Sembcorp Marine Bundle

How Does Sembcorp Marine Stack Up in Today's Marine Industry?

The global Sembcorp Marine SWOT Analysis reveals a company deeply rooted in Singapore's industrial evolution, now operating as Seatrium. The offshore, marine, and energy sectors are experiencing a massive transformation, and Seatrium is at the forefront. This analysis dives into the competitive dynamics shaping Seatrium's future.

Understanding the Competitive Landscape is crucial for investors and industry watchers. This exploration delves into Sembcorp Marine's strategic positioning, examining its rivals, Market Share, and the forces driving its success. The Marine Industry Analysis presented here will help you understand Sembcorp Marine's market position and how it leverages its Competitive advantages of Sembcorp Marine in the face of evolving industry trends, including the Offshore Oil and Gas and Shipbuilding sectors.

Where Does Sembcorp Marine’ Stand in the Current Market?

Seatrium Limited, the merged entity of Sembcorp Marine and Keppel Offshore & Marine, has a significant market position in the global offshore, marine, and energy sectors. The merger, completed in April 2023, created a major player with enhanced scale and capabilities. The company aims to be a global leader in its segment. The core operations of Seatrium encompass newbuilds for offshore production and renewable energy, conversions and upgrades, repairs and services, and specialized marine and offshore engineering.

The company's value proposition lies in its comprehensive range of services, its strong presence in key maritime hubs, and its strategic shift toward renewable energy solutions. This positioning allows it to serve a diverse customer base. Seatrium leverages its extensive engineering expertise and integrated capabilities, particularly in complex, high-value projects. The company's focus on project execution and cost management is crucial for improving its financial health.

Geographically, Seatrium has a strong presence across key maritime and energy hubs globally, including Singapore, Brazil, Norway, and the United States. This widespread operational footprint allows it to serve a diverse customer base, including major oil and gas companies, offshore contractors, and renewable energy developers. Over time, the company has strategically shifted its positioning to align with the energy transition, increasing its focus on renewable energy solutions such as offshore wind farm substations and hydrogen-related projects. This shift reflects a move towards higher-value, more sustainable offerings.

The Marine Industry Analysis reveals that Seatrium, through the merger of Sembcorp Marine and Keppel Offshore & Marine, is a major player. While specific market share figures are still emerging post-merger, the combined strengths suggest a dominant position in rig building, FPSO conversions, and offshore platform construction. The company competes with other major shipyards globally.

Seatrium reported a net loss of S$1.7 billion for the full year 2023. However, the company's order book as of February 2024 stood at S$17.7 billion, indicating a strong pipeline of future projects. This robust order book, particularly in the green energy sector, positions Seatrium for future growth. The company is focused on improving its financial health through project execution and cost management.

Seatrium is strategically positioning itself to align with the energy transition, focusing on renewable energy solutions. This includes offshore wind farm substations and hydrogen-related projects. The company is leveraging its extensive engineering expertise and integrated capabilities, particularly in complex, high-value projects. The future outlook is positive, supported by a strong order book.

Seatrium's primary product lines and services encompass a comprehensive range. These include newbuilds for offshore production and renewable energy, conversions and upgrades, repairs and services, and specialized marine and offshore engineering. The company's diverse offerings cater to a wide array of customers and projects within the Offshore Oil and Gas and renewable energy sectors.

Seatrium's competitive advantages include its enhanced scale and capabilities post-merger, its strong presence in key maritime hubs, and its focus on high-value projects. Recent developments include the completion of the merger with Keppel Offshore & Marine and the strategic shift towards renewable energy. The company's commitment to the evolving energy landscape is evident in its focus on green energy projects.

- The merger created a formidable player in the Marine Industry Analysis.

- Strong order book of S$17.7 billion as of February 2024.

- Strategic focus on renewable energy solutions.

- Leveraging engineering expertise for complex projects.

