Triumph Financial Bundle

How has Triumph Financial Transformed the Financial Landscape?

Embark on a journey through the Triumph Financial SWOT Analysis and discover the remarkable evolution of Triumph Financial, Inc. from its humble beginnings. This financial services company, headquartered in Dallas, Texas, has strategically navigated the complexities of the financial world since its inception. Learn how Triumph Financial, initially Triumph Bancorp, Inc., has become a pivotal player in the transportation industry.

The Triumph Financial company timeline began in 2006, starting as a commercial bank before expanding its services to meet the specific demands of the freight and logistics sector. With a market capitalization of approximately $600 million in October 2023, Triumph Financial continues to leverage technology to improve its customer service and increase its market share. This strategic focus has solidified its position as a key provider of financial solutions in the transportation market, demonstrating impressive growth and a commitment to innovation in financial services.

What is the Triumph Financial Founding Story?

The story of Triumph Financial, Inc. begins in 2006 in Dallas, Texas. Initially known as Triumph Bancorp, Inc., the company was founded with a clear vision. The goal was to offer comprehensive financial solutions, focusing on service, tailored products, and innovative technology to benefit customers.

Aaron P. Graft, the founder, set out to create a financial institution that would truly empower its customers. The company's journey began with a focus on commercial banking and financial services. A significant milestone came with its initial public offering (IPO) on June 26, 2014, which raised approximately $64 million.

This is the Revenue Streams & Business Model of Triumph Financial.

Triumph Financial's journey started in 2006 in Dallas, Texas, as Triumph Bancorp, Inc. Aaron P. Graft founded the company with a vision to provide comprehensive financial solutions.

- The initial focus was on commercial banking and financial services.

- The IPO in 2014 raised around $64 million.

- A key strategic move was the acquisition of a small factoring business in 2012.

- This acquisition led to specialization in the transportation industry.

In 2012, Triumph Financial made a strategic acquisition of a small factoring business. This move proved crucial, as it addressed the needs of small and medium-sized trucking companies. This acquisition laid the foundation for Triumph Financial's deep involvement in the transportation sector, recognizing the inefficiencies in how truckers were paid. This specialization helped the company grow and establish a strong presence in the financial services market.

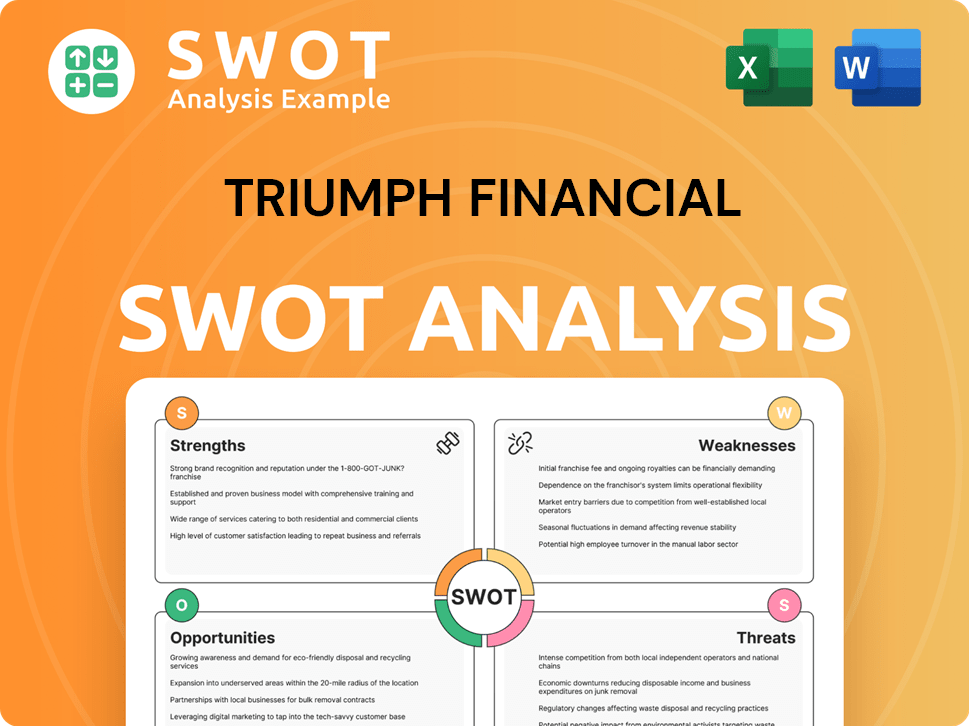

Triumph Financial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Triumph Financial?

