Sdiptech Bundle

What's the Story Behind Sdiptech's Rise?

Ever wondered how a company becomes a key player in shaping sustainable infrastructure? Sdiptech, a name synonymous with innovation in infrastructure technology, has a compelling story. From its humble beginnings to its current market presence, Sdiptech's journey offers valuable insights for investors and business strategists alike. Discover the key milestones that have defined the Sdiptech SWOT Analysis and its impact on the industry.

This article dives deep into the brief history of Sdiptech, exploring its strategic acquisitions and the evolution of its business model. Understanding the Sdiptech company profile, including its financial performance and market capitalization, provides a solid foundation for anyone looking to invest or gain a deeper understanding of this important player. We'll also touch upon Sdiptech's leadership team and the industry sector it operates in, offering a comprehensive Sdiptech company overview.

What is the Sdiptech Founding Story?

The story of Sdiptech began in Sweden in 2004. The company, a player in the infrastructure technology sector, was created to invest in and develop small and medium-sized enterprises (SMEs). This approach focused on niche technology areas that support societal infrastructure.

The founders of Sdiptech saw an opportunity to support specialized companies that were essential for critical infrastructure. They aimed to provide these companies with a supportive structure to help them grow and innovate. This strategy has shaped the Sdiptech company's approach from its inception.

The initial business model involved acquiring these niche companies. Sdiptech offered strategic guidance, capital, and operational support. The acquired companies were encouraged to maintain their entrepreneurial spirit and specialized expertise. This decentralized method was designed to maximize the potential of each acquired entity. Early funding probably came from the founders and initial investors.

The company's founding was based on identifying and supporting SMEs in niche technology sectors.

- Sdiptech focused on companies vital for societal infrastructure.

- The company acquired companies, offering support while allowing them to maintain their expertise.

- Early funding involved the founders and initial investors.

- The early 2000s in Sweden, with its tech scene and sustainability focus, likely influenced Sdiptech's direction.

The economic and cultural environment of the early 2000s in Sweden, with its growing tech scene and emphasis on sustainability, influenced Sdiptech's focus on infrastructure technology. This focus has been a key part of the Sdiptech history. For more details on the company's growth strategy, you can read about the Growth Strategy of Sdiptech.

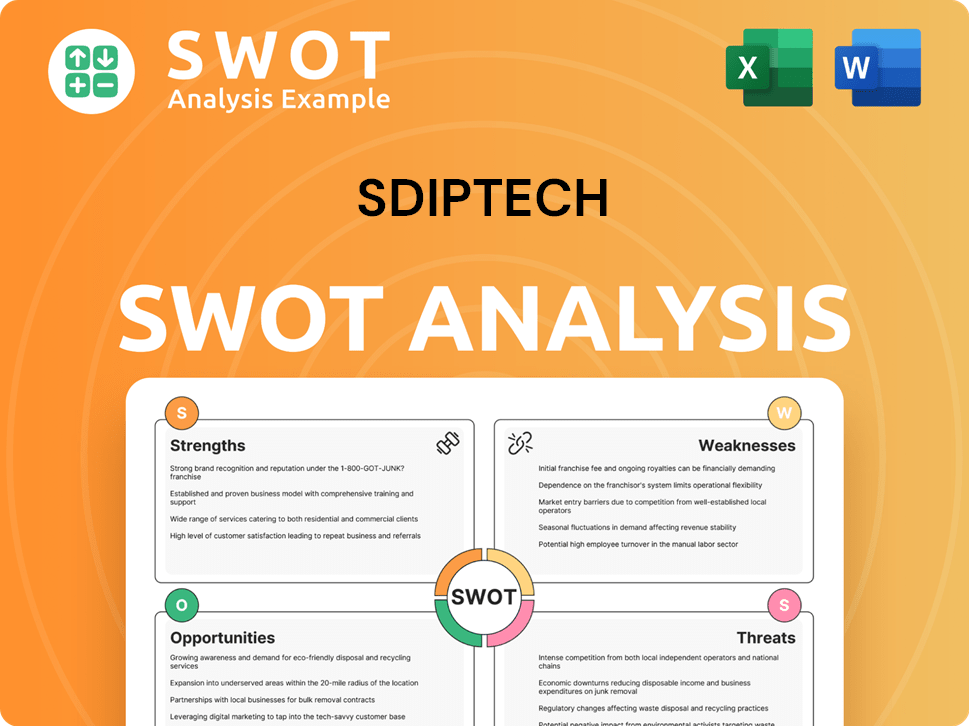

Sdiptech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Sdiptech?