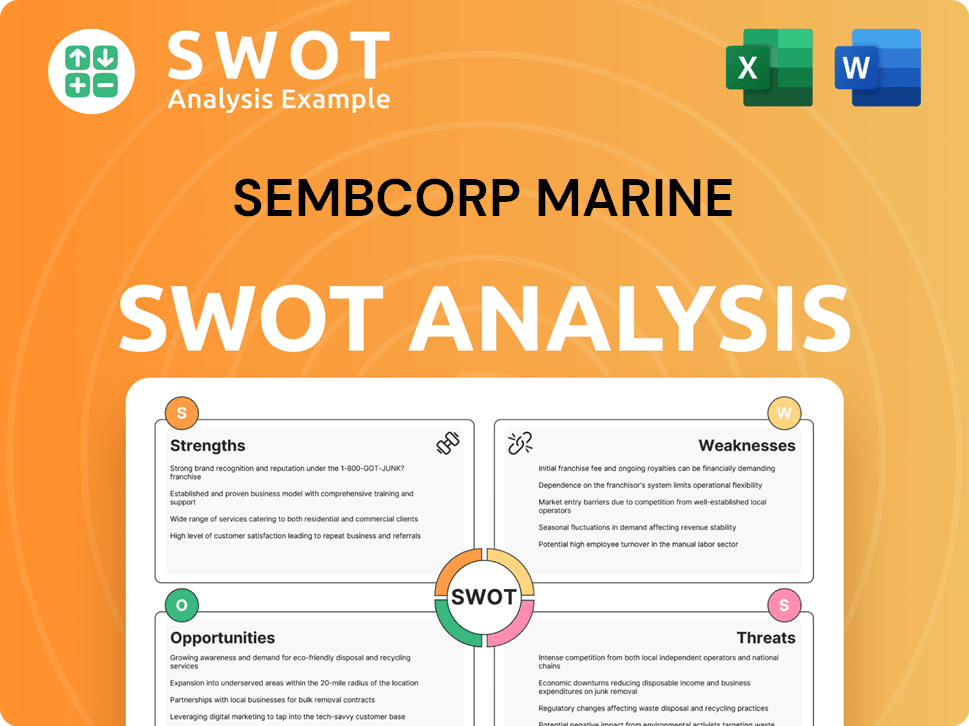

Sembcorp Marine SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Sembcorp Marine?

The competitive landscape for Seatrium (formerly Sembcorp Marine) is complex, encompassing a wide range of players across various sectors within the marine industry analysis. Understanding the key competitors is crucial for assessing Seatrium's market position and strategic challenges. The company faces competition in offshore rig building, conversion projects, and broader offshore and marine engineering services.

The competitive dynamics are further shaped by the emergence of new players and ongoing industry consolidation. This includes the growing influence of Chinese shipyards and the impact of mergers and acquisitions. Analyzing the competitive landscape provides insights into Seatrium's competitive advantages, potential threats, and opportunities for growth. The competitive strategy of the company is constantly evolving to adapt to market changes and technological advancements.

Seatrium's financial performance is directly influenced by its ability to secure and execute projects in a competitive environment. The company's order book analysis and recent developments reflect its success in winning contracts and adapting to industry trends. A thorough understanding of the competitive landscape is essential for investors, analysts, and stakeholders evaluating Seatrium's future outlook.

Major competitors in offshore rig building and conversion include South Korean shipbuilders. Hyundai Heavy Industries (HHI), Samsung Heavy Industries (SHI), and Hanwha Ocean (formerly Daewoo Shipbuilding & Marine Engineering) are key rivals. These companies have significant capacity and often compete on cost-effectiveness.

European companies like Saipem and Technip Energies are significant competitors. They specialize in integrated solutions for offshore developments and renewable energy projects. Saipem is a major player in offshore drilling and construction, while Technip Energies focuses on floating platforms and subsea systems.

Seatrium also competes with specialized service providers and smaller firms. These companies focus on niche segments such as vessel repair, specialized equipment manufacturing, and digital solutions for maritime operations. This creates a diverse competitive environment.

