Qualys Bundle

How did Qualys, Inc. revolutionize cybersecurity?

Founded in 1999, Qualys, Inc. quickly became a trailblazer in the cybersecurity world. It pioneered the Software-as-a-Service (SaaS) model, a groundbreaking approach that distinguished it from competitors. Initially focused on automating vulnerability detection, Qualys has charted an impressive course of innovation and growth.

From its inception, the Qualys SWOT Analysis reveals a company that has consistently adapted to the evolving cybersecurity landscape. Understanding the Qualys history is crucial for investors and strategists alike, as it showcases the company's resilience and its ability to capitalize on market opportunities. This Qualys company background provides essential context for evaluating its current position and future prospects within the dynamic field of Qualys vulnerability management.

What is the Qualys Founding Story?

The story of Qualys, a prominent player in the cybersecurity field, began in the late 1990s. The company was incorporated in Delaware on December 30, 1999, marking the official start of its journey. The principal executive offices were established in Redwood City, California.

The co-founders of Qualys were Philippe Langlois and Gilles Samoun. Philippe Courtot later joined, investing in 1999 and taking on the roles of CEO and board chair in 2001. They saw an emerging need in the early days of the internet: the need for automated detection of network vulnerabilities. This realization shaped their initial goal of revolutionizing how organizations secure their IT infrastructure and applications.

Qualys's business model was innovative for its time, built around Software-as-a-Service (SaaS). This made Qualys one of the first security vendors to adopt this approach. Their first product, QualysGuard Vulnerability Management, was launched in 2000. This solution provided automated scanning of corporate local area networks (LANs) to identify vulnerabilities and suggest patches. This cloud-based model removed the need for on-premise software installations, offering a cost-effective and scalable solution for vulnerability management. The company's early funding came from seed rounds. Qualys went public on Nasdaq on September 28, 2012, and raised $87.5 million in net proceeds.

Qualys's early days were marked by innovation in cloud-based security.

- Incorporated in Delaware on December 30, 1999.

- Launched QualysGuard Vulnerability Management in 2000.

- Went public on Nasdaq on September 28, 2012.

- Revolutionized how organizations secure their IT infrastructure and applications.

For more insights into their approach, you can explore the Marketing Strategy of Qualys.

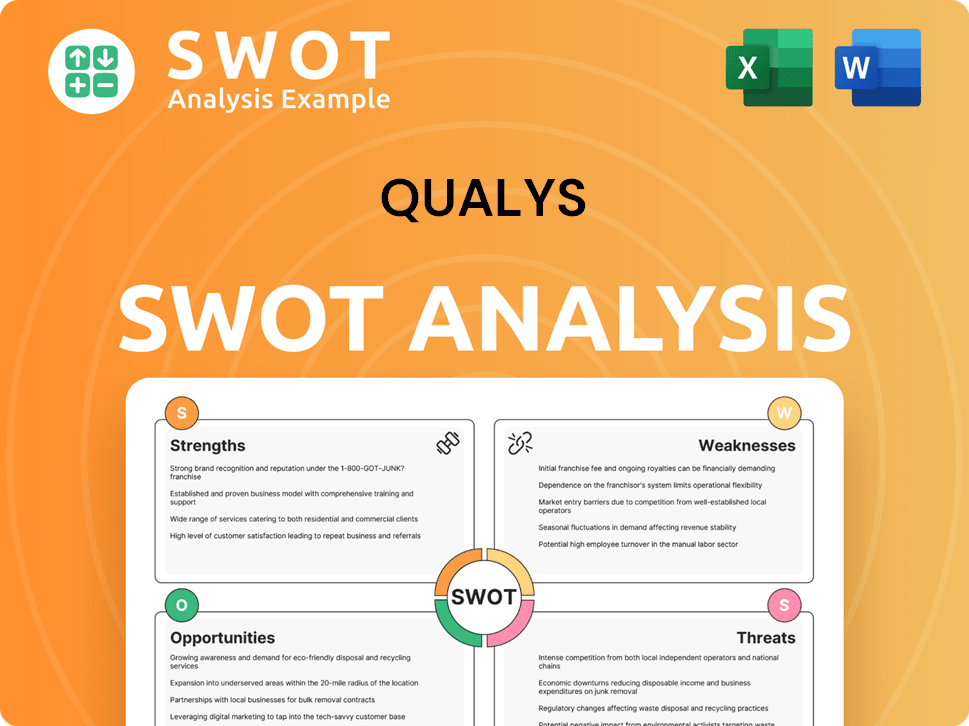

Qualys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Qualys?

