ST Engineering Bundle

How did ST Engineering rise to become a global technology powerhouse?

ST Engineering, a name synonymous with innovation and engineering prowess, has a compelling story. From its humble beginnings in Singapore, the company has transformed into a global leader, providing cutting-edge solutions across multiple sectors. This journey showcases remarkable growth and strategic adaptation in a rapidly evolving technological landscape.

Tracing back to 1967, the ST Engineering SWOT Analysis reveals a rich history of strategic moves and technological advancements. Understanding the brief history of ST Engineering Singapore provides crucial insights into its current market position and future prospects. The company's evolution includes significant milestones, acquisitions, and expansions, solidifying its status as a diversified engineering giant. Exploring the ST Engineering company's core businesses and ST Engineering subsidiaries will help to understand its global presence.

What is the ST Engineering Founding Story?

The story of ST Engineering, a prominent player in the global technology and engineering landscape, begins with Singapore's push for industrialization and defense capabilities. The company's establishment in 1967 marks a pivotal moment in Singapore's economic development. This initiative was driven by the Singaporean government's vision to foster local expertise in critical sectors.

While the company's inception wasn't the result of a single founder, it stemmed from a strategic government effort. This effort aimed to build a robust industrial base, especially in defense and engineering. This laid the foundation for what would become a diversified technology and engineering group. The initial focus was on essential engineering and technical services.

The primary objective was to develop indigenous capabilities in maintenance, repair, and overhaul (MRO) for defense assets. This was crucial for supporting the industrial growth of a newly independent nation. The initial business model revolved around providing these vital services, with early operations likely centered on shipbuilding and the maintenance of defense equipment. Over time, the company expanded into aerospace and electronics, adapting to the evolving needs of the nation. To learn more about the company's business model, you can read about the Revenue Streams & Business Model of ST Engineering.

ST Engineering's founding was a strategic move by the Singaporean government to build up local industrial capabilities.

- Established in 1967, coinciding with Singapore's industrialization efforts.

- Focused initially on MRO for defense assets and shipbuilding.

- Evolved to include aerospace and electronics, reflecting Singapore's growing needs.

- Influenced by Singapore's post-independence emphasis on self-reliance and economic development.

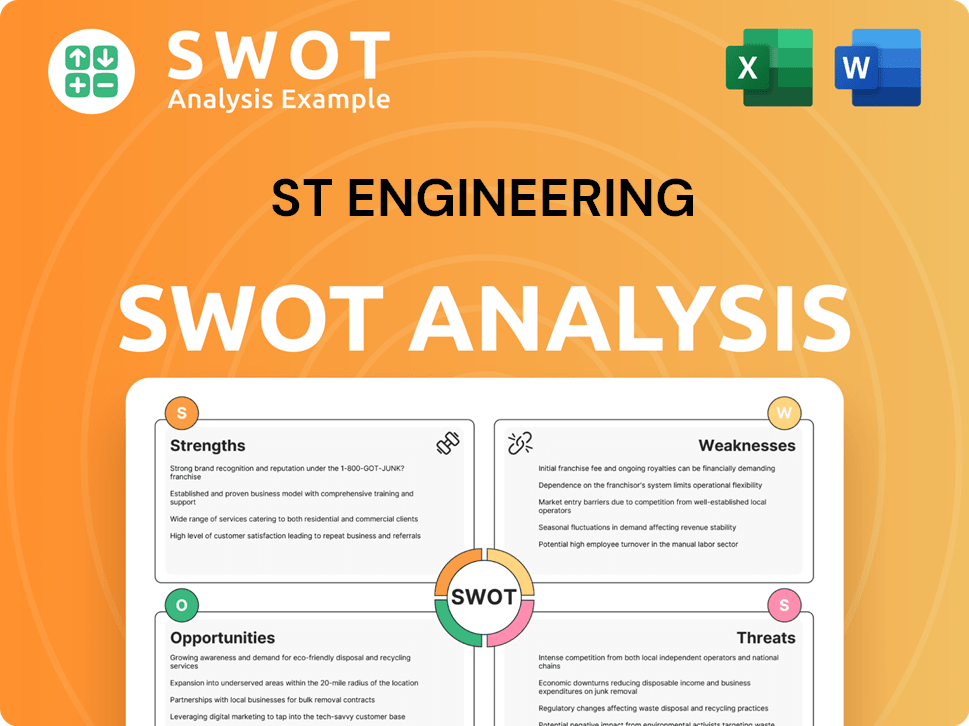

ST Engineering SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of ST Engineering?