The early years of Triumph Financial, initially known as Triumph Bancorp, Inc., were marked by strategic expansion and diversification. This period saw the company establish a strong foothold in the financial services sector through acquisitions and organic growth. Key milestones during this phase included entering the public market and expanding its service offerings to cater to specific industry needs.

In 2012, the company began its journey with the acquisition of a small factoring business, setting the stage for its future in the transportation industry. This initial move was followed by the creation of Equipment Finance and Asset-Based Lending divisions. These divisions helped Triumph Financial focus on specialized financial services. This strategic shift was crucial for the company's early growth.

Triumph Financial, Inc. went public on June 26, 2014, raising approximately $64 million through its IPO. This financial injection supported further expansion efforts. In 2016, the company expanded its presence in Texas by acquiring First Horizon Bank. These moves demonstrated Triumph Financial's commitment to growth through strategic acquisitions.

The company continued its expansion with the acquisition of Commerce Bank in 2017, adding approximately $100 million in assets. Also in 2017, TriumphPay.com was launched, a payment processing tool designed for the supply chain. Further acquisitions like Interstate Capital Corp. in 2018 and Transportation Factoring Services in 2020 strengthened its position in transportation factoring.

A significant strategic shift occurred in June 2021 with the acquisition of HubTran, Inc. for $97 million, transforming TriumphPay into a fee-revenue-focused payments network. In December 2022, Triumph Bancorp, Inc. officially became Triumph Financial, Inc. In Q3 2023, the company reported total assets of $3.56 billion, total deposits of $3.00 billion, and total loans of $2.50 billion. The net income for Q3 2023 was $28 million, an increase from $23 million in Q3 2022.

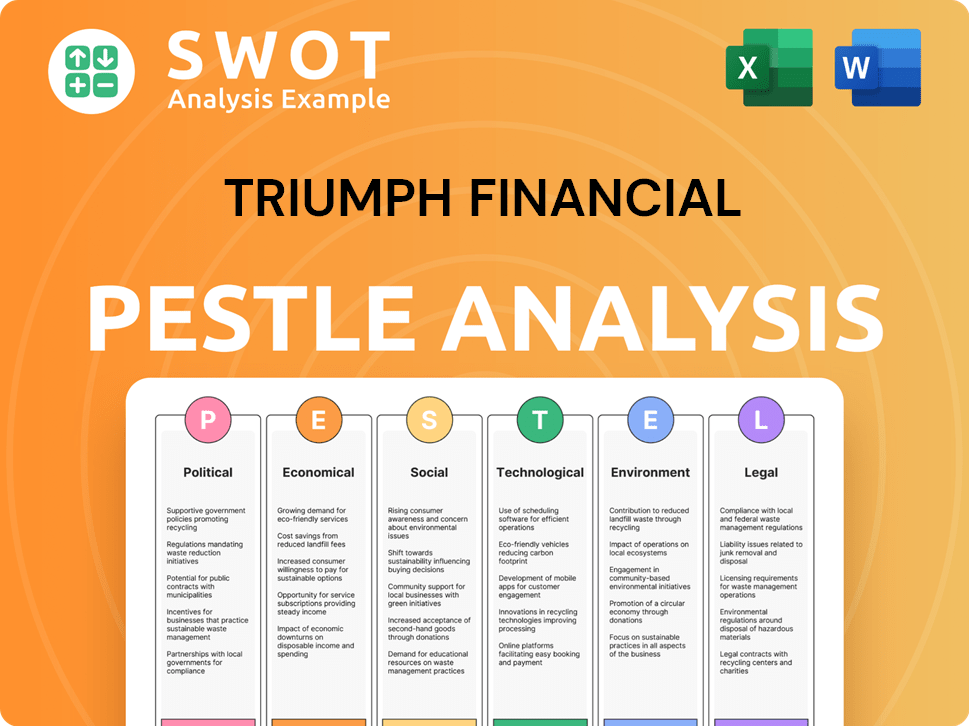

Triumph Financial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Triumph Financial history?

