Richelieu Bundle

What's the Story Behind Richelieu Company's Success?

Delve into the Richelieu SWOT Analysis to understand the company's strategic moves. From its humble beginnings, Richelieu Company has transformed into a North American leader, shaping the landscape of the furniture and hardware industry. Explore the Richelieu history and discover the key milestones that define its remarkable journey.

The Richelieu Company story, dating back to 1968, is a compelling narrative of strategic growth and adaptation. Its evolution reflects a deep understanding of the market, a commitment to innovation, and a keen ability to capitalize on opportunities. This exploration into Richelieu furniture will reveal how the company has maintained its relevance and leadership in a competitive market, impacting both French furniture and cabinetmaking over time.

What is the Richelieu Founding Story?

The Richelieu Company, a prominent name in the hardware and furniture industries, has a rich history. Its story begins with humble roots in Quebec, Canada, evolving into a significant player in North America's building materials and cabinetmaking sectors.

The company's official incorporation took place in 1968, but its origins stretch back much further. This early start set the stage for Richelieu's growth, demonstrating a long-term commitment to serving the construction and woodworking industries.

Richelieu Hardware Ltd. was officially incorporated on October 8, 1968, in Montreal, Quebec, Canada. However, its beginnings can be traced back to 1929.

- Aimé Robitaille opened a business in Saint-Georges-de-Beauce, Quebec, in 1929.

- The initial focus was on supplying building materials to regional hardware stores and lumber yards.

- Georges C. Forest is also recognized as a founder.

- The company initially focused on distribution, meeting the needs of local businesses.

Over the years, Richelieu has significantly expanded its product range. The company's strategy has included an 'aggressive acquisition program' since 1987. This has been key to increasing its customer base, product offerings, geographical reach, and market share. For instance, in 2009, Richelieu offered approximately 58,000 different products, a number that has more than doubled since then.

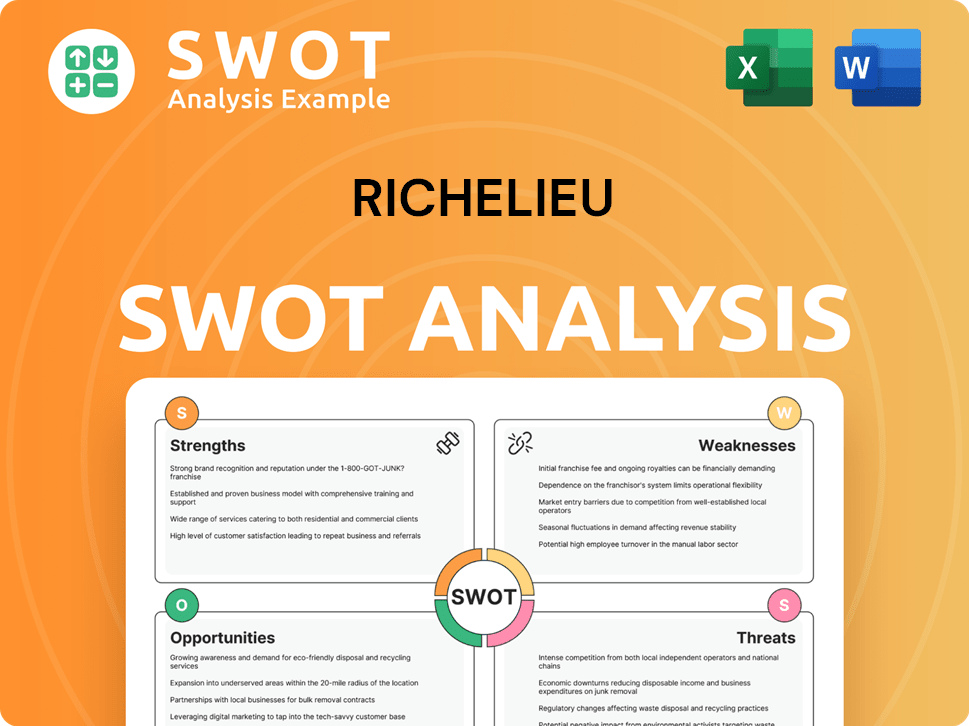

Richelieu SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Richelieu?

The early growth and expansion of the Richelieu Company, a key player in the furniture and cabinetmaking industries, were marked by strategic acquisitions and a broadening product portfolio. This approach significantly shaped the Richelieu history, allowing it to expand its geographical reach across North America. The company's focus on acquisitions has been a cornerstone of its growth strategy since its inception.

Since its incorporation in 1968 and formal listing in 1993, Richelieu has consistently pursued an acquisition-driven growth strategy. By the end of 2020, the company had completed 71 specific acquisitions. This strategy has been crucial to its expansion and market penetration, particularly in the competitive world of French furniture and antique furniture.

