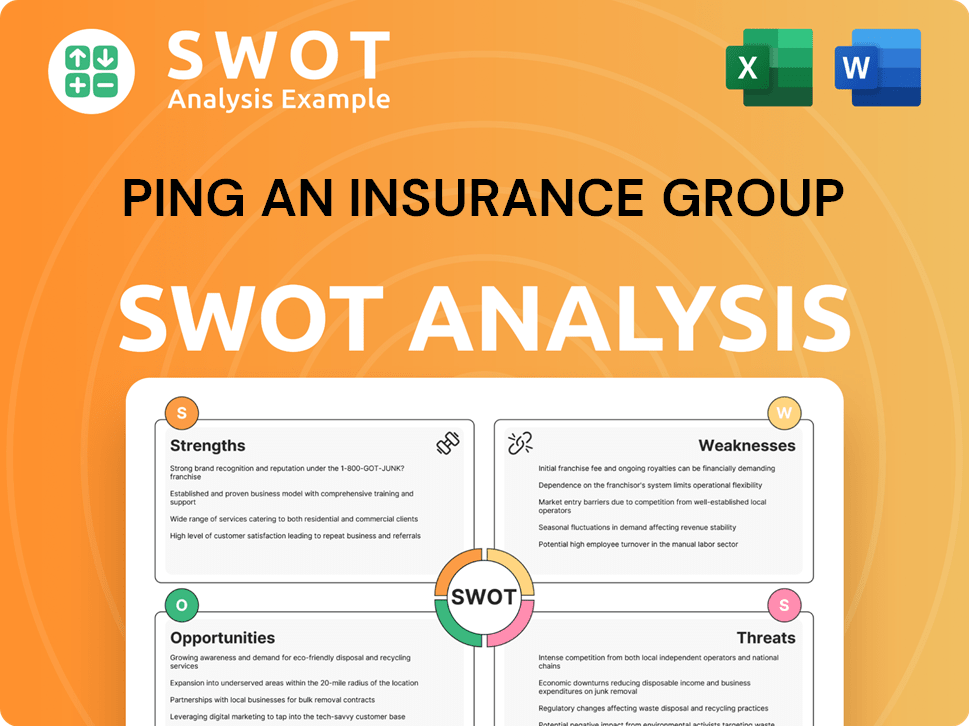

Ping An Insurance Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Ping An Insurance Group?

The early growth of Ping An Insurance Group was marked by strategic expansion within China's evolving financial landscape. Following its establishment, the company quickly broadened its product offerings, moving beyond property and casualty insurance to include life insurance in the early 1990s. This diversification was a key factor in its early success, allowing it to tap into the growing demand for personal financial protection. By 1994, the company had already begun establishing a nationwide presence, opening branches in major cities across China.

Ping An's expansion included diversifying its insurance products. This move allowed the company to cater to a wider range of customer needs, significantly boosting its market reach. The introduction of life insurance in the early 1990s was a pivotal step in this diversification strategy.

In the mid-1990s, Ping An secured strategic investments from international financial institutions. These investments, including those from Morgan Stanley and Goldman Sachs, provided crucial capital and expertise. This influx of resources helped professionalize operations and adopt international best practices.

Ping An rapidly expanded its physical presence by opening branches across major Chinese cities. Simultaneously, the company invested heavily in technology and developed a robust agent network. These efforts were key to reaching a wider customer base and improving service delivery.

The market responded positively to Ping An's diversified offerings, fueled by increasing awareness of insurance benefits among the Chinese populace. The competitive landscape was less saturated, which allowed Ping An to establish a strong foothold. By the late 1990s, Ping An was recognized as a leading insurance provider in China.