The history of Triumph Financial is marked by significant milestones, strategic innovations, and the navigation of various challenges within the financial services sector. The company has expanded its offerings and capabilities, particularly in the transportation and payments industry.

| Year | Milestone |

|---|---|

| 2021 | Acquired HubTran, Inc., enhancing TriumphPay's capabilities and shifting its strategy towards a fee-revenue-focused payments network. |

| 2021 | TriumphPay achieved $1 billion in volume within its first year after the HubTran acquisition. |

| Q4 2024 | Launched an Intelligence segment, using trucking data for actionable insights following the acquisition of Isometric Technologies Inc. |

| Q2 2025 (Anticipated) | Anticipated closing of the acquisition of GreenScreens AI, Inc., to enhance logistics pricing intelligence. |

Triumph Financial has focused on innovations to streamline financial services, especially in the transportation sector. The development of TriumphPay stands out as a key innovation, aiming to reduce inefficiencies in the payments process for the transportation market.

TriumphPay is a payments network designed to reduce inefficiencies and accelerate payments within the transportation market. It connects freight brokers, shippers, factors, and carriers, streamlining financial transactions.

LoadPay is a digital bank account specifically designed for carriers. This offering provides specialized financial tools tailored to the needs of trucking companies.

The Intelligence segment leverages trucking data to provide actionable insights. This segment aims to offer data-driven solutions to the transportation industry, enhancing decision-making processes.

Despite its achievements, Triumph Financial has faced challenges, particularly in the freight sector, impacting its financial performance. The company's Q1 2025 earnings and revenue fell short of expectations, leading to adjustments in analysts' outlooks.

In Q1 2025, Triumph Financial reported earnings of $0.04 per share, missing the Zacks Consensus Estimate of $0.06 per share. Revenue for the quarter was $101.57 million, which was below the anticipated $104.49 million.

KBW reduced Triumph Financial's price target from $68.00 to $56.00 in April 2025, citing slowing growth in Payments revenue. The company is focusing on leveraging revenue opportunities from new platforms and products.

Triumph Financial reported a net loss of $0.8 million, or $0.03 per diluted share, in Q1 2025. This loss was impacted by non-core expenses.

