Sdiptech Bundle

How Does Sdiptech Thrive in the Infrastructure Sector?

Sdiptech, a Stockholm-based technology group, is making waves in sustainable societal infrastructure. Their strategic acquisitions and focus on essential services have solidified their influence. But how does this company, with its unique approach, actually operate and generate value? Understanding the inner workings of Sdiptech is key to grasping its potential.

This analysis will explore the core of Sdiptech SWOT Analysis, examining its operational framework, revenue streams, and strategic moves within the infrastructure landscape. With net sales up and a strong adjusted EBITA, the Sdiptech company is demonstrating robust financial performance. By dissecting its business model and acquisition strategy, we can better understand how Sdiptech works and its long-term value creation in a dynamic market. This comprehensive review will cover all aspects of the Sdiptech business model and its potential for investors, customers, and industry observers alike.

What Are the Key Operations Driving Sdiptech’s Success?

The core operations of the Sdiptech company revolve around acquiring and developing businesses that provide niche technologies and solutions for sustainable societal infrastructure. The company's value proposition lies in delivering essential products and services across critical infrastructure sectors. As of January 1, 2025, Sdiptech operates through four key business areas, each contributing to its overall mission of fostering sustainable development.

Sdiptech's approach involves a decentralized operational model, allowing acquired companies to maintain their entrepreneurial spirit while benefiting from the parent company's market insights and technical expertise. This structure supports the growth of individual units and enables Sdiptech to offer customized solutions, attracting new customers in diverse sectors. The company's supply chain and distribution networks are diversified across its subsidiaries, primarily in the Nordic region, the UK, and Northern Italy.

The company's strategy focuses on niche markets with limited competition, contributing to stable competitive landscapes and high-profit margins. Sdiptech's effectiveness stems from its ability to integrate these niche businesses, leveraging their specialized knowledge while providing strategic support and resources for continuous development. This approach supports Sdiptech's growth strategy and enhances its financial performance.

This segment focuses on innovative solutions for modernizing and streamlining transport and supply chains. It addresses the increasing demand for sustainable and efficient logistics. This area is driven by the need for advanced technologies in the logistics sector.

The Energy & Electrification area provides niche solutions in energy efficiency, electrification, power supply, and temporary electricity. It capitalizes on the global transition to future energy systems. This segment is vital for supporting the shift towards renewable energy sources.

This segment specializes in systems and technologies for water, waste management, and the circular use of natural resources. It addresses the challenges of population growth, urbanization, and regulatory demands for infrastructure modernization. This area is crucial for sustainable resource management.

Safety & Security offers solutions in fire and personal safety, workplace and public environment safety, and information security. It is propelled by technological advancements and evolving societal needs. This segment is essential for ensuring public safety and security.

Sdiptech's decentralized model, combined with its focus on niche markets, contributes to its financial stability and growth. The company's diversified revenue base and strategic acquisitions enhance its market position. The company's investment strategy is centered on acquiring and developing niche technology companies.

- Decentralized operational model fostering entrepreneurial spirit.

- Diversified supply chain and distribution networks across key regions.

- Focus on niche markets with limited competition, ensuring high-profit margins.

- Strategic integration of acquired businesses, leveraging specialized knowledge.

