ProSiebenSat.1 Media Bundle

How Does ProSiebenSat.1 Thrive in the Dynamic Media Landscape?

ProSiebenSat.1 Media SE, a leading German media company, has become a significant force in the European media market, particularly in the DACH region. This media company operates a diverse portfolio, including free-to-air TV channels, pay-TV offerings, and digital platforms. Despite economic challenges, the company demonstrated resilience with a 2% revenue increase to €3.92 billion in 2024.

ProSiebenSat.1's success hinges on understanding its ProSiebenSat.1 Media SWOT Analysis, which reveals its strengths and weaknesses. Its hybrid video-on-demand platform, Joyn, showcases impressive growth, with a 62% rise in monthly users between Q3 2023 and Q3 2024, and a 44% increase in monthly video users by March 2025, highlighting its effective digital strategy. This examination will explore ProSiebenSat.1's core operations, revenue streams, and strategic initiatives to understand its ability to sustain growth in the competitive broadcasting environment.

What Are the Key Operations Driving ProSiebenSat.1 Media’s Success?

The core operations of ProSiebenSat.1 Media SE revolve around creating and delivering value through its diverse business segments. The company's strategy focuses on leveraging its strong position in the German media market, particularly within the DACH region. The company's business model is built on a multi-platform approach, ensuring content reaches audiences through various channels, including free-to-air TV, pay-TV, and streaming services.

ProSiebenSat.1 generates revenue through three main segments: Entertainment, Commerce & Ventures, and Dating & Video. The Entertainment segment is the largest, contributing significantly to the company's overall financial performance. This segment's operational processes include content production, distribution, and marketing, with a focus on local and live programming to differentiate itself in the competitive media landscape. The company's ability to capitalize on advertising synergies across its ventures is a key aspect of its market differentiation.

The value proposition of ProSiebenSat.1 lies in its ability to connect with a broad audience through its various media brands and platforms. This reach allows the company to offer attractive advertising opportunities and create synergies across its different business segments. The company's focus on local content and innovative digital strategies aims to maintain and grow its market share. To understand more about how the company has grown, you can read about the Growth Strategy of ProSiebenSat.1 Media.

The Entertainment segment is the core of ProSiebenSat.1's operations, accounting for approximately 67% of the company's FY23 revenues. This segment emphasizes multi-platform digital media delivery within the DACH region. Key elements include free-to-air TV channels like SAT.1 and ProSieben, along with pay-TV channels and the Joyn streaming platform.

The Commerce & Ventures segment supports young companies through 'media-for-revenue' or 'media-for-equity' partnerships. This approach leverages ProSiebenSat.1's extensive TV reach to enhance brand awareness. Key areas include consumer advice, experiences, and beauty and lifestyle businesses, with flaconi being a notable contributor.

The Dating & Video segment offers online matchmaking services and social entertainment. Brands like Parship, ElitePartner, and LOVOO are part of this segment's portfolio. This segment provides a diverse range of platforms for social interaction and dating, targeting a wide audience.

ProSiebenSat.1 capitalizes on advertising synergies across its ventures, including online shops and digital platforms like Joyn. This approach translates its core capabilities into broad customer reach and market differentiation. The ability to offer integrated advertising solutions enhances its value proposition.

ProSiebenSat.1's operational success is underpinned by its diversified business segments and strategic content focus. The company's ability to adapt to changing media consumption habits is crucial for its sustained performance. The focus on local and live programming is a key differentiator.

- Entertainment Segment Revenue: Approximately 67% of FY23 revenues.

- Content Production: Focus on exclusive local and live programming.

- Commerce & Ventures: Media-for-revenue and media-for-equity partnerships.

- Dating & Video: Online matchmaking and social entertainment platforms.