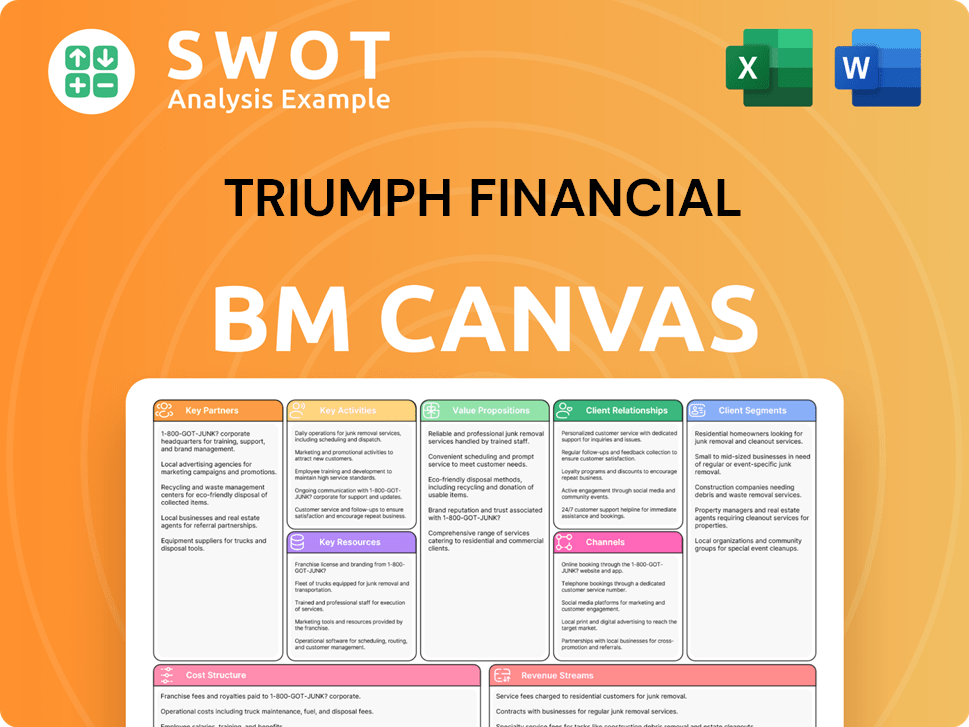

Triumph Financial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Triumph Financial?

The Triumph Financial history is characterized by strategic expansions and technological advancements, particularly within the transportation finance sector. Founded in 2006, the company, initially named Triumph Bancorp, Inc., has evolved significantly through acquisitions and innovations, marking its journey from commercial banking to a key player in financial services. The company's timeline reflects a dynamic approach to growth and adaptation within the financial services landscape.

| Year | Key Event |

|---|---|

| 2006 | Founded in Dallas, Texas, as Triumph Bancorp, Inc., focusing on commercial banking and financial services. |

| 2012 | Acquired a small factoring business, shifting towards transportation finance. |

| June 26, 2014 | Completed its Initial Public Offering (IPO), raising approximately $64 million. |

| 2016 | Acquired First Horizon Bank, expanding its footprint in Texas. |

| 2017 | Acquired Commerce Bank and launched TriumphPay.com, a payment processing tool for the supply chain. |

| 2018 | Acquired Texas-based factoring company, Interstate Capital Corp. |

| 2019 | Acquired the assets of T Bank, N.A., further increasing market presence. |

| 2020 | Acquired Chattanooga-based factoring company, Transportation Factoring Services. |

| June 2021 | Acquired HubTran, Inc. for $97 million, enhancing TriumphPay's automation and payment capabilities. |

| December 2022 | Triumph Bancorp, Inc. changed its name to Triumph Financial, Inc. |

| Q4 2024 | Introduced the Intelligence segment, leveraging trucking data, following the acquisition of Isometric Technologies Inc. |

| April 16, 2025 | Released Q1 2025 financial results, reporting earnings of $0.04 per share and revenue of $101.57 million. |

| May 8, 2025 | Completed the acquisition of Greenscreens.ai, expected to enhance logistics pricing intelligence. |

Triumph Financial's growth strategy includes expanding its financial product offerings and increasing market share in targeted regions. The acquisition of Greenscreens.ai in May 2025 is a step towards enhancing logistics pricing intelligence. The company is focused on leveraging its investments in new platforms to drive future growth.

The company continues to enhance customer service through technology, including its payment processing tool, TriumphPay.com. The introduction of the Intelligence segment, following the acquisition of Isometric Technologies Inc., demonstrates a commitment to leveraging data. These technological advancements are key to long-term success.

In Q1 2025, Triumph Financial reported earnings of $0.04 per share and revenue of $101.57 million. Analysts predict potential revenue growth in the second half of 2025. The company’s focus on its core transaction model and products like LoadPay and Factoring-as-a-Service aims to boost profitability.

Triumph Financial's leadership is committed to building a strong, focused structure to achieve ambitious goals. The company's vision emphasizes driving innovation and delivering value to customers and shareholders. The strategic direction is centered on sustainable growth within the financial services sector.

Triumph Financial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Triumph Financial Company?

- What is Growth Strategy and Future Prospects of Triumph Financial Company?

- How Does Triumph Financial Company Work?

- What is Sales and Marketing Strategy of Triumph Financial Company?

- What is Brief History of Triumph Financial Company?

- Who Owns Triumph Financial Company?

- What is Customer Demographics and Target Market of Triumph Financial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.