The early growth of the company, now known as Qualys Inc., centered on expanding its cloud platform and integrated applications. Following the launch of QualysGuard Vulnerability Management in 2000, the company introduced new solutions to address evolving IT security needs. This strategic approach helped establish Qualys as a key player in the cybersecurity market, driving innovation and expanding its customer base.

In 2006, Qualys added its PCI Compliance solution. In 2008, it launched its Policy Compliance solution. The year 2009 saw the broadening of its cloud services with the addition of Web Application Scanning. In 2010, the company launched Malware Detection Service and Qualys SECURE Seal for automated website protection.

Qualys' growth strategy involved continuous innovation and enhancement of its cloud platform and suite of solutions. It also focused on driving new customer growth and expanding its global reach. The company targeted key accounts, offered free IT, security, and compliance services, and expanded its sales and marketing organization and network of channel partners.

Qualys has demonstrated consistent revenue growth. Revenue growth for fiscal years ending December 2020 to 2024 averaged 13.6%. For the full-year 2024, revenue reached $607.6 million, an increase from $554 million in 2023. Non-U.S. revenue surged 16% year-over-year in Q1 2025, outpacing the 6% growth in the U.S., indicating successful international expansion.

Channel partnerships have become increasingly significant, with reseller and partner-driven revenue accounting for 49% of total revenue in Q1 2025, up from 45% in 2024. Qualys serves over 10,000 subscription customers globally. This includes 72% of the Forbes Global 50 and 55% of the Forbes Global 500 companies. For more details on the company's approach, see the Growth Strategy of Qualys.

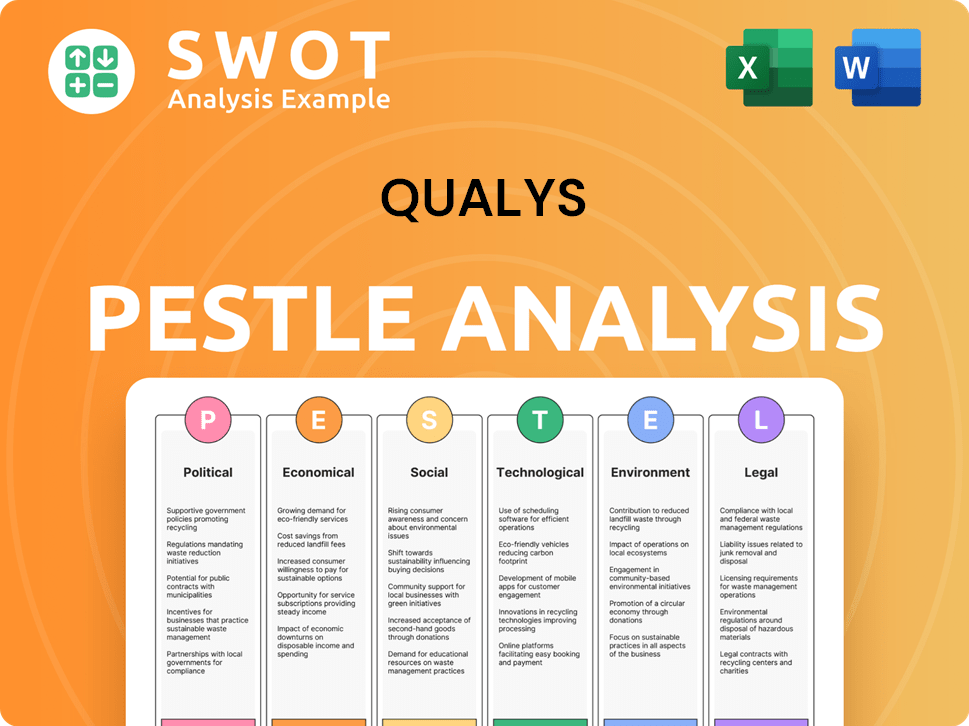

Qualys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Qualys history?