Chinese shipyards, such as China State Shipbuilding Corporation (CSSC) and its subsidiaries, are expanding their capabilities. They offer competitive pricing, particularly in standard vessel construction and certain offshore modules. This adds another layer of competition.

The consolidation within the industry, including the Seatrium merger itself, reshapes competitive dynamics. Larger entities with broader service offerings and greater financial resources emerge. This impacts the competitive landscape.

Seatrium's competitive strategy involves focusing on high-value projects, technological innovation, and expanding into new markets. This includes the offshore wind market and sustainable solutions. The company aims to differentiate itself through its expertise and capabilities.

The competitive landscape is dynamic, with established players and emerging competitors vying for market share. Understanding the strengths and weaknesses of each competitor is crucial for analyzing Seatrium's market position. Recent developments and industry trends continue to shape the competitive environment.

- Hyundai Heavy Industries (HHI): A major South Korean shipbuilder with vast capacity and strong capabilities in offshore projects. HHI competes with Seatrium in rig building and conversion.

- Samsung Heavy Industries (SHI): Another significant South Korean player, SHI competes for large-scale offshore projects. SHI often focuses on cost-effectiveness and delivery timelines.

- Hanwha Ocean (formerly Daewoo Shipbuilding & Marine Engineering): Hanwha Ocean is a key competitor in the offshore sector, known for its expertise in various marine projects. This company also competes for high-value projects globally.

- Saipem: A European competitor specializing in offshore drilling and construction. Saipem often bids for large EPCI contracts.

- Technip Energies: A leader in offshore floating platforms and subsea systems, increasingly focused on sustainable solutions. Technip Energies competes in the offshore and marine engineering space.

- China State Shipbuilding Corporation (CSSC): CSSC and its subsidiaries are rapidly expanding and offering competitive pricing, especially in standard vessel construction. CSSC's growth impacts the competitive landscape.

Sembcorp Marine PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Sembcorp Marine a Competitive Edge Over Its Rivals?

Seatrium's competitive advantages are rooted in its extensive engineering expertise and integrated capabilities. Following the merger of Sembcorp Marine and Keppel Offshore & Marine, the company has significantly enhanced its strengths. This strategic move created a combined entity with a deeper talent pool and broader operational footprint, which is a key factor in the Marine Industry Analysis.

One of the primary advantages lies in its proven track record and proprietary technologies in designing and constructing complex offshore structures. This includes advanced drillships, semi-submersibles, and FPSO units. Seatrium's ability to execute intricate FPSO conversion projects, which require high levels of engineering precision and project management, sets it apart from many competitors in the Competitive Landscape.

Furthermore, Seatrium benefits from economies of scale and an integrated value chain. This encompasses design, engineering, procurement, construction, and commissioning. This end-to-end capability allows for greater control over project timelines and costs, enhancing its competitiveness in the Offshore Oil and Gas sector.

Seatrium possesses significant engineering expertise, particularly in the design and construction of complex offshore structures. This includes a strong focus on advanced drillships, semi-submersibles, and FPSO units, which are critical for the Offshore Oil and Gas industry. The company's technological capabilities are a key differentiator.

Seatrium's integrated value chain, covering design, engineering, procurement, construction, and commissioning, provides a significant competitive edge. This integrated approach allows for better control over project timelines and costs. The company benefits from economies of scale due to its size and operational scope.

Seatrium is actively developing and deploying solutions for offshore wind farm foundations and other green energy infrastructure. This strategic shift positions the company at the forefront of the energy transition. This proactive approach allows it to tap into new growth markets and differentiate itself from competitors.

The company's global network of yards and facilities, strategically located in key maritime regions, provides a significant logistical advantage. This enables efficient service to a diverse international clientele. Seatrium's long-standing client relationships and strong brand reputation help sustain its competitive advantages.

Seatrium's competitive strategy is built on several key advantages. These include its strong engineering capabilities, integrated value chain, and strategic focus on renewable energy. The company's commitment to innovation, evidenced by its ongoing projects in new energy solutions, underscores its strategy to maintain a leadership position.

