Strategy Bundle

How Did Strategy Software Become a Dual Powerhouse?

In a business world increasingly reliant on data, Strategy Software emerged as a game-changer in cloud-based financial solutions. Initially focused on simplifying complex financial processes, the company has evolved significantly. Its journey reflects the growing demand for streamlined financial management, with the budgeting software market alone poised for substantial growth.

From its inception in 1989 as MicroStrategy Incorporated, the Strategy SWOT Analysis company has consistently pushed the boundaries of business strategy. Founded with a vision to leverage data for better decision-making, it quickly became a pioneer in business intelligence. This article explores the brief history of the strategy company, including its evolution from a data analytics firm to a leader in both enterprise analytics and digital asset management, showcasing key milestones in its strategic planning journey.

What is the Strategy Founding Story?

The story of the strategy company, originally known as MicroStrategy Incorporated, began in 1989. It was the brainchild of Michael J. Saylor, Sanju Bansal, and Thomas Spahr. Their vision was to leverage data for strategic decision-making, a concept that would revolutionize how businesses operated.

Saylor launched the company with a consulting contract from DuPont, which provided $250,000 in seed funding and office space in Wilmington, Delaware. Sanju Bansal, a fellow MIT graduate, joined soon after. Their shared background in systems-dynamics theory at MIT shaped their initial focus: developing software for data mining and business intelligence.

The founders saw a gap in the market for businesses struggling to analyze their data effectively. Their early business model centered on providing business intelligence software and consulting services. This approach would later solidify the company's position in the business strategy landscape.

The early years of the strategy company were marked by significant milestones that shaped its trajectory. The company's ability to translate complex data into actionable business intelligence was crucial for its early success.

- 1989: Founded by Michael J. Saylor, Sanju Bansal, and Thomas Spahr.

- Early Funding: Initially funded by a consulting contract from DuPont, securing $250,000 in start-up capital.

- Initial Focus: Developing software for data mining and business intelligence.

- 1992: Secured a $10 million contract with McDonald's, a major breakthrough.

The company's initial success was driven by a focus on providing business intelligence software and consulting services. This approach helped them secure a $10 million contract with McDonald's in 1992, a major validation of their approach. The name 'MicroStrategy' reflected their commitment to providing granular insights for strategic decision-making. For a deeper dive into the competitive landscape, check out the Competitors Landscape of Strategy.

The founders' technical expertise and ability to transform complex data into actionable business intelligence were crucial for overcoming early challenges. This ability helped them secure foundational clients and establish the company's position in the strategic planning sector. Early funding primarily came from the DuPont contract, highlighting a strong start based on a significant client engagement.

