ProSiebenSat.1 Media Bundle

How Did ProSiebenSat.1 Conquer the German Media Landscape?

The German media scene witnessed a seismic shift with the rise of commercial television, and at the heart of this evolution was ProSiebenSat.1. This ProSiebenSat.1 Media SWOT Analysis will show you how the company emerged as a challenger to public broadcasters, ultimately becoming a dominant force in European media. Founded in 2000 through a strategic merger, ProSiebenSat.1 quickly capitalized on the growing demand for diverse entertainment and information.

This article delves into the fascinating Media Company History of ProSiebenSat.1, exploring its early strategic moves and key milestones. From its origins as a German Television pioneer to its current position in the digital age, we'll examine how ProSiebenSat.1 navigated challenges and innovated to stay ahead. Discover how ProSieben and Sat.1 shaped the German media landscape.

What is the ProSiebenSat.1 Media Founding Story?

The ProSiebenSat.1 Media Company's history is a story of strategic mergers and adaptations within the dynamic German media landscape. It began with the independent ventures of Sat.1 and ProSieben, which later merged to form a media powerhouse.

The formal establishment of ProSiebenSat.1 Media SE in 2000 marked a pivotal moment, but the roots of the company extend back to the early days of German private television. This consolidation aimed to enhance market position and foster operational synergies.

Understanding the Media Company History requires a look at the origins of its key components: Sat.1 and ProSieben, both of which played crucial roles in the evolution of German Television.

Sat.1, originally known as PKS (Programmgesellschaft für Kabel- und Satellitenrundfunk), was established on January 1, 1984, in Ludwigshafen. It was Germany's first private television broadcaster.

- Sat.1's founders included several publishing houses, with Leo Kirch's BetaFilm becoming a major shareholder.

- The channel aimed to offer a diverse range of programming to compete with the established public broadcasters ARD and ZDF.

ProSieben launched on January 13, 1989, from Munich, emerging from Eureka Television. It quickly established itself with a focus on movies and series, targeting a younger demographic.

- The channel quickly gained popularity for its entertainment-focused content.

- ProSieben's programming strategy was designed to attract a younger audience.

The merger of Sat.1 and ProSieben in 2000 was a strategic move to consolidate market share and create a stronger competitor in the fragmented German media market.

- The primary goal was to compete effectively against public broadcasters and emerging digital platforms.

- The combined entity aimed to leverage the strengths of both channels: Sat.1's broad appeal and ProSieben's entertainment focus.

The initial business model of the merged entity revolved around advertising-funded free-to-air television. This model later evolved to include pay-TV and digital ventures, reflecting the changing media landscape. The evolution of ProSiebenSat.1 and its German Media Group is a testament to its adaptability and strategic vision. For more insights, explore the Marketing Strategy of ProSiebenSat.1 Media.