The early growth of the Sdiptech company was marked by a strategic focus on acquiring businesses aligned with its vision for sustainable societal infrastructure. This approach involved building a diverse portfolio of niche technology companies. Key to this phase was the expansion through strategic

As

Major capital raises, including its listing on Nasdaq First North in 2014 and subsequent uplisting to Nasdaq Stockholm's main market in 2017, provided capital for accelerated growth. These financial milestones were pivotal, allowing

By the end of 2023,

The strategic

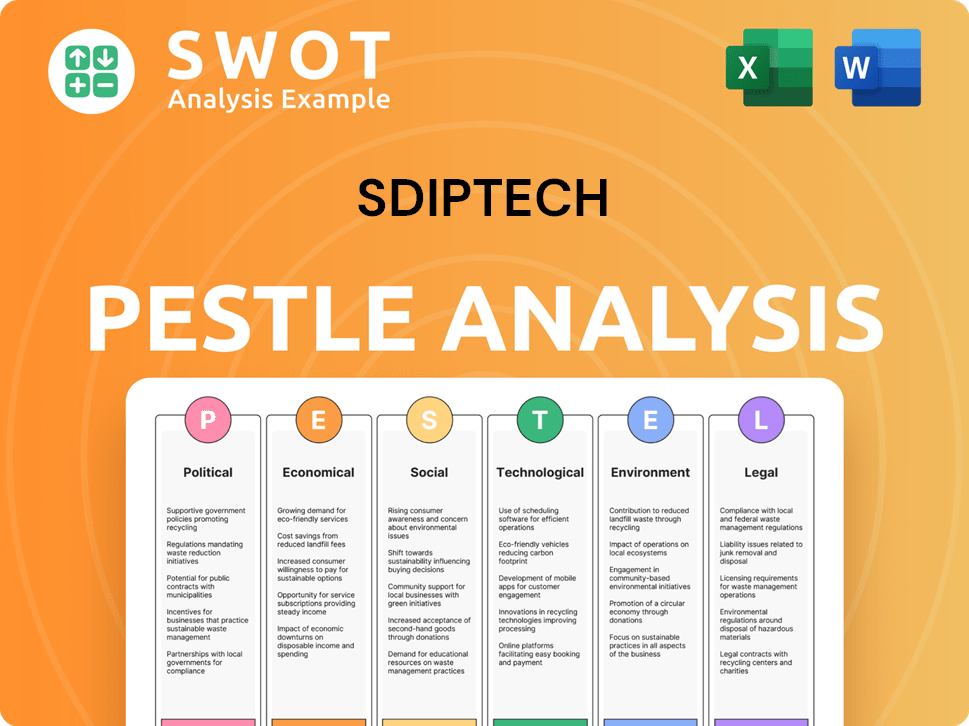

Sdiptech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Sdiptech history?

The Sdiptech history is marked by strategic growth and adaptation within the sustainable societal infrastructure sector. The company has consistently expanded its operations and market presence, demonstrating a commitment to long-term value creation and sustainable solutions.

| Year | Milestone |

|---|---|

| 2014 | Initial Public Offering (IPO) on Nasdaq First North, providing capital for expansion. |

| 2017 | Uplisting to Nasdaq Stockholm's main market, reflecting increased market confidence. |

| 2023 | Net sales increased by 24% to SEK 3,694 million, with an adjusted EBITA of SEK 1,027 million. |

A key aspect of the

The company strategically acquires companies with strong recurring revenue models. This focus enhances the stability and predictability of the overall portfolio performance.

Sdiptech is committed to providing sustainable solutions, such as efficient water management and reliable power supply. This commitment addresses critical societal needs and aligns with global sustainability goals.

The company has expanded its operations geographically, with a significant portion of its adjusted EBITA generated outside of Sweden. This expansion indicates successful internationalization and diversification of revenue streams.

Challenges for

The company faces challenges related to economic downturns affecting its various markets. Strategic financial planning and diversification help mitigate these risks.

Integrating the acquired companies and their diverse corporate cultures presents challenges. Effective integration is crucial for realizing synergies and achieving operational efficiencies.

