Sembcorp Marine Bundle

How has Sembcorp Marine, now Seatrium, navigated the turbulent waters of the global offshore industry?

For nearly six decades, Sembcorp Marine, now known as Seatrium, has been a cornerstone of the global offshore, marine, and energy sectors. Its story is one of constant adaptation, from its roots in traditional shipbuilding to its current position as a leading provider of innovative engineering solutions. A pivotal moment was the 2023 merger with Keppel Offshore & Marine, reshaping the landscape of Sembcorp Marine SWOT Analysis and the industry.

This transformation reflects Sembmarine's commitment to sustainability and its proactive response to the energy transition. From its Singapore headquarters, the company has consistently delivered cutting-edge projects, including rigs, offshore platforms, and specialized vessels. Understanding the company history, including key milestones and the impact of the merger, is crucial for anyone interested in the offshore industry or the evolution of marine engineering.

What is the Sembcorp Marine Founding Story?

The story of Sembcorp Marine, registered under company number 196300098Z, spans nearly six decades within the marine and offshore industry. The exact founding details, including the specific date and the founders' backgrounds, are not readily available in the provided information. However, the company's inception is closely tied to Singapore's development as a major maritime center.

The establishment and growth of companies like Sembcorp Marine were significantly influenced by Singapore's emergence as a global business hub for Asia. This broader context played a crucial role in shaping the marine and offshore engineering (M&OE) sector.

The initial goal of Sembcorp Marine, as suggested by its long-standing operations, was to offer engineering solutions to the global offshore, marine, and energy sectors. This included ship repair, ship conversion, rig building, and offshore platform construction. This business model was designed to meet the growing demand for infrastructure and services in the maritime and energy industries. The company's subsequent diversification into specialized services in offshore and marine engineering reflects its ongoing adaptation to market needs and technological advancements.

Sembcorp Marine's early strategy centered on establishing itself as a key player in the marine engineering sector, focusing on ship repair, conversion, and building. This strategic direction was crucial for capitalizing on the opportunities presented by Singapore's strategic location and the growing global demand for maritime services.

- The company's early projects likely involved ship repair and maintenance, which provided a stable revenue stream and established a reputation for quality and reliability.

- The focus on ship conversion allowed Sembcorp Marine to adapt to changing market demands, such as the need for specialized vessels.

- Rig building became a significant part of the business as the offshore oil and gas industry expanded, creating a need for drilling platforms.

- The company's location in Singapore offered advantages, including access to a skilled workforce and strategic access to major shipping routes.

Over time, Sembcorp Marine expanded its capabilities and services to meet the evolving needs of the offshore industry. This expansion included investments in new technologies and infrastructure, as well as strategic partnerships and acquisitions.

- The company invested in advanced technologies, such as those related to offshore platform construction and specialized vessel design.

- Sembcorp Marine expanded its global presence by establishing shipyards and offices in strategic locations.

- Strategic partnerships helped the company to enter new markets and gain access to new technologies.

- Acquisitions allowed Sembcorp Marine to broaden its service offerings and increase its market share.

Several milestones mark Sembcorp Marine's journey, illustrating its growth and adaptation within the marine and offshore industry. These include significant project completions, technological innovations, and strategic shifts in business focus.

- Successful completion of major offshore platform construction projects, which boosted the company's reputation.

- Introduction of innovative designs and technologies in shipbuilding and offshore engineering.

- Strategic shifts in business focus to align with market trends and opportunities.

- Expansion into new market segments, such as renewable energy projects.

Sembcorp Marine has consistently adapted to the volatile nature of the marine and offshore markets. This adaptability has been crucial for maintaining its competitiveness and ensuring long-term sustainability. The company's ability to adjust to market fluctuations and technological advancements has been key to its success.

- The company has adjusted its strategies to address fluctuations in oil prices and demand for offshore services.

- Sembcorp Marine has invested in research and development to stay at the forefront of technological advancements.

- The company has diversified its portfolio to include projects in renewable energy and other emerging sectors.