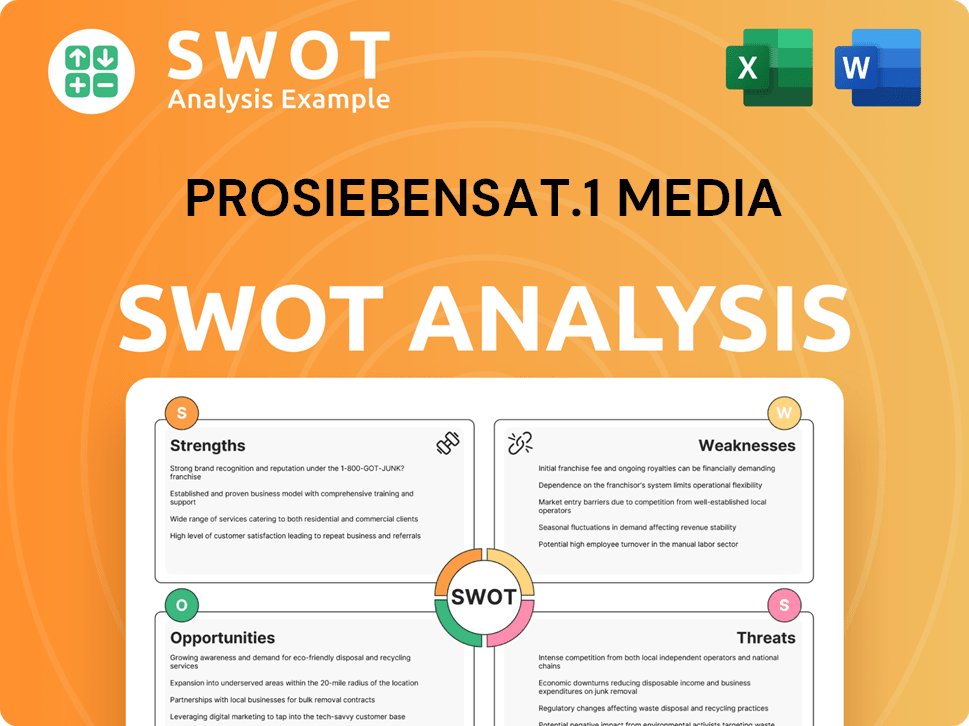

ProSiebenSat.1 Media SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of ProSiebenSat.1 Media?

Following its formation in 2000, the ProSiebenSat.1 Media Company, a prominent German media group, experienced substantial early growth and strategic expansion. This period focused on consolidating its merged assets, optimizing programming, and attracting advertisers through its increased reach. The company aimed to deepen its penetration in Germany, Austria, and Switzerland, its primary market. Its early success set the stage for its future in the competitive world of German television.

Immediately after its formation, ProSiebenSat.1 focused on integrating its newly acquired assets. This included refining channel lineups and introducing new formats across its flagship channels, ProSieben and Sat.1. The company aimed to streamline operations and maximize efficiency to compete effectively in the German media landscape.

Recognizing the shift in media consumption, ProSiebenSat.1 began exploring digital platforms and online content. This included initial forays into digital platforms and online content. This strategic move was crucial for future growth, as it allowed the company to reach a broader audience and diversify its revenue streams, marking an important step in the company's evolution.

The competitive environment in German television was intense, with established public broadcasters and other private entities vying for audience share and advertising revenue. ProSiebenSat.1 needed to differentiate its content to attract diverse demographics. This included investing in proprietary productions and exploring cross-platform synergies.

Strategic decisions during this period included optimizing content acquisition and exploring international syndication. The company aimed to diversify its revenue streams by investing in proprietary productions. For more information on the target audience of ProSiebenSat.1 Media, you can read about it here: Target Market of ProSiebenSat.1 Media.

