SYNLAB Bundle

How has SYNLAB Transformed Medical Diagnostics?

Discover the fascinating SYNLAB SWOT Analysis and trace the remarkable journey of SYNLAB, a European leader in medical diagnostics. From its humble beginnings in 1998, SYNLAB has redefined the landscape of healthcare through innovation and strategic growth. Explore the key milestones that have shaped SYNLAB into a global force, impacting millions worldwide.

This brief history of SYNLAB AG reveals how the company, founded by Bartl Wimmer, evolved from a network of laboratories in Germany to a leading international provider. Understanding SYNLAB's origins and timeline offers crucial insights into its impact on the medical diagnostics industry. Delve into SYNLAB's background to appreciate its strategic acquisitions, financial performance, and its ambitious plans for the future, solidifying its position as a key player in global healthcare.

What is the SYNLAB Founding Story?

The SYNLAB company, a prominent player in medical diagnostics, has an interesting founding story. The company's roots trace back to 1998 in Augsburg, Germany, where Bartl Wimmer and his associates established SYNLAB GmbH.

The initial concept revolved around a collaborative model, bringing together freelance laboratory physicians. This approach aimed to create a more integrated and efficient system for medical diagnostics, improving both the quality and accessibility of laboratory services. While specific funding details from the early stages aren't readily available, the initial structure suggested a foundation built on shared expertise and resources.

The early business model focused on providing comprehensive medical diagnostic services. SYNLAB's initial offerings included a full spectrum of routine and specialized laboratory tests. This was in response to the increasing demand for accurate and timely diagnostic information to support patient care and clinical decision-making. The late 1990s, marked by advances in medical science and a growing emphasis on preventative healthcare, set the stage for the company's creation, positioning it to meet the evolving needs of the healthcare sector.

SYNLAB's origins lie in 1998, with the founding of SYNLAB GmbH in Augsburg, Germany. The founders, Bartl Wimmer and his partners, aimed to create a collaborative network of laboratory physicians.

- The initial focus was on providing comprehensive medical diagnostic services.

- The company's early structure was based on an association of independent professionals.

- The late 1990s saw an increase in preventative healthcare, which SYNLAB was well-positioned to capitalize on.

- SYNLAB's diagnostic services history began with a full range of routine and specialty laboratory testing.

SYNLAB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of SYNLAB?

The early growth of the SYNLAB company was characterized by strategic mergers and a strong focus on expansion. This period saw significant acquisitions and the company's broadening reach beyond its initial markets. The company's growth strategy, driven by both organic initiatives and mergers and acquisitions (M&A), significantly shaped its trajectory. The company's history is a testament to its adaptability and its crucial role in medical infrastructure.

A key moment in the SYNLAB timeline occurred in 2010 when it merged with Futurelab and Fleming Labs. In 2015, Cinven acquired SYNLAB and then merged it with Labco, forming the SYNLAB Group. This merger created Europe's leading provider of medical diagnostic services. The company has a rich history of strategic acquisitions.

Under the leadership of Dr. Bartl Wimmer and CEO Mathieu Floreani since 2018, SYNLAB pursued an aggressive growth strategy. The company executed over 100 add-on transactions, entering new markets in Latin America and Africa. The company's expansion is a key part of its growth.

By 2020, SYNLAB had increased its revenues to €2.6 billion and employed over 20,000 people. The Group's network included more than 450 laboratories and over 1,600 blood collection points. During the COVID-19 pandemic, SYNLAB rapidly scaled up SARS-CoV-2 testing. To understand more about SYNLAB's business model, you can read about it here: Revenue Streams & Business Model of SYNLAB.

In Q1 2024, SYNLAB reported revenues of €682 million. The company continued its bolt-on M&A strategy in 2024, with an expected enterprise value spend between €50 million and €100 million. This demonstrates the company's ongoing commitment to growth and expansion.

SYNLAB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in SYNLAB history?