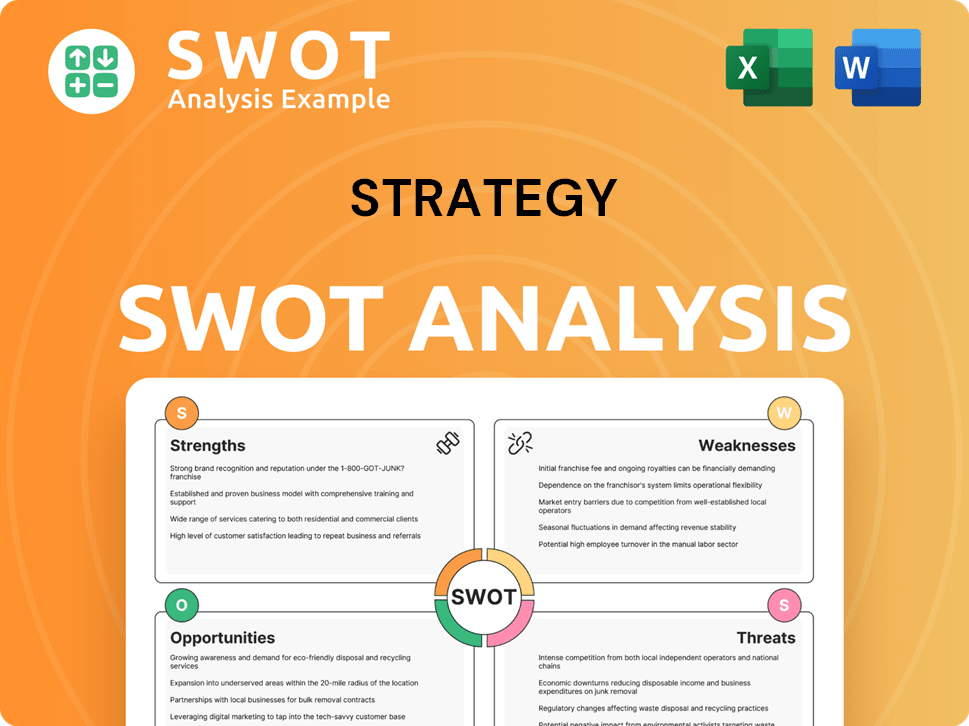

Strategy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Strategy?

The early years of Strategy Software, then known as MicroStrategy, were focused on establishing a strong foundation in business intelligence. Following a significant contract with McDonald's in 1992, the company expanded its client base, becoming a key player in data mining and business intelligence. This growth was fueled by helping organizations analyze large datasets for better decision-making. The company's solutions were well-received by enterprises seeking to leverage their data more effectively.

The company expanded its team and established its headquarters in Tysons Corner, Virginia. MicroStrategy's growth was marked by continuous development in its software capabilities. The competitive landscape included other emerging business analytics platforms from companies like SAP AG Business Objects, IBM Cognos, and Oracle Corporation's BI Platform. This period highlights the Growth Strategy of Strategy, particularly in its initial phases.

Around 2020, a pivotal strategic shift occurred as the company began accumulating Bitcoin. This move transformed its treasury strategy, positioning it as the world's first Bitcoin Treasury Company. This involved using proceeds from equity and debt financings to acquire Bitcoin. Leadership transitions also took place, with Michael J. Saylor moving to Executive Chairman in 2022, and Phong Le becoming the President and CEO.

The company's growth efforts were dual-focused: advancing its enterprise analytics software and aggressively pursuing its Bitcoin acquisition strategy. In the fourth quarter of 2024, operating expenses increased by 693.2% year-over-year, primarily due to impairment losses on digital assets totaling $1.006 billion. Despite this, the company reported a 'BTC Yield' KPI of 74.3% in FY 2024 and 2.9% in QTD 2025.

Key milestones included the significant contract with McDonald's in 1992 and the strategic shift towards Bitcoin. The competitive landscape included companies like SAP AG Business Objects, IBM Cognos, and Oracle Corporation's BI Platform. These companies were also competing in the business strategy and management consulting space, driving innovation and growth.