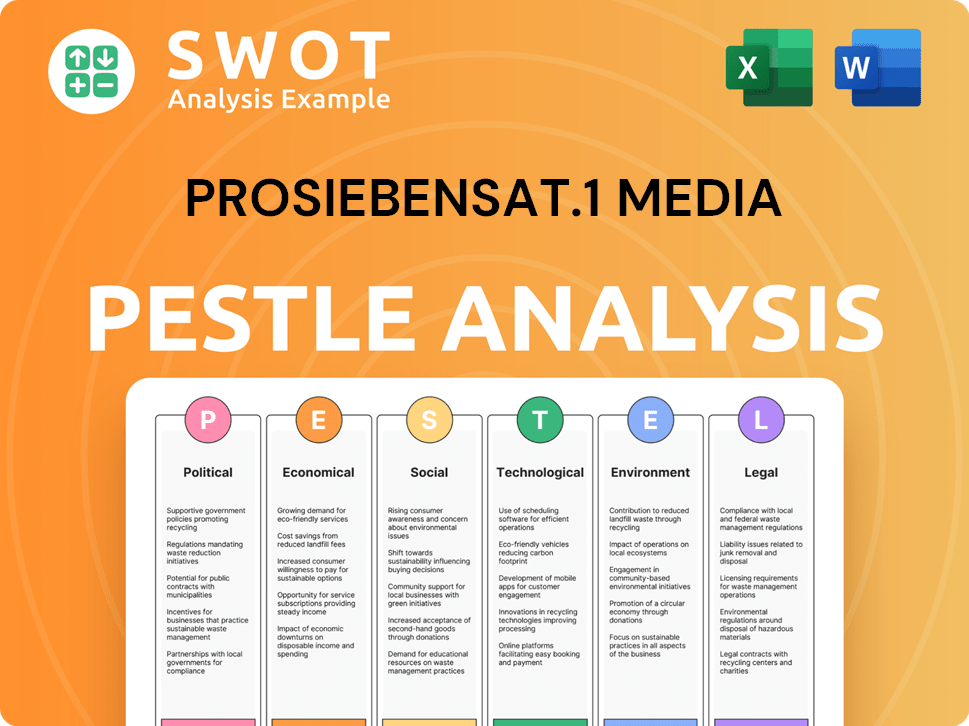

ProSiebenSat.1 Media PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in ProSiebenSat.1 Media history?

The ProSiebenSat.1 Media SE, a prominent German Media Group, has a rich history marked by significant milestones. From its inception, the company has evolved, adapting to the changing media landscape and solidifying its position in the German Television market.

| Year | Milestone |

|---|---|

| 1988 | ProSieben, one of the core channels, is launched, marking the beginning of the company's presence in the German television market. |

| 1988 | Sat.1, another key channel, is established, expanding the company's reach and influence in the German media landscape. |

| 2000 | ProSiebenSat.1 Media AG is formed through a merger, creating a major player in the German media industry. |

| 2007 | The company is acquired by private equity firms, reflecting significant changes in ownership and strategic direction. |

| 2010 | ProSiebenSat.1 is re-listed on the stock exchange, signaling a return to public ownership and a new phase of growth. |

| 2019 | The launch of Joyn, a streaming platform, marks a significant step into digital media and content distribution. |

ProSiebenSat.1 has consistently embraced innovation, particularly in the digital sphere. The company's early investment in digital platforms and online video content showcases its foresight in anticipating the shift away from traditional linear television.

The early adoption of digital platforms and online video content was a key innovation. This strategic move allowed the company to prepare for the changing media consumption habits.

The launch of Joyn in 2019, a streaming platform, was a notable innovation. This platform provided a comprehensive entertainment offering, showcasing the company's commitment to digital transformation.

Continuous investment in content differentiation and local productions. This strategy helped in attracting and retaining viewers in a competitive market.

Expansion into the Commerce & Ventures segment. This diversification strategy has proven crucial, contributing significantly to the group's overall revenue.

Streamlining operations and focusing on core competencies. This approach enabled the company to adapt to market changes more effectively.

Leadership changes aimed at driving digital transformation. These changes have been instrumental in guiding the company through the evolving media landscape.

The German Media Group has faced several challenges throughout its history. Intense competition from global streaming services and the fluctuating advertising market have been persistent obstacles. The company's ability to adapt and diversify has been crucial for its continued success, as highlighted in the Competitors Landscape of ProSiebenSat.1 Media.

Intense competition from global streaming giants like Netflix and Amazon Prime Video has necessitated continuous content differentiation. This has led to increased investment in local productions to maintain relevance.

The fluctuating advertising market, influenced by economic cycles, has posed a recurring challenge. This has driven the need for diversification beyond traditional television advertising.

Strategic expansion into the Commerce & Ventures segment has been a key response. This has helped in diversifying revenue streams and reducing reliance on traditional advertising.

Adapting to the shift towards digital consumption has been critical. The growth of Joyn, with over 6 million monthly active users in 2023, demonstrates this successful pivot.

In the first quarter of 2024, the Entertainment segment generated 69% of the group's revenues. The Dating & Video and Commerce & Ventures segments contributed 15% and 16% respectively, highlighting the success of diversification.