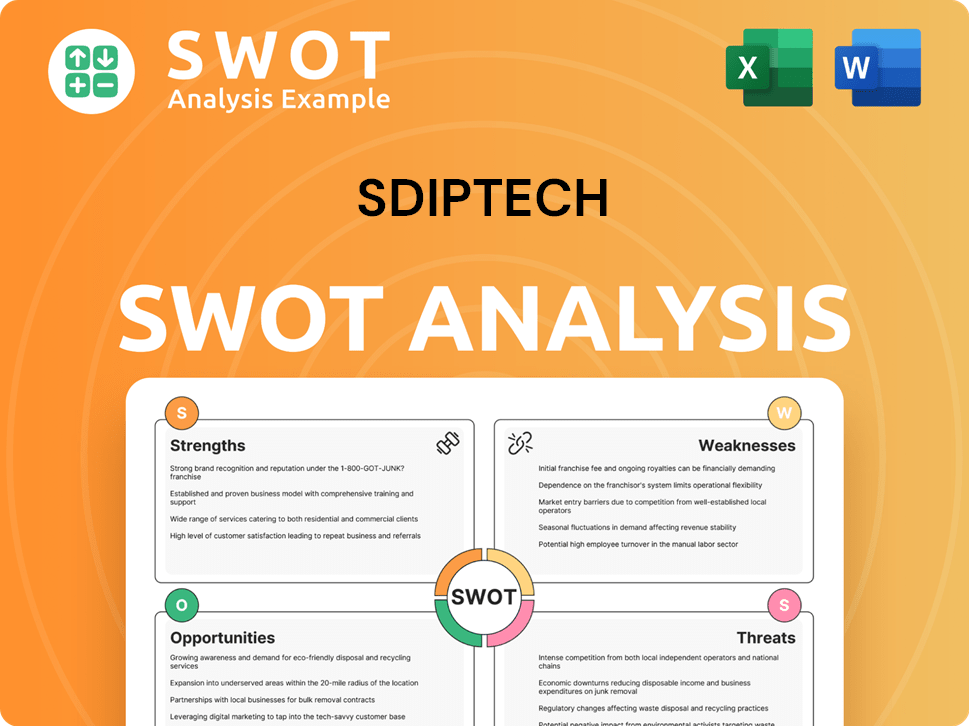

Sdiptech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sdiptech Make Money?

The core of how the Sdiptech company operates revolves around its revenue streams and monetization strategies. This involves generating income through product sales and services offered by its portfolio of acquired niche technology companies. The company's approach is closely tied to its acquisition model, where it purchases profitable businesses and uses their cash flow to fund further acquisitions.

Sdiptech's business model is centered on acquiring and growing profitable businesses. This strategy allows for diversification across different sectors, enhancing its overall financial stability and growth potential. The company continually assesses and adjusts its portfolio to optimize revenue and profitability.

In the first quarter of 2025, Sdiptech reported net sales of SEK 1,330 million, marking a 4% increase compared to the previous year. For the full year 2024, net sales saw a 13% rise, reaching SEK 5,166 million, with an adjusted EBITA of SEK 1,010 million. The company's focus on proprietary products is evident, with these products now accounting for approximately 62% of total sales, a slight increase from 61% in Q4 2024.

Sdiptech's revenue is diversified across four main business areas: Supply Chain & Transportation, Energy & Electrification, Water & Bioeconomy, and Safety & Security, effective from January 1, 2025. This diversification helps mitigate risks and capitalize on growth opportunities in various sectors. The company's strategy includes divesting lower-margin service businesses and replacing them with higher-margin product businesses.

- The company’s acquisitions often involve paying 7-9x EBITA for acquired businesses.

- The goal is to achieve an implied yield of 11-14% and requires at least 1-4% EBITA growth from these units to achieve a 15%+ return on capital.

- This strategic shift is part of a continuous effort to optimize its revenue mix and profitability.

- The ongoing strategic adjustments, including the planned divestment of its remaining elevator operations, reflect a continuous effort to optimize its revenue mix and profitability.