As of 2021, Richelieu operated 82 distribution centers, with 41 in Canada and 41 in the United States, alongside two manufacturing centers. This extensive network has allowed the company to efficiently serve its growing customer base. Understanding the Target Market of Richelieu is key to appreciating how this expansion has been targeted.

Acquisitions such as Outwater Hardware in January 2011, which expanded its customer base, and Madico Inc., which brought expertise in hardware floor protection, played significant roles. In September 2018, the acquisition of Chair City Supply added four distribution centers. These moves have broadened Richelieu's product lines and market presence.

Richelieu's strategic moves, coupled with consistent product inventory growth, have led to steady long-term sales. Consolidated sales reached $1.8 billion for the fiscal year ending November 30, 2024, a 2.5% increase over 2023. This growth highlights the effectiveness of its expansion efforts, even in a challenging market.

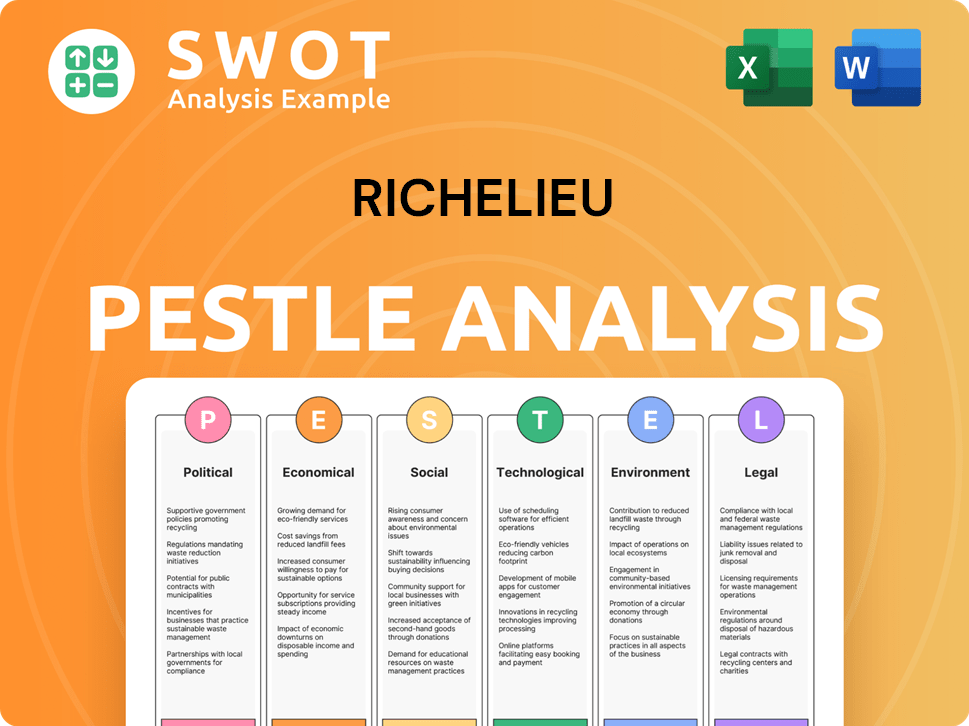

Richelieu PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Richelieu history?

The Richelieu Company's journey, a significant part of Richelieu history, is marked by strategic acquisitions and market expansions. Starting with an 'aggressive acquisition program' since 1987, the company has continually evolved, establishing a strong presence in the furniture and hardware sectors. This approach has been pivotal in shaping its growth and market leadership, making it a key player in the Richelieu furniture industry.

| Year | Milestone |

|---|---|

| 1987 | Initiation of an aggressive acquisition program, shaping the company's future growth. |

| 2010-2014 | Acquisition of 17 companies, enhancing market presence and product offerings. |

| 2015-2019 | Acquisition of 13 companies, further solidifying market position. |

| 2020 | Acquisitions contributed significantly to consolidated sales, reaching an all-time high of 7.6%. |

| 2024 | Completion of seven acquisitions in North America, adding approximately $100 million in annual sales. |

| Early 2025 | Further acquisitions, including Mill Supply and Darant Distributing, continuing the expansion strategy. |

Innovation is central to Richelieu Company's strategy, consistently introducing new and diversified products. The company focuses on offering functional and decorative hardware, including 'Smart Living®' products designed to maximize space and organization. Moreover, Richelieu Company emphasizes technological advancements, such as LUMIN-R lighting solutions and new glass sliding door systems.

These systems are designed for wall units, enhancing accessibility and functionality. This innovation reflects Richelieu Company's commitment to practical and user-friendly solutions.