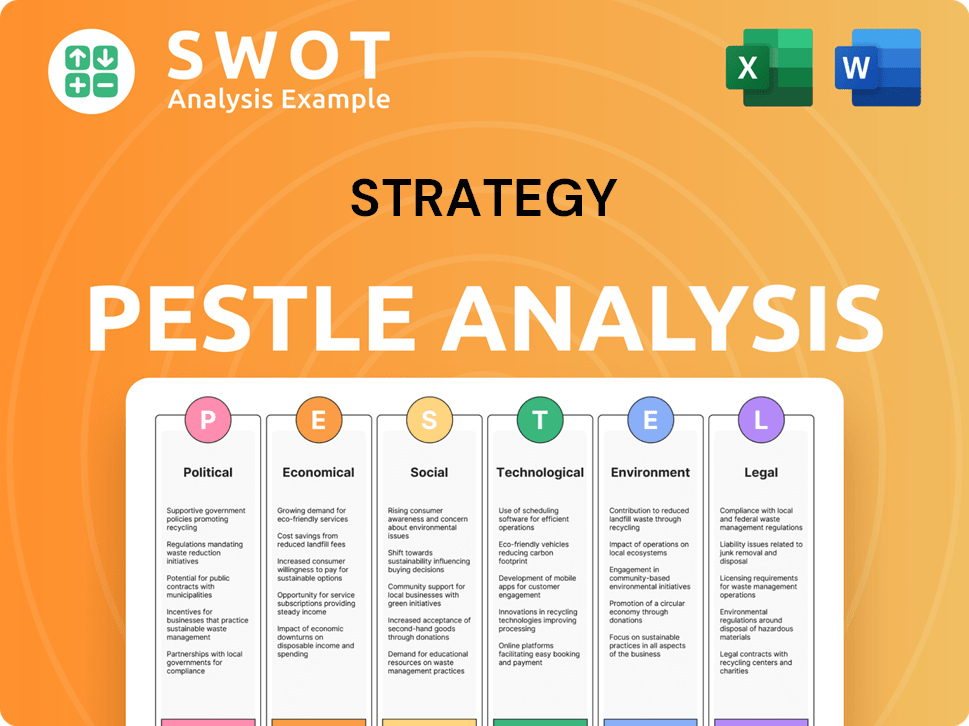

Strategy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Strategy history?

The evolution of the strategy company, formerly known as MicroStrategy, showcases a journey marked by significant milestones in business intelligence, data analytics, and strategic investments. The company's transformation reflects its adaptability and strategic vision in response to market dynamics and technological advancements, including its significant pivot towards Bitcoin.

| Year | Milestone |

|---|---|

| Early Years | Pioneering work in business intelligence and data analytics software, enabling organizations to analyze complex data. |

| 2020 | Significant investment in Bitcoin, becoming the world's largest corporate holder of the cryptocurrency. |

| 2025 | Rebranding to 'Strategy', reflecting a broader vision that encompasses enterprise analytics software and its Bitcoin treasury strategy. |

Strategy Software has consistently focused on innovation, especially in business intelligence and data analytics. This includes developing advanced analytics and collaboration tools, and integrating AI and machine learning into its strategic planning and software development processes.

The company was a pioneer in business intelligence, offering tools to analyze complex data for informed decisions. This early focus laid the foundation for its later innovations in data analytics and strategic planning.

Continuous development of advanced analytics tools has been a key area of innovation. These tools help clients gain deeper insights from their data.

The company has expanded into cloud-based budgeting, planning, and forecasting solutions. This move reflects the trend towards cloud computing in business strategy.

Integration of AI and machine learning into its software development is a current focus. With over 80% of software development teams expected to use AI tools by 2025, this is a crucial area of innovation.

The company has focused on improving collaboration tools within its platform. This enhances teamwork and streamlines the strategic planning process.

Strategy Software has consistently developed and improved its data analytics software. This ensures that clients can effectively analyze data for strategic planning.

The company has faced challenges, including market competition and the volatility associated with its Bitcoin holdings. The substantial investment in Bitcoin, while strategic, has introduced significant financial risks, as demonstrated by the Q4 2024 operating expenses increase of 693.2% year-over-year, primarily due to $1.006 billion in impairment losses on digital assets.

The company has faced competition from major players in the business intelligence space. SAP, IBM, and Oracle are among the competitors that have challenged Strategy Software.

The company's investment in Bitcoin has introduced volatility into its financial statements. This volatility can impact the company's financial performance.

The company has undertaken strategic repositioning to overcome challenges and adapt to market dynamics. This includes rebranding and focusing on its dual strategy.

The investment in Bitcoin has significantly impacted the company's financial statements. This includes impairment losses and fluctuations in asset values.

The company must adapt to evolving market dynamics to maintain its competitive edge. This requires strategic agility and the ability to embrace transformative technologies.

The company aims to enhance shareholder value through its strategic plan. This involves leveraging support from institutional and retail investors.