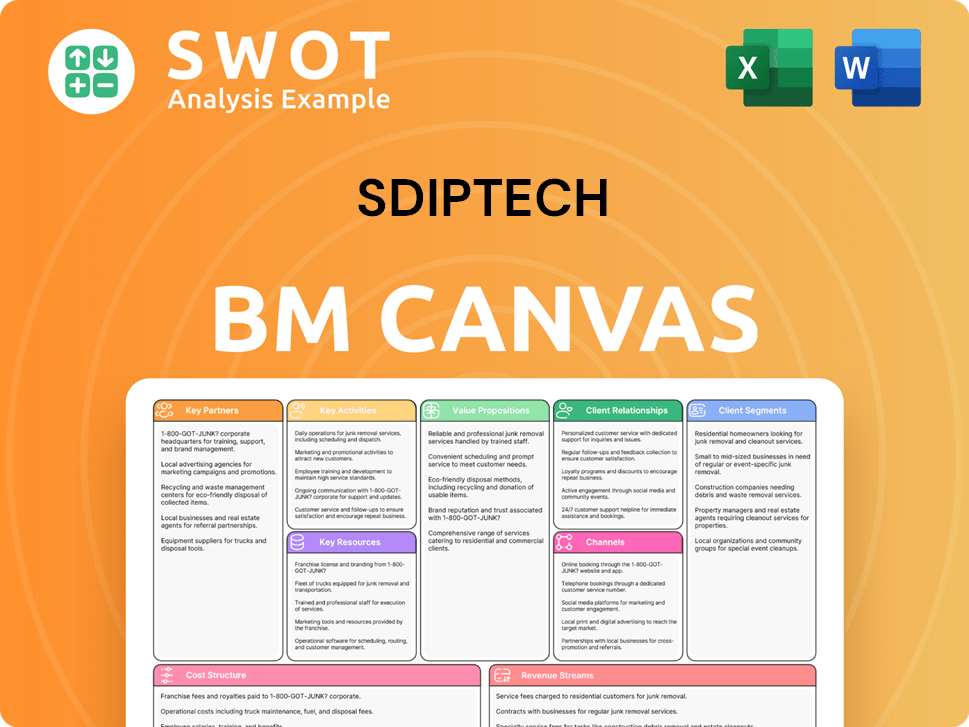

Sdiptech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Sdiptech?

The

| Year | Key Event |

|---|---|

| 2004 | |

| 2014 | Initial public offering (IPO) on Nasdaq First North. |

| 2017 | Uplisted to Nasdaq Stockholm's main market, indicating increased market presence. |

| 2020-2023 | Continued strong growth through strategic |

| 2023 | Reported net sales of SEK 3,694 million and adjusted EBITA of SEK 1,027 million, demonstrating robust financial performance. |

| 2024-2025 |

The company plans to continue its geographic expansion and diversify its portfolio within sustainable infrastructure.

Industry trends, such as increasing demand for smart city solutions, energy efficiency, and resilient water infrastructure, provide ample opportunities for

The company's forward-looking strategy remains consistent with its founding vision: to be a leading enabler of sustainable societal infrastructure. This vision guides

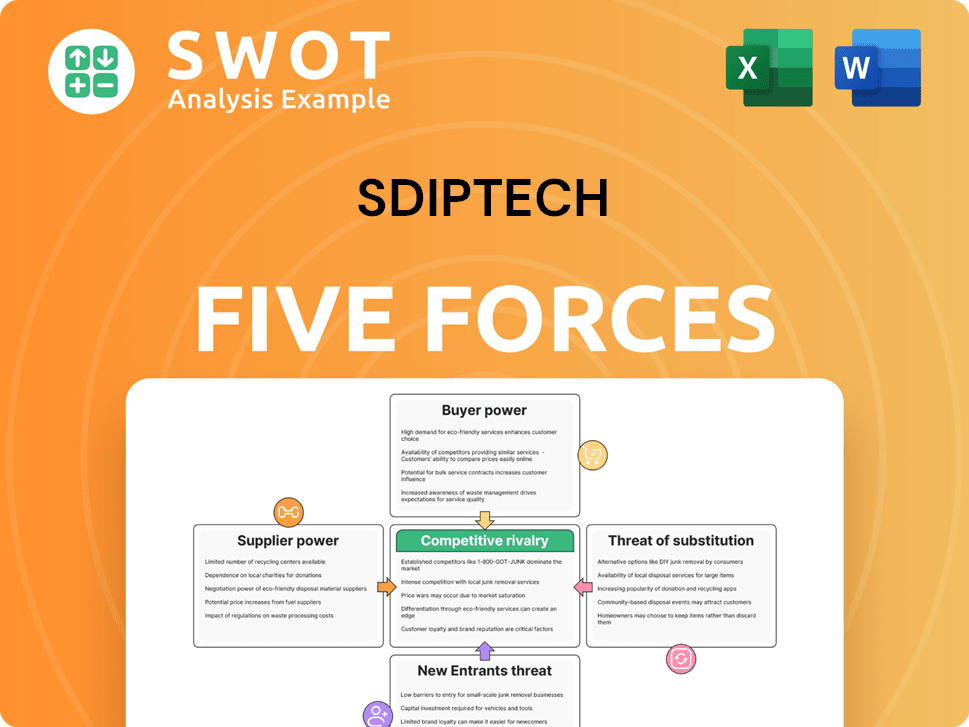

Sdiptech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Sdiptech Company?

- What is Growth Strategy and Future Prospects of Sdiptech Company?

- How Does Sdiptech Company Work?

- What is Sales and Marketing Strategy of Sdiptech Company?

- What is Brief History of Sdiptech Company?

- Who Owns Sdiptech Company?

- What is Customer Demographics and Target Market of Sdiptech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.