Strategy Bundle

Can Strategy Software Outpace the Exploding Fintech Market?

In a financial technology landscape revolutionized by cloud solutions, Strategy SWOT Analysis is a key player. This company is at the forefront of empowering businesses with cloud-based budgeting, planning, and forecasting tools. With the global software market projected to surge to trillions of dollars, understanding Strategy Software's growth strategy and future prospects is crucial.

This analysis will explore Strategy Software's strategic initiatives, including continuous innovation and technology integration, within the burgeoning Enterprise Performance Management (EPM) and Corporate Performance Management (CPM) market. We'll examine how the company leverages strategic planning to capitalize on the rising demand for real-time financial insights and the integration of AI-enabled analytics, providing a comprehensive market analysis of its potential for business growth.

How Is Strategy Expanding Its Reach?

The expansion initiatives of a strategy company are pivotal for its business growth and future prospects. A well-defined growth strategy is essential for navigating the complexities of the market and achieving sustainable success. This involves a multi-faceted approach that includes entering new markets, diversifying product offerings, and establishing strategic partnerships. These initiatives are designed to capitalize on emerging opportunities and adapt to the evolving needs of the market.

A key aspect of this expansion involves extending its reach into new geographical markets, particularly in regions showing rapid technological adoption and economic growth. For instance, the Asia-Pacific region is expected to witness substantial growth in the budgeting and forecasting software market, driven by increasing technological adoption and economic expansion in key markets like China and India, presenting a significant opportunity for the company. This strategic move allows the company to tap into new customer bases and increase its overall market share.

In terms of product development, the company is committed to enhancing its existing cloud-based budgeting, planning, and forecasting solutions while also exploring new product categories. The budgeting software market alone is projected to increase from $1.55 billion in 2024 to $1.66 billion in 2025, with a CAGR of 6.9%, indicating a healthy environment for product innovation. This includes integrating advanced analytics and AI capabilities to provide predictive insights and enable more proactive financial management. The company's product roadmap likely includes initiatives aligned with these advancements, focusing on features that provide significant value to customers.

The company is focusing on entering new geographical markets, particularly in regions with high technological adoption and economic growth. The Asia-Pacific region is a key target, with substantial growth expected in the budgeting and forecasting software market. This expansion is driven by the increasing demand for advanced financial management solutions in rapidly developing economies.

The company is committed to enhancing its existing cloud-based budgeting, planning, and forecasting solutions. They are exploring new product categories and integrating advanced analytics and AI capabilities. This approach aims to provide predictive insights and enable more proactive financial management for clients.

The company is actively seeking collaborations with well-established companies to access new expertise, assets, and clientele. These partnerships will focus on integrations with Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) platforms. This strategic move aims to diversify revenue streams and accelerate market presence.

The company is focused on integrating advanced technologies like AI and analytics into its products. This will provide predictive insights and enhance financial management capabilities. The goal is to offer cutting-edge solutions that meet the evolving needs of businesses in the digital age.

Strategic partnerships are a critical component of the company's expansion plans, offering access to new expertise and clientele. The broader B2B SaaS market is increasingly recognizing the importance of such partnerships. This includes potential integrations with Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) platforms, which are seeing a rising trend of integration with EPM and CPM solutions (61% increase).

- Collaborations with established companies to gain expertise and access to new clients.

- Integration with ERP and CRM platforms to enhance service offerings.

- Diversification of revenue streams through co-selling, co-marketing, and co-innovation.

- Accelerated market presence through strategic alliances and joint ventures.