- Strong Engineering Capabilities: Expertise in designing and constructing complex offshore structures.

- Integrated Value Chain: End-to-end capabilities from design to commissioning.

- Strategic Focus on Renewable Energy: Developing solutions for offshore wind farms.

- Global Network: Strategic locations in key maritime regions.

- Client Relationships: Long-standing relationships and strong brand reputation.

The merger of Sembcorp Marine and Keppel Offshore & Marine has significantly altered the Competitive Landscape. For more insights into the company's history, consider reading Brief History of Sembcorp Marine. The company's ability to adapt to changing market conditions, particularly its pivot towards sustainable solutions, positions it well for future growth. The market share and financial performance of Seatrium will be influenced by its ability to capitalize on these advantages and navigate the challenges of the Marine Industry Analysis.

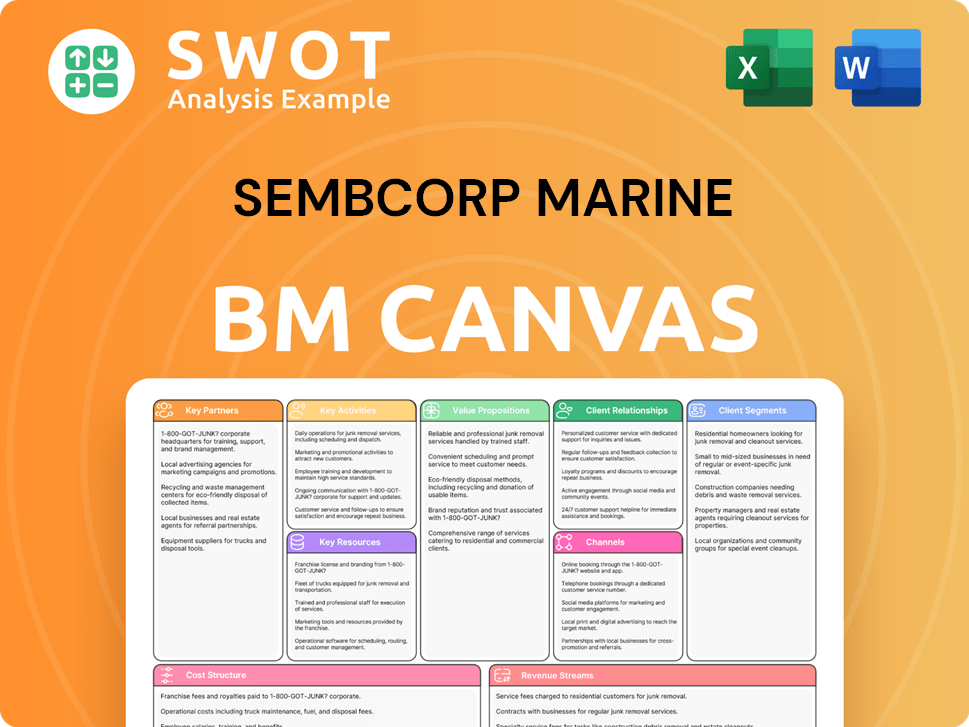

Sembcorp Marine Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Sembcorp Marine’s Competitive Landscape?

The Sembcorp Marine faces a dynamic Competitive Landscape, shaped by evolving Marine Industry Analysis. The company navigates significant shifts in the offshore, marine, and energy sectors. Its strategic focus on sustainable solutions and operational efficiency will determine its future success.

The company’s position is influenced by global energy transition, digitalization, and regulatory changes. These factors present both challenges and opportunities, impacting its Market Share and overall Financial Performance. Understanding these trends is crucial for stakeholders assessing Sembcorp Marine's long-term viability and growth potential.

The primary trend is the global energy transition, moving away from fossil fuels toward renewable energy. Digitalization and automation, including AI and robotics, are transforming shipyard operations. Regulatory changes, especially those related to environmental protection, are also significantly impacting the industry.