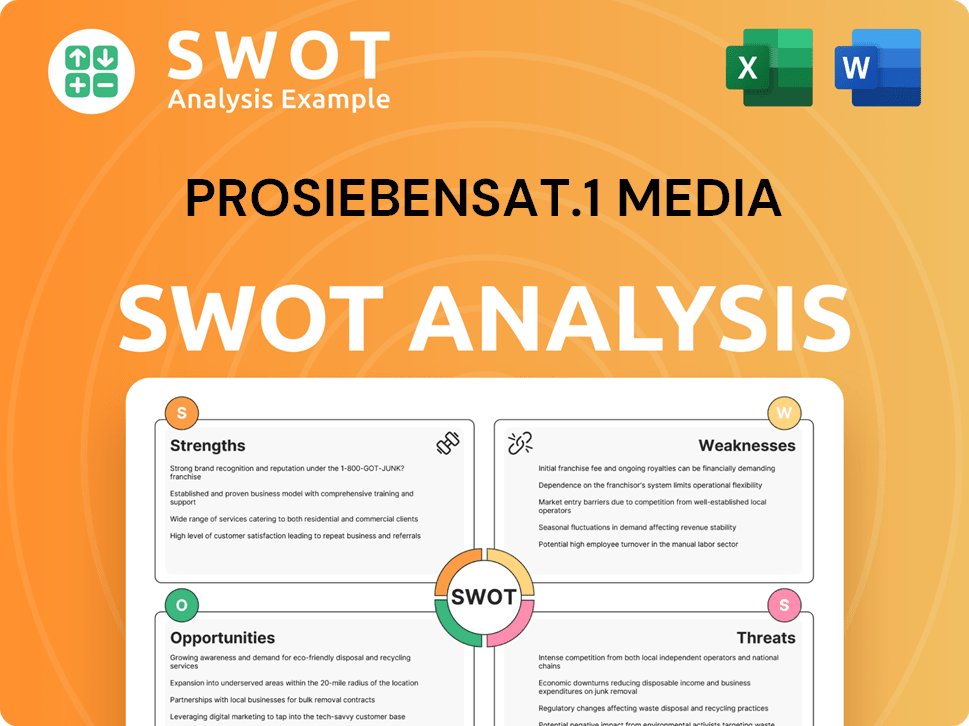

ProSiebenSat.1 Media SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ProSiebenSat.1 Media Make Money?

The ProSiebenSat.1 Media company's revenue streams are primarily driven by advertising, subscription fees, and content production. This German media company has strategically diversified its revenue sources, particularly focusing on digital advertising and content offerings. Understanding these revenue streams is key to analyzing the ProSiebenSat.1 business model and its financial performance.

Advertising remains a core component of ProSiebenSat.1's revenue, with a significant emphasis on expanding its digital and smart advertising capabilities. The company's monetization strategies involve innovative advertising products, especially within the Advanced TV segment. This focus on digital advertising is critical for adapting to the changing media landscape and maintaining a competitive edge.

In 2024, the company reported total revenues of €3.92 billion, marking a 2% increase from the previous year. The Entertainment segment's external revenues were €2.537 billion. These figures highlight the company's financial health and its ability to navigate market challenges.

ProSiebenSat.1 employs several strategies to generate revenue and monetize its content and services. These strategies are essential for understanding how ProSiebenSat.1 makes money and its overall broadcasting strategy.

- Advertising: Advertising is a primary revenue source, including TV advertising and digital advertising. In FY23, advertising accounted for approximately 58% of total revenue.

- Digital & Smart Advertising: The company is increasing its digital advertising revenues. Digital & Smart advertising revenues in the DACH region increased by 5% in 2024.

- Subscription Fees: Subscription fees from services like Joyn contribute to revenue. Joyn saw strong growth in ad-supported video-on-demand (AVoD) revenues, increasing by 36% in 2024.

- Content Production: ProSiebenSat.1 produces content for its channels and other platforms, generating revenue through licensing and distribution.

- Commerce & Ventures: This segment includes various ventures, such as Beauty & Lifestyle, and Dating & Video. The Commerce & Ventures segment surpassed €1 billion in revenue in 2024.