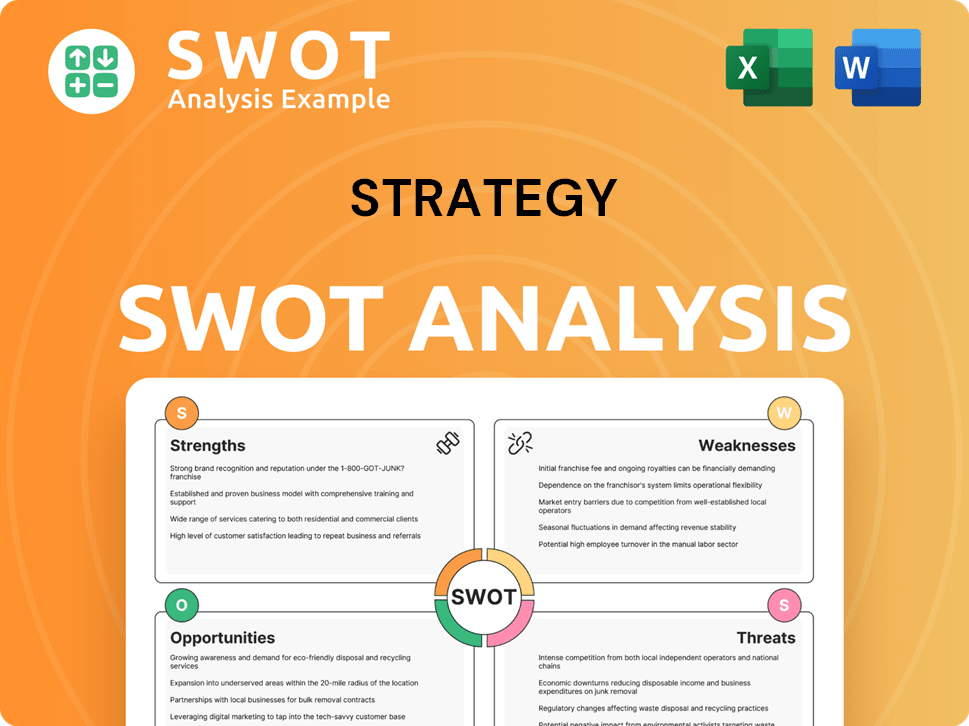

Strategy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Strategy Invest in Innovation?

The innovation and technology strategy of Strategy Software is designed to maintain its competitive edge and drive sustained business growth. This involves a significant focus on integrating Artificial Intelligence (AI) and machine learning (ML) into its core cloud-based budgeting, planning, and forecasting solutions. This strategic approach aims to provide businesses with predictive insights for proactive financial management.

The company's commitment to innovation also includes digital transformation initiatives. This involves embracing new technologies like cloud computing, IoT, and potentially blockchain, which will redefine sectors and create new business opportunities. The finance cloud market is experiencing substantial growth, driven by the accelerating demand for digital transformation, which Strategy Software is well-positioned to capitalize on.

Furthermore, Strategy Software is dedicated to improving user experience and productivity through continuous software modernization. This includes developing new software that can learn from usage and improve user experience without active coding. This commitment to innovation is key to the company's future prospects and ability to adapt to market changes.

Strategy Software is heavily investing in AI and ML to enhance its cloud-based solutions. This integration allows for more accurate forecasting and scenario modeling. The EPM and CPM market is seeing significant growth in AI-based tools.

The company is embracing digital transformation through cloud computing and other technologies. This includes enhancing its cloud-native platform for greater scalability and cost reduction. The finance cloud market is projected to grow substantially.

Strategy Software is committed to improving user experience and productivity. This involves continuous software modernization and the development of new, adaptive software. This focus ensures the platform remains competitive and user-friendly.

The company is working on software that learns from usage to improve user experience without active coding. This approach marks the beginning of a new era in software transformation. Real-time analytics and enhanced security measures are also being implemented.

Strategy Software is enhancing its cloud-native platform to offer greater scalability and reduced costs. This strategic move aligns with the growing demand for cloud-based solutions in the finance sector. This is crucial for long-term growth strategy.

The company is implementing enhanced security measures, such as encryption protocols and multi-factor authentication. These measures are becoming standard in the finance cloud market. This is crucial for maintaining customer trust and data security.

The finance cloud market, which includes cloud-based finance solutions, was valued at $32.8 billion in 2024. It is estimated to register a CAGR of 22.7% between 2025 and 2034, according to recent market analysis. The EPM and CPM market has seen AI-based forecasting tools rise by 54% and AI integration in CPM software increase by 52% globally. These statistics underscore the importance of AI and cloud technologies in the financial sector. For more details on the company's business model and revenue streams, you can read Revenue Streams & Business Model of Strategy.