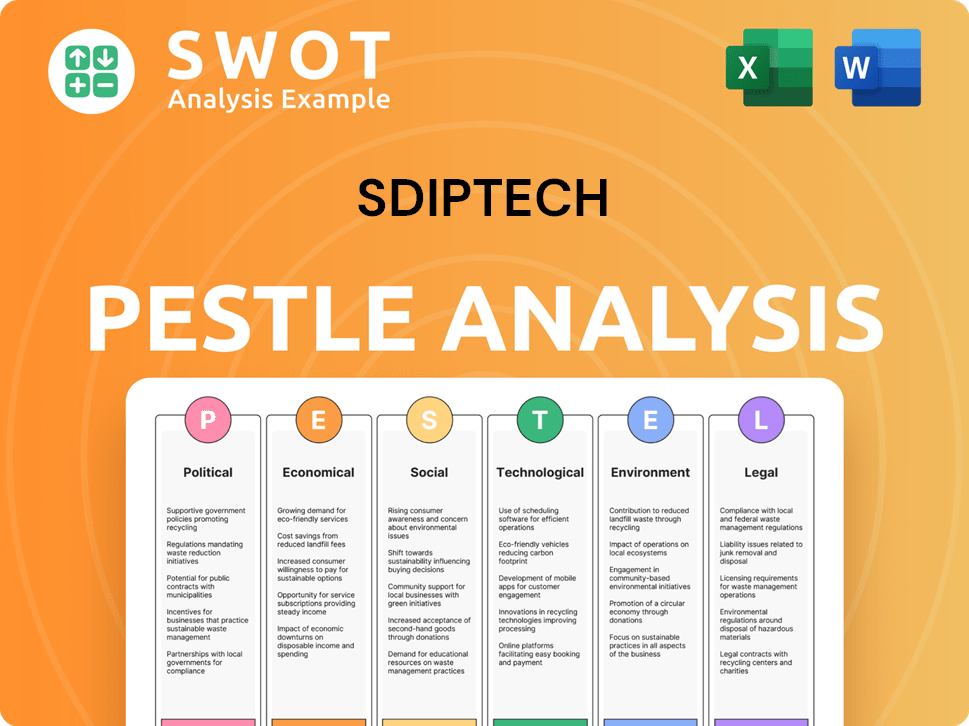

Sdiptech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Sdiptech’s Business Model?

The operational and financial trajectory of the Sdiptech company has been significantly shaped by strategic initiatives and key milestones, particularly its consistent acquisition strategy. Since its IPO in 2015, Sdiptech has completed over 30 acquisitions, demonstrating a commitment to growth through strategic investments. These acquisitions are central to Sdiptech's business model, aiming to acquire profitable companies and leverage their cash flows for further expansion. This approach has allowed Sdiptech to build a diversified portfolio of businesses within the infrastructure sector.

A pivotal strategic shift occurred in 2019 when Sdiptech updated its strategy to focus exclusively on acquiring high-margin companies with proprietary products within the broadly defined infrastructure sector, moving away from lower-margin service businesses. This strategic pivot has been instrumental in shaping the company's focus on higher-value offerings. This shift has led to proprietary products making up approximately 62% of total sales as of Q1 2025. The company has also demonstrated adaptability in response to challenges, such as the decision to divest its remaining elevator operations as they no longer align with its strategic investment plan.

Sdiptech's competitive advantages are multifaceted. Its decentralized strategy allows acquired companies to maintain their entrepreneurial drive while benefiting from Sdiptech's market insight and technical expertise. Furthermore, its diversified revenue base across multiple business units and end-markets reduces dependency on single products or customers. The company continues to adapt by constantly evaluating new acquisition opportunities and developing its business units to drive organic growth. For a deeper understanding of the company's origins, explore Brief History of Sdiptech.

Sdiptech has a strong track record of strategic acquisitions, which are a core part of its growth strategy. Recent acquisitions include Wintex Agro in December 2024, Eagle Automation Systems in October 2024, WaterTech in April 2024, and Phase 3 Connectors in January 2025. These acquisitions are carefully chosen to align with the company's focus on high-margin companies with proprietary products in the infrastructure sector.

The strategic focus on acquiring high-margin companies with proprietary products is a key differentiator for Sdiptech. This focus allows the company to build a portfolio of businesses that generate strong cash flows and provide opportunities for organic growth. By concentrating on niche markets within infrastructure, Sdiptech aims to establish a stable competitive landscape.

Sdiptech's decentralized strategy allows acquired companies to maintain their entrepreneurial drive. The company's focus on niche markets within infrastructure often means fewer competitors and stable competitive landscapes. Furthermore, its diversified revenue base across multiple business units and end-markets reduces dependency on single products or customers. This diversification helps to mitigate risks and ensures long-term stability.

Sdiptech's commitment to sustainability and solutions that contribute to societal good also aligns with long-term value creation. The company recognizes the growing market demand for sustainable infrastructure solutions. By investing in sustainable technologies, Sdiptech positions itself for future growth and contributes to a more sustainable future.

Sdiptech's business model revolves around acquiring and developing companies within the infrastructure sector. The company targets profitable businesses with proprietary products, focusing on high-margin opportunities. This strategy is supported by a decentralized management approach, allowing acquired companies to retain their operational autonomy while benefiting from Sdiptech's resources and expertise.

- Acquisition of profitable companies.

- Focus on high-margin products and services.

- Decentralized management to foster entrepreneurial spirit.

- Diversified revenue streams to reduce risk.