The SYNLAB company history is marked by significant achievements and strategic decisions that have shaped its trajectory in the medical diagnostics sector. The SYNLAB origins can be traced through several key milestones, reflecting its growth and expansion over the years.

| Year | Milestone |

|---|---|

| 2015 | Merger with Labco, solidifying its position as a European leader in diagnostic services. |

| April 30, 2021 | Successful listing on the Regulated Market (Prime Standard) of the Frankfurt Stock Exchange, with an implied market capitalization of €4.0 billion at the IPO price. |

| 2023 | Divested its veterinary diagnostics segment to Mars Incorporated. |

| Early 2025 | Divested operations in several Eastern European countries, including Croatia, Cyprus, North Macedonia, Romania, Slovenia, and Turkey, to Medicover Group. |

SYNLAB has consistently invested in innovation to enhance its service offerings. These innovations include the development of optimized laboratory networks and the introduction of advanced testing services across various diagnostic disciplines. The company's focus on preventative medical services and personalized genomic medicine, such as the BRCA+ PLUS Test, highlights its commitment to advancing healthcare.

SYNLAB offers over 5,000 types of testing services, covering a wide range of diagnostic disciplines. This extensive portfolio includes genetic and anatomical pathology testing, catering to diverse medical needs.

The company is at the forefront of preventative medical services, aiming to detect and address health issues early. This proactive approach enhances patient care and outcomes.

SYNLAB has developed tests like the BRCA+ PLUS Test for hereditary gynecological cancer. This advancement in personalized genomic medicine allows for tailored diagnostics and treatment strategies.

SYNLAB publishes over 300 articles annually in scientific journals, demonstrating its commitment to advancing medical research. This research focus supports continuous innovation and improvement in diagnostic services.

SYNLAB consistently invests in new technologies and optimized laboratory networks. This enhances efficiency and ensures high-quality diagnostic services.

The BRCA+ PLUS Test is a key innovation in personalized genomic medicine. It is designed to identify hereditary risks, particularly in gynecological cancers, allowing for early detection and intervention.

The SYNLAB company has faced challenges, including navigating a fragmented market and adapting to evolving healthcare policies. Strategic decisions, such as the divestiture of certain business segments, reflect efforts to refocus and strengthen its market position. Despite these challenges, SYNLAB has demonstrated resilience and financial strength.

The medical diagnostics market is fragmented, presenting challenges in terms of competition and market access. SYNLAB addresses this through strategic acquisitions and partnerships to consolidate its presence.

Adapting to changes in healthcare policies and regulations is an ongoing challenge. SYNLAB stays compliant and competitive by monitoring and responding to policy shifts.

In early 2025, SYNLAB divested its operations in several Eastern European countries to focus on markets with stronger growth prospects. This strategic move aims to streamline operations and improve profitability.

SYNLAB reported strong financial performance in Q1 2024, with an adjusted EBITDA of €123 million, an increase of 4% from Q1 2023. The company also reduced its net debt by €56 million to €1.285 billion at the end of March 2024.

In 2023, SYNLAB sold its veterinary diagnostics segment to Mars Incorporated. This move allowed SYNLAB to concentrate on its core human diagnostics business.

The divestiture of operations in several Eastern European countries in early 2025, representing approximately 1.5% of SYNLAB's 2024 revenue, was part of a broader strategy to optimize its network and enhance focus.

SYNLAB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for SYNLAB?

The SYNLAB history is marked by strategic expansions and acquisitions, evolving from its SYNLAB origins in Germany to become a leading international provider of medical diagnostic services. The SYNLAB company has grown significantly through mergers and strategic market entries, adapting to the changing landscape of healthcare and diagnostics.

| Year | Key Event |

|---|---|

| 1998 | SYNLAB GmbH was founded in Augsburg, Germany, by Bartl Wimmer and partners. |

| 2010 | SYNLAB merged with Futurelab and Fleming Labs, expanding its service offerings. |

| 2015 | Cinven acquired SYNLAB and merged it with Labco, forming the SYNLAB Group; SYNLAB also entered the African market. |

| 2016-2019 | SYNLAB spent an average of €200 million annually on acquisitions to bolster its market presence. |

| 2018 | Mathieu Floreani became Group CEO, leading the company's strategic direction. |

| 2021 | SYNLAB AG was listed on the Frankfurt Stock Exchange, and it sold its Analytics & Services activities to SGS. |

| 2022 | SYNLAB expanded into the Latin American market, including Chile. |

| 2023 | SYNLAB sold its veterinary diagnostics segment to Mars Incorporated. |

| Q1 2024 | SYNLAB reported Q1 revenue of €682 million and an adjusted EBITDA of €123 million. |

| 2024 | SYNLAB's revenue reached approximately €2.62 billion. |

| Q1 2025 | Cinven completed the sale of a minority stake in SYNLAB to Labcorp; SYNLAB divested its Eastern European businesses to Medicover Group. |