Specifically for upper kitchen cabinets, these solutions maximize space and organization. This focus on efficient design is a hallmark of Richelieu Company's product development.

A wide array of functional, flexible, and aesthetic products designed to maximize space and organization. These products cater to modern living needs, highlighting Richelieu Company's adaptability.

These solutions represent technological advancements in lighting. This shows Richelieu Company's investment in cutting-edge technology.

These systems offer innovative design and functionality. This showcases Richelieu Company's commitment to modern design.

Despite its growth, Richelieu Company faced challenges, including a slowdown in the renovation market in 2024. This downturn led to a decline in sales to retailers and renovation superstores, alongside decreases in EBITDA and net earnings. To address these challenges, Richelieu Company continues strategic acquisitions and diversification, as explained in Revenue Streams & Business Model of Richelieu.

A significant slowdown in the renovation market in 2024 impacted sales. This led to a 9.7% decline in sales to retailers and renovation superstores in Q4 2024.

A 10.9% drop in sales for the full year in the renovation segment. This reflects the impact of market conditions on sales figures.

A decrease in EBITDA and net earnings in 2024, with EBITDA totaling $201.4 million, down 12.6% from 2023, and net earnings attributable to shareholders falling 23.1% to $85.8 million. These decreases were attributed to higher inventory costs, lower product selling prices, and expenses related to consolidation and expansion projects.

Richelieu addresses these challenges through continued strategic acquisitions, diversification of market segments, and ongoing investments in new product lines and in-store displays to boost sales to retail customers. This reflects a proactive approach to navigate market fluctuations.

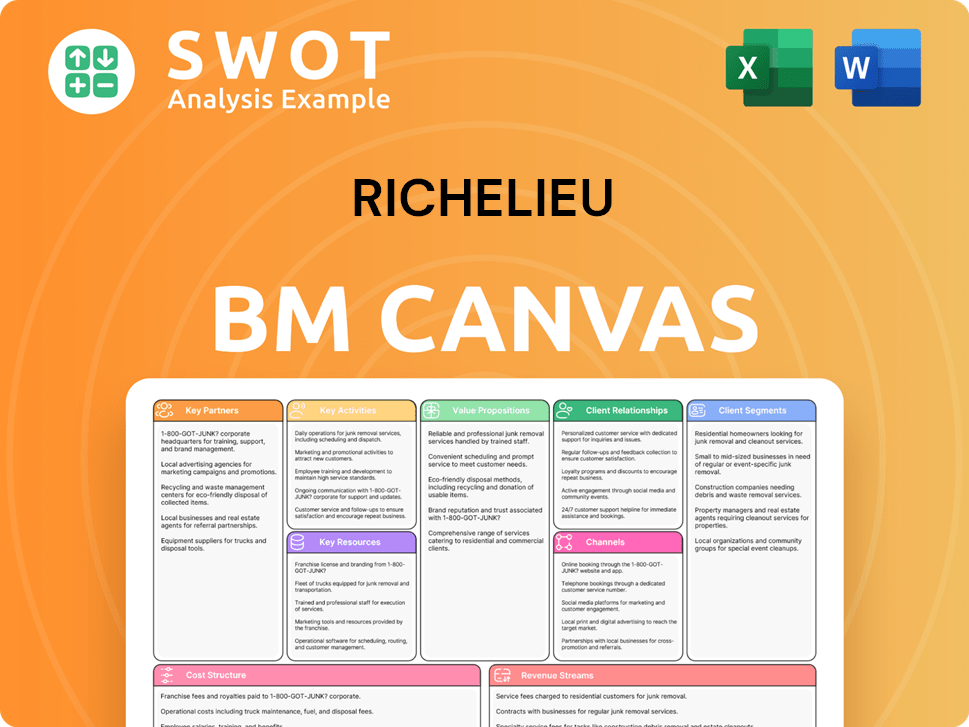

Richelieu Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Richelieu?

The Richelieu Company has a rich Richelieu history, marked by strategic moves and expansion. From its beginnings in Montreal, Quebec, to its current position, the company has consistently adapted to market demands, driven by acquisitions and product diversification. The Richelieu furniture business, now a key player in the industry, shows a clear path of growth and evolution.