The Qualys company has achieved significant milestones, establishing itself as a leader in cloud security. From its early days, Qualys has consistently innovated, expanding its offerings and solidifying its market position in the cybersecurity industry.

| Year | Milestone |

|---|---|

| 2015 | Launched its cloud platform and lightweight cloud agent, enabling continuous monitoring of IT infrastructure. |

| 2025 | Introduced TotalAppSec, an AI-powered application risk management solution. |

| Ongoing | Secured strategic partnerships with major cloud providers like Amazon Web Services, Microsoft Azure, and Google Cloud Platform. |

Qualys has been at the forefront of innovation in cloud security. A key focus has been on developing advanced solutions to address emerging threats and streamline security operations.

The introduction of the cloud platform and lightweight agent in 2015 enabled continuous monitoring of IT infrastructure, a pivotal innovation for Qualys. This allowed for real-time assessment and management of security vulnerabilities across various IT environments.

Qualys developed Qualys TotalAI for AI workload security, showcasing its commitment to adapting to new technological landscapes. This solution helps organizations secure their AI-driven operations.

The Risk Operations Center (ROC) with Enterprise TruRisk Management (ETM) provides comprehensive risk management capabilities. This offering is designed to address emerging security challenges and offers a holistic view of an organization's risk posture.

In February 2025, Qualys introduced TotalAppSec, an AI-powered application risk management solution. This solution unifies API security, web application scanning, and malware detection.

The introduction of Patch Management and Cybersecurity Asset Management has significantly contributed to Qualys' bookings. These tools enhance the company's ability to offer comprehensive security solutions.

Qualys has formed strategic partnerships with major cloud providers like Amazon Web Services, Microsoft Azure, and Google Cloud Platform. These collaborations expand Qualys' reach and enhance its integration capabilities.

Despite its successes, Qualys faces challenges in a competitive market. The cybersecurity landscape is crowded, and Qualys must continually innovate to maintain its position.

Qualys competes with larger vendors such as CrowdStrike and Palo Alto Networks, as well as other significant players like Tenable and Rapid7. This intense competition can exert pressure on pricing and market share.

The net dollar retention rate, which stood at 103% in Q3 2024, has remained flat, indicating potential difficulties in expanding revenue from existing customers. This is a key metric for assessing customer loyalty and growth.

Investments in sales and marketing have been significant, but analysts have noted that they have not yet translated into substantial revenue acceleration beyond 2024. This suggests a need for strategic adjustments in sales and marketing strategies.

The company has experienced leadership transitions, such as the departure of its Chief Product Officer in mid-2024 and Chief Revenue Officer in early 2025. These changes can lead to potential disruptions in sales execution.

Qualys aims to overcome these challenges through strategic pivots, including a channel-first approach to drive new customer acquisitions. Enhancing its product offerings to streamline security operations is also a key focus.

To better understand Qualys' position in the market, it's helpful to examine the Competitors Landscape of Qualys. This analysis provides insights into the competitive dynamics and key players in the cybersecurity industry.