- Sembcorp Marine has focused on operational efficiency and cost management to enhance its competitiveness.

For a deeper dive into the company's financial structure and operational strategies, consider exploring the Revenue Streams & Business Model of Sembcorp Marine.

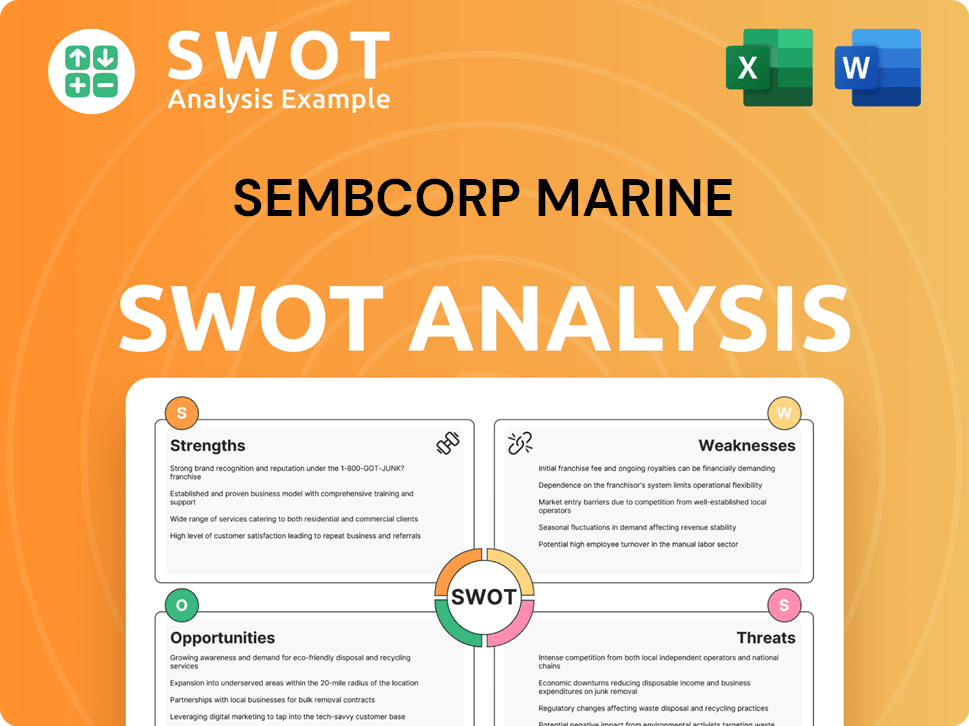

Sembcorp Marine SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Sembcorp Marine?

The early growth and expansion of Sembcorp Marine were marked by continuous enhancement of its capabilities and production capacity. This strategy enabled the company to undertake complex offshore projects and maintain a competitive edge in the marine engineering sector. A key aspect of its early growth involved strategic expansions of overseas hubs, alongside strengthening its local presence in Singapore. These developments were pivotal in shaping Sembcorp Marine's trajectory within the offshore industry.

A significant milestone for Sembcorp Marine was the opening of the Sembmarine Integrated Yard @ Tuas in Singapore. Phase I operations commenced in August 2013, and the facility was officially opened in November 2013. This yard, spanning 73.3 hectares, was designed for operational synergy and logistical efficiency. It featured advanced automation and facilities, including four VLCC drydocks.

Beyond Singapore, Sembcorp Marine expanded its global presence with operations in Brazil, India, Indonesia, and the United Kingdom. In India, the Sembmarine Kakinada joint venture saw its first newbuild floating dock become operational in January 2013. This expansion enhanced its capabilities in drydocking, repairs, and conversions. Additionally, the company established Estaleiro Jurong Aracruz in Brazil.

These expansions and strategic facility developments were crucial in shaping Sembcorp Marine's trajectory. They enabled the company to meet the stringent safety and quality requirements of the global marine and offshore sector. The company focused on delivering innovative solutions to its customers. For further insights, consider the Competitors Landscape of Sembcorp Marine.