Overcoming challenges through strategic restructuring, such as streamlining operations and focusing on core competencies. This approach has improved efficiency and focus.

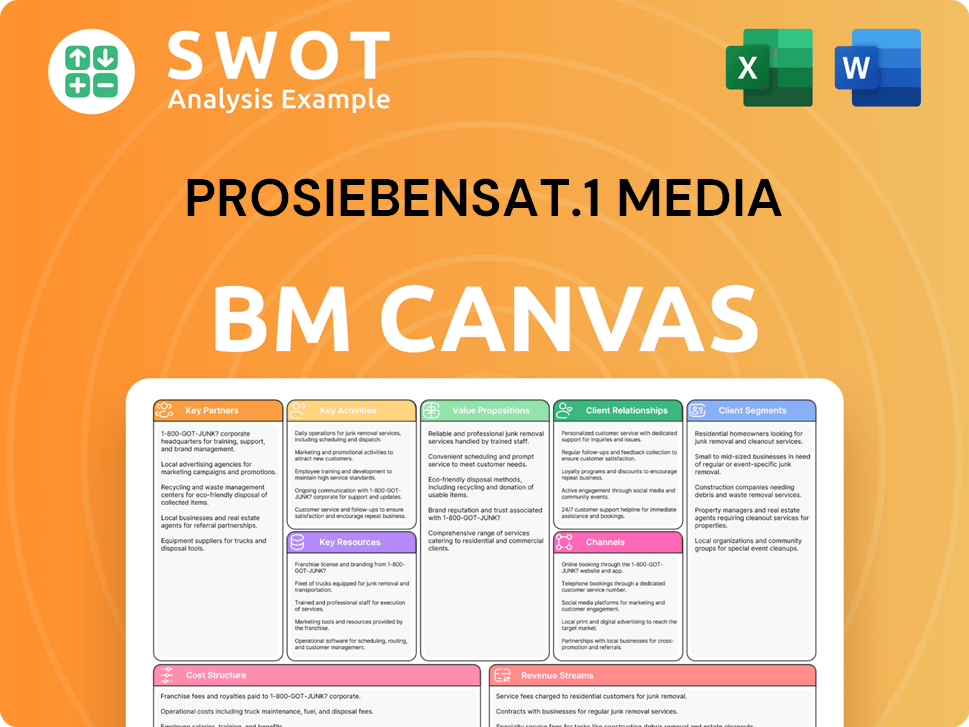

ProSiebenSat.1 Media Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for ProSiebenSat.1 Media?

The Growth Strategy of ProSiebenSat.1 Media has evolved significantly since its inception, marked by strategic mergers, acquisitions, and shifts in ownership, reflecting the dynamic nature of the German media landscape. From its formation through the merger of ProSieben and Sat.1 to its ventures into digital content and streaming, the company has adapted to changing consumer habits and technological advancements.

| Year | Key Event |

|---|---|

| 2000 | Formation of ProSiebenSat.1 Media AG through the merger of ProSieben Television GmbH and Sat.1 SatellitenFernsehen GmbH. |

| 2003 | Haim Saban's P7S1 Group acquired a majority stake. |

| 2007 | KKR and Permira acquired a majority stake. |

| 2013 | Company fully regains independence from private equity ownership. |

| 2014 | Launch of the multi-channel network Studio71, marking a significant step into digital content creation. |

| 2015 | Acquisition of the online dating platform Parship Elite Group (now part of the Dating & Video segment). |

| 2019 | Launch of Joyn, a joint venture streaming platform with Discovery (later fully acquired by ProSiebenSat.1). |

| 2020 | Focus on a three-pillar strategy: Entertainment, Dating & Video, and Commerce & Ventures. |

| 2023 | Joyn reports over 6 million monthly active users, demonstrating strong digital growth. |

| 2024 | ProSiebenSat.1 Media SE continues to focus on its three-pillar strategy, with a strong emphasis on the Entertainment segment and the growth of its digital platforms like Joyn. |

ProSiebenSat.1 is concentrating on its three-pillar strategy: Entertainment, Dating & Video, and Commerce & Ventures. This approach allows for diversification and growth across various media and digital platforms. The Entertainment segment remains a core focus, with significant investment in local content.