SYNLAB is focused on expanding its market presence across its operating segments, including Germany, France, North & East, and South. The company aims to bolster its network in key markets while diversifying its presence in others. This strategic approach supports sustainable growth and enhanced service delivery.

The company plans to continue its bolt-on M&A strategy, with an expected enterprise value spend between €50 million and €100 million in 2024. SYNLAB is exploring future opportunities with Labcorp to bring innovative specialty tests to European markets, consider procurement collaborations, and support advances in clinical trials and personalized care.

For 2024, SYNLAB anticipates revenues of approximately €2.7 billion with an underlying organic growth rate of approximately 4%, and an adjusted EBITDA margin of 17-18%. These projections indicate continued financial health and strategic success.

SYNLAB is actively preparing for the implementation of the new EU Corporate Sustainability Reporting Directive (CSRD). This commitment underscores SYNLAB's dedication to providing actionable diagnostic information for healthy lives and well-being, aligning with its founding vision and ensuring long-term sustainability.

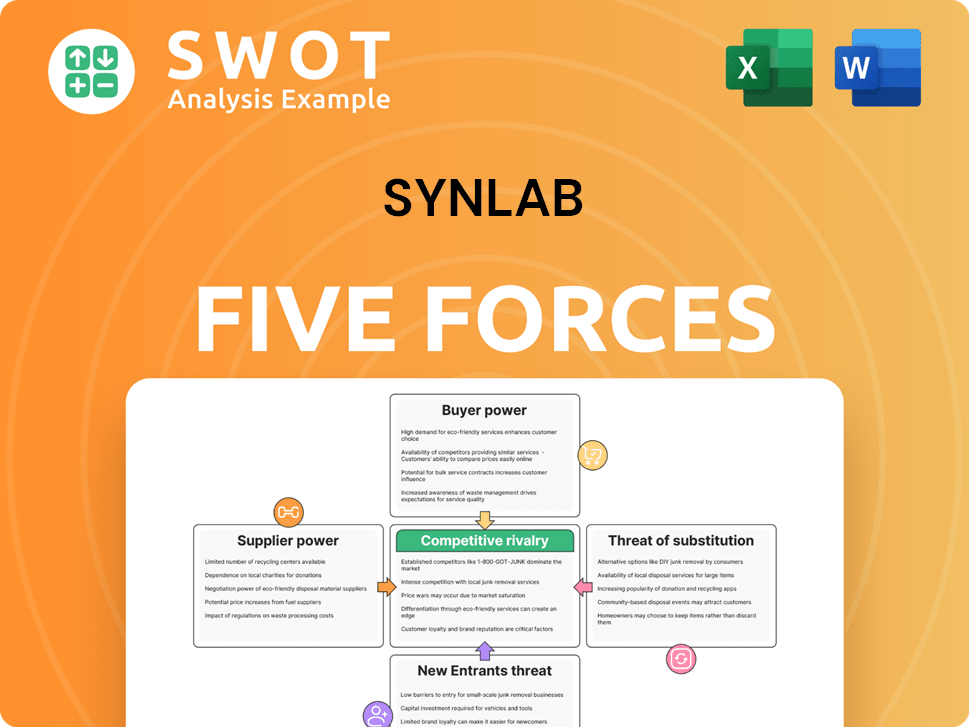

SYNLAB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of SYNLAB Company?

- What is Growth Strategy and Future Prospects of SYNLAB Company?

- How Does SYNLAB Company Work?

- What is Sales and Marketing Strategy of SYNLAB Company?

- What is Brief History of SYNLAB Company?

- Who Owns SYNLAB Company?

- What is Customer Demographics and Target Market of SYNLAB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.