The investments in infrastructure and global presence allowed Sembcorp Marine to cater to a diverse range of projects. These included mega-containerships, LNG carriers, passenger ships, ultra-deepwater rigs, and offshore platforms. The company's ability to adapt and expand its capabilities was key to its success in the offshore industry. The company’s commitment to innovation and expansion continues to be a core part of its strategy.

Sembcorp Marine PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Sembcorp Marine history?

The history of Sembcorp Marine, now known as Seatrium, is marked by significant milestones in the marine engineering and offshore industry. The company has evolved from its roots in Singapore to become a global player, adapting to the changing demands of the energy sector and embracing sustainable solutions. This evolution showcases Sembcorp Marine's resilience and strategic foresight in a dynamic market.

| Year | Milestone |

|---|---|

| 2015 | Strategic diversification into cleaner, greener, and renewable energy solutions began. |

| March 2023 | Secured a framework cooperation agreement for three 2GW high-voltage direct current (HVDC) offshore converter platforms. |

| February 28, 2023 | Completed the merger with Keppel Offshore & Marine (Keppel O&M), leading to the name change to Seatrium Limited. |

| 1HFY2024 | Reported a net profit of $115 million, a significant turnaround from the previous year's losses. |

Sembcorp Marine has been at the forefront of innovation in the offshore industry, particularly in renewable energy. This includes developing specialized vessels like wind turbine installation vessels (WTIVs) and exploring zero-emission technologies for maritime transport. The company's focus on sustainable solutions highlights its commitment to adapting to the global energy transition.

Designed and built WTIVs to handle next-generation wind turbines, facilitating the growth of offshore wind energy projects. These vessels are designed to operate with feeder vessels.

Developed zero-emission battery-powered and hydrogen fuel cell-powered vessels, as well as LNG-battery hybrid tugs, to reduce environmental impact. This is part of the company's sustainability initiatives.

Converting Sevan drilling vessels into floating LNG (FLNG) facilities, expanding its capabilities in the LNG sector. The first is scheduled for delivery in the first half of 2024.

Secured a €6 billion (US$6.5 billion) deal for three 2GW high-voltage direct current (HVDC) offshore converter platforms. Construction started in the third quarter of 2024.

Offering Gravifloat LNG export and import terminals, providing innovative solutions for LNG infrastructure. This expands the company's portfolio in the LNG market.

Developed LNG-battery hybrid tugs, which combine LNG and battery technology to reduce emissions. This is an example of the company's commitment to sustainability.

The Company history of Sembcorp Marine, now Seatrium, has faced challenges, including industry downturns and financial losses. The merger with Keppel O&M was a strategic move to strengthen its market position and capitalize on opportunities in the evolving energy landscape. For more information on the company's ownership and structure, you can read about Owners & Shareholders of Sembcorp Marine.

Experienced a prolonged period of losses from 1HFY2018 to FY2018, which continued for three consecutive years of pre-tax losses. This impacted the company's financial performance.

The merger with Keppel O&M, while strategic, involved integrating two large entities. This merger was valued at $4.5 billion.

Navigating the volatility of the offshore industry, influenced by fluctuating oil prices and changing energy demands. This requires constant adaptation.

Facing competition from other marine engineering companies in the global market. The company must remain competitive to secure projects.

Being affected by broader economic factors, including inflation, supply chain issues, and geopolitical instability. These factors influence project costs and timelines.

Keeping pace with rapid technological advancements in the offshore industry and renewable energy sectors. This requires continuous investment in R&D.