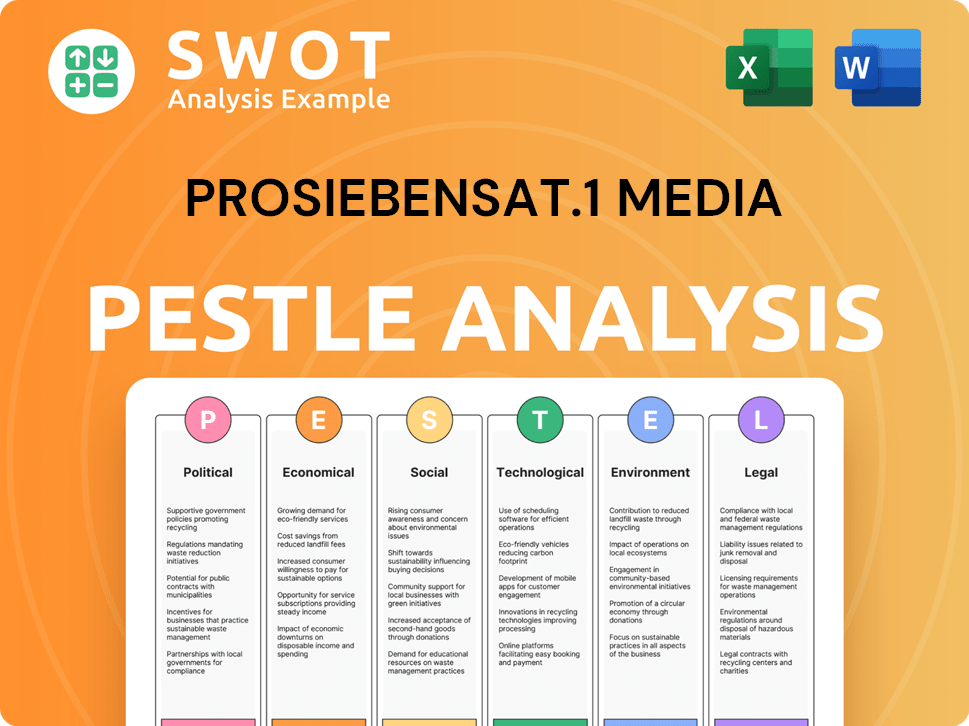

ProSiebenSat.1 Media PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ProSiebenSat.1 Media’s Business Model?

ProSiebenSat.1 Media SE has navigated significant shifts in the media landscape through strategic adjustments. A critical move involved fully integrating the streaming service Joyn, which has become a key growth driver. The company's focus on local content and live programming aims to differentiate Joyn from global streaming competitors.

The company's strategy includes expanding exclusive local content on Joyn and its linear TV stations. This expansion involves increasing programming expenses to strengthen content offerings and audience share. These efforts are designed to maintain a strong presence in the German-speaking media market.

Operational challenges, including a weak economic environment and a stagnant advertising market, have influenced the company's financial performance. In response, ProSiebenSat.1 has implemented organizational restructuring and cost optimization measures. The company's competitive advantages include a leading position in the German-speaking media market and strong brand recognition.

A key milestone was the full takeover of Joyn, which increased monthly users by 62% between Q3 2023 and Q3 2024. The company has also focused on expanding its exclusive local content offerings. This strategic shift is aimed at strengthening its market position and enhancing its digital presence.

ProSiebenSat.1 plans to cut around 430 full-time positions in 2025 to streamline operations. The sale of Verivox for approximately €232 million in March 2025 was a strategic move to focus on the Entertainment business. These moves aim to improve financial flexibility and concentrate on core business areas.

ProSiebenSat.1 holds a 24.6% audience share among viewers aged 14 to 49 in FY23 in the German-speaking media market. The company leverages innovative concepts like 'Media-for-Equity' and 'Media-for-Revenue' and advanced TV advertising. These strategies help monetize its extensive reach and maintain a competitive advantage.