Strategy Software's growth strategy hinges on adopting cutting-edge technologies to stay competitive. This includes the integration of AI and ML for enhanced forecasting and planning. The company also focuses on digital transformation and continuous software modernization.

- AI-powered forecasting tools are becoming increasingly prevalent in the EPM and CPM market.

- The finance cloud market is experiencing rapid growth, driven by digital transformation.

- Continuous software modernization improves user experience and productivity.

- Enhanced security measures are being implemented to protect client data.

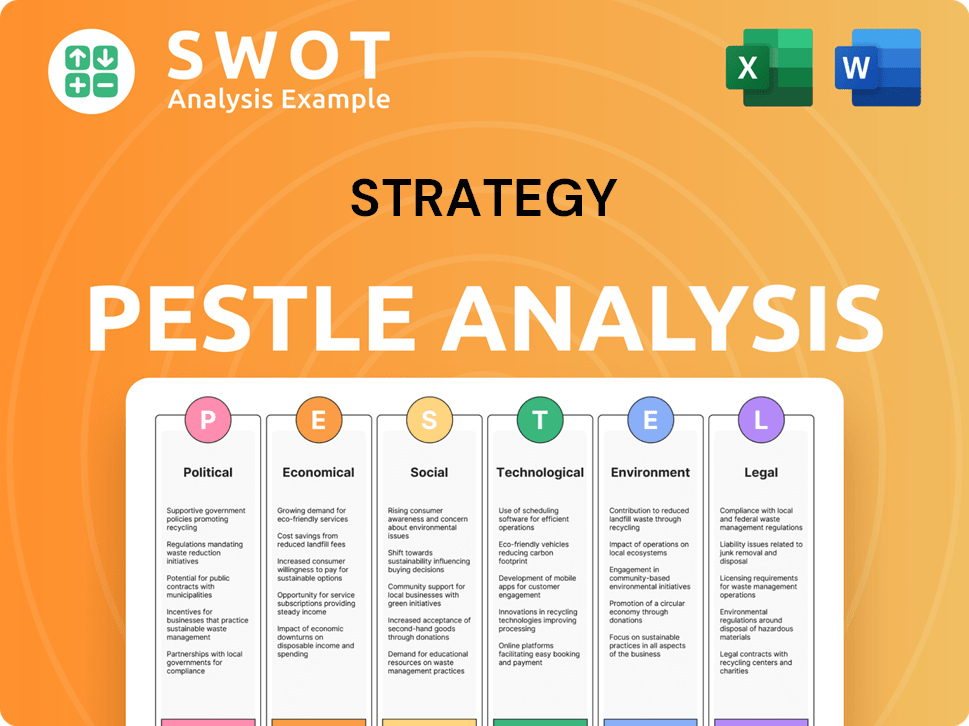

Strategy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Strategy’s Growth Forecast?

The financial outlook for Strategy Software is promising, supported by substantial growth in the software and financial planning sectors. The global software market is projected to reach approximately $2,248.33 billion by 2034, reflecting an 11.8% Compound Annual Growth Rate (CAGR). This robust market environment provides a solid foundation for the company's financial ambitions and future prospects.

Specifically, the budgeting software market is expected to grow from $1.55 billion in 2024 to $1.66 billion in 2025, with a CAGR of 6.9%. Moreover, the budgeting and forecasting software market is valued at $1.126 billion in 2025 and is anticipated to expand at a CAGR of 8.7% from 2025 to 2033. These figures highlight the significant opportunities within the financial planning software space, which Strategy Software is well-positioned to capitalize on, driving its business growth.

The overall software market is expected to experience significant expansion, with a projected value of $2,248.33 billion by 2034. This growth is driven by increasing demand for software solutions across various industries.

The budgeting software market is forecasted to grow from $1.55 billion in 2024 to $1.66 billion in 2025. This growth indicates a strong demand for financial planning tools.

The budgeting and forecasting software market is valued at $1.126 billion in 2025. It is projected to grow at a CAGR of 8.7% from 2025 to 2033, highlighting the sector's potential.

The adoption of cloud-based EPM and CPM solutions has grown by 70%, driven by scalability and cost reduction benefits. This trend supports the company's cloud-based approach.