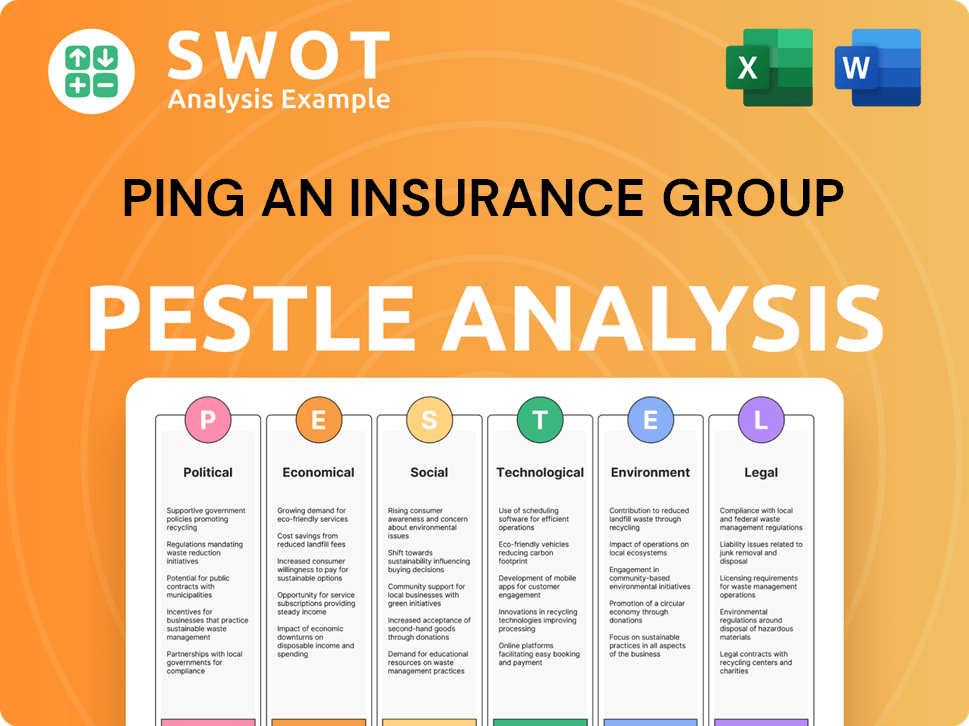

Ping An Insurance Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Ping An Insurance Group history?

The Ping An Insurance Group Company origins can be traced back to its founding, with several key milestones shaping its trajectory as a leading Chinese insurance company. These achievements highlight its evolution and expansion within the financial services sector in China.

| Year | Milestone |

|---|---|

| 1988 | Ping An Insurance was founded in Shenzhen, marking the beginning of its journey in the insurance industry. |

| 2004 | Ping An Insurance completed its initial public offering (IPO) on the Hong Kong Stock Exchange, enhancing its capital base and visibility. |

| 2006 | The acquisition of Shenzhen Commercial Bank, later renamed Ping An Bank, signaled its strategic move into banking and comprehensive financial services. |

| 2010 | Ping An Insurance established Ping An Health Insurance, expanding its presence in the health insurance market. |

| 2018 | Ping An Good Doctor, the online healthcare platform, was listed on the Hong Kong Stock Exchange, showcasing its fintech innovation. |

| 2023 | Ping An reported a total revenue of approximately CNY 973.9 billion, demonstrating its robust financial performance. |

Throughout its history, Ping An has consistently embraced technological advancements to enhance its services and operational efficiency. This commitment has positioned it at the forefront of innovation within the insurance industry development.

Ping An has heavily invested in fintech, integrating AI, big data, and cloud computing across its operations.

This has led to improved customer service, streamlined processes, and the development of innovative products.

The launch of Ping An Good Doctor revolutionized healthcare access by providing online consultations and health management services.

By 2024, Good Doctor had expanded its user base significantly, offering a wide range of healthcare solutions.

Lufax, Ping An's online wealth management platform, offers a variety of investment products and services.

It has become a significant player in the Chinese online wealth management market, attracting a large customer base.

Ping An leverages AI to enhance its risk assessment and fraud detection capabilities.

This has improved the accuracy of underwriting and claims processing, leading to better financial outcomes.

Ping An has been involved in smart city projects, using technology to improve urban management and services.

These initiatives include smart healthcare, smart transportation, and smart finance solutions.

Ping An has built a robust cloud computing infrastructure to support its digital platforms and services.

This has enabled scalability, flexibility, and cost-efficiency in its operations.

Despite its successes, Ping An Group has faced several challenges, including navigating the complexities of the Chinese financial market and adapting to evolving regulatory landscapes. These challenges have shaped its strategic decisions and operational adjustments.

Ping An faces intense competition from both domestic and international insurance companies.

Maintaining market share and profitability in a competitive environment requires continuous innovation and strategic adjustments.

The Chinese financial sector is subject to frequent regulatory changes, requiring Ping An to adapt its business practices.

Compliance with new regulations can be complex and may impact operational strategies.

Managing the integration of its diverse financial businesses, including insurance, banking, and wealth management, presents operational challenges.

Ensuring seamless customer experiences across multiple platforms requires significant coordination and investment.

With its extensive digital offerings, Ping An must prioritize data security and customer privacy.

Protecting sensitive customer information from cyber threats and ensuring compliance with data protection regulations is crucial.

Ping An's financial performance is influenced by economic conditions, including market downturns and interest rate changes.

Adapting to economic fluctuations and managing financial risks is essential for maintaining stability and growth.

Building and maintaining customer trust is vital for the long-term success of Ping An.

This involves providing reliable services, transparent communication, and ethical business practices.