The early growth and expansion of ST Engineering, a key player in the global technology and engineering sector, involved a strategic broadening of its capabilities and market presence. This expansion included the establishment of specialized units and a diversification of product and service offerings beyond its initial defense focus. ST Engineering's journey has been marked by significant acquisitions, partnerships, and investments in technology and human capital, all contributing to its evolution into a leading global group.

ST Engineering systematically developed specialized units to focus on different engineering disciplines. This approach allowed the company to broaden its product and service offerings beyond its initial defense-centric activities. The diversification strategy has been a key driver of its growth, enabling the company to serve a wider range of markets and customer needs.

The Commercial Aerospace division has experienced impressive growth. Revenue nearly doubled from S$2.3 billion in 2020 to S$4.4 billion in 2024. This growth was primarily driven by strong demand in the Maintenance, Repair, and Overhaul (MRO) sector, reflecting the company's ability to capitalize on market opportunities.

ST Engineering strategically entered new markets through acquisitions and partnerships. This approach extended its geographical footprint across Asia, Europe, the Middle East, and the U.S. The company's global presence has been a crucial factor in its ability to serve diverse customer needs and mitigate regional economic fluctuations.

The company's order book has shown significant growth. It almost doubled from S$14.4 billion in 2020 to S$28.5 billion by the end of 2024. This substantial order book provides strong revenue visibility for future years, indicating robust demand for ST Engineering's products and services. For more insights into the company's strategic positioning, consider reading about the Target Market of ST Engineering.

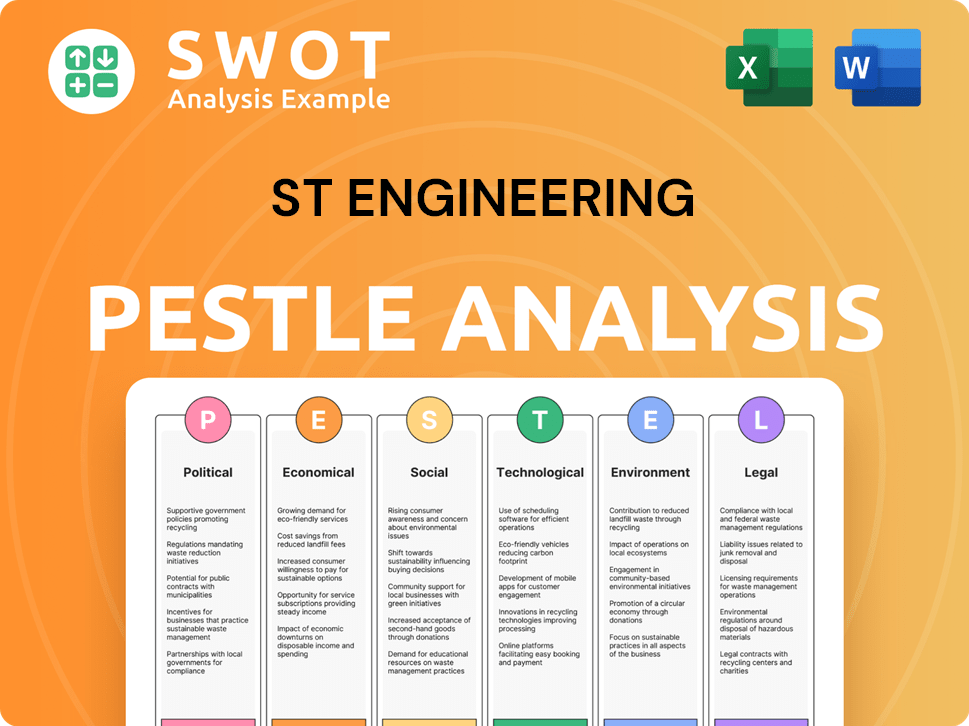

ST Engineering PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in ST Engineering history?