| Year | Key Event |

|---|---|

| 1968 | Richelieu Hardware Ltd. was incorporated in Montreal, Quebec, marking the beginning of its journey. |

| 1987 | The company began an aggressive acquisition program to broaden its market reach, setting the stage for future growth. |

| 1993 | Richelieu was first listed on a formal exchange, a significant step in its corporate development. |

| 2009 | The company offered approximately 58,000 different products through its distribution centers, showcasing its extensive product range. |

| 2011 | Acquisitions of Outwater Hardware and Madico Inc. expanded its customer base and product lines in the U.S. |

| 2018 | Chair City Supply was acquired, adding four distribution centers in North Carolina and Tennessee. |

| 2019 | Euro Architectural Components Inc. was purchased, expanding into new product markets with two additional distribution centers. |

| 2020 | Acquisitions accounted for 7.6% of Richelieu's consolidated sales, an all-time high. |

| 2024 | Reported consolidated sales of $1.8 billion, a 2.5% increase over 2023, and completed seven acquisitions in North America. |

| December 1, 2024 | Acquired Mill Supply in Nova Scotia and Prince Edward Island. |

| January 6, 2025 | Acquired Darant Distributing in Denver, Colorado. |

| January 13, 2025 | Acquired Midwest Specialty Products in Minneapolis, Minnesota. |

| February 4, 2025 | Acquired Modulex Partition in Hillside, New Jersey. |

| February 28, 2025 | Reported Q1 2025 consolidated sales of $441.7 million, an 8.6% increase from Q1 2024, with total assets reaching $1.48 billion. |

| April 1, 2025 | Completed the acquisition of Rhoads & O'Hara Architectural Products in Vineland, New Jersey. |

The company anticipates growth from North America's housing shortage and the renovation market's recovery. Strategic initiatives include strengthening product offerings and expanding through acquisitions. Key sectors for future sales growth include kitchen cabinets, closets, and commercial renovations.

Richelieu plans to strengthen its product offerings with new diversified products. They are continuing their acquisition program to expand their presence in strategic markets. The company is focused on long-term growth, supported by its extensive distribution network.

Key areas of focus for future sales growth include the kitchen cabinet, closet, storage solutions, and commercial renovation sectors. The company is adapting to market needs through innovation and strategic expansion. These sectors represent significant growth potential for the Richelieu Company.

Richelieu's leadership emphasizes a commitment to long-term growth, supported by its extensive network of 112 distribution centers. This customer-focused business model aligns with its founding vision. This approach ensures the company's sustained success in the Richelieu furniture market.

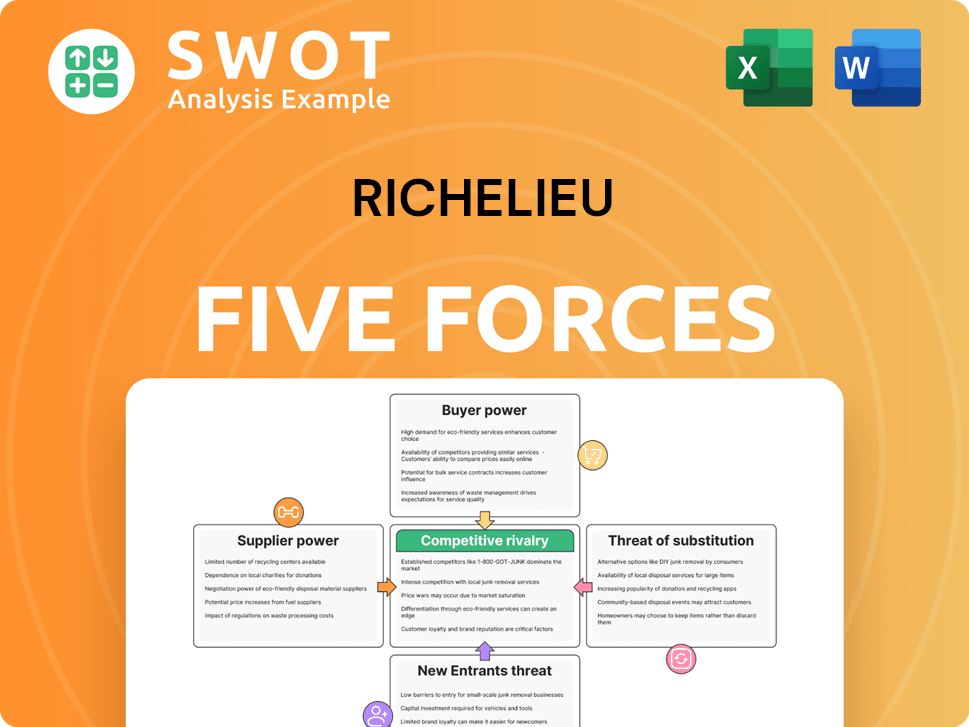

Richelieu Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Richelieu Company?

- What is Growth Strategy and Future Prospects of Richelieu Company?

- How Does Richelieu Company Work?

- What is Sales and Marketing Strategy of Richelieu Company?

- What is Brief History of Richelieu Company?

- Who Owns Richelieu Company?

- What is Customer Demographics and Target Market of Richelieu Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.