The Mission, Vision & Core Values of Strategy reflect its commitment to strategic planning and its ability to adapt to market changes. The company's journey underscores the importance of strategic agility and embracing transformative technologies to drive long-term value creation.

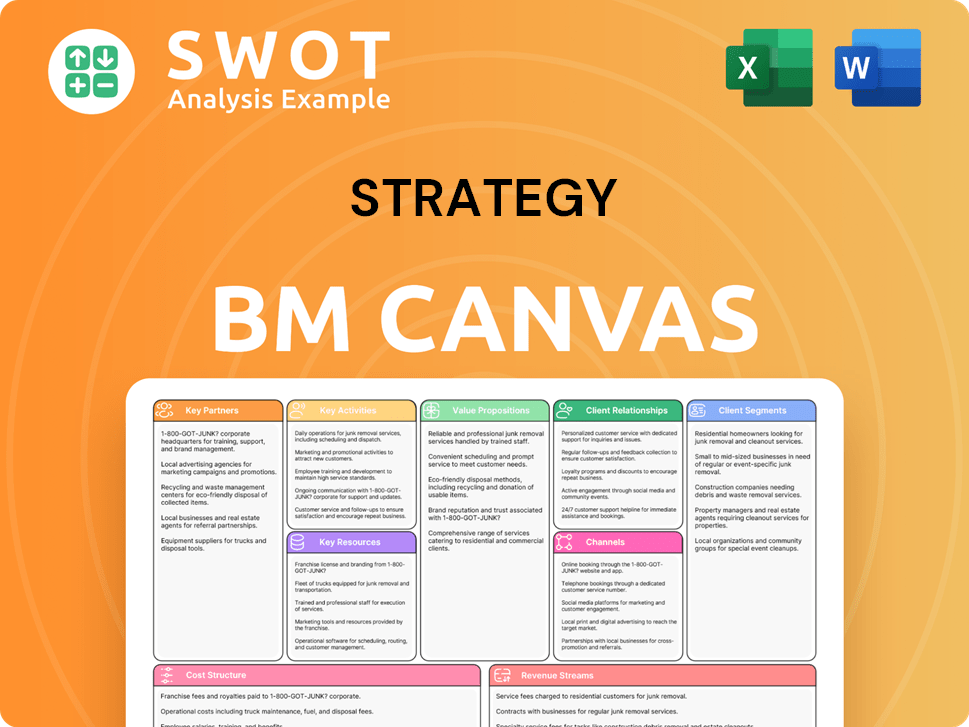

Strategy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Strategy?

The history of Strategy, formerly known as MicroStrategy, showcases significant milestones in its evolution, from its inception as a data mining and business intelligence software provider to its current status as a prominent player in enterprise analytics and a major holder of Bitcoin.

| Year | Key Event |

|---|---|

| 1989 | Founded as MicroStrategy Incorporated by Michael J. Saylor, Sanju Bansal, and Thomas Spahr, focusing on data mining and business intelligence software. |

| 1992 | Secured its first major client, McDonald's, with a $10 million contract. |

| Around 2020 | Initiated its strategy of accumulating Bitcoin, becoming the world's first Bitcoin Treasury Company. |

| 2022 | Michael J. Saylor transitioned from CEO to Executive Chairman; Phong Le became President and CEO. |

| November 2024 | Completed a $3 billion offering of convertible senior notes due 2029. |

| December 2024 | MicroStrategy ONE worked with Zebra Technologies to enhance its Workcloud Workforce Optimization Suite. |

| January 2025 | Stockholders approved an increase in authorized Class A Common Stock and Preferred Stock. |

| January 2025 | MicroStrategy is recognized as a Customers' Choice through Gartner Peer Insights for the third consecutive year. |

| Early 2025 | Rebranded from MicroStrategy Incorporated to 'Strategy'. |

| February 2025 | Announced Q4 2024 financial results, reporting total revenues of $120.7 million and subscription services revenue of $31.9 million. The company also reports holding 471,107 BTC. |

| May 2025 | Announced Q1 2025 financial results, with total revenues of $111.1 million, but subscription services revenues increasing to $37.1 million. The company reports holding 553,555 bitcoin as of April 28, 2025. |

Strategy is focused on expanding its enterprise analytics offerings and its Bitcoin holdings. The global budgeting software market, a key area for Strategy, is expected to reach $2.16 billion by 2029, with a CAGR of 6.7%. The cloud-based financial platform market is also projected to grow rapidly, reaching $200.27 billion in 2025, at a CAGR of 14.4%.