The brief history of ST Engineering showcases a journey marked by significant milestones and strategic expansions. From its beginnings, the company has evolved into a global technology, defense, and engineering powerhouse, consistently adapting to market dynamics and technological advancements. Exploring the mission and values of ST Engineering further illuminates its commitment to innovation and growth.

| Year | Milestone |

|---|---|

| 2024 | Achieved testing capabilities for LEAP-1A and LEAP-1B engines in the Commercial Aerospace sector. |

| 2024 | Secured major contracts in the Defence & Public Security segment, including a partnership for armored vehicle production and over $100 million in European ammunition orders. |

| 2024 | Ventured into advanced air mobility and initiated groundbreaking projects in the space sector. |

ST Engineering has consistently demonstrated its commitment to innovation across its diverse business segments. Recent advancements include expanding offerings to include LEAP PRSV to support growing maintenance demands in the aerospace division. The company's focus on technological advancements and strategic partnerships has propelled its growth and market position.

Achieved testing capabilities for LEAP-1A and LEAP-1B engines in 2024, enhancing its MRO services. Expanded offerings to include LEAP PRSV to support growing maintenance demands, showcasing adaptability in the aviation market.

Secured major contracts, including a partnership with Kazakhstan Paramount Engineering (KPE) for armored vehicle production in 2024. Received over $100 million in European ammunition orders for NATO-standard rounds in 2024, demonstrating its global presence.

Initiated groundbreaking projects in the space sector in 2024, signaling a move into new technological frontiers. Ventured into advanced air mobility in 2024, positioning itself at the forefront of emerging transport solutions.

Despite its successes, ST Engineering has faced challenges, including market downturns and competitive threats. The Urban Solutions & Satcom division aimed to grow its smart city revenue to S$3.5 billion by 2026, but its 2024 revenue was S$2.7 billion, indicating slower-than-expected growth in this segment. The company's ability to adapt and overcome these obstacles is evident in its consistent financial performance.

The commercial aviation market is not expected to see new aircraft until the next decade, requiring strategic pivots. Diversification beyond the commercial aviation market has been a key strategy for resilience.

The Urban Solutions & Satcom division's revenue of S$2.7 billion in 2024, against a target of S$3.5 billion by 2026, indicates competitive pressures. Despite challenges, the company has maintained a strong financial performance.

Focus on operational efficiencies and cost discipline has strengthened resilience. Consistent financial performance, including record revenue and net profit in 2024, demonstrates the effectiveness of these strategies.