The company's strategic focus on cloud-based solutions aligns with the growing market trend where cloud-based EPM and CPM adoption increased by 70%. This growth is fueled by the benefits of scalability and cost reduction. Furthermore, the integration of AI and advanced analytics is a key driver, with AI-based forecasting tools rising by 54% in the EPM and CPM market. For detailed financial performance, the First Quarter 2025 Financial Results Webinar Recording and Earnings Presentation on May 1, 2025, and the Fourth Quarter 2024 Financial Results released on February 5, 2025, are available. These resources provide insights into the company's financial health and strategic planning. To learn more about the company's journey, read Brief History of Strategy.

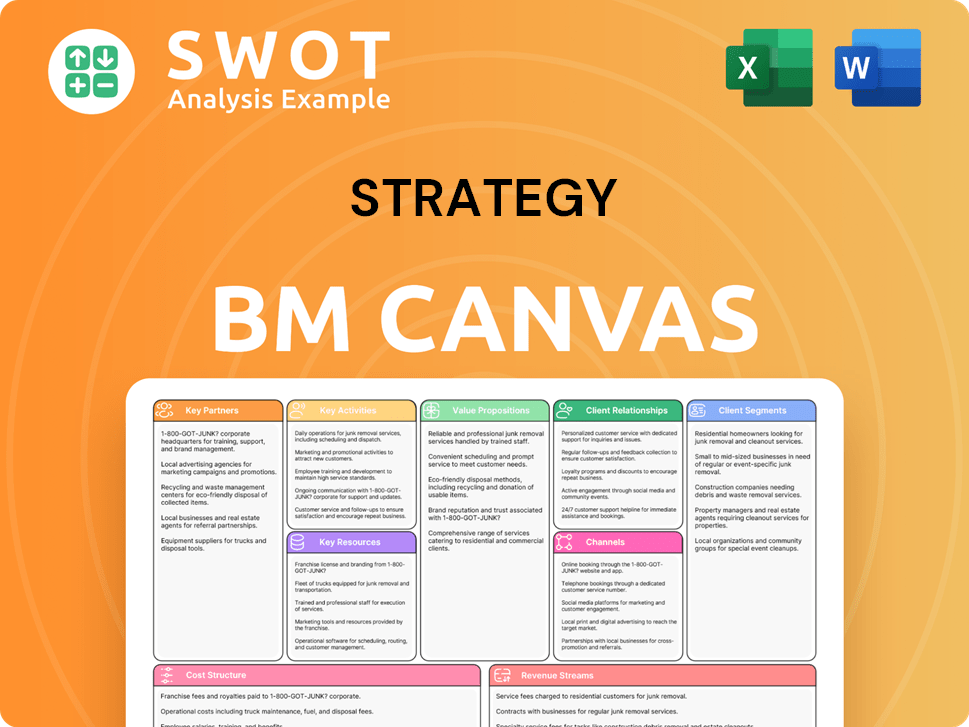

Strategy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Strategy’s Growth?

The path to business growth for a strategy company isn't without its hurdles. Several potential risks and obstacles can impact the future prospects of such firms, especially in the rapidly evolving technology and consulting landscapes. Understanding these challenges is crucial for developing robust strategies and ensuring sustainable expansion.

One of the primary challenges is the competitive environment. The financial planning software market, for example, is crowded with established players like Oracle NetSuite, Anaplan, and Workday Adaptive Planning. New entrants and evolving technologies require companies to remain agile. Additionally, regulatory changes, supply chain vulnerabilities, and internal resource constraints pose significant threats that must be proactively managed.

To navigate these complexities, a strategy company must adopt a multifaceted approach. This includes continuous innovation, robust risk management, and a focus on operational efficiency. Addressing these challenges proactively is essential to capitalize on opportunities and achieve long-term success.

The financial planning software market is highly competitive, with established firms and new entrants vying for market share. The strategy company must differentiate its offerings to stand out. This requires a focus on innovation, customer service, and competitive pricing strategies. Check out Competitors Landscape of Strategy for more information.

The financial software industry is subject to evolving data privacy, security, and financial reporting regulations. Compliance requires continuous adaptation and investment in development and auditing. Staying ahead of these changes is vital to avoid penalties and maintain customer trust.