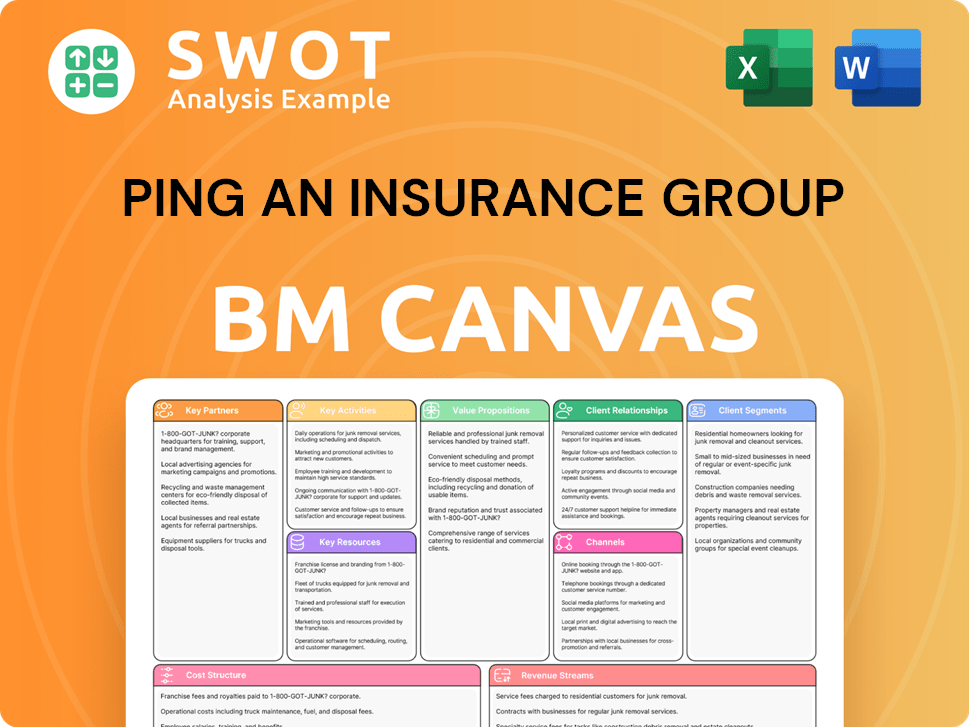

Ping An Insurance Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Ping An Insurance Group?

The Ping An Insurance Group, a prominent Chinese insurance company, has a rich history marked by strategic expansions and technological advancements. From its humble beginnings in Shekou, Shenzhen, to its current status as a diversified financial conglomerate, the company's journey reflects the dynamic evolution of the Chinese insurance industry.

| Year | Key Event |

|---|---|

| 1988 | Founded in Shekou, Shenzhen, initially focusing on property and casualty insurance, marking the origins of the Ping An history. |

| 1990s | Expanded into life insurance and established a nationwide presence across China, solidifying its position in the financial services China market. |

| 1994 | Received strategic investments from international financial institutions, providing capital for further growth. |

| 2004 | Listed on the Hong Kong Stock Exchange (HKEX), entering international capital markets. |

| 2006 | Acquired Shenzhen Commercial Bank, later Ping An Bank, diversifying into banking services. |

| 2007 | Listed on the Shanghai Stock Exchange (SSE), becoming a dual-listed company. |

| 2013 | Launched Lufax, its online wealth management platform, embracing fintech early on. |

| 2015 | Launched Ping An Good Doctor, entering the healthtech sector and offering online healthcare services. |

| 2018 | Celebrated its 30th anniversary, highlighting its transformation into a technology-driven financial conglomerate. |

| 2020-2023 | Continued to invest heavily in AI, big data, and cloud computing, integrating these technologies across its financial and healthcare ecosystems. |

| 2024-2025 | Focused on deepening its 'integrated financial services + healthcare' strategy, enhancing customer experience and operational efficiency. |

The company is committed to its 'finance + technology' and 'finance + ecosystem' strategies, aiming to leverage technological capabilities. This includes AI and big data to drive innovation in financial services and healthcare. Strategic initiatives involve expanding the digital health ecosystem and enhancing personalized financial advisory services.

Ping An Group continues to invest heavily in AI, big data, and cloud computing. These technologies are integrated across its financial and healthcare ecosystems. The company aims to use these advancements to improve customer experience and operational efficiency.

Analysts predict that Ping An will continue to be a leading force in the digital transformation of the financial industry. The diversified business model provides resilience against market fluctuations. The company's focus remains on customer-centricity and technological empowerment.

Strategic initiatives include exploring new growth opportunities in areas like elderly care and smart city solutions. The company is focused on expanding its digital health ecosystem. This includes enhancing personalized financial advisory services through AI.

Ping An Insurance Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Ping An Insurance Group Company?

- What is Growth Strategy and Future Prospects of Ping An Insurance Group Company?

- How Does Ping An Insurance Group Company Work?

- What is Sales and Marketing Strategy of Ping An Insurance Group Company?

- What is Brief History of Ping An Insurance Group Company?

- Who Owns Ping An Insurance Group Company?

- What is Customer Demographics and Target Market of Ping An Insurance Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.