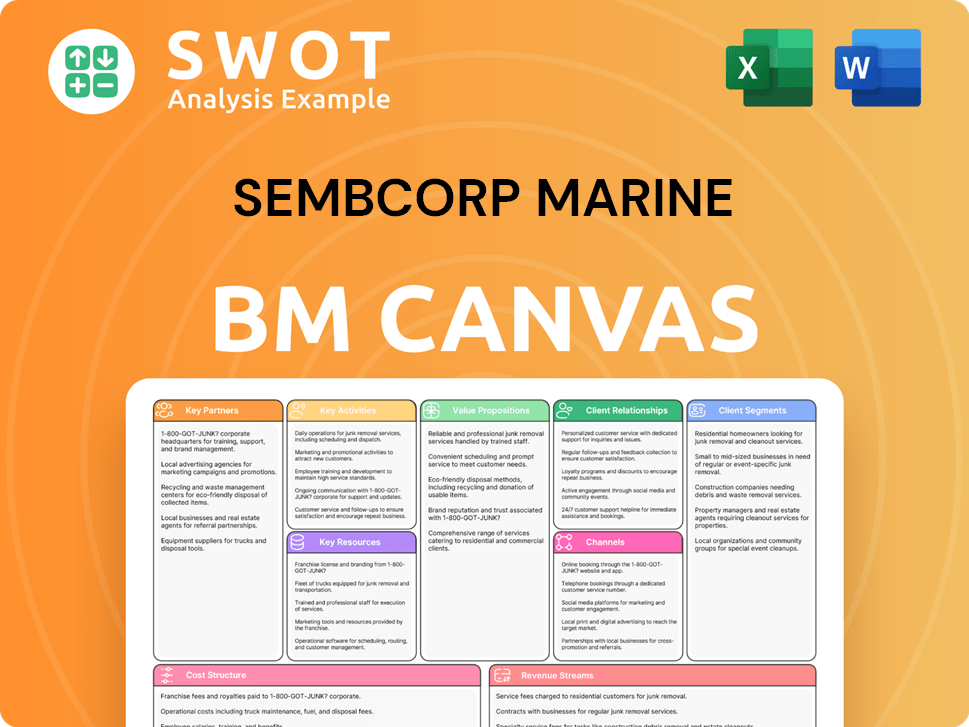

Sembcorp Marine Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Sembcorp Marine?

The journey of Sembcorp Marine, now Seatrium, reflects a dynamic evolution in the marine engineering and offshore industry. The company's history is marked by strategic shifts and significant projects that have shaped its current standing. From its early beginnings to its recent merger, the company has consistently adapted to market demands and technological advancements.

| Year | Key Event |

|---|---|

| 1963 | Original company registration, signaling its founding. |

| 2013 (August) | Phase I operations commenced at the Sembmarine Integrated Yard @ Tuas in Singapore. |

| 2013 (November 6) | Official grand opening of the Sembmarine Integrated Yard @ Tuas. |

| 2015 | Sembcorp Marine diversified into cleaner, greener, and renewable energy solutions, showcasing a proactive approach to sustainability. |

| 2020 | Demerger from Sembcorp Industries, allowing Sembcorp Marine to focus on energy and urban sectors. |

| 2021 (March 4) | Secured its first SORA-based sustainability-linked loan facility with DBS Bank, demonstrating a commitment to sustainable financing. |

| 2022 (April 27) | Entered a non-binding agreement with Keppel Corporation for a potential merger of their yard operations. |

| 2023 (February 28) | Completion of the combination of Sembcorp Marine and Keppel Offshore & Marine businesses. |

| 2023 (April 3) | Proposed changing its name to Seatrium Limited. |

| 2023 (March 30/31) | Secured a €6 billion (US$6.5 billion) deal with GE Renewable Energy's Grid Solutions for HVDC offshore converter platforms for TenneT. |

| 2024 (First Half) | Hull conversion and topside fabrication for the first FLNG liquefaction facility scheduled for delivery. |

| 2024 (Third Quarter) | Construction of HVDC offshore converter platforms for TenneT commences at Sembcorp Marine's Singapore and Batam yards. |

| 2024 (August 4) | Seatrium reports a net profit of $115 million for 1HFY2024, a significant turnaround from a net loss in the previous year. |

| 2024 (December 31) | Seatrium is on track to report a full-year profit for FY2024. |

| 2025 (Early) | Construction of a wind turbine installation vessel is expected to be completed. |

| 2025 (April 11) | Keppel Limited and Seatrium agree to terminate the segregated account arrangement related to the merger. |

The offshore industry is experiencing an upturn, driven by increased global energy demand. Global offshore spending is projected to reach $100 billion annually for the next two years, creating demand for new rigs, OSVs, and FPSOs. This positive trend supports Seatrium's strategic focus on capturing contracts in growing markets.