Reliance on third-party cloud infrastructure, specialized hardware, and skilled IT professionals can create supply chain risks. Disruptions, such as cybersecurity threats or talent shortages, can impact operations. Diversifying suppliers and strengthening cybersecurity are crucial mitigation strategies.

Rapid advancements in AI and machine learning can lead to competitors quickly developing new features, potentially eroding the strategy company's competitive advantage. Continuous R&D investment and a flexible product roadmap are essential to stay ahead of the curve. The software industry is highly dynamic.

Limited bandwidth or an IT skills shortage can hinder innovation and project delivery. Strong financial planning, scalable infrastructure, and efficient resource allocation are critical. Hiring quality leadership and management can help address these constraints and support business growth.

Economic downturns can lead to reduced budgets for software and consulting services. This can impact sales and profitability. Diversifying the client base and offering cost-effective solutions can help mitigate this risk. In 2023, the global IT spending decreased by about 5.6%.

To address these challenges, a strategy company should prioritize a proactive approach. This includes investing in research and development to stay ahead of technological advancements. A strong focus on customer relationship management (CRM) is essential to understand and meet customer needs. Additionally, building a diversified client base can help reduce the impact of economic downturns. According to a 2024 report, companies that invest in CRM see a 25% increase in sales productivity.

Effective strategic planning is crucial for navigating market complexities. Conducting thorough market analysis to identify opportunities and threats is essential. This involves understanding competitor strategies, customer preferences, and regulatory changes. Using tools like SWOT analysis and PESTLE analysis can provide valuable insights. A well-defined growth strategy is a key to success.

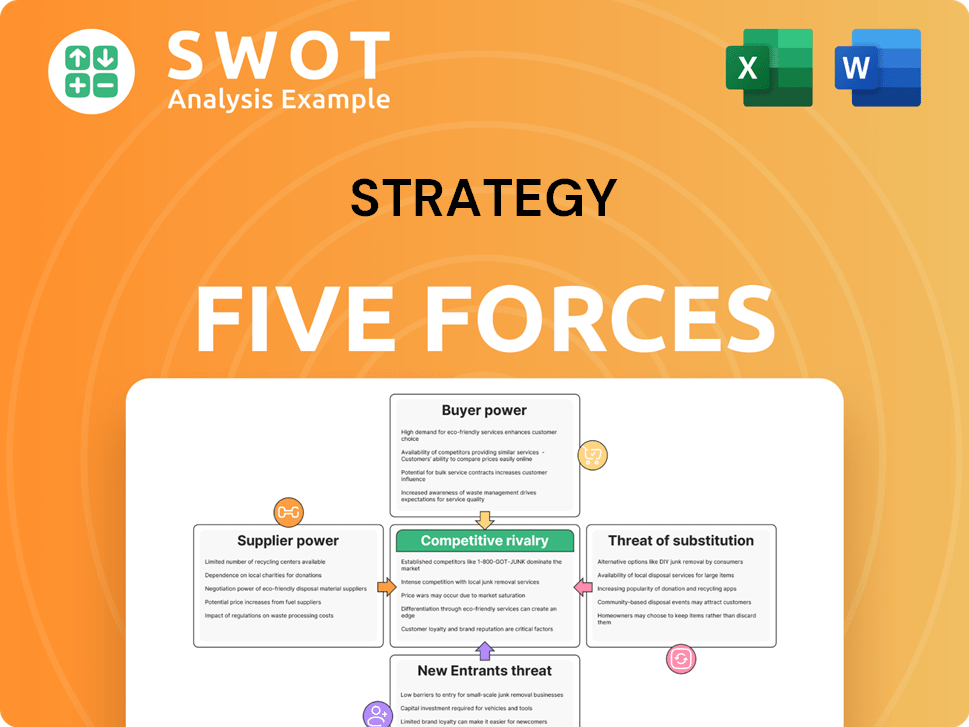

Strategy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Strategy Company?

- What is Competitive Landscape of Strategy Company?

- How Does Strategy Company Work?

- What is Sales and Marketing Strategy of Strategy Company?

- What is Brief History of Strategy Company?

- Who Owns Strategy Company?

- What is Customer Demographics and Target Market of Strategy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.