Challenges include managing legacy projects, geopolitical uncertainties, and global economic fluctuations. Continuous investment in technology is needed to maintain a competitive edge. Adapting to stricter environmental regulations and carbon emission standards is also a key challenge.

Opportunities lie in expanding into emerging renewable energy markets, particularly offshore wind. Developing cutting-edge technologies for future energy infrastructure is crucial. Forming strategic partnerships to enhance capabilities can also drive growth.

Sembcorp Marine's competitive advantages include its expertise in offshore engineering and its focus on green energy solutions. The company is well-positioned to offer smart and sustainable solutions to clients. Its ability to manage legacy projects and seize opportunities in the global energy transition is also key.

Sembcorp Marine's future depends on its strategic pivot toward sustainable solutions and its ability to integrate merged entities effectively. The company must optimize operational efficiencies and proactively seize opportunities from the global energy transition. For more insights into the company's business model, explore Revenue Streams & Business Model of Sembcorp Marine.

- Focus on renewable energy projects, such as offshore wind farms, to diversify revenue streams.

- Invest in advanced technologies to improve efficiency and reduce operational costs.

- Develop strategic partnerships to enhance capabilities and expand market reach.

- Adapt to evolving environmental regulations to ensure long-term sustainability.

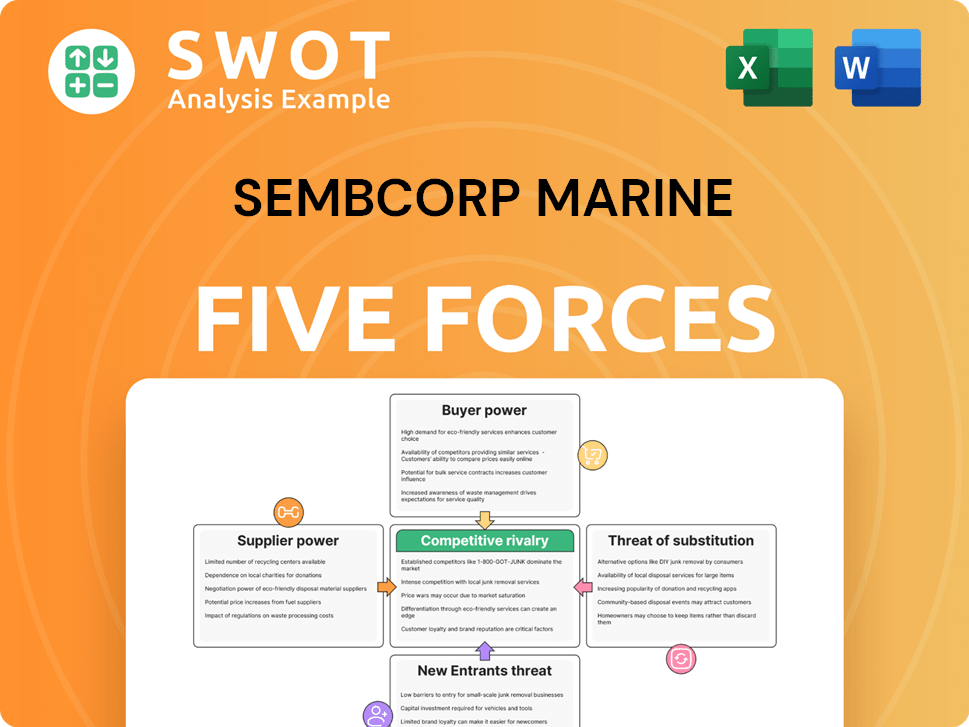

Sembcorp Marine Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sembcorp Marine Company?

- What is Growth Strategy and Future Prospects of Sembcorp Marine Company?

- How Does Sembcorp Marine Company Work?

- What is Sales and Marketing Strategy of Sembcorp Marine Company?

- What is Brief History of Sembcorp Marine Company?

- Who Owns Sembcorp Marine Company?

- What is Customer Demographics and Target Market of Sembcorp Marine Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.