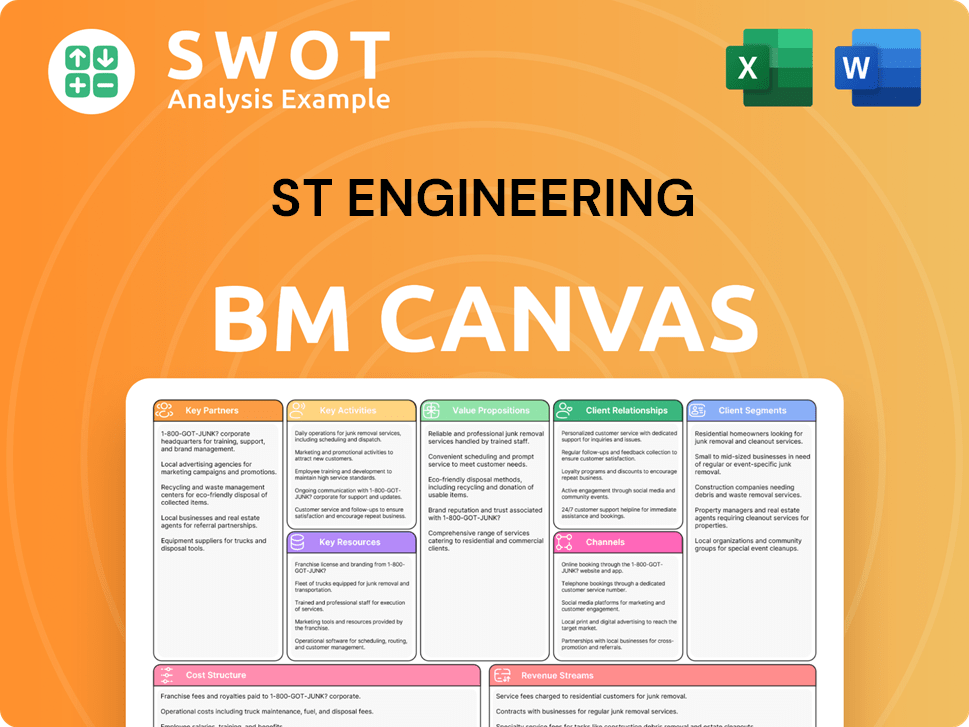

ST Engineering Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for ST Engineering?

The Owners & Shareholders of ST Engineering journey, a key player in technology and engineering, is marked by strategic growth and adaptation, reflecting its evolution from its founding in Singapore to its current global presence. The company has consistently expanded its capabilities and market reach, adapting to global trends and technological advancements, which has driven its financial performance over the years.

| Year | Key Event |

|---|---|

| 1967 | Founding of the company in Singapore. |

| 2020 | Group's order book stands at S$14.4 billion. |

| 2024 | Achieved record revenues of S$11.28 billion and earnings of S$702 million, with an order book reaching S$28.5 billion and securing S$12.6 billion in new contract wins. |

| 1Q2025 | Reported revenue of S$2.9 billion, an 8% year-on-year increase. |

| 2025 | Plans to increase annual dividend to S$0.18 per share and is expected to deliver approximately S$8.8 billion from its order book. |

ST Engineering is focusing on capitalizing on global megatrends such as digitalization, urbanization, sustainability, and security. The company is expanding its presence in business aviation, advanced air mobility, defense, and space sectors. The company's strategic initiatives include further expansion in business aviation, advanced air mobility, defense, and space sectors.

With an order book of S$29.8 billion as of March 31, 2025, and approximately S$7.3 billion expected to be delivered for the rest of the year, ST Engineering has strong revenue visibility. The company aims to grow group revenue to S$17 billion by 2029. ST Engineering’s share price saw a significant increase, climbing more than 68% since the start of 2025, reaching an all-time high of S$7.82 on May 30, 2025.

By 2029, the company aims for a defense & Public Security segment revenue of S$7.5 billion, a Commercial Aerospace segment revenue of S$6 billion, and a Smart City revenue of S$4.5 billion. They also aim to double digital business revenue to more than S$1.3 billion and target cost savings of around S$1 billion. The net profit compound annual growth rate (CAGR) is projected to exceed revenue CAGR by up to five percentage points.

ST Engineering is focused on innovation and leveraging technology to create a more secure and sustainable world. In early 2025, Benoit Rolland was appointed as the new CEO of ST Engineering Antycip. ST Engineering MRAS aims to establish a Composites Centre of Excellence. The company is predicted to experience three consecutive years of double-digit earnings growth by FY25.

ST Engineering Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of ST Engineering Company?

- What is Growth Strategy and Future Prospects of ST Engineering Company?

- How Does ST Engineering Company Work?

- What is Sales and Marketing Strategy of ST Engineering Company?

- What is Brief History of ST Engineering Company?

- Who Owns ST Engineering Company?

- What is Customer Demographics and Target Market of ST Engineering Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.