The company is focusing on its core entertainment business, enhancing digital offerings, and optimizing its cost structure. ProSiebenSat.1 is adapting to the evolving media landscape by investing in local content and digital platforms. For more insights, explore the Marketing Strategy of ProSiebenSat.1 Media.

ProSiebenSat.1's strategic initiatives include strengthening its content offerings and optimizing its cost structure. The company is investing in local content to differentiate itself from global competitors. These efforts are designed to enhance its market position and ensure long-term sustainability.

- Expansion of exclusive local content on Joyn and linear TV stations.

- Increasing programming expenses to approximately €1.05 billion in 2024.

- Focus on core entertainment business and digital offerings.

- Cost optimization through organizational restructuring and job cuts.

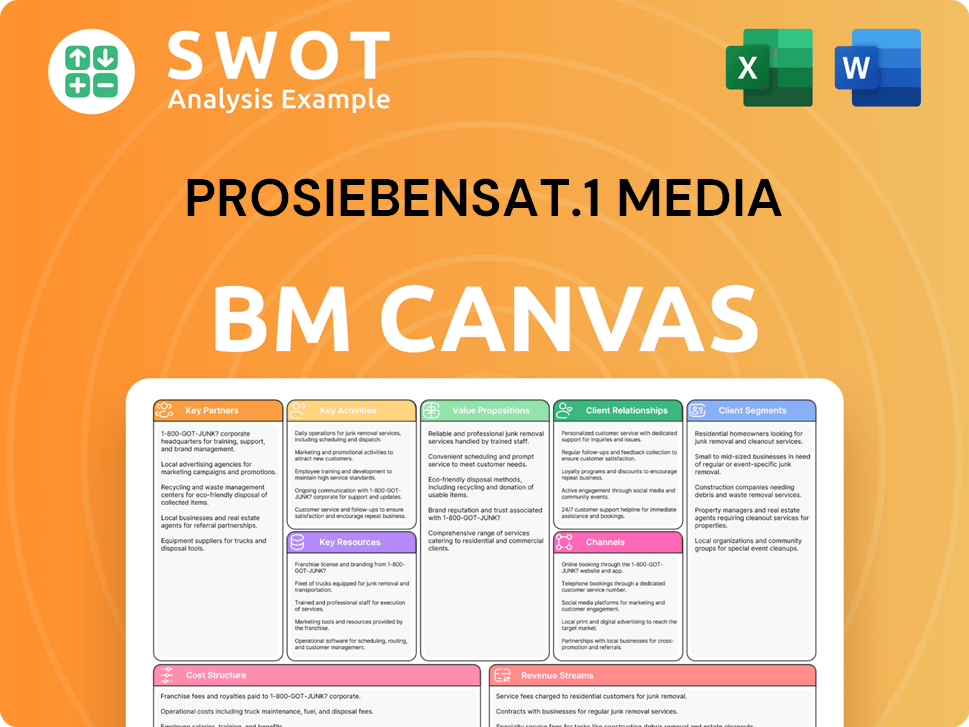

ProSiebenSat.1 Media Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ProSiebenSat.1 Media Positioning Itself for Continued Success?

ProSiebenSat.1 Media SE holds a leading position in the German-speaking (DACH) media market. It has a strong presence in the TV channels and broadcasting sectors. The company's success is reflected in its audience share and revenue generation. The Brief History of ProSiebenSat.1 Media reveals how it has evolved.

However, the media company faces risks inherent in a competitive and evolving industry. The advertising-based ProSiebenSat.1 business model is sensitive to economic cycles and shifts in consumer behavior. Global streaming platforms also exert increasing pressure. The company's financial performance is subject to these market dynamics.

ProSiebenSat.1 maintains a significant market share in the DACH region. In FY23, it held a 24.6% audience share among viewers aged 14 to 49. This demonstrates its strong reach and influence in the German media landscape, making it a key player in the broadcasting sector.