The company aims to increase its 'BTC Yield' target for 2025 from 15% to 25% and its 'BTC $ Gain' target from $10 billion to $15 billion. In Q1 2025, Strategy announced a new $21 billion at-the-market common stock equity offering. These initiatives underscore a commitment to leveraging Bitcoin as a key asset.

Strategy is exploring innovations in Bitcoin applications, integrating its analytics expertise with its commitment to digital asset growth. This forward-looking approach ties back to its founding vision of leveraging data and technology to empower decision-making, now expanded to encompass the transformative potential of digital assets.

Industry trends such as the integration of AI and machine learning into software development and strategic planning, as well as the increasing adoption of cloud-based solutions, are likely to significantly influence Strategy's future. The company is well-positioned to capitalize on these developments.

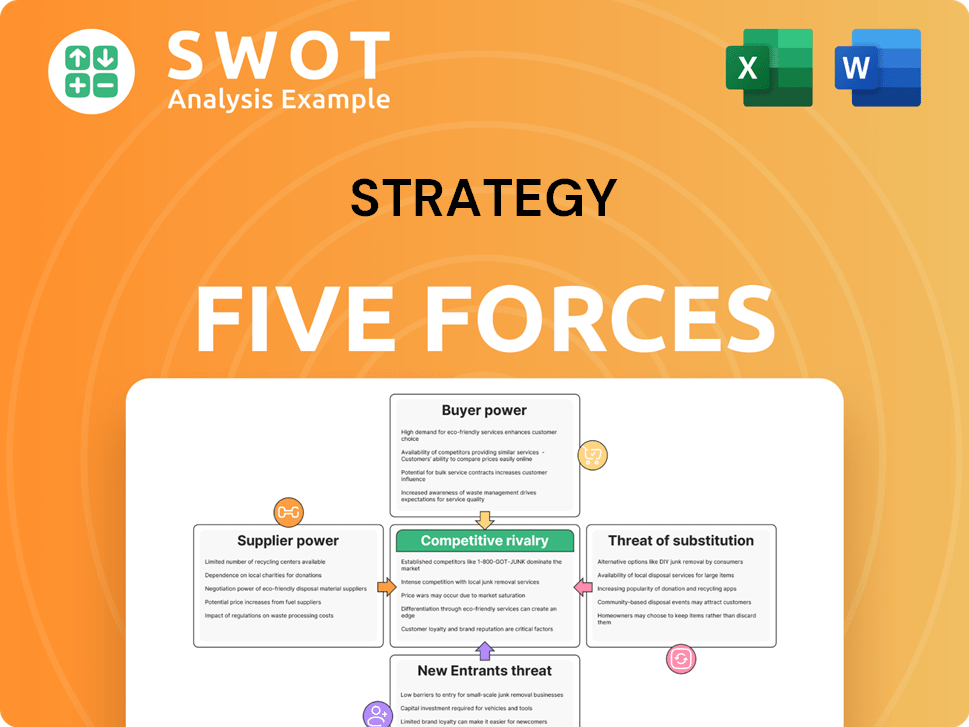

Strategy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Strategy Company?

- What is Growth Strategy and Future Prospects of Strategy Company?

- How Does Strategy Company Work?

- What is Sales and Marketing Strategy of Strategy Company?

- What is Brief History of Strategy Company?

- Who Owns Strategy Company?

- What is Customer Demographics and Target Market of Strategy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.