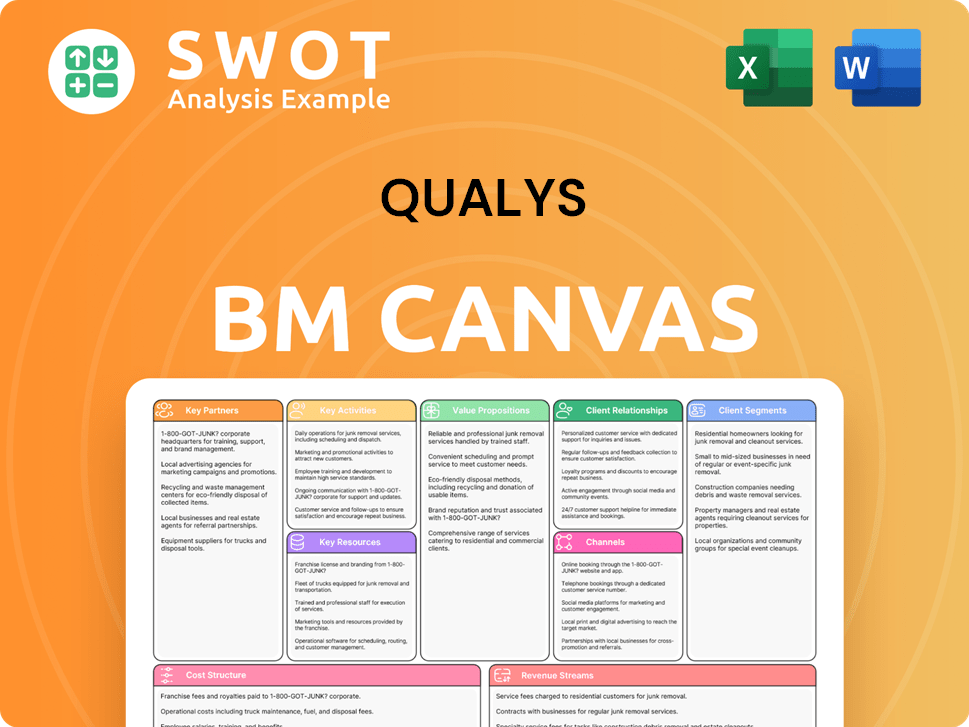

Qualys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Qualys?

The journey of Qualys, from its inception to its current standing, is a testament to its innovation and strategic vision in the cybersecurity sector. The company's evolution, marked by significant product launches and strategic decisions, has positioned it as a key player in the industry.

| Year | Key Event |

|---|---|

| 1999 | Founded in December and incorporated in Delaware. |

| 2000 | Launched QualysGuard Vulnerability Management, its first cloud solution. |

| 2001 | Philippe Courtot becomes CEO and board chair. |

| 2003 | Sumedh Thakar joins Qualys. |

| 2006 | Introduced PCI Compliance solution. |

| 2008 | Added Policy Compliance solution. |

| 2009 | Broadened cloud services with Web Application Scanning. |

| 2010 | Launched Malware Detection Service and Qualys SECURE Seal. |

| 2012 | Went public on Nasdaq under the ticker QLYS, raising $87.5 million. |

| 2015 | Launched its cloud platform and lightweight cloud agent. |

| 2024 | Reported revenues of $607.6 million, a 10% increase over 2023. |

| February 2025 | Introduced TotalAppSec, an AI-powered application risk management solution. |

| May 2025 | Reported revenues of $159.9 million, a 10% year-over-year increase. |

The company is transitioning from vulnerability management to a comprehensive cyber risk management platform. Enterprise TruRisk Management (ETM) and Risk Operations Center (ROC) are central to this strategy. This shift aims to provide a more holistic approach to cybersecurity, addressing the evolving needs of its clients.

Qualys anticipates full-year 2025 revenues to be in the range of $648.0 million to $657.0 million, representing a 7% to 8% growth over 2024. The total addressable market is projected to grow from $55 billion in 2025 to $79 billion by 2028. This growth underscores the company's potential for sustained financial success.

The company plans to continue significant investments in research and development to extend its cloud platform's functionality. It also plans to selectively pursue technology acquisitions to bolster its capabilities. This commitment to innovation is crucial for staying ahead in the competitive cybersecurity market.

Qualys is focusing on high-growth markets like cloud security, IoT security, and AI-driven security solutions. The company's strategic initiatives and robust product roadmap aim to sustain its growth trajectory in the evolving cybersecurity landscape. These areas represent significant opportunities for expansion.

Qualys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Qualys Company?

- What is Growth Strategy and Future Prospects of Qualys Company?

- How Does Qualys Company Work?

- What is Sales and Marketing Strategy of Qualys Company?

- What is Brief History of Qualys Company?

- Who Owns Qualys Company?

- What is Customer Demographics and Target Market of Qualys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.