The company faces risks related to its advertising-based revenue model. Approximately 66.5% of FY23 sales came from advertising, making it vulnerable to market volatility. Increasing competition from global streaming platforms and macro headwinds in the German TV advertising market pose further challenges.

ProSiebenSat.1 aims for slight revenue growth to around €4.00 billion (plus/minus €150 million) in 2025. DACH advertising revenues are expected to increase by 2% for the full year. Adjusted EBITDA for 2025 is projected at approximately €550 million (plus/minus €50 million).

The company has a 'Low Risk' ESG rating from Sustainalytics with a score of 11.8. Strategic initiatives include strengthening the entertainment business and developing Joyn as a leading ad-financed superstreamer. The company plans to increase its return on capital employed (ROCE) to over 15% in the medium term.

ProSiebenSat.1 is focusing on several key strategies to navigate the evolving media landscape. These strategies are designed to enhance financial flexibility and ensure sustainable growth. This includes a focus on digital offerings and content production.

- Investment in local content to attract and retain viewers.

- Expansion of digital offerings to diversify revenue streams.

- Disciplined cost management to maintain profitability.

- Portfolio realignment through the sale of non-strategic assets.

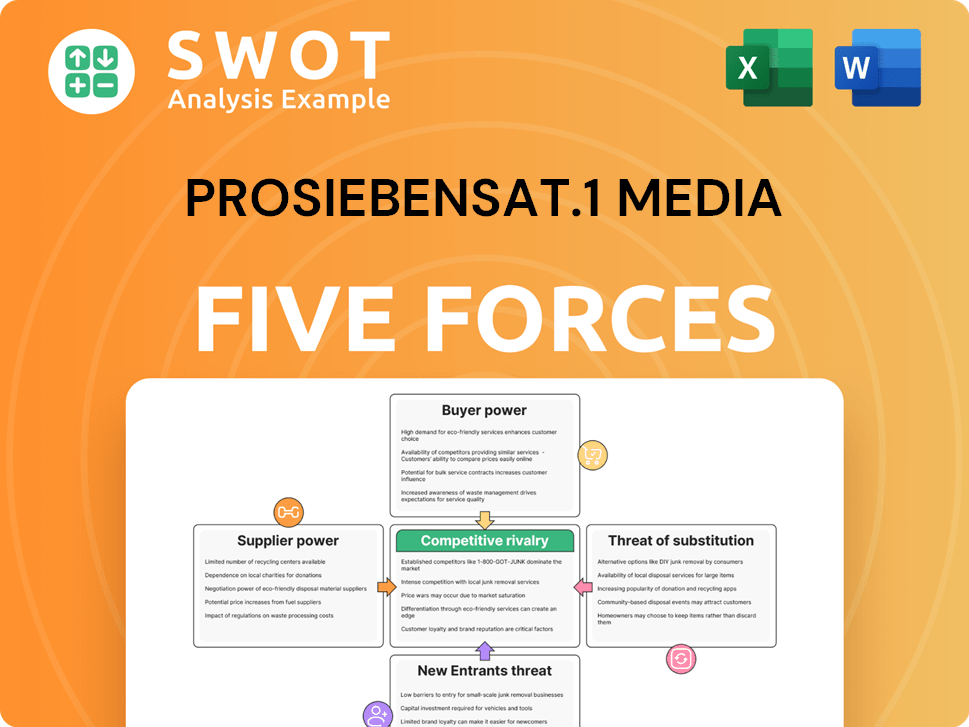

ProSiebenSat.1 Media Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ProSiebenSat.1 Media Company?

- What is Competitive Landscape of ProSiebenSat.1 Media Company?

- What is Growth Strategy and Future Prospects of ProSiebenSat.1 Media Company?

- What is Sales and Marketing Strategy of ProSiebenSat.1 Media Company?

- What is Brief History of ProSiebenSat.1 Media Company?

- Who Owns ProSiebenSat.1 Media Company?

- What is Customer Demographics and Target Market of ProSiebenSat.1 Media Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.