The company is heavily invested in expanding its digital reach, particularly through its streaming platform, Joyn. Joyn's growth is central to ProSiebenSat.1's future, with a focus on exclusive content and user engagement. Digital advertising is a key area of growth, with the market expected to continue expanding.

ProSiebenSat.1 is positioned to capitalize on the shift to digital consumption and the rise of ad-supported video on demand (AVOD). The increasing importance of data-driven advertising is also a key trend. The company's diversified portfolio allows it to benefit from these evolving market dynamics.

Analysts predict continued growth in the digital advertising market, which ProSiebenSat.1 is well-positioned to capitalize on. The company's leadership emphasizes innovation, strategic partnerships, and delivering compelling content. This forward-looking approach aligns with the goal of being a leading media group.

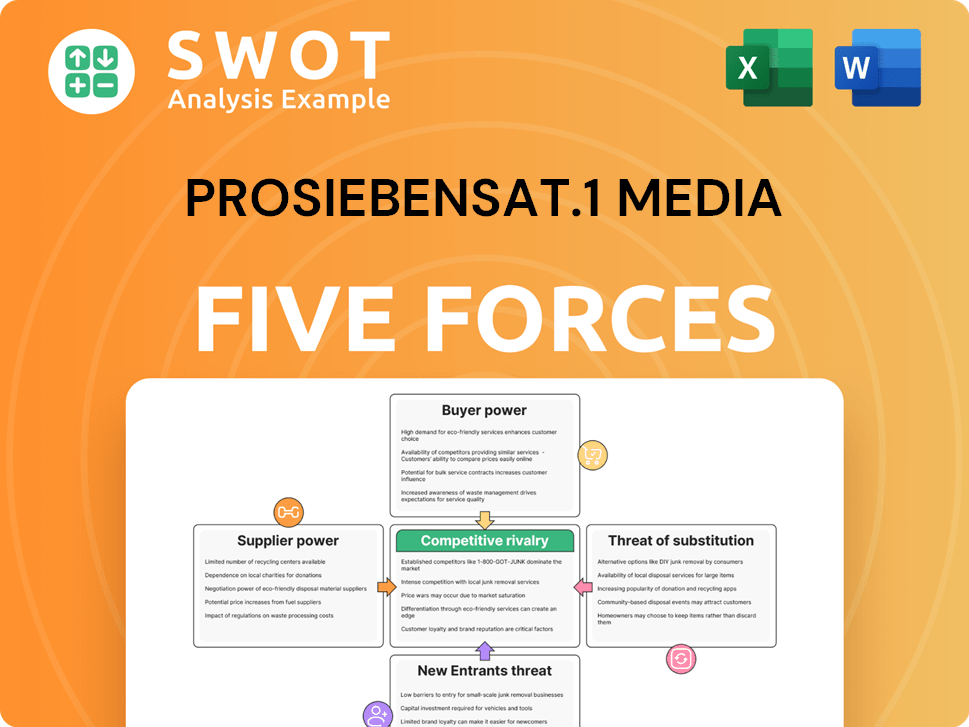

ProSiebenSat.1 Media Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of ProSiebenSat.1 Media Company?

- What is Growth Strategy and Future Prospects of ProSiebenSat.1 Media Company?

- How Does ProSiebenSat.1 Media Company Work?

- What is Sales and Marketing Strategy of ProSiebenSat.1 Media Company?

- What is Brief History of ProSiebenSat.1 Media Company?

- Who Owns ProSiebenSat.1 Media Company?

- What is Customer Demographics and Target Market of ProSiebenSat.1 Media Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.