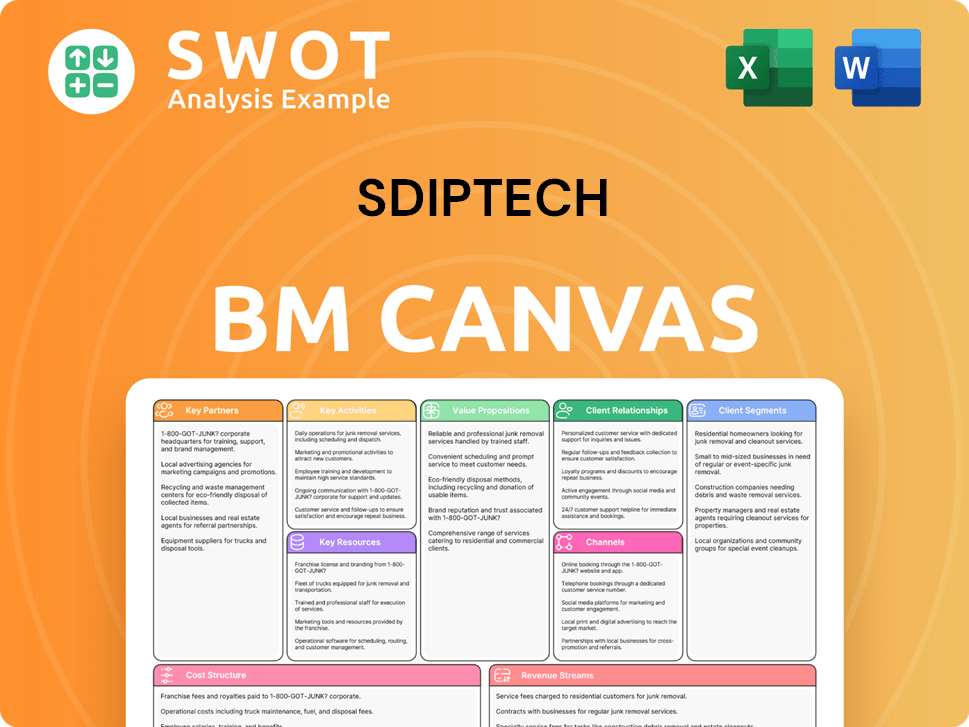

Sdiptech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Sdiptech Positioning Itself for Continued Success?

The Sdiptech company holds a strong market position in niche infrastructure sectors, mainly in the Nordic region, the UK, and Northern Italy, with a presence in other European countries. Its strategy of acquiring market-leading niche operations significantly contributes to its competitive standing. The company benefits from secular tailwinds in its markets, such as increased demand for energy efficiency, electrification, and sustainable logistics solutions, driven by population growth, urbanization, and stricter environmental regulations.

Despite its strong position, Sdiptech faces several key risks. These include potential increased competition in growing markets, which could impact its acquisition strategy and profitability. Financing costs and expected earn-outs from previous acquisitions, totaling approximately SEK 411 million in 2025 and SEK 530 million in 2026-2027, are also considerations. Supply chain disruptions and climate change-related physical risks, such as increased insurance costs or production stoppages, are also factors.

Sdiptech operates in niche infrastructure sectors, primarily in the Nordic region, the UK, and Northern Italy. The company's strategy of acquiring market-leading niche operations contributes to its competitive standing. It benefits from increased demand for energy efficiency and sustainable solutions.

Key risks include potential increased competition and challenges related to acquisitions. Financing costs and earn-outs from previous acquisitions are factors. Supply chain disruptions and climate-related physical risks also pose challenges.

Sdiptech is focused on continued strategic acquisitions and organic growth within its newly structured business areas. The company aims to acquire SEK 120 million to SEK 150 million in EBITA per year without raising additional equity. They forecast organic sales growth of approximately 3-4% from 2025 onwards.

Sdiptech's growth strategy centers around strategic acquisitions and organic growth within its four business areas. Efficiency measures and portfolio reviews are underway. The company aims to acquire SEK 120 million to SEK 150 million in EBITA per year without needing to raise additional equity.

Sdiptech's financial performance is influenced by its acquisitions and organic growth initiatives. The company aims for organic sales growth of approximately 3-4% from 2025 onwards, with slightly higher organic EBITA growth. The company is also focused on managing costs and improving operational efficiency.

- Organic sales growth forecast: approximately 3-4% from 2025 onwards

- Expected earn-outs: SEK 411 million in 2025 and SEK 530 million in 2026-2027

- Target for acquisitions: SEK 120 million to SEK 150 million in EBITA per year

- Focus on efficiency measures and portfolio reviews

Sdiptech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sdiptech Company?

- What is Competitive Landscape of Sdiptech Company?

- What is Growth Strategy and Future Prospects of Sdiptech Company?

- What is Sales and Marketing Strategy of Sdiptech Company?

- What is Brief History of Sdiptech Company?

- Who Owns Sdiptech Company?

- What is Customer Demographics and Target Market of Sdiptech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.