Seatrium is expanding its offerings in offshore renewables, new energies, and cleaner offshore solutions. This includes significant investments in offshore wind and exploration of cleaner fuels like ammonia and hydrogen. The company's focus on sustainability aligns with industry trends towards decarbonization.

Seatrium's net order book stood at $24.4 billion in 3QFY2024, with deliveries extending until 2031. The company reported a net profit of $115 million for 1HFY2024 and is on track to report a full-year profit for FY2024. Leadership is focused on project execution, cost management, and operational efficiencies to sustain improved financial performance.

Construction of HVDC offshore converter platforms for TenneT is underway at Singapore and Batam yards. The company is also involved in hull conversion and topside fabrication for the first FLNG liquefaction facility, scheduled for delivery. These projects highlight Seatrium's capabilities in marine engineering and offshore platforms.

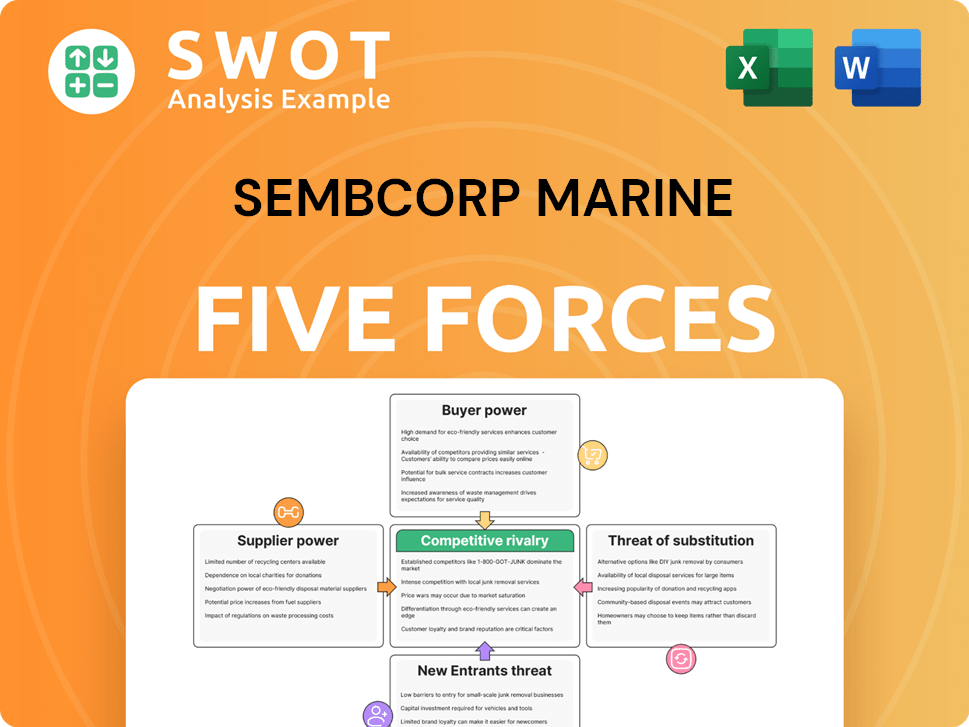

Sembcorp Marine Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Sembcorp Marine Company?

- What is Growth Strategy and Future Prospects of Sembcorp Marine Company?

- How Does Sembcorp Marine Company Work?

- What is Sales and Marketing Strategy of Sembcorp Marine Company?

- What is Brief History of Sembcorp Marine Company?

- Who Owns Sembcorp Marine Company?

- What is Customer Demographics and Target Market of